Algeria Vending Machine Market (2025-2031) | Size, Share, Outlook, Companies, Growth, Industry, Analysis, Forecast, Trends, Revenue & Value

Market Forecast By Product Type (Beverages, Snacks, Chocolate and Candies, Tobacco & Others), By End Users (QSR, Shopping Malls, Retail Stores, Offices and Institutions, Public Transport & Others) and competitive landscape

| Product Code: ETC002651 | Publication Date: Aug 2024 | Updated Date: Dec 2024 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

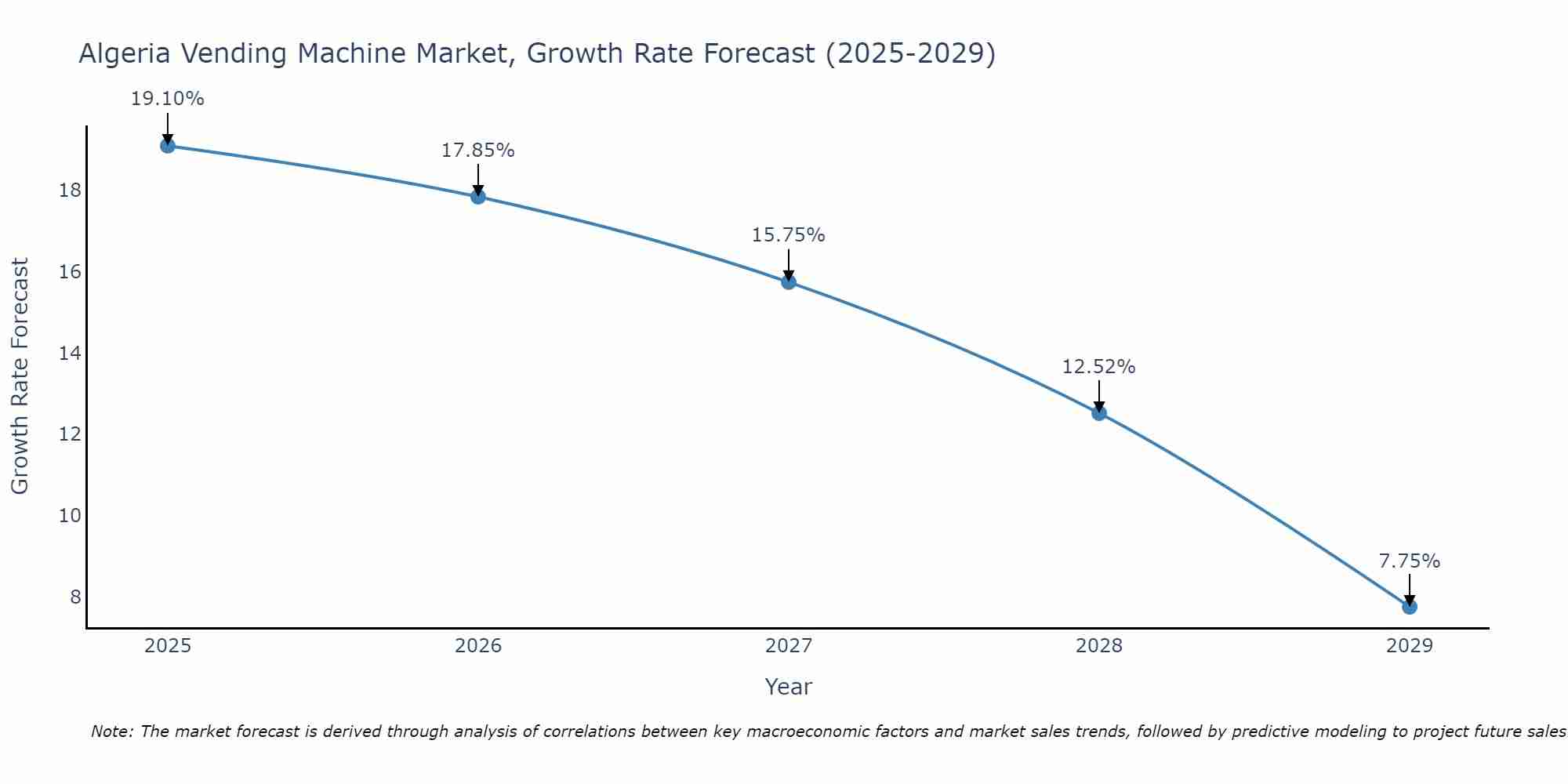

Algeria Vending Machine Market Size Growth Rate

The Algeria Vending Machine Market could see a tapering of growth rates over 2025 to 2029. Beginning strongly at 19.10% in 2025, growth softens to 7.75% in 2029.

Algeria Vending Machine Market Highlights

| Report Name | Algeria Vending Machine Market |

| Forecast period | 2025-2031 |

| CAGR | 7.2% |

| Growing Sector | QSR (Quick Service Restaurants) |

Topics Covered in Algeria Vending Machine Market Report

Algeria Vending Machine Market report thoroughly covers the market by Product Type and End Users. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers, which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Algeria Vending Machine Market Synopsis

The Algeria Vending Machine Market is witnessing significant growth due to the increasing demand for convenient and quick food and beverage options in various locations.

According to 6Wresearch, the Algeria Vending Machine Market is projected to grow at a CAGR of 7.2% from 2025-2031. The QSR (Quick Service Restaurants) sector is showing robust growth, driven by the demand for fast and convenient food options. Additionally, the growing number of shopping malls, retail stores, and public transportation hubs is driving the installation of vending machines. The increased adoption of advanced vending machine technologies, such as cashless payment systems, is also fueling market growth.

However, the market faces challenges, including high initial costs and maintenance expenses of vending machines, which can deter small businesses. Additionally, the need for regular restocking and the potential for vandalism pose challenges. Moreover, the market must address issues related to product freshness and hygiene to maintain consumer trust.

Algeria Vending Machine Market Leading Players

Leading players in the Algeria Vending Machine Market include Azkoyen Group, Jofemar Corporation, and Bianchi Vending Group. Azkoyen Group is known for its innovative beverage vending solutions that cater to diverse consumer preferences. Jofemar Corporation offers a wide range of vending machines, including those for snacks and beverages, known for their reliability and advanced features. Bianchi Vending Group specializes in tobacco and confectionery vending machines, recognized for their robust design and user-friendly interfaces.

Algeria Vending Machine Industry Government Initiatives

The Algerian government is actively promoting the adoption of vending machines through various initiatives aimed at modernizing retail infrastructure. Policies that encourage the deployment of vending machines in public places and transport hubs are expected to drive market growth. Efforts to enhance cashless payment infrastructure and promote digital transactions are also supporting the vending machine market. Additionally, the government’s focus on boosting tourism and improving public amenities is likely to increase the demand for vending machines across various sectors.

Future Insights of the Market

The Algeria Vending Machine Market is anticipated to witness significant growth over the next five years. Market growth is expected to be driven by technological advancements such as IoT and AI integration in vending machines. The increasing preference for cashless and contactless payment options, coupled with the demand for smart and eco-friendly vending solutions by environmentally conscious consumers, is expected to boost the sales of advanced models. In addition to this, the food and beverage industry will remain a key driver, with more QSRs and retail stores adopting vending machines to enhance customer convenience. Moreover, the residential sector presents growth opportunities as consumers seek convenient snack and beverage options at home. In summary, innovation and sustainability will be the primary drivers of market growth.

Market Segmentation By Product Type

According to Ravi Bhandari, Research Head, 6Wresearch, beverages and snacks are leading the market due to their widespread adoption in various settings, including offices and retail locations.

Market Segmentation By End Users

QSRs are seeing a surge in demand for vending machines due to their ability to provide quick and convenient food and beverage options, enhancing customer satisfaction.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Algeria Vending Machine Market Overview

- Algeria Vending Machine Market Outlook

- Algeria Vending Machine Market Forecast

- Historical Data of Algeria Vending Machine Market Revenues for the Period 2021-2031

- Algeria Vending Machine Market Size and Algeria Vending machine Market Forecast of Revenues, Until 2031

- Historical Data of Algeria Vending Machine Market Revenues, By Product Type, for the period 2021-2031

- Market Size & Forecast of Algeria Vending Machine Market Revenues and Volumes, By Product Type, Until 2031.

- Historical Data of Algeria Vending Machine Market Revenues, By End Users, for the period 2021-2031

- Market Size & Forecast of Algeria Vending Machine Market Revenues and Volumes, By End Users, Until 2031.

- Market Drivers and Restraints

- Algeria Vending Machine Market Trends and Industry Life Cycle

- Market Opportunity Assessment

- Algeria Vending Machine Market Share, By Players

- Algeria Vending Machine Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments

By Product Type

- Beverages

- Snacks

- Chocolate and Candies

- Tobacco

- Others

By End Users

- QSR

- Shopping Malls

- Retail Stores

- Offices and Institutions

- Public Transport

- Others

Algeria Vending Machine Market (2025-2031); FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. Algeria Vending Machine Market Overview |

| 3.1 Algeria Vending Machine Market Revenues and Volume, 2021-2031F |

| 3.2 Algeria Vending Machine Market Revenue Share, By Product Types, 2021 & 2031F |

| 3.3 Algeria Vending Machine Market Revenue Share, By End Users, 2021 & 2031F |

| 3.4 Algeria Vending Machine Market - Industry Life Cycle |

| 3.5 Algeria Vending Machine Market - Porter’s Five Forces |

| 4. Algeria Vending Machine Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5. Algeria Vending Machine Market Trends |

| 6. Algeria Vending Machine Market Overview, By Product Types |

| 6.1 Algeria Vending Machine Market Revenues and Volume, By Beverages, 2021-2031F |

| 6.2 Algeria Vending Machine Market Revenues and Volume, By Snacks, 2021-2031F |

| 6.4 Algeria Vending Machine Market Revenues and Volume, By Chocolates and Candies, 2021-2031F |

| 6.3 Algeria Vending Machine Market Revenues and Volume, By Tobacco, 2021-2031F |

| 6.4 Algeria Vending Machine Market Revenues and Volume, By Others, 2021-2031F |

| 7. Algeria Vending Machine Market Overview, By End Users |

| 7.1 Algeria Vending Machine Market Revenue and Volumes, By QSR, 2021-2031F |

| 7.2 Algeria Vending Machine Market Revenue and Volumes, By Shopping Malls, 2021-2031F |

| 7.3 Algeria Vending Machine Market Revenue and Volumes, By Retail Stores, 2021-2031F |

| 7.4 Algeria Vending Machine Market Revenue and Volumes, By Offices and Institutions, 2021-2031F |

| 7.5 Algeria Vending Machine Market Revenue and Volumes, By Public Transport, 2021-2031F |

| 7.6 Algeria Vending Machine Market Revenue and Volumes, By Others, 2021-2031F |

| 8. Algeria Vending Machine Market Key Performance Indicators |

| 9. Algeria Vending Machine Market Opportunity Assessment |

| 9.1 Algeria Vending Machine Market Opportunity Assessment, By Product Types, 2031F |

| 9.2 Algeria Vending Machine Market Opportunity Assessment, By End Users, 2031F |

| 10. Algeria Vending Machine Market Competitive Landscape |

| 10.1 Algeria Vending Machine Market By Companies, 2024 |

| 10.2 Algeria Vending Machine Market Competitive Benchmarking, By Operating Parameters, 2021 |

| 11. Company Profiles |

| 12. Key Strategic Recommendations |

| 13. Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero