Australia Aerial Work Platform Market (2025-2031) | Outlook, Size, Value, Growth, Revenue, Companies, Outlook, Forecast, Trends, Share, Analysis & Industry

Market Forecast By Engine Type (Electric, Engine-powered), By Product Type (Boom Lifts, Scissor Lifts, Vertical Mast Lifts, Personal Portable Lifts), By End-Users (Construction, Retail, Storage, and Warehouses, Transportation and Logistics, Others) And Competitive Landscape

| Product Code: ETC044295 | Publication Date: Jan 2021 | Updated Date: Apr 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

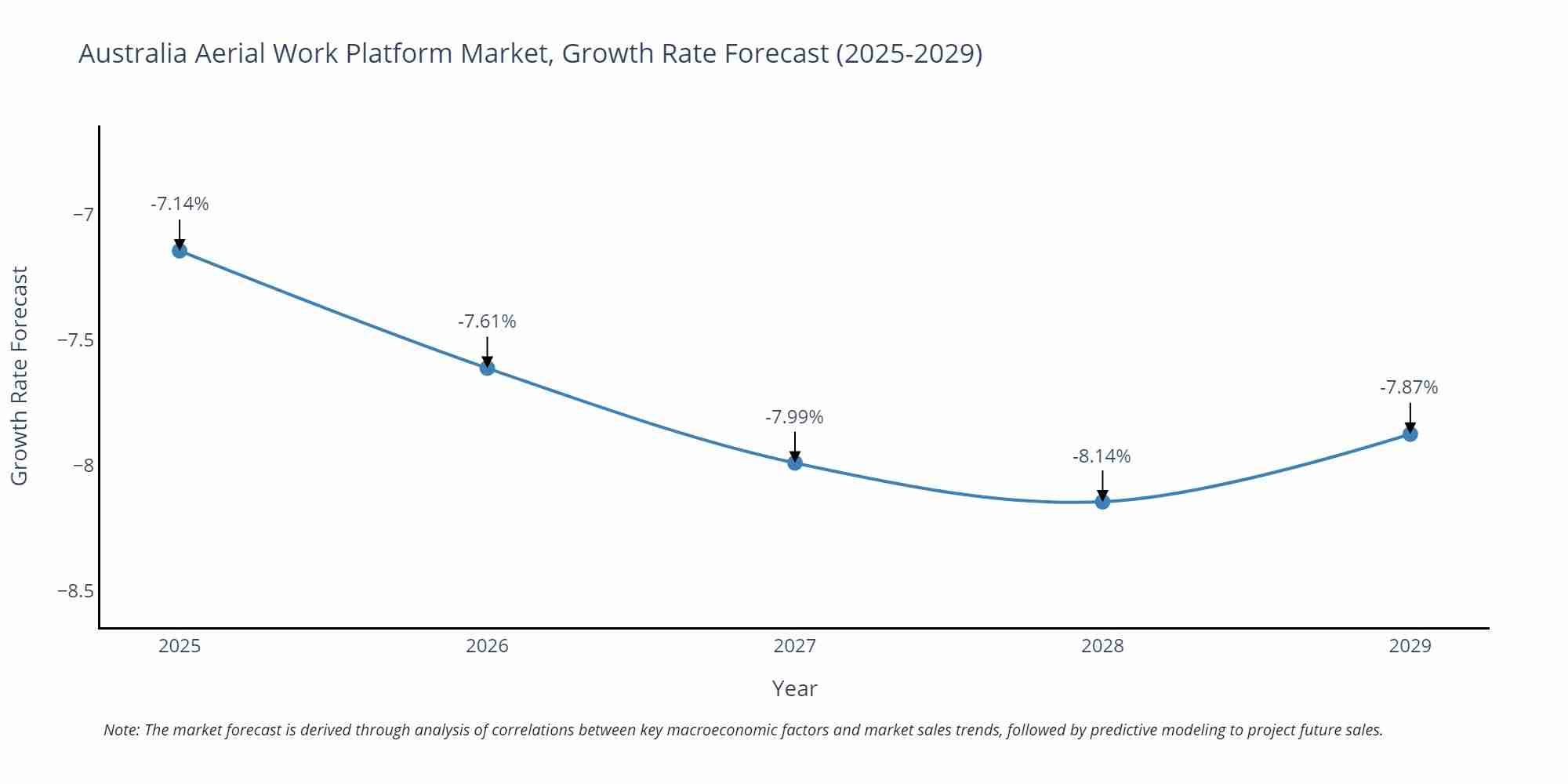

Australia Aerial Work Platform Market Size Growth Rate

The Australia Aerial Work Platform Market is projected to witness mixed growth rate patterns during 2025 to 2029. Although the growth rate starts strong at -7.14% in 2025, it steadily loses momentum, ending at -7.87% by 2029.

Australia Aerial Work Platform Market Highlights

| Report Name | Australia Aerial Work Platform Market |

| Forecast period | 2025-2031 |

| CAGR | 3.4% |

| Growing Sector | Construction |

Topics Covered in the Australia Aerial Work Platform Market Report

Australia Aerial Work Platform Market report thoroughly covers the market by Engine type, product type, and End -Users. The market outlook report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Australia Aerial Work Platform Market Synopsis

Australia Aerial Work Platform Market is projected to grow significantly in the coming years. The increasing demand for efficient and safe construction and maintenance operations has led to a rise in the adoption of AWP equipment. These platforms are used to elevate workers, tools, and materials to an elevated location, providing a safer alternative to traditional methods like ladders or scaffolding. The market is currently witnessing a significant upsurge , driven by growth in construction activities, investment in infrastructure, and the need for efficient workplace safety solutions. Increasing urbanization and commercial development projects are fueling demand for AWPs, which are essential for tasks such as exterior building maintenance, installation work, and high-level access across various industries. Recent trends also indicate a shift towards electric and hybrid AWP units, aligning with global sustainability efforts and stricter emissions regulations.

According to 6Wresearch, the Australia Aerial Work Platform Market size is projected to grow at the CAGR of 3.4% during the forecast period of 2025-2031. One of the major drivers for the growth of Australia's AWP market is the booming construction industry. The country has seen a rise in infrastructure projects, both public and private, leading to an increased demand for AWP equipment. Additionally, there has been a shift towards sustainable and eco-friendly construction practices, which require the use of specialized equipment like electric or hybrid AWPs. Another significant driver is the maintenance sector, particularly in industries such as oil and gas, power generation, and telecommunications. The need for regularly inspecting and maintaining structures at heights has made AWP equipment an essential tool for these industries. While the AWP market in Australia is poised for growth, there are some challenges that must be addressed to ensure its success. The high initial cost of purchasing AWP equipment can be a deterrent for small and medium-sized businesses, making it difficult for them to adopt these machines. Moreover, there are also safety concerns related to the use of AWPs. Operators require specialized training and certification to operate these platforms safely, and failure to do so can lead to accidents and injuries. This has led to strict regulations and standards for the use of AWP equipment, which can be a barrier for some companies and these factors have hindered Australia Aerial Work Platform Market Growth.

Government policies and schemes introduced in the Australia Aerial Work Platform Market

The Australian government has taken proactive steps to ensure that aerial work platforms (AWPs) are used safely across industries. Regulatory bodies such as Safe Work Australia have drafted detailed guidelines and compliance standards to ensure operator safety. Additionally, initiatives like the Elevating Work Platform Association of Australia (EWPA) promote the safe use of AWPs through advocacy, education, and best practice development. The National Equipment Register (NER) also helps reduce theft of expensive AWP equipment, further safeguarding the investments of businesses in this sector.

Leading players in the Australia Aerial Work Platform Market

The Aerial Work Platform Market in Australia is characterized by the presence of several leading players who contribute to the industry's growth. Notable companies such as Haulotte Australia, United Rentals (UR), and JLG Industries dominate the market due to their extensive product lines, exceptional service, and a strong focus on safety and innovation. Haulotte Australia, for example, offers a broad range of access equipment that includes telescopic booms and scissor lifts, catering to varying operational needs. These companies are at the forefront of integrating new technologies to enhance the functionality and eco-friendliness of their AWP offerings.

Future Insight of the Australia Aerial Work Platform Market

The future of Australia Aerial Work Platform Industry looks promising, with continued growth expected in the coming years. The country's construction sector is projected to continue its upward trend, driven by major infrastructure projects like the Western Sydney Airport and Melbourne Suburban Rail Loop. Moreover, the rising demand for sustainable and eco-friendly construction practices will further drive the need for specialized AWP equipment. As technology continues to advance, we can also expect to see more efficient and advanced AWPs being introduced in the market, making them more accessible and cost-effective for businesses of all sizes. In addition, with increased awareness and focus on safety, we can expect to see stricter regulations and training requirements for AWP operators, further promoting safe practices and reducing the risk of accidents.

Market analysis by Engine Type

On the basis of type, the market is divided into two categories: electric and engine-powered platforms. The electric aerial work platforms are expected to witness a higher growth rate due to their lower emission levels, noise reduction, and cost-effectiveness compared to engine-powered platforms.

Market analysis By Product Type

According to Dhaval, Research Manager, 6Wresearch, On the basis of product type, the boom lifts and scissor lifts sub-segments are expected to dominate the market due to their ability to reach greater heights and carry heavier loads.

Market analysis By End -users

The end-user segment also plays a crucial role in the growth of the Australia aerial work platform market. The construction sector is expected to hold the largest share due to the increasing number of construction projects and regulations regarding worker safety.

Key attractiveness of the report

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024.

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Australia Aerial Work Platform Market Outlook

- Market Size of Australia Aerial Work Platform Market, 2024

- Forecast of Australia Aerial Work Platform Market, 2031

- Historical Data and Forecast of Australia Aerial Work Platform Revenues & Volume for the Period 2021-2031

- Australia Aerial Work Platform Market Trend Evolution

- Australia Aerial Work Platform Market Drivers and Challenges

- Australia Aerial Work Platform Price Trends

- Australia Aerial Work Platform Porter's Five Forces

- Australia Aerial Work Platform Industry Life Cycle

- Historical Data and Forecast of Australia Aerial Work Platform Market Revenues & Volume By Engine Type for the Period 2021-2031

- Historical Data and Forecast of Australia Aerial Work Platform Market Revenues & Volume By Electric for the Period 2021-2031

- Historical Data and Forecast of Australia Aerial Work Platform Market Revenues & Volume By Engine-powered for the Period 2021-2031

- Historical Data and Forecast of Australia Aerial Work Platform Market Revenues & Volume By Product Type for the Period 2021-2031

- Historical Data and Forecast of Australia Aerial Work Platform Market Revenues & Volume By Boom Lifts for the Period 2021-2031

- Historical Data and Forecast of Australia Aerial Work Platform Market Revenues & Volume By Scissor Lifts for the Period 2021-2031

- Historical Data and Forecast of Australia Aerial Work Platform Market Revenues & Volume By Vertical Mast Lifts for the Period 2021-2031

- Historical Data and Forecast of Australia Aerial Work Platform Market Revenues & Volume By Personal Portable Lifts for the Period 2021-2031

- Historical Data and Forecast of Australia Aerial Work Platform Market Revenues & Volume By End-Users for the Period 2021-2031

- Historical Data and Forecast of Australia Aerial Work Platform Market Revenues & Volume By Construction for the Period 2021-2031

- Historical Data and Forecast of Australia Aerial Work Platform Market Revenues & Volume By Retail, Storage, and Warehouses for the Period 2021-2031

- Historical Data and Forecast of Australia Aerial Work Platform Market Revenues & Volume By Transportation and Logistics for the Period 2021-2031

- Historical Data and Forecast of Australia Aerial Work Platform Market Revenues & Volume By Others for the Period 2021-2031

- Australia Aerial Work Platform Import Export Trade Statistics

- Market Opportunity Assessment By Engine Type

- Market Opportunity Assessment By Product Type

- Market Opportunity Assessment By End-Users

- Australia Aerial Work Platform Top Companies Market Share

- Australia Aerial Work Platform Competitive Benchmarking By Technical and Operational Parameters

- Australia Aerial Work Platform Company Profiles

- Australia Aerial Work Platform Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Engine Type

- Electric

- Engine-Powered

By Product Type

- Boom Lifts

- Scissor Lifts

- Vertical Mast Lifts

- Personal Portable Lifts

By End-Users

- Construction

- Retail Storage And Warehouses

- Transportation And Logistics

- Others

Australia Aerial Work Platform Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Australia Aerial Work Platform Market Overview |

| 3.1 Australia Country Macro Economic Indicators |

| 3.2 Australia Aerial Work Platform Market Revenues & Volume, 2021 & 2031F |

| 3.3 Australia Aerial Work Platform Market - Industry Life Cycle |

| 3.4 Australia Aerial Work Platform Market - Porter's Five Forces |

| 3.5 Australia Aerial Work Platform Market Revenues & Volume Share, By Engine Type, 2021 & 2031F |

| 3.6 Australia Aerial Work Platform Market Revenues & Volume Share, By Product Type, 2021 & 2031F |

| 3.7 Australia Aerial Work Platform Market Revenues & Volume Share, By End-Users, 2021 & 2031F |

| 4 Australia Aerial Work Platform Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Australia Aerial Work Platform Market Trends |

| 6 Australia Aerial Work Platform Market, By Types |

| 6.1 Australia Aerial Work Platform Market, By Engine Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 Australia Aerial Work Platform Market Revenues & Volume, By Engine Type, 2021-2031F |

| 6.1.3 Australia Aerial Work Platform Market Revenues & Volume, By Electric, 2021-2031F |

| 6.1.4 Australia Aerial Work Platform Market Revenues & Volume, By Engine-powered, 2021-2031F |

| 6.2 Australia Aerial Work Platform Market, By Product Type |

| 6.2.1 Overview and Analysis |

| 6.2.2 Australia Aerial Work Platform Market Revenues & Volume, By Boom Lifts, 2021-2031F |

| 6.2.3 Australia Aerial Work Platform Market Revenues & Volume, By Scissor Lifts, 2021-2031F |

| 6.2.4 Australia Aerial Work Platform Market Revenues & Volume, By Vertical Mast Lifts, 2021-2031F |

| 6.2.5 Australia Aerial Work Platform Market Revenues & Volume, By Personal Portable Lifts, 2021-2031F |

| 6.3 Australia Aerial Work Platform Market, By End-Users |

| 6.3.1 Overview and Analysis |

| 6.3.2 Australia Aerial Work Platform Market Revenues & Volume, By Construction, 2021-2031F |

| 6.3.3 Australia Aerial Work Platform Market Revenues & Volume, By Retail, Storage, and Warehouses, 2021-2031F |

| 6.3.4 Australia Aerial Work Platform Market Revenues & Volume, By Transportation and Logistics, 2021-2031F |

| 6.3.5 Australia Aerial Work Platform Market Revenues & Volume, By Others, 2021-2031F |

| 7 Australia Aerial Work Platform Market Import-Export Trade Statistics |

| 7.1 Australia Aerial Work Platform Market Export to Major Countries |

| 7.2 Australia Aerial Work Platform Market Imports from Major Countries |

| 8 Australia Aerial Work Platform Market Key Performance Indicators |

| 9 Australia Aerial Work Platform Market - Opportunity Assessment |

| 9.1 Australia Aerial Work Platform Market Opportunity Assessment, By Engine Type, 2021 & 2031F |

| 9.2 Australia Aerial Work Platform Market Opportunity Assessment, By Product Type, 2021 & 2031F |

| 9.3 Australia Aerial Work Platform Market Opportunity Assessment, By End-Users, 2021 & 2031F |

| 10 Australia Aerial Work Platform Market - Competitive Landscape |

| 10.1 Australia Aerial Work Platform Market Revenue Share, By Companies, 2024 |

| 10.2 Australia Aerial Work Platform Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero