Australia Diesel Genset (Generator) Market Outlook (2023-2029) | Share, Value, Size, Analysis, Trends, Revenue, Companies, Growth, Industry, Forecast & COVID-19 IMPACT

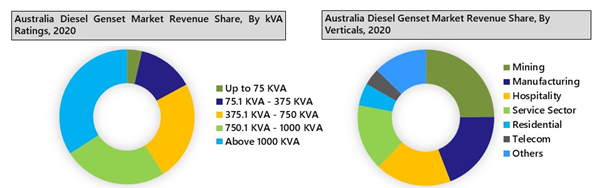

Market Forecast By kVA Ratings (Up to 75 KVA, 75.1 KVA - 375 KVA, 375.1 KVA - 750 KVA, 750.1 KVA - 1000 KVA, Above 1000 KVA), By Vehicles (Residential, Telecommunications, Manufacturing, Mining, Construction, Hospitality, Commercial/Service Sector, Power Utilities, Others (Events & Entertainment, Agriculture, Oil & Gas, Government and Defence)), By Region (New South Wales, Queensland, Victoria, Tasmania, Northern Territory, Southern Australia, Western Australia) And Competitive Landscape

| Product Code: ETC115039 | Publication Date: Sep 2023 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 80 | No. of Figures: 22 | No. of Tables: 9 |

Australia Diesel Genset Market Synopsis

During 2019-22, Australia diesel genset market witnessed a remarkable upsurge, primarily propelled by the flourishing mining sector and the surging prices of metals, notably iron ore. Notably, in the 2019–20 period, the mining industry contributed a substantial 4.9% to the nation's GDP, firmly establishing itself as the preeminent sector, commanding a notable 10.4% share of the entire national economy. Regrettably, the pandemic's emergence prompted a transient downturn in diesel genset sales, a consequence of the suspension of industrial activities aimed at mitigating its impact.

According to 6Wresearch, Australia diesel genset market size is projected to shrink at a CAGR of 4% during 2023-2029. Australia diesel genset market is poised for significant expansion, driven by several key factors. The thriving mining industry, exemplified by a remarkable Gross Value Added of 283.2 in 2022, stands as a compelling driver of this growth. Additionally, the manufacturing sector has displayed robust performance, witnessing a substantial rise from $107.8 billion in 2021 to $124.2 billion in 2022, a surge buoyed by government incentives and substantial investments in infrastructure. Furthermore, Australia is currently in the midst of a substantial construction boom, with an impressive lineup of infrastructure projects totaling approximately $647 billion, all slated for completion by 2026. This staggering sum represents a substantial 57% share of the nation's construction market for this period. As these ambitious projects advance, the demand for diesel gensets is poised to experience a significant surge, playing a vital role as indispensable power backup solutions to guarantee seamless and uninterrupted operations.

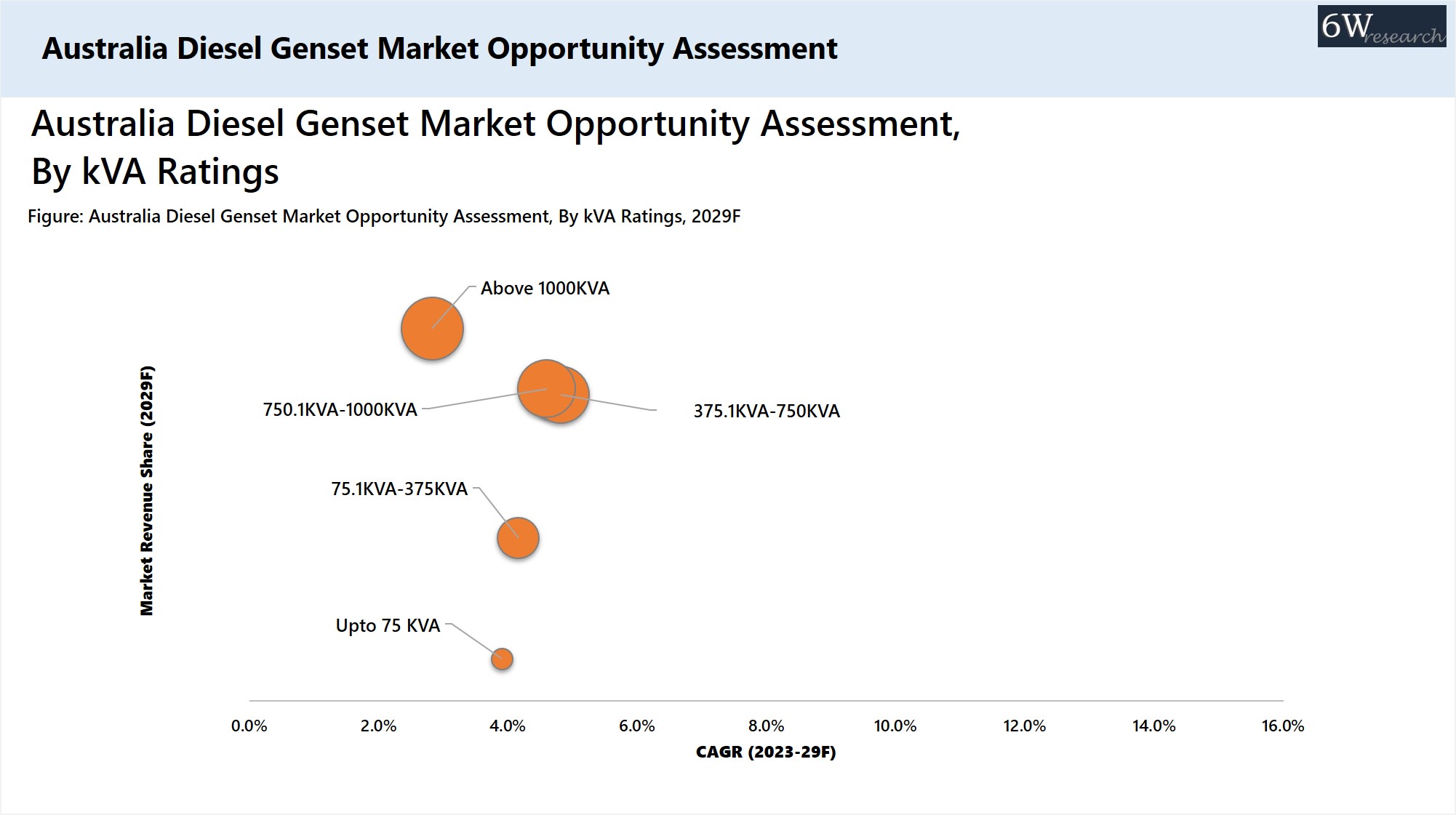

Market by kVA Ratings

Diesel gensets with a rating above 1000 KVA maintained their strong grip in 2022, and this robust trend is poised to endure in the forecast period. This enduring dominance can be chiefly attributed to the substantial demand emanating from the mining sector and the burgeoning number of manufacturing facilities.

Market by Vehicles

In 2022, the mining sector was the primary contributor to the Australian diesel genset market's revenue. Australia's global prominence in mining, with extensive mineral reserves including iron ore, zinc, nickel, and cobalt, played a pivotal role. The sector's significant growth was further supported by a notable 50% year-over-year increase in drilling activity across all commodities in 2021.

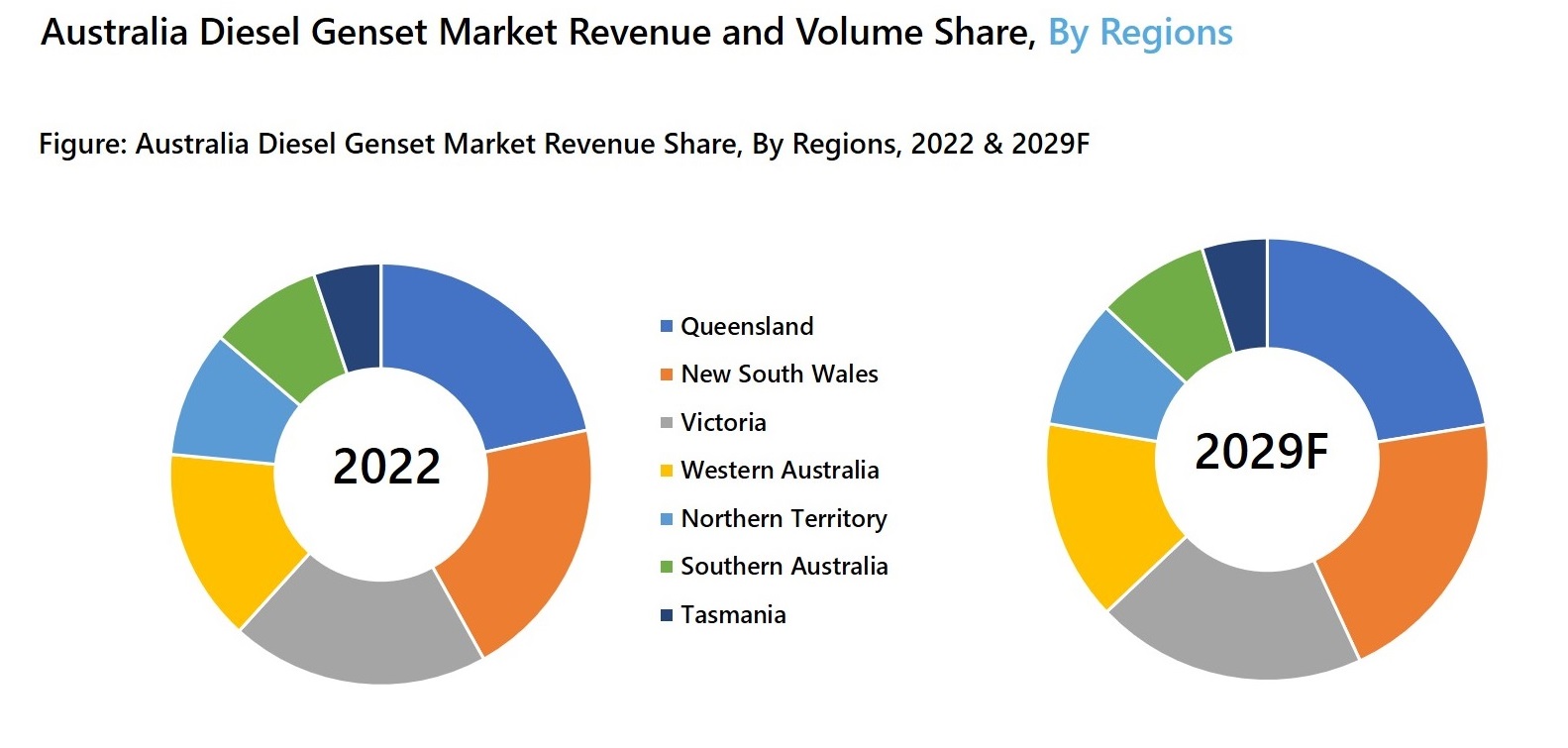

Market by Region

In 2022, Queensland led Australia diesel genset market due to its vital role in the economy, driven by agriculture, construction, mining, and tourism. New South Wales and Victoria closely followed, fueled by growing mining and industrial developments, promising future growth for the diesel genset industry.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 11 Years Market Numbers.

- Historical Data Starting from 2019 to 2022.

- Base Year: 2022

- Forecast Data until 2029.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Australia Diesel Genset Market Overview

- Australia Diesel Genset Market Outlook

- Australia Diesel Genset Market Forecast

- Historical Data and Forecast of Australia Diesel Genset Market Revenues for the Period 2019-2029F

- Historical Data and Forecast of Market Revenues and Volume, By kVA Ratings, for the Period 2019-2029F

- Historical Data and Forecast of Market Revenues and Volume, By Verticals, for the Period 2019-2029F

- Historical Data and Forecast of Market Revenues, By Regions, for the Period 2019-2029F

- Market Drivers and Restraints

- Australia Diesel Genset Market Trends

- Industry Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- Australia Diesel Genset Market Share, By Companies

- Australia Diesel Genset Market COVID-19 Impact Analysis

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By kVA Ratings

- Up to 75 KVA

- 75.1 KVA - 375 KVA

- 375.1 KVA - 750 KVA

- 750.1 KVA - 1000 KVA

- Above 1000 KVA

By Vehicles

- Residential

- Telecommunications

- Manufacturing

- Mining

- Construction

- Hospitality

- Commercial/Service Sector

- Power Utilities

- Others (Events & Entertainment, Agriculture, Oil & Gas, Government and Defence)

By Region

- New South Wales

- Queensland

- Victoria

- Tasmania

- Northern Territory

- Southern Australia

- Western Australia

Australia Diesel Genset (Generator) Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of the Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. Australia Diesel Genset Market Overview |

| 3.1 Australia Diesel Genset Market Revenues and Volume, 2019-2029F |

| 3.2 Australia Diesel Genset Market-Industry Life Cycle |

| 3.3 Australia Diesel Genset Market-Porter’s Five Forces |

| 3.5 Australia Diesel Genset Market Revenue and Volume Share, By kVA Ratings, 2022 & 2029F |

| 3.6 Australia Diesel Genset Market Revenue and Volume Share, By Verticals, 2022 & 2029F |

| 3.7 Australia Diesel Genset Market Revenue Share, By Regions, 2022 & 2029F |

| 4. Australia Diesel Genset Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5. Australia Diesel Genset Market Trends |

| 6. Australia Diesel Genset Market Overview, By kVA Ratings |

| 6.1 Australia Diesel Genset Market Revenues and Volume, By Up to 75 kVA, 2019-2029F |

| 6.2 Australia Diesel Genset Market Revenues and Volume, By 75.1 KVA - 375 kVA, 2019-2029F |

| 6.3 Australia Diesel Genset Market Revenues and Volume, By 375.1 KVA - 750 kVA, 2019-2029F |

| 6.4 Australia Diesel Genset Market Revenues and Volume, By 750.1 KVA - 1000 kVA, 2019-2029F |

| 6.5 Australia Diesel Genset Market Revenues and Volume, By Above 1000 kVA, 2019-2029F |

| 7. Australia Diesel Genset Market, By Verticals |

| 7.1 Australia Diesel Genset Market Revenues and Volume, By Residential, 2019-2029F |

| 7.2 Australia Diesel Genset Market Revenues and Volume, By Telecom, 2019-2029F |

| 7.3 Australia Diesel Genset Market Revenues and Volume, By Manufacturing, 2019-2029F |

| 7.4 Australia Diesel Genset Market Revenues and Volume, By Mining, 2019-2029F |

| 7.5 Australia Diesel Genset Market Revenues and Volume, By Hospitality, 2019-2029F |

| 7.6 Australia Diesel Genset Market Revenues and Volume, By Service Sector, 2019-2029F |

| 7.7 Australia Diesel Genset Market Revenues and Volume, By Others, 2019-2029F |

| 8. Australia Diesel Genset Market, By Regions |

| 8.1 Australia Diesel Genset Market Revenues, By New South Wales, 2019-2029F |

| 8.2 Australia Diesel Genset Market Revenues, By Queensland Region, 2019-2029F |

| 8.3 Australia Diesel Genset Market Revenues, By Victoria, 2019-2029F |

| 8.4 Australia Diesel Genset Market Revenues, By Tasmania, 2019-2029F |

| 8.5 Australia Diesel Genset Market Revenues, By Northern Territory Region, 2019-2029F |

| 8.6 Australia Diesel Genset Market Revenues, By Southern Australia, 2019-2029F |

| 8.7 Australia Diesel Genset Market Revenues, By Western Australia, 2019-2029F |

| 9. Australia Diesel Genset Market Key Performance Indicators |

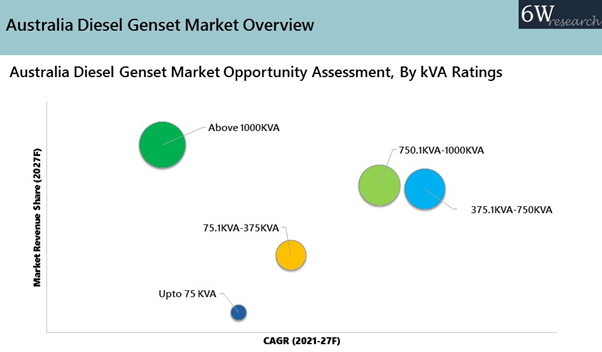

| 10. Australia Diesel Genset Market Opportunity Assessment |

| 10.1 Australia Diesel Genset Market Opportunity Assessment, By kVA Ratings, 2029F |

| 10.2 Australia Diesel Genset Market Opportunity Assessment, By Verticals, 2029F |

| 10.3 Australia Diesel Genset Market Opportunity Assessment, By Regions, 2029F Australia Diesel Genset Market Opportunity Assessment, By Regions, 2029F |

| 11. Australia Diesel Genset Market Competitive Landscape |

| 11.1 Australia Diesel Genset Market Revenues Share, By Company, 2022 |

| 11.2 Australia Diesel Genset Market Competitive Benchmarking, By Technical Parameters |

| 11.3 Australia Diesel Genset Market Competitive Benchmarking, By Operating Parameters |

| 12. Company Profiles |

| 12.1 Caterpillar Inc. |

| 12.2 Cummins Inc. |

| 12.3 Yanmar Co. Ltd. |

| 12.4 Deutz AG |

| 12.5 Scania AB |

| 12.6 MTU Onsite Energy Corp. |

| 12.7 Kubota Corporation |

| 12.8 Kohler Power Systems |

| 12.9 Atlas Copco AB |

| 12.10 Generac Power Systems, Inc |

| 12.11 Powerlite Australia Pty Ltd. |

| 13. Key Strategic Recommendation |

| 14. Disclaimer |

| List of Figures |

| 1. Australia Diesel Genset Market Revenues and Volume, 2019-2029F ($ Million, Units) |

| 2. Australia Diesel Genset Market Revenue Share, By kVA Ratings, 2022 & 2029F |

| 3. Australia Diesel Genset Market Volume Share, By kVA Ratings, 2022 & 2029F |

| 4. Australia Diesel Genset Market Revenue Share, By Verticals, 2022 & 2029F |

| 5. Australia Diesel Genset Market Volume Share, By Verticals, 2022 & 2029F |

| 6. Australia Diesel Genset Market Revenue Share, By Regions, 2022 & 2029F |

| 7. Australia Data Center Status, As of Q4 2022 |

| 8. Australia Renewable Energy Generation, 2016-21 (Twh) |

| 9. Australia Industry Gross Value Added For Selected Industries, 2021-22 ( Billion $). |

| 10. Australia Number of Mining Projects, By Commodities, 2020-22 ( Units). |

| 11. Australia International Tourism Forecast 2020- 2027F (Million) |

| 12. Australia Number of Upcoming Hotel Projects, 2022-25F |

| 13. Total overseas arrivals, Australia ('000) Jan 2023 – Jun 2023 |

| 14. Total overseas arrivals, Australia ('000) Jan 2023 – Jun 2023 |

| 15. Short-term visitor arrivals, Australia ('000) Jul 2021 – Jun 2023 |

| 16. Australia Office Space Under Construction (Square Meter) |

| 17. Australia Number of Under Construction Projects, 2023-2024 |

| 18. Australia Diesel Genset Market Opportunity Assessment, By kVA Ratings, 2029F |

| 19. Australia Diesel Genset Market Opportunity Assessment, By Verticals, 2029F |

| 20. Australia Diesel Genset Market Opportunity Assessment, By Regions, 2029F |

| 21. Australia Diesel Genset Market Revenue Share, By Companies, 2020 |

| 22. Mining, Commercial and Manufacturing Region in Queensland |

| List of Tables |

| 1. Australia upcoming major construction projects |

| 2. Australian Electricity Generation From Renewable Sources, 2016-2021 (Gigawatt/Hour) |

| 3. Australia Percentage of Renewable Energy Production, By States, 2021 (%) |

| 4. Australia Diesel Genset Market Revenues, By kVA Ratings, 2019-2029F ($ Million) |

| 5. Australia Diesel Genset Market Volume, By kVA Ratings, 2019-2029F (Units) |

| 6. Australia Diesel Genset Market Revenues, By Verticals, 2019-2029F ($ Million) |

| 7. Australia Diesel Genset Market Volume, By Verticals, 2019-2029F (Units) |

| 8. Australia Diesel Genset Market Revenues, By Regions, 2019-2029F ($ Million) |

| 9. Australia Upcoming Projects, 2023-2025 |

Market Forecast By KVA Ratings (Up To 75 KVA, 75.1 – 375 KVA, 375.1 - 750 KVA, 750.1 - 1000 KVA, Above 1000 KVA), By Verticals (Mining, Manufacturing, Hospitality, Service Sector, Residential, Telecom, Others), By Regions (New South Wales, Queensland, Victoria, Tasmania, Northern Territory, Southern Australia, Western Australia) And Competitive Landscape

| Product Code: ETC115039 | Publication Date: Sep 2021 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 76 | No. of Figures: 21 | No. of Tables: 8 |

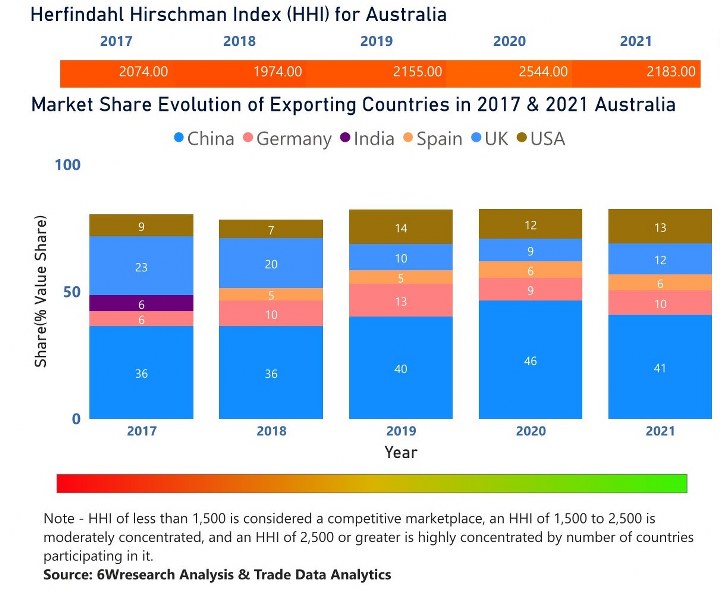

Australia Diesel Genset Market | Country-Wise Share and Competition Analysis

In the year 2021, China was the largest exporter in terms of value, followed by USA. It has registered a growth of 29.68% over the previous year. While USA registered a growth of 71.77% as compare to the previous year. In the year 2017 China was the largest exporter followed by UK. In term of Herfindahl Index, which measures the competitiveness of countries exporting, Australia has the Herfindahl index of 2074 in 2017 which signifies moderately concentrated also in 2021 it registered a Herfindahl index of 2183 which signifies moderately concentrated in the market.

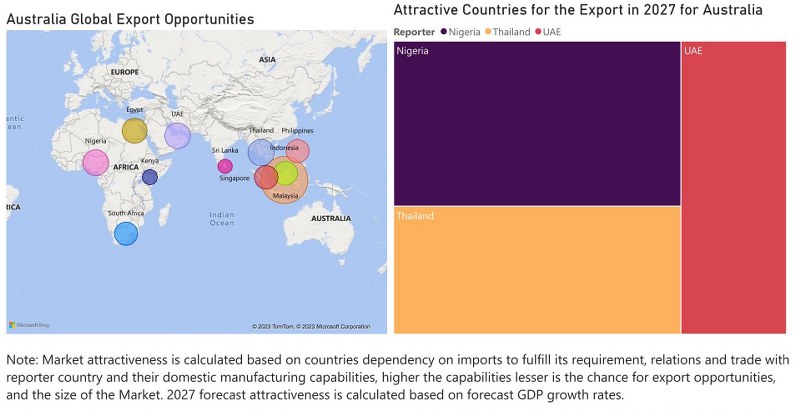

Australia Diesel Genset Market - Export Market Opportunities

The report thoroughly covers the Australia diesel genset market by kVA Ratings, verticals, and regions. The report provides an unbiased and detailed analysis of the ongoing trends, opportunities / high growth areas, market drivers, which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Australia Diesel Genset Market Synopsis

Australia diesel genset market revenues declined in 2020 due to the ongoing pandemic of COVID-19, which resulted in a suspension of economic activities, mining sector, and construction activity in the region due to lockdown across the country. This further led to the disruption in the supply chain and international trade. However, the upsurge in the construction activities, tourism sector, rising urbanization in different states of the country under the ambit of Australia vision 2030 and, growing investment to boost Australia’s diesel storage program, and projects such as MSQ Commercial, 555 Collins Street, West Side Place, Box Hill Town Square, 435 Bourke Street, among others launched by the Australian government would be the key catalysers for the overall growth of the diesel genset market in Australia.

According to 6Wresearch, Australia Diesel Genset Market size is projected to grow at CAGR of 3.2% during 2021-27. In Australia, the diesel genset market is anticipated to experience steady growth in the forecast period on account of developments in the mining and construction sector of the country. These sectors comprise a considerable share in the overall Australian GDP, thereby creating opportunities for diesel genset market in the coming years. Additionally, growing tourism industry and rising international tourist arrivals of Australia has led to increasing number of hotels, villas, commercial complexes, and restaurants, which have major application of diesel genset for standby application and thus their positive outlook would surge the demand for Australia diesel generator market in the coming years.

Market by KVA Rating Analysis

By kVA Rating more than above 1000 KVA accounted for most of the market revenue share due to their extensive usage in the manufacturing and mining sector. Additionally, the regional share of the diesel genset market is dominated by Queensland in Australia due to the presence of huge mining industry and construction sector.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2017 to 2020.

- Base Year: 2020

- Forecast Data until 2027.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report

- Australia Diesel Genset Market Overview

- Australia Diesel Genset Market Outlook

- Australia Diesel Genset Market Forecast

- Historical Data and Forecast of Australia Diesel Genset Market Revenues for the Period 2017-2027F

- Historical Data and Forecast of Market Revenues and Volume, By kVA Ratings, for the Period 2017-2027F

- Historical Data and Forecast of Market Revenues and Volume, By Verticals, for the Period 2017-2027F

- Historical Data and Forecast of Market Revenues, By Regions, for the Period 2017-2027F

- Market Drivers and Restraints

- Australia Diesel Genset Market Trends

- Industry Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment Australia Diesel Genset Market Share, By Companies

- Australia Diesel Genset Market COVID-19 Impact Analysis

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

- By kVA Ratings

- Up to 75 kVA

- 75.1 – 375 kVA

- 375.1 - 750 kVA

- 750.1 - 1000 kVA

- Above 1000 kVA

- By Verticals

- Mining

- Manufacturing

- Hospitality

- Service Sector

- Residential

- Telecom

- Others

- By Regions

- New South Wales

- Queensland

- Victoria

- Tasmania

- Northern Territory

- Southern Australia

- Western Australia

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Tajikistan Thermal Camera Market (2025-2031) | Trends, Size, Growth, Share, Industry, Companies, Value, Analysis, Revenue, Forecast & Outlook

- Singapore Professional AV Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- Saudi Arabia Genset Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- India OOH Advertising Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- Vietnam Twisted Pair Cables Market (2024-2030) | Size & Revenue, Forecast, Share, Companies, Competitive Landscape, Analysis, Trends, Value, Segmentation, Outlook, Industry, Growth

- South Africa B2B Cleaning Market (2025-2031) | Size & Revenue, Forecast, Share, Companies, Competitive Landscape, Analysis, Trends, Value, Segmentation, Outlook, Industry, Growth

- Mexico Dispersion Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- United States Video Conferencing Market (2025-2031) | Outlook, Industry, Size, Revenue, Share, Trends, Forecast, Growth, Companies, Analysis & Value

- Australia Electric Motor Market (2025-2031) | Trends, Share, Size, Value, Revenue, Industry, Growth, Analysis, Segmentation & Outlook

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- India's Printer Market Faces 20.7% Decline in Q4 2023: Epson and HP Lead Amidst Downturn

- India's Camera Market Sees 8.9% Decline in Q4 2023; Canon Leads with 38.4% Share

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- The future of gaming industry in the Philippines