Australia Elevator and Escalator Market (2023-2029) | Share, Size, Analysis, Trends, Revenue, Growth, Value, Outlook, Segmentation & COVID-19 IMPACT

Market Forecast By Product Types (Elevator, Escalator), By Service Type (Maintenance, Modernization), By Regions (East Australia (Victoria, New South Wales, Queensland, Tasmania), West Australia, South Australia, North Australia), And Competitive Landscape

| Product Code: ETC005695 | Publication Date: Sep 2020 | Updated Date: May 2023 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 107 | No. of Figures: 45 | No. of Tables: 27 | |

Australia Elevator And Escalator Market | Country-Wise Share and Competition Analysis

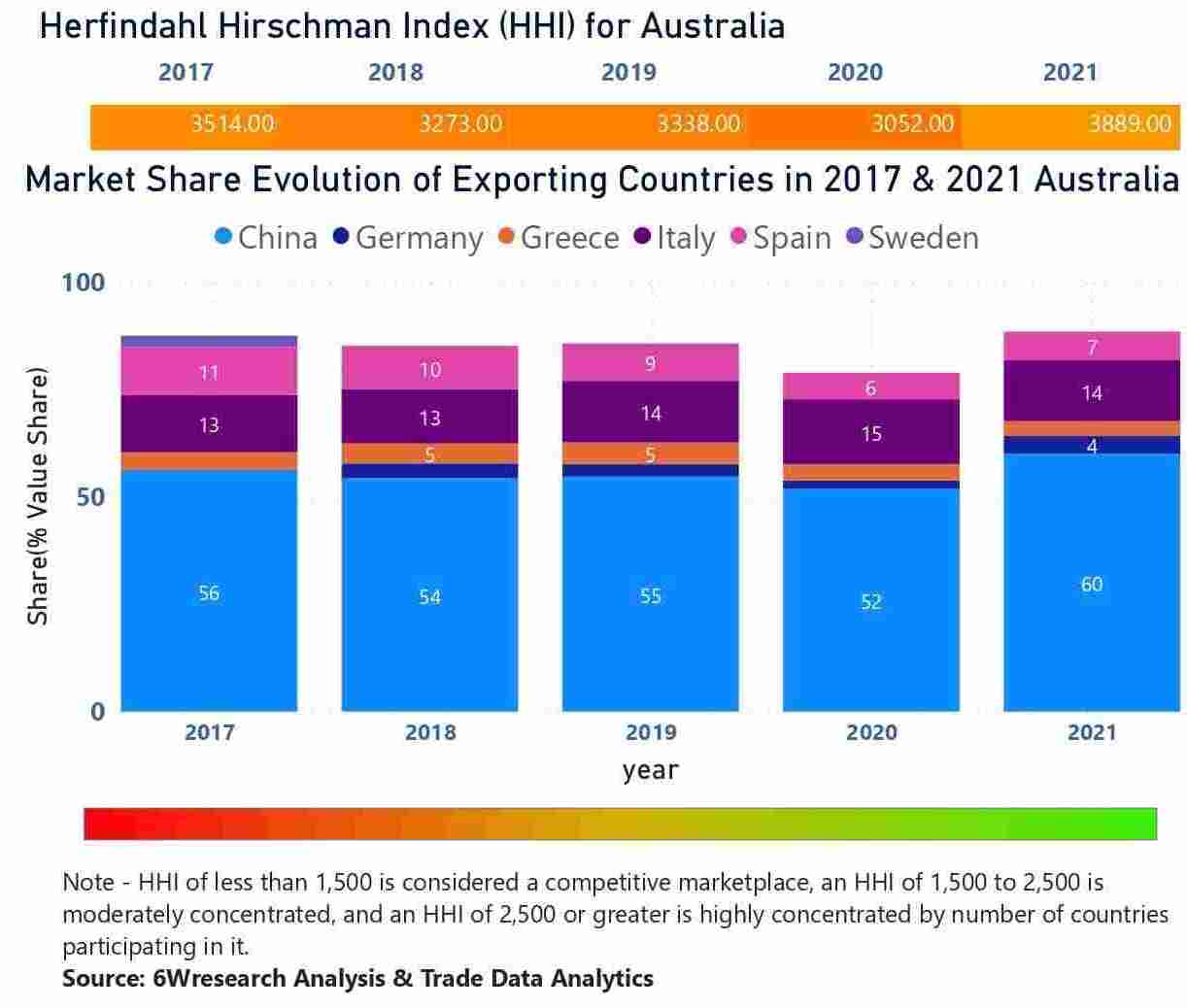

In the year 2021, China was the largest exporter in terms of value, followed by Italy. It has registered a growth of 29.53% over the previous year. While Italy registered a growth of 5.56% as compared to the previous year. In the year 2017, China was the largest exporter followed by Italy. In terms of the Herfindahl Index, which measures the competitiveness of countries exporting, Australia has a Herfindahl index of 3514 in 2017 which signifies high concentration also in 2021 it registered a Herfindahl index of 3889 which signifies high concentration in the market.

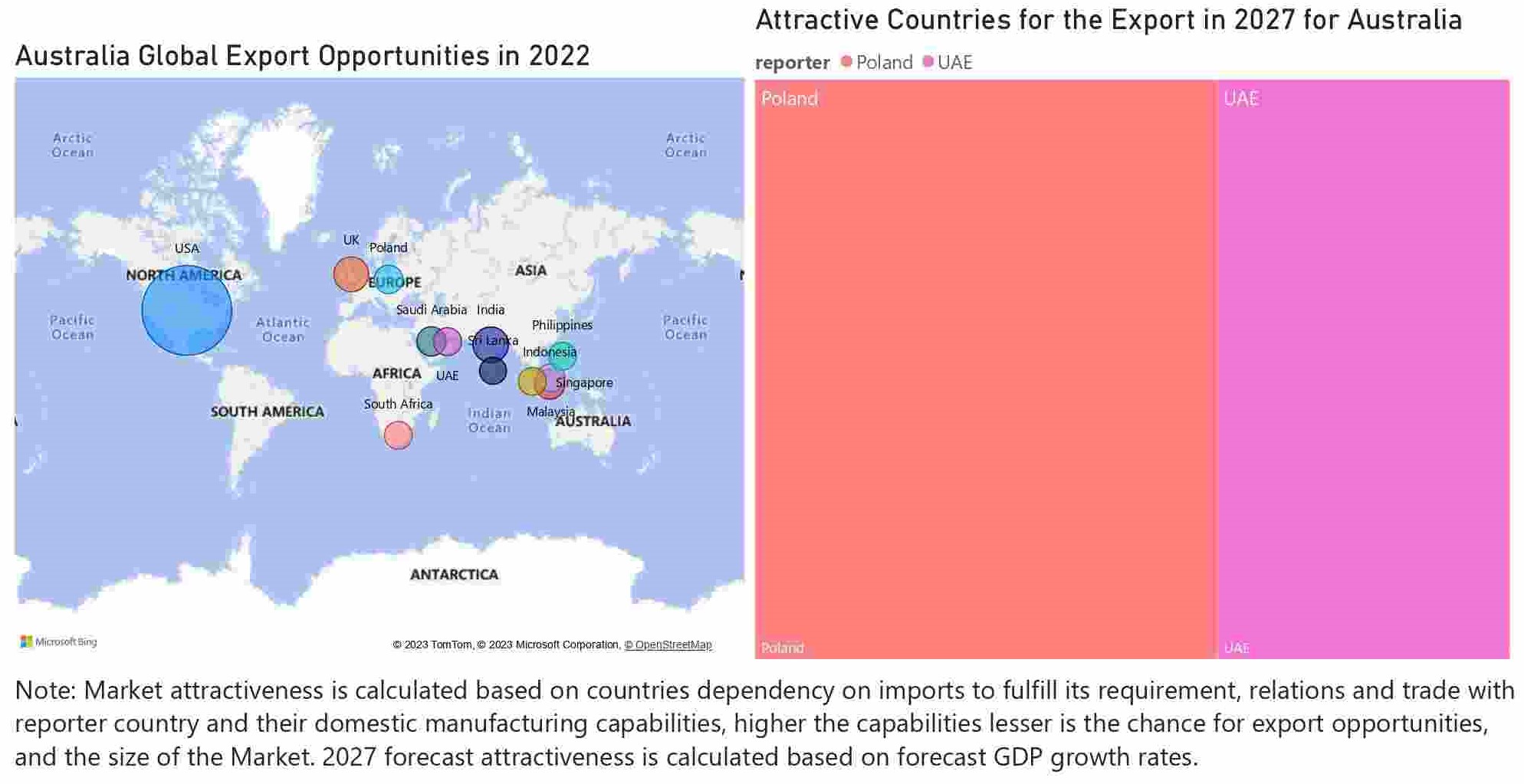

![Australia Elevator And Escalator Market - Country Wise Share and Competition Analysis]() Australia Elevator And Escalator Market - Export Market Opportunities

Australia Elevator And Escalator Market - Export Market Opportunities

Australia Elevator and Escalator Market Synopsis

The Australia Elevator and Escalator Market during the COVID-19 pandemic in 2020 got negatively affected as there was a decline in forward bookings across all construction industry sectors caused by border closures, lockdowns and supply chain disruptions due to Australia’s higher dependency on importing building materials and equipment from overseas, particularly China. However, it was the combination of government infrastructure spending and scheme such as the homebuilder program under which a grant of $25,000 followed by $15,000 had been provided for building a home, which pushed the overall construction market to regain its momentum after the pandemic.

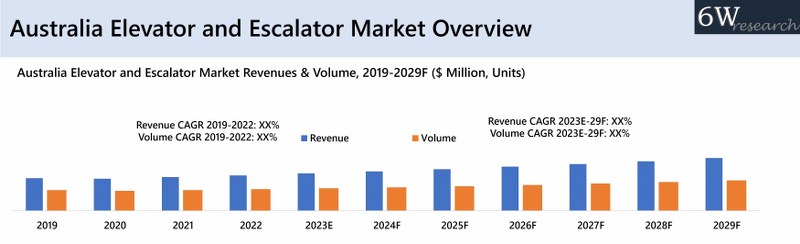

According to 6Wresearch, The Australia Elevator and Escalator Market size is projected to grow at a CAGR of 6.0% during 2023-2029. The Australia Elevator and Escalator Industry is expected to show significant growth over the coming years on account of the growing construction, transportation and infrastructure sector. Also, commercial building demand is proving to be sustainable, along with the increasing expenditure on social and economic infrastructure. Moreover, the positive demand outlook along with traditionally higher yields for prime commercial properties in Sydney and Melbourne which is around 8%, is expected to attract more investors to invest in commercial buildings and properties hence furthering the growth in the number of new installation of elevators and escalators across tier one and tier two cities across Australia.

According to 6Wresearch, The Australia Elevator and Escalator Market size is projected to grow at a CAGR of 6.0% during 2023-2029. The Australia Elevator and Escalator Industry is expected to show significant growth over the coming years on account of the growing construction, transportation and infrastructure sector. Also, commercial building demand is proving to be sustainable, along with the increasing expenditure on social and economic infrastructure. Moreover, the positive demand outlook along with traditionally higher yields for prime commercial properties in Sydney and Melbourne which is around 8%, is expected to attract more investors to invest in commercial buildings and properties hence furthering the growth in the number of new installation of elevators and escalators across tier one and tier two cities across Australia.

As per Australian Construction Industry Forum (ACIF), Infrastructure Construction has continued to grow steadily, by 3.8% in 2022-23, which is mainly due to infrastructure development programs pursued by the government and its plan as per budget 2022-23 to make an infrastructure investment of $4.4 billion in over four years period till 2025-26 to sustain a smooth construction activity in public transportation to support the transition to a more sustainable energy future in coming years, which in turn would propel the demand for new installations and modernization of already installed elevators and escalators in Australia.

![Australia Elevator and Escalator Market Revenue Share]() Market by Product Types

Market by Product Types

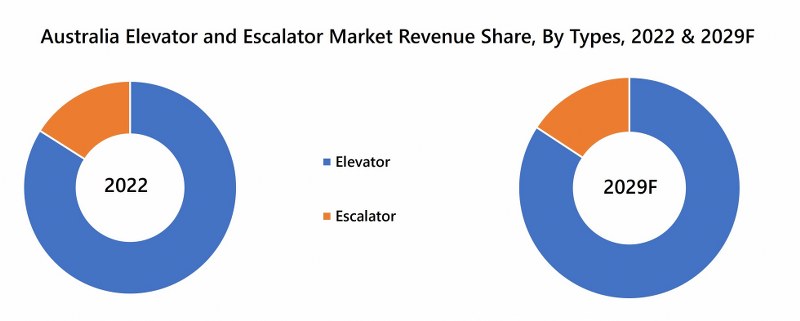

Elevator acquired the largest revenue and volume share in the 2022 owing to rising infrastructure projects and plans to further expand and develop cities under Plan Melbourne, Sydney’s Six Cities Vision, International Airport in Western Sydney would further boost the demand for elevators in the long term. Elevators will continue to propel in the Elevator and Escalator Market in Australia.

Market by Service Type

Maintenance segment accounted for the largest share in the market and this segment will continue to retain its dominance in the future owing to the presence of large installed based.

Market by Regions

Eastern region acquired the largest market share in Australia for elevator and escalator market in 2022 and same trends are expected in the future on account increasing investment in the commercial and logistics & industrial sector in the region.

![Australia Escalator & Elevator Market Opportunity Assessment]() Key Attractiveness of the Report

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 11 Years Market Numbers.

- Historical Data Starting from 2019 to 2022.

- Base Year: 2022

- Forecast Data until 2029.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Australia Elevator and Escalator Market Overview

- Australia Elevator and Escalator Market Outlook

- Australia Elevator and Escalator Market Forecast

- Historical Data and Forecast of Australia Elevator and Escalator Market Revenues and Volume, for the Period 2019-2029F

- Historical Data and Forecast of Australia Elevator and Escalator Market Revenues, By Product Types, for the Period 2019-2029F

- Historical Data and Forecast of Australia Elevator and Escalator Market Revenues, By Services, for the Period 2019-2029F

- Historical Data and Forecast of Australia Elevator and Escalator Market Revenues, By Regions, for the Period 2019-2029F

- Australia Elevator and Escalator Market Revenue Share, By Market Players

- COVID-19 Impact on Australia Elevator and Escalator Market

- Australia Elevator and Escalator Market Drivers and Restraints

- Australia Elevator and Escalator Market Trends

- Australia Elevator and Escalator Porters Five Forces

- Australia Elevator and Escalator Opportunity Assessment, By Product Types, 2029F

- Australia Elevator and Escalator Opportunity Assessment, By Services, 2029F

- Australia Elevator and Escalator Opportunity Assessment, By Regions, 2029F

- Market Player’s Revenue Shares

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Product Types

- Elevator

- Escalator

By Service Type

- Maintenance

- Modernization

By Regions

- East Australia (Victoria, New South Wales, Queensland, Tasmania)

- West Australia

- South Australia

- North Australia

Australia Elevator and Escalator Market: FAQs

|

1. Executive Summary |

|

2. Introduction |

|

2.1. Report Description |

|

2.2. Key Highlights of the Report |

|

2.3. Market Scope & Segmentation |

|

2.4. Research Methodology |

|

2.5. Assumptions |

|

3. Australia Elevator & Escalator Market Overview |

|

4. Impact Analysis of COVID-19 on Australia Elevator and Escalator Markets |

|

5. Australia Elevator & Escalator Market Dynamics |

|

5.1. Impact Analysis |

|

5.2. Market Drivers |

|

5.3. Market Restraints |

|

6. Australia Elevator and Escalator Market Trends & Evolution |

|

7. Australia Elevator and Escalator Market Overview |

|

7.1. Australia Elevator & Escalator Market Revenue & Volume Share, By Product Types (2022 & 2029F) |

|

7.2. Australia Elevator & Escalator Market Revenues & Volumes, By Product Types (2019-2029F) |

|

7.2.1 Australia Elevator & Escalator Market Revenues & Volumes, By Elevator (2019-2029F) |

|

7.2.2 Australia Elevator & Escalator Market Revenues & Volumes, By Escalator (2019-2029F) |

|

7.3. Australia Elevator and Escalator Market Revenue Share, By Region (2022 & 2029F) |

|

7.3.1 Australia Elevator and Escalator Market Revenues, By East (2019-2029F) |

|

7.3.2 Australia Elevator and Escalator Market Revenues, By West (2019-2029F) |

|

7.3.3 Australia Elevator and Escalator Market Revenues, By South (2019-2029F) |

|

7.3.4 Australia Elevator and Escalator Market Revenues, By North (2019-2029F) |

|

7.4. Australia Elevator and Escalator Market Revenue Share, By End Users (2022 & 2029F) |

|

7.4.1 Australia Elevator and Escalator Market Revenues, By Residential (2019-2029F) |

|

7.4.2 Australia Elevator and Escalator Market Revenues, By Commercial (2019-2029F) |

|

7.4.3 Australia Elevator and Escalator Market Revenues, By Infrastructure (2019-2029F) |

|

8. Australia Elevator Market Overview |

|

8.1. Australia New Installed Elevator Market Revenue Share, By Function (2022 & 2029F) |

|

8.1.1 Australia New Installation Elevator Market Revenues, By Passenger (2019-2029F) |

|

8.1.2 Australia New Installation Elevator Market Revenues, By Cargo (2019-2029F) |

|

8.1.3 Australia New Installation Elevator Market Revenues, By Home (2019-2029F) |

|

8.2. Australia New Installed Elevator Market Volume Share, By Function (2022 & 2029F) |

|

8.2.1 Australia New Installation Elevator Market Volumes, By Passenger (2019-2029F) |

|

8.2.2 Australia New Installation Elevator Market Volumes, By Cargo (2019-2029F) |

|

8.2.3 Australia New Installation Elevator Market Volumes, By Home (2019-2029F) |

|

8.3. Australia New Installed Elevator Market Revenue Share, By Technology (2022 & 2029F) |

|

8.3.1 Australia New Installation Elevator Market Revenues, By Machine Room Less (2019-2029F) |

|

8.3.2 Australia New Installation Elevator Market Revenues, By Machine Room Above (2019-2029F) |

|

8.4. Australia New Installed Elevator Market Volume Share, By Technology (2022 & 2029F) |

|

8.4.1 Australia New Installation Elevator Market Volumes, By Machine Room Less(2019-2029F) |

|

8.4.2 Australia New Installation Elevator Market Volumes, By Machine Room Above (2019-2029F) |

|

8.5. Australia New Installed Elevator Market Revenue Share, By Rise (2022 & 2029F) |

|

8.5.1 Australia New Installation Elevator Market Revenues, By Low Rise (2019-2029F) |

|

8.5.2 Australia New Installation Elevator Market Revenues, By Mid Rise (2019-2029F) |

|

8.5.3 Australia New Installation Elevator Market Revenues, By High Rise (2019-2029F) |

|

8.6. Australia New Installed Elevator Market Volume Share, By Rise (2022 & 2029F) |

|

8.6.1 Australia New Installation Elevator Market Volumes, By Low Rise (2019-2029F) |

|

8.6.2 Australia New Installation Elevator Market Volumes, By Mid Rise (2019-2029F) |

|

8.6.3 Australia New Installation Elevator Market Volumes, By High Rise (2019-2029F) |

|

8.7. Australia New Installed Elevator Market Revenue Share, By End Users (2022 & 2029F) |

|

8.7.1 Australia New Installation Elevator Market Revenues, By Residential (2019-2029F) |

|

8.7.2 Australia New Installation Elevator Market Revenues, By Commercial (2019-2029F) |

|

8.7.3 Australia New Installation Elevator Market Revenues, By Infrastructure (2019-2029F) |

|

8.8. Australia New Installed Elevator Market Volume Share, By End Users (2022 & 2029F) |

|

8.8.1 Australia New Installation Elevator Market Volumes, By Residential (2019-2029F) |

|

8.8.2 Australia New Installation Elevator Market Volumes, By Commercial (2019-2029F) |

|

8.8.3 Australia New Installation Elevator Market Volumes, By Infrastructure (2019-2029F) |

|

8.9. Australia New Installed Elevator Market Revenue Share, By Speed (2022 & 2029F) |

|

8.9.1 Australia New Installation Elevator Market Revenues, By Up to 1m/sec (2019-2029F) |

|

8.9.2 Australia New Installation Elevator Market Revenues, By 1.1-2m/sec(2019-2029F) |

|

8.9.3 Australia New Installation Elevator Market Revenues, By Above 2m/sec (2019-2029F) |

|

8.10. Australia New Installed Elevator Market Volume Share, By Speed (2022 & 2029F) |

|

8.10.1 Australia New Installation Elevator Market Volumes, By Up to 1m/sec (2019-2029F) |

|

8.10.2 Australia New Installation Elevator Market Volumes, By 1.1-2m/sec (2019-2029F) |

|

8.10.3 Australia New Installation Elevator Market Volumes, By Above 2m/sec (2019-2029F) |

|

8.11. Australia New Installed Elevator Market Revenue Share, By Capacity (2022 & 2029F) |

|

8.11.1 Australia New Installation Elevator Market Revenues, By Up to 630 kg (2019-2029F) |

|

8.11.2 Australia New Installation Elevator Market Revenues, By 631-1000 kg (2019-2029F) |

|

8.11.3 Australia New Installation Elevator Market Revenues, By 1001-1600 kg (2019-2029F) |

|

8.11.4 Australia New Installation Elevator Market Revenues, By 1601-2000 kg (2019-2029F) |

|

8.11.5 Australia New Installation Elevator Market Revenues, By Above 2000 kg (2019-2029F) |

|

8.12. Australia New Installed Elevator Market Volume Share, By Capacity (2022 & 2029F) |

|

8.12.1 Australia New Installation Elevator Market Volumes, By Up to 630 kg (2019-2029F) |

|

8.12.2 Australia New Installation Elevator Market Volumes, By 631-1000 kg (2019-2029F) |

|

8.12.3 Australia New Installation Elevator Market Volumes, By 1001-1600 kg (2019-2029F) |

|

8.12.4 Australia New Installation Elevator Market Volumes, By 1601-2000 kg (2019-2029F) |

|

8.12.5 Australia New Installation Elevator Market Volumes, By Above 2000 kg (2019-2029F) |

|

8.13. Australia New Installed Elevator Market Revenue Share, By System (2022 & 2029F) |

|

8.13.1 Australia New Installation Elevator Market Revenues, By Traction (2019-2029F) |

|

8.13.2 Australia New Installation Elevator Market Revenues, By Hydraulic (2019-2029F) |

|

8.14. Australia New Installed Elevator Market Volume Share, By System (2022 & 2029F) |

|

8.14.1 Australia New Installation Elevator Market Volumes, By Traction (2019-2029F) |

|

8.14.2 Australia New Installation Elevator Market Volumes, By Hydraulic (2019-2029F) |

|

8.15. Australia New Installed Elevator Market Volume Share, By Prices (2022 & 2029F) |

|

8.15.1 Australia New Installation Elevator Market Volumes, By Low End (2019-2029F) |

|

8.15.2 Australia New Installation Elevator Market Volumes, By Medium End (2019-2029F) |

|

8.15.2 Australia New Installation Elevator Market Volumes, By High End (2019-2029F) |

|

9. Australia Escalator Market Overview |

|

9.1. Australia New Installed Elevator Market Revenue Share, By Types (2022 & 2029F) |

|

9.1.1 Australia New Installation Elevator Market Revenues, By Moving Stairway (2019-2029F) |

|

9.1.2 Australia New Installation Elevator Market Revenues, By Moving Walkway (2019-2029F) |

|

9.2. Australia New Installed Elevator Market Volume Share, By Function (2022 & 2029F) |

|

9.2.1 Australia New Installation Elevator Market Volumes, By Moving Stairway (2019-2029F) |

|

9.2.2 Australia New Installation Elevator Market Volumes, By Moving Walkway (2019-2029F) |

|

10. Australia Elevator Service Market Overview |

|

10.1. Australia Elevator Service Market Revenue and Volumes (2019-2029F) |

|

10.1.1 Australia Elevator Service Market Revenues and Volumes, By Modernization (2019-2029F) |

|

10.1.2 Australia Elevator Service Market Revenues and Volumes Market, By Maintenance (2019-2029F) |

|

11. Australia Escalator Service Market Overview |

|

11.1. Australia Escalator Service Market Revenue and Volumes (2019-2029F) |

|

11.1.1 Australia Escalator Service Market Revenues and Volumes, By Modernization (2019-2029F) |

|

11.1.2 Australia Escalator Service Market Revenues and Volumes Market, By Maintenance (2019-2029F) |

|

12. Australia Elevator & Escalator Market Key Performance Indicators |

|

13. Australia Elevator & Escalator Market Opportunity Assesment |

|

13.1 Australia Elevator and Escalator Market Opportunity Assessment, By Product Type (2029F) |

|

13.2 Australia Elevator and Escalator Market Opportunity Assessment, By Service Type (2029F) |

|

13.3 Australia Elevator and Escalator Market Opportunity Assessment, By Regions (2028F) |

|

14. Australia Elevator and Escalator Market Competitive Landscape |

|

14.1 Australia Elevator and Escalator Market Revenue Share and Revenues, By Companies (2019-2022) |

|

14.2 Australia Elevator and Escalator Market Competitive Benchmarking, By Technical Parameter |

|

14.3 Australia Elevator and Escalator Market Competitive Benchmarking, By Operating Parameter |

|

15. Australia Elevator and Escalator Market – Company Profile |

|

15.1 Otis Worldwide Corporation |

|

15.2 Schindler Holding Ltd. |

|

15.3 KONE Corporation |

|

15.4 Octagon Lifts Pty Ltd. |

|

15.5 TK Elevator GmbH |

|

15.6 Mitsubishi Electric Corporation |

|

15.1 Kleemann Hellas S.A |

|

15.2 Shotton Group Pty Ltd. |

|

15.3 FUJITEC Co. Ltd. |

|

15.4 Hitachi Ltd |

|

16. Key Strategic Recommendations |

|

17. Disclaimer |

|

List of Figures |

|

1. Australia Elevator and Escalator Market Revenues & Volume, 2019-2029F ($ Million, Units) |

|

2. Australia Number of Upcoming Hotel Projects, 2022-25F |

|

3. Australia Percentage of Technical Occupations in Shortage and number of Technical Occupations in Shortage, 2021-22 |

|

4. Australia Percentage Of Machine Operator and Driver Labour Shortage and Number of Machine Operator and Driver Occupation Shortage, 2021-22 |

|

5. Australia Elevator and Escalator Market Revenue Share, By Types, 2022 & 2029F |

|

6. Australia Elevator and Escalator Market Volume Share, By Types, 2022 & 2029F |

|

7. Australia Elevator & Escalator Market Revenue Share, By Region 2022 & 2029F |

|

8. Australia Elevator & Escalator Market Revenue Share, By End User 2022 & 2029F |

|

9. Australia New Installation Elevator Market Revenue Share, By Function, 2022 & 2029F |

|

10. Australia New Installation Elevator Market Volume Share, By Function, 2022 & 2029F |

|

11. Australia New Installation Elevator Market Revenue Share, By Technology, 2022 & 2029F |

|

12. Australia New Installation Elevator Market Volume Share, By Technology, 2022 & 2029F |

|

13. Australia New Installation Elevator Market Revenue Share, By Rise, 2022 & 2029F |

|

14. Australia New Installation Elevator Market Volume Share, By Rise, 2022 & 2029F |

|

15. Australia New Installation Elevator Market Revenue Share, By End User, 2022 & 2029F |

|

16. Australia New Installation Elevator Market Volume Share, By End User, 2022 & 2029F |

|

17. Australia New installation Elevator Market Revenue Share, By Speed, 2022 & 2029F |

|

18. Australia New installation Elevator Market Volume Share, By Speed, 2022 & 2029F |

|

19: Australia New Installation Elevator Market Revenue Share, By Capacity, 2022 & 2029F |

|

20: Australia New Installation Elevator Market Volume Share, By Capacity, 2022 & 2029F |

|

21. Australia New Installation Elevator Market Revenue Share, By System Type, 2022 & 2029F |

|

22. Australia New Installation Elevator Market Volume Share, By System Type, 2022 & 2029F |

|

23: Australia Maintenance Elevator Market Volume Share, By Prices, 2022 & 2029F |

|

24. Australia Escalator Market Revenue Share, By Type, 2022 & 2029F |

|

25. Australia Escalator Market Volume Share, By Type, 2022 & 2029F |

|

26. Australia New Installation Escalator Market Revenue Share, By End User, 2022 & 2029F |

|

27. Australia New Installation Escalator Market Volume Share, By End User, 2022 & 2029F |

|

28. Australia Elevator Service Market Revenues & Volume, 2019-2029F ($ Million, Units) |

|

28. Australia Elevator Service Market Revenues & Volume, 2019-2029F ($ Million, Units) |

|

29. Australia Elevator Service Market Revenue and Volume Share, By Service Type 2022 & 2029F |

|

30. Australia Elevator Services Market Revenues & Volume, By Maintenance, 2019-2029F ($ Million, Units) |

|

31. Australia Elevator Services Market Revenues & Volume, By Modernization, 2019-2029F ($ Million, units) |

|

32. Australia Escalator Service Market Revenues & Volume, 2019-2029F ($ Million, Units) |

|

33. Australia Escalator Service Market Revenue and Volume Share, By Service Type 2022 & 2029F |

|

34. Australia Escalator Services Market Revenues & Volume, By Maintenance, 2019-2029F ($ Million, Units) |

|

35. Australia Escalator Services Market Revenues & Volume, By Modernization, 2019-2029F ($ Million, units) |

|

36. Australia Office Space Under Construction (Square Meter) |

|

37. Australia Number of Apartments Under Construction by Cities, 2022 (%) |

|

38. Australia Number of Apartments Under Different Phases, 2022 |

|

39. Australia Number of Retail Under Construction Projects, 2023-2024 |

|

40. Australia Escalator & Elevator Market Opportunity Assessment, By Product Type, 2029F |

|

41. Australia Escalator & Elevator Market Opportunity Assessment, By Product Type, 2029F |

|

42. Australia Escalator & Elevator Market Opportunity Assessment, By Product Type, 2029F |

|

43: Australia Escalator & Elevator Market, Company Share, 2019 & 2022 |

|

44. Value Of Construction Work Done, ($ Million) |

|

45. Dwellings Approved, By States And Territories, (Seasonally Adjusted), January 2023 (Units) |

|

List of Tables |

|

1. Australia upcoming major construction projects |

|

2. Australia Elevator and Escalator Market Revenues, By Types, 2018-2028F ($ Million) |

|

3. Australia Elevator and Escalator Market Volume, By Types, 2018-2028F (Units) |

|

4. Australia Elevator & Escalator Market Revenues, By Region 2019-2029F ($ Million) |

|

5. Australia Elevator & Escalator Market Revenues, By End User 2019-2029F ($ Million) |

|

6. Australia New Installation Elevator Market Revenues, By Function, 2019-2029F ($ Million) |

|

7. Australia New Installation Elevator Market Volume, By Function, 2019-2029F (Units) |

|

8. Australia New Installation Elevator Market Revenues, By Technology, 2019-2029F ($ Million) |

|

9. Australia New Installation Elevator Market Volume, By Technology, 2019-2029F (Units) |

|

10. Australia New Installation Elevator Market Revenues, By Rise 2019-2029F ($ Million) |

|

11. Australia New Installation Elevator Market Volume, By Rise 2019-2029F (Units) |

|

12. Australia New Installation Elevator Market Revenues, By End User 2019-2029F ($ Million) |

|

13. Australia New Installation Elevator Market Volume, By End User, 2019-2029F (Units) |

|

14. Australia New Installation Elevator Market Revenues, By Speed, 2019-2029F ($ Million) |

|

15. Australia New Installation Elevator Market Volume, By Speed, 2019-2029F (Units) |

|

16. Australia New Installation Elevator Market Revenues, By Capacity, 2019-2029F ($ Million) |

|

17. Australia New Installation Elevator Market Volume, By Capacity, 2019-2029F (Units) |

|

18. Australia New Installation Elevator Market Revenues, By System Type, 2019-2029F ($ Million) |

|

19. Australia New Installation Elevator Market Volume, By System Type, 2019-2029F (Units) |

|

20. Australia Maintenance Elevator Market Volume, By Prices, 2019-2029F (Units) |

|

21. Australia Escalator Market Revenues, By Type, 2019-2029F ($ Million) |

|

22. Australia Escalator Market Volume, By Type, 2019-2029F (Units) |

|

23. Australia New Installation Escalator Market Revenues, By End User, 2019-2029F ($ Million) |

|

24. Australia New Installation Escalator Market Volume, By End User, 2019-2029F (Units) |

|

25. Australia Upcoming Retail Projects, 2023-2025 |

|

26. Australia Elevator and Escalator Market Revenues , By Companies, 20219-2022Australia Elevator and Escalator Market Revenues , By Companies, 20219-20 |

|

27. Australia Dwelling Type, By State And Territory, 2021, (In Units) |

Market Forecast By Types (Elevator, Escalator, Moving Walkways), By Services (Maintenance & Repair, New Installation, Modernization), By End-User (Residential, Commercial, Public) And Competitive Landscape

| Product Code: ETC005695 | Publication Date: Sep 2020 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

Australia Elevator And Escalator Market is projected to grow over the coming years. Australia Elevator And Escalator Market report is a part of our periodical regional publication Asia Pacific Elevator And Escalator Market outlook report. 6W tracks elevator and escalator market for over 60 countries with individual country-wise market opportunity assessment and publishes with the report titled Global Elevator And Escalator Market outlook report annually.

Australia Elevator and Escalator Market report comprehensively covers the market by Types, Services and End Users. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities, high growth areas, and market drivers, which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Australia Elevator and Escalator Market Synopsis

Australia Elevator and Escalator Market is expected to gain momentum during the forthcoming years owing to the increasing development in residential sector. The growing infrastructure development along with the establishment of high rise building backed by rising urbanization beholds the Australia Elevator and Escalator Market Growth. Moreover, the rising disposable income coupled with improvement in standard of living led to the substantial increase in the number of hotels, shopping malls and multicomplex adds to the Australia Elevator and Escalator Market Share.

According to 6Wresearch, the Australia Elevator And Escalator Market size is expected to record growth during 2020-2026. The establishment of various development project and increasing penetration by the government in order to strengthen the infrastructure sector beholds the growth of the market. Moreover, upsurge in the ageing population backed by rising need for elevators in residential sector contributes to the Australia Elevator and Escalator Market Revenue. Amid the outbreak of coronavirus pandemic and health emergency led to the decline in the growth of the market owing to the disruption in supply chain. However, the market is likely to re-gain its growth during the forecast period.

Market Analysis by Type

Based on type, the elevator segment is expected to dominate the market during the upcoming years owing to the comprehensive safety measures associated with it.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2016 to 2019.

- Base Year: 2019

- Forecast Data until 2026.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Australia Elevator and Escalator Market Outlook

- Market Size of Australia Elevator and Escalator Market, 2019

- Forecast of Australia Elevator and Escalator Market, 2026

- Historical Data and Forecast of Australia Elevator and Escalator Revenues & Volume for the Period 2016 - 2026

- Australia Elevator and Escalator Market Trend Evolution

- Australia Elevator and Escalator Market Drivers and Challenges

- Australia Elevator and Escalator Price Trends

- Australia Elevator and Escalator Porter's Five Forces

- Australia Elevator and Escalator Industry Life Cycle

- Historical Data and Forecast of Australia Elevator and Escalator Market Revenues & Volume By Types for the Period 2016 - 2026

- Historical Data and Forecast of Australia Elevator and Escalator Market Revenues & Volume By Elevator for the Period 2016 - 2026

- Historical Data and Forecast of Australia Elevator and Escalator Market Revenues & Volume By Escalator for the Period 2016 - 2026

- Historical Data and Forecast of Australia Elevator and Escalator Market Revenues & Volume By Moving Walkways for the Period 2016 - 2026

- Historical Data and Forecast of Australia Elevator and Escalator Market Revenues & Volume By Services for the Period 2016 - 2026

- Historical Data and Forecast of Australia Elevator and Escalator Market Revenues & Volume By Maintenance & Repair for the Period 2016 - 2026

- Historical Data and Forecast of Australia Elevator and Escalator Market Revenues & Volume By New Installation for the Period 2016 - 2026

- Historical Data and Forecast of Australia Elevator and Escalator Market Revenues & Volume By Modernization for the Period 2016 - 2026

- Historical Data and Forecast of Australia Elevator and Escalator Market Revenues & Volume By End-User for the Period 2016 - 2026

- Historical Data and Forecast of Australia Elevator and Escalator Market Revenues & Volume By Residential for the Period 2016 - 2026

- Historical Data and Forecast of Australia Elevator and Escalator Market Revenues & Volume By Commercial for the Period 2016 - 2026

- Historical Data and Forecast of Australia Elevator and Escalator Market Revenues & Volume By Public for the Period 2016 - 2026

- Australia Elevator and Escalator Import Export Trade Statistics

- Market Opportunity Assessment By Types

- Market Opportunity Assessment By Services

- Market Opportunity Assessment By End-User

- Australia Elevator and Escalator Top Companies Market Share

- Australia Elevator and Escalator Competitive Benchmarking By Technical and Operational Parameters

- Australia Elevator and Escalator Company Profiles

- Australia Elevator and Escalator Key Strategic Recommendations

Market Segmentation:

The report provides a detailed analysis of the following market segments:

- By Types

- Elevator

- Escalator

- Moving Walkways

- By Services

- Maintenance & Repair

- New Installation

- Modernization

- By End-User

- Residential

- Commercial

- Public

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero