Australia Liquid Nitrogen Market (2025-2031) | Analysis, Forecast, Share, Industry, Value, Revenue, Growth, Size, Trends, COVID-19 IMPACT, Outlook & Companies

| Product Code: ETC044835 | Publication Date: Jan 2021 | Updated Date: Apr 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

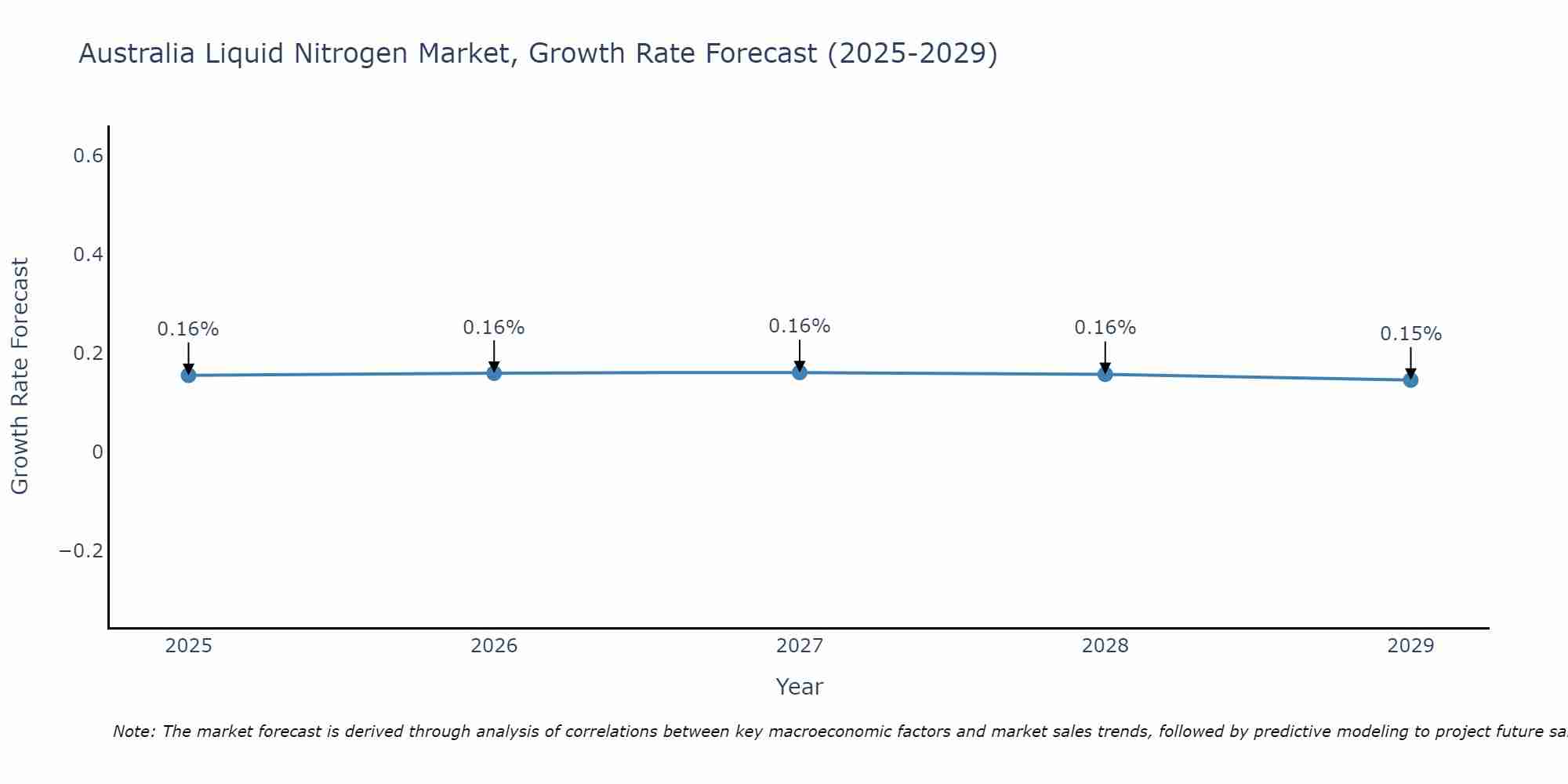

Australia Liquid Nitrogen Market Size Growth Rate

The Australia Liquid Nitrogen Market is projected to witness mixed growth rate patterns during 2025 to 2029. Starting at 0.16% in 2025, the market peaks at 0.16% in 2027, and settles at 0.15% by 2029.

Australia Liquid Nitrogen Market Overview

Liquid nitrogen is widely used in Australia across various industries including healthcare, food processing, electronics, and manufacturing, offering inert cooling and freezing solutions for preservation, processing, and cryogenic applications. The market is driven by factors such as increasing demand for cryopreservation and cryosurgery techniques, advancements in cryogenic storage and transportation technologies, and growing applications in semiconductor manufacturing and metal fabrication. With ongoing research and development activities focused on expanding the use of liquid nitrogen in emerging fields such as biotechnology, nanotechnology, and aerospace, the market in Australia is poised for further growth and innovation.

Drivers of the market

The liquid nitrogen market in Australia is influenced by factors such as industrial gas applications, technological advancements, and the growing demand for cryogenic storage and transportation solutions. Liquid nitrogen is widely used across various industries, including healthcare, food and beverage, electronics, and manufacturing, for applications such as cryopreservation, cryosurgery, food freezing, and inerting. As industries seek to improve product quality, extend shelf life, and enhance process efficiency, there is a growing reliance on liquid nitrogen as a versatile and cost-effective cryogenic fluid. Moreover, the expanding healthcare sector, including medical research, biotechnology, and pharmaceuticals, drives the demand for liquid nitrogen for cryogenic storage of biological samples and medical gases. Additionally, investments in cryogenic infrastructure, storage facilities, and distribution networks contribute to market growth and accessibility within the Australia industrial gas sector.

Challenges of the market

Supply chain logistics, storage requirements, and safety regulations pose challenges for the Australia liquid nitrogen market. Ensuring uninterrupted supply, maintaining product purity, and adhering to stringent safety standards are critical considerations for companies operating in this sector.

Government Policy of the market

Government policies in Australia related to the liquid nitrogen market may encompass safety regulations, storage requirements, and transportation guidelines. Measures aim to ensure the safe handling, storage, and use of liquid nitrogen in various industrial, medical, and research applications.

Key Highlights of the Report:

- Australia Liquid Nitrogen Market Outlook

- Market Size of Australia Liquid Nitrogen Market, 2024

- Forecast of Australia Liquid Nitrogen Market, 2031

- Historical Data and Forecast of Australia Liquid Nitrogen Revenues & Volume for the Period 2021-2031

- Australia Liquid Nitrogen Market Trend Evolution

- Australia Liquid Nitrogen Market Drivers and Challenges

- Australia Liquid Nitrogen Price Trends

- Australia Liquid Nitrogen Porter's Five Forces

- Australia Liquid Nitrogen Industry Life Cycle

- Historical Data and Forecast of Australia Liquid Nitrogen Market Revenues & Volume By End-Use Industry for the Period 2021-2031

- Historical Data and Forecast of Australia Liquid Nitrogen Market Revenues & Volume By Chemicals & pharmaceuticals for the Period 2021-2031

- Historical Data and Forecast of Australia Liquid Nitrogen Market Revenues & Volume By Food & beverage for the Period 2021-2031

- Historical Data and Forecast of Australia Liquid Nitrogen Market Revenues & Volume By Healthcare for the Period 2021-2031

- Historical Data and Forecast of Australia Liquid Nitrogen Market Revenues & Volume By Metal manufacturing & construction for the Period 2021-2031

- Historical Data and Forecast of Australia Liquid Nitrogen Market Revenues & Volume By Rubber & Plastic for the Period 2021-2031

- Historical Data and Forecast of Australia Liquid Nitrogen Market Revenues & Volume By Others for the Period 2021-2031

- Historical Data and Forecast of Australia Liquid Nitrogen Market Revenues & Volume By Storage, Distribution and Transportation for the Period 2021-2031

- Historical Data and Forecast of Australia Liquid Nitrogen Market Revenues & Volume By Cylinder & packaged distribution for the Period 2021-2031

- Historical Data and Forecast of Australia Liquid Nitrogen Market Revenues & Volume By Merchant liquid distribution for the Period 2021-2031

- Historical Data and Forecast of Australia Liquid Nitrogen Market Revenues & Volume By Tonnage distribution for the Period 2021-2031

- Historical Data and Forecast of Australia Liquid Nitrogen Market Revenues & Volume By Function for the Period 2021-2031

- Historical Data and Forecast of Australia Liquid Nitrogen Market Revenues & Volume By Coolant for the Period 2021-2031

- Historical Data and Forecast of Australia Liquid Nitrogen Market Revenues & Volume By Refrigerant for the Period 2021-2031

- Historical Data and Forecast of Australia Liquid Nitrogen Market Revenues & Volume By Manufacturing Process for the Period 2021-2031

- Historical Data and Forecast of Australia Liquid Nitrogen Market Revenues & Volume By Cryogenic distillation for the Period 2021-2031

- Historical Data and Forecast of Australia Liquid Nitrogen Market Revenues & Volume By Pressure swing adsorption for the Period 2021-2031

- Australia Liquid Nitrogen Import Export Trade Statistics

- Market Opportunity Assessment By End-Use Industry

- Market Opportunity Assessment By Storage, Distribution and Transportation

- Market Opportunity Assessment By Function

- Market Opportunity Assessment By Manufacturing Process

- Australia Liquid Nitrogen Top Companies Market Share

- Australia Liquid Nitrogen Competitive Benchmarking By Technical and Operational Parameters

- Australia Liquid Nitrogen Company Profiles

- Australia Liquid Nitrogen Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 Australia Liquid Nitrogen Market Overview |

3.1 Australia Country Macro Economic Indicators |

3.2 Australia Liquid Nitrogen Market Revenues & Volume, 2021 & 2031F |

3.3 Australia Liquid Nitrogen Market - Industry Life Cycle |

3.4 Australia Liquid Nitrogen Market - Porter's Five Forces |

3.5 Australia Liquid Nitrogen Market Revenues & Volume Share, By End-Use Industry, 2021 & 2031F |

3.6 Australia Liquid Nitrogen Market Revenues & Volume Share, By Storage, Distribution and Transportation, 2021 & 2031F |

3.7 Australia Liquid Nitrogen Market Revenues & Volume Share, By Function, 2021 & 2031F |

3.8 Australia Liquid Nitrogen Market Revenues & Volume Share, By Manufacturing Process, 2021 & 2031F |

4 Australia Liquid Nitrogen Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.3 Market Restraints |

5 Australia Liquid Nitrogen Market Trends |

6 Australia Liquid Nitrogen Market, By Types |

6.1 Australia Liquid Nitrogen Market, By End-Use Industry |

6.1.1 Overview and Analysis |

6.1.2 Australia Liquid Nitrogen Market Revenues & Volume, By End-Use Industry, 2021-2031F |

6.1.3 Australia Liquid Nitrogen Market Revenues & Volume, By Chemicals & pharmaceuticals, 2021-2031F |

6.1.4 Australia Liquid Nitrogen Market Revenues & Volume, By Food & beverage, 2021-2031F |

6.1.5 Australia Liquid Nitrogen Market Revenues & Volume, By Healthcare, 2021-2031F |

6.1.6 Australia Liquid Nitrogen Market Revenues & Volume, By Metal manufacturing & construction, 2021-2031F |

6.1.7 Australia Liquid Nitrogen Market Revenues & Volume, By Rubber & Plastic, 2021-2031F |

6.1.8 Australia Liquid Nitrogen Market Revenues & Volume, By Others, 2021-2031F |

6.2 Australia Liquid Nitrogen Market, By Storage, Distribution and Transportation |

6.2.1 Overview and Analysis |

6.2.2 Australia Liquid Nitrogen Market Revenues & Volume, By Cylinder & packaged distribution, 2021-2031F |

6.2.3 Australia Liquid Nitrogen Market Revenues & Volume, By Merchant liquid distribution, 2021-2031F |

6.2.4 Australia Liquid Nitrogen Market Revenues & Volume, By Tonnage distribution, 2021-2031F |

6.3 Australia Liquid Nitrogen Market, By Function |

6.3.1 Overview and Analysis |

6.3.2 Australia Liquid Nitrogen Market Revenues & Volume, By Coolant, 2021-2031F |

6.3.3 Australia Liquid Nitrogen Market Revenues & Volume, By Refrigerant, 2021-2031F |

6.4 Australia Liquid Nitrogen Market, By Manufacturing Process |

6.4.1 Overview and Analysis |

6.4.2 Australia Liquid Nitrogen Market Revenues & Volume, By Cryogenic distillation, 2021-2031F |

6.4.3 Australia Liquid Nitrogen Market Revenues & Volume, By Pressure swing adsorption, 2021-2031F |

7 Australia Liquid Nitrogen Market Import-Export Trade Statistics |

7.1 Australia Liquid Nitrogen Market Export to Major Countries |

7.2 Australia Liquid Nitrogen Market Imports from Major Countries |

8 Australia Liquid Nitrogen Market Key Performance Indicators |

9 Australia Liquid Nitrogen Market - Opportunity Assessment |

9.1 Australia Liquid Nitrogen Market Opportunity Assessment, By End-Use Industry, 2021 & 2031F |

9.2 Australia Liquid Nitrogen Market Opportunity Assessment, By Storage, Distribution and Transportation, 2021 & 2031F |

9.3 Australia Liquid Nitrogen Market Opportunity Assessment, By Function, 2021 & 2031F |

9.4 Australia Liquid Nitrogen Market Opportunity Assessment, By Manufacturing Process, 2021 & 2031F |

10 Australia Liquid Nitrogen Market - Competitive Landscape |

10.1 Australia Liquid Nitrogen Market Revenue Share, By Companies, 2024 |

10.2 Australia Liquid Nitrogen Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero