Azerbaijan Paints Market (2025-2031) | Revenue, Share, Growth, Size, Value, Analysis, Companies, Outlook, Forecast, Industry & Trends

Market Forecast By Resin (Acrylic, Alkyd, Epoxy, Polyurethane, Polyester), By Technology (Waterborne, Solventborne, Powder), By Application (Architectural, Industrial) And Competitive Landscape

| Product Code: ETC017597 | Publication Date: Jun 2023 | Updated Date: Apr 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

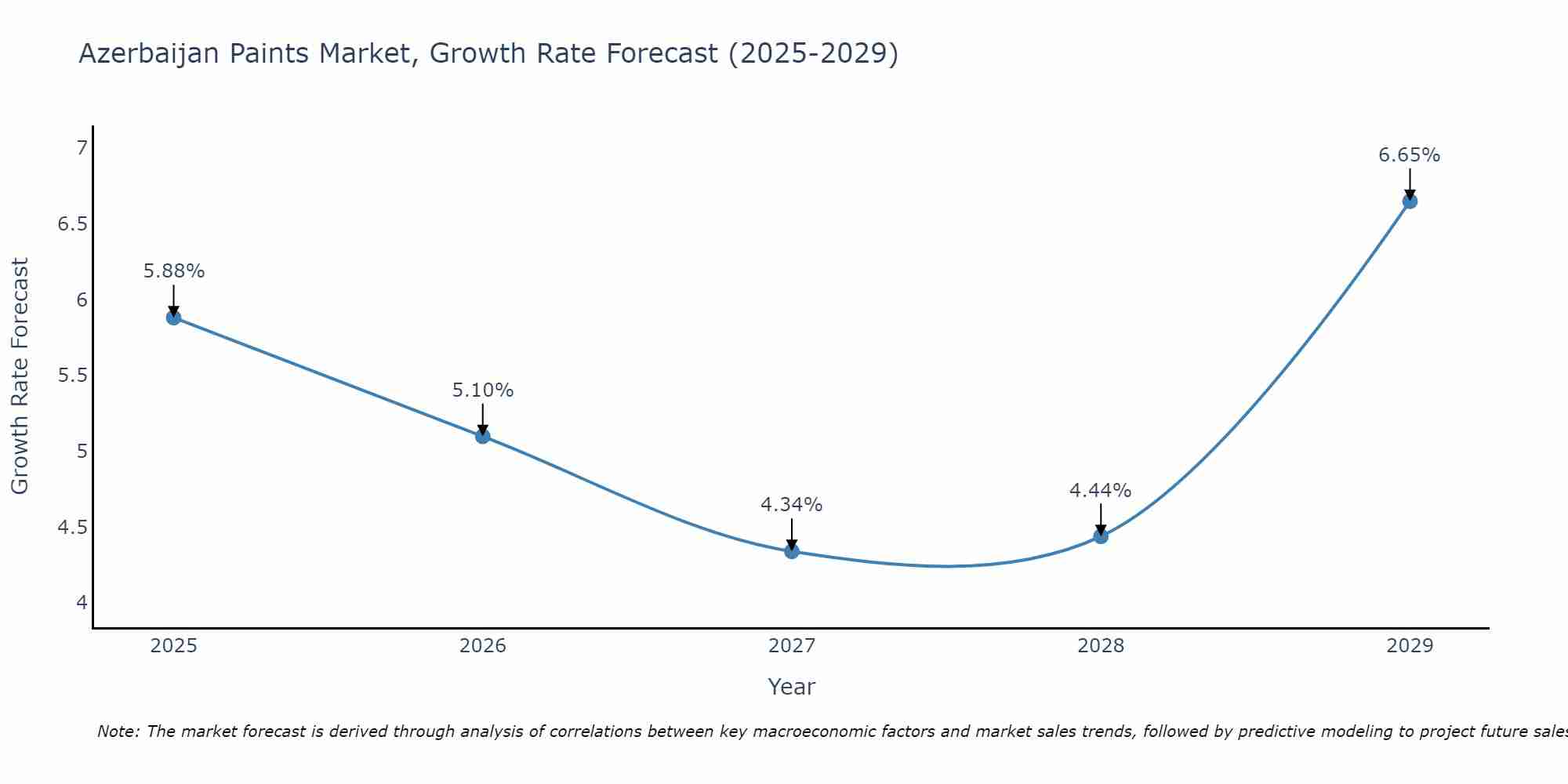

Azerbaijan Paints Market Size Growth Rate

The Azerbaijan Paints Market is projected to witness mixed growth rate patterns during 2025 to 2029. From 5.88% in 2025, the growth rate steadily ascends to 6.65% in 2029.

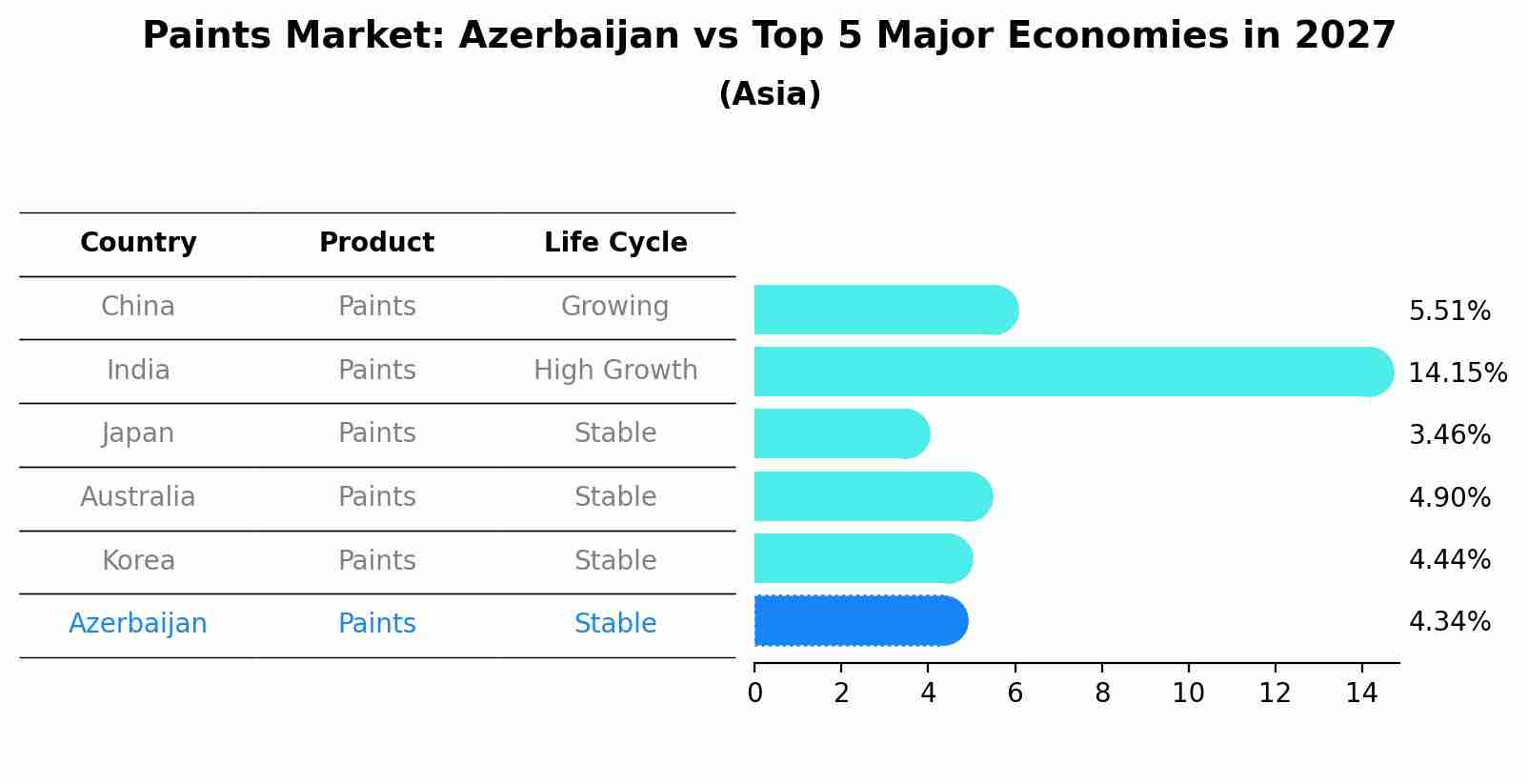

Paints Market: Azerbaijan vs Top 5 Major Economies in 2027 (Asia)

By 2027, the Paints market in Azerbaijan is anticipated to reach a growth rate of 4.34%, as part of an increasingly competitive Asia region, where China remains at the forefront, supported by India, Japan, Australia and South Korea, driving innovations and market adoption across sectors.

Azerbaijan Paints Market Highlights

| Report Name | Azerbaijan Paints Market |

| Forecast period | 2025-2031 |

| CAGR | 6% |

| Growing Sector | Architecture |

Topics Covered in the Azerbaijan Paints Market Report

The Azerbaijan Paints Market report thoroughly covers the market by Resin, Technology, and Application. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Azerbaijan Paints Market Synopsis

The Azerbaijan Paints Market has anticipated growth in recent years, driven by various factors such as increasing population, urbanization, government initiatives promoting industrial growth, rising demand for decorative paints, and changing lifestyles. The market is further expected to grow significantly in the coming years.

According to 6Wresearch, the Azerbaijan Paints Market size is expected to grow at a significant CAGR of 6% during 2025-2031. One of the major drivers of this market is the growing construction industry in Azerbaijan. With an increase in population and urbanization, there has been a surge in demand for residential and commercial buildings. Additionally, government initiatives such as the State Program on Socio-Economic Development have also contributed to the growth of this sector by promoting investments in the construction of new buildings and renovation of existing ones. Another important driver for the paints market in Azerbaijan is the rising demand for decorative paints. As people become more affluent, there is a growing trend towards using high-quality paints to enhance the aesthetic appeal of homes and commercial spaces.

One major challenge is the import dependency of raw materials required for paint production. Moreover, the paint market in Azerbaijan is highly competitive, with numerous international and local players vying for market share. This leads to intense pricing pressure and can make it challenging for smaller companies to survive.

Azerbaijan Paints Industry: Leading Players

Some of the key players dominating the Azerbaijani paint market include Azersun Holding, Akzo Nobel N.V., Jotun A/S, Sherwin-Williams Company, PPG Industries Inc., BASF SE, Kansai Paint Co. Ltd., Nippon Paint Holdings Co. Ltd., Hempel A/S, and Berger Paints Limited. These companies have a strong presence in the country and are continuously expanding their market share by introducing innovative products and technologies.

Azerbaijan Paints Market: Government Regulations

One initiative is the implementation of a supportive regulatory framework for the industry. This includes regulations that ensure quality control, safety standards, and environmental sustainability in the production and distribution of paints. Additionally, the government has also implemented policies to promote local manufacturing of paints. This not only reduces reliance on imports but also creates job opportunities within the country. Another important factor contributing to the growth of the paint market in Azerbaijan is infrastructure development projects initiated by the government. Furthermore, the government has also taken steps to support and promote small and medium-sized enterprises (SMEs) in the paints industry such as providing access to funding and resources, as well as conducting training programs.

Future Insights of the Market

The Azerbaijan paints market is projected to witness significant growth in the coming years due to various factors such as rapid urbanization, infrastructure development, and growing demand for eco-friendly paints. The rise in construction activities and increasing investments in industrial projects are expected to boost demand for paints in the country. Additionally, with a focus on sustainable development, there is a growing trend towards using environmentally friendly paints, which is likely to drive the growth of the market.

Market Segmentation by Resin

According to Ravi Bhandari, Research Head, 6Wresearch, the acrylic resin segment is experiencing high growth in the Azerbaijan paints market. This can be attributed to its versatility and ability to adhere to various surfaces, making it suitable for both interior and exterior painting projects.

Market Segmentation by Technology

In terms of technology, the waterborne segment is witnessing significant growth due to its low volatile organic compound (VOC) content, making it an eco-friendly option for consumers.

Market Segmentation by Application

The architectural segment holds the largest share of the Azerbaijan paints market. This can be attributed to the growing construction and renovation activities in the country, and the increasing demand for decorative paints for residential and commercial buildings.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Data Starting from 2021 to 2024.

- Base Year: 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Azerbaijan Paints Market Outlook

- Market Size of Azerbaijan Paints Market, 2024

- Forecast of Azerbaijan Paints Market, 2031

- Historical Data and Forecast of Azerbaijan Paints Revenues & Volume for the Period 2021-2031

- Azerbaijan Paints Market Trend Evolution

- Azerbaijan Paints Market Drivers and Challenges

- Azerbaijan Paints Price Trends

- Azerbaijan Paints Porter's Five Forces

- Azerbaijan Paints Industry Life Cycle

- Historical Data and Forecast of Azerbaijan Paints Market Revenues & Volume By Resin for the Period 2021-2031

- Historical Data and Forecast of Azerbaijan Paints Market Revenues & Volume By Acrylic for the Period 2021-2031

- Historical Data and Forecast of Azerbaijan Paints Market Revenues & Volume By Alkyd for the Period 2021-2031

- Historical Data and Forecast of Azerbaijan Paints Market Revenues & Volume By Epoxy for the Period 2021-2031

- Historical Data and Forecast of Azerbaijan Paints Market Revenues & Volume By Polyurethane for the Period 2021-2031

- Historical Data and Forecast of Azerbaijan Paints Market Revenues & Volume By Polyester for the Period 2021-2031

- Historical Data and Forecast of Azerbaijan Paints Market Revenues & Volume By Technology for the Period 2021-2031

- Historical Data and Forecast of Azerbaijan Paints Market Revenues & Volume By Waterborne for the Period 2021-2031

- Historical Data and Forecast of Azerbaijan Paints Market Revenues & Volume By Solventborne for the Period 2021-2031

- Historical Data and Forecast of Azerbaijan Paints Market Revenues & Volume By Powder for the Period 2021-2031

- Historical Data and Forecast of Azerbaijan Paints Market Revenues & Volume By Application for the Period 2021-2031

- Historical Data and Forecast of Azerbaijan Paints Market Revenues & Volume By Architectural for the Period 2021-2031

- Historical Data and Forecast of Azerbaijan Paints Market Revenues & Volume By Industrial for the Period 2021-2031

- Azerbaijan Paints Import Export Trade Statistics

- Market Opportunity Assessment By Resin

- Market Opportunity Assessment By Technology

- Market Opportunity Assessment By Application

- Azerbaijan Paints Top Companies Market Share

- Azerbaijan Paints Competitive Benchmarking By Technical and Operational Parameters

- Azerbaijan Paints Company Profiles

- Azerbaijan Paints Key Strategic Recommendations

Markets Covered

The report provides a detailed analysis of the following market segments:

By Resin

- Acrylic

- Alkyd

- Epoxy

- Polyurethane

- Polyester

By Technology

- Waterborne

- Solventborne

- Powder

By Application

- Architectural

- Industrial

Azerbaijan Paints Market (2025-2031) : FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Azerbaijan Paints Market Overview |

| 3.1 Azerbaijan Country Macro Economic Indicators |

| 3.2 Azerbaijan Paints Market Revenues & Volume, 2021 & 2031F |

| 3.3 Azerbaijan Paints Market - Industry Life Cycle |

| 3.4 Azerbaijan Paints Market - Porter's Five Forces |

| 3.5 Azerbaijan Paints Market Revenues & Volume Share, By Resin, 2021 & 2031F |

| 3.6 Azerbaijan Paints Market Revenues & Volume Share, By Technology, 2021 & 2031F |

| 3.7 Azerbaijan Paints Market Revenues & Volume Share, By Application, 2021 & 2031F |

| 4 Azerbaijan Paints Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Azerbaijan Paints Market Trends |

| 6 Azerbaijan Paints Market, By Types |

| 6.1 Azerbaijan Paints Market, By Resin |

| 6.1.1 Overview and Analysis |

| 6.1.2 Azerbaijan Paints Market Revenues & Volume, By Resin, 2021-2031F |

| 6.1.3 Azerbaijan Paints Market Revenues & Volume, By Acrylic, 2021-2031F |

| 6.1.4 Azerbaijan Paints Market Revenues & Volume, By Alkyd, 2021-2031F |

| 6.1.5 Azerbaijan Paints Market Revenues & Volume, By Epoxy, 2021-2031F |

| 6.1.6 Azerbaijan Paints Market Revenues & Volume, By Polyurethane, 2021-2031F |

| 6.1.7 Azerbaijan Paints Market Revenues & Volume, By Polyester, 2021-2031F |

| 6.2 Azerbaijan Paints Market, By Technology |

| 6.2.1 Overview and Analysis |

| 6.2.2 Azerbaijan Paints Market Revenues & Volume, By Waterborne, 2021-2031F |

| 6.2.3 Azerbaijan Paints Market Revenues & Volume, By Solventborne, 2021-2031F |

| 6.2.4 Azerbaijan Paints Market Revenues & Volume, By Powder, 2021-2031F |

| 6.3 Azerbaijan Paints Market, By Application |

| 6.3.1 Overview and Analysis |

| 6.3.2 Azerbaijan Paints Market Revenues & Volume, By Architectural, 2021-2031F |

| 6.3.3 Azerbaijan Paints Market Revenues & Volume, By Industrial, 2021-2031F |

| 7 Azerbaijan Paints Market Import-Export Trade Statistics |

| 7.1 Azerbaijan Paints Market Export to Major Countries |

| 7.2 Azerbaijan Paints Market Imports from Major Countries |

| 8 Azerbaijan Paints Market Key Performance Indicators |

| 9 Azerbaijan Paints Market - Opportunity Assessment |

| 9.1 Azerbaijan Paints Market Opportunity Assessment, By Resin, 2021 & 2031F |

| 9.2 Azerbaijan Paints Market Opportunity Assessment, By Technology, 2021 & 2031F |

| 9.3 Azerbaijan Paints Market Opportunity Assessment, By Application, 2021 & 2031F |

| 10 Azerbaijan Paints Market - Competitive Landscape |

| 10.1 Azerbaijan Paints Market Revenue Share, By Companies, 2024 |

| 10.2 Azerbaijan Paints Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero