Brazil Construction Equipment Market (2024-2030) | Industry, Size, Share, Trend, Growth, Forecast, Analysis, Outlook

Market Forecastby By Types (Mobile Cranes, Construction Tractors and Bulldozers, Earthmoving Equipment, Aerial Work Equipment, Material Handling Equipment, Dump Trucks, Road Construction Equipment), By Applications (Corporate Enterprise, Oil and Gas, Mining, Others (Municipality and Road Construction)) and competitive landscape

| Product Code: ETC001654 | Publication Date: Dec 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 64 | No. of Figures: 10 | No. of Tables: 6 | |

Brazil Construction Equipment Market

The Brazil Construction Equipment Market experienced a steady rise from 2019 to 2022, primarily due to increased investments in infrastructure projects by the Brazilian government, totalling approximately US$ 10 billion. This growth was further fuelled by the flourishing mining sector, driven by Brazil's abundant mineral resources like iron ore, manganese, tantalite, and bauxite. In 2023, mineral exports surged to US$ 42.98 billion, indicating significant expansion. The demand for construction equipment remained robust, especially heavy earth-moving machinery such as excavators, loaders, dozers, and dump trucks, essential for various mining operations such as exploration, extraction, material handling, and maintenance.

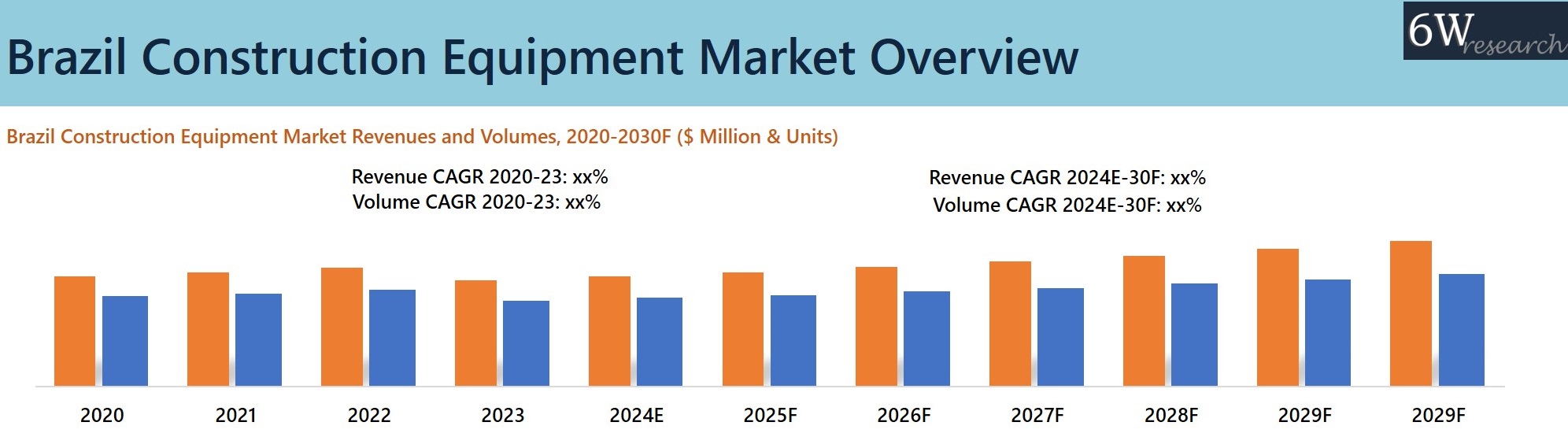

According to 6Wresearch, The Brazil Construction Equipment Market size is projected to grow at a CAGR of 4.8% during 2024E-2030F. The Brazil Construction Equipment Market is on the brink of substantial expansion in the upcoming years, fueled by several factors driving demand across crucial sectors. A pivotal catalyst is the government’s ambitious “New Growth Acceleration Program,” which aims to inject an estimated $340 billion into the infrastructure sector. This initiative will prioritize projects such as road construction, bridge building, and urban development, thereby boosting the demand for various construction machinery and equipment including excavators, bulldozers, cranes, and concrete mixers. Furthermore, the Brazilian government has unveiled plans to construct 2 million affordable homes by 2026, revitalizing the housing program "Minha Casa, Minha Vida" and creating a new avenue for growth in the construction equipment market. Continuing this growth trajectory, anticipated investments of around $4.3 billion in Oil and Gas exploration activities from 2023 to 2027 will facilitate the drilling of 91 new wells.

Market Segmentation by Types

By type, the earthmoving segment is set to grow significantly in Brazil construction equipment industry on account of increasing construction projects in the country. For instance, the “New Growth Acceleration Program” with a projected investment of $340 billion into the infrastructure sector created significant demand. Additionally, In the upcoming years, the Oil and gas sector will continue to rise due to the increasing energy needs. This is expected to boost the sales of Earthmoving types of equipment in the forecasted Period.

Market Segmentation by Application

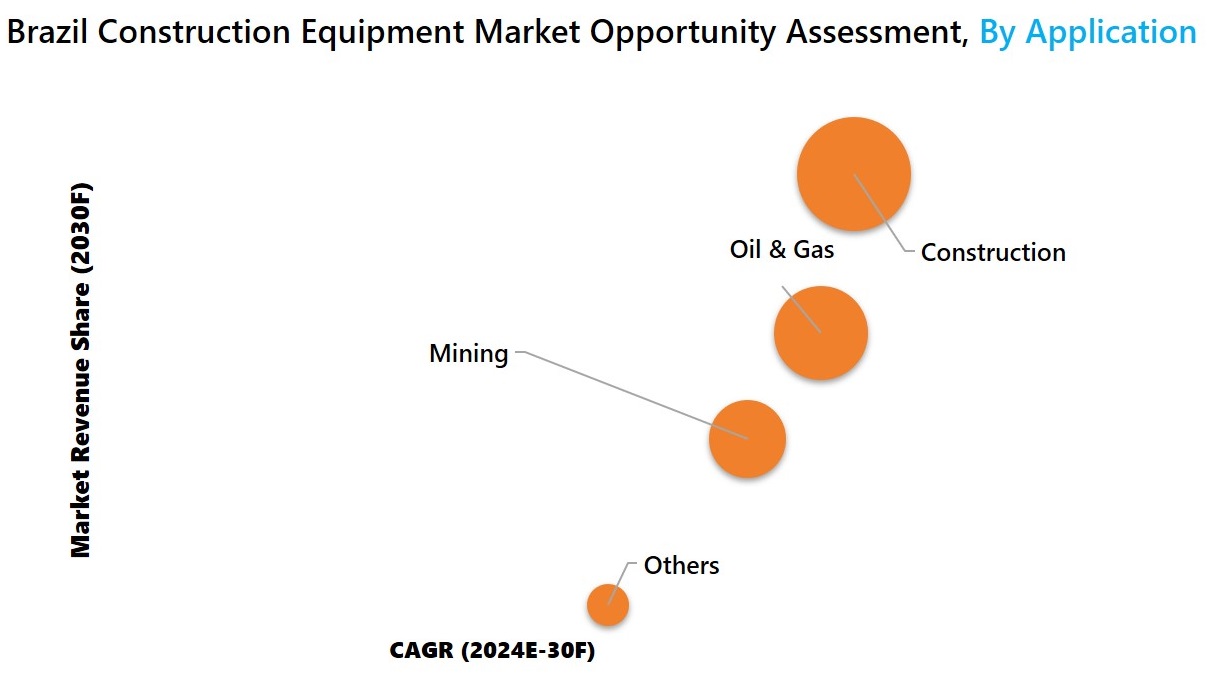

The construction sector holds the maximum market revenue share due to the growing investment and upcoming residential and commercial projects such as hotel projects like W Gramado Hotel, Radisson Hotel, and 8 new projects from Hard Rock Hotels across several cities such as Fortaleza, Ilha de Sol, Natal, Recife, among others in Brazil further contribute to the demand for construction equipment.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2020 to 2023.

- Base Year: 2023

- Forecast Data until 2030.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Brazil Construction Equipment Market Overview

- Brazil Construction Equipment Market Outlook

- Brazil Construction Equipment Market Forecast

- Historical Data and Forecast of Brazil Construction Equipment Market Revenues for the Period 2020-2030F

- Historical Data and Forecast of Brazil Construction Equipment Market Revenues, By Types, for the Period 2020-2030F

- Historical Data and Forecast of Brazil Construction Equipment Market Revenues, By Application, for the Period 2020-2030F

- Market Drivers and Restraints

- Industry Life Cycle

- Porter’s Five Force

- Market Trends

- Key Performance Indicators

- Brazil Construction Equipment Market Revenue Ranking, By Companies, 2024

- Key Competitors Analysis

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

Thereportprovides a detailed analysis of the following market segments:

By Types

- Mobile Cranes

- Construction Tractors and Bulldozers

- Earthmoving Equipment

- Aerial Work Equipment

- Material Handling Equipment

- Dump Truck

- Road Construction Equipment

By Application

- Construction

- Oil & Gas

- Mining

- Others

Brazil Construction Equipment Market (2024-2030): FAQ

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. Brazil Construction Equipment Market Overview |

| 3.1 Brazil Construction Equipment Market Revenues and Volume, 2020-2030F |

| 3.2 Brazil Construction Equipment Market Industry Life Cycle |

| 3.3 Brazil Construction Equipment Market Porter's Five Forces |

| 4. Brazil Construction Equipment Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Infrastructure development projects in Brazil |

| 4.2.2 Growth in the construction industry |

| 4.2.3 Government investments in construction projects |

| 4.2.4 Technological advancements in construction equipment |

| 4.2.5 Increasing urbanization and population growth in Brazil |

| 4.3 Market Restraints |

| 4.3.1 Economic instability and fluctuations in the Brazilian market |

| 4.3.2 High import taxes on construction equipment |

| 4.3.3 Environmental regulations impacting equipment usage |

| 4.3.4 Skilled labor shortages in the construction sector |

| 4.3.5 Volatility in raw material prices affecting equipment manufacturing costs |

| 5. Brazil Construction Equipment Market Trends and Evolution |

| 6. Brazil Construction Equipment Market Overview, By Types |

| 6.1 Brazil Construction Equipment Market Revenues and Revenue Share, By Types, 2020-2030F |

| 6.1.1 Brazil Construction Equipment Market Revenues, By Earthmoving Equipment 2020-2030F |

| 6.1.2 Brazil Construction Equipment Market Revenues, By Dump Truck, 2020-2030F |

| 6.1.3 Brazil Construction Equipment Market Revenues, By Material Handling Equipment 2020-2030F |

| 6.1.4 Brazil Construction Equipment Market Revenues, By Mobile Cranes, 2020-2030F |

| 6.1.3 Brazil Construction Equipment Market Revenues, By Aerial Work Equipment, 2020-2030F |

| 6.1.4 Brazil Construction Equipment Market Revenues, By Construction Tractors and Bulldozers, 2020-2030F |

| 6.1.4 Brazil Construction Equipment Market Revenues, By Road Construction Equipment, 2020-2030F |

| 7. Brazil Construction Equipment Market Overview, By Application |

| 7.1 Brazil Construction Equipment Market Revenues and Revenue Share, By Application, 2020-2030F |

| 7.1.1 Brazil Construction Equipment Market Revenues, By Construction, 2020-2030F |

| 7.1.2 Brazil Construction Equipment Market Revenues, By Oil & Gas, 2020-2030F |

| 7.1.3 Brazil Construction Equipment Market Revenues, By Mining, 2020-2030F |

| 7.1.4 Brazil Construction Equipment Market Revenues, By Others, 2020-2030F |

| 8. Brazil Construction Equipment Market Key Performance Indicators |

| 8.1 Utilization rate of construction equipment |

| 8.2 Average age of construction equipment fleet in Brazil |

| 8.3 Adoption rate of advanced construction technologies |

| 8.4 Construction equipment rental market growth |

| 8.5 Average project completion time for construction projects in Brazil |

| 9. Brazil Construction Equipment Market Opportunity Assessment |

| 9.1 Brazil Construction Equipment Market Opportunity Assessment, By Types, 2030F |

| 9.2 Brazil Construction Equipment Market Opportunity Assessment, By Applications, 2030F |

| 10. Brazil Construction Equipment Market Competitive Landscape |

| 10.1 Brazil Construction Equipment Market Revenue Ranking, By Companies, 2023 |

| 10.2 Brazil Construction Equipment Market Competitive Benchmarking, By Technical Parameters |

| 10.3 Brazil Construction Equipment Market Competitive Benchmarking, By Operating Parameters |

| 11. Company Profiles |

| 11.1 Volvo Construction Equipment |

| 11.2 Komatsu do Brasil Ltda. |

| 11.3 Xuzhou Construction Machinery Group Co., Ltd. (XCMG) |

| 11.4 SANY Heavy Industry Co Ltd. |

| 11.5 John Deere Brasil Ltda. |

| 11.6 Liebherr Group |

| 11.7 CNH Industrial Latin America LTDA |

| 11.8 JC Bamford Excavators Ltd. |

| 11.9 HD Hyundai Infracore South America |

| 11.10 Caterpillar Inc. |

| 12. Key Strategic Recommendations |

| 13. Disclaimer |

| List of Figures |

| 1. Brazil Construction Equipment Market Revenues and Volume, 2020-2030F ($ Million & Units) |

| 2. Transportation Projects-Asset Auctioned / Signed Contracts, 2019-2021, ( In Billion) |

| 3. Mineral Sector Investment in Brazil (US$ Billion) 2019-2027 |

| 4. Brazil Construction Equipment Market Revenue Share, By Types, 2023 & 2030F |

| 5. Brazil Construction Equipment Market Revenue Share, By Application, 2023-2030F |

| 6. Brazil Commercial and Residential Market Size, 2018-2025 ( USD Billion) |

| 7. Brazil Oil and Gas Production, 2021-2023, (In Mbpd, in Mm /d) |

| 8. Brazil Construction Equipment Market Opportunity Assessment, By Types, 2030F |

| 9. Brazil Construction Equipment Market Opportunity Assessment, By Application, 2030F |

| 10. Brazil Construction Equipment Market Revenue Ranking, By Companies, 2023 |

| List of Tables |

| 1. Rising Construction Index, (YoY), (2022-2023) |

| 2. Brazil Construction Equipment Market Revenue, By Types, 2020-2030F |

| 3. Brazil Construction Equipment Market Revenues, By Application, 2020 - 2030F |

| 4. Brazil Upcoming Residential Skyscraper Projects |

| 5. Brazil Market Size, By Sectors, (2018-2025) |

| 6. Offshore Projects to start operation in 2024 & 2025 |

Market Forecast By Types(Cranes (Mobile Cranes, Crawler Cranes, Tower Cranes), Earthmoving Equipment(Loaders, Excavators, Motor Grader)), Aerial Work Equipment(Articulated Boom Lifts, Telescopic Boom Lifts, Scissor Lifts), Material Handling Equipment(Telescopic Handlers, Forklifts), Road Construction Equipment(Pavers, Road Rollers), Dump Trucks, Construction Tractor and Bulldozer), By Applications(Construction, Oil & Gas, Mining)and competitive landscape

| Product Code: ETC001654 | Publication Date: Mar 2023 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

Brazil construction equipment market report comprehensively covers the market by types and applications. The Brazil construction equipment market outlook report provides an unbiased and detailed analysis of the ongoing Brazil construction equipment market trends, opportunities/high growth areas, and market drivers which would help the stakeholders device and align their market strategies according to the current and future market dynamics.

Latest 2023 Development of the Brazil Construction Equipment Market

Brazil Construction Equipment Market is predicted to grow over the years owing to government initiatives to boost the construction industry, increasing investments in infrastructure development projects, and the advancements in technology and the adoption of digitalization in the construction sector. The government has been investing heavily in infrastructure development which has led to increased demand for construction equipment. Additionally, rapid urbanization has led to the development of new commercial and residential buildings, which require heavy equipment for construction. Moreover, the country is a major producer of natural resources which require heavy equipment for extraction.

Furthermore, the government has implemented several initiatives to encourage investment in the construction sector which includes tax incentives and subsidies for companies that invest in the industry. The development of advanced technologies in the construction equipment industry in Brazil has led to increased productivity and efficiency.

Brazil construction equipment market Synopsis

Brazil construction equipment market growth is driven by the increasing adoption of construction equipment on renting basis with no big payments. This supports small and average companies by providing the opportunity to purchase the equipment on provisional terms which is one of the major aspects of growing the demand for Brazil construction equipment market. The manufacturing of the construction equipment market before was import driven while over the past few years, the market has shifted towards domestic manufacturing due to economic issues.

According to 6wresearch, Brazil Construction Equipment Market is expected to grow during 2020-2026. The government has planned to enhance the commercial and residential infrastructure which is expected to support economic conditions to regain investments producing positive effects on the construction equipment sector. The construction equipment industry in Brazil is expected to face challenges such as increasing the cost of construction equipment due to increasing raw material prices in the industry. Moreover, the construction application segment is expected to hold the construction equipment market of Brazil on account of growing infrastructure in the public and private sectors during the forecast period. The rising shortage of labour coupled with surging disposable income is driving the modern and advanced equipment adding to Brazil Construction Equipment Market Growth. The growing investment in infrastructure, airports, and transport is also adding to the development of the market.

Brazil construction equipment market is anticipated to register sound revenues in the foreseeable future on the back of the substantial growth of the construction, oil & gas, and mining industry. Moreover, the rise in the need for efficiency and productivity backed by rising the need to complete major tasks within the stipulated time frame is leading to more profit and is estimated to foster the demand for construction equipment in the market. Further, eliminating human manual work that causes fatigue and major injuries would be the crucial factor in driving sales revenue owing to compelled contractors to use advanced equipment while construction is anticipated to benefit Brazil construction equipment market during the forecast period.

Caterpillar and Komatsu are the major players in the Brazil construction equipment market.

COVID-19 influence on Brazil Construction Equipment Market

The COVID-19 pandemic had initially given rise to a slowdown in the construction equipment market and halted many infrastructure development projects due to lockdowns and other restrictions. However, as the situation improved and restrictions were lifted, the market began to recover, and it is expected to grow in the forthcoming years.

Market Analysis by Types

Based on types, earthmoving equipment is expected to dominate the construction equipment market share owing to the increasing sale of excavators and loaders. Furthermore, the manufacturers are aiming to advance and enhance the productivity of construction equipment which is anticipated to boost the demand for the construction equipment market in Brazil in the coming years.

Key Highlights of the Report:

- Brazil Construction Equipment Market Overview.

- Brazil Construction Equipment Market Outlook.

- Brazil Construction Equipment Market Size and Brazil Construction Equipment Market Forecast until 2026.

- Historical Data of Brazil Construction Equipment Market Revenues & Volume for the Period 2016-2019.

- Market Size & Forecast of Brazil Construction Equipment Market Revenues & Volume until 2026.

- Historical Data of Brazil Construction Equipment Market Revenues and Volume, By Application, for the Period 2016-2019

- Market Size & Forecast of Brazil Construction Equipment Market Revenues and Volume, By Application, until 2026

- Market Drivers and Restraints

- Brazil Construction Equipment Market Trends and Industry Life Cycle

- Porter's Five Force Analysis

- Market Opportunity Assessment

- Brazil Construction Equipment Market Share, By Players

- Brazil Construction Equipment Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Markets Covered

The Brazil Construction Equipment Market report provides a detailed analysis of the following market segments:

-

By Types:

- Cranes

- Mobile Crane

- Crawler Crane

- Tower Crane

- Construction Tractor and Bulldozer

- Earthmoving Equipment

- Loaders

- Excavators

- Motor Grader

- Aerial Work Equipment

- Articulated Boom Lifts

- Telescopic Boom Lifts

- Scissor Lifts

- Material Handling Equipment

- Telescopic Handlers

- Forklifts

- Dump Trucks

- Road Construction Equipment

- Pavers

- Road Rollers

- Cranes

- By Applications:

- Construction

- Oil & Gas

- Mining

- Others (Municipality, Road Construction)

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero