Egypt Air Conditioner Market (2021-2027) | Size, Growth, Outlook, Share, Revenue, Trends, Value, Industry, Analysis, Segmentation & COVID-19 IMPACT

Market Forecast By Types (Room Air Conditioner (Window, Split), Ducted (Ceiling Concealed, Rooftop Packaged), Ductless (Suspended, Floor Standing, Cassette), Centralized (AHU/FCU, Chiller, VRF, Other (Evaporator Coils, Condensing Units, Etc.))), By Applications (Residential, Healthcare, Commercial Offices & Retail, Transportation, Hospitality, Other (Education, BFSI, Manufacturing Etc)), By Regions (Nile Valley And Delta, Eastern Desert, Western Desert, Sinai Peninsula) And Competitive Landscape

| Product Code: ETC054272 | Publication Date: Mar 2021 | Updated Date: May 2024 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 101 | No. of Figures: 32 | No. of Tables: 11 | |

Egypt Air Conditioner Market Competition 2023

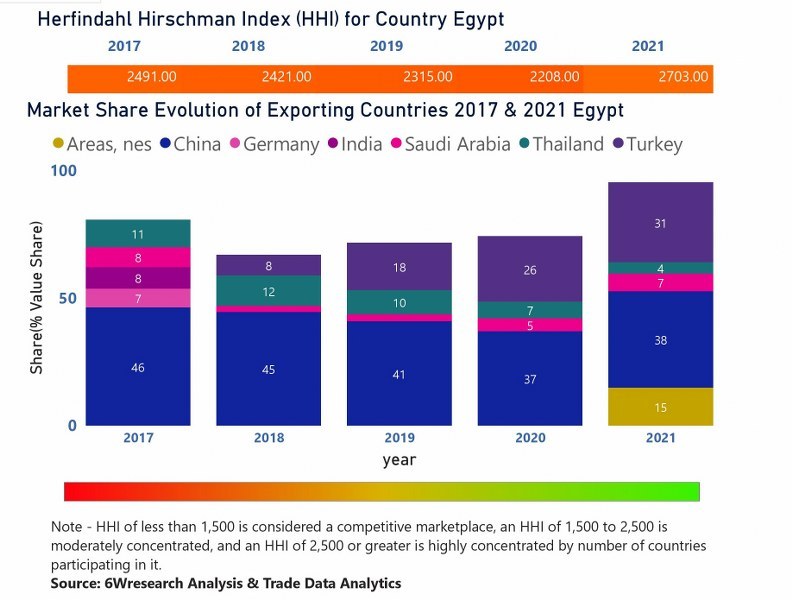

Egypt Air Conditioner market currently, in 2023, has witnessed an HHI of 3797, Which has increased moderately as compared to the HHI of 2491 in 2017. The market is moving towards concentrated. Herfindahl index measures the competitiveness of exporting countries. The range lies from 0 to 10000, where a lower index number represents a larger number of players or exporting countries in the market while a large index number means fewer numbers of players or countries exporting in the market.

Egypt Export Potential Assessment For Air Conditioner Market (Values in USD Thousand)

Egypt Air Conditioner (AC) Market | Country-Wise Share and Competition Analysis

In the year 2021, China was the largest exporter in terms of value, followed by Turkey. It has registered a growth of 13.56% over previous year. While Turkey registered a growth of 34.29% over previous year. While in 2017 China was the largest exporter followed by Thailand. In term of Herfindahl Index, which measures the competitiveness of countries exporting, Egypt has Herfindahl index of 2491 in 2017 which signifies moderately concentrated while in 2021 it registered a Herfindahl index of 2703 which signifies high concentration in the market

Egypt Air Conditioner (AC) Market - Export Market Opportunities

![Egypt Air Conditioner (AC) Market - Export Market Opportunities]() Latest (2023) Development of the Egypt Air Conditioner (AC) Market

Latest (2023) Development of the Egypt Air Conditioner (AC) Market

Egypt Air Conditioner (AC) Market is anticipated to grow at the fastest growth rate with several developments in the industry. For instance, shift towards smart and energy-efficient models to save on electricity bills. In response to this, manufacturers are focusing on introducing eco-friendly refrigerants which have zero ozone depletion potential. They are also leveraging Artificial Intelligence (AI) technology to enable customers to control their AC units. Moreover, increased demand for portable air conditioners due to their flexibility and portability has been augmented over the years. in general, these devices can be easily moved from one room to another and require minimal effort.

Furthermore, manufacturers are offering extended warranties on their products to build customer trust which has resulted in increased competition among key players, driving them towards innovation while keeping prices competitive.

Topics Covered in the Egypt Air Conditioner Market

The Egypt Air Conditioner Market report thoroughly covers the market by types, applications and regions. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Egypt Air Conditioner Market Synopsis

The Egypt Air Conditioner Market witnessed moderate growth during the period 2017-2020 underpinned by rapid growth in population and rising urbanization in the country. The Egyptian government has placed a strong emphasis on infrastructure and construction as a key engine of urban growth and financial stability on account of the IMF (International Monetary Fund) backed economic reform program, henceforth driving the growth of the air conditioner market in the country.

According to 6Wresearch, Egypt Air Conditioner Market size is projected to grow at CAGR of 5.7% during 2021-27. The primary reason for the growth in the Egypt air conditioner industry can be attributed to the upcoming projects including the Middle East region’s largest private medical city and entertainment district. Moreover, the rising economic growth and per capita income of Egypt would play a crucial role in improving the living standards and in increasing the disposable income of the Egyptians, hence boosting the sales of home appliances including air conditioners in the country.

The Impact of COVID-19 on the Egypt Air Conditioner (AC) Market

The COVID-19 pandemic has adversely influenced the growth of Egypt Air Conditioner (AC) Industry in several ways. The COVID-19 pandemic brought a decline in market revenues during the year 2020 as the air conditioner market in Egypt is both manufacturing and import-dependent and the movement restrictions imposed during the pandemic period disrupted the supply chain leading to falling market demand and hence the market revenues. With construction activities being postponed, demand dropped significantly. However, with restrictions being eased, the market is predicted to recover gradually primarily due to government initiatives such as reduced electricity tariffs for energy-efficient ACs.

Key Players in the Egypt Air Conditioner (AC) Market

The Egypt Air Conditioner (AC) Market is fiercely competitive, with several key players holding a significant share of the market. These players are investing heavily in R&D activities to launch new products. Some of the key players leading the market are;

- Carrier Egypt S.A.E.

- LG Electronics Egypt S.A.E.

- Gree Electric Appliances Egypt Co., Ltd

- Samsung Electronics Egypt S.A.E.

- Daikin Air Conditioning Egypt LLC

- Mitsubishi Electric Corporation

- Johnson Controls Company LLC

Market Analysis by Type

Based on types, the room air conditioner segment has acquired the majority of the revenue share in the air conditioner market of Egypt in 2020 on account of higher penetration of room air conditioners in the residential segments. Based on applications, the residential sector garnered the majority of the market revenue share during the year 2020 and is expected to dominate the market over the coming years as well on account of growing residential infrastructure development in the country. Split air conditioners led the Egypt room air conditioner market in recent years owing to their increasing adoption in the residential sector and small shops as the split air conditioners are energy efficient and they need less space in comparison to its counterpart, that is a window air conditioner.

Market Analysis by Application

Amongst all the applications, the residential and commercial sectors account for about 50% of the total market revenues in 2020. The residential sector garnered the majority of the market revenue share during the year 2020 and the same trend is anticipated to persist over the coming years as a result of the rapid expansion in residential infrastructure development across the country. With the increasing number of commercial buildings including hotels, hospitals, supermarkets, and educational infrastructure, commercial offices & retail sector is projected to grow at a faster pace in the Egypt air conditioner market in near future.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2017 to 2020.

- Base Year: 2020

- Forecast Data until 2027.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Egypt Air Conditioner Market Overview

- Egypt Air Conditioner Market Outlook

- Egypt Air Conditioner Market Forecast

- Historical Data and Forecast of Egypt Air Conditioner Market Revenues, for the Period 2017-2027F

- Historical Data and Forecast of Egypt Room Air Conditioner Market Revenues & Volume, By Types, for the Period 2017-2027F

- Historical Data and Forecast of Egypt Ducted Air Conditioner Market Revenues & Volume, By Types, for the Period 2017-2027F

- Historical Data and Forecast of Egypt Ductless Air Conditioner Market Revenues & Volume, By Types, for the Period 2017-2027F

- Historical Data and Forecast of Egypt Centralized Air Conditioner Market Revenues & Volume, By Components, for the Period 2017-2027F

- Historical Data and Forecast of Egypt Air Conditioner Market Revenues, By Applications, for the Period 2017-2027F

- Historical Data and Forecast of Egypt Air Conditioner Market Revenues, By Regions, for the Period 2017-2027F

- Egypt Air Conditioner Market Revenue Share, By Market Players

- Egypt Air Conditioner Market Value Chain and Ecosystem

- Covid-19 Impact on Egypt Air Conditioner Market

- Market Drivers and Restraints

- Market Trends

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Types

- Room Air Conditioner (Window, Split)

- Ducted (Ceiling Concealed, Rooftop Packaged)

- Ductless (Suspended, Floor Standing, Cassette)

- Centralized (AHU/FCU, Chiller, VRF, Other (Evaporator Coils, Condensing Units, Etc.)

By Applications

- Residential

- Healthcare

- Commercial Offices & Retail

- Transportation,

- Hospitality, Other (Education, BFSI, Manufacturing Etc)

By Regions

- Nile Valley And Delta

- Eastern Desert

- Western Desert

- Sinai Peninsula

Egypt Air Conditioner Market: FAQs

|

1. Executive Summary |

|

2. Introduction |

|

2.1 Report Description |

|

2.2 Key Highlights of the Report |

|

2.3 Market Scope & Segmentation |

|

2.4 Research Methodology |

|

2.5 Assumptions |

|

3. Egypt Air Conditioner Market Overview |

|

3.1 Egypt Air Conditioner Market Revenues, 2017-2027F |

|

3.2 Egypt Air Conditioner Market - Industry Life Cycle |

|

3.3 Egypt Air Conditioner Market - Porter’s Five Forces |

|

3.4 Egypt Air Conditioner Market - Ecosystem |

|

3.5. Egypt Air Conditioner Market Revenue Share, By Types (2020 & 2027F) |

|

3.6. Egypt Air Conditioner Market Revenue Share, By Applications (2020 & 2027F) |

|

3.7. Egypt Air Conditioner Market Revenue Share, By Regions (2020 & 2027F) |

|

4. Impact Analysis of Covid-19 on Egypt Air Conditioner Market |

|

5. Egypt Air Conditioner Market Dynamics |

|

5.1 Impact Analysis |

|

5.2 Market Drivers |

|

5.3 Market Restraints |

|

6. Egypt Air Conditioner Market Trends |

|

7. Egypt Room Air Conditioner Market Overview |

|

7.1. Egypt Room Air Conditioner Market Revenues & Volume (2017-2027F) |

|

7.2. Egypt Room Air Conditioner Market Revenue & Volume Share, By Types (2020 & 2027F) |

|

7.3. Egypt Room Air Conditioner Market Revenues & Volume, By Types |

|

7.3.1. Egypt Window Air Conditioner Market Revenues & Volume (2017-2027F) |

|

7.3.2. Egypt Split Air Conditioner Market Revenues & Volume (2017-2027F) |

|

8. Egypt Ducted Air Conditioner Market Overview |

|

8.1. Egypt Ducted Air Conditioner Market Revenues & Volume (2017-2027F) |

|

8.2. Egypt Ducted Air Conditioner Market Revenue & Volume Share, By Types (2020 & 2027F) |

|

8.3. Egypt Ducted Air Conditioner Market Revenues & Volume, By Types |

|

8.3.1. Egypt Ceiling Concealed Air Conditioner Market Revenues & Volume (2017-2027F) |

|

8.3.2. Egypt Rooftop Packaged Air Conditioner Market Revenues & Volume (2017-2027F) |

|

9. Egypt Ductless Air Conditioner Market Overview |

|

9.1. Egypt Ductless Air Conditioner Market Revenues & Volume (2017-2027F) |

|

9.2. Egypt Ductless Air Conditioner Market Revenue & Volume Share, By Types (2020 & 2027F) |

|

9.3. Egypt Ductless Air Conditioner Market Revenues & Volume, By Types |

|

9.3.1. Egypt Suspended Air Conditioner Market Revenues & Volume (2017-2027F) |

|

9.3.2. Egypt Floor Standing Packaged Air Conditioner Market Revenues & Volume (2017-2027F) |

|

9.3.3. Egypt Cassette Concealed Air Conditioner Market Revenues & Volume (2017-2027F) |

|

10. Egypt Centralized Air Conditioner Market Overview |

|

10.1. Egypt Centralized Air Conditioner Market Revenues (2017-2027F) |

|

10.2. Egypt Ductless Air Conditioner Market Revenue Share & Revenues, By Components |

|

10.2.1. Egypt AHU/FCU Market Revenues (2017-2027F) |

|

10.2.2. Egypt VRF Market Revenues (2017-2027F) |

|

10.2.3. Egypt Chiller Market Revenues (2017-2027F) |

|

10.2.4. Egypt Other Components Market Revenues (2017-2027F) |

|

11. Egypt Air Conditioner Market Overview, By Applications |

|

11.1. Egypt Air Conditioner Market Revenues, By Applications |

|

11.1.1. Egypt Air Conditioner Market Revenues, By Residential Application (2017-2027F) |

|

11.1.2. Egypt Air Conditioner Market Revenues, By Commercial Offices & Retail Application (2017-2027F) |

|

11.1.3. Egypt Air Conditioner Market Revenues, By Hospitality Application (2017-2027F) |

|

11.1.4. Egypt Air Conditioner Market Revenues, By Healthcare Application (2017-2027F) |

|

11.1.5. Egypt Air Conditioner Market Revenues, By Commercial Offices & Retail Application (2017-2027F) |

|

11.1.6. Egypt Air Conditioner Market Revenues, By Oil & Gas Application (2017-2027F) |

|

11.1.7. Egypt Air Conditioner Market Revenues, By Other Application (2017-2027F) |

|

12. Egypt Air Conditioner Market Overview, By Regions |

|

12.1. Egypt Air Conditioner Market Revenues, By Regions |

|

12.1.1. Egypt Air Conditioner Market Revenues, By Nile Valley and Delta (2017-2027F) |

|

12.1.2. Egypt Air Conditioner Market Revenues, By Sinai Peninsula (2017-2027F) |

|

12.1.3. Egypt Air Conditioner Market Revenues, By Western Desert (2017-2027F) |

|

12.1.4. Egypt Air Conditioner Market Revenues, By Eastern Desert (2017-2027F) |

|

13. Egypt Air Conditioner Market - Key Performance Indicators |

|

14. Nigeria Farm Tractor Market Opportunity Assessment |

|

14.1. Egypt Air Conditioner Market Opportunity Assessment, By Types (2027F) |

|

14.2. Egypt Air Conditioner Market Opportunity Assessment, By Applications (2027F) |

|

14.3. Egypt Air Conditioner Market Opportunity Assessment, By Regions (2027F) |

|

15. Egypt Air Conditioner Market – Competitive Landscape |

|

15.1. Egypt Air Conditioner Market Revenue Share, By Company (2020) |

|

15.2. Egypt Air Conditioner Market Competitive Benchmarking, By Operating Parameters |

|

16. Company Profiles |

|

16.1 Mitsubishi Electric Corporation |

|

16.2 Sharp Corporation |

|

16.3 Zamil Air Conditioners |

|

16.4 GREE Electric Appliances Inc. |

|

16.5 Midea Group Co. Ltd. |

|

16.6 Daikin Industries |

|

16.7 LG Electronics Inc. |

|

16.8 Carrier Corporation |

|

16.9 Samsung Electronics Co., Ltd. |

|

16.10 FRESH Company |

|

17. Key Strategic Recommendations |

|

18. Disclaimer |

|

List of Figures: |

|

1. Egypt Air Conditioner Market Revenues, 2017-2027F ($ Million) |

|

2. Egypt Air Conditioner Market Revenue Share, By Types, 2020 & 2027F |

|

3. Egypt Air Conditioner Market Revenue Share, By Applications, 2020 & 2027F |

|

4. Egypt Air Conditioner Market Revenue Share, By Regions, 2020 & 2027F |

|

5. Egypt Population, 2015-2020 (Million) |

|

6. Egypt Urban Population, 2015-2020 (Million) |

|

7. Egypt's Visitor Arrivals, 2016-2019 (Million) |

|

8. Tourism revenues in Egypt, 2016-2019 (Billion USD) |

|

9. Rise in Egypt’s Poor Population, 2000-2019 |

|

10. Egypt Room Air Conditioner Market Revenues & Volume, 2017-2027F ($ Million, Thousand Units) |

|

11. Egypt Room Air Conditioner Market Revenue Share, By Types, 2020 & 2027F |

|

12. Egypt Room Air Conditioner Market Volume Share, By Types, 2020 & 2027F |

|

13. Egypt Ducted Air Conditioner Market Revenues & Volume, 2017-2027F ($ Million, Thousand Units) |

|

14. Egypt Ducted Air Conditioner Market Revenue Share, By Types, 2020 & 2027F |

|

15. Egypt Ducted Air Conditioner Market Volume Share, By Types, 2020 & 2027F |

|

16. Egypt Ductless Air Conditioner Market Revenues & Volume, 2017-2027F ($ Million, Thousand Units) |

|

17. Egypt Ductless Air Conditioner Market Revenue Share, By Types, 2020 & 2027F |

|

18. Egypt Ductless Air Conditioner Market Volume Share, By Types, 2020 & 2027F |

|

19. Egypt Centralized Air Conditioner Market Revenues, 2017-2027F ($ Million) |

|

20. Egypt Centralized Air Conditioner Market Revenue Share, By Components, 2020 & 2027F |

|

21. Egypt Health Spending Per Capita ($) |

|

22. Average Annual Investment in Egypt 2016-40 ($ Billion) |

|

23. Infrastructure Investment in Egypt, as a percentage of GDP, 2016-40 |

|

24. Telecommunications Infrastructure Investment current trends in Egypt, 2015-40 ($ Billion) |

|

25. Infrastructure Investment current trends & need in Egypt, 2015-40 ($ Billion) |

|

26. Airport Infrastructure Investment current trends in Egypt, 2015-40 ($ Million) |

|

27. Rail Infrastructure Investment current trends in Egypt, 2015-40 ($ Million) |

|

28. Cairo Tourism Industry Hotel Supply, 2019-2021F (Thousand Units of Rooms) |

|

29. Egypt Air Conditioner Market Opportunity Assessment, By Types, 2027F |

|

30. Egypt Air Conditioner Market Opportunity Assessment, By Types, 2027F |

|

31. Egypt Air Conditioner Market Opportunity Assessment, By Regions, 2027F |

|

32. Egypt Air Conditioner Market Revenue Share, By Companies, 2020 |

|

List of Tables: |

|

1. Egypt Room Air Conditioner Market Revenues, By Types, 2017-2027F ($ Million) |

|

2. Egypt Room Air Conditioner Market Volume, By Types, 2017-2027F (Thousand Units) |

|

3. Egypt Ducted Air Conditioner Market Revenues, By Types, 2017-2027F ($ Million) |

|

4. Egypt Ducted Air Conditioner Market Volume, By Types, 2017-2027F (Thousand Units) |

|

5. Egypt Ductless Air Conditioner Market Revenues, By Types, 2017-2027F ($ Million) |

|

6. Egypt Ductless Air Conditioner Market Volume, By Types, 2017-2027F (Thousand Units) |

|

7. Egypt Centralized Air Conditioner Market Revenues, By Components, 2017-2027F ($ Million) |

|

8. Egypt Air Conditioner Market Revenues, By Applications, 2017 & 2027F |

|

9. Egypt Air Conditioner Market Revenues, By Regions, 2017 & 2027F |

|

10. Cumulative Infrastructure Investment Estimate in Egypt, 2016-40 ($ Billion) |

|

11. Egypt Under Construction Projects, as on April 2020 |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Tajikistan Thermal Camera Market (2025-2031) | Trends, Size, Growth, Share, Industry, Companies, Value, Analysis, Revenue, Forecast & Outlook

- Singapore Professional AV Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- Saudi Arabia Genset Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- India OOH Advertising Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- Vietnam Twisted Pair Cables Market (2024-2030) | Size & Revenue, Forecast, Share, Companies, Competitive Landscape, Analysis, Trends, Value, Segmentation, Outlook, Industry, Growth

- South Africa B2B Cleaning Market (2025-2031) | Size & Revenue, Forecast, Share, Companies, Competitive Landscape, Analysis, Trends, Value, Segmentation, Outlook, Industry, Growth

- Mexico Dispersion Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- United States Video Conferencing Market (2025-2031) | Outlook, Industry, Size, Revenue, Share, Trends, Forecast, Growth, Companies, Analysis & Value

- Australia Electric Motor Market (2025-2031) | Trends, Share, Size, Value, Revenue, Industry, Growth, Analysis, Segmentation & Outlook

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- India's Printer Market Faces 20.7% Decline in Q4 2023: Epson and HP Lead Amidst Downturn

- India's Camera Market Sees 8.9% Decline in Q4 2023; Canon Leads with 38.4% Share

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- The future of gaming industry in the Philippines