France Cutlery Market (2025-2031) | Forecast, Share, Size, Growth, Companies, Value, Industry, Outlook, Trends, Analysis & Revenue

Market Forecast By Product Type (Forks, Spoons, Knives, Others), By Price Range (Low End, Medium Range, Premium), By Material (Stainless Steel, Plastic, Silver, Others) And Competitive Landscape

| Product Code: ETC028110 | Publication Date: Jun 2023 | Updated Date: Jan 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

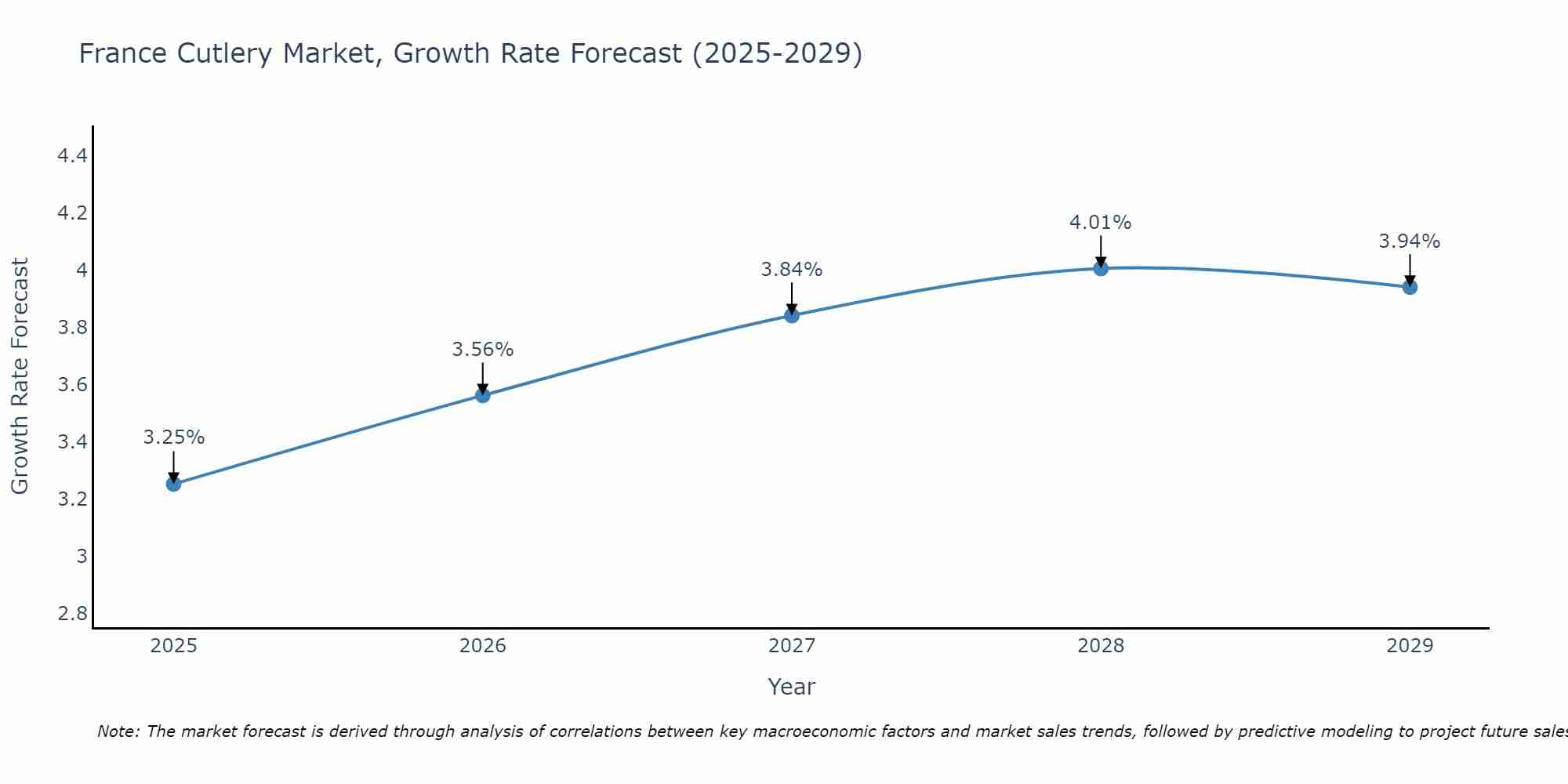

France Cutlery Market Size Growth Rate

The France Cutlery Market is projected to witness mixed growth rate patterns during 2025 to 2029. Growth accelerates to 4.01% in 2028, following an initial rate of 3.25%, before easing to 3.94% at the end of the period.

France Cutlery Market Highlights

| Report Name | France Cutlery Market |

| Forecast Period | 2025-2031 |

| Market Size | USD 1.4 Billion – USD 2.9 Billion |

| CAGR | 5.8% |

| Growing Sector | Food and Beverage |

Topics Covered in the France Cutlery Market Report

The France Cutlery market report thoroughly covers the market by product type, by price range and by material. The report provides an unbiased and detailed analysis of the on-going market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

France Cutlery Market Size & Analysis

In 2025, the France Cutlery market is valued at approximately $ 1.4 billion, with a projected CAGR of 5.8% over the next five years. Additionally, by 2031, the market is expected to reach around $ 2.9 billion. The food and beverage segment holds significant position in the overall market.

France Cutlery Market Synopsis

The France cutlery market is characterized by a blend of traditional craftsmanship and modern manufacturing techniques, reflecting the country's rich culinary heritage. With a strong emphasis on quality and design, French consumers tend to favor premium cutlery brands that offer both functionality and aesthetic appeal. The market includes a wide range of products, from everyday kitchen cutlery to high-end designer pieces, catering to both domestic and professional needs. The increasing trend toward home cooking has further boosted demand for kitchen utensils, including cutlery. Additionally, the growth of the hospitality sector and the rise of dining experiences have contributed to the market's expansion. As sustainability becomes a priority for consumers, manufacturers are focusing on eco-friendly materials and production methods, positioning themselves to meet changing consumer preferences in the French market.

According to 6Wresearch, France Cutlery market size is projected to grow at a CAGR of 5.8% during 2025-2031. The France cutlery market is primarily driven by several factors, including a rising interest in culinary experiences, increased home cooking, and the growing popularity of gourmet dining. As consumers seek to enhance their kitchenware with high-quality cutlery, demand for premium products has surged, particularly in the stainless steel segment due to its durability, aesthetic appeal, and hygiene properties. Furthermore, the expansion of e-commerce has made it easier for consumers to access a diverse range of cutlery brands and styles, contributing to market growth. However, the France Cutlery industry faces challenges such as fluctuating raw material prices, particularly for stainless steel, can impact production costs and pricing strategies. Additionally, competition from lower-cost alternatives and the presence of counterfeit products can hinder market growth. Finally, environmental concerns regarding the sustainability of materials used in cutlery production have prompted consumers to seek eco-friendly options, presenting an additional challenge for traditional manufacturers.

France Cutlery Market Trends

- Premiumization - Increasing demand for high-quality, premium cutlery products as consumers invest in better kitchen tools.

- Sustainability Focus - Growing consumer interest in eco-friendly and sustainably sourced materials, leading to a rise in brands offering biodegradable or recyclable cutlery options.

- E-commerce Growth - Significant increase in online shopping for kitchenware, allowing consumers to access a wider variety of brands and styles.

- Customization and Personalization - Rising popularity of personalized cutlery, with options for engraving and bespoke designs appealing to consumers seeking unique kitchenware.

- Kitchen Trends Influence - Increasing interest in cooking and culinary experiences, particularly during the pandemic, has led to heightened focus on kitchenware, including cutlery.

- Health and Safety Awareness - Heightened emphasis on hygiene and safety has spurred interest in cutlery that is easy to clean and made from non-porous materials like stainless steel.

Investment Opportunities in the France Cutlery Market

- E-commerce Expansion - Invest in online retail platforms or develop direct-to-consumer (DTC) models to capture the growing demand for cutlery purchases online.

- Sustainable Products - Focus on developing and marketing eco-friendly cutlery made from sustainable materials, tapping into the rising consumer preference for green products.

- Customization Services - Create business models that offer personalized or customized cutlery options, catering to consumers' desires for unique kitchen tools.

- Premium and Luxury Lines - Launch or invest in premium cutlery brands that emphasize high-quality materials and craftsmanship, capitalizing on the trend toward luxury kitchenware.

- Smart Cutlery Innovations - Explore the development of smart cutlery products that integrate technology for enhanced user experience, such as temperature indicators or nutritional tracking.

- Gourmet and Culinary Partnerships - Collaborate with chefs or culinary schools to create specialized cutlery lines, leveraging their influence to attract gourmet cooking enthusiasts.

Key Players in the France Cutlery Market

The France cutlery market features several key companies that drive innovation and quality in the industry. Prominent players include Tefal, known for its durable and user-friendly kitchen products; Groupe SEB, which encompasses a range of brands including Moulinex and Rowenta, offering high-quality kitchen utensils and cutlery; Opinel, famed for its iconic folding knives and commitment to craftsmanship; and Christofle, a luxury brand specializing in fine silverware and cutlery. Other notable companies include Duralex, recognized for its tempered glass products, and Eclat, which focuses on high-end stainless steel cutlery. Additionally, some of these players hold majority of the France Cutlery market share. Moreover, together, these companies cater to a diverse consumer base, ranging from everyday users to gourmet chefs, and continually adapt to market trends through innovative designs and sustainable practices.

Government Regulations in the France Cutlery Market

In France, the cutlery market is governed by a range of regulations aimed at ensuring product safety, environmental protection, and consumer rights. The European Union's General Product Safety Directive mandates that all cutlery products must meet stringent safety standards before they can be marketed, requiring manufacturers to conduct thorough testing for durability and user safety. Additionally, the REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation imposes restrictions on the use of hazardous substances in manufacturing processes, promoting the use of safer materials. France also enforces labeling laws that require clear information on product composition, care instructions, and country of origin to inform consumers effectively. Further, these initiatives have further boosted the France Cutlery market revenues. Furthermore, sustainability initiatives encourage cutlery producers to adopt eco-friendly practices, aligning with the EU's broader goals of reducing environmental impact and promoting circular economy principles. Compliance with these regulations is crucial for manufacturers to maintain market access and consumer trust.

Future Insights of the France Cutlery Market

The future of the cutlery market in France is poised for growth, driven by increasing consumer demand for sustainable and high-quality products. As the trend toward eco-friendly materials continues to gain traction, manufacturers are likely to invest in innovative production techniques that reduce environmental impact while enhancing durability and design. The rise of online shopping is also expected to reshape the market landscape, with more consumers opting for convenience and variety in their purchasing decisions. Additionally, the growing popularity of culinary experiences and home cooking, spurred by social media influences, will likely fuel demand for premium cutlery sets. As manufacturers adapt to these trends and invest in research and development, the market is anticipated to evolve, focusing on customization, technology integration, and enhanced functionality, which will further enhance consumer engagement and market growth in the coming years.

Spoons to Dominate the Market - By Product Type

According to Ravi Bhandari, Research Head, 6Wresearch, the spoons product category is experiencing notable growth, driven by several factors including the rising popularity of cooking at home and the increasing demand for versatile kitchen tools. As consumers seek multifunctional and aesthetically pleasing utensils, spoons made from various materials—such as stainless steel, wood, and silicone—are gaining traction for their durability and ease of use. Additionally, the trend towards sustainable living is prompting a shift towards eco-friendly materials, further boosting sales in this category. The growing awareness of health and hygiene has also led to a preference for high-quality, easy-to-clean options. With the expansion of online retail channels, consumers have greater access to a variety of spoon designs and styles, enhancing market growth as they seek unique and specialized products for their culinary needs.

Stainless Steel Category to Dominate the Market – By Material

The growth of stainless steel as a preferred material for cutlery is fueled by its durability, resistance to corrosion, and ease of maintenance. Consumers are increasingly opting for stainless steel cutlery due to its long lifespan, which makes it a cost-effective choice compared to other materials. Additionally, the sleek and modern aesthetic of stainless steel enhances the overall dining experience, appealing to both casual and formal dining settings. The rising trend of health-conscious eating has also contributed to its popularity, as stainless steel is non-reactive and safe for food use. Furthermore, the shift towards sustainable products is driving demand for stainless steel, as it is recyclable and does not contribute to plastic waste. This combination of factors positions stainless steel as a dominant material in the cutlery market, ensuring continued growth in this segment.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year - 2024.

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- France Cutlery Market Outlook

- Market Size of France Cutlery Market, 2024

- Forecast of France Cutlery Market, 2031

- Historical Data and Forecast of France Cutlery Revenues & Volume for the Period 2021 - 2031

- France Cutlery Market Trend Evolution

- France Cutlery Market Drivers and Challenges

- France Cutlery Price Trends

- France Cutlery Porter's Five Forces

- France Cutlery Industry Life Cycle

- Historical Data and Forecast of France Cutlery Market Revenues & Volume By Product Type for the Period 2021 - 2031

- Historical Data and Forecast of France Cutlery Market Revenues & Volume By Forks for the Period 2021 - 2031

- Historical Data and Forecast of France Cutlery Market Revenues & Volume By Spoons for the Period 2021 - 2031

- Historical Data and Forecast of France Cutlery Market Revenues & Volume By Knives for the Period 2021 - 2031

- Historical Data and Forecast of France Cutlery Market Revenues & Volume By Others for the Period 2021 - 2031

- Historical Data and Forecast of France Cutlery Market Revenues & Volume By Price Range for the Period 2021 - 2031

- Historical Data and Forecast of France Cutlery Market Revenues & Volume By Low End for the Period 2021 - 2031

- Historical Data and Forecast of France Cutlery Market Revenues & Volume By Medium Range for the Period 2021 - 2031

- Historical Data and Forecast of France Cutlery Market Revenues & Volume By Premium for the Period 2021 - 2031

- Historical Data and Forecast of France Cutlery Market Revenues & Volume By Material for the Period 2021 - 2031

- Historical Data and Forecast of France Cutlery Market Revenues & Volume By Stainless Steel for the Period 2021 - 2031

- Historical Data and Forecast of France Cutlery Market Revenues & Volume By Plastic for the Period 2021 - 2031

- Historical Data and Forecast of France Cutlery Market Revenues & Volume By Silver for the Period 2021 - 2031

- Historical Data and Forecast of France Cutlery Market Revenues & Volume By Others for the Period 2021 - 2031

- France Cutlery Import Export Trade Statistics

- Market Opportunity Assessment By Product Type

- Market Opportunity Assessment By Price Range

- Market Opportunity Assessment By Material

- France Cutlery Top Companies Market Share

- France Cutlery Competitive Benchmarking By Technical and Operational Parameters

- France Cutlery Company Profiles

- France Cutlery Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Product Type

- Forks

- Spoons

- Knives

- Others

By Price Range

- Low End

- Medium Range

- Premium

By Material

- Stainless Steel

- Plastic

- Silver

- Others

France Cutlery Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 France Cutlery Market Overview |

| 3.1 France Country Macro Economic Indicators |

| 3.2 France Cutlery Market Revenues & Volume, 2021 & 2031F |

| 3.3 France Cutlery Market - Industry Life Cycle |

| 3.4 France Cutlery Market - Porter's Five Forces |

| 3.5 France Cutlery Market Revenues & Volume Share, By Product Type, 2021 & 2031F |

| 3.6 France Cutlery Market Revenues & Volume Share, By Price Range, 2021 & 2031F |

| 3.7 France Cutlery Market Revenues & Volume Share, By Material, 2021 & 2031F |

| 4 France Cutlery Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 France Cutlery Market Trends |

| 6 France Cutlery Market, By Types |

| 6.1 France Cutlery Market, By Product Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 France Cutlery Market Revenues & Volume, By Product Type, 2021-2031F |

| 6.1.3 France Cutlery Market Revenues & Volume, By Forks, 2021-2031F |

| 6.1.4 France Cutlery Market Revenues & Volume, By Spoons, 2021-2031F |

| 6.1.5 France Cutlery Market Revenues & Volume, By Knives, 2021-2031F |

| 6.1.6 France Cutlery Market Revenues & Volume, By Others, 2021-2031F |

| 6.2 France Cutlery Market, By Price Range |

| 6.2.1 Overview and Analysis |

| 6.2.2 France Cutlery Market Revenues & Volume, By Low End, 2021-2031F |

| 6.2.3 France Cutlery Market Revenues & Volume, By Medium Range, 2021-2031F |

| 6.2.4 France Cutlery Market Revenues & Volume, By Premium, 2021-2031F |

| 6.3 France Cutlery Market, By Material |

| 6.3.1 Overview and Analysis |

| 6.3.2 France Cutlery Market Revenues & Volume, By Stainless Steel, 2021-2031F |

| 6.3.3 France Cutlery Market Revenues & Volume, By Plastic, 2021-2031F |

| 6.3.4 France Cutlery Market Revenues & Volume, By Silver, 2021-2031F |

| 6.3.5 France Cutlery Market Revenues & Volume, By Others, 2021-2031F |

| 7 France Cutlery Market Import-Export Trade Statistics |

| 7.1 France Cutlery Market Export to Major Countries |

| 7.2 France Cutlery Market Imports from Major Countries |

| 8 France Cutlery Market Key Performance Indicators |

| 9 France Cutlery Market - Opportunity Assessment |

| 9.1 France Cutlery Market Opportunity Assessment, By Product Type, 2021 & 2031F |

| 9.2 France Cutlery Market Opportunity Assessment, By Price Range, 2021 & 2031F |

| 9.3 France Cutlery Market Opportunity Assessment, By Material, 2021 & 2031F |

| 10 France Cutlery Market - Competitive Landscape |

| 10.1 France Cutlery Market Revenue Share, By Companies, 2024 |

| 10.2 France Cutlery Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero