GCC Video Surveillance Storage Market (2019-2025) | Analysis, Size, Share, Revenue, Trends, Forecast, Value, industry, Growth, Outlook & Segmentation

Market Forecast By Technology (Storage Area Network, Direct Attached Storage and Network Attached Storage), By Deployment (On-Premises, Cloud and Hybrid), By Verticals (BFSI (Banking, Financial Services & Insurance Sector), Government & Transportation, Retail & Logistics, Commercial Offices, Hospitality & Healthcare, Industrial, Residential and Educational Institutions), By Countries (Saudi Arabia, United Arab Emirates, Kuwait, Qatar, Oman and Bahrain) and Competitive Landscape

| Product Code: ETC000609 | Publication Date: Jul 2019 | Updated Date: May 2023 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 270 | No. of Figures: 186 | No. of Tables: 18 | |

Latest 2023 Developments of the GCC Video Surveillance Storage Market

GCC Video Surveillance Storage Market has seen the latest innovations that include the introduction of a storage area network (SAN) which has numerous advancements such as better speed, efficient data management, and more flexibility than other technologies and options available for cloud computing. Further, the integrity, confidentiality, and accessibility of video surveillance data is also protected during recording, retrieval and in transit whether across the local network or across a public network to a remote location. The same company have also started to provide SMEs data storage services that include online backup, data protection, and recovery solutions.

Mergers and Acquisitions:

- On March 1, 2021, Cisco announced the acquisition of Acacia Communications, Inc.

- In April 2021, River Associates acquired Pelco Products, Inc.

- In July 2021, Quantum Acquires HCI Pioneer Pivot3’s Video Surveillance Tech

GCC Video Surveillance Storage Market Synopsis

Installation of IP video surveillance systems, increasing FDI inflow in the region, and improved implementation of government norms for mandatory installation of video surveillance systems with regulations that mandates the retention of the footage for a fixed time period in most of the GCC countries are some of the key factors contributing significantly to the growth of GCC video surveillance storage market.

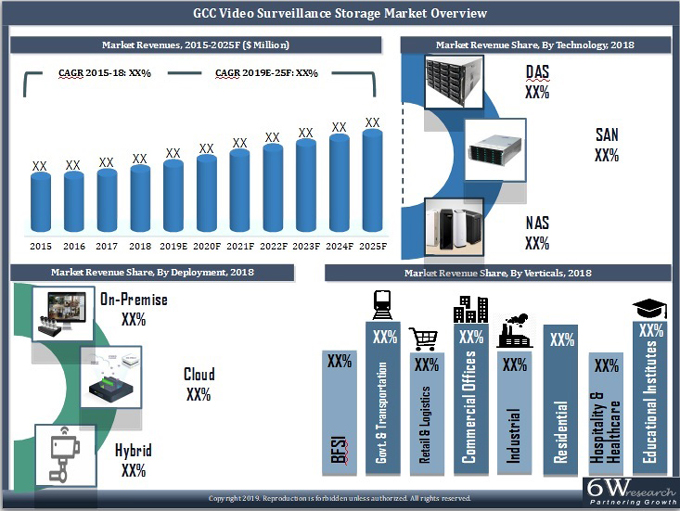

According to 6Wresearch, the GCC Video Surveillance Storage Market size is projected to grow at a CAGR of 6.6% during 2019-2025. Countries such as Saudi Arabia and UAE experienced a setback in the GCC video surveillance storage market in 2015-17 due to a decline in oil prices, resulting in a halt in various construction projects. However, the market recovered from the year 2017 onwards. Expansion and construction of new hotels, shopping malls, and public infrastructures across the region spurred the demand for the video surveillance systems market in the GCC market.

In the GCC video surveillance storage market forecast report, storage area network (SAN) is expected to demonstrate the maximum growth in the region over the next six years due to several key factors such as better speed, efficient data management, more flexibility than other technologies and options available for cloud computing. Further, upcoming data centres in GCC regions are also expected to boost the growth of GCC video surveillance storage market revenues. Some of the key players in the GCC video surveillance storage market include Pelco, Avigilon Corporation, BCD Video, Rasilient, Dell EMC, Pivot3, Cisco, Hanwha Techwin and Fujitsu.

In the GCC video surveillance storage market forecast report, storage area network (SAN) is expected to demonstrate the maximum growth in the region over the next six years due to several key factors such as better speed, efficient data management, more flexibility than other technologies and options available for cloud computing. Further, upcoming data centres in GCC regions are also expected to boost the growth of GCC video surveillance storage market revenues. Some of the key players in the GCC video surveillance storage market include Pelco, Avigilon Corporation, BCD Video, Rasilient, Dell EMC, Pivot3, Cisco, Hanwha Techwin and Fujitsu.

The GCC video surveillance storage market report thoroughly covers the market by technology, deployment, verticals, and countries. The GCC video surveillance storage market report provides an unbiased and detailed analysis of the GCC video surveillance storage market outlook, GCC video surveillance storage market trends, GCC video surveillance storage market share, opportunities/ high growth areas, and market drivers, which would help stakeholders to device and align market strategies according to the current and future market dynamics.

In GCC Video Surveillance Storage Market very good growth mark in 2017-18 and the prices of oil increased because of spending on the infrastructural due to the development of the countries. government compulsory installed video surveillance cameras for the public and in the public area and in hotels, commercial offices, tourism places and hospitality industries sending of video observation frameworks in the GCC district.

Key Highlights of the Report:

- GCC Video Surveillance Storage Market Overview

- GCC Video Surveillance Storage Market Outlook

- GCC Video Surveillance Storage Market Size and GCC Video Surveillance Storage Market Forecast until 2025

- Historical Data of Saudi Arabia, UAE, Qatar, Kuwait, Bahrain and Oman Video Surveillance Storage Market Revenues for the period, 2015-2018

- Market Size and Forecast of Saudi Arabia, UAE, Qatar, Kuwait, Bahrain and Oman Video Surveillance Storage Market Revenues until 2025

- Historical Data of Saudi Arabia, UAE, Qatar, Kuwait, Bahrain and Oman Video Surveillance Storage Market Revenues, by Technology, for the Period 2015-2018

- Market Size & Forecast of Saudi Arabia, UAE, Qatar, Kuwait, Bahrain and Oman Video Surveillance Storage Market Revenues, by Technology, until 2025

- Historical Data of Saudi Arabia, UAE, Qatar, Kuwait, Bahrain and Oman Video Surveillance Storage Market Revenues, by Deployment, for the Period 2015-2018

- Market Size & Forecast of Saudi Arabia, UAE, Qatar, Kuwait, Bahrain and Oman Video Surveillance Storage Market Revenues, by Deployment, until 2025

- Historical Data of Saudi Arabia, UAE, Qatar, Kuwait, Bahrain and Oman Video Surveillance Storage Market Revenues and Revenue Share, by Verticals, for the Period 2015-2018

- Market Size & Forecast of Saudi Arabia, UAE, Qatar, Kuwait, Bahrain and Oman Video Surveillance Storage Market Revenues and Revenue Share, by Verticals, until 2025

- Market Drivers and Restraints

- GCC Video Surveillance Storage Market Trends and Industry Life Cycle

- Porter’s Five Force Analysis

- GCC Video Surveillance Storage Market Opportunity Assessment

- GCC Video Surveillance Storage Market Share, By Players

- GCC Video Surveillance Storage Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Markets Covered:

The GCC video surveillance storage market report provides a detailed analysis of the following market segments:

By Technology:

- Storage Area Network

- Direct Attached Storage

- Network Attached Storage

By Deployment:

- On-Premises

- Cloud

- Hybrid

By Verticals:

- BFSI (Banking, Financial Services & Insurance Sector)

- Government & Transportation

- Retail & Logistics

- Commercial Offices

- Hospitality & Healthcare

- Industrial

- Residential

- Educational Institutions

By Countries:

- Saudi Arabia

- United Arab Emirates

- Kuwait

- Qatar

- Oman

- Bahrain

Frequently Asked Questions About the Market Study (FAQs):

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumption |

| 3. GCC Video Surveillance Storage Market Overview |

| 3.1. GCC Video Surveillance Storage Market Revenues (2015-2025F) |

| 3.2. GCC Video Surveillance Storage Market Revenue Share, By Technology (2018 & 2025F) |

| 3.3. GCC Video Surveillance Storage Market Revenue Share, By Deployment (2018 & 2025F) |

| 3.4. GCC Video Surveillance Storage Market Revenue Share, By Verticals (2018 & 2025F) |

| 3.5. GCC Video Surveillance Storage Market Revenue Share, By Countries (2018 & 2025F) |

| 3.6. GCC Video Surveillance Storage Market-Industry Life Cycle, 2018 |

| 3.7. GCC Video Surveillance Storage Market-Porter’s Five Forces, 2018 |

| 4. GCC Video Surveillance Storage Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.3. Market Restraints |

| 5. GCC Video Surveillance Storage Market Trends |

| 6. Saudi Arabia Video Surveillance Storage Market Overview |

| 6.1. Saudi Arabia Country Indicators |

| 6.2. Saudi Arabia Video Surveillance Storage Market Revenues (2015-2025F) |

| 6.3. Saudi Arabia Video Surveillance Storage Market Revenues, By Technology |

| 6.4. Saudi Arabia Video Surveillance Storage Market Revenues, By Deployment |

| 6.5. Saudi Arabia Video Surveillance Storage Market Overview, By Verticals |

| 6.5.1. Saudi Arabia BFSI Vertical Video Surveillance Storage Market Revenues, 2015-2025F |

| 6.5.1.1. Saudi Arabia Banking Sector Outlook |

| 6.5.2. Saudi Arabia Government & Transportation Vertical Video Surveillance Storage Market Revenues, |

| 2015-2025F |

| 6.5.2.1. Saudi Arabia Transportation Sector Outlook |

| 6.5.3. Saudi Arabia Retail & Logistics Vertical Video Surveillance Storage Market Revenues, 2015-2025F |

| 6.5.3.1. Saudi Arabia Retail Sector Outlook |

| 6.5.4. Saudi Arabia Industrial Vertical Video Surveillance Storage Market Revenues, 2015-2025F |

| 6.5.4.1. Saudi Arabia Industrial Sector Outlook |

| 6.5.5. Saudi Arabia Commercial Offices Vertical Video Surveillance Storage Market Revenues, 2015-2025F |

| 6.5.5.1. Saudi Arabia Commercial Offices Sector Outlook |

| 6.5.6. Saudi Arabia Hospitality & Healthcare Vertical Video Surveillance Storage Market Revenues, 2015-2025F |

| 6.5.6.1. Saudi Arabia Hospitality & Healthcare Sector Outlook |

| 6.5.7. Saudi Arabia Residential Vertical Video Surveillance Storage Market Revenues, 2015-2025F |

| 6.5.8. Saudi Arabia Educational Institutes Vertical Video Surveillance Storage Market Revenues, 2015-2025F |

| 6.6. Saudi Arabia Video Surveillance Storage Market, Key Performance Indicators |

| 6.6.1. Saudi Arabia Government Spending Outlook |

| 6.6.2. Saudi Arabia Project Awards Outlook |

| 6.6.3. Major Infrastructure Projects in Saudi Arabia |

| 6.7. Saudi Arabia Video Surveillance Storage Market, Competitive Landscape |

| 6.8. Saudi Arabia Video Surveillance Storage Market, Opportunity Assessment, By verticals, 2025F |

| 7. UAE Video Surveillance Storage Market Overview |

| 7.1. UAE Country Indicators |

| 7.2. UAE Video Surveillance Storage Market Revenues (2015-2025F) |

| 7.3. UAE Video Surveillance Storage Market Revenues, By Technology |

| 7.4. UAE Video Surveillance Storage Market Revenues, By Deployment |

| 7.5. UAE Video Surveillance Storage Market Overview, By Verticals |

| 7.5.1. UAE BFSI Vertical Video Surveillance Storage Market Revenues, 2015-2025F |

| 7.5.1.1. UAE Banking Sector Outlook |

| 7.5.2. UAE Government & Transportation Vertical Video Surveillance Storage Market Revenues, 2015-2025F |

| 7.5.2.1. UAE Transportation Sector Outlook |

| 7.5.3. UAE Retail & Logistics Vertical Video Surveillance Storage Market Revenues, 2015-2025F |

| 7.5.3.1. UAE Retail Sector Outlook |

| 7.5.4. UAE Industrial Vertical Video Surveillance Storage Market Revenues, 2015-2025F |

| 7.5.4.1. UAE Industrial Sector Outlook |

| 7.5.5. UAE Commercial Offices Vertical Video Surveillance Storage Market Revenues, 2015-2025F |

| 7.5.5.1. UAE Commercial Offices Sector Outlook |

| 7.5.6. UAE Hospitality & Healthcare Vertical Video Surveillance Storage Market Revenues, 2015-2025F |

| 7.5.6.1. UAE Healthcare Sector Outlook |

| 7.5.6.2. UAE Hospitality Sector Outlook |

| 7.5.7. UAE Residential Vertical Video Surveillance Storage Market Revenues, 2015-2025F |

| 7.5.7.1. UAE Residential Sector Outlook |

| 7.5.8. UAE Educational Institutes Vertical Video Surveillance Storage Market Revenues, 2015-2025F |

| 7.5.8.1. UAE Educational Sector Outlook |

| 7.6. UAE Video Surveillance Storage Market, Key Performance Indicators |

| 7.6.1. UAE Governmnet Spending Outlook |

| 7.6.2. UAE Upcoming Projects, By Sectors |

| 7.6.3. Dubai Expo 2020 Overview |

| 7.7. UAE Video Surveillance Storage Market Overview, Competitive Landscape |

| 7.8. UAE Video Surveillance Storage Market Opportunity Assessment, By Verticals, 2025F |

| 8. Qatar Video Surveillance Storage Market Overview |

| 8.1. Qatar Country Indicators |

| 8.2. Qatar Video Surveillance Storage Market Revenues (2015-2025F) |

| 8.3. Qatar Video Surveillance Storage Market Revenues, By Technology |

| 8.4. Qatar Video Surveillance Storage Market Revenues, By Deployment |

| 8.5. Qatar Video Surveillance Storage Market Overview, By Verticals |

| 8.5.1. Qatar BFSI Vertical Video Surveillance Storage Market Revenues, 2015-2025F |

| 8.5.1.1. Qatar Banking Sector Outlook |

| 8.5.2. Qatar Government & Transportation Vertical Video Surveillance Storage Market Revenues, 2015-2025F |

| 8.5.2.1. Qatar Transportation Sector Outlook |

| 8.5.3. Qatar Retail & Logistics Vertical Video Surveillance Storage Market Revenues, 2015-2025F |

| 8.5.3.1. Qatar Retail Sector Outlook |

| 8.5.4. Qatar Industrial Vertical Video Surveillance Storage Market Revenues, 2015-2025F |

| 8.5.5. Qatar Commercial Offices Vertical Video Surveillance Storage Market Revenues, 2015-2025F |

| 8.5.6. Qatar Hospitality & Healthcare Vertical Video Surveillance Storage Market Revenues, 2015-2025F |

| 8.5.6.1. Qatar Hospitality & Healthcare Sector Outlook |

| 8.5.7. Qatar Residential Vertical Video Surveillance Storage Market Revenues, 2015-2025F |

| 8.5.7.1. Qatar Residential Sector Outlook |

| 8.5.8. Qatar Educational Institutes Vertical Video Surveillance Storage Market Revenues, 2015-2025F |

| 8.6. Qatar Video Surveillance Storage Market, Key Performance Indicators |

| 8.6.1. Qatar Government Spending Outlook |

| 8.6.2. Qatar Commercial Sector Outlook |

| 8.6.3. Qatar Project Awards Outlook |

| 8.6.4. Qatar Infrastructure Sector Outlook |

| 8.7. Qatar Video Surveillance Market Overview, Competitive Landscape |

| 8.8. Qatar Video Surveillance Storage Market Opportunity Assessment, By Verticals, 2025F |

| 9. Kuwait Video Surveillance Storage Market Overview |

| 9.1. Kuwait Country Indicators |

| 9.2. Kuwait Video Surveillance Storage Market Revenues (2015-2025F) |

| 9.3. Kuwait Video Surveillance Storage Market Revenues, By Technology |

| 9.4. Kuwait Video Surveillance Storage Market Revenues, By Deployment |

| 9.5. Kuwait Video Surveillance Storage Market Overview, By Verticals |

| 9.5.1. Kuwait BFSI Vertical Video Surveillance Storage Market Revenues, 2015-2025F |

| 9.5.1.1. Kuwait Banking Sector Outlook |

| 9.5.2. Kuwait Government & Transportation Vertical Video Surveillance Storage Market Revenues, 2015-2025F |

| 9.5.2.1. Kuwait Transportation Sector Outlook |

| 9.5.3. Kuwait Retail & Logistics Vertical Video Surveillance Storage Market Revenues, 2015-2025F |

| 9.5.4. Kuwait Industrial Vertical Video Surveillance Storage Market Revenues, 2015-2025F |

| 9.5.5. Kuwait Commercial Offices Vertical Video Surveillance Storage Market Revenues, 2015-2025F |

| 9.5.6. Kuwait Hospitality & Healthcare Vertical Video Surveillance Storage Market Revenues, 2015-2025F |

| 9.5.6.1. Kuwait Hospitality Sector Outlook |

| 9.5.6.2. Kuwait Healthcare Sector Outlook |

| 9.5.7. Kuwait Residential Vertical Video Surveillance Storage Market Revenues, 2015-2025F |

| 9.5.7.1. Kuwait Residential Sector Outlook |

| 9.5.8. Kuwait Educational Institutes Vertical Video Surveillance Storage Market Revenues, 2015-2025F |

| 9.6. Kuwait Video Surveillance Storage Market Overview, Key Performance Indicators |

| 9.6.1. Kuwait Government Spending Outlook |

| 9.6.2. Kuwait Project Awards Outlook |

| 9.6.3. Major Construction Projects in Kuwait |

| 9.7. Kuwait Video Surveillance Storage Market Overview, Competitive Landscape |

| 9.8. Kuwait Video Surveillance Storage Market Opportunity Assessment, By Verticals, 2025F |

| 10. Bahrain Video Surveillance Storage Market Overview |

| 10.1. Bahrain Country Indicators |

| 10.2. Bahrain Video Surveillance Storage Market Revenues (2015-2025F) |

| 10.3. Bahrain Video Surveillance Storage Market Revenues, By Technology |

| 10.4. Bahrain Video Surveillance Storage Market Revenues, By Deployment |

| 10.5. Bahrain Video Surveillance Storage Market Overview, By Verticals |

| 10.5.1. Bahrain BFSI Vertical Video Surveillance Storage Market Revenues, 2015-2025F |

| 10.5.2. Bahrain Government & Transportation Vertical Video Surveillance Storage Market |

| Revenues, 2015-2025F |

| 10.5.2.1. Bahrain Transportation Sector Outlook |

| 10.5.3. Bahrain Retail & Logistics Vertical Video Surveillance Storage Market Revenues, 2015-2025F |

| 10.5.3.1. Bahrain Retail Sector Outlook |

| 10.5.4. Bahrain Industrial Vertical Video Surveillance Storage Market Revenues, 2015-2025F |

| 10.5.4.1. Bahrain Industrial Sector Outlook |

| 10.5.5. Bahrain Commercial Offices Vertical Video Surveillance Storage Market Revenues, 2015-2025F |

| 10.5.6. Bahrain Hospitality & Healthcare Vertical Video Surveillance Storage Market Revenues, 2015-2025F |

| 10.5.6.1. Bahrain Hospitality & Healthcare Sector Outlook |

| 10.5.7. Bahrain Residential Vertical Video Surveillance Storage Market Revenues, 2015-2025F |

| 10.5.7.1. Bahrain Residential Sector Outlook |

| 10.5.8. Bahrain Educational Institutes Vertical Video Surveillance Storage Market Revenues, 2015-2025F |

| 10.6. Bahrain Video Surveillance Storage Market Overview, Key Performance Indicators |

| 10.6.1. Bahrain Government Spending Outlook |

| 10.6.2. Bahrain Project Awards Outlook |

| 10.6.3. Bahrain Commercial Sector Outlook |

| 10.7. Bahrain Video Surveillance Storage Market Overview, Competitive Landscape |

| 10.8. Bahrain Video Surveillance Storage Market Opportunity Assessment, By Verticals, 2025F |

| 11. Oman Video Surveillance Storage Market Overview |

| 11.1. Oman Country Indicators |

| 11.2. Oman Video Surveillance Storage Market Revenues (2015-2025F) |

| 11.3. Oman Video Surveillance Storage Market Revenues, By Technology |

| 11.4. Oman Video Surveillance Storage Market Revenues, By Deployment |

| 11.5. Oman Video Surveillance Storage Market Overview, By Verticals |

| 11.5.1. Oman BFSI Vertical Video Surveillance Storage Market Revenues, 2015-2025F |

| 11.5.2. Oman Government & Transportation Vertical Video Surveillance Storage Market Revenues, 2015-2025F |

| 11.5.2.1. Oman Transportation Sector Outlook |

| 11.5.3. Oman Retail & Logistics Vertical Video Surveillance Storage Market Revenues, 2015-2025F |

| 11.5.4. Oman Industrial Vertical Video Surveillance Storage Market Revenues, 2015-2025F |

| 11.5.4.1. Oman Industrial Sector Outlook |

| 11.5.5. Oman Commercial Offices Vertical Video Surveillance Storage Market Revenues, 2015-2025F |

| 11.5.5.1. Oman Commercial Offices Sector Outlook |

| 11.5.6. Oman Hospitality & Healthcare Vertical Video Surveillance Storage Market Revenues, 2015-2025F |

| 11.5.6.1. Oman Tourism Sector Outlook |

| 11.5.7. Oman Residential Vertical Video Surveillance Storage Market Revenues, 2015-2025F |

| 11.5.7.1. Oman Residential Sector Outlook |

| 11.5.8. Oman Educational Institutes Vertical Video Surveillance Storage Market Revenues, 2015-2025F |

| 11.6 Oman Video Surveillance Storage Market Overview, Key Performance Indicators |

| 11.6.1 Oman Government Spending Outlook |

| 11.6.2 Oman Project Awards Outlook |

| 11.7 Oman Video Surveillance Market Overview, Competitive Landscape |

| 11.8 Oman Video Surveillance Storage Market, Opportunity Assessment, By Verticals |

| 12. GCC Video Surveillance Storage Market, Opportunity Assessment |

| 12.1. GCC Video Surveillance Storage Market Opportunity Assessment, By Technology |

| 12.2. GCC Video Surveillance Storage Market Opportunity Assessment, By Deployment |

| 12.3. GCC Video Surveillance Storage Market Opportunity Assessment, By Verticals |

| 13. Company Profiles |

| 13.1. Pelco Inc. |

| 13.2. Honeywell Middle-East FZE |

| 13.3. Hanwha Techwin Middle-East FZE |

| 13.4. Avigilon Corporation |

| 13.5. BCD Video |

| 13.6. Dell Technologies, Inc. |

| 13.7. Cisco Systems Inc. |

| 13.8. Fujitsu Technology Solutions |

| 13.9. Rasilient Systems Middle East FZE |

| 13.10. Pivot3, Inc. |

| 14. Key Strategic Recommendations |

| 15. Disclaimer |

| List of Figures |

| Figure1. GCC Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure2. GCC Video Surveillance Storage Market Revenue Share, By Technology, 2018 & 2025F |

| Figure3. GCC Video Surveillance Storage Market Revenue Share, By Deployment, 2018 & 2025F |

| Figure4. GCC Video Surveillance Storage Market Revenue Share, By Verticals, 2018 & 2025F |

| Figure5. GCC Video Surveillance Storage Market Revenue Share , By Countries, 2018 & 2025F |

| Figure6. GCC Video Surveillance Storage Market - Industry Life Cycle, 2018 |

| Figure7. Evolution Of Video Surveillance Storage Market |

| Figure8. Saudi Arabia Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure9. Saudi Arabia NAS Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure10. Saudi Arabia SAN Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure11. Saudi Arabia DAS Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure12. Saudi Arabia On-Premise Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure13. Saudi Arabia Cloud Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure14. Saudi Arabia Hybrid Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure15. Saudi Arabia BFSI Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure16. Saudi Arabia Bank ATMs per 100 Thousand People, 2010-17 |

| Figure17. Number Of Bank Branches Operating in Saudi Arabia, 2010-17 |

| Figure18. Saudi Arabia Government & Transportation Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure19. Saudi Arabia Retail & Logistics Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure20. Riyadh Retail Supply, 2015-2020F (Million Sq. m.) |

| Figure21. Jeddah Retail Supply, 2015-2020F (Million Sq. m.) |

| Figure22. DMA Retail Supply, 2015-2020F (Million Sq. m.) |

| Figure23. Makkah Retail Supply, 2015-2020F (Million Sq. m.) |

| Figure24. Saudi Arabia Industrial Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure25. Saudi Arabia Steel Production, 2018-2019 (Thousand Tonnes) |

| Figure26. Saudi Arabia Manufacturing Production, 2016-2018 (% Increase) |

| Figure27. Saudi Arabia Commercial Offices Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure28. Riyadh Office Supply, 2015-2020F (Million sq. m.) |

| Figure29. Jeddah Office Supply, 2015-2020F (Million sq. m.) |

| Figure30. DMA Office Supply, 2015-2020F (Million sq. m.) |

| Figure31. Makkah Office Supply, 2015-2020F (Million sq. m.) |

| Figure32. Saudi Arabia Hospitality & Healthcare Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure33. Riyadh Hotel Supply, 2015-2020F (‘000 No. of Rooms) |

| Figure34. Jeddah Hotel Supply, 2015-2020F (‘000 No. of Rooms) |

| Figure35. Major Upcoming Healthcare Projects in Saudi Arabia |

| Figure36. Upcoming Healthcare Projects in Saudi Arabia |

| Figure37. Saudi Arabia Residential Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure38. Saudi Arabia Educational Institutes Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure39. Saudi Arabia Actual Government Spending Vs Actual Government Revenues, 2015-2024F (SAR Billion) |

| Figure40. Saudi Arabia Government Budget Spending Outlook, 2019 ($ Billion) |

| Figure41. Saudi Arabia Forecasted Project Awards, 2018-2022 ($ Billion) |

| Figure42. Saudi Arabia Upcoming Projects, By Sectors ($ Billion) |

| Figure43. Saudi Arabia Video Surveillance Storage Market, Company Rankings, 2018 |

| Figure44. Saudi Arabia Video Surveillance Storage Market Revenue Share, By Companies, 2018 |

| Figure45. Saudi Arabia Video Surveillance Storage Market Opportunity Assessment, By Verticals, 2025F |

| Figure46. UAE Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure47. UAE NAS Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure48. UAE SAN Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure49. UAE DAS Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure50. UAE On-Premise Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure51. UAE Cloud Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure52. UAE Hybrid Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure53. UAE BFSI Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure54. UAE Bank ATMs per 100 Thousand People, 2010-17 |

| Figure55. Number Of Bank Branches Operating in UAE per 100 Thousand People, 2010-17 |

| Figure56. UAE Government & Transportation Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure57. UAE Retail & Logistics Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure58. Dubai Retail Supply, 2015-2021F (Million Sq. m.) |

| Figure59. Abu Dhabi Retail Supply, 2015-2020F (Million Sq. m.) |

| Figure60. UAE Industrial Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure61. Upcoming Industrial Projects in UAE |

| Figure62. UAE Commercial Offices Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure63. Dubai Office Supply, 2015-2021F (Million Sq. m.) |

| Figure64. Abu Dhabi Office Supply, 2015-2020F (Million Sq. m.) |

| Figure65. UAE Hospitality & Healthcare Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure66. UAE Upcoming Healthcare Projects |

| Figure67. Dubai Hotel Supply, 2015-2021F ('000 No. of Keys) |

| Figure68. Abu Dhabi Hotel Supply, 2015-2020F (‘000 No. Of Rooms) |

| Figure69. UAE Residential Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure70. Dubai Residential Supply, 2014-2021F (Thousand Units) |

| Figure71. Abu Dhabi Residential Supply, 2014-2020F (Thousand Units) |

| Figure72. UAE Educational Institutes Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure73. Upcoming Educational Projects in UAE |

| Figure74. UAE Actual Government Spending Vs Actual Government Revenues, 2015-2024F (AED Billion) |

| Figure75. UAE Budget Allocation for Financial Year, 2019 ($Billion) |

| Figure76. UAE Budget Allocation for Financial Year, 2018 ($Billion) |

| Figure77. UAE Federal Budget Allocation, 2018 (AED Billion) |

| Figure78. UAE Future Project Breakdown, by Sectors ($ Billion) |

| Figure79. UAE Video Surveillance Storage Market, By Ranking, 2018 |

| Figure80. UAE Video Surveillance Storage Market Revenue Share, By Companies, 2018 |

| Figure81. UAE Video Surveillance Storage Market Opportunity Assessment, By Verticals, 2025F |

| Figure82. Qatar Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure83. Qatar NAS Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure84. Qatar SAN Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure85. Qatar DAS Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure86. Qatar On-Premise Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure87. Qatar Cloud Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure88. Qatar Hybrid Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure89. Qatar BFSI Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure90. Qatar Bank ATMs Per 100 Thousand People, 2010-17 |

| Figure91. Number Of Bank Branches Operating in Qatar Per 100 Thousand People, 2010-17 |

| Figure92. Qatar Government & Transportation Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure93. Qatar Upcoming Major Transportation Infrastructure Projects |

| Figure94. Qatar Retail & Logistics Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure95. Qatar Organized Retail Supply, 2012-2019 ('000 Sq.m. GLA) |

| Figure96. Upcoming Malls in Qatar |

| Figure97. Qatar Industrial Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure98. Qatar Commercial Offices Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure99. Qatar Hospitality & Healthcare Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure100. Qatar Private Healthcare Spending, 2016 & 2026 ($ Billion) |

| Figure101. Qatar Public Healthcare Spending, 2016 & 2026 ($ Billion) |

| Figure102. Qatar Residential Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure103. Qatar Prime Apartment Supply, Prime Districts, 2012-2020 (Thousand Units) |

| Figure104. Qatar Educational Institutes Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure105. Qatar Actual Government Spending Vs Actual Government Revenues, 2015-2024F (QAR Billion) |

| Figure106. Qatar Budget Allocation, 2019 ($ Billion) |

| Figure107. Qatar Forecast Project Awards, 2018-2022 ($ Billion) |

| Figure108. Qatar Upcoming Projects, By Sectors ($ Billion) |

| Figure109. Qatar Video Surveillance Storage Market, Company Rankings, 2018 |

| Figure110. Qatar Video Surveillance Storage Market Revenue Share, By Companies, 2018 |

| Figure111. Qatar Video Surveillance Storage Market Opportunity Assessment, By Verticals, 2025F |

| Figure112. Kuwait Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure113. Kuwait NAS Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure114. Kuwait SAN Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure115. Kuwait DAS Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure116. Kuwait On-Premise Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure117. Kuwait Cloud Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure118. Kuwait Hybrid Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure119. Kuwait BFSI Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure120. Kuwait Bank ATMs per 100 Thousand People (2010-17) |

| Figure121. Number Of Bank Branches Operating in Kuwait, per 100 Thousand People (2010-17) |

| Figure122. Kuwait Government & Transportation Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure123. Kuwait Retail & Logistics Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure124. Kuwait Industrial Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure125. Kuwait Commercial Offices Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure126. Kuwait Hospitality & Healthcare Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure127. Kuwait Residential Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure128. Kuwait Educational Institutes Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure129. Kuwait Actual Government Spending Vs Actual Government Revenues, 2015-2024F (KWD Billion) |

| Figure130. Kuwait Forecasted Project Awards, 2018-2022 ($ Billion) |

| Figure131. Kuwait Future Project Breakdown, by Sector ($ Billion) |

| Figure132. Kuwait Video Surveillance Storage Market, Company Rankings, 2018 |

| Figure133. Kuwait Video Surveillance Storage Market Revenue Share, By Companies, 2018 |

| Figure134. Kuwait Video Surveillance Storage Market Opportunity Assessment, By Verticals, 2025F |

| Figure135. Bahrain Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure136. Bahrain NAS Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure137. Bahrain SAN Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure138. Bahrain DAS Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure139. Bahrain On-Premise Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure140. Bahrain Cloud Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure141. Bahrain Hybrid Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure142. Bahrain BFSI Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure143. Bahrain Government & Transportation Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure144. Phase-wise Plans Under Bahrain Public Transport Masterplan |

| Figure145. Bahrain Retail & Logistics Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure146. Bahrain New Retail Space Supply, 2017-2020 (sq.m.) |

| Figure147. Bahrain Retail Market Size, Gross Leasable Area By Grade, 2007-2019 (sq.m.) |

| Figure148. Bahrain Industrial Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure149. Bahrain Commercial Offices Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure150. Bahrain Hospitality & Healthcare Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure151. Manama Hotel Supply, 2016-2020 (Number of Branded Hotel Keys) |

| Figure152. Bahrain Residential Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure153. Bahrain Residential Supply Pipeline, 2017-2020 (Units) |

| Figure154. Bahrain Residential Units Under Construction By Submarket (Units) |

| Figure155. Bahrain Educational Institutes Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure156. Bahrain Actual Government Spending Vs Actual Government Revenues, 2015-2024F (BHD Billion) |

| Figure157. Bahrain Forecasted Project Awards, 2018-2022 ($ Billion) |

| Figure158. Bahrain Upcoming Projects, By Sectors ($ Billion) |

| Figure159. Bahrain Video Surveillance Storage Market, Company Rankings, 2018 |

| Figure160. Bahrain Video Surveillance Storage Market Revenue Share, By Companies, 2018 |

| Figure161. Bahrain Video Surveillance Storage Market Opportunity Assessment, By Verticals, 2025F |

| Figure162. Oman Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure163. Oman NAS Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure164. Oman SAN Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure165. Oman DAS Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure166. Oman On-Premise Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure167. Oman Cloud Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure168. Oman Hybrid Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure169. Oman BFSI Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure170. Oman Government & Transportation Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure171. Oman Retail & Logistics Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure172. Oman Industrial Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure173. Oman Commercial Offices Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure174. Oman Hospitality & Healthcare Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure175. Muscat Hotel Supply, 2016 - 2021 (Number of Keys) |

| Figure176. Oman Residential Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure177. Oman Educational Institutes Vertical Video Surveillance Storage Market Revenues, 2015-2025F ($ Million) |

| Figure178. Oman Actual Government Spending Vs Actual Government Revenues, 2015-2024F (OMR Billion) |

| Figure179. Oman Forecasted Project Awards, 2018-2022 ($ Billion) |

| Figure180. Oman Upcoming Projects, By Sectors ($ Billion) |

| Figure181. Oman Video Surveillance Storage Market, Company Rankings, 2018 |

| Figure182. Oman Video Surveillance Storage Market Revenue Share, By Companies, 2018 |

| Figure183. Oman Video Surveillance Storage Market Opportunity Assessment, By Verticals, 2025F |

| Figure184. GCC Video Surveillance Storage Market Opportunity Assessment, By Technology, 2025F |

| 185. GCC Video Surveillance Storage Market Opportunity Assessment, By Deployment, 2025F |

| 186. GCC Video Surveillance Storage Market Opportunity Assessment, By Verticals, 2025F |

| List of Tables |

| Table1. Saudi Arabia Upcoming Transportation Projects |

| Table2. Upcoming Hotel Projects in Saudi Arabia |

| Table3. List of Major Infrastructure Projects in Saudi Arabia |

| Table4. UAE Upcoming Transportation Projects |

| Table5. Upcoming Malls in UAE |

| Table6. Upcoming Commercial Office Projects in Dubai |

| Table7. Upcoming Hospitality Projects in UAE |

| Table8. Upcoming Infrastructural Projects in Dubai |

| Table9. Upcoming Residential Projects in UAE |

| Table10. Upcoming Dubai World Expo 2020 Projects |

| Table11. Qatar Upcoming Residential Projects |

| Table12. Qatar Upcoming Commercial Building Projects |

| Table13. Qatar Under Development Commercial Infrastructure Projects |

| Table14. Kuwait Upcoming Hospitality Projects |

| Table15. Kuwait Upcoming Residential Projects |

| Table16. Bahrain Upcoming Residential Projects |

| Table17. Oman Upcoming Industrial Projects |

| Table18. Oman Upcoming Residential Projects |

- Single User License$ 4,560

- Department License$ 5,055

- Site License$ 5,595

- Global License$ 6,000

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Tajikistan Thermal Camera Market (2025-2031) | Trends, Size, Growth, Share, Industry, Companies, Value, Analysis, Revenue, Forecast & Outlook

- Singapore Professional AV Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- Saudi Arabia Genset Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- India OOH Advertising Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- Vietnam Twisted Pair Cables Market (2024-2030) | Size & Revenue, Forecast, Share, Companies, Competitive Landscape, Analysis, Trends, Value, Segmentation, Outlook, Industry, Growth

- South Africa B2B Cleaning Market (2025-2031) | Size & Revenue, Forecast, Share, Companies, Competitive Landscape, Analysis, Trends, Value, Segmentation, Outlook, Industry, Growth

- Mexico Dispersion Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- United States Video Conferencing Market (2025-2031) | Outlook, Industry, Size, Revenue, Share, Trends, Forecast, Growth, Companies, Analysis & Value

- Australia Electric Motor Market (2025-2031) | Trends, Share, Size, Value, Revenue, Industry, Growth, Analysis, Segmentation & Outlook

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- India's Printer Market Faces 20.7% Decline in Q4 2023: Epson and HP Lead Amidst Downturn

- India's Camera Market Sees 8.9% Decline in Q4 2023; Canon Leads with 38.4% Share

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- The future of gaming industry in the Philippines