India Hard Disk Market Tracker (2024-2030) | Analysis, Trends, Forecast, Companies, Value, Outlook, Size, Share, Revenue, Growth & Industry

India Hard Disk Market Tracker, CY Q1'2014

| Product Code: ETC000167 | Publication Date: Aug 2023 | Product Type: Report | |

| Publisher: 6Wresearch | |||

India Hard Disk Market Competition 2023

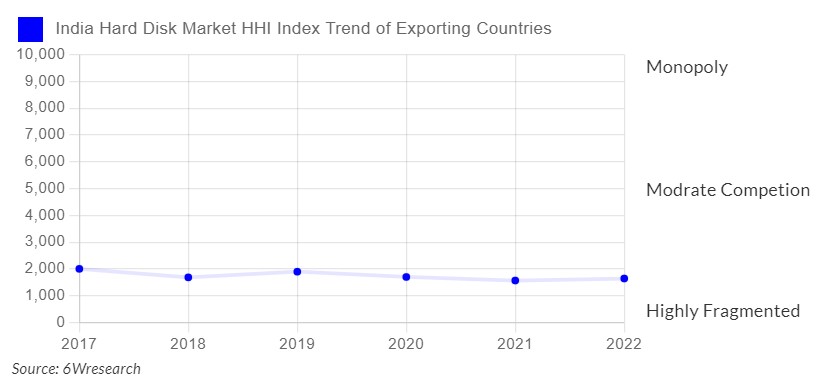

India Hard Disk market currently, in 2023, has witnessed an HHI of 1643, Which has decreased slightly as compared to the HHI of 2004 in 2017. The market is moving towards moderately competitive. Herfindahl index measures the competitiveness of exporting countries. The range lies from 0 to 10000, where a lower index number represents a larger number of players or exporting countries in the market while a large index number means fewer numbers of players or countries exporting in the market.

India Export Potential Assessment For Hard Disk Market (Values in USD Thousand)

India Hard Disk Market Shipment Analysis

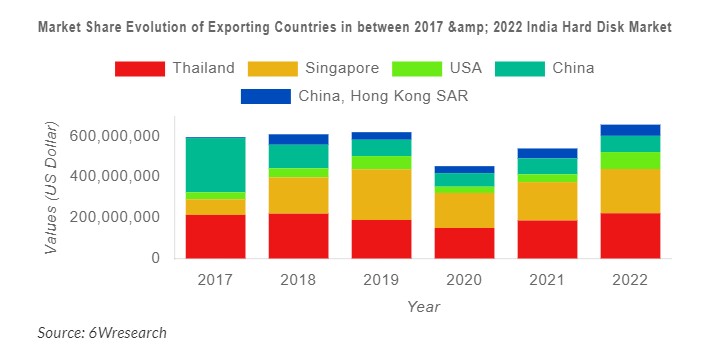

India Hard Disk Market registered a growth of 11.26% in value shipments in 2022 as compared to 2021 and a decrease of -1.04% CAGR in 2022 over a period of 2017. In Hard Disk Market India is becoming more competitive as the HHI index in 2022 was 1643 while in 2017 it was 2004. Herfindahl Index measures the competitiveness of exporting countries. The range lies from 0 to 10000, where a lower index number represents a larger number of players or exporting countries in the market while a large index number means less numbers of players or countries exporting in the market. India has reportedly relied more on imports to meet its growing demand in Hard Disk Market.

India Hard Disk Market Competition 2023

India Hard Disk market currently, in 2023, has witnessed an HHI of 1643, Which has decreased substantially as compared to the HHI of 2004 in 2017. The market is moving towards moderately competitive. Herfindahl index measures the competitiveness of exporting countries. The range lies from 0 to 10000, where a lower index number represents a larger number of players or exporting countries in the market while a large index number means fewer numbers of players or countries exporting in the market.

India Export Potential Assessment For Hard Disk Market (USD Values in Thousand)

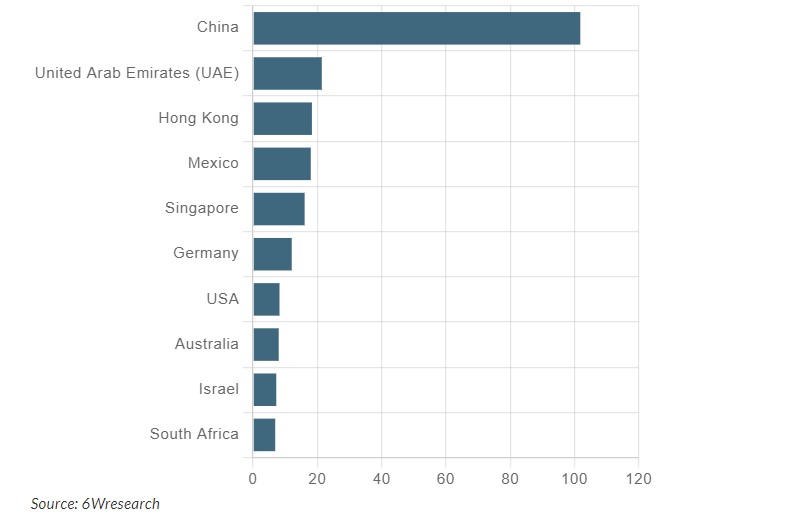

For India Exporters of Hard Disk, China seems to be the most attractive market (in 2028) in terms of export potential followed by United Arab Emirates (UAE), Hong Kong, Mexico and Singapore. However, in terms of total import demand across all countries, Thailand occupies the top position. Hence considering overall import demand, Thailand leads the importing demand but considering India as a partner, China provides high unmet demand potential as Compared to others for 2028.

India Hard Disk Market Synopsis

The India Hard Disk Market has accomplished noteworthy growth in recent years and this growth of the market is primarily driven by the growing demand for data storage solutions in numerous sectors. The proliferation of virtual content, escalating IT infrastructure, and the increase of e-commerce and cloud services have stimulated the India Hard Disk Market growth.

According to 6Wresearch, the India Hard Disk Market size is anticipated to rise at a higher growth rate during 2024-2030. Many factors fuel the growth of the hard disk industry in India. The burgeoning data-driven ecosystem, coupled with the growth in digitalization as well as the implementation of emerging technologies such as IoT and AI, has led to a growth in data generation. This, in turn, drives the demand for high-capacity storage devices, stimulating the sales of hard disks. In addition, the growing number of businesses and individuals depending on virtual platforms further amplifies the requirement for robust and consistent storage solutions.

The India Hard Disk Industry experiences challenges such as intense competition from alternative storage solutions such as SSDs and the constant requirement for innovation to keep up with expanding technological trends. Economic uncertainties and fluctuations in currency exchange rates also limit the market progress.

India Hard Disk Market: Government Initiatives

The government in India has recognized the significance of the IT and electronics sector, including data storage devices, in its virtual transformation initiatives. Policies promoting local manufacturing, like the "Make in India" campaign, have inspired domestic production of hard disks. Import regulations as well as tax incentives have been executed in order to support the growth of the indigenous hard disk manufacturing sector.

Leading Players of the Market

Many key players have been leading the Hard Disk Market in India. Established international brands, as well as developing local players, contribute to the competitive landscape. Players such as Seagate, Western Digital, Toshiba, as well as Samsung, hold noteworthy market shares, leveraging their technological expertise and global presence. Indian players such as WDC (Western Digital Corporation) and local manufacturing initiatives also contribute to market development. These key players have a major role to play in the market's success.

Key Highlights of the Report:

- India Hard Disk Market Overview

- India Hard Disk Market Outlook

- Market Size of India Hard Disk Market, 2023

- Forecast of India Hard Disk Market, 2030

- Historical Data and Forecast of India Hard Disk Revenues & Volume for the Period 2020 - 2030

- India Hard Disk Market Trend Evolution

- India Hard Disk Market Drivers and Challenges

- India Hard Disk Price Trends

- India Hard Disk Porter's Five Forces

- India Hard Disk Industry Life Cycle

- Historical Data and Forecast of India Hard Disk Market Revenues & Volume By Type for the Period 2020 - 2030

- Historical Data and Forecast of India Hard Disk Market Revenues & Volume By Hybrid disk drives (HHD) for the Period 2020 - 2030

- Historical Data and Forecast of India Hard Disk Market Revenues & Volume By Solid-State drives (SDD) for the Period 2020 - 2030

- Historical Data and Forecast of India Hard Disk Market Revenues & Volume By Hard disk drive (HDD) for the Period 2020 - 2030

- Historical Data and Forecast of India Hard Disk Market Revenues & Volume By Application for the Period 2020 - 2030

- Historical Data and Forecast of India Hard Disk Market Revenues & Volume By Servers for the Period 2020 - 2030

- Historical Data and Forecast of India Hard Disk Market Revenues & Volume By Desktop for the Period 2020 - 2030

- Historical Data and Forecast of India Hard Disk Market Revenues & Volume By Notebook for the Period 2020 - 2030

- India Hard Disk Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Application

- India Hard Disk Top Companies Market Share

- India Hard Disk Competitive Benchmarking By Technical and Operational Parameters

- India Hard Disk Company Profiles

- India Hard Disk Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 India Hard Disk Market Overview |

| 3.1 India Country Macro Economic Indicators |

| 3.2 India Hard Disk Market Revenues & Volume, 2021 & 2031F |

| 3.3 India Hard Disk Market - Industry Life Cycle |

| 3.4 India Hard Disk Market - Porter's Five Forces |

| 3.5 India Hard Disk Market Revenues & Volume Share, By Type, 2021- 2031F |

| 3.6 India Hard Disk Market Revenues & Volume Share, By Application, 2021- 2031F |

| 4 India Hard Disk Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 India Hard Disk Market Trends |

| 6 India Hard Disk Market, Segmentations |

| 6.1 India Hard Disk Market, By Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 India Hard Disk Market Revenues & Volume, By Hybrid disk drives (HHD), 2021- 2031F |

| 6.1.3 India Hard Disk Market Revenues & Volume, By Solid-State drives (SDD), 2021- 2031F |

| 6.1.4 India Hard Disk Market Revenues & Volume, By Hard disk drive (HDD), 2021- 2031F |

| 6.2 India Hard Disk Market, By Application |

| 6.2.1 Overview and Analysis |

| 6.2.2 India Hard Disk Market Revenues & Volume, By Servers, 2021- 2031F |

| 6.2.3 India Hard Disk Market Revenues & Volume, By Desktop, 2021- 2031F |

| 6.2.4 India Hard Disk Market Revenues & Volume, By Notebook, 2021- 2031F |

| 7 India Hard Disk Market Import-Export Trade Statistics |

| 7.1 India Hard Disk Market Export to Major Countries |

| 7.2 India Hard Disk Market Imports from Major Countries |

| 8 India Hard Disk Market Key Performance Indicators |

| 9 India Hard Disk Market - Opportunity Assessment |

| 9.1 India Hard Disk Market Opportunity Assessment, By Type, 2021- 2031F |

| 9.2 India Hard Disk Market Opportunity Assessment, By Application, 2021- 2031F |

| 10 India Hard Disk Market - Competitive Landscape |

| 10.1 India Hard Disk Market Revenue Share, By Companies, 2024 |

| 10.2 India Hard Disk Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

- Kenya Road Stabilization Equipment Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- North America Sodium chloride Market (2025-2031) | Analysis, Revenue, Forecast, Trends, Companies, Size, Growth, Share, Industry, Outlook & Value

- North America Vinyl Flooring Market (2025-2031) | Value, Growth,Size, Analysis, Revenue, Industry, Forecast, Share, Outlook, Companies & Trends

- Tajikistan Thermal Camera Market (2025-2031) | Trends, Size, Growth, Share, Industry, Companies, Value, Analysis, Revenue, Forecast & Outlook

- Singapore Professional AV Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- Saudi Arabia Genset Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- India OOH Advertising Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- Vietnam Twisted Pair Cables Market (2024-2030) | Size & Revenue, Forecast, Share, Companies, Competitive Landscape, Analysis, Trends, Value, Segmentation, Outlook, Industry, Growth

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero