India Alcoholic Beverages Market Outlook (2021-2027) | Growth, Share, Size, industry, Forecast, Revenue & COVID-19 IMPACT

Market Forecast By Types (Beer, Spirit, Wine), By Packaging (Plastic Bottles, Glass Bottles, Cans), By Distribution Channels (Hypermarkets/Supermarkets, Online Retail Stores, Specialty Stores, Restaurants/Bars) and competitive landscape

| Product Code: ETC002382 | Publication Date: Aug 2023 | Updated Date: May 2024 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 77 | No. of Figures: 14 | No. of Tables: 5 | |

India Alcoholic Beverages Market Competition 2023

India Alcoholic Beverages market currently, in 2023, has witnessed an HHI of 6185, Which has decreased substantially as compared to the HHI of 7096 in 2017. The market is moving towards Highly concentrated. Herfindahl index measures the competitiveness of exporting countries. The range lies from 0 to 10000, where a lower index number represents a larger number of players or exporting countries in the market while a large index number means fewer numbers of players or countries exporting in the market.

India Export Potential Assessment For Alcoholic Beverages Market (Values in USD Thousand)

Latest 2023 Development of the India Alcoholic Beverages Market

India Alcoholic Beverages Market is one of the largest markets in the world. The market is being driven by increasing disposable income, growing middle class, and changing lifestyle preferences. The India Alcoholic Beverages Market size is expected to grow at a CAGR of around XX% in the forthcoming years. The major trends and development in the industry include increasing demand for premium beer. Wine and spirits are gaining popularity among consumers, and the market for these products is expanding due to their increasing availability of this product. The trend towards health and wellness has also impacted the alcoholic beverages market as consumers are increasingly opting for low-calorie and low-alcohol drinks. The government of India has implemented strict regulations on the sale and distribution of alcoholic beverages which has affected the growth of the market. However, the impact has been alleviated by increasing online sales.

The alcoholic beverages industry in India is anticipated to witness substantial growth in the coming years by the changing demographics, rapid urbanization, and growing tourism as India is a popular tourist destination. The proliferation of e-commerce platforms and the increasing penetration of smartphones have further created new opportunities for the sale of alcoholic beverages.

India Alcoholic Beverages Market Synopsis

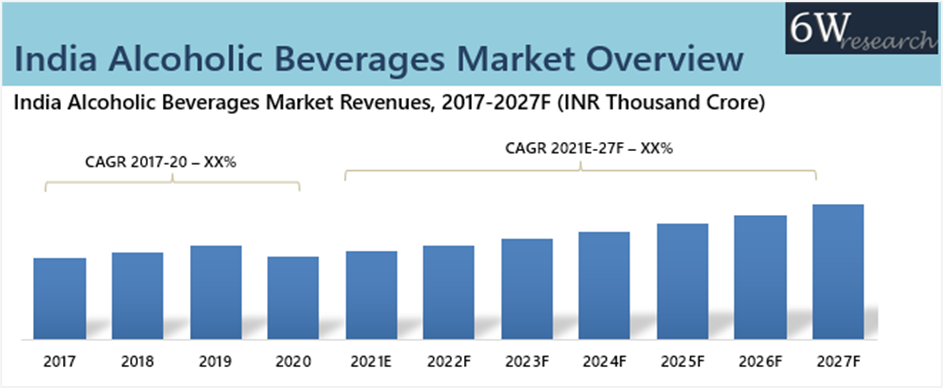

India alcoholic beverages market witnessed steady growth during 2018-19 owing to rising income and changing lifestyles however encountered a decline in 2020 owing to the outbreak of Covid-19. The sudden outbreak of the Covid-19 pandemic resulted in the full prohibition on the sale of alcohol due to the lockdown in 2020 which affected the consumption of alcohol among consumers in India.

India alcoholic beverages market is likely to experience rapid growth in the forecast period on account of increasing disposable income, urbanization, and changing lifestyles, along with the growth of the youth population and working women population. Moreover, the increasing demand for cafes, bars, and restaurants is thereby expected to lead to an increased demand for alcohol during the forecast period

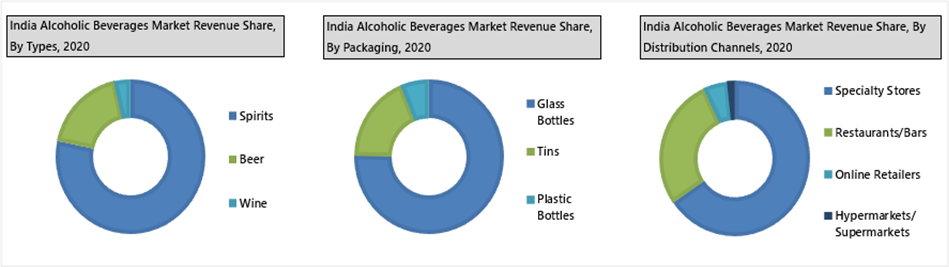

According to 6Wresearch, India Alcoholic Beverages Market size is projected to grow at a CAGR of 7.2% during 2021-2027. Spirits are the most consumed alcoholic beverage in India owing to increasing disposable income along with growing youth and working women populations Based on packaging, glass bottles acquired the maximum revenue share in 2020 on account of the rising premiumization of brands and premium brands prefer selling alcohol in glass bottles as it looks elegant. Based on distribution channel, Specialty stores have the highest share among all other distribution channels as Specialty Stores sells alcohol on MRP and a large variety of alcohol brands are available at the same place. Within regions, the southern region captured the majority share in terms of revenue as five southern states i.e., Andhra Pradesh, Telangana, Tamil Nadu, Karnataka, and Kerala together acquired the major revenue share in the Indian Alcoholic Beverages market due to their increase in demand for alcohol in the regions among youth.

Market by Type Analysis

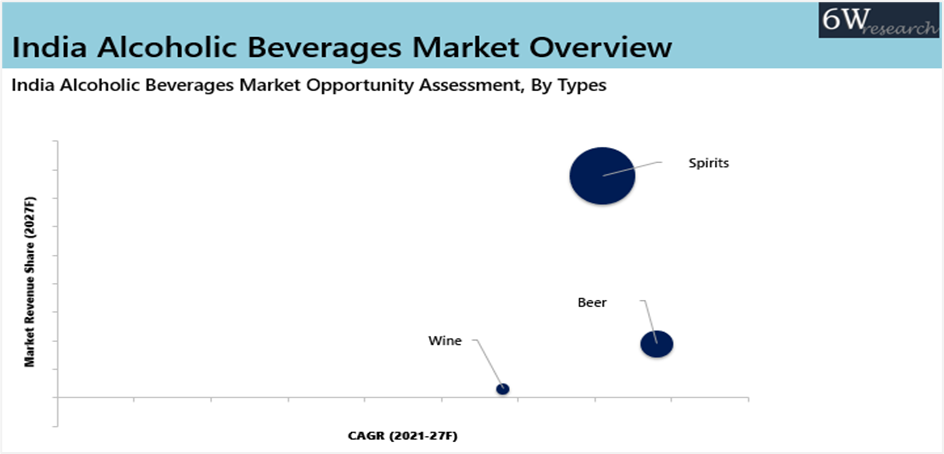

Within by types, Spirits acquired more than 75% of the market share in terms of revenue. They are projected to show significant growth during the forecast period owing to increasing demand for whiskey among consumers. Also, India is one of the largest consumers and producers of whiskey. However, spirits are driven primarily by whiskey growth, other subsegments like brandy, rum, vodka, and gin have also been garnering steady numbers in the last few years

Market by Regions Analysis

By regions, the Southern region dominated the India alcoholic beverages market in 2020 owing to which, five southern states i.e., Andhra Pradesh, Telangana, Tamil Nadu, Karnataka, and Kerala together acquired the major revenue share in the Indian Alcoholic Beverages market. Also, the Southern region is expected to register the highest growth in the fore coming years in India alcohol beverages market as the per capita income of southern states is higher than other regions with an increase in income, the consumer purchasing power increases and thus it would result in increased consumption of alcohol.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2017 to 2020.

- Base Year: 2020

- Forecast Data until 2027.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- India Alcoholic Beverages Market Overview

- India Alcoholic Beverages Market Outlook

- India Alcoholic Beverages Market Forecast

- Historical Data and Forecast of India Alcoholic Beverages Market Revenues for the Period 2017-2027F

- Historical Data and Forecast of India Alcoholic Beverages Market Revenues, By Types, for the Period 2017-2027F

- Historical Data and Forecast of India Alcoholic Beverages Market Revenues, By Packaging, for the Period 2017-2027F

- Historical Data and Forecast of India Alcoholic Beverages Market Revenues, By Distribution Channels, for the Period 2017-2027F

- Historical Data and Forecast of India Alcoholic Beverages Market Revenues, By Regions, for the Period 2017-2027F

- Market Drivers and Restraints

- Industry Life Cycle

- Porter’s Five Force Analysis

- Impact Analysis of COVID-19

- Market Trends

- India Alcoholic Beverages Market Revenue Ranking, By Companies

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Types

- Spirits

- Beer

- Wine

By Packaging

- Glass Bottles

- Plastic Bottles

- Tins

By Distribution Channels

- Specialty Stores

- Online Retailers

- Hypermarkets/Supermarkets

- Restaurants/Bars

By Regions

- Southern

- Western

- Eastern

- Northern

India Alcoholic Beverages Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. India Alcoholic Beverages Market Overview |

| 3.1. India Alcoholic Beverages Market Revenues, 2017-2027F |

| 3.2. India Alcoholic Beverages Market Industry Life Cycle |

| 3.3. India Alcoholic Beverages Market Porter's Five Forces |

| 3.4. India Alcoholic Beverages Market Revenue, By Types, 2020 & 2027F |

| 3.5. India Alcoholic Beverages Market Revenue, By Packaging, 2020 & 2027F |

| 3.6. India Alcoholic Beverages Market Revenue, By Distribution Channels, 2020 & 2027F |

| 3.7. India Alcoholic Beverages Market Revenue Share, By Regions, 2020 & 2027F |

| 4. Impact Analysis of COVID-19 on India Alcoholic Beverages Market |

| 5. India Alcoholic Beverages Market Dynamics |

| 5.1. Impact Analysis |

| 5.2. Market Drivers |

| 5.3. Market Restraints |

| 6. India Alcoholic Beverages Market Trends & Evolution |

| 7. India Alcoholic Beverages Market Overview, By Types |

| 7.1. India Alcoholic Beverages Market Revenues, By Spirits, 2017-2027F |

| 7.2. India Alcoholic Beverages Market Revenues, By Beer, 2017-2027F |

| 7.3. India Alcoholic Beverages Market Revenues, By Wine, 2017-2027F |

| 8. India Alcoholic Beverages Market Overview, By Packaging |

| 8.1. India Alcoholic Beverages Market Revenues, By Glass Bottles, 2017-2027F |

| 8.2. India Alcoholic Beverages Market Revenues, By Tins, 2017-2027F |

| 8.3. India Alcoholic Beverages Market Revenues, By Plastic Bottles, 2017-2027F |

| 9. India Alcoholic Beverages Market Overview, By Distribution Channels |

| 9.1. India Alcoholic Beverages Market Revenues, By Specialty Stores , 2017-2027F |

| 9.2. India Alcoholic Beverages Market Revenues, By Restaurants/Bars, 2017-2027F |

| 9.3. India Alcoholic Beverages Market Revenues, By Online Retailers Hypermarkets/Supermarkets, 2017-2027F |

| 9.4. India Alcoholic Beverages Market Revenues, By Hypermarkets/Supermarkets, 2017-2027F |

| 10. India Alcoholic Beverages Market Overview, By Regions |

| 10.1. India Alcoholic Beverages Market Revenues, By Southern , 2017-2027F |

| 10.2. India Alcoholic Beverages Market Revenues, By Western, 2017-2027F |

| 10.3. India Alcoholic Beverages Market Revenue, By Northern , 2017-2027F |

| 10.4. India Alcoholic Beverages Market Revenue, By Eastern, 2017-2027F |

| 11. India Alcoholic Beverages Market - Key Performance Indicators |

| 12. India Alcoholic Beverages Market - Opportunity Assessment |

| 12.1. India Alcoholic Beverages Market Opportunity Assessment, By Types, 2027F |

| 12.2. India Alcoholic Beverages Market Opportunity Assessment, By Packaging, 2027F |

| 12.3. India Alcoholic Beverages Market Opportunity Assessment, By Distribution channels, 2027F |

| 12.4. India Alcoholic Beverages Market Opportunity Assessment, By Regions, 2027F |

| 13. India Alcoholic Beverages Market Competitive Landscape |

| 13.1. India Alcoholic Beverages Market Revenue Share, By Company, 2020 |

| 13.2. India Alcoholic Beverages Market Competitive Benchmarking, By Operating Parameters |

| 14. Company Profiles |

| 14.1. United Spirits Limited |

| 14.2. United Breweries Limited |

| 14.3. Radico Khaitan Limited |

| 14.4. Globus Spirits Limited |

| 14.5. Tilak Nagar Industries Limited |

| 14.6. Associated Alcoholic & Breweries Limited |

| 14.7. GM Breweries Limited |

| 14.8. Jagatjit Industries Limited |

| 14.9. Som Distilleries & Breweries Limited |

| 14.10. Winsome Breweries Limited |

| 15. Key Strategic Recommendations |

| 16. Disclaimer |

| List of Figures |

| Figure 1. India Alcoholic Beverages Market Revenues, 2017-2027F (INR Thousand Crore) |

| Figure 2. India Alcoholic Beverages Market Revenue Share, By Types, 2020 & 2027F |

| Figure 3. India Alcoholic Beverages Market Revenue Share, By Packaging, 2020 & 2027F |

| Figure 4. India Alcoholic Beverages Market Revenue Share, By Distribution Channels, 2020 & 2027F |

| Figure 5. India Alcoholic Beverages Market Revenue Share, By Regions, 2020 & 2027F |

| Figure 6. GDP per capita of India, 2000 to 2020 (USD) |

| Figure 7. Percentage of Urban Population in India, 2000-2020 |

| Figure 8. Prestige and Above Brands Growth, 2016-2020, (Million cases) |

| Figure 9. Number of Hotels by Cities, 2018-2020, (Percentage) |

| Figure 10. India Alcoholic Beverages Market Opportunity Assessment, By Types, 2027F |

| Figure 11. India Alcoholic Beverages Market Opportunity Assessment, By Packaging, 2027F |

| Figure 12. India Alcoholic Beverages Market Opportunity Assessment, By Distribution Channels, 2027F |

| Figure 13. India Alcoholic Beverages Market Opportunity Assessment, By Regions, 2027F |

| Figure 14. India Alcoholic Beverages Market Revenue Share, By Companies, 2020 |

| List of Tables |

| Table 1. Legal age of drinking by states in India |

| Table 2: India Alcoholic Beverages Market Revenues, By Types, 2017-2027F (INR Thousand Crore) |

| Table 3. India Alcoholic Beverages Market Revenues, By Packaging, 2017-2027F (INR Thousand Crore) |

| Table 4. India Alcoholic Beverages Market Revenues, By Distribution Channels, 2017-2027F (INR Thousand Crore) |

| Table 5. India Alcoholic Beverages Market Revenues, By Regions, 2017-2027F (INR Thousand Crore) |

Market Forecast By Types (Beer, Spirit, Wine), By Packaging (Plastic Bottles, Glass Bottles, Cans), By Distribution Channels (Hypermarkets/Supermarkets, Online Retail Stores, Specialty Stores, Restaurants/Bars) and competitive landscape

| Product Code: ETC002382 | Publication Date: Apr 2020 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

India Alcoholic Beverage market is expected to register growth during the forecast period 2020-26F owing to rising consumer preferences for premium alcohol drinking coupled with rising per capita alcohol consumption amongst the young population. However, the spread of the COVID-19 virus would lead to a decline in alcoholic beverage market revenues in the first few months of 2020 on the back of complete lockdown across the country leading to the closure of retail alcohol stores, which would act as a restraint for the growth of India Alcoholic Beverage market during 2020. The market is expected to gain momentum at the beginning of 2021, as the disease outbreak registers slowdown.

According to 6Wresearch, India Alcoholic Beverage Market is anticipated to witness growth during the forecast period 2020-26F. Further, increasing tourism will also contribute towards increased demand for imported alcoholic beverages and would further propel the growth of the Indian alcoholic beverage market in the near future.

On the basis of types, whiskey is expected to register the highest growth in the overall India alcoholic beverage market owing to the high preference of the population towards whiskey over other alcoholic beverages such as beer and spirits. According to Bank of America, India consumes around 1.5 billion liters of whiskey each year, which is equivalent to about half of the world’s total whiskey production. Further, wine and spirits including rum and vodka are expected to register sound growth in the coming years on the back of rising preference for vodka and rum amongst the women and youth, the growing consumer base for the aforementioned drinks is expected to contribute significantly towards the growth of the India alcoholic beverage market in the near term.

The India Alcoholic Beverage report thoroughly covers the market by Types, Packaging, and Distribution Channels. India Alcoholic Beverage outlook report provides an unbiased and detailed analysis of the on-going India Alcoholic Beverage trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies accordingly to the current and future market dynamics.

India Alcoholic Beverage market is expected to register potential growth during the forecast period 2020-26F owing to the changing the behavior of the consumers towards premium alcohol drinking coupled with rising per capita alcohol consumption amongst the young population. Owing to the sizable middle-class population, increase in the per capita consumer spending on alcohol, sound economic conditions for the development of the alcohol industry, and rapid urbanization in the country, the alcoholic beverage market in India is anticipated to fuel in the upcoming six years. Further, increasing tourism will also contribute towards increased demand for imported alcoholic beverages and would further propel the growth of the India alcoholic beverage market in the near future.

India Alcoholic Beverage market is expected to witness growth during the forecast period 2020-26F owing to the growing number of prosperous young adults gaining interest in alcohol consumption coupled with the premiumization of beer, wine, and other light alcohol-based beverages in the country. On the basis of types, spirits are expected to register the highest growth rate in the overall Indian alcoholic beverage market in the coming years owing to increased consumer spending by the natives of the country on leisure and entertainment which includes most of the time spending on quality dining at bars, pubs, and restaurants. Moreover, rapid urbanization in the country coupled with an increase in the middle-class population spending along with emerging tastes and preferences of women as well as youth towards wine, rum, and vodka are anticipated to proliferate the market growth of India alcoholic beverage market during the forecast period. on the basis of country, India alcoholic beverage market is expected to contribute towards the significant growth of India with beer captivated to be the growth contributing factor backed by an increase in the consumption of Beer in the country. a shift towards weekend partying is expected to contribute to the growth of the India alcoholic beverage market and is, further, expected to leave a positive outlook in the overall market growth of the India alcoholic beverage market in the coming time zone.

India Alcoholic Beverages Market is projected to witness substantial growth in the upcoming six years on the back of the rising alcoholic drinkers steadily in the country. Additionally, Goa is estimated to generate lucrative opportunities in the country owing to the rising number of tourist along with bars and restaurants contains a wide range of alcohol which has led to attracts massive drinkers especially youth which is estimated to propelling demand for Alcoholic beverages like beer and whisky and this would benefit the progressive growth of India Alcoholic Beverages Market in the upcoming six years. Additionally, youth base consumers are expected to secure massive Alcoholic drinkers which would strengthen India Alcoholic Beverages Market in the upcoming six years.

Key Highlights of the Report:

- India Alcoholic Beverage Market Overview

- India Alcoholic Beverage Market Outlook

- India Alcoholic Beverage Market Forecast

- India Alcoholic Beverage Market Size and India Alcoholic Beverage Market Forecast until 2025

- India Alcoholic Beverage Market Share, By Types

- India Alcoholic Beverage Market Share, By Packaging

- India Alcoholic Beverage Market Share, By Distribution Channels

- India Alcoholic Beverage Market Share, By Region

- Historical Data of India Alcoholic Beverage Market Revenues and Volume for the period, 2015-2018

- Market size and Forecast of India Alcoholic Beverage Market Revenues and Volume until 2025

- Historical Data of India Alcoholic Beverage Market Revenues and Volume, By Types, for the Period 2015-2018

- Market size and Forecast of India Alcoholic Beverage Market Revenues and Volume, By Types, until 2025

- Historical Data of India Alcoholic Beverage Market Revenues and Volume, By Packaging, for the Period 2015-2018

- Market size and Forecast of India Alcoholic Beverage Market Revenues and Volume, By Packaging, until 2025

- Historical Data of India Alcoholic Beverage Market Revenues and Volume, By Distribution Channels, for the Period 2015-2018

- Market size and Forecast of India Alcoholic Beverage Market Revenues and Volume, By Distribution Channels, until 2025

- Historical Data of India Alcoholic Beverage Market Revenues and Volume, By Region, for the Period 2015-2018

- Market size and Forecast of India Alcoholic Beverage Market Revenues and Volume, By Region, until 2025

- India Alcoholic Beverage Market Drivers and Restraints

- India Alcoholic Beverage Market Trends and Industry Life Cycle

- Porter’s Five Force Analysis

- India Alcoholic Beverage Market Opportunity Assessment

- India Alcoholic Beverage Market Revenue Share, By Company

- India Alcoholic Beverage Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

India Alcoholic Beverage Market Report Covered:

The India Alcoholic Beverage Market report provides a detailed analysis of the following market segments:

- By Types:

- Beer

- Spirit

- Wine

- By Packaging:

- Plastic Bottles

- Glass Bottles

- Cans

- By Distribution Channels:

- Hypermarkets/Supermarkets

- Online Retail Stores

- Specialty Stores

- Restaurants/Bars

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

- Kenya Road Stabilization Equipment Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- North America Sodium chloride Market (2025-2031) | Analysis, Revenue, Forecast, Trends, Companies, Size, Growth, Share, Industry, Outlook & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero