India Electric Motor Market (2025-2031) | Growth, Share, Industry, Segmentation, Forecast, Value, Trends, Size, Revenue, Analysis, Outlook

Market Forecast By Types (AC Electric Motor And DC Electric Motor), By Power Output (Fractional Horsepower And Integral Horsepower), By Voltage (Low Voltage, Medium Voltage And High Voltage), By Application (Pumps, Fans, Compressors, Conveyors And Others (Centrifuges, Extruders And Winches)), By End-User (Industrial Machinery, HVAC Equipment, Automobile, Consumer Appliances, Aerospace & Transportation, Power Generation And Others Commercial Application (Agriculture And Mining)) And Competitive Landscape

| Product Code: ETC002430 | Publication Date: Dec 2023 | Updated Date: Oct 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

India Electric Motor Market Import Shipment Trend (2020-2024)

The India electric motor market import shipment demonstrated robust growth with a notable CAGR from 2020 to 2024. The growth rate between 2023 and 2024 accelerated, indicating increasing momentum in the market expansion. Overall, the market exhibited a strong upward trend, showcasing significant growth potential.

India Electric Motor Market Growth Rate

According to 6Wresearch internal database and industry insights, the India Electric Motor Market is anticipated to expand at a robust compound annual growth rate (CAGR) of 10.2% during the forecast period 2025-2031.

India Electric Motor Market Highlights

| Report Name | India Electric Motor Market |

| Forecast Period | 2025-2031 |

| CAGR | 10.2% |

| Growing Sector | Industrial Machinery & Power Generation |

Topics Covered in the India Electric Motor Market Report

The India Electric Motor Market report thoroughly covers the market by types, by output power, by voltage range, by application, and by end-user. The market report provides an unbiased and detailed analysis of ongoing market trends, opportunities/high growth areas, and market drivers, which would help stakeholders to devise and align their market strategies according to the current and future market dynamics.

India Electric Motor Market Synopsis

India Electric Motor Market is growing at a robust pace throughout the years due to increasing investments in industrial automation, growth in power generation capacity, and strong domestic manufacturing capabilities. Initiatives such as “Make in India” and increasing EV adoption are further strengthening demand. Apart from this, agricultural mechanization, rapid growth in construction, and increasing demand for efficient HVAC systems are fuelling the market.

Evaluation of Growth Drivers in the India Electric Motor Market

Below mentioned some major drivers and their impacts on the market:

| Drivers | Primary Segments Affected | Why it Matters |

| Rising EV Adoption & Auto Sector Growth | Automobile, Powertrain Components | Under FAME-II and expansion of domestic EV production drive demand for integral horsepower motors. |

| Expansion of Industrial Automation | Industrial Machinery, Conveyors, Compressors | Across states like Maharashtra, Gujarat, and Tamil Nadu, manufacturing hubs are growing and heavily adopting automation and robotics requiring high-efficiency motors. |

| Renewable Energy Investments | Power Generation, Pumps, Wind Turbines | Solar and wind projects in Rajasthan, Tamil Nadu, and Gujarat demand high-voltage and premium efficiency motors. |

| Agricultural Mechanization | Pumps, Agriculture & Mining | Groundwater irrigation pumps and processing equipment for sugarcane, wheat, and rice require low- and medium-voltage motors. |

| Infrastructure & Urbanization | HVAC, Consumer Appliances | Projects related to smart city and metro expansion are driving demand for motors in HVAC, escalators, and household appliances. |

India Electric Motor Market Size is predicted to grow exponentially at a CAGR of 10.2% during the forecast period 2025-2031. Owing to strong demand from industrial and infrastructure sectors, combined with power generation expansion, makes India one of the fastest-growing motor markets in Asia. The presence of strong domestic manufacturers such as Bharat Heavy Electricals Limited (BHEL) and Crompton Greaves adds flexibility to the local supply. Further, government push for EVs and renewables ensures steady demand for high-efficiency motors.

Evaluation of Restraints in the India Electric Motor Market

Below mentioned some major restraints and their influence on the market dynamics:

| Restraints | Primary Segments Affected | What this Means |

| Raw Material Price Volatility | All Segments | There is heavy dependence on copper and steel imports raises cost uncertainty. |

| Energy Shortages & Grid Instability | Industrial, Agriculture | Irregularities in power supply affects performance and increases downtime for motors. |

| Financing Barriers for SMEs | Industrial Machinery, Agriculture | SMEs delays the motor upgrades due to limited credit access and high interest rates. |

| Competition from Low-Cost Imports | Industrial, Consumer Appliances | From China and Southeast Asia, the imports are cheaper that pressurize local manufacturers. |

| Regulatory Complexity | Power Generation, Auto | Lengthy approval processes for energy-efficient motor certification delay adoption. |

India Electric Motor Market Challenges

India Electric Motor Market has numbers of the challenges that could affect the growth of market in the future. For instance, fluctuating commodity prices is always a concern. Heavy competition from imports, and financing limitations for small-scale industries are some major obstacles. Further, the lack of skilled technicians in advanced automation and smart motor technologies restricts growth. Furthermore, electricity distribution losses and grid instability in rural areas create operational risks for industrial and agricultural applications.

India Electric Motor Market Trends

Some emerging trends in the market are:

- Adoption of Energy-Efficient Motors (IE3/IE4): Government mandates and cost-saving incentives are driving the adoption of high-efficiency motors in industrial and power sectors.

- Electrification of Mobility: There is strong growth noticed in two-wheeler and three-wheeler EV adoption pushes demand for compact and integral horsepower motors.

- Smart Motors & IoT Integration: Manufacturing plants are increasingly installing smart motor systems with VFDs and predictive maintenance tools.

- Domestic Manufacturing Expansion: Initiatives such as “Make in India” encourage the local production, reducing dependency on imports and supporting cost competitiveness.

- Agriculture-based Innovations: In rural part of India, solar-powered pump motors and efficient irrigation systems are expanding, which ensure the strong motor demand.

Investment Opportunities in the India Electric Motor Industry

Here are some latent opportunities in the market

- Industrial Smart Motor Systems: Electric vehicles are integrated with IoT, VFDs, and real-time monitoring that opens a high-margin segment for automation players.

- EV Components Manufacturing: EV penetration is rising which offers opportunities in traction motors, battery cooling systems, and assembly line automation.

- Renewable Energy Projects: Motors for wind turbines and solar pumping systems will see long-term demand with ambitious national targets.

- Agricultural Pumping Solutions: Government subsidies are expanding for solar-powered irrigation create steady demand for efficient motors.

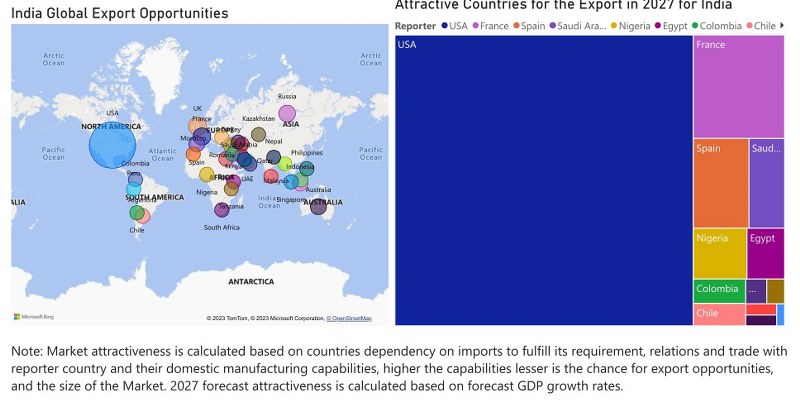

- Export Market Growth: Due to scaling up domestic production, India has opportunities to export motors to Africa, Middle East, and Southeast Asia.

Top 5 Leading Players in the India Electric Motor Market

There are some leading players in the market include:

ABB

| Company Name | ABB |

| Established Year | 1988 |

| Headquarters | Zurich, Switzerland |

| Website | Click Here |

This companies supplies advanced motors and automation solutions in India, widely used in power generation, renewables, and high-end industrial applications.

Siemens

| Company Name | Siemens |

| Established Year | 1847 |

| Headquarters | Munich, Germany |

| Website | Click Here |

This company provides the broad portfolio of medium- and low-voltage motors in India, focusing on industrial automation and energy-efficient systems.

Bharat Heavy Electricals Limited (BHEL)

| Company Name | Bharat Heavy Electricals Limited (BHEL) |

| Established Year | 1964 |

| Headquarters | New Delhi, India |

| Website | Click Here |

This company manufactures a wide range of electric motors domestically, catering to power generation, industrial machinery, and railway applications.

Crompton Greaves Consumer Electricals

| Company Name | Crompton Greaves Consumer Electricals |

| Established Year | 1937 |

| Headquarters | Mumbai, India |

| Website | Click Here |

This company provides motors for HVAC, pumps, and consumer appliances, with a strong distribution network across India.

Havells India Limited

| Company Name | Havells India Limited |

| Established Year | 1958 |

| Headquarters | Noida, India |

| Website | Click Here |

This company delivers integral horsepower and fractional horsepower motors for consumer appliances, fans, and small industrial equipment.

Government Regulations Introduced in the India Electric Motor Market

According to Indian Government Data, numbers of the policies and regulations are implemented in the India Electric Motor Market such as Bureau of Energy Efficiency (BEE) ratings for motors, encouraging the adoption of IE3 and above efficiency classes. Also, there is FAME-II scheme which supports the EV adoption, driving demand for traction motors. Further, solar irrigation pump schemes under MNRE (Ministry of New and Renewable Energy) require the high-efficiency motor integration.

Future Insights of the India Electric Motor Market

India Electric Motor Market is predicted to experience double-digit growth in the coming years. This market is fuelled by EV adoption, industrial automation, and renewable expansion. In the future, the investments are continued to increase in smart motor technologies, IoT-enabled monitoring, and local production scaling up, India is positioned as a regional hub for motor manufacturing. Further, rising agricultural demand and urbanization will further contribute to steady growth through 2031.

Market Segmentation Analysis

The report offers a comprehensive study of the following market segments and their leading categories:

Integral Horsepower Motor to Dominate the Market -By Power Output

According to Parth, Senior Research Analyst, 6Wresearch, integral horsepower motors lead the market as these are essential for industrial machinery, EV applications, and pumps. Their strength and performance make them critical for large-scale operations. Also, fractional horsepower motors are mainly used in consumer appliances and small devices.

Alternate Current (AC) Motors to Dominate the Market -By Types

AC electric motors dominate the market due to their cost-effectiveness, durability, and wide use in industrial machinery, HVAC systems, and automobiles. DC motors remain important in EVs and specialized automation, but their market share is smaller compared to AC motors.

60 V & Above Motors to Dominate the Market - By Voltage Range

Low-voltage motors hold the largest India electric motor market share, as they are widely used in HVAC equipment, household appliances, pumps, and conveyors. Medium- and high-voltage motors are significant in heavy industries and power generation, but low-voltage motors dominate because of their broad application base.

Pumps to Dominate the Market -By Application

Pumps are the most purchased by consumers, especially in agriculture, irrigation, water treatment, and industrial utilities. Their necessity for irrigation and infrastructure development ensures the highest demand compared to fans, compressors, and conveyors.

Industrial machinery to Dominate the Market -By End-User

Industrial machinery is the leading end-user segment, supported by India’s growing manufacturing and automation adoption. While HVAC, automobiles, and consumer appliances are growing, industrial machinery holds the top share due to large-scale demand.

Key Attractiveness of the Report:

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024.

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects

Key Highlights of the Report:

- India Electric Motor Market Overview

- India Electric Motor Market Outlook

- India Electric Motor Market Forecast

- Historical Data of India Electric Motor Market Revenues and Volumes, for the Period 2024.

- Market Size & Forecast of India Electric Motor Market Revenues and Volumes, until 2031.

- Historical Data of India Electric Motor Market Revenues and Volumes, by type, for the Period 2021-2031.

- Market Size & Forecast of India Electric Motor Market Revenues and Volumes, by type, until 2031.

- Historical Data of India Electric Motor Market Revenues and Volumes, by power output, for the Period 2021-2031.

- Market Size & Forecast of India Electric Motor Market Revenues and Volumes, by power output, until 2031.

- Historical Data of India Electric Motor Market Revenues and Volumes, by voltage, for the Period 2021-2031.

- Market Size & Forecast of India Electric Motor Market Revenues and Volumes, by voltage, until 2031.

- Historical Data of India Electric Motor Market Revenues and Volumes, by end-user, for the Period 2021-2031.

- Market Size & Forecast of India Electric Motor Market Revenues and Volumes, by end-user, until 2031.

- Historical Data of India Electric Motor Market Revenues and Volumes, by application, for the Period 2021-2031.

- Market Size & Forecast of India Electric Motor Market Revenues and Volumes, by application, until 2031.

- Market Drivers and Restraints

- India Electric Motor Market Price Trends

- India Electric Motor Market Trends and Industry Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- India Electric Motor Market Share, By Players

- India Electric Motor Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Types

- AC Motors

- DC Motors

By Power Capacity

- Fractional Horsepower

- Integral Horsepower

By Voltage

- Low Voltage

- Medium Voltage

- High Voltage

By Sectors

- Industrial

- Commercial

- Residential

- Automotive

- Others

By Regions

- Eastern

- Northern

- Western

- Southern

India Electric Motor Market (2025-2031): FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. India Electric Motor Market Overview |

| 3.1 India Electric Motor Market Revenues And Volume, 2021-2031 |

| 3.2 India Electric Motor Market Revenue Share, By Voltage, 2021 & 2031 |

| 3.3 India Electric Motor Market Revenue Share, By Power Output, 2021 & 2031 |

| 3.4 India Electric Motor Market Revenue Share, By Types, 2021 & 2031 |

| 3.5 India Electric Motor Market Revenue Share, By End-User, 2021 & 2031 |

| 3.6 India Electric Motor Market Revenue Share, By Application, 2021 & 2031 |

| 3.7 India Electric Motor Market - Industry Life Cycle |

| 3.8 India Electric Motor Market - Porter’s Five Forces |

| 4. India Electric Motor Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Government initiatives promoting electric vehicles and renewable energy usage |

| 4.2.2 Increasing industrial automation and adoption of electric motors in manufacturing processes |

| 4.2.3 Growing awareness about energy efficiency and sustainability among consumers and businesses |

| 4.3 Market Restraints |

| 4.3.1 High initial investment cost of electric motors compared to traditional combustion engine systems |

| 4.3.2 Lack of widespread charging infrastructure for electric vehicles in India |

| 4.3.3 Supply chain disruptions and raw material price fluctuations impacting electric motor manufacturing |

| 5. India Electric Motor Market Trends |

| 6. India Electric Motor Market Overview, By Voltage |

| 6.1 India Low Voltage Electric Motor Electric Motor Market Revenues And Volume, 2021-2031 |

| 6.2 India Medium Voltage Electric Motor Electric Motor Market Revenues And Volume, 2021-2031 |

| 6.3 India High Voltage Electric Motor Electric Motor Market Revenues And Volume, 2021-2031 |

| 7. India Electric Motor Market Overview, By Power Output |

| 7.1 India Electric Motor Market Revenue And Volumes, By Integral Horsepower, 2021-2031 |

| 7.2 India Electric Motor Market Revenue And Volumes, By Fractional Horsepower, 2021-2031 |

| 8. India Electric Motor Market Overview, By Types |

| 8.1 India Electric Motor Market Revenue And Volumes, By Ac Motor, 2021-2031 |

| 8.2 India Electric Motor Market Revenue And Volumes, By Dc Motor, 2021-2031 |

| 9. India Electric Motor Market Overview, By End-User |

| 9.1 India Electric Motor Market Revenue And Volumes, By Industrial Machinery, 2021-2031 |

| 9.2 India Electric Motor Market Revenue And Volumes, By Hvac Equipment, 2021-2031 |

| 9.3 India Electric Motor Market Revenue And Volumes, By Automobile, 2021-2031 |

| 9.4 India Electric Motor Market Revenue And Volumes, By Consumer Applaince, 2021-2031 |

| 9.5 India Electric Motor Market Revenue And Volumes, By Aerospace & Transportation, 2021-2031 |

| 9.6 India Electric Motor Market Revenue And Volumes, By Power Generation, 2021-2031 |

| 9.7 India Electric Motor Market Revenue And Volumes, By Other Commercial Application (Agriculture And Mining), 2021-2031 |

| 10. India Electric Motor Market Overview, By Application |

| 10.1 India Electric Motor Market Revenue And Volumes, By Pumps, 2021-2031 |

| 10.2 India Electric Motor Market Revenue And Volumes, By Fans, 2021-2031 |

| 10.3 India Electric Motor Market Revenue And Volumes, By Compressors, 2021-2031 |

| 10.4 India Electric Motor Market Revenue And Volumes, By Conveyors, 2021-2031 |

| 10.5 India Electric Motor Market Revenue And Volumes, By Others (Centrifuges, Extruders And Winches), 2021-2031 |

| 11. India Electric Motor Market Key Performance Indicators |

| 11.1 Average energy efficiency rating of electric motors used in India |

| 11.2 Percentage of electric motor sales in the industrial sector compared to traditional motor types |

| 11.3 Adoption rate of electric vehicles and corresponding demand for electric motors |

| 12. India Electric Motor Market Opportunity Assessment |

| 12.1 India Electric Motor Market Opportunity Assessment, By Voltage, 2031 |

| 12.2 India Electric Motor Market Opportunity Assessment, By Power Output, 2031 |

| 12.3 India Electric Motor Market Opportunity Assessment, By Types, 2031 |

| 12.4 India Electric Motor Market Opportunity Assessment, By End-User, 2031 |

| 12.5 India Electric Motor Market Opportunity Assessment, By Application, 2031 |

| 13. India Electric Motor Market Competitive Landscape |

| 13.1 India Electric Motor Market By Companies, 2024 |

| 13.2 India Electric Motor Market Competitive Benchmarking, By Operating Parameters |

| 14. Company Profiles |

| 15. Key Strategic Recommendations |

| 16. Disclaimer |

Market Forecast By Types (AC Electric Motor And DC Electric Motor), By Power Output (Fractional Horsepower And Integral Horsepower), By Voltage (Low Voltage, Medium Voltage And High Voltage), By Application (Pumps, Fans, Compressors, Conveyors And Others (Centrifuges, Extruders And Winches)), By End-User (Industrial Machinery, HVAC Equipment, Automobile, Consumer Appliances, Aerospace & Transportation, Power Generation And Others Commercial Application (Agriculture And Mining)) And Competitive Landscape

| Product Code: ETC002430 | Publication Date: Aug 2023 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

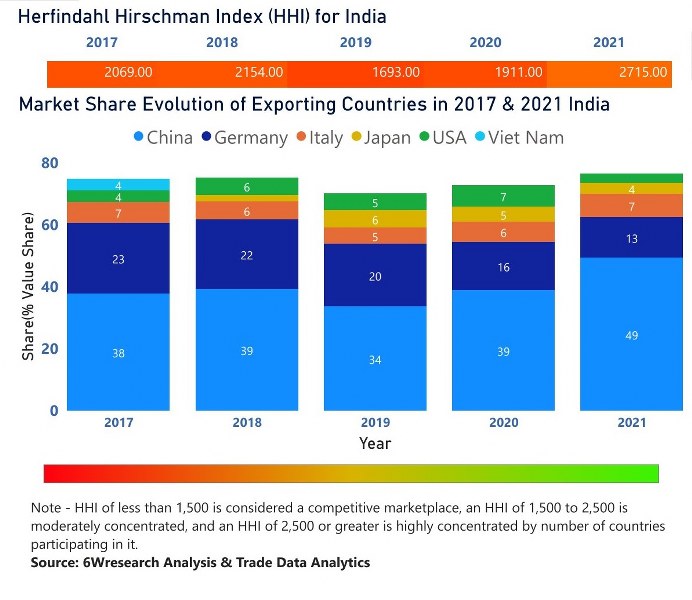

India Electric Motor Market | Country-Wise Share and Competition Analysis

In the year 2021, China was the largest exporter in terms of value, followed by Germany. It has registered a growth of 91.26% over the previous year. While Germany registered a growth of 26.8% as compared to the previous year. In the year 2017, China was the largest exporter followed by Germany. In term of the Herfindahl Index, which measures the competitiveness of countries exporting, India has a Herfindahl index of 2069 in 2017 which signifies moderately concentrated also in 2021 it registered a Herfindahl index of 2715 which signifies high concentration in the market.

India Electric Motor Market - Export Market Opportunities

India Electric Motor Market - Export Market Opportunities

Latest 2023 Developments of the India Electric Motor Market

The India Electric Motor Market is attaining growth and many trends are undergoing in the market and first major trend which is happening in this sector is the acceptance of electric vehicles in the nation. Consumers are now seeking more sustainable transportation options with growing concerns regarding fuel prices and environmental pollution. The government of the country has also been playing a huge role in the market success since the government is promoting renewable energy sources and this play a huge role in the market progression. The industrial sector in the country is another area where these electric motors have attained traction. Companies these days are looking to decrease their energy costs and carbon footprint by switching to more efficient motors, which is helping in boosting the growth of this sector.

Topics Covered in India Electric Motor Market Report

India Electric Motor Market report thoroughly covers the market by type, power output, voltage, applications, and end-user. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

India Electric Motor Market is projected to grow over the coming year. The India Electric Motor Market report is a part of our periodical regional publication Asia Pacific Electric Motor Market outlook report. 6W tracks the electric motor market for over 60 countries with individual country-wise market opportunity assessments and publishes the report titled Global Electric Motor Market outlook report annually.

India Electric Motor Market Synopsis

India Electric Motor Market has witnessed substantial growth on account of the rising automotive industry and growing industrialization in the country. The factors driving the demand for electric motors are rapid urbanization, growing industrialization, and increasing constructional activities.

According to 6Wresearch, the India Electric Motor Market size is expected to grow during 2020-2026. Several factors have been playing a crucial role in driving the market and these factors are the rising industrialization, rising constructional activities as well as faster urbanization. Additionally, growing energy consumption and growing government initiatives towards the adoption of electric motors would further fuel the growth of the electric motor market in India. The government of the country has also been playing a huge role in the market success since the government is promoting the renewable energy sources. The rising concern towards protecting the environment from harmful gases is also boosting the India Electric Motors Market Growth. The government of the country is making efforts to promote renewable energy sources, which drives the market. Technological advancements are also supporting the market progression since it is owing to these smart technologies that manufacturers are able to develop efficient motors.

COVID-19 Impact on India Electric Motor Market

The market in India registered significant decline as the country had to go through economic crises since the government imposed lockdown owing to which a number of industries were not supposed to operate. Only a very few and significant industries were allowed to operate during the pandemic and these industries include healthcare, retail, agriculture, and online education. The automotive sector completely impeded by the pandemic since there was a huge restriction on travel and as people were spending more time at home, so there was a decline in sales of vehicles, and electric motors are majorly used in vehicles, which brough challenges for the market. Other major consumers also faced significant challenges which became the reason behind the declining demand and sales of electric motors, and this further lowered the India Electric Motor Market Share.

India Electric Motor Market: Key Players

Many players are operating in the market but only a few players have a crucial role to play and these players are:

- ABB Ltd.

- Siemens AG

- Bharat Heavy Electricals Limited (BHEL)

- Kirloskar Electric Company Limited

- Havells India Limited

- Toshiba Corporation.

Market by Type

According to Gyan, Senior Research Analyst, 6Wresearch, the AC electric motor segment is expected to dominate the electric motor market in India owing to increasing demand for machine control in the automotive industry and growing demand for energy-efficient systems in manufacturing.

Market by Power Output

In terms of power output, the fractional horsepower segment is holding a major revenue share in the market due to enhancing deployment of electric motors in small-scale industries as well as other applications coupled with increasing investment in the industrial sector.

Market by End-User

In terms of end-user, the industrial machinery segment is anticipated to dominate the India Electric Motor Industry revenue share owing to surging demand for energy-efficient conveyor systems in the automotive and manufacturing industries.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2016 to 2019.

- Base Year: 2019

- Forecast Data until 2026.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Reports

- India Electric Motor Market Overview

- India Electric Motor Market Outlook

- India Electric Motor Market Forecast

- Historical Data of India Electric Motor Market Revenues and Volumes, for the Period 2016-2019.

- Market Size & Forecast of India Electric Motor Market Revenues and Volumes, until 2026.

- Historical Data of India Electric Motor Market Revenues and Volumes, by type, for the Period 2016-2019.

- Market Size & Forecast of India Electric Motor Market Revenues and Volumes, by type, until 2026.

- Historical Data of India Electric Motor Market Revenues and Volumes, by power output, for the Period 2016-2019.

- Market Size & Forecast of India Electric Motor Market Revenues and Volumes, by power output, until 2026.

- Historical Data of India Electric Motor Market Revenues and Volumes, by voltage, for the Period 2016-2019.

- Market Size & Forecast of India Electric Motor Market Revenues and Volumes, by voltage, until 2026.

- Historical Data of India Electric Motor Market Revenues and Volumes, by end-user, for the Period 2016-2019.

- Market Size & Forecast of India Electric Motor Market Revenues and Volumes, by end-user, until 2026.

- Historical Data of India Electric Motor Market Revenues and Volumes, by application, for the Period 2016-2019.

- Market Size & Forecast of India Electric Motor Market Revenues and Volumes, by application, until 2026.

- Market Drivers and Restraints

- India Electric Motor Market Price Trends

- India Electric Motor Market Trends and Industry Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- India Electric Motor Market Share, By Players

- India Electric Motor Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Types

- AC Electric Motor

- DC Electric Motor

By Power Output

- Integral Horsepower

- Fractional Horsepower

By Voltage

- Low Voltage

- Medium Voltage

- High Voltage

By Applications

- Pumps

- Fans

- Compressors

- Conveyors

- Others (Centrifuges, Extruders and Winches)

By End-User

- Industrial Machinery

- HVAC Equipment

- Automobile

- Consumer Appliances

- Aerospace & Transportation

- Power generation

- Other Commercial Application (Agriculture and Mining)

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero