India Electric Vehicle Powertrain Systems Market (2017-2023) | Growth, Value, Analysis, Size, Outlook, Companies, Forecast, Industry, Share, Trends & Revenue

Market Forecast By Technology (Battery Electric Vehicle Powertrain and Hybrid Electric Vehicle Powertrain), Components (Transmission, Battery, Motor/Generator, Engine, and Controller), Vehicle Type (Passenger Cars, Commercial Vehicles, Two Wheelers, and Three-Wheelers) and Competitive Landscape

| Product Code: ETC000387 | Publication Date: Nov 2021 | Updated Date: Jun 2024 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 130 | No. of Figures: 43 | No. of Tables: 17 | |

Latest (2024) Development of the India Electric Vehicle Powertrain Systems Market

India electric vehicle powertrain systems industry is poised for innovative advancements as the nation pivots towards electrification in transportation. The proliferation of electric vehicles necessitates robust and efficient powertrain systems, which are critical components in delivering power from the vehicle’s battery to its wheels. The India Electric Vehicle Powertrain Systems Market Growth is bolstered by substantial investments in research and development, led by both domestic manufacturers and international corporations.

The focus areas include enhancing the efficiency of electric motors, improving battery management systems, and incorporating lightweight materials to optimize vehicle performance. Additionally, advancements in semiconductor technology are contributing to more sophisticated and reliable powertrain systems. The anticipated rise in domestic production capabilities, coupled with favorable regulatory frameworks, will likely reduce dependence on imports and foster a self-reliant ecosystem for the industry.

India Electric Vehicle Powertrain Systems Market Synopsis

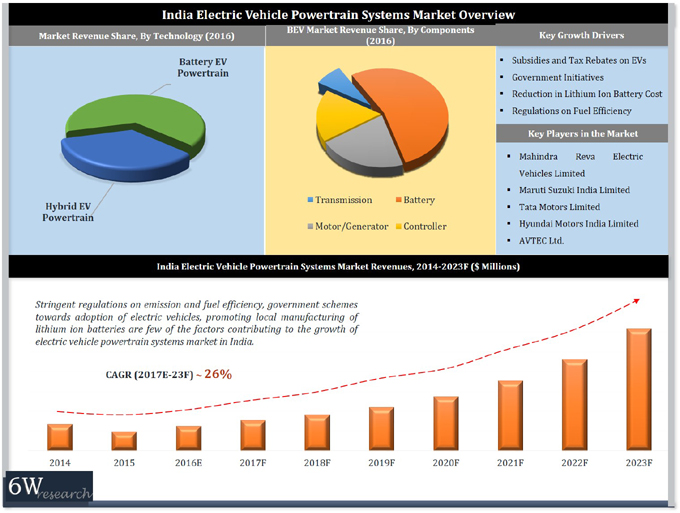

Stringent regulations on emission and fuel efficiency, government schemes towards the adoption of electric vehicles coupled with the need for a pollution-free environment are a few of the factors contributing to the growth of the electric vehicle powertrain systems market in India. The growth of the electric vehicle market is also critical for the energy transition in the country, reducing the reliance on oil imports and escalating the demand for renewable power. Further, technology improvement, cost reduction, and local manufacturing of lithium-ion batteries are expected to catalyze the growth of the EV market in India.

According to 6Wresearch, India electric vehicle powertrain market size is projected to grow at a CAGR of over 26% during 2017-23. Battery EV powertrain systems captured the majority of the India electric vehicle powertrain market share in terms of revenues, owing to the subsidies and tax rebates offered by the government to EV users and manufacturers. Although, charging infrastructure challenges are still present, however, government's target of 6 million EVs on roads backed by its firm actions is likely to overcome these challenges during the forecast period.

In 2016, two-wheeler EV registered the majority of the market volume, however, as a result of rising income level coupled with cost reduction of electric cars, the passenger car segment is anticipated to register the highest growth in the India Electric Vehicle Powertrain Market forecast period.

The India electric vehicle powertrain market report thoroughly covers the market by technologies, components, and vehicle types. The India electric vehicle powertrain market outlook report provides an unbiased and detailed analysis of the ongoing India electric vehicle powertrain market trends, opportunities/ high growth areas, market drivers which would help the stakeholders to decide and align their market strategies according to the current and future market dynamics.

Government Initiatives Introduced in the India Electric Vehicle Powertrain Systems Market

The Government of India has recognized the importance of electric vehicles and has taken several initiatives to encourage their use. Under the National Electric Mobility Mission Plan (NEMMP), the government aims to have six to seven million electric vehicles on Indian roads by 2020. In 2015, the Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles (FAME) scheme was launched to promote the use of electric and hybrid vehicles in the country. The scheme provides incentives to buyers of electric vehicles and also supports the development of EV infrastructure. Additionally, these actions have raised the India Electric Vehicle Powertrain Systems Market Share. Further, the Indian government has also encouraged automobile manufacturers to invest in the EV market. In 2018, the government announced that it planned to have only electric vehicles on the roads by 2030. Later, it was revised to have 30% of all vehicles in the country run on electricity by 2030. This target is being pursued with vigour by several automobile manufacturers who are now developing and launching electric vehicles in India.

Key Players in the India Electric Vehicle Powertrain Systems Market

The India Electric Vehicle Powertrain Systems Market is highly competitive, with key players like Tata Motors, Mahindra & Mahindra, and Ashok Leyland taking a significant share of the market. Likewise, some of the corporations occupy immense India Electric Vehicle Powertrain Systems Market Revenues. Additionally, global players such as Bosch, Continental, and Denso Corporation have invested heavily in the market, providing technologically advanced solutions and strengthening their presence in the country.

Market by Component

According to Ravi Bhandari, Research Head, 6Wresearch, the key components in the India Electric Vehicle Powertrain Systems market include motor/generator and engines. The motor/generator in an electric vehicle powertrain system is responsible for converting electrical energy stored in the battery to mechanical energy that powers the wheels. In India, the most common type of motor used in electric vehicles is the Permanent Magnet Synchronous Motor (PMSM). PMSMs are highly efficient, have a high power density and provide fast acceleration. They are also relatively smaller in size and more lightweight than their counterparts, thereby making them ideal for use in electric vehicles. Additionally, the traditional internal combustion engine that powers conventional vehicles is replaced by an electric motor in an electric vehicle powertrain system. The electric motor provides a cleaner and greener alternative to conventional fuels, helping to reduce carbon emissions. In India, electric vehicles are touted as the future of mobility, with the government providing incentives to promote their adoption. However, the high cost of electric vehicles and limited charging infrastructure acts as a bottleneck to their widespread adoption.

Market by Vehicle Type

The commercial vehicle segment of the India electric vehicle powertrain systems market is also experiencing rapid development. The segment includes all electric vehicles designed for cargo or passenger transportation, such as buses and trucks. With the continuing growth of e-commerce and logistics industries in India, the demand for electric commercial vehicles is steadily increasing. This trend is supported by supportive government policies to promote electric public transportation, as well as the need for more environmentally friendly cargo transport solutions.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2013 to 2016.

- Base Year: 2016.

- Forecast Data until 2023.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

• Market Size & Forecast of Global Electric Vehicle Powertrain Systems Market until 2023

• India Electric Vehicle Powertrain Market Size and India Electric Vehicle Powertrain Market Forecast

• India Electric Vehicle Powertrain Market Overview

• India Electric Vehicle Powertrain Market Outlook

• Historical Data of India Electric Vehicle Powertrain Market Revenues for the Period 2014-2016

• Market Size & Forecast of India Electric Vehicle Powertrain Market Revenues until 2023

• Historical Data of India Electric Vehicle Powertrain Systems components Market for the Period 2014-2016

• Market Size & Forecast of India Electric Vehicle Powertrain Systems Components Market until 2023

• Historical Data of India Electric Vehicle Powertrain Systems Vehicle Types Market for the Period 2014-2016

• Market Size & Forecast of India Electric Vehicle Powertrain Systems Market, By Vehicle Types until 2023

• Market Size & Forecast of India Battery Electric Vehicle Powertrain Systems Market until 2023

• Market Size & Forecast of India Hybrid Electric Vehicle Powertrain Systems Market until 2023

• Market Drivers, Restraints, and India Electric Vehicle Powertrain Market Trends

• Industry Life Cycle

• Value Chain Analysis

• Porter's Five Forces Analysis

• India Electric Vehicle Powertrain Market Share, By Players

• India Electric Vehicle Powertrain Market Overview on Competitive Landscape

• Company Profiles

• Key Strategic Notes

Markets Covered

The India Electric Vehicle Powertrain Market report provides a detailed analysis of the following market segments:

By Technology

- Battery Electric Vehicle Powertrain

- Hybrid Electric Vehicle Powertrain

By Components

- Transmission

- Battery

- Motor/Generator

- Engine

- Controller

By Vehicle Type

- Passenger Cars

- Two-Wheelers

- Commercial Vehicles

- Three-Wheelers

Frequently Asked Questions About the Market Study (FAQs):

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Assumptions & Methodology |

| 3 Global Electric Vehicle Powertrain Systems Market Overview |

| 3.1 Global Electric Vehicle Powertrain Systems Market Revenues (2014-2023F) |

| 3.2 Global Electric Vehicle Powertrain Systems Market Volume (2014-2023F) |

| 3.3 Global Electric Vehicle Powertrain Systems Market Revenue Share, By Region (2014 & 2023F) |

| 4 India Electric Vehicle Powertrain Systems Market Overview |

| 4.1 India Electric Vehicle Powertrain Systems Market Revenues (2014-2023F) |

| 4.2 India Electric Vehicle Powertrain Systems Market Volume (2014-2023F) |

| 4.3 India Electric Vehicle Powertrain Systems Industry Life Cycle |

| 4.4 India Electric Vehicle Powertrain Systems Market Opportunistic Matrix |

| 4.5 India Electric Vehicle Powertrain Systems Market Value Chain Analysis |

| 4.6 India Electric Vehicle Powertrain Systems Market Porter's Five Forces Model |

| 4.7 India Electric Vehicle Powertrain Systems Market Revenue Share, By Technology (2016 & 2023F) |

| 4.8 India Electric Vehicle Powertrain Systems Market Revenue Share, By Components (2016 & 2023F) |

| 4.9 India Electric Vehicle Powertrain Systems Market Revenue Share, By Vehicle Type (2016 & 2023F) |

| 5 India Electric Vehicle Powertrain Systems Market Dynamics |

| 5.1 Impact Analysis |

| 5.2 Market Drivers |

| 5.3 Market Restraints |

| 5.4 Market Opportunity |

| 6 India Electric Vehicle Powertrain Systems Market Trends |

| 6.1 Plug-in Hybrids |

| 6.2 Alternative Fuel |

| 6.3 High-Density High Power Small Size Li-ion Batteries |

| 6.4 The EVI Initiative |

| 7 India Battery Electric Vehicle Powertrain Systems Market Overview |

| 7.1 India Battery Electric Vehicle Powertrain Systems Market Revenues (2014-2023F) |

| 7.2 India Battery Electric Vehicle Powertrain Systems Market Revenues, By Components (2014-2023F) |

| 7.3 India Battery Electric Vehicle Powertrain Systems Market Volume (2014-2023F) |

| 8 India Hybrid Electric Vehicle Powertrain Systems Market Overview |

| 8.1 India Hybrid Electric Vehicle Powertrain Systems Market Revenues (2014-2023F) |

| 8.2 India Hybrid Electric Vehicle Powertrain Systems Market Revenues, By Components (2014-2023F) |

| 8.3 India Hybrid Electric Vehicle Powertrain Systems Market Volume (2014-2023F) |

| 9 India Electric Vehicle Powertrain Systems Market Overview, By Components |

| 9.1 India Electric Vehicle Powertrain Systems Market, By Engine(2014-2023F) |

| 9.2 India Electric Vehicle Powertrain Systems Market, By Transmission (2014-2023F) |

| 9.3 India Electric Vehicle Powertrain Systems Market, By Battery (2014-2023F) |

| 9.4 India Electric Vehicle Powertrain Systems Market, By Generator/Motor (2014-2023F) |

| 9.5 India Electric Vehicle Powertrain Systems Market, By Controller (2014-2023F) |

| 10 India Electric Vehicle Powertrain Systems Market Overview, By Vehicle Types |

| 10.1 India Electric Vehicle Powertrain Systems Market, By Passenger Car (2014-2023F) |

| 10.2 India Electric Vehicle Powertrain Systems Market, By Two-Wheelers (2014-2023F) |

| 10.3 India Electric Vehicle Powertrain Systems Market, By Commercial Vehicles (2014-2023F) |

| 10.4 India Electric Vehicle Powertrain Systems Market, By Three-Wheelers (2014-2023F) |

| 11 Competitive Landscape |

| 11.1 India Electric Vehicle Powertrain Systems Market Players Revenue Share (2016) |

| 11.2 Competitive Benchmarking, By Operating Parameters |

| 11.3 Competitive Benchmarking, By Electric Vehicle Manufacturing |

| 11.4 Electric Vehicle Powertrain System Manufacturers and Distributors |

| 12 India Electric Vehicle Powertrain Systems Market - Ecosystem Analysis |

| 13 India Electric Vehicle Powertrain Systems Market - Import & Export Scenario |

| 14 India Electric Vehicle Powertrain Systems Market - Government Initiatives & Regulations |

| 15 Company Profiles |

| 15.1 Mahindra Reva Electric Vehicles Ltd. |

| 15.2 Maruti Suzuki India Limited |

| 15.3 TATA Motors Limited |

| 15.4 Hyundai Motor India Limited |

| 15.5 AVTEC Ltd. |

| 16 Key Strategic Notes |

| 17 Disclaimer |

| List of Figures |

| 1 Global Electric Vehicle Powertrain Systems Market Revenues, 2014-2023F ($ Billion) |

| 2 Global Electric Vehicle Powertrain Systems Market Volume, 2014-2023F (Million Units) |

| 3 Global Electric Vehicle Powertrain Systems Revenue Share, By Regions (2016) |

| 4 India Electric Vehicle Powertrain Systems Market Revenues, 2014-2023F ($ Million) |

| 5 India Electric Vehicle Powertrain Systems Market Volume, 2014-2023F (In Thousands) |

| 6 India Electric Vehicle Powertrain Systems Industry Life Cycle (2016) |

| 7 Value Chain Analysis Of India Electric Vehicle Powertrain Systems Market |

| 8 India Electric Vehicle Powertrain Systems Market Revenue Share, By Technology (2016) |

| 9 India Electric Vehicle Powertrain Systems Market Revenue Share, By Technology (2023F) |

| 10 India Battery Electric Vehicle Powertrain Systems Market Revenue Share, By Components (2016) |

| 11 India Battery Electric Vehicle Powertrain Systems Market Revenue Share, By Components (2023F) |

| 12 India Hybrid Electric Vehicle Powertrain Systems Market Revenue Share, By Components (2016) |

| 13 India Hybrid Electric Vehicle Powertrain Systems Market Revenue Share, By Components (2023F) |

| 14 India Electric Vehicle Powertrain Systems Market Revenue Share, By Vehicle Type (2016) |

| 15 India Electric Vehicle Powertrain Systems Market Revenue Share, By Vehicle Type (2023F) |

| 16 India Battery Electric Vehicle Powertrain Systems Market Revenues, 2014-2023F ($ Million) |

| 17 India Battery Electric Vehicle Powertrain Systems Market Volume, 2014-2023F (In Thousands) |

| 18 India Hybrid Electric Vehicle Powertrain Systems Market Revenues, 2014-2023F (In $ Million) |

| 19 India Hybrid Electric Vehicle Powertrain Systems Market Volume, 2014-2023F (In Thousands) |

| 20 India Hybrid Electric Vehicle Powertrain Systems Market Revenues, By Engine, 2014-2023F ($ Million) |

| 21 India Hybrid Electric Vehicle Powertrain Systems Market Revenues, By Transmission, 2014-2023F ($ Million) |

| 22 India Battery Electric Vehicle Powertrain Systems Market Revenues, By Transmission, 2014-2023F ($ Million) |

| 23 India Hybrid Electric Vehicle Powertrain Systems Market Revenues, By Battery, 2014-2023F |

| 24 India Battery Electric Vehicle Powertrain Systems Market Revenues, By Battery, 2014-2023F |

| 25 Average Battery Pack Price ($ Per Kwh) |

| 26 India Hybrid Electric Vehicle Powertrain Systems Market Revenues, By Generator/Motor, 2014-2023F, ($ Million) |

| 27 India Battery Electric Vehicle Powertrain Systems Market Revenues, By Generator/Motor, 2014-2023F, ($ Million) |

| 28 India Hybrid Electric Vehicle Powertrain Systems Market Revenues, By Controller, 2014-2023F, ($ Million) |

| 29 India Battery Electric Vehicle Powertrain Systems Market Revenues, By Controller, 2014-2023F, ($ Million) |

| 30 India Electric Vehicle Powertrain Systems Market Revenues, By Passenger Car, 2014-2023F ($ Million) |

| 31 Domestic Market Volume Share For 2015-16 |

| 32 India Electric Vehicle Powertrain Systems Price Trend, By Passenger Car, 2014-2023F ($ Thousand) |

| 33 India Electric Vehicle Powertrain Systems Market Revenues, By Two-wheelers, 2014-2023F ($ Million) |

| 34 India Electric Vehicle Powertrain Systems Price Trend, By Two-wheelers, 2014-2023F ($) |

| 35 India Electric Vehicle Powertrain Systems Market Revenues, By Light/Medium Commercial Vehicles, 2014-2023F ($ Million) |

| 36 India Electric Vehicle Powertrain Systems Market Revenues, By Heavy Commercial Vehicles, 2014-2023F ($ Million) |

| 37 India Electric Vehicle Powertrain Systems Price Trend, By Light/Medium Commercial Vehicle, 2014-2023F ($ Thousand) |

| 38 India Electric Vehicle Powertrain Systems Price Trend, By Heavy Commercial Vehicle, 2014-2023F ($ Thousand) |

| 39 India Electric Vehicle Powertrain Systems Market Revenues, By Three-wheelers, 2014-2023F ($ Million) |

| 40 India Electric Vehicle Powertrain Systems Price Trend, By Three-wheelers, 2014-2023F ($) |

| 41 India Electric Vehicle Powertrain Systems Market Revenue Share, By Players (2016) |

| 42 Overall Domestic Market Potential by Auto Components, 2020F |

| 43 Overall Export Market Potential by Auto Components, 2020F |

| List of Tables |

| 1 Fund Allocation Under FAME Scheme |

| 2 Break-up Of Fund Allocation Under FAME In 2015-16 |

| 3 Incentives By Government Of India For Different Types Of Electric Vehicles |

| 4 India Battery Electric Vehicle Powertrain Systems Market Revenues, By Components Types, 2014-2023F ($ Million) |

| 5 Average Running Cost Analysis Of Electric And Petrol Two-wheeler |

| 6 India Hybrid Electric Vehicle Powertrain Systems Market Revenues, By Components, 2014-2023F ($ Million) |

| 7 Types Of Electric Vehicles |

| 8 Types Of Hybrid Electric Vehicles |

| 9 Domestic Sales Trend 2011-2017E |

| 10 Comparison Of Diesel, CNG, Hybrid And Electric Buses |

| 11 India Three Wheelers Sales Volume Analysis |

| 12 India Electric Vehicle Powertrain Systems Market Revenues, By Players (2016) |

| 13 Different Electric Vehicle Models In India |

| 14 Electric /Hybrid Vehicle Manufacturers In India |

| 15 Cost-Comparison Of Different Vehicle Types |

| 16 GST Tax Rate Structure On Vehicles In India |

| 17 Automobiles Export Trend In India |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero