India Gas Genset Market (2025-2031) | Growth, Value, Revenue, Share, Forecast, Industry, Analysis, Size, Outlook, Trends & Companies

Market Forecast By Rating (Up to 100 kVA, 100.1 kVA - 375 kVA, 375.1 kVA - 1,000 kVA and Above 1,000 kVA), By Verticals (Industrial, Commercial and Residential), By Applications (Standby Power, Primary Power, and Peak Shaving), By Regions (Northern, Eastern, Western and Southern) and Competitive Landscape

| Product Code: ETC000529 | Publication Date: Sep 2024 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 3 |

India Gas Genset Market Highlights

| Report Name | India Gas Genset Market |

| Forecast period | 2025-2031 |

| CAGR | 5.9% |

| Growing Sector | Industrial |

Topics Covered in the India Gas Genset Market Report

India Gas Genset Market report thoroughly covers the by countries, by rating, by verticals, by applications, and by regions. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

India Gas Genset Market Synopsis

The India gas genset market is witnessing massive growth, underpinned by the increasing demand for reliable and efficient power backup solutions. Gas gensets, which use natural gas or liquefied petroleum gas (LPG) as fuel, offer a cleaner and more cost-effective alternative to traditional diesel gensets. The rising industrialization, rapid urbanization, and government initiatives to promote cleaner energy solutions are propelling the market forward.

According to 6Wresearch, the India Gas Genset Market revenue is expected to reach at a significant CAGR of 5.9% during the forecast period 2025-2031. The growing need for uninterrupted power supply in critical sectors such as healthcare, IT, and commercial spaces is boosting the demand for gas gensets. Additionally, the increasing awareness about the environmental benefits of using gas over diesel is encouraging the adoption of gas gensets. The cost savings associated with lower operating and maintenance expenses of gas gensets compared to diesel counterparts also act as a significant driver for India Gas Genset Market growth. Despite the promising growth prospects, the market faces several challenges. High initial capital investment required for gas genset installation remains a major barrier, particularly for small and medium enterprises (SMEs). Moreover, the lack of widespread natural gas infrastructure in certain regions of the country poses a significant logistical challenge.

India Gas Genset Market Trends

- Shift Towards Sustainable Energy Solutions – The increasing adoption of sustainable and clean energy solutions, with gas gensets emerging as an ideal preference owing to their lower emissions compared to diesel gensets.

- Expansion of Natural Gas Infrastructure – The wider availability of natural gas has been seeing with rising expansion of natural gas pipelines, increasing the use of gas gensets.

- Increasing Demand for Reliable Power Supply – Across various sectors, the rising need for uninterrupted power supply, especially in healthcare, IT, and manufacturing, driving the demand for reliable and efficient gas gensets.

Investment Opportunities in the India Gas Genset Market

- Infrastructure Development: Investing in the expansion of natural gas infrastructure to improve accessibility and supply stability.

- Technological Innovation: Funding research and development to advance gas genset technology, increasing efficiency and reducing operational costs.

- Renewable Energy Integration: Exploring opportunities to integrate gas gensets with renewable energy sources for hybrid power solutions.

Leading Players of the India Gas Genset Market

The India gas genset market is characterized by the presence of several leading players who drive the market's growth with innovative products and robust distribution networks. Some of the prominent companies in this sector include Cummins India, Caterpillar Inc., Kirloskar Oil Engines Ltd., and Mahindra Powerol.

Government Regulations Introduced in the India Gas Genset Market

The Indian government has implemented a series of regulations aimed at promoting cleaner and more efficient energy solutions, influencing the gas genset market significantly. Policies such as the National Electric Mobility Mission Plan (NEMMP) and the push for cleaner alternative fuels are designed to reduce the carbon footprint and enhance energy security.

Future Insights of the India Gas Genset Market

The future of the India gas genset industry looks promising, with several factors poised to drive growth. Increasing urbanization and industrialization require reliable power backup solutions, positioning gas gensets as a critical component of infrastructure development. Technological advancements, such as integrating IoT and remote monitoring capabilities, are expected to enhance the efficiency and reliability of these systems.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories.

100.1 kVA to 375 kVA to Dominate the Market - By Rating

According to Ravi Bhandari, Research Head, 6wresearch, the rating segment of 100.1 kVA to 375 kVA is currently leading. This segment has gained significant traction across various applications including commercial establishments, small to medium-sized industries, and residential complexes.

Industrial to dominate the market - By Verticals

The industrial segment is leading due to the extensive use of gas gensets in manufacturing plants, refineries, and other large-scale industrial facilities. These sites require a continuous and reliable power supply to maintain operations, making gas gensets a crucial component in mitigating power disruptions.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- India Gas Genset Market Outlook

- Market Size of India Gas Genset Market, 2024

- Forecast of India Gas Genset Market, 2031

- Historical Data and Forecast of India Gas Genset Revenues & Volume for the Period 2021 - 2031

- India Gas Genset Market Trend Evolution

- India Gas Genset Market Drivers and Challenges

- India Gas Genset Price Trends

- India Gas Genset Porter's Five Forces

- India Gas Genset Industry Life Cycle

- Historical Data and Forecast of India Gas Genset Market Revenues & Volume By Rating for the Period 2021 – 2031

- Historical Data and Forecast of India Gas Genset Market Revenues & Volume By Up to 100 kVA for the Period 2021 - 2031

- Historical Data and Forecast of India Gas Genset Market Revenues & Volume By 100.1 kVA - 375 kVA for the Period 2021 - 2031

- Historical Data and Forecast of India Gas Genset Market Revenues & Volume By 375.1 kVA - 1,000 kVA for the Period 2021 - 2031

- Historical Data and Forecast of India Gas Genset Market Revenues & Volume By Above 1,000 kVA for the Period 2021 – 2031

- Historical Data and Forecast of India Gas Genset Market Revenues & Volume By Verticals for the Period 2021 - 2031

- Historical Data and Forecast of India Gas Genset Market Revenues & Volume By Industrial for the Period 2021 - 2031

- Historical Data and Forecast of India Gas Genset Market Revenues & Volume By Commercial for the Period 2021 - 2031

- Historical Data and Forecast of India Gas Genset Market Revenues & Volume By Residential for the Period 2021 – 2031

- Historical Data and Forecast of India Gas Genset Market Revenues & Volume By Applications for the Period 2021 – 2031

- Historical Data and Forecast of India Gas Genset Market Revenues & Volume By Standby Power for the Period 2021 - 2031

- Historical Data and Forecast of India Gas Genset Market Revenues & Volume By Primary Power for the Period 2021 - 2031

- Historical Data and Forecast of India Gas Genset Market Revenues & Volume By Peak Shaving for the Period 2021 - 2031

- Historical Data and Forecast of India Gas Genset Market Revenues & Volume By Regions for the Period 2021 – 2031

- Historical Data and Forecast of India Gas Genset Market Revenues & Volume By Northern for the Period 2021 - 2031

- Historical Data and Forecast of India Gas Genset Market Revenues & Volume By Eastern for the Period 2021 - 2031

- Historical Data and Forecast of India Gas Genset Market Revenues & Volume By Western for the Period 2021 - 2031

- Historical Data and Forecast of India Gas Genset Market Revenues & Volume By Southern for the Period 2021 - 2031

- India Gas Genset Market - Key Performance Indicators

- India Gas Genset Market - Import Export Trade Statistics

- India Gas Genset Market - Opportunity Assessment By Ratings

- India Gas Genset Market - Opportunity Assessment By Verticals

- India Gas Genset Market - Opportunity Assessment By Regions

- India Gas Genset Market - Opportunity Assessment By Application

- India Gas Genset Market - Top Companies Market Share

- India Gas Genset Market - Top Companies Profiles

- India Gas Genset Market - Comparison of Players in Technical and Operating Parameters

- India Gas Genset Market - Strategic Recommendations

Market Covered

The market report has been segmented and sub segmented into the following categories:

By Rating

- Up to 100 kVA

- 100.1 kVA - 375 kVA

- 375.1 kVA - 1,000 kVA

- Above 1,000 kVA

By Verticals

- Industrial

- Commercial

- Residential

By Applications

- Standby Power

- Primary Power

- Peak Shaving

By Regions

- Northern

- Eastern

- Western

- Southern

India Gas Genset Market (2021-2031): FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of The Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. Global Gas Genset Market Overview |

| 3.1. Global Gas Genset Market Revenues (2021-2031F) |

| 3.2. Global Gas Genset Market Revenue Share, By Regions (2024) |

| 4. India Gas Genset Market Overview |

| 4.1. India Gas Genset Market Revenues & Volume (2021-2031F) |

| 4.2. India Gas Genset Market Industry Life Cycle |

| 4.3. India Gas Genset Market Value Chain Analysis |

| 4.4. India Gas Genset Market Porter's Five Force Model |

| 4.5. India Gas Genset Market Revenue Share, By Rating (2021 & 2031F) |

| 4.6. India Gas Genset Market Revenue Share, By Verticals (2021 & 2031F) |

| 4.7. India Gas Genset Market Revenue Share, By Applications (2021 & 2031F) |

| 4.8. India Gas Genset Market Revenue Share, By Regions (2021 & 2031F) |

| 5. India Gas Genset Market Dynamics |

| 5.1. Impact Analysis |

| 5.2. Market Drivers |

| 5.3. Market Restraints |

| 6. India Gas Genset Market Trends |

| 7. India Gas Genset Market Overview, By Rating |

| 7.1. India Gas Genset Market Revenues & Volume, By Up to 100 kVA (2021-2031F) |

| 7.2. India Gas Genset Market Revenues & Volume, By 100.1 kVA-375 kVA (2021-2031F) |

| 7.3. India Gas Genset Market Revenues & Volume, By 375.1 kVA-1,000 kVA (2021-2031F) |

| 7.4. India Gas Genset Market Revenues & Volume, By Above 1,000 kVA (2021-2031F) |

| 8. India Gas Genset Market Overview, By Verticals |

| 8.1. India Gas Genset Market Revenues, By Industrial Vertical (2021-2031F) |

| 8.2. India Gas Genset Market Revenues, By Commercial Vertical (2021-2031F) |

| 8.3. India Gas Genset Market Revenues, By Residential Vertical (2021-2031F) |

| 9. India Gas Genset Market Overview, By Applications |

| 9.1. India Gas Genset Market Revenues, By Standby Power Application (2021-2031F) |

| 9.2. India Gas Genset Market Revenues, By Primary Power Application (2021-2031F) |

| 9.3. India Gas Genset Market Revenues, By Peak Shaving Application (2021-2031F) |

| 10. India Gas Genset Market Overview, By Regions |

| 10.1. India Northern Region Gas Genset Market Revenues (2021-2031F) |

| 10.2. India Eastern Region Gas Genset Market Revenues (2021-2031F) |

| 10.3. India Western Region Gas Genset Market Revenues (2021-2031F) |

| 10.4. India Southern Region Gas Genset Market Revenues (2021-2031F) |

| 11. India Gas Genset Market Price Trend |

| 12. India Gas Genset Market Key Performance Indicators |

| 12.1. India Energy Sector Outlook |

| 12.2. Government Spending Outlook in India |

| 12.3. Power Capacity Addition Targets in India |

| 13. India Gas Genset Market Opportunity Assessment |

| 13.1. India Gas Genset Market Opportunity Assessment, By Rating (2024) |

| 13.2. India Gas Genset Market Opportunity Assessment, By Verticals (2024) |

| 14. India Gas Genset Market - Competitive Landscape |

| 14.1. India Gas Genset Market Players Revenue Share (2024) |

| 14.2. Competitive Benchmarking, By Operating Parameters |

| 14.3. Competitive Benchmarking, By kVA Rating |

| 15. Company Profiles |

| 15.1. Cummins India Ltd. |

| 15.2. Caterpillar India Pvt. Ltd. |

| 15.3. Ashok Leyland |

| 15.4. Mahindra & Mahindra Ltd. |

| 15.5. Cooper Corporation Pvt. Ltd. |

| 15.6. Generac Power Systems Inc. |

| 15.7. F.G. Wilson Inc. |

| 15.8. Kohler Power India Pvt. Ltd. |

| 15.9. Green Power International Pvt. Ltd. |

| 15.10. Kirloskar Oil Engines Ltd. |

| 16. Key Strategic Notes |

| 17. Disclaimer |

Market Forecast By Rating (Up to 100 kVA, 100.1 kVA - 375 kVA, 375.1 kVA - 1,000 kVA and Above 1,000 kVA), By Verticals (Industrial, Commercial and Residential), By Applications (Standby Power, Primary Power, and Peak Shaving), By Regions (Northern, Eastern, Western and Southern) and Competitive Landscape

| Product Code: ETC000529 | Publication Date: Dec 2021 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 120 | No. of Figures: 55 | No. of Tables: 18 |

Latest 2021 Developments:

India Gas Genset Market is witnessing innovation as on 15th July 2019, Caterpillar introduced a new gas the engine which can drop fuel use and cost drastically broadens the range of fuels that can be used and maintain greenhouse gas footprint. Last week the Wärtsilä 20DF dual-fuel engine has been improved to produce higher power while using less energy. Maharashtra State Power Generation Company Limited has received a tender from Maharashtra state govt regarding Comprehensive Annual Work Contract for Operation and Maintenance of Ozone Generating Plant. BHEL has received a tender from Uttaranchal govt regarding Establishment of An In-Premises Oxygen Manufacturing Plant on Boom (Built-Own-Operate & Maintain) Basis and Supply of Oxygen & Nitrogen Gases and Liquid Nitrogen Through It For 5 Years Period.

To enquire about latest release please click here

Previous Release:

India gas Genset market recorded a declining trend over the past 2-3 years owing to lower product awareness coupled with strict emission norms by the Central Pollution Control Board (CPCB) of India. However, surging environmental awareness is predicted to result in a consumer shift from diesel Genset towards gas Genset over the coming years. Further, the gas Genset market is projected to recover in near future on account of improving gas pipeline infrastructure in the country along with government efforts towards creating consumer awareness regarding environment-friendly products, development of City Gas Distribution (CGD) network, and subsidy on using renewable resources.

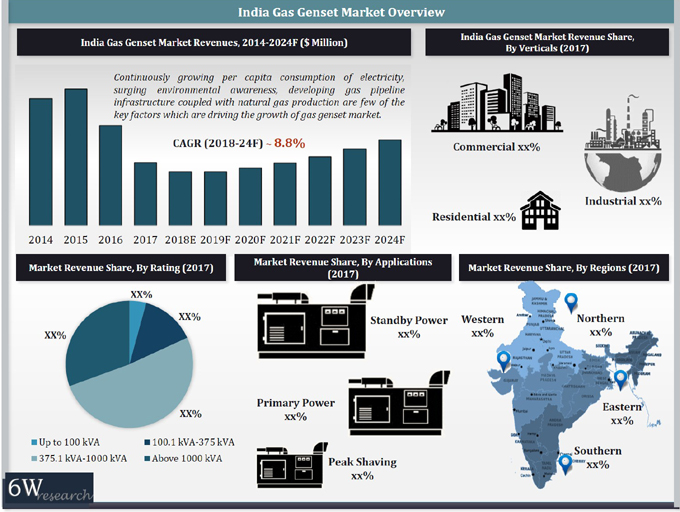

According to 6Wresearch, India gas Genset market size is projected to reach $31 million by 2024. Due to the launch of new norms, the market, especially in industrial verticals which includes the power utility segment, was majorly impacted during the last few years. This also resulted in increased prices of gas Gensets, which further impacted the growth of the market during 2014-17. Standby power applications bagged the highest India gas Genset market share in 2017, while peak shaving and primary power applications contributed nearly 15% altogether.

Furthermore, in terms of gas Genset rating, the 375.1 kVA-1000 kVA segment captured the largest India gas Genset market revenue share while low rating Genset up to 100 kVA attributed to the largest market volume share in 2017. With the ongoing demand for medium rating gas Genset from commercial and industrial segments, the 100.1 kVA-375 kVA segment is projected to exhibit high growth during the forecast period.

The India gas Genset market report thoroughly covers the India gas Genset market by rating, verticals, applications, and regions. The India gas Genset market outlook report provides an unbiased and detailed analysis of the India gas Genset market trends, opportunities/ high growth areas, and market drivers which would help the stakeholders to decide and align their market strategies according to the current and future market dynamics.

India Gas Genset Market takes estimates and forecasts the market of the gas Genset by verticals, applications, rating, and regions. The report details are analyzed based on the ongoing trends, opportunities, and high growth areas according to the market. India gas Genset market is anticipated to gain traction in the coming years backed by the increased grid development in the country coupled with rapid growth in industries such as infrastructure, telecommunication, information technology, and IT-enabled services. Also, an increase in chronic power shortages and rapid growth across various industrial verticals is expected to turn the Indian gas Genset market into a highly competitive and organized market in the upcoming six years. Also, an increase in the energy requirement in the country is expected to drive potential market growth for the India gas Genset market in the coming years.

India gas Genset market is estimated to witness promising growth during the forecast period 2020-26F backed by rising constructional projects like Bharat mala projects has been stared to create highways for efficient movement tends to require uninterpretable power system equipment at times of power failure has led to evolving gas Genset adoption in the country. Moreover, the rising gas pipeline infrastructure in the country requires gas gen-sets to operate and in the agriculture sector to power water pumps to ensure stable water supply to perform the irrigation process. these key components act as a backbone for the promising future growth of India gas Genset market during the forecast period.

India gas Genset market is projected to gain popularity in the coming timeframe on the back of the rising need for uninterruptible power supply source systems in the country. India gas Genset is experiencing extensive growth due to the accelerating use of gas Genset in rural areas to keep on the parties and in religious programs, As in India, rural areas attain less electricity access where gas Gensets plays a significant role in providing adequate electricity access during power outages. Additionally, rising construction sector like char Dham expressway is expected to paving the way towards the robust demand for gas Genset by proving emergence power during construction in remote areas and where the absence of power grid, Gas Genset is likely to consider best at times of emergency and is expected to spur the enormous growth of India gas Genset market in the upcoming six years.

India gas Genset market is projected to secure tremendous growth in the forthcoming years backed by the growth of the industrial landscape in the country therefore the is impacting positively by rising product adoption especially in the manufacturing sector to power machinery during power outages.

The top key players operating in India gas Genset market are General electric company, Kohler co, Cummins Inc, Caterpillar Inc, and Kirloskar electric company limited.

Key Highlights of the Report:

• India Gas Genset Market Overview

• India Gas Genset Market Outlook

• India Gas Genset Market Forecast

• Historical data of Global Gas Genset Market for the Period, 2014-2017

• Market Size & Forecast data of Global Gas Genset Market, until 2024

• Historical and Forecast data of India Gas Genset Market Revenues for the Period, 2014-2024

• Historical data of India Gas Genset Market, By Rating for the Period, 2014-2017

• India Gas Genset Market Size and India Gas Genset Market Forecast, By Rating, until 2024

• Historical data of India Gas Genset Market, By Verticals for the Period, 2014-2017

• Market Size & Forecast data of India Gas Genset Market, By Verticals until 2024

• Historical data of India Gas Genset Market, By Applications for the Period, 2014-2017

• Market Size & Forecast data of India Gas Genset Market, By Applications, until 2024

• Historical and Forecast data of India Gas Genset Market, By Regions for the Period, 2014-2024

• Market Drivers and Restraints

• India Gas Genset Market Trends and Opportunities

• Industry Life Cycle and Value Chain Analysis

• Porter's Five Forces Analysis

• India Gas Genset Market Share, By Players

• India Gas Genset Market Overview on Competitive Landscape

• Competitive Benchmarking, and Company Profiles

• Recommendations

Markets Covered:

The India gas Genset market report provides a detailed analysis of the following market segments:

• By Ratings

o Up to 100 kVA

o 100.1 kVA - 375 kVA

o 375.1 kVA - 1,000 kVA

o Above 1,000 kVA

• By Verticals

o Industrial

o Commercial

o Residential

• By Applications

o Standby Power

o Primary Power

o Peak Shaving

• By Regions

o Northern

o Eastern

o Western

o Southern

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Tajikistan Thermal Camera Market (2025-2031) | Trends, Size, Growth, Share, Industry, Companies, Value, Analysis, Revenue, Forecast & Outlook

- Singapore Professional AV Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- Saudi Arabia Genset Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- India OOH Advertising Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- Vietnam Twisted Pair Cables Market (2024-2030) | Size & Revenue, Forecast, Share, Companies, Competitive Landscape, Analysis, Trends, Value, Segmentation, Outlook, Industry, Growth

- South Africa B2B Cleaning Market (2025-2031) | Size & Revenue, Forecast, Share, Companies, Competitive Landscape, Analysis, Trends, Value, Segmentation, Outlook, Industry, Growth

- Mexico Dispersion Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- United States Video Conferencing Market (2025-2031) | Outlook, Industry, Size, Revenue, Share, Trends, Forecast, Growth, Companies, Analysis & Value

- Australia Electric Motor Market (2025-2031) | Trends, Share, Size, Value, Revenue, Industry, Growth, Analysis, Segmentation & Outlook

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- India's Printer Market Faces 20.7% Decline in Q4 2023: Epson and HP Lead Amidst Downturn

- India's Camera Market Sees 8.9% Decline in Q4 2023; Canon Leads with 38.4% Share

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- The future of gaming industry in the Philippines