India Pet Food Market (2025-2031) | Outlook, Growth, Size, Value, Industry, Companies, Forecast, Revenue, Analysis, Share & Trends

Market Forecast By Type (Dry Food, Wet Food, Snacks/Treats), By Animal (Dog, Cat, Others) And Competitive Landscape

| Product Code: ETC383904 | Publication Date: Aug 2023 | Updated Date: Feb 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

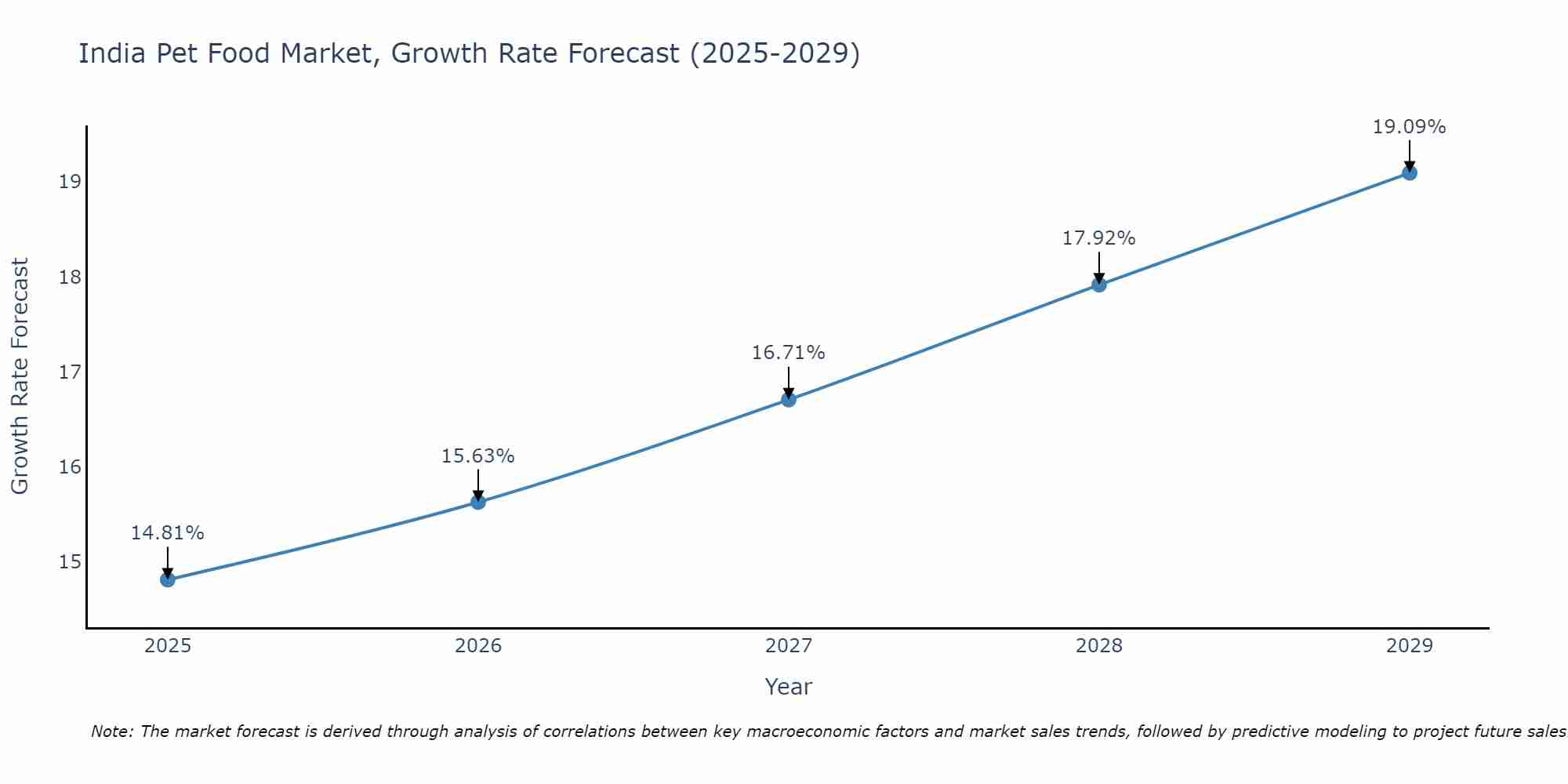

India Pet Food Market Size Growth Rate

The India Pet Food Market is poised for steady growth rate improvements from 2025 to 2029. Commencing at 14.81% in 2025, growth builds up to 19.09% by 2029.

India Pet Food Market Highlights

| Report Name | India Pet Food Market |

| Forecast period | 2025-2031 |

| CAGR | 15.4% |

| Growing Sector | Premium and Specialized Pet Food Products |

Topics Covered in the India Pet Food Market Report

The India Pet Food Market report thoroughly covers the market by type, and by animal. The report provides an unbiased and detailed analysis of the ongoing market trends, opportunities in high-growth areas, and market drivers to help stakeholders align their strategies with current and future market dynamics.

India Pet Food Market Synopsis

The Indian pet food industry is experiencing rapid expansion, primarily due to the burgeoning pet population and the evolving perception of pets as family members. Urbanization and the rise of nuclear families have contributed to increased pet adoption, particularly of dogs and cats. This trend has led to a surge in demand for high-quality, nutritious pet food products. Additionally, the proliferation of e-commerce platforms has made pet food more accessible, offering consumers a wide array of choices and convenient purchasing options.

According to 6Wresearch, the India Pet Food Market is anticipated to grow at a CAGR of 15.4% during the forecast period 2025-2031. The growth of the India Pet Food Market is propelled by several key drivers. Firstly, the increasing pet ownership across urban and semi-urban areas has significantly expanded the consumer base for pet food products. As more households embrace pets, there is a heightened demand for nutritious and convenient feeding solutions. Secondly, rising disposable incomes have empowered consumers to spend more on premium pet care products. This economic upliftment has facilitated a shift from home-cooked pet meals to commercially prepared, balanced diets that cater to specific health needs. Pet owners are now more willing to invest in specialized diets that promote overall well-being and address particular health concerns. Thirdly, the humanization of pets has led to increased awareness about pet health and nutrition. Pet owners are seeking products that mirror human food trends, such as organic, grain-free, and natural ingredient-based diets. This shift in perception has encouraged manufacturers to innovate and offer products that align with these evolving consumer preferences. This trend is reflected in the India Pet Food Market Growth.

However, the market faces certain challenges. One significant hurdle is the lack of awareness about the nutritional requirements of pets, especially in rural areas. Many pet owners are still inclined towards feeding table scraps or home-cooked meals, which may not provide balanced nutrition. Educating consumers about the benefits of specialized pet food is essential to drive market penetration. Another challenge is price sensitivity among consumers. While there is a growing segment willing to invest in premium products, a considerable portion of the market remains cost-conscious. Balancing quality with affordability is crucial for manufacturers aiming to cater to this demographic. Additionally, the market is fragmented with numerous local and international players, leading to intense competition. Establishing brand loyalty in such a competitive landscape requires continuous innovation, effective marketing strategies, and maintaining high product quality standards.

India Pet Food Market Trends

The India Pet Food Market is witnessing a trend towards premiumization and customization. Consumers are increasingly opting for high-quality products that offer specific health benefits, such as improved digestion, weight management, and enhanced immunity. This trend is driving manufacturers to develop functional foods enriched with vitamins, minerals, and other essential nutrients.

Another notable trend is the rise of e-commerce as a preferred distribution channel. The convenience of online shopping, coupled with a wider product selection and competitive pricing, has attracted a significant number of pet owners to digital platforms. This shift is prompting companies to strengthen their online presence and collaborate with e-commerce platforms to reach a broader audience.

Investment Opportunities in the India Pet Food Market

The expanding pet food market in India presents lucrative investment opportunities, particularly in the premium and specialized segments. Investors can explore ventures focusing on organic and natural pet food products, as health-conscious consumers are increasingly seeking these options for their pets. Additionally, there is potential in developing therapeutic diets that cater to pets with specific health conditions, a niche yet growing market segment.

Investments in e-commerce infrastructure and digital marketing can also yield substantial returns. As online sales of pet food continue to rise, establishing a robust digital presence and efficient supply chain logistics will be critical for capturing market share. Collaborations with veterinary clinics and pet care centers can further enhance credibility and consumer trust, providing an added advantage in this competitive market.

Leading Players in the India Pet Food Market

Prominent players in the India Pet Food Market include Mars International India Pvt. Ltd., Nestlé Purina Petcare India, Drools Pet Food Pvt. Ltd., and Royal Canin India. These companies have established strong brand recognition and extensive distribution networks, enabling them to maintain a significant market presence. Their continuous focus on product innovation and quality has solidified their positions as market leaders.

Government Regulations in the India Pet Food Market

The Indian pet food industry is subject to regulations aimed at ensuring product safety and quality. The Food Safety and Standards Authority of India (FSSAI) oversees the standards for pet food products, mandating compliance with specified nutritional and safety guidelines. Manufacturers are required to adhere to labeling norms that provide clear information about ingredients, nutritional content, and usage instructions, ensuring transparency for consumers. Import regulations are also in place, with the Directorate General of Foreign Trade (DGFT) governing the import of pet food products into the country. Importers must comply with stringent quality checks and obtain necessary approvals before distributing their products in the Indian market.

These measures ensure that international brands meet local safety standards, maintaining product integrity and consumer confidence. Furthermore, taxation policies, including the Goods and Services Tax (GST), impact the pricing of pet food products. Currently, pet food falls under a higher tax bracket, which affects affordability, especially for cost-sensitive consumers. Industry stakeholders continue to advocate for tax reductions to make pet food more accessible across different income segments. In addition, growing concerns over pet food quality have prompted discussions on stricter regulatory enforcement. Authorities are increasingly emphasizing the need for standardized testing and certification processes to prevent substandard or counterfeit products from entering the market. This regulatory shift aims to enhance consumer trust and ensure that pets receive nutritionally balanced diets.

Future Insights of the India Pet Food Market

The India Pet Food Market is poised for substantial growth, driven by evolving consumer preferences and increasing urbanization. As pet ownership continues to rise, the demand for high-quality, nutritionally balanced pet food will witness significant expansion. Market players will likely introduce more tailored products catering to specific breed requirements, age groups, and dietary needs to appeal to a diverse customer base. E-commerce and direct-to-consumer sales channels will play a crucial role in market expansion. With the increasing penetration of digital platforms, pet food brands are expected to leverage online marketplaces and subscription-based models to enhance customer retention. The integration of AI and data analytics in consumer behavior analysis will further help brands personalize product recommendations and improve user experience. Sustainability will emerge as a key focus area for pet food manufacturers.

Companies will explore plant-based, insect-based, and lab-grown protein sources as sustainable alternatives to traditional meat-based diets. The shift toward eco-friendly ingredients and biodegradable packaging solutions will align with both global and domestic environmental concerns, appealing to a growing segment of conscious consumers. Additionally, pet healthcare integration with nutrition will drive innovation in the market. Veterinary-formulated diets targeting specific health conditions such as obesity, allergies, and digestive disorders will gain traction. Pet owners' increasing willingness to invest in holistic pet wellness solutions will fuel the demand for functional and therapeutic pet foods, creating new revenue streams for industry participants.

Market Segmentation Analysis

The report offers a comprehensive study of the following market segments and their leading categories

Dog Food to Lead the Market – By Animal

According to Ravi Bhandari, Research Head, 6Wresearch, Dogs constitute the largest pet population in India, making dog food the dominant segment in the market. Premiumization trends and growing awareness about breed-specific dietary requirements are driving demand for high-quality dog food. The segment is expected to maintain its leading position, driven by increasing adoption rates and the introduction of breed-specific and age-specific formulations.

Dry Food to Dominate the Market – By Type

Dry pet food is projected to be the most consumed category due to its convenience, affordability, and long shelf life. The segment includes kibble-based formulations that offer balanced nutrition and are easy to store. Manufacturers are focusing on enhancing the palatability and nutritional profile of dry food to cater to the evolving preferences of pet owners.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- India Pet Food Market Outlook

- Market Size of India Pet Food Market 2024

- Forecast of India Pet Food Market 2031

- Historical Data and Forecast of India Pet Food Market Revenues& Volume for the Period 2021-2031

- India Pet Food Market Trend Evolution

- India Pet Food Market Drivers and Challenges

- India Pet Food Market Price Trends

- India Pet Food Market Porter's Five Forces

- India Pet Food Market Industry Life Cycle

- Historical Data and Forecast of India Pet Food Market Market Revenues & Volume ByType for the Period 2021 - 2031

- Historical Data and Forecast of India Pet Food Market Market Revenues & Volume ByDry Food for the Period 2021 - 2031

- Historical Data and Forecast of India Pet Food Market Market Revenues & Volume ByWet Food for the Period 2021 - 2031

- Historical Data and Forecast of India Pet Food Market Market Revenues & Volume BySnacks/Treats for the Period 2021 - 2031

- Historical Data and Forecast of India Pet Food Market Market Revenues & Volume ByAnimal for the Period 2021 - 2031

- Historical Data and Forecast of India Pet Food Market Market Revenues & Volume ByDog for the Period 2021 - 2031

- Historical Data and Forecast of India Pet Food Market Market Revenues & Volume ByCat for the Period 2021 - 2031

- Historical Data and Forecast of India Pet Food Market Market Revenues & Volume ByOthers for the Period 2021 - 2031

- India Pet Food Market Import Export Trade Statistics

- Market Opportunity Assessment By Product Type

- Market Opportunity Assessment By Application

- India Pet Food Market Top Companies Market Share

- India Pet Food Market Competitive Benchmarking By Technical and Operational Parameters

- India Pet Food Market Market Company Profiles

- India Pet Food Market Key Strategic Recommendations

Markets Covered

The report offers a comprehensive analysis of the following market segments

By Type

- Dry Food

- Wet Food

- Snacks/Treats

By Animal

- Dog

- Cat

- Others

India Pet Food Market (2025-2031): FAQs

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero