India Switchgear Market Outlook (2021-2027) | Size, Share, Trends, Growth, Revenue, Forecast, Analysis, Value, Outlook & COVID-19 IMPACT

Market Forecast By Voltage (Low Voltage (0-1.1 KV), Medium Voltage (1.1-36 KV), High Voltage (>36 KV)), By Low Voltage (Types (MCB, MCCB, ACB, Others), Applications (Residential, Commercial, Power Utilities, Industrial, Others (Transportation, Oil And Gas))), By Medium Voltage (Insulation Types (AIS, GIS), Applications (Residential, Commercial, Power Utilities, Industrial, Others (Transportation, Oil And Gas))), By High Voltage (Insulation Types (AIS, GIS), Applications (Residential, Commercial, Power Utilities, Industrial, Others (Transportation, Oil And Gas))) And Competitive Landscape.

| Product Code: ETC060880 | Publication Date: Aug 2023 | Updated Date: Apr 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

India Switchgear Market Competition 2023

India Switchgear market currently, in 2023, has witnessed an HHI of 1265, which has increased slightly as compared to the HHI of 854 in 2017. The market is moving towards a highly competitive environment. The herfindahl index measures the competitiveness of exporting countries. The range lies from 0 to 10000, where a lower index number represents a larger number of players or exporting countries in the market, while a larger index number means fewer numbers of players or countries exporting in the market.

India Export Potential Assessment For Switchgear Market (Values in USD Thousand)

India Switchgear Market Size and Growth Rate

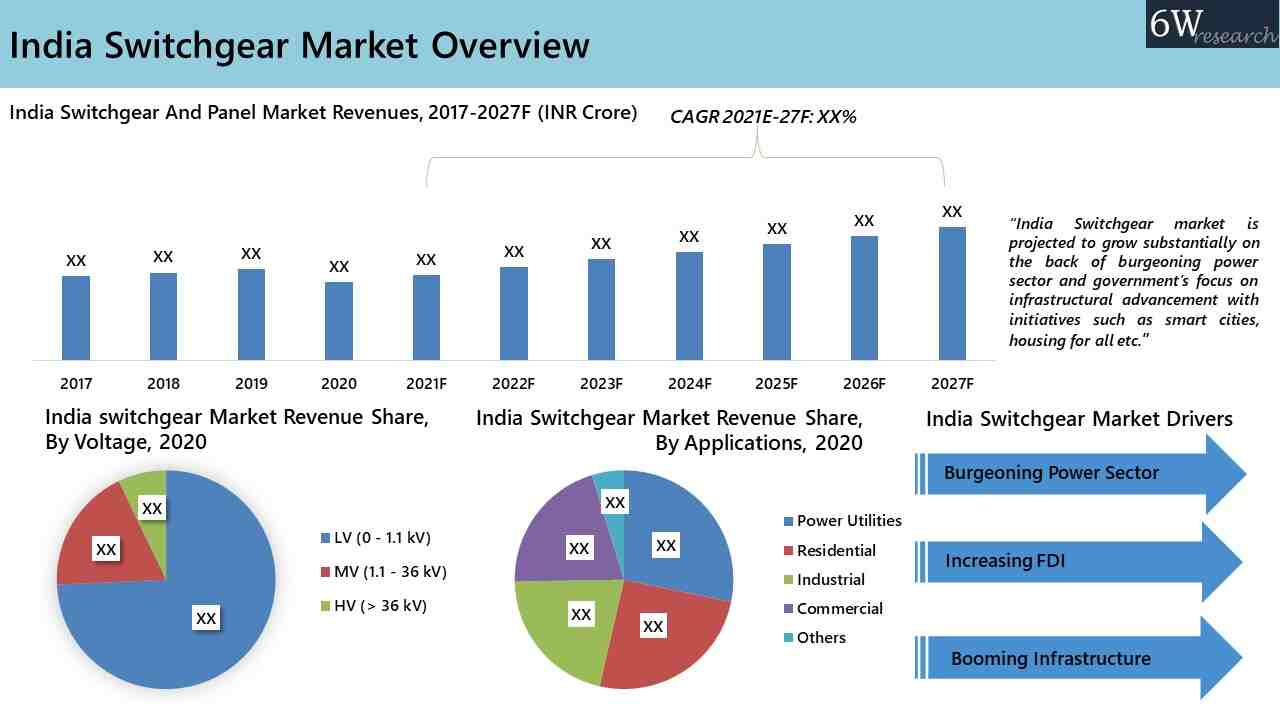

According to 6Wresearch, the India Switchgear Market Size is estimated to grow at a CAGR of 7.17% during the forecast period. This growth is attributed to urbanization and increasing demand for renewable energy.

India Switchgear Market Synopsis

India Switchgear Market is expected to register significant growth over the coming years on account of rising population, increasing energy requirement, and major infrastructural development projects being carried out across the country. Furthermore, government initiatives such as Deen Dayal Upadhyaya Gram Jyoti Yojana, Integrated Power Development Scheme, and Green Energy Corridor, and initiatives such as Housing for All in would lead to the development of the power and real estate sector. These sectors would, in turn, lead to an increase in demand for switchgear in the country. The market saw a sharp decline in 2020 as a result of the complete lockdown brought in force by the Indian Government to prevent the spread of coronavirus, which disrupted the supply chain, manufacturing processes and put a halt to all the developmental activities residential and commercial sectors. However, the decline in the market is expected to be temporary and is anticipated to return to a healthy growth rate on account of declining COVID-19 cases and the vaccination drive, which started in early 2021.

According to 6Wresearch, the India Switchgear Market size is projected to grow at a CAGR of 7.17% during 2021-27. The Government of India plans to reduce the emissions caused by thermal energy plants and increase its renewable energy production to 220 GW by 2022 to meet its commitment made towards the Paris Agreement. As a result, the renewable energy sector is seeing a major rush in investments. This capacity addition of the sector is growing at a rate of ~14% over the last five years. Additionally, to reduce emissions caused by conventional vehicles, the government is promoting electric vehicles, which would require a huge charging infrastructure over the coming years. Railways are also moving towards renewable energy by installing solar panels on top of their buildings and on unused land. Under the ‘UDAAN’ scheme, the government is planning to build several airports across the country and upgrade the existing ones. All these sectors have a direct impact on the switchgear market in India.

India Switchgear Market Competitive Landscape

- The market for switchgear in India is highly fragmented with significant competition observed between domestic as well as international players.

- Some players are world-renowned global players, Schneider Electric, Siemen,s and ABB, as well as local companies like L&T Electrical & Automation.

- The market competition is intensifying due to the increasing urbanization and development of the industry.

- Pricing strategies, technological innovation, and expanded distribution networks are among the competitive advantages.

Switchgear Technology Trends: What’s on the Horizon?

- Such energy monitoring and analytics in real-time is gaining popularity in industrial and commercial space in the form of smart and digital switchgear.

- IoT (Internet of Things) technology has improved predictive maintenance and reduced downtime.

- Alternating current (AC) high-voltage and gas-insulated switchgear (GIS) are being designed for maximum scaling and space saving.

- Modern designs are incorporating improved safety features, including arc flash detection systems and advanced insulation materials.

Import Export Trade Statistics of India Switchgear Industry

- With government incentives, India is slowly increasing self-reliance and slashing reliance on imports through domestic production.

- As far as imports are concerned in the past, high-end products such as advanced gas-insulated switchgear from China and Germany have also been at the top of the list.

- Exports are booming, especially to neighbouring countries and newly emerging markets that are exploring advanced electrical systems.

- To encourage domestic players competitively through protectionist measures like higher import duties.

Future Trends in the India Switchgear Market

- A drastic transition to adopting green and sustainable switchgear, utilizing environmentally friendly materials and designs in line with the worldwide green certification.

- Increasing deployment of AI-enabled switchgear offering that will lead to better predictive maintenance and operational efficiency in large-scale facilities.

- Growing investment in smart grids and microgrids as India shifts to renewable power generation through advanced generation management technology.

- Increase in demand for modular and compact designs due to the growing requirement for efficient space utilization in broader city developments.

Market Analysis by Voltage

Based on the voltage, low-voltage switchgear accounted for the major market revenue share in 2020, and it is anticipated to maintain the same over the forthcoming years, owing to its application in residential and commercial sectors. MCB dominated the low switchgear market, followed by ACB. The medium voltage switchgear market is also expected to grow generously over the coming years on account of reliable operations, safety, and easy maintenance. Additionally, rising demand to curb fire hazards, short circuits, and electricity faults would also drive the market growth.

Market Analysis by Application

Residential and Power Utilities sector accounted for the major revenue share in the India Switchgear Market in 2020 and is expected to retain its dominance for the coming years owing to the increasing population, increasing investment in the renewable energy sector and major expansion and upgradation programs carried out by the government of India in the power sector. The growth in the real estate and transportation sectors would directly contribute to the growth of the switchgear market in the forthcoming years.

Key Attractiveness of the Report

- Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2018 to 2020.

- Base Year: 2020

- Forecast Data until 2027.

- Key Performance Indicators

- Factors Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- India Switchgear Market Overview

- India Switchgear Market Outlook

- India Switchgear Market Forecast

- India Switchgear Market Size

- Historical Data of India Switchgear Market Revenues for the Period 2017-2020

- Market Size & Forecast of India Switchgear Market Revenues until 2027F

- Historical Data of India Switchgear Market Revenues for the Period 2017-2020, By Types

- Market Size & Forecast of India Switchgear Market Revenues until 2027F, By Types

- Historical Data of India Low Voltage Switchgear Market Revenues for the Period 2017-2020, By Types

- Market Size & Forecast of India Low Voltage Switchgear Market Revenues until 2027F, By Types

- Historical Data of India Low Voltage Switchgear Market Revenues for the Period 2017-2020, By Applications

- Market Size & Forecast of India Low Voltage Switchgear Market Revenues until 2027F, By Applications

- Historical Data of India Medium Voltage Switchgear Market Revenues for the Period 2017-2020, By Insulation Type

- Market Size & Forecast of India Medium Voltage Switchgear Market Revenues until 2027F, By Insulation Type

- Historical Data of India Medium Voltage Switchgear Market Revenues for the Period 2017-2020, By Types

- Market Size & Forecast of India Medium Voltage Switchgear Market Revenues until 2027F, By Types

- Historical Data of India Medium Voltage Switchgear Market Revenues for the Period 2017-2020, By Applications

- Historical Data of India High Voltage Switchgear Market Revenues for the Period 2017-2020, By Insulation Type

- Market Size & Forecast of India High Voltage Switchgear Market Revenues until 2027F, By Insulation Type

- Historical Data of India High Voltage Switchgear Market Revenues for the Period 2017-2020, By Types

- Market Size & Forecast of India High Voltage Switchgear Market Revenues until 2027F, By Types

- Historical Data of India High Voltage Switchgear Market Revenues for the Period 2017-2020, By Applications

- Historical Data of India Switchgear Market Revenues for the Period 2017-2020, By Applications

- Market Size & Forecast of India Switchgear Market Revenues until 2027F, By Applications

- Market Drivers and Restraints

- India Switchgear Market Trends

- Players Market Share

- Company Profiles

- Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Voltage

- Low Voltage (0-1.1 KV)

- Medium Voltage (1.1-36 KV)

- High Voltage (>36 KV)

By Low Voltage

- Types

- MCB

- MCCB

- ACB

- Others

- Applications

- Residential

- Commercial

- Power Utilities

- Industrial

- Others (Transportation, Oil, and Gas)

By Medium Voltage

- Insulation Types

- AIS

- GIS

- Applications

- Residential

- Commercial

- Power Utilities

- Industrial

- Others

- Transportation

- Oil And Gas

By High Voltage

- Insulation Types

- AIS

- GIS

- Applications

- Residential

- Commercial

- Power Utilities

- Industrial

- Others (Transportation Oil, And Gas)

India Switchgear Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2 Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. India Switchgear Market Overview |

| 3.1 India Switchgear Market Revenues (2017- 2027F) |

| 3.2 India Switchgear Market - Industry Life Cycle, 2020 |

| 3.3 India Switchgear Market - Porter’s Five Forces |

| 3.4 Impact Analysis of COVID-19 on the India Switchgear Market |

| 4. India Switchgear Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5. India Switchgear Market Trends |

| 6. India Low Voltage Switchgear Market Overview |

| 6.1 India Low Voltage Switchgear and Panels Market Revenues (2017- 2027F) |

| 6.2 India Low Voltage Switchgear Market Overview, By Types |

| 6.2.1 India Low Voltage Switchgear Market Revenue Share, By Types (2020 & 2027F) |

| 6.2.2 India Low Voltage Switchgear Market Revenues, By Types (2017- 2027F) |

| 6.3 India Low Voltage Switchgear Market Overview, By Applications |

| 6.3.1 India Low Voltage Switchgear Market Revenue Share, By Applications (2020 & 2027F) |

| 6.3.2 India Low Voltage Switchgear Market Revenues, By Applications (2017- 2027F) |

| 7. India Medium Voltage Switchgear Market Overview |

| 7.1 India Medium Voltage Switchgear Market Revenues (2017- 2027F) |

| 7.2 India Medium Voltage Switchgear Market Overview, By Insulation Types |

| 7.2.1 India Medium Voltage Switchgear Market Revenue Share, By Insulation Types (2020 & 2027F) |

| 7.2.2 India Medium Voltage Switchgear Market Revenues, By Insulation Types (2017- 2027F) |

| 7.3 India Medium Voltage Switchgear Market Overview, By Applications |

| 7.3.1 India Medium Voltage Switchgear Market Revenue Share, By Applications (2020 & 2027F) |

| 7.3.2 India Medium Voltage Switchgear Market Revenues, By Applications (2017- 2027F) |

| 8. India High Voltage Switchgear Market Overview |

| 8.1 India High Voltage Switchgear Market Revenues (2017- 2027F) |

| 8.2 India High Voltage Switchgear Market Overview, By Insulation Types |

| 8.2.1 India High Voltage Switchgear Market Revenue Share, By Insulation (2020 & 2027F) |

| 8.2.2 India High Voltage Switchgear Market Revenues, By Insulation (2017- 2027F) |

| 8.3 India High Voltage Switchgear Market Overview, By Application Types |

| 8.3.1 India High Voltage Switchgear Market Revenue Share, By Application Types (2020 & 2027F) |

| 8.3.2 India High Voltage Switchgear Market Revenues, By Application Types (2017- 2027F) |

| 9. India Switchgear Market Overview, By Applications |

| 9.1 India Switchgear Market Revenues, By Residential Application (2017- 2027F) |

| 9.2 India Switchgear Market Revenues, By Commercial Application (2017- 2027F) |

| 9.3 India Switchgear Market Revenues, By Industrial Application (2017- 2027F) |

| 9.4 India Switchgear Market Revenues, By Power Utilities Application (2017- 2027F) |

| 9.5 India Switchgear Market Revenues, By Other Application (2017- 2027F) |

| 10. India Switchgear Market Key Performance Indicators |

| 11. India Switchgear Market Opportunity Assessment |

| 11.1 India Switchgear Market Opportunity Assessment, By Voltage (2027F) |

| 11.2 India Switchgear Market Opportunity Assessment, By Applications (2027F) |

| 12. India Switchgear Market Competitive Landscape |

| 12.1 India Switchgear Market Revenue Share, By Voltage, By Company (2020) |

| 12.2 India Switchgear Market Competitive Benchmarking, By Technical Parameters |

| 12.3 India Switchgear Market Competitive Benchmarking, By Operational Parameters |

| 13. Company Profiles |

| 14. Key Strategic Recommendations |

| 15. Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero