India Ultrasound Market Tracker (2025-2031) | Value, Industry, Forecast, Size, Share, Analysis, Outlook, Revenue, Trends, Growth & Companies

India Ultrasound Market Tracker, CY Q4’2013

| Product Code: ETC000141 | Publication Date: Aug 2023 | Updated Date: Feb 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 01 | No. of Figures: 01 | No. of Tables: 01 | |

India Ultrasound Market Competition 2023

India Ultrasound market currently, in 2023, has witnessed an HHI of 1910, Which has increased slightly as compared to the HHI of 1832 in 2017. The market is moving towards moderately competitive. Herfindahl index measures the competitiveness of exporting countries. The range lies from 0 to 10000, where a lower index number represents a larger number of players or exporting countries in the market while a large index number means fewer numbers of players or countries exporting in the market.

India Export Potential Assessment For Ultrasound Market (Values in USD Thousand)

India Ultrasound Market Shipment Analysis

India Ultrasound Market registered a growth of 22.04% in value shipments in 2022 as compared to 2025 and an increase of 7.39% CAGR in 2022 over a period of 2017. In Ultrasound Market India is becoming less competitive as HHI index in 2022 was 1910 while in 2017 it was 1832. Herfindahl Index measures the competitiveness of exporting countries. The range lies from 0 to 10000, where a lower index number represents a larger number of players or exporting countries in the market while a large index number means less numbers of players or countries exporting in the market. India has reportedly relied more on imports to meet its growing demand in Ultrasound Market.

India Ultrasound Market Competition 2025

India Ultrasound market currently, in 2025, has witnessed an HHI of 1910, Which has increased slightly as compared to the HHI of 1832 in 2017. The market is moving towards moderately competitive. Herfindahl index measures the competitiveness of exporting countries. The range lies from 0 to 10000, where a lower index number represents a larger number of players or exporting countries in the market while a large index number means fewer numbers of players or countries exporting in the market.

India Export Potential Assessment For Ultrasound Market (USD Values in Thousand)

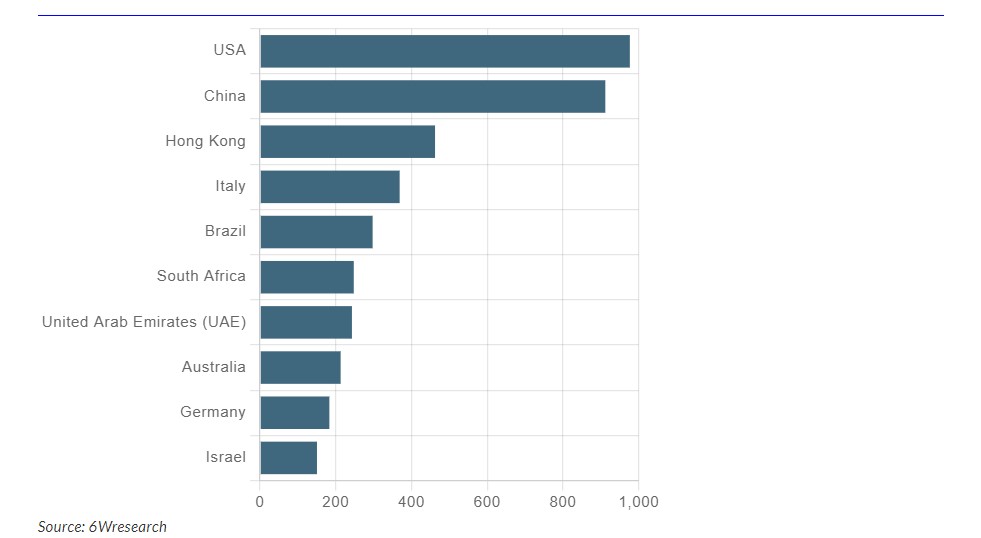

For India Exporters of Ultrasound, USA seems to be the most attractive market (in 2031) in terms of export potential followed by China, Hong Kong, Italy and Brazil. However, in terms of total import demand across all countries, Thailand occupies the top position. Hence considering overall import demand, Thailand leads the importing demand but considering India as a partner, USA provides high unmet demand potential as Compared to others for 2031.

India Ultrasound Market Synopsis:

The ultrasound market in India has experienced significant growth in recent years, driven by increasing healthcare awareness, rising healthcare expenditure, and advancements in technology. The demand for ultrasound devices has expanded across various medical fields, including obstetrics, gynecology, cardiology, and radiology.

Challenges of the Market

Despite the positive trends, the ultrasound market in India faces challenges. Affordability remains a concern for a significant portion of the population, limiting access to advanced ultrasound technologies. Additionally, the shortage of skilled professionals proficient in operating and interpreting ultrasound results poses a challenge to widespread adoption. Addressing these challenges will be crucial for sustained market expansion.

Government Policy of the Market

The Indian government has recognized the importance of diagnostic imaging in healthcare and has implemented policies to support the growth of the ultrasound market. Initiatives focus on improving healthcare infrastructure, providing subsidies for medical equipment purchases, and promoting skill development programs for healthcare professionals. Continued government support is expected to play a pivotal role in shaping the future landscape of the ultrasound market in India.

Drivers of the Market

Several factors contribute to the robust growth of the ultrasound market in India. Firstly, the growing population and rising incidence of diseases necessitate advanced diagnostic tools, with ultrasound being a key player. Additionally, the increasing preference for non-invasive and radiation-free imaging procedures fuels the adoption of ultrasound technology. Moreover, advancements in ultrasound equipment, such as 3D and 4D imaging capabilities, further enhance diagnostic accuracy and drive market growth.

Key Players of the Market

Several key players dominate the ultrasound market in India. Companies such as Siemens Healthineers, GE Healthcare, Philips Healthcare, and Mindray have established a significant presence, offering a wide range of ultrasound devices catering to different medical specialties. Collaboration with healthcare institutions, continuous innovation, and strategic partnerships are key strategies employed by these players to maintain their market leadership. As the market continues to evolve, competition and technological advancements are likely to shape the dynamics of the ultrasound industry in India.

Key Highlights of the India Ultrasound Market

- India Ultrasound Market Overview

- India Ultrasound Market Outlook

- Market Size of India Ultrasound Market, 2024

- Forecast of India Ultrasound Market, 2031

- Historical Data and Forecast of India Ultrasound Revenues & Volume for the Period 2025-2031

- India Ultrasound Market Trend Evolution

- India Ultrasound Market Drivers and Challenges

- India Ultrasound Price Trends

- India Ultrasound Porter's Five Forces

- India Ultrasound Industry Life Cycle

- Historical Data and Forecast of India Ultrasound Market Revenues & Volume By Technology for the Period 2025-2031

- Historical Data and Forecast of India Ultrasound Market Revenues & Volume By 2D for the Period 2025-2031

- Historical Data and Forecast of India Ultrasound Market Revenues & Volume By 3D for the Period 2025-2031

- Historical Data and Forecast of India Ultrasound Market Revenues & Volume By Doppler for the Period 2025-2031

- Historical Data and Forecast of India Ultrasound Market Revenues & Volume By Contrast-Enhanced for the Period 2025-2031

- Historical Data and Forecast of India Ultrasound Market Revenues & Volume By HIFU for the Period 2025-2031

- Historical Data and Forecast of India Ultrasound Market Revenues & Volume By ESWL for the Period 2025-2031

- Historical Data and Forecast of India Ultrasound Market Revenues & Volume By Component for the Period 2025-2031

- Historical Data and Forecast of India Ultrasound Market Revenues & Volume By Workstation for the Period 2025-2031

- Historical Data and Forecast of India Ultrasound Market Revenues & Volume By Probe for the Period 2025-2031

- Historical Data and Forecast of India Ultrasound Market Revenues & Volume By Type for the Period 2025-2031

- Historical Data and Forecast of India Ultrasound Market Revenues & Volume By Cart for the Period 2025-2031

- Historical Data and Forecast of India Ultrasound Market Revenues & Volume By Handled for the Period 2025-2031

- Historical Data and Forecast of India Ultrasound Market Revenues & Volume By PoC for the Period 2025-2031

- Historical Data and Forecast of India Ultrasound Market Revenues & Volume By Application for the Period 2025-2031

- Historical Data and Forecast of India Ultrasound Market Revenues & Volume By OB/GYN for the Period 2025-2031

- Historical Data and Forecast of India Ultrasound Market Revenues & Volume By CVD for the Period 2025-2031

- Historical Data and Forecast of India Ultrasound Market Revenues & Volume By Urology for the Period 2025-2031

- Historical Data and Forecast of India Ultrasound Market Revenues & Volume By Ortho for the Period 2025-2031

- Historical Data and Forecast of India Ultrasound Market Revenues & Volume By End-User for the Period 2025-2031

- Historical Data and Forecast of India Ultrasound Market Revenues & Volume By Hospitals for the Period 2025-2031

- Historical Data and Forecast of India Ultrasound Market Revenues & Volume By Clinics for the Period 2025-2031

- Historical Data and Forecast of India Ultrasound Market Revenues & Volume By ASCs for the Period 2025 – 2031

- India Ultrasound Import Export Trade Statistics

- Market Opportunity Assessment By Technology

- Market Opportunity Assessment By Component

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Application

- Market Opportunity Assessment By End-User

- India Ultrasound Top Companies Market Share

- India Ultrasound Competitive Benchmarking By Technical and Operational Parameters

- India Ultrasound Company Profiles

- India Ultrasound Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 India Ultrasound Market Overview |

| 3.1 India Country Macro Economic Indicators |

| 3.2 India Ultrasound MarketRevenues & Volume, 2021 & 2031F |

| 3.3 India Ultrasound Market - Industry Life Cycle |

| 3.4 India Ultrasound Market - Porter's Five Forces |

| 3.5 India Ultrasound Market Revenues & Volume Share, By Technology, 2021 & 2031F |

| 3.6 India Ultrasound Market Revenues & Volume Share, By Component, 2021 & 2031F |

| 3.7 India Ultrasound Market Revenues & Volume Share, By Type, 2021 & 2031F |

| 3.8 India Ultrasound Market Revenues & Volume Share, By Application, 2021 & 2031F |

| 3.9 India Ultrasound Market Revenues & Volume Share, By End-User, 2021 & 2031F |

| 4 India Ultrasound Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 India Ultrasound Market Trends |

| 6. India Ultrasound Market , By Technology |

| 6.1 India Ultrasound Market Revenues & Volume, By 2D, 2021-2031F |

| 6.2 India Ultrasound Market Revenues & Volume, By 3D, 2024- 2031F |

| 6.3 India Ultrasound Market Revenues & Volume, By Doppler, 2024- 2031F |

| 6.4 India Ultrasound Market Revenues & Volume, By Contrast-Enhanced, 2024- 2031F |

| 6.5 India Ultrasound Market Revenues & Volume, By HIFU, 2024- 2031F |

| 6.6 India Ultrasound Market Revenues & Volume, By ESWL, 2024- 2031F |

| 7. India Ultrasound Market , By Component |

| 7.1 India Ultrasound Market Revenues & Volume, By Workstation, 2021-2031F |

| 7.2 India Ultrasound Market Revenues & Volume, By Probe, 2024- 2031F |

| 8. India Ultrasound Market , By Type |

| 8.1 India Ultrasound Market Revenues & Volume, By Cart, 2021-2031F |

| 8.2 India Ultrasound Market Revenues & Volume, By Handheld, 2024- 2031F |

| 8.3 India Ultrasound Market Revenues & Volume, By PoC, 2024- 2031F |

| 9. India Ultrasound Market , By Application |

| 9.1 India Ultrasound Market Revenues & Volume, By OB/GYN, 2021-2031F |

| 9.2 India Ultrasound Market Revenues & Volume, By CVD, 2024- 2031F |

| 9.3 India Ultrasound Market Revenues & Volume, By Urology, 2024- 2031F |

| 9.4 India Ultrasound Market Revenues & Volume, By Ortho, 2024- 2031F |

| 10. India Ultrasound Market , By End-User |

| 10.1 India Ultrasound Market Revenues & Volume, By Hospitals, 2021-2031F |

| 10.2 India Ultrasound Market Revenues & Volume, By Clinics, 2024- 2031F |

| 10.3 India Ultrasound Market Revenues & Volume, By ASCs, 2024- 2031F |

| 11 India Ultrasound Market Imports from Major Countries |

| 12 India Ultrasound Market Key Performance Indicators |

| 13 India Ultrasound Market - Opportunity Assessment |

| 13.1 India Ultrasound Market Opportunity Assessment, By Technology, 2031 |

| 13.2 India Ultrasound Market Opportunity Assessment, By Component, 2031 |

| 13.3 India Ultrasound Market Opportunity Assessment, By Type, 2031 |

| 13.4 India Ultrasound Market Opportunity Assessment, By Application, 2031 |

| 13.5 India Ultrasound Market Opportunity Assessment, By End-User, 2031 |

| 14 India Ultrasound Market - Competitive Landscape |

| 14.1 India Ultrasound Market Revenue Share, By Companies, 2024 |

| 14.2 India Ultrasound Market Competitive Benchmarking, By Operating and Technical Parameters |

| 15 Company Profiles |

| 16 Recommendations |

| 17 Disclaimer |

6Wresearch publishes monthly/quarterly/annual shipments data of ultrasound market in India. The publication would enable the player to enter or devise strategies to expand its presence in the India ultrasound market by monitoring the shipments data by various types and specifications on a regular basis. This would also allow Companies to track their competitors' performance on a periodical basis.

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

- Kenya Road Stabilization Equipment Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- North America Sodium chloride Market (2025-2031) | Analysis, Revenue, Forecast, Trends, Companies, Size, Growth, Share, Industry, Outlook & Value

- North America Vinyl Flooring Market (2025-2031) | Value, Growth,Size, Analysis, Revenue, Industry, Forecast, Share, Outlook, Companies & Trends

- Tajikistan Thermal Camera Market (2025-2031) | Trends, Size, Growth, Share, Industry, Companies, Value, Analysis, Revenue, Forecast & Outlook

- Singapore Professional AV Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- Saudi Arabia Genset Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- India OOH Advertising Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero