Indonesia Kombucha Market (2024-2030) | Share, Industry, Analysis, Outlook, Trends, Forecast, Revenue, Value, Growth, Companies & Size

Market Forecast By Types (Bacteria, Yeast, Mold, Others), By Flavors (Herbs & Spices, Citrus, Berries, Apple, Coconut & Mangoes, Flowers, Others) And Competitive Landscape

| Product Code: ETC4541669 | Publication Date: Jul 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 85 | No. of Figures: 45 | No. of Tables: 25 |

Topics Covered in Indonesia Kombucha Market Report

Indonesia Kombucha Market Report thoroughly covers the market by types, beverage flavours and distribution channels. Indonesia Kombucha Market Outlook report provides an unbiased and detailed analysis of the ongoing Indonesia Kombucha Jewelry Market trends, opportunities/high growth areas, and market drivers. This would help stakeholders devise and align their market strategies according to the current and future market dynamics.

Indonesia Kombucha Market Synopsis

Indonesia Kombucha Market has been growing rapidly. This surge in popularity is driven by the rising demand for natural and organic products, attributed to increasing health consciousness and the rapid expansion of e-commerce. A study by the International Food Policy Research Institute revealed that over 95% of Indonesian consumers perceive organic and pesticide-free food products as safer and healthier than conventional alternatives. This perception has fueled a notable increase in Kombucha demand, especially following the COVID-19 pandemic. Additionally, Indonesia's position as the largest e-commerce market in ASEAN, with $51.9 billion in revenue in 2022, has facilitated consumer access to Kombucha, further boosting its popularity among health-conscious individuals.

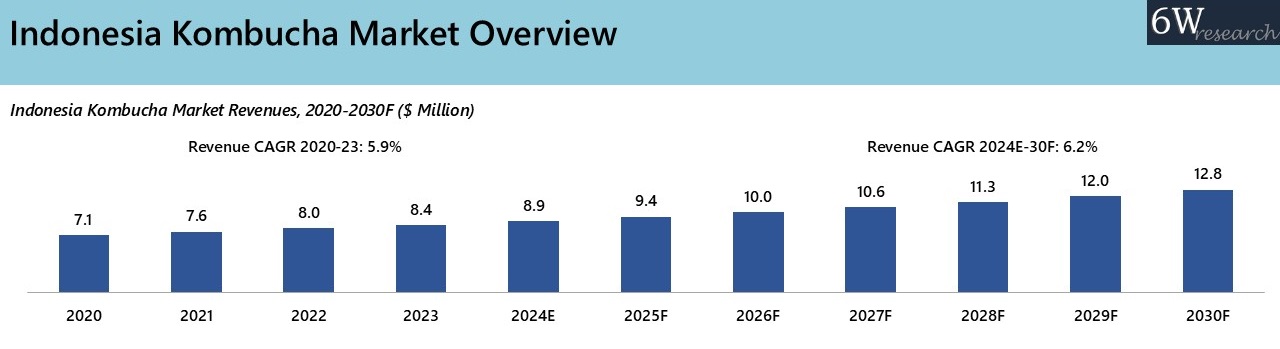

According to 6Wresearch, Indonesia Kombucha Market is projected to grow at a CAGR of 6.2% during 2024-30. The Indonesian Kombucha Market is poised for significant growth during the forecast period, driven by the expanding retail sector, which is projected to reach $71.89 billion by 2031. Additionally, the growing tourism industry in Indonesia is expected to drive market expansion. In 2022, the tourism sector contributed $52 billion, or 3.9% to the country's GDP, and by 2033, this contribution is projected to rise to 5.7% of GDP. With government programs such as the Tourism Village Program and initiatives towards green tourism, the Ministry of Tourism has set a target of 14 million foreign tourist visits in 2024. This anticipated surge in tourism is expected to elevate the demand for kombucha, driven by the influx of health-conscious visitors seeking natural and organic beverage options.

Market Segmentation by Types

Beverage products dominate the revenue share in the Indonesian kombucha industry, primarily due to their health benefits, effective marketing, and easy availability. Furthermore, over 95% of Indonesian consumers perceive organic and pesticide-free food products as 'safer' and 'healthier' than conventional alternatives, indicating a strong market perception for health-oriented beverages like kombucha.

Market Segmentation by Beverage Flavours

By Flavours, fruit-flavoured kombucha holds a significant market share and is generally more popular in the Indonesian market due to its appealing taste and high demand. Additionally, it is perceived as a refreshing, lightly sweet beverage that complements Indonesia's tropical climate, thereby making it a preferred choice in the market.

Market Segmentation by Distribution Channels

Offline distribution channels currently hold the largest revenue share in the market, as they offer a wide variety of kombucha brands and Flavours to meet diverse consumer preferences. Additionally, the growth of e-commerce, particularly after the Covid-19 pandemic, has led to substantial growth in online channels, which are projected to experience the highest growth in the future.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2020 to 2023.

- Base Year: 2023

- Forecast Data until 2030.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Indonesia Kombucha Market Overview

- Indonesia Kombucha Market Outlook

- Indonesia Kombucha Market Forecast

- Indonesia Kombucha Market Porter’s Five forces Analysis

- Indonesia Kombucha Market Industry Life Cycle Analysis

- Historical Data and Forecast of Indonesia Kombucha Market Revenues and Volume, for the Period 2020-2030F

- Market Drivers and Restraints

- Historical Data and Forecast of Indonesia Kombucha Market Revenues, By Types, for the Period 2020-2030F

- Historical Data and Forecast of Indonesia Kombucha Market Revenues, By Flavours, for the Period 2020-2030F

- Historical Data and Forecast of Indonesia Kombucha Market Revenues, By Distribution Channel, for the Period 2020-2030F

- Key Performance Indicators

- Market Opportunity Assessment

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

Thereportprovides a detailed analysis of the following market segments:

By Types

- Beverages Products

- Non-Beverages Products

By Beverage Flavour

- Fruits

- Herbs & Spices

- Vegetable

- Flowers

By Distribution Channel

- Offline

- Online

Indonesia Kombucha Market (2024-2030) :FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of the Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. Indonesia Kombucha Market Overview |

| 3.1 Indoneia Kombucha Market Revenues, 2020-2030F |

| 3.2 Indoneia Kombucha Market Industry Life Cycle |

| 3.3 Indoneia Kombucha Market Porter’s 5 Forces Analysis |

| 4. Indonesia Kombucha Market Dynamics |

| 4.1 Indonesia Kombucha Market Impact Analysis |

| 4.2 Indonesia Kombucha Market Drivers |

| 4.2.1 Growing health consciousness among Indonesian consumers |

| 4.2.2 Increasing disposable income leading to higher spending on premium health beverages |

| 4.2.3 Rise in popularity of natural and organic products in the market |

| 4.3 Indonesia Kombucha Market Restraints |

| 4.3.1 Lack of awareness and education about kombucha among Indonesian consumers |

| 4.3.2 High price points of kombucha products compared to traditional beverages |

| 4.3.3 Limited distribution channels and availability in remote areas |

| 5. Indonesia Kombucha Market Trends & Evolution |

| 6. Indonesia Kombucha Market Overview, By Types |

| 6.1 Indonesia Kombucha Market Revenues and Revenue Share, By Types, 2023 & 2030F |

| 6.1.1 Indonesia Kombucha Market Revenues, By Beverages Product (2020-2030F) |

| 6.1.2 Indonesia Kombucha Market Revenues, By Non-Beverages Product (2020-2030F) |

| 7. Indonesia Kombucha Market Overview, By Beverage Flavours |

| 7.1 Indonesia Kombucha Market Revenues and Revenue Share, By Beverage Flavours, 2023 & 2030F |

| 7.1.1 Indonesia Kombucha Market Revenues, By Fruits (2020-2030F) |

| 7.1.2 Indonesia Kombucha Market Revenues, By Herbs & Spices (2020-2030F) |

| 7.1.3 Indonesia Kombucha Market Revenues, By Vegetable (2020-2030F) |

| 7.1.4 Indonesia Kombucha Market Revenues, By Flowers (2020-2030F) |

| 8. Indonesia Kombucha Market Overview, By Distribution Channel |

| 8.1 Indonesia Kombucha Market Revenues and Revenue Share, By Distribution Channel, 2023 & 2030F |

| 8.1.1 Indonesia Kombucha Market Revenues, By Offline (2020-2030F) |

| 8.1.2 Indonesia Kombucha Market Revenues, By Online (2020-2030F) |

| 9. Indonesia Kombucha Market Key Performance Indicators |

| 9.1 Percentage increase in the number of health and wellness stores carrying kombucha products |

| 9.2 Growth in the number of kombucha brands entering the Indonesian market |

| 9.3 Number of educational campaigns and workshops conducted to raise awareness about kombucha and its benefits |

| 10. Indonesia Kombucha Market Opportunity Assessment |

| 10.1 Indonesia Kombucha Market Opportunity Assessment, By Types, 2030F |

| 10.2 Indonesia Kombucha Market Opportunity Assessment, By Beverage Flavour, 2030F |

| 10.3 Indonesia Kombucha Market Opportunity Assessment, By Distribution Channels, 2030F |

| 11. Indonesia Kombucha Market Competitive Landscape |

| 11.1 Indonesia Kombucha Market Revenue Ranking, By Companies, 2023 |

| 11.2 Indonesia Kombucha Market Competitive Benchmarking, By Operating Parameters |

| 12. Company Profiles |

| 12.1 Heal Probiotics |

| 12.2 Remedy Drinks |

| 12.3 GT’s Living Foods |

| 12.4 Kombuchi Brewing |

| 12.5 Fresh INC. |

| 12.6 Nature Republic |

| 12.7 Teazen Inc. |

| 12.8 Rudy's Brewing Co. |

| 12.9 Bali Bucha |

| 13. Key Strategic Recommendations |

| 14. Disclaimer |

| List of Figures |

| 1. Indonesia Kombucha Market Revenues, 2020-2030F ($ Million) |

| 2. Indonesia GDP (Current), 2018-2023, By $ Trillions |

| 3. Indonesia GDP Growth (%), 2019-2023 |

| 4. Indonesia Kombucha Market Revenue Share, By Types, 2023 & 2030F |

| 5. Indonesia Kombucha Market Revenue Share, By Beverage Flavours, 2023 & 2030F |

| 6. Indonesia Kombucha Market Revenue Share, By Distribution Channels, 2023 & 2030F |

| 7. Indonesia Retail Export to the World, 2017-2022, By $ Million |

| 8. Indonesia Top Retail Outlets, 2022, By Outlets % |

| 9. Indonesia E-commerce Market, 2023-2028F, By $ Billion |

| 10. Indonesia Total Contribution of Travel & Tourism to GDP (%), 2022 & 2033F |

| 11. Rise in Indonesia Cosmetic Company Numbers (2021-2022) |

| 12. Export of Cosmetic Products Per Category In Indonesia, 2020-2022, $ Million |

| 13. Indonesia Kombucha Market Opportunity Assessment, By Types, 2030F |

| 14. Indonesia Kombucha Market Opportunity Assessment, By Beverage Flavours, 2030F |

| 15. Indonesia Kombucha Market Opportunity Assessment, By Distribution Channel, 2030F |

| 16. Indonesia Kombucha Market Revenue Ranking, By Companies, 2023 |

| List of Tables |

| 1. Indonesia Kombucha Market Revenues, By Types, 2020-2030F ($ Million) |

| 2. Indonesia Kombucha Market Revenues, By Beverage Flavours, 2020-2030F ($ Million) |

| 3. Indonesia Kombucha Market Revenues, By Distribution Channels, 2020-2030F ($ Million) |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero