Indonesia UPS Systems Market (2024-2030) | Growth, Outlook, Companies, Size, Forecast, Value, Analysis, Revenue, Trends, Share & Industry

Market Forecast By KVA Ratings (Up To 1.1 KVA, 1.1 KVA - 5 KVA, 5.1 KVA - 20 KVA, 20.1 KVA - 50 KVA, 50.1 KVA - 200 KVA And Above 200 KVA), By Phases (1 Phase, 3 Phase), By Applications (Commercial, Industrial And Residential) And Competitive Landscape

| Product Code: ETC000540 | Publication Date: Jun 2024 | Updated Date: Jun 2024 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 75 | No. of Figures: 18 | No. of Tables: 8 | |

Indonesia Uninterruptible Power Supply (UPS) System Market Synopsis

Indonesia uninterruptible power supply (UPS) system market has seen notable growth in recent years, fueled by the thriving startup ecosystem. In 2022 alone, there were around 340 investments, with significant ones like Qiming Venture Partners, GGV Capital, and Qndine Capital pouring $22 million into Swap Energy, while Sumitomo Corporation Equity Asia and others invested $5.5 million in Komunal, among others. This surge in startups has spurred demand for zero power downtime, prompting many industries and businesses in Indonesia to adopt UPS systems. The UPS system market in Indonesia is set for substantial growth in the coming years, buoyed by increasing digitalization and supportive government policies. For instance, the government aims to onboard more micro, small, and medium enterprises (MSMEs) into the digital market, targeting 30 million MSMEs by 2024, including 19.5 million in 2022.

According to 6Wresearch, Indonesia UPS System Market is projected to grow at a CAGR of 6.9% during 2024-30F. Indonesia boasts a robust banking sector, with the nation hosting 106 commercial banks and a network of over 27.92 thousand bank offices in 2023. Alongside this, the BFSI sector is witnessing digitalization and is estimated to have 202 million mobile wallet users by 2025. This growth trajectory in the banking sector is driving demand for 10 kVA-50 kVA uninterruptible power supply (UPS) systems to ensure reliable power for electronic transactions and financial services. Furthermore, with 120 hotels and 21,847 rooms estimated to open around Indonesia in 2024, there is an anticipated surge in demand for UPS systems as backup power sources for critical equipment in the coming years. Additionally, with six construction projects in progress, with plans to collectively deliver approximately 260,000 square meters of new office space by 2025 outside the CBD area, there would be a further propulsion in the demand for UPS systems in commercial spaces in the coming years.

The shortage of tech talent in Indonesia with approximately 600,000 gap annually between demand and supply impedes UPS industry growth by hampering innovation, prolonging project timelines, and increasing costs, ultimately limiting the industry's capacity to meet the evolving demands of customers and provide quality services.

Market Segmentation by kVA Rating

The 50.1kVA-200kVA UPS dominates the Indonesia UPS system market owing to the rising ICT sector and digitalization. Indonesia's digital economy attained a significant GMV of $77 billion in 2022, and it is predicted to grow further to a range of $280-300 billion by 2030.

Market Segmentation by Phases

The 3-phase UPS system dominates the Indonesian market due to its expansive power capacity, especially in the high-powered and high-capacity range. This makes them well-suited for a diverse array of applications, ranging from small businesses to large enterprises. Furthermore, Indonesia's vibrant startup ecosystem, with more than 200 startups raising million-dollar funding in 2022, further contributes to the dominance of 3-phase UPS systems.

Market Segmentation by Applications

The commercial segment acquired the highest revenue share in the Indonesia UPS system market as several commercial office projects, such as The Autograph Tower (93,000 square meters) in Sudirman and Rajawali Place (42,350 square meters) in Kuningan in Q4 2022, and others resulted in an increase in demand for uninterrupted power supply in the country.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2020 to 2023.

- Base Year: 2023

- Forecast Data until 2030.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Indonesia Uninterruptible Power Supply (UPS) System Market Overview

- Indonesia Uninterruptible Power Supply (UPS) System Market Outlook

- Indonesia Uninterruptible Power Supply (UPS) System Market Forecast

- Indonesia Uninterruptible Power Supply (UPS) System Market Porter’s Five forces Analysis

- Indonesia Uninterruptible Power Supply (UPS) System Market Industry Life Cycle Analysis

- Historical Data and Forecast of Indonesia Uninterruptible Power Supply (UPS) System Market Revenues and Volume, for the Period 2020-2030F

- Market Drivers and Restraints

- Historical Data and Forecast of Indonesia Uninterruptible Power Supply (UPS) System Market Revenues and Volume, By kVA Ratings, for the Period 2020-2030F

- Historical Data and Forecast of Indonesia Uninterruptible Power Supply (UPS) System Market Revenues, By Phase, for the Period 2020-2030F

- Historical Data and Forecast of Indonesia Uninterruptible Power Supply (UPS) System Market Revenues, By Applications, for the Period 2020-2030F

- Key Performance Indicators

- Market Opportunity Assessment

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By kVA Rating

- Up to 1kVA

- 1.1- 5kVA

- 5.1- 20kVA

- 20.1- 50kVA

- 50.1- 200kVA

- Above 200kVA

By Phases

- 1 Phase

- 3 Phase

By Applications

- Residential

- Industrial

- Commercial

Frequently Asked Questions About the Market Study (FAQs):

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of the Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Methodology |

| 2.5 Assumptions |

| 3. Indonesia Uninterruptible Power Supply (UPS) System Market Overview |

| 3.1 Indonesia Uninterruptible Power Supply (UPS) System Market Revenues & Volume, 2020-2030F |

| 3.2 Indonesia Uninterruptible Power Supply (UPS) System Market Industry Life Cycle |

| 3.4 Indonesia Uninterruptible Power Supply (UPS) System Market Porter’s Five Forces |

| 4. Indonesia Uninterruptible Power Supply (UPS) System Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5. Indonesia Uninterruptible Power Supply (UPS) System Market Evolution & Trends |

| 6. Indonesia Uninterruptible Power Supply (UPS) System Market Overview, By kVA Ratings |

| 6.1 Indonesia Uninterruptible Power Supply (UPS) System Market Revenue Share and Revenues, By kVA Ratings, 2023 & 2030F |

| 6.1.1 Indonesia Uninterruptible Power Supply (UPS) System Market Revenues, By Up to 1kVA, 2020-2030F |

| 6.1.2 Indonesia Uninterruptible Power Supply (UPS) System Market Revenues, By 1.1- 5kVA, 2020-2030F |

| 6.1.3 Indonesia Uninterruptible Power Supply (UPS) System Market Revenues, By 5.1-20kVA, 2020-2030F |

| 6.1.4 Indonesia Uninterruptible Power Supply (UPS) System Market Revenues, By 20.1-50kVA, 2020-2030F |

| 6.1.5 Indonesia Uninterruptible Power Supply (UPS) System Market Revenues, By 50.1-200kVA, 2020-2030F |

| 6.1.6 Indonesia Uninterruptible Power Supply (UPS) System Market Revenues, By Above 200kVA, 2020-2030F |

| 6.2 Indonesia Uninterruptible Power Supply (UPS) System Market Volume Share and Volume, By kVA Ratings, 2023 & 2030F |

| 6.2.1 Indonesia Uninterruptible Power Supply (UPS) System Market Volume, By Up to 1kVA, 2020-2030F |

| 6.2.2 Indonesia Uninterruptible Power Supply (UPS) System Market Volume, By 1.1- 5kVA, 2020-2030F |

| 6.2.3 Indonesia Uninterruptible Power Supply (UPS) System Market Volume, By 5.1-20kVA, 2020-2030F |

| 6.2.4 Indonesia Uninterruptible Power Supply (UPS) System Market Volume, By 20.1-50kVA, 2020-2030F |

| 6.2.5 Indonesia Uninterruptible Power Supply (UPS) System Market Volume, By 50.1-200kVA, 2020-2030F |

| 6.2.6 Indonesia Uninterruptible Power Supply (UPS) System Market Volume, By Above 200kVA, 2020-2030F |

| 7. Indonesia Uninterruptible Power Supply (UPS) System Market Overview, By Phase |

| 7.1 Indonesia Uninterruptible Power Supply (UPS) System Market Revenue Share & Revenues, By Phase, 2023 & 2030F |

| 7.1.1 Indonesia Uninterruptible Power Supply (UPS) System Market Revenues, By 1 Phase, 2020-2030F |

| 7.1.2 Indonesia Uninterruptible Power Supply (UPS) System Market Revenues, By 3 Phase, 2020-2030F |

| 8. Indonesia Uninterruptible Power Supply (UPS) System Market Overview, By Applications |

| 8.1 Indonesia Uninterruptible Power Supply (UPS) System Market Revenue Share & Revenues, By Applications, 2023 & 2030F |

| 8.1.1 Indonesia Uninterruptible Power Supply (UPS) System Market Revenues, By Residential, 2020-2030F |

| 8.1.2 Indonesia Uninterruptible Power Supply (UPS) System Market Revenues, By Industrial, 2020-2030F |

| 8.1.3 Indonesia Uninterruptible Power Supply (UPS) System Market Revenues, By Commercial, 2020-2030F |

| 8.1.3.1 Indonesia Uninterruptible Power Supply (UPS) System Market Revenues, By Data Centers, 2020-2030F |

| 8.1.3.2 Indonesia Uninterruptible Power Supply (UPS) System Market Revenues, By BFSI, 2020-2030F |

| 8.1.3.3 Indonesia Uninterruptible Power Supply (UPS) System Market Revenues, By Government Building and Offices, 2020-2030F |

| 8.1.3.4 Indonesia Uninterruptible Power Supply (UPS) System Market Revenues, By Healthcare, 2020-2030F |

| 8.1.3.5 Indonesia Uninterruptible Power Supply (UPS) System Market Revenues, By Hospitality, 2020-2030F |

| 8.1.3.6 Indonesia Uninterruptible Power Supply (UPS) System Market Revenues, By Others, 2020-2030F |

| 9. Indonesia Uninterruptible Power Supply (UPS) System Market Key Performance Indicators |

| 10. Indonesia Uninterruptible Power Supply (UPS) System Market Opportunity Assessment |

| 10.1 Indonesia Uninterruptible Power Supply (UPS) System Market Opportunity Assessment, By kVA Rating, 2030F |

| 10.2 Indonesia Uninterruptible Power Supply (UPS) System Market Opportunity Assessment, By Phases, 2030F |

| 10.3 Indonesia Uninterruptible Power Supply (UPS) System Market Opportunity Assessment, By Applications, 2030F |

| 11. Indonesia Uninterruptible Power Supply (UPS) System Market Competitive Landscape |

| 11.1 Indonesia Uninterruptible Power Supply (UPS) System Market Revenue Ranking, By Company, 2023 |

| 11.2 Indonesia Uninterruptible Power Supply (UPS) System Market Competitive Benchmarking, By Technical Parameters |

| 11.3 Indonesia Uninterruptible Power Supply (UPS) System Market Competitive Benchmarking, By Operating Parameters |

| 12. Company Profiles |

| 12.1 Eaton Corporation PLC |

| 12.2 Schneider Electric SE |

| 12.3 Vertiv Co. |

| 12.4 General Electric Company |

| 12.5 ABB Ltd. |

| 12.6 Delta Electronics (Thailand) Public Co., Ltd. |

| 12.7 RPS S.p.A. |

| 12.8 Socomec |

| 12.9 PT Fuji Electric Indonesia |

| 12.10 Huawei Digital Power Technologies Co., Ltd. |

| 12.11 Emerson Electric Co. |

| 13. Key Strategic Recommendations |

| 14. Disclaimer |

| List of Figures |

| 1. Indonesia Uninterruptible Power Supply (UPS) System Market Revenues and Volume, 2020-2030F ($ Million, Units) |

| 2. Indonesia Total IT Spend, 2022-2027F ($ Billion) |

| 3. Indonesia Digital economy GMV 2022-2030F ($ Billion) |

| 4. Indonesia Digital Economy, 2022-2027F ($ Billion) |

| 5. Indonesia Uninterruptible Power Supply (UPS) System Market Revenue Share, By kVA Ratings, 2023 & 2030F |

| 6. Indonesia Uninterruptible Power Supply (UPS) System Market Volume Share, By kVA Ratings, 2023 & 2030F |

| 7. Indonesia Uninterruptible Power Supply (UPS) System Market Revenue Share, By Phase, 2023 & 2030F |

| 8. Indonesia Uninterruptible Power Supply (UPS) System Market Revenue Share, By Applications, 2023 & 2030F |

| 9. Indonesia Uninterruptible Power Supply (UPS) System Market Revenue Share, By Commercial Application, 2023 & 2030F |

| 10. Indonesia 5G deployment by Region and Companies, 2021 |

| 11. Indonesia CBD and Outside CBD Annual Office Supply, 2019-2023 (square meter) |

| 12. Indonesia Upcoming First Class & Luxury Hotel Projects, 2021-2024E (No. of Projects) |

| 13. Indonesia Number of Upcoming Hotel Projects, By Cities, 2024E |

| 14. Indonesia Number of Data Centers, By Regions, 2023 |

| 15. Indonesia Uninterruptible Power Supply (UPS) System Market Opportunity Assessment, By kVA Ratings, 2030F ($ Million) |

| 16. Indonesia Uninterruptible Power Supply (UPS) System Market Opportunity Assessment, By Phase, 2030F ($ Million) |

| 17. Indonesia Uninterruptible Power Supply (UPS) System Market Opportunity Assessment, By Applications, 2030F ($ Million) |

| 18. Indonesia Uninterruptible Power Supply (UPS) System Market Revenue Ranking, By Companies, 2023 |

| List of Tables |

| 1. Indonesia Upcoming Data Centers, 2023 |

| 2. Indonesia Uninterruptible Power Supply (UPS) System Market Revenues, By kVA Ratings, 2020-2030F ($ Million) |

| 3. Indonesia Uninterruptible Power Supply (UPS) System Market Volume, By kVA Ratings, 2020-2030F (Units) |

| 4. Indonesia Uninterruptible Power Supply (UPS) System Market Revenues, By Phase, 2020-2030F ($ Million) |

| 5. Indonesia Uninterruptible Power Supply (UPS) System Market Revenues, By Applications, 2020-2030F ($ Million) |

| 6. Indonesia Uninterruptible Power Supply (UPS) System Market Revenues, By Commercial Application, 2020-2030F ($ Million) |

| 7. Jakarta CBD Major Office Projects, 2023 |

| 8. Indonesia Major Hotel Projects, 2023 |

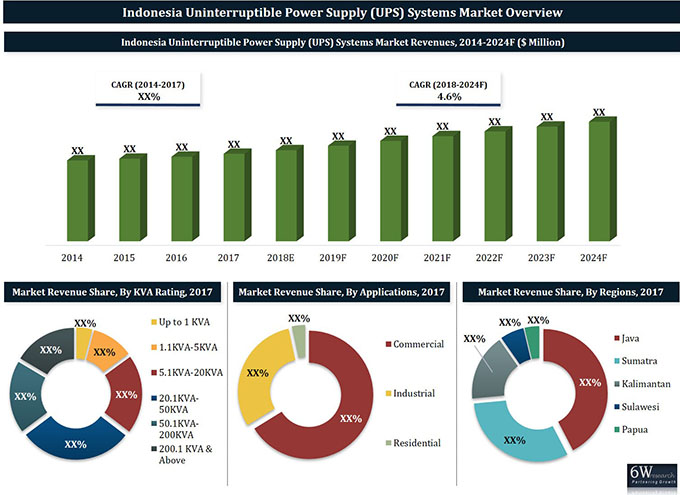

Market Forecast By KVA Ratings (Up to 1.1 kVA, 1.1 kVA - 5 kVA, 5.1 kVA - 20 kVA, 20.1 kVA - 50 kVA, 50.1 kVA - 200 kVA and Above 200 kVA), By Applications (Commercial (Offices, Healthcare, Hospitality, BFSI, Data Center and Others including Retail, Government Buildings, and Transportation Infrastructure), Industrial and Residential)), By Regions (Java, Sumatra, Kalimantan, Sulawesi, and Papua) and Competitive Landscape

| Product Code: ETC000540 | Publication Date: Dec 2021 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 130 | No. of Figures: 51 | No. of Tables: 19 |

Indonesia Uninterruptible Power Supply (UPS) systems market is gaining pace on account of growing demand in IT, commercial and industrial sectors. Further, the country's government is focusing on strengthening the economy by investing heavily in the commercial and industrial sector infrastructure, which in turn would ultimately spur the growth of commercial and industrial sectors, resulting in an increase in demand for UPS systems in the country.

According to 6Wresearch, Indonesia UPS systems Market size is projected to grow at a CAGR of 4.6% during 2018-24. Expected growth in the country's infrastructure on account of significant emphasis on ICT, Banking and Financial, Healthcare, Aviation, and Commercial sectors would drive the demand for UPS systems in these segments, where seamless power support is necessary for several crucial operations. Government initiatives such as 100 Smart cities by 2020 and 1,000 technopreneurs by 2020 are expected to further boost the UPS market during the forecast period.

Java Region is projected to capture the highest Indonesia UPS market share over the coming years due to the development of the commercial and industrial sectors owing to the outsize concentration of people, wealth, foreign investment, and political capital as well as rapid urbanization. Java will continue to account for an outsize proportion of investment and construction activity in Indonesia over the next 10 years. On account of robust economic growth and industrial expansion, Java is predicted to continue its dominance in the future as well.

The Indonesia UPS market report thoroughly covers Indonesia Uninterruptible Power Supply (UPS) systems market by KVA ratings, applications, and regions. The Indonesia UPS market outlook report provides an unbiased and detailed analysis of the Indonesia UPS market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Key Highlights of the Report:

• Indonesia UPS Market Overview

• Indonesia UPS Market Outlook

• Indonesia UPS Market Forecast

• Historical Data of Global Uninterruptible Power Supply (UPS) Systems Market for The Period 2014-2017

• Market Size & Forecast of Global Uninterruptible Power Supply (UPS) Systems Market Until 2024

• Historic Data of Indonesia UPS Market Revenues & Volume 2014-2017

• Indonesia UPS Market Size & Indonesia UPS Market Forecast, Until 2024

• Historic Data for Up to 1 kVA of Indonesia UPS Market Revenues & Volume for 2014-2017

• Market Size & Forecast of Indonesia Up to 1 kVA UPS Systems Market Revenues & Volume Market Until 2024

• Historic Data of Indonesia 1.1 kVA - 5 kVA UPS Systems Market Revenues & Volume for 2014-2017

• Market Size & Forecast of Indonesia 1.1 kVA - 5 kVA UPS Systems Market Revenues & Volume Market, Until 2024

• Historic Data of Indonesia 5.1 kVA - 20 kVA UPS Systems Market Revenues & Volume 2014-2017

• Market Size & Forecast of Indonesia 5.1 kVA - 20 kVA UPS Systems Market Revenues & Volume Market, Until 2024

• Historic Data of Indonesia 20.1 kVA - 50 kVA UPS Systems Market Revenues & Volume 2014-2017

• Market Size & Forecast of Indonesia 20.1 kVA - 50 kVA UPS Systems Market Revenues & Volume Market, Until 2024

• Historic Data of Indonesia 50.1 kVA - 200 kVA UPS Systems Market Revenues & Volume 2014-2017

• Market Size & Forecast of Indonesia 50.1 kVA - 200 kVA UPS Systems Market Revenues & Volume Market, Until 2024

• Historic Data of Indonesia Above 200 kVA UPS Systems Market Revenues & Volume 2014-2017

• Market Size & Forecast of Indonesia 200 kVA & Above UPS Systems Market Revenues & Volume Market, Until 2024

• Historical data and Forecast of Indonesia UPS Systems Market, By Applications

• Historical data and Forecast of Indonesia UPS Systems Market, By Regions

• Market Drivers and Restraints

• Market Trends and Developments

• Indonesia UPS Market Trends and Opportunities

• Indonesia UPS Market Overview on Competitive Landscape

• Indonesia UPS Market Share, By Players

• Company Profiles

• Strategic Recommendations

Markets Covered

The Indonesia UPS market report provides a detailed analysis of the following market segments:

• By KVA Ratings

o Up to 1.1 kVA

o 1.1 kVA - 5 kVA

o 5.1 kVA - 20 kVA

o 20.1 kVA - 50 kVA

o 50.1 kVA - 200 kVA

o Above 200 kVA

• By Applications

o Commercial:

? Offices

? Healthcare

? Hospitality

? BFSI

? Data Centers

? Others (Retail, Government Buildings, Transportation Infrastructure, etc.)

o Industrial

o Residential

• By Regions

o Java Region

o Sumatra Region

o Kalimantan Region

o Sulawesi

o Papua Region

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero