Kenya Construction Equipment Market (2023-2029) | Share, Size, Outlook, Revenue, Analysis, Forecast, Trends, Growth & COVID-19 IMPACT

Market Forecast By Types (Crane, Bulldozer and Construction Tractor, Earthmoving Equipment, Dump Truck, Material Handling Equipment, Aerial Work Platform, Road Construction Equipment), By Applications (Construction, Oil & Gas, Mining, Others (Municipality, Road Construction etc.)), By Regions (Northern, Southern, Eastern, Western) and Competitive Landscape

| Product Code: ETC001944 | Publication Date: Aug 2023 | Updated Date: Dec 2023 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 87 | No. of Figures: 47 | No. of Tables: 20 | |

Topics Covered in Kenya Construction Equipment Market Report

The Kenya construction equipment market report thoroughly covers the market by types and applications. Kenya construction equipment market outlook report provides an unbiased and detailed analysis of the ongoing Kenya construction equipment market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Kenya Construction Equipment Market Synopsis

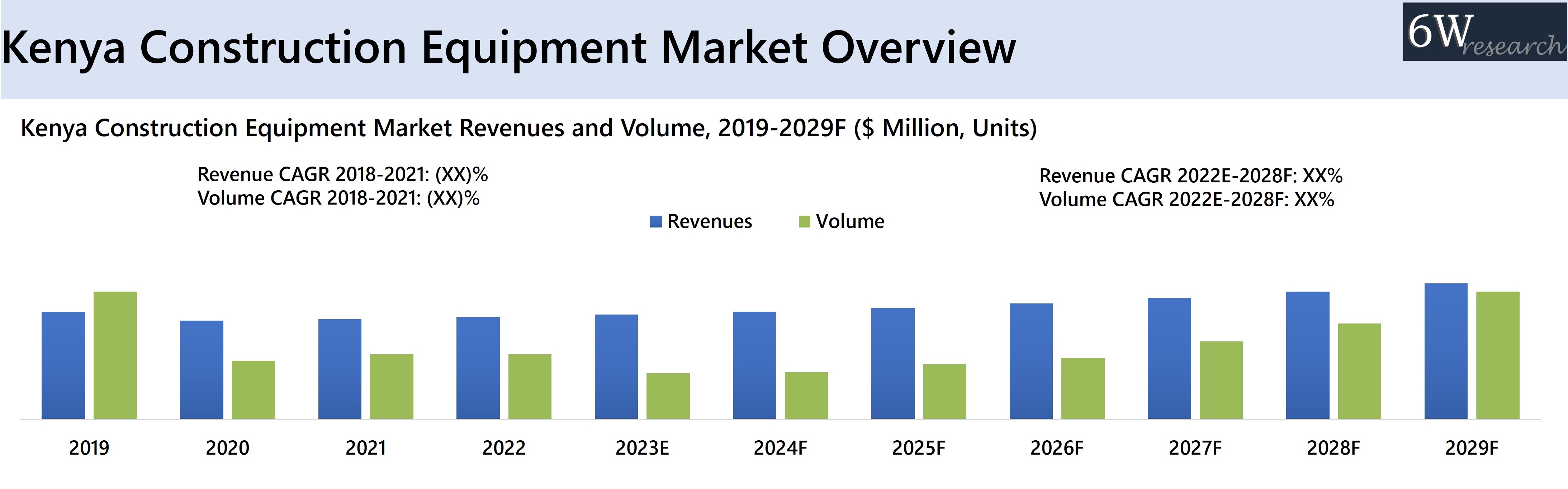

The Kenya Construction Equipment Market experienced notable growth driven by government investment in infrastructure development. However, due to the global pandemic and its impact on large-scale construction projects and supply chains, the market only grew by a growth rate of 6.6% compared to 10.1% in 2020. Despite these challenges, the construction industry still contributes approximately 5.6% to the country's gross domestic product (GDP). In the past, the industry had witnessed an impressive annual average growth of 13% during its peak a decade ago.

According to 6Wresearch, Kenya Construction Equipment Market size is projected to Grow at a CAGR of 4.5% during 2023-2029. The Kenya construction equipment market is expected to observe significant growth in the coming years, primarily attributed to major projects like the LAPSSET Corridor Program and the Lamu-Isiolo Road, among others, planned under Kenya's Vision 2030. The infrastructure sector in Kenya has witnessed substantial expansion, driven by the Ministry of Transport and Infrastructure's initiatives to enhance transportation networks and promote construction and housing ventures. Notable projects such as Pangani affordable housing projects, Nairobi-Mombasa Highway, Mariguini informal settlement, and Kibera Soweta East zone B exemplify the ongoing development efforts in the country.

According to 6Wresearch, Kenya Construction Equipment Market size is projected to Grow at a CAGR of 4.5% during 2023-2029. The Kenya construction equipment market is expected to observe significant growth in the coming years, primarily attributed to major projects like the LAPSSET Corridor Program and the Lamu-Isiolo Road, among others, planned under Kenya's Vision 2030. The infrastructure sector in Kenya has witnessed substantial expansion, driven by the Ministry of Transport and Infrastructure's initiatives to enhance transportation networks and promote construction and housing ventures. Notable projects such as Pangani affordable housing projects, Nairobi-Mombasa Highway, Mariguini informal settlement, and Kibera Soweta East zone B exemplify the ongoing development efforts in the country.

Construction Equipment Market in Kenya: Key Players

One of the leading players in the Kenya construction equipment market is Volvo Construction Equipment. They offer a wide range of equipment, including excavators, wheel loaders, and articulated haulers. Another player in the market is SANY Group. They provide a variety of construction equipment, such as concrete pumps, excavators, and cranes. Other notable players in the Kenya construction equipment market include Caterpillar, JCB, Manitou, and Liebherr. These companies have established a strong presence in the market and continue to innovate and improve their offerings to meet the changing demands of the industry.

Kenya Construction Equipment Industry: Government Initiatives

The Kenyan government has launched several initiatives to support the growth of the construction industry and the equipment market. One such initiative is the Affordable Housing Program. This program aims to provide affordable housing for low and middle-income earners by building 500,000 affordable homes by 2022. The program has created a high demand for construction equipment, such as concrete mixers, cranes, and excavators. Another government initiative is the Big Four Agenda. This initiative focuses on four key areas, including affordable housing, universal healthcare, manufacturing, and food security. The government has allocated a significant amount of funding to these areas, which has also contributed to the growth of the construction equipment market in Kenya.

Market by Types

On the basis of types, the earthmoving equipment segments is projected to grow in the coming years. By earthmoving, loaders accounted for highest revenue share in 2022 and anticipated to witness the same trend in future on the back of its extensive use in both construction and mining activities.

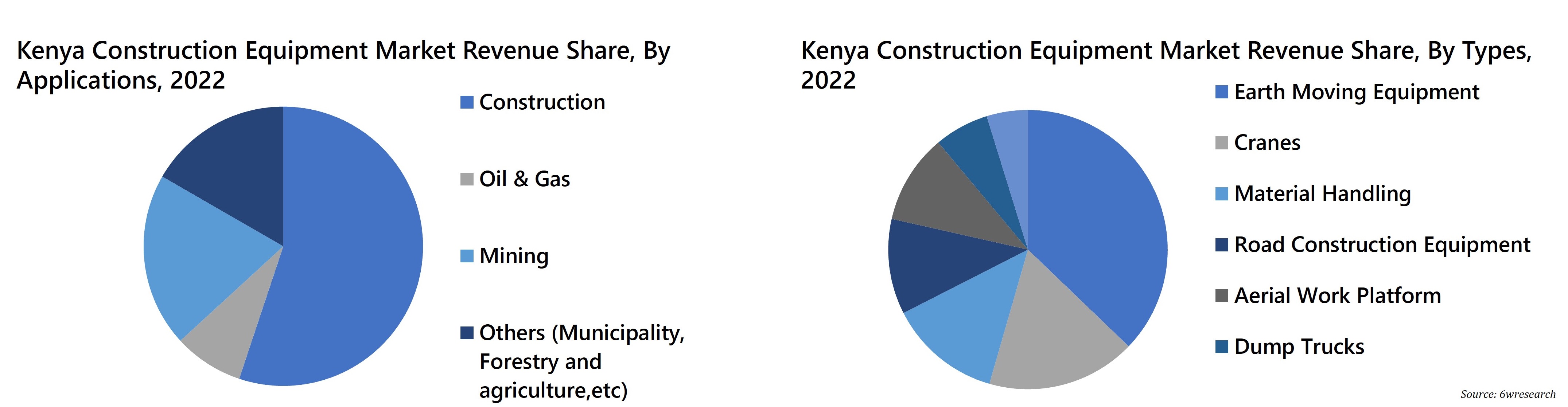

Market by Applications

The construction sector recorded the highest revenue share in 2021 and is projected to maintain its dominance in the upcoming years in the Construction Equipment Market in Kenya. This is attributed to the upcoming projects in offices spaces, road and bridge construction, hotels, and healthcare facilities, along with the proposed investment of $7.4 billion in road infrastructure through Public-Private Partnerships. Additionally, the development of the Tanhan River nuclear plant with an investment of $3.8 million is expected to contribute to the growth of the construction equipment market in the future.

Market by Regions

Owing to its significance as a center for the nation's economic growth, the southern region held a significant market revenue share in Kenya's construction equipment market in 2022 owing to major construction activities held in the capital and is anticipated to continue this trend in the coming years.

![Kenya Construction Equipment Market – Opportunity Assessment]() Key Attractiveness of the Report

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 11 Years Market Numbers.

- Historical Data Starting from 2019 to 2022.

- Base Year: 2022

- Forecast Data until 2029.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Kenya Construction Equipment Market Outlook

- Market Size of Kenya Construction Equipment Market, 2022

- Forecast of Kenya Construction Equipment Market, 2029

- Historical Data and Forecast of Kenya Construction Equipment Market Revenues & Volume for the Period 2019 - 2029

- Kenya Construction Equipment Market Trend Evolution

- Kenya Construction Equipment Market Drivers and Challenges

- Kenya Construction Equipment Price Trends

- Kenya Construction Equipment Porter's Five Forces

- Kenya Construction Equipment Industry Life Cycle

- Historical Data and Forecast of Kenya Construction Equipment Market Revenues and volume by Type for the Period 2019 – 2029

- Historical Data and Forecast of Kenya Construction Equipment Market Revenues and Volume by Cranes for the Period 2019 - 2029

- Historical Data and Forecast of Kenya Construction Equipment Market Revenues and volume by Construction Tractor and Bulldozer for the Period 2019 - 2029

- Historical Data and Forecast of Kenya Construction Equipment Market Revenues and volume by Earthmoving Equipment for the Period 2019 - 2029

- Historical Data and Forecast of Kenya Construction Equipment Market Revenues and volume by Aerial Work Equipment for the Period 2019 - 2029

- Historical Data and Forecast of Kenya Construction Equipment Market Revenues and volume by Material Handling Equipment for the Period 2019 - 2029

- Historical Data and Forecast of Kenya Construction Equipment Market Revenues and volume by Dump Trucks for the Period 2019 - 2029

- Historical Data and Forecast of Kenya Construction Equipment Market Revenues and volume by Road Construction Equipment for the Period 2019 - 2029

- Historical Data and Forecast of Kenya Construction Equipment Market Revenues and volume by Application for the Period 2019 - 2029

- Historical Data and Forecast of Kenya Construction Equipment Market Revenues and volume by Corporate Enterprise for the Period 2019 - 2029

- Historical Data and Forecast of Kenya Construction Equipment Market Revenues and volume by Oil and Gas for the Period 2019 - 2029

- Historical Data and Forecast of Kenya Construction Equipment Market Revenues and volume by Mining for the Period 2019 - 2029

- Historical Data and Forecast of Kenya Construction Equipment Market Revenues and volume by Others for the Period 2019 – 2029

- Historical Data and Forecast of Kenya Construction Equipment Market Revenues and volume by Regions for the Period 2019 - 2029

- Historical Data and Forecast of Kenya Construction Equipment Market Revenues and volume by Northern for the Period 2019 - 2029

- Historical Data and Forecast of Kenya Construction Equipment Market Revenues and volume by Southern for the Period 2019 - 2029

- Historical Data and Forecast of Kenya Construction Equipment Market Revenues and volume by Eastern for the Period 2019 - 2029

- Historical Data and Forecast of Kenya Construction Equipment Market Revenues and volume by Western for the Period 2019 – 2029

- Kenya Construction Equipment Import Export Trade Statistics

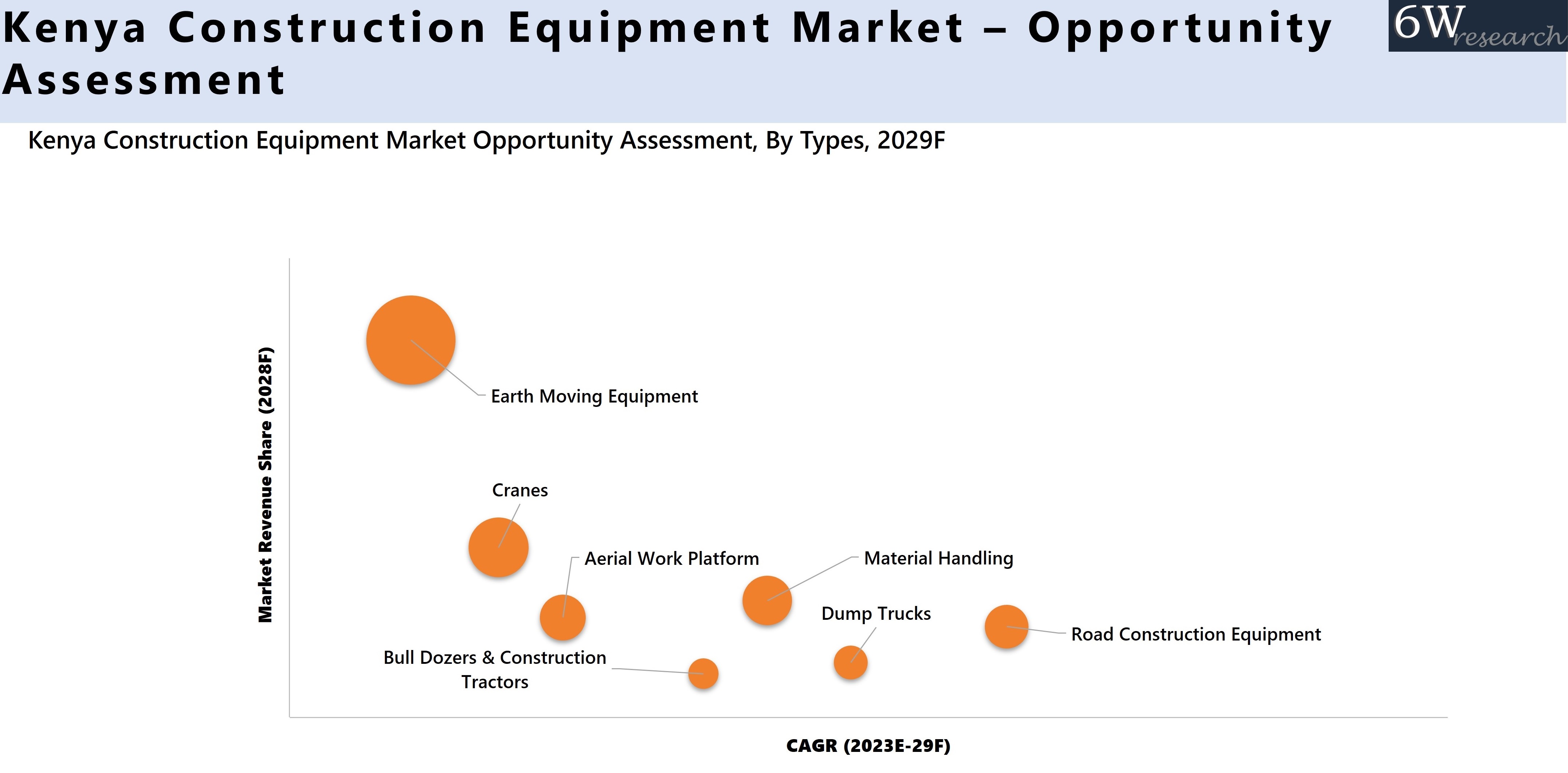

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Application

- Market Opportunity Assessment By Regions

- Kenya Construction Equipment Top Companies Market Share

- Kenya Construction Equipment Competitive Benchmarking By Technical and Operational Parameters

- Kenya Construction Equipment Company Profiles

- Kenya Construction Equipment Key Strategic Recommendation

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Types

- Crane

- Bulldozer and Construction Tractor

- Earthmoving Equipment

- Dump Truck

- Material Handling Equipment

- Aerial Work Platform

- Road Construction Equipment

By Applications

- Construction

- Oil & Gas

- Mining

- Others (Municipality, Road Construction etc.)

By Regions

- Northern

- Southern

- Eastern

- Western

Kenya Construction Equipment Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. Kenya Construction Equipment Market Overview |

| 3.1. Kenya Construction Equipment Market Revenues and Volume 2019-2029F |

| 3.2. Kenya Construction Equipment Market - Industry Life Cycle |

| 3.3. Kenya Construction Equipment Market - Porter’s Five Forces |

| 3.4. Kenya Construction Equipment Market Revenue Share and Volume share, By Equipment Type, 2022 & 2029F |

| 4. Kenya Construction Equipment Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5. Kenya Construction Equipment Market Trends |

| 6. Kenya Construction Equipment Market Overview, By Cranes |

| 6.1 Kenya Construction Equipment Revenue Share and Revenues, By Crane, 2022 & 2029F |

| 6.2 Kenya Construction Equipment Volume Share and Volumes, By Crane, 2022 & 2029F |

| 7. Kenya Construction Equipment Market Overview, By Bull Dozers/Construction Tractors |

| 7.1 Kenya Construction Equipment Market Revenues and Volume, By Bull Dozers/Construction Tractors Types, 2019-2029F |

| 8. Kenya Construction Equipment Market Overview, By Earth Moving Equipment |

| 8.1 Kenya Construction Equipment Market Revenue Share, By Earth Moving Equipment, 2022 & 2029F |

| 8.1.1 Kenya Excavator Market Revenues, 2019-2029F |

| 8.1.1.1 Wheeled Excavator Market Revenues, 2019-2029F |

| 8.1.1.2 Mini Excavator Market Revenues, 2019-2029F |

| 8.1.1.3 Tracked Excavator Market Revenues, 2019-2029F |

| 8.1.2 Kenya Loader Market Revenues, 2019-2029F |

| 8.1.2.1 Backhoe Loader Market Revenues, 2019-2029F |

| 8.1.2.2 Wheeled Loader Market Revenues, 2019-2029F |

| 8.1.2.3 Skid Steer loader Market Revenues, 2019-2029F |

| 8.1.2.4 Compact Track loader Market Revenues, 2019-2029F |

| 8.1.3 Kenya Motor Grader Market Revenues, 2019-2029F |

| 8.2 Kenya Construction Equipment Market Volume Share, By Earth Moving Equipment, 2022 & 2029F |

| 8.2.1 Kenya Excavator Market Volume, 2019-2029F |

| 8.2.1.1 Wheeled Excavator Market Volume, 2019-2029F |

| 8.2.1.2 Mini Excavator Market Volume, 2019-2029F |

| 8.2.1.3 Tracked Excavator Market Volume, 2019-2029F |

| 8.2.2 Kenya Loader Market Volume, 2019-2029F |

| 8.2.2.1 Backhoe Loader Market Volume, 2019-2029F |

| 8.2.2.2 Wheeled Loader Market Volume, 2019-2029F |

| 8.2.2.3 Skid Steer loader Market Volume, 2019-2029F |

| 8.2.2.4 Compact Track loader Market Volume, 2019-2029F |

| 8.2.3 Kenya Motor Grader Market Volume, 2019-2029F |

| 9. Kenya Construction Equipment Market Overview, By Material Handling |

| 9.1 Kenya Construction Equipment Revenue Share, By Material Handling, 2022 & 2029F |

| 9.1.1 Telescopic Handler Market Revenues, 2019-2029F |

| 9.1.2 Telescopic Boom Lift Market Revenues, 2019-2029F |

| 9.1.3 Articulated Boom Lift Market Revenues, 2019-2029F |

| 9.1.4 Aerial Work Platform Market Revenues, 2019-2029F |

| 9.1.5 Scissor Lift Market Revenues, 2019-2029F |

| 9.2 Kenya Construction Equipment Volume Share, By Material Handling, 2022 & 2029F |

| 9.2.1 Telescopic Handler Market Volume, 2019-2029F |

| 9.2.2 Telescopic Boom Lift Market Volume, 2019-2029F |

| 9.2.3 Articulated Boom Lift Market Volume, 2019-2029F |

| 9.2.4 Aerial Work Platform Market Volume, 2019-2029F |

| 9.2.5 Scissor Lift Market Revenues Volume, 2019-2029F |

| 10. Kenya Construction Equipment Market Overview, By Dump Truck |

| 10.1 Kenya Construction Equipment Market Revenues and Volume, By Dump Trucks, 2019-2029F |

| 11. Kenya Construction Equipment Market Overview, By Aerial Work Equipment |

| 11.1 Kenya Construction Equipment Revenue Share, By Aerial Work Equipment, 2022 & 2029F |

| 11.1.1 Kenya Construction Equipment Revenues, By Telescopic Boom Lift, 2019-2029F |

| 11.1.2 Kenya Construction Equipment Revenues, By Articulated Boom Lift, 2019-2029F |

| 11.1.3 Kenya Construction Equipment Revenues, By Scissor Lift, 2019-2029F |

| 11.2 Kenya Construction Equipment Volume Share, By Aerial Work Equipment, 2022 & 2029F |

| 11.2.1 Kenya Construction Equipment Volume, By Telescopic Boom Lift, 2019-2029F |

| 11.2.2 Kenya Construction Equipment Volume, By Articulated Boom Lift, 2019-2029F |

| 11.2.3 Kenya Construction Equipment Volume, By Scissor Lift, 2019-2029F |

| 12. Kenya Construction Equipment Market Overview, By Road Construction Equipment |

| 12.1 Kenya Construction Equipment Revenue Share, By Road Construction Equipment, 2022 & 2029F |

| 12.1.1 Kenya Construction Equipment Revenues, By Paver, 2019-2029F |

| 12.1.2 Kenya Construction Equipment Revenues, By Road Roller, 2019-2029F |

| 12.2 Kenya Construction Equipment Volume Share, By Road Construction Equipment, 2022 & 2029F |

| 12.2.1 Kenya Construction Equipment Volume, By Paver, 2019-2029F |

| 12.2.2 Kenya Construction Equipment Volume, By Road Roller, 2019-2029F |

| 13. Kenya Construction Equipment Market Overview, By Applications |

| 13.1 Kenya Construction Equipment Revenue Share, By Applications, 2022 & 2029F |

| 13.1.1 Kenya Construction Equipment Market Revenues, By Construction Application, 2019-2029F |

| 13.1.2 Kenya Construction Equipment Market Revenues, By Mining Application, 2019-2029F |

| 13.1.3 Kenya Construction Equipment Market Revenues, By Oil & Gas Application, 2019-2029F |

| 13.1.4 Kenya Kenya Construction Equipment Market Revenues, By Others Application, 2019-2029F |

| 14. Kenya Construction Equipment Market Overview, By Regions |

| 14.1 Kenya Construction Equipment Revenues Share, By Regions, 2022 & 2029F |

| 14.1.1 Kenya Construction Equipment Market Revenues, By the Nile Valley and the Delta, 2019-2029F |

| 14.1.2 Kenya Construction Equipment Market Revenues, By Western Desert, 2019-2029F |

| 14.1.3 Kenya Construction Equipment Market Revenues, By Eastern Desert, 2019-2029F |

| 14.1.4 Kenya Construction Equipment Market Revenues, By Sinai Peninsula, 2019-2029F |

| 15. Kenya Construction Equipment Market – Government Initiatives and Regulations |

| 16. Kenya Construction Equipment Market - Key Performance Indicators |

| 17. Kenya Construction Equipment Market - Opportunity Assessment |

| 17.1 Kenya Construction Equipment Market Opportunity Assessment, By Equipment Types, 2029F |

| 17.2 Kenya Construction Equipment Market Opportunity Assessment, By Applications, 2029F |

| 18. Kenya Construction Equipment Market - Competitive Landscape |

| 18.1 Kenya Construction Equipment Market Revenue Share Ranking, By Top 3 Companies, 2022 |

| 18.2 Kenya Construction Equipment Market Key Companies Competitive Benchmarking, By Technical Parameters |

| 19. Company Profiles |

| 19.1 Avic Shantui Construction Pvt. Ltd. |

| 19.2 Caterpillar Inc. |

| 19.3 Komastsu Ltd. |

| 19.4 Hitachi Construction Machinery Co., Ltd |

| 19.5 Hyundai Construction Equipment Co., Ltd. |

| 19.6 Volvo Construction Equipment |

| 19.7 J C Bamford Excavator Limited |

| 19.8 XCMG East Africa |

| 19.9 Sany Heavy Industry Co., Ltd. |

| 19.10 Action Construction Equipment Ltd. |

| 20. Key Strategic Recommendations |

| 21. Disclaimer |

| List of Figures |

| 1. Kenya Construction Equipment Market Revenues and Volume, 2019-2029F ($ Million, Units) |

| 2. Kenya Construction Equipment Market Revenue Share, By Types, 2022 & 2029F |

| 3. Kenya Construction Equipment Market Volume Share, By Types, 2022 & 2029F |

| 4. Growth Rate of Real Estate Sector in Kenya, 2018-Q3’2022, (in %) |

| 5. Real Estate Sector Contribution to Kenya GDP, 2017-2022, (in %) |

| 6. Kenya Construction Output 2018-2022 (USD Billion) |

| 7. Kenya Inflation Rate 2018-22 |

| 8. Kenya Construction Equipment Market Revenue Share, By Crane Types, 2022 & 2029F |

| 9. Kenya Construction Equipment Market Revenues, By Crane, 2019-2029F($ Million) |

| 10. Kenya Construction Equipment Market Volume Share, By Crane Types, 2022 & 2029F |

| 11. Kenya Construction Equipment Market Volume, By Crane, 2019-2029F(Units) |

| 12. Kenya Bull Dozers/Construction Tractors Market Revenues and Volume, 2019-2029F ($ Million, Units) |

| 13. Kenya Construction Equipment Market Revenue Share, By Earth Moving Equipment Types, 2022 & 2029F |

| 14. Kenya Construction Equipment Market Revenues, By Earth Moving Equipment, 2019-2029F ($ Million) |

| 15. Kenya Construction Equipment Market Volume Share, By Earth Moving Equipment Types, 2022 & 2029F |

| 16. Kenya Construction Equipment Market Volume, By Earth Moving Equipment, 2019-2029F (Units) |

| 17. Kenya Construction Equipment Market Revenue Share, By Loader, 2022 & 2029F |

| 18. Kenya Construction Equipment Market Revenues, By Loader, 2019-2029F ($ Million) |

| 19. Kenya Construction Equipment Market Volume Share, By Loader Types, 2022 & 2029F |

| 20. Kenya Construction Equipment Market Volume, By Loader, 2019-2029F (Units) |

| 21. Kenya Construction Equipment Market Revenue Share, By Excavator Types, 2022 & 2029F |

| 22. Kenya Construction Equipment Market Revenues, By Excavator, 2019-2029F ($ Million) |

| 23. Kenya Construction Equipment Market Volume Share, By Excavator Types, 2022 & 2029F |

| 24. Kenya Construction Equipment Market Volume, By Excavator, 2019-2029F (Units) |

| 25. Kenya Motor Grader Market Revenues and Volume, 2019-2029F ($ Million, Units) |

| 26. Kenya Construction Equipment Market Revenue Share, By Material Handling, 2022 & 2029F |

| 27. Kenya Construction Equipment Market Revenues, By Material Handling, 2019-2029F ($ Million) |

| 28. Kenya Construction Equipment Market Volume Share, By Material Handling, 2022 & 2029F |

| 29. Kenya Construction Equipment Market Volume, By Material Handling, 2019-2029F (Units) |

| 30. Kenya Forklift Market Revenues and Volume, 2019-2029F ($ Million, Units) |

| 31. Kenya Construction Equipment Market Revenue Share, By Aerial Work Equipment Types, 2022 & 2029F |

| 32. Kenya Construction Equipment Market Revenues, By, Aerial Work Equipment 2019-2029F ($ Million) |

| 33. Kenya Construction Equipment Market Volume Share, By Aerial Work Equipment Types, 2022 & 2029F |

| 34. Kenya Construction Equipment Market Volume, By, Aerial Work Equipment 2019-2029F ($ Million) |

| 35. Kenya Construction Equipment Market Revenue Share, By Road Construction Equipment Types, 2022 & 2029F |

| 36. Kenya Construction Equipment Market Revenues, By Road Construction Equipment 2019-2029F ($ Million) |

| 37. Kenya Construction Equipment Market Volume Share, By Road Construction Equipment Types, 2022 & 2029F |

| 38. Kenya Construction Equipment Market Volume, By Road Construction Equipment 2019-2029F (Units) |

| 39. Kenya Construction Equipment Market Revenue Share, By Applications, 2022 & 2029F |

| 40. Kenya Construction Equipment Market Revenue Share, By Regions, 2022 & 2029F |

| 41. Kenya Investment Forecast with Current Trends and Needs, 2017-2040 ($ Billion) |

| 42. Kenya Investment Forecasts for Rail Infrastructure, 2021-2040F ($ Million) |

| 43. GDP by Mining 2018-2022 US$ Million |

| 44. Kenya Construction Equipment Market Opportunity Assessment, By Types, 2029F |

| 45. Kenya Construction Equipment Market Opportunity Assessment, By Applications, 2028F |

| 46. Kenya Construction Equipment Market Company Rankings, By Companies, 2022 |

| 47. Nairobi Population, 2023-2025F (In million) |

| List of Tables |

| 1. Kenya Value Of Upcoming And Ongoing Projects |

| 2. Rental Cost of using Construction Equipment in Kenya, 2022 |

| 3. Kenya Construction Equipment Market Revenues, By Crane Types, 2019-2029F ($ Million) |

| 4. Kenya Construction Equipment Market Volume, By Crane Types, 2019-2029F(Units) |

| 5. Kenya Construction Equipment Market Revenues, By Earth Moving Equipment Types, 2019-2029F ($ Million) |

| 6. Kenya Construction Equipment Market Volume, By Earth Moving Equipment Types, 2019-2029F (Units) |

| 7. Kenya Construction Equipment Market Revenues, By Loader, 2019-2029F ($ Million) |

| 8. Kenya Construction Equipment Market Volume, By Loader Types, 2019-2029F(Units) |

| 9. Kenya Construction Equipment Market Revenues, By Excavator Types, 2019-2029F ($ Million) |

| 10. Kenya Construction Equipment Market Volume, By Excavator Types, 2022-2029F (Units) |

| 11. Kenya Construction Equipment Market Revenues, By Material Handling, 2019-2029F ($ Million) |

| 12. Kenya Construction Equipment Market Volume, By Material Handling, 2019-2029F(Units) |

| 13. Kenya Construction Equipment Market Revenues, By, Aerial Work Equipment Types, 2019-2029F($ Million) |

| 14. Kenya Construction Equipment Market Volumes, By, Aerial Work Equipment Types, 2019-2029F(Units) |

| 15. Kenya Construction Equipment Market Revenues, By, Road Construction Equipment Types, 2019-2029F ($ Million) |

| 16. Kenya Construction Equipment Market Volume, By, Road Construction Equipment Types, 2019-2029F (Units) |

| 17. Kenya Construction Equipment Market Revenues, By Applications, 2019-2029F ($ Million) |

| 18. Kenya Construction Equipment Market Revenues, By Regions, 2019-2029F ($ Million) |

| 19. Kenya Major Mining Projects |

| 20. Nairobi Office Pipeline |

Market Forecast By Types (Mobile Cranes, Construction Tractor and Bulldozer, Earthmoving Equipment (Loaders, Excavators, Motor Grader)), Aerial Work Equipment (Articulated Boom Lifts, Telescopic Boom Lifts, Scissor Lifts), Material Handling Equipment (Telescopic Handlers, Forklifts), Dump Trucks, Road Construction Equipment (Pavers, Road Rollers), By Applications (Corporate Enterprise, Oil and Gas, Mining), Others (Municipality and Road Construction) and Competitive Landscape

| Product Code: ETC001944 | Publication Date: Mar 2023 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

Latest 2023 Development of the Kenya Construction Equipment Market

Kenya construction equipment market is adopting new technologies, such as Building Information Modeling (BIM) and 3D printing. This has led to an increased demand for construction equipment that is compatible with these technologies. Additionally, the Kenyan government has been actively promoting affordable housing schemes to address the country's housing shortage. This has led to an increase in demand for construction equipment, such as cranes, excavators, and concrete mixers. Further, the Kenyan government has also been investing heavily in the country's road network, with a particular focus on rural roads. This has led to an increase in demand for construction equipment, such as bulldozers, graders, and pavers.

The construction equipment industry in Kenya is highly competitive, with several international and domestic players vying for market share. This has led to a greater emphasis on innovation, product differentiation, and pricing strategies among equipment suppliers. Additionally, the construction industry in Kenya has been placing greater emphasis on environmental sustainability, with a focus on reducing carbon emissions, conserving natural resources, and minimizing waste. This has led to an increased demand for construction equipment that is energy-efficient and environmentally friendly. Moreover, due to the high cost of construction equipment in Kenya, there has been an increased demand for compact equipment, such as mini excavators and skid steer loaders. These machines are more affordable and versatile, making them popular among small and medium-sized construction companies.

Kenya construction equipment market Synopsis

Kenya construction equipment market has witnessed growth over the past few years primarily due to rising infrastructural development activities in the country under the Kenya Vision 2030. Additionally, the rising population has created the need to construct new housing units which would further accelerate the demand for the construction equipment market in Kenya over the coming years. However, the Kenya market is likely to witness a slowdown in economic activity in the first three quarters of the year 2020 due to the outbreak of the coronavirus pandemic which had a negative impact on businesses worldwide. However, the market in Kenya is expected to recover the economic scenario during the second half of 2020 and the construction equipment market in Kenya is also likely to recover gradually by the end of 2020.

According to 6Wresearch, Kenya Construction Equipment Market size is likely to witness growth during 2020-2026. This growth is primarily driven by the entry of several new companies in the construction market of Kenya as well as due to new technological developments taking place in the construction equipment market of Kenya. Additionally, government initiatives towards several infrastructural development projects such as the Standard Gauge Railway and the Lamu Port South Sudan Ethiopia Transport (LAPPSET) would further spur the demand of the construction equipment market in Kenya during the forecast period.

Based on equipment types, earthmoving equipment is dominating the overall Kenya construction equipment market primarily due to increasing infrastructural development activities through public and private sector partnerships in the country.

The Kenya construction equipment market report thoroughly covers the market by equipment types, equipment sub-segment types, applications, and regions. Kenya's construction equipment market outlook report provides an unbiased and detailed analysis of the ongoing Kenya construction equipment market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Key Highlights of the Report

- Kenya Construction Equipment Market Overview

- Kenya Construction Equipment Market Outlook

- Kenya Construction Equipment Market Forecast

- Historical Data of Kenya Construction Equipment Market Revenues and Volumes for the Period 2016-2019.

- Market Size & Forecast of Kenya Construction Equipment Market Revenues and Volumes, Until 2026.

- Historical Data of Kenya Cranes Market for the Period 2016-2019.

- Market Size & Forecast of Kenya Cranes Market, Until 2026.

- Historical Data of Kenya Bull Dozers & Construction Tractors Market for the Period 2016-2019.

- Market Size & Forecast of Kenya Bull Dozers & Construction Tractors Market, Until 2026.

- Historical Data of Kenya Earth Moving Equipment Market for the Period 2016-2019.

- Market Size & Forecast of Kenya Earthmoving Equipment Market, Until 2026.

- Historical Data of Kenya Material Handling Market for the Period 2016-2019.

- Market Size & Forecast of Kenya Material Handling Market, Until 2026.

- Historical Data of Kenya Dump Trucks Market for the Period 2016-2019.

- Market Size & Forecast of Kenya Dump Trucks Market, Until 2026.

- Historical Data of Kenya Aerial Work Platform Market for the Period 2016-2019.

- Market Size & Forecast of Kenya Aerial Work Platform Market, Until 2026.

- Historical Data of Kenya Road Construction Equipment Market for the Period 2016-2019.

- Market Size & Forecast of Kenya Road Construction Equipment Market, Until 2026.

- Historical Data of Kenya Construction Equipment Market Revenues and Volumes, by Applications, for the Period 2016-2019

- Market Size & Forecast of Kenya Construction Equipment Market Revenues and Volumes, by Applications, Until 2026

- Historical Data of Kenya Construction Equipment Market Revenues and Volumes, by Regions, for the Period 2016-2019

- Market Size & Forecast of Kenya Construction Equipment Market Revenues and Volumes, by Regions, Until 2026

- Market Drivers and Restraints

- Kenya Construction Equipment Market Trends and Industry Life Cycle

- Porter’s Five Forces Analysis

- Market Opportunity Assessment

- Kenya Construction Equipment Market Share, By Countries

- Kenya Construction Equipment Market Share, By Companies

- Kenya Construction Equipment Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Markets Covered

The Kenya construction equipment market report provides a detailed analysis of the following market segments:

-

By Types:

- Mobile Cranes

- Construction Tractor and Bulldozer

- Earthmoving Equipment

- Loaders

- Excavators

- Motor Grader

- Aerial Work Equipment

- Articulated Boom Lifts

- Telescopic Boom Lifts

- Scissor Lifts

- Material Handling Equipment

- Telescopic Handlers

- Forklifts

- Dump Trucks

- Road Construction Equipment

- Pavers

- Road Rollers

By Applications:

- Corporate Enterprise

- Oil and Gas

- Mining

- Others (Municipality, Road Construction)

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Tajikistan Thermal Camera Market (2025-2031) | Trends, Size, Growth, Share, Industry, Companies, Value, Analysis, Revenue, Forecast & Outlook

- Singapore Professional AV Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- Saudi Arabia Genset Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- India OOH Advertising Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- Vietnam Twisted Pair Cables Market (2024-2030) | Size & Revenue, Forecast, Share, Companies, Competitive Landscape, Analysis, Trends, Value, Segmentation, Outlook, Industry, Growth

- South Africa B2B Cleaning Market (2025-2031) | Size & Revenue, Forecast, Share, Companies, Competitive Landscape, Analysis, Trends, Value, Segmentation, Outlook, Industry, Growth

- Mexico Dispersion Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- United States Video Conferencing Market (2025-2031) | Outlook, Industry, Size, Revenue, Share, Trends, Forecast, Growth, Companies, Analysis & Value

- Australia Electric Motor Market (2025-2031) | Trends, Share, Size, Value, Revenue, Industry, Growth, Analysis, Segmentation & Outlook

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- India's Printer Market Faces 20.7% Decline in Q4 2023: Epson and HP Lead Amidst Downturn

- India's Camera Market Sees 8.9% Decline in Q4 2023; Canon Leads with 38.4% Share

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- The future of gaming industry in the Philippines