Kenya Construction Materials Market (2025-2031) | Outlook, Trends, Forecast, Value, Analysis, Revenue, Industry, Companies, Share, Growth & Size

Market Forecast By Product type (Construction aggregates, Concrete bricks, Cement, Construction metals), By Application (Residential, Commercial, Industrial) And Competitive Landscape

| Product Code: ETC016750 | Publication Date: Oct 2020 | Updated Date: Dec 2024 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

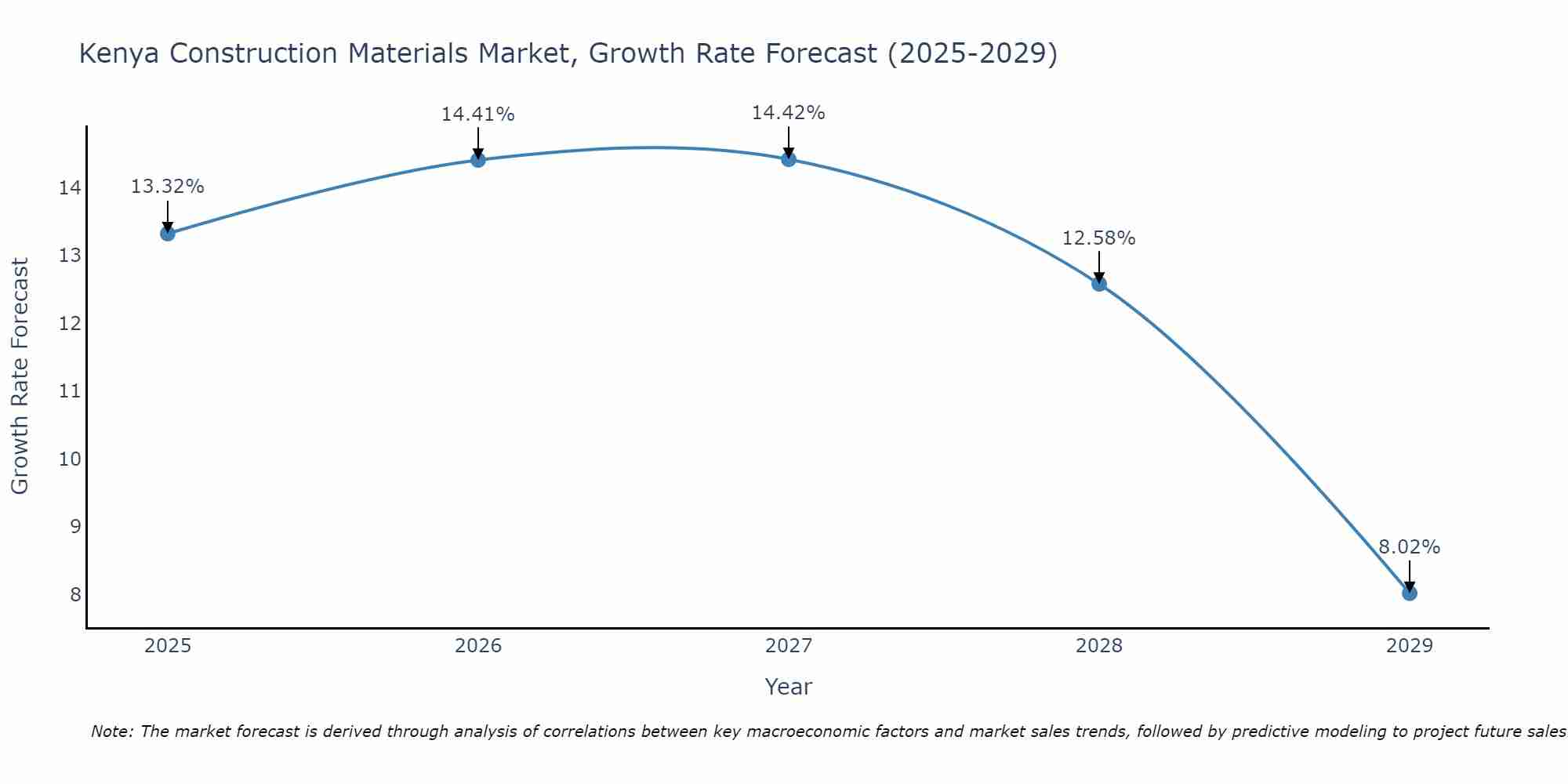

Kenya Construction Materials Market Size Growth Rate

The Kenya Construction Materials Market is projected to witness mixed growth rate patterns during 2025 to 2029. The growth rate begins at 13.32% in 2025, climbs to a high of 14.42% in 2027, and moderates to 8.02% by 2029.

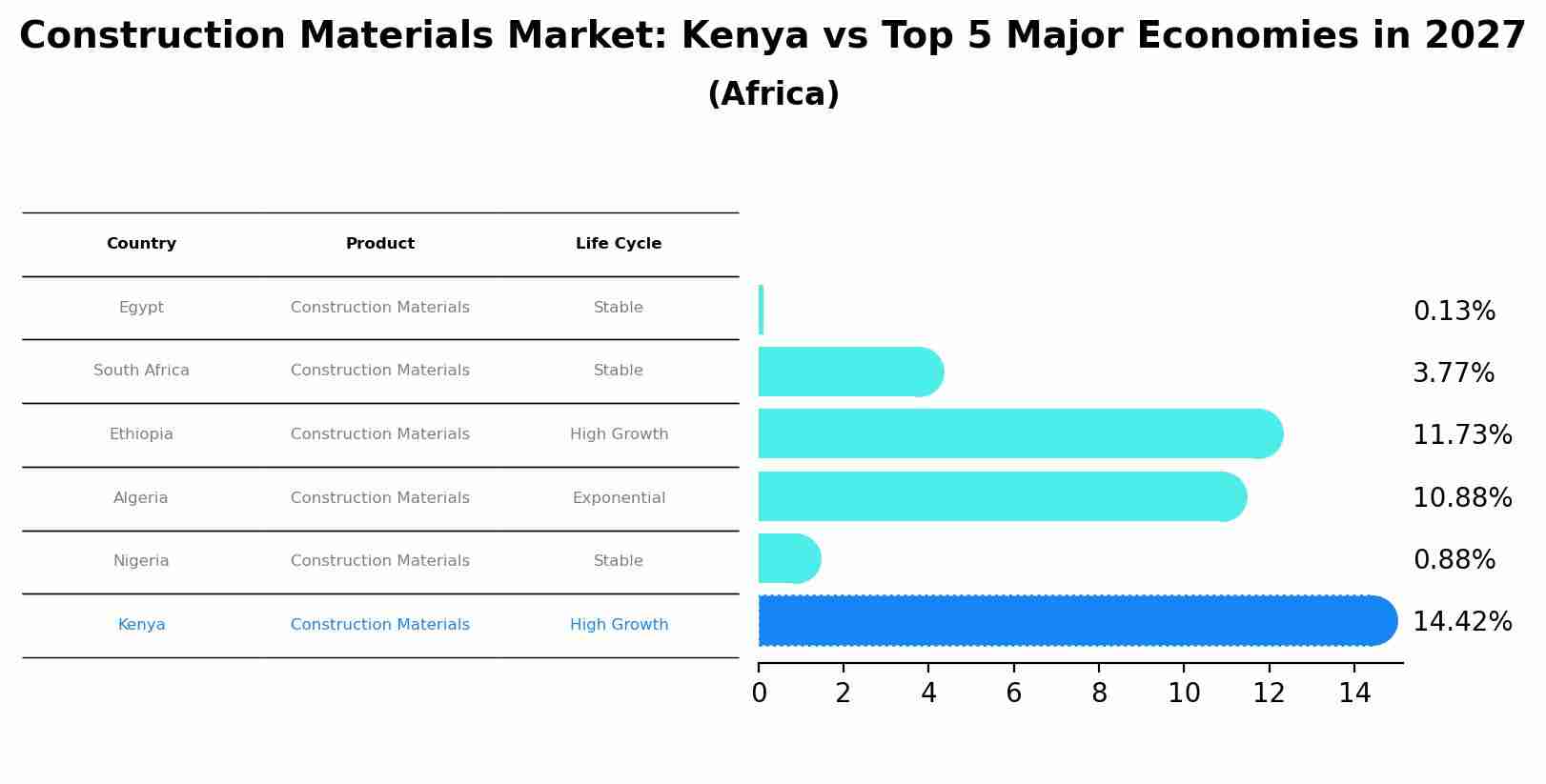

Construction Materials Market: Kenya vs Top 5 Major Economies in 2027 (Africa)

The Construction Materials market in Kenya is projected to grow at a high growth rate of 14.42% by 2027, within the Africa region led by Egypt, along with other countries like South Africa, Ethiopia, Algeria and Nigeria, collectively shaping a dynamic and evolving market environment driven by innovation and increasing adoption of emerging technologies.

Topics Covered in the Kenya Construction Materials Market

Kenya Construction Materials Market report thoroughly covers the market by product type and by application. The market outlook report provides an unbiased and detailed analysis of the ongoing market trends, opportunities high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Kenya Construction Materials Market Synopsis

The Kenya construction materials market is augmented to grow significantly over the coming years. The growth can be driven by the rising middle class and the need for decent & affordable housing, commercial buildings, and infrastructural development in the country. The Kenyan construction industry is massively securing a growth, offering it significant leverage over other sectors. With the increase in demand for housing and infrastructural development, the need for quality construction materials is essential.

According to 6Wresearch, the Kenya Construction Materials Market size is projected to grow at a CAGR of 6.9% during the forecast period 2025-2031. The market growth is followed by an increasing financial support by the government in the construction sector. The government has set ambitious goals for the industry, such as the Affordable Housing Program (AHP) that aims to provide affordable & decent housing to Kenyans. The increase in foreign investment and the need for infrastructural development are some major growing aspects fuelling the Kenya Construction Materials Market growth. On the other hand, some challenges exist in the market that can hinder the its growth are high transportation costs, lack of investment in research and development, and a fragmented market structure that makes it difficult for investors to enter the market.

The sector also suffers from a lack of skilled labor, restricting the sector's growth potential. Apart from these challenges market still register a substantial growth potential in the country with the presence of several market trends. One of the significant trends is population shifting towards the use of eco-friendly and sustainable materials. Consumers are also becoming environment conscious and demanding products that prioritize their safety and that of wildlife. Other trends in the market include the emergence of mobile apps and online platforms, which aid in the delivery of construction materials to clients.

Government Initiatives introduced in the Kenya Construction Materials Market

The government has been instrumental in surging the growth of the Kenya construction materials industry through strategic investments. The Affordable Housing Program is one of the government's prominent initiatives aimed at addressing the housing shortage in the country. The 2021 budget set aside USD 540.05 million for the construction of affordable housing units. Other initiatives include the Lamu Port-South Sudan-Ethiopia Transport Corridor (LAPSSET) project, which aims to connect Kenya with neighbouring countries through a network of roads, railways, and pipelines.

Key Players in the Kenya Construction Materials Market

The Kenya construction materials market is highly competitive, with several key players dominating the industry. Some of the notable players in the market include

- Bamburi Cement Limited

- ARM Cement Limited

- East African Portland Cement Company

- Mabati Rolling Mills

- Crown Paints Kenya Limited.

These players have a strong presence in the market and have invested in research and development, leading to innovative products, facilitating market growth.

Market Analysis by Application

According to Nitesh, Research Manager, 6Wresearch, the industrial sector is recently leading and dominating Kenya Construction Materials Market share in the market backed by various drivers, including government policies, natural resources, and strategic location.

Market Analysis by Product Type

Based on the product type, Cement is the most critical material in the construction industry and is used for concrete production. However, other construction materials including Construction Aggregates, Concrete Bricks, and Construction Metals also have a high demand, depending on the construction types.

Key attractiveness of the report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Kenya Construction Materials Market Outlook

- Market Size of Kenya Construction Materials Market, 2024

- Forecast of Kenya Construction Materials Market, 2031

- Historical Data and Forecast of Kenya Construction Materials Revenues & Volume for the Period 2021 - 2031

- Kenya Construction Materials Market Trend Evolution

- Kenya Construction Materials Market Drivers and Challenges

- Kenya Construction Materials Price Trends

- Kenya Construction Materials Porter's Five Forces

- Kenya Construction Materials Industry Life Cycle

- Historical Data and Forecast of Kenya Construction Materials Market Revenues & Volume By Product type? for the Period 2021 - 2031

- Historical Data and Forecast of Kenya Construction Materials Market Revenues & Volume By Construction aggregates for the Period 2021 - 2031

- Historical Data and Forecast of Kenya Construction Materials Market Revenues & Volume By Concrete bricks for the Period 2021 - 2031

- Historical Data and Forecast of Kenya Construction Materials Market Revenues & Volume By Cement for the Period 2021 - 2031

- Historical Data and Forecast of Kenya Construction Materials Market Revenues & Volume By Construction metals for the Period 2021 - 2031

- Historical Data and Forecast of Kenya Construction Materials Market Revenues & Volume By Application for the Period 2021 - 2031

- Historical Data and Forecast of Kenya Construction Materials Market Revenues & Volume By Residential for the Period 2021 - 2031

- Historical Data and Forecast of Kenya Construction Materials Market Revenues & Volume By Commercial for the Period 2021 - 2031

- Historical Data and Forecast of Kenya Construction Materials Market Revenues & Volume By Industrial for the Period 2021 - 2031

- Kenya Construction Materials Import Export Trade Statistics

- Market Opportunity Assessment By Product type

- Market Opportunity Assessment By Application

- Kenya Construction Materials Top Companies Market Share

- Kenya Construction Materials Competitive Benchmarking By Technical and Operational Parameters

- Kenya Construction Materials Company Profiles

- Kenya Construction Materials Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Product Type

- Construction Aggregates

- Concrete Bricks

- Cement

- Construction Metals

By Application

- Residential

- Commercial

- Industrial

Kenya Construction Materials Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Kenya Construction Materials Market Overview |

| 3.1 Kenya Country Macro Economic Indicators |

| 3.2 Kenya Construction Materials Market Revenues & Volume, 2021 & 2031F |

| 3.3 Kenya Construction Materials Market - Industry Life Cycle |

| 3.4 Kenya Construction Materials Market - Porter's Five Forces |

| 3.5 Kenya Construction Materials Market Revenues & Volume Share, By Product type 2024 & 2031F |

| 3.6 Kenya Construction Materials Market Revenues & Volume Share, By Application, 2024 & 2031F |

| 4 Kenya Construction Materials Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Kenya Construction Materials Market Trends |

| 6 Kenya Construction Materials Market, By Types |

| 6.1 Kenya Construction Materials Market, By Product type |

| 6.1.1 Overview and Analysis |

| 6.1.2 Kenya Construction Materials Market Revenues & Volume, By Product type 2021 - 2031F |

| 6.1.3 Kenya Construction Materials Market Revenues & Volume, By Construction aggregates, 2021 - 2031F |

| 6.1.4 Kenya Construction Materials Market Revenues & Volume, By Concrete bricks, 2021 - 2031F |

| 6.1.5 Kenya Construction Materials Market Revenues & Volume, By Cement, 2021 - 2031F |

| 6.1.6 Kenya Construction Materials Market Revenues & Volume, By Construction metals, 2021 - 2031F |

| 6.2 Kenya Construction Materials Market, By Application |

| 6.2.1 Overview and Analysis |

| 6.2.2 Kenya Construction Materials Market Revenues & Volume, By Residential, 2021 - 2031F |

| 6.2.3 Kenya Construction Materials Market Revenues & Volume, By Commercial, 2021 - 2031F |

| 6.2.4 Kenya Construction Materials Market Revenues & Volume, By Industrial, 2021 - 2031F |

| 7 Kenya Construction Materials Market Import-Export Trade Statistics |

| 7.1 Kenya Construction Materials Market Export to Major Countries |

| 7.2 Kenya Construction Materials Market Imports from Major Countries |

| 8 Kenya Construction Materials Market Key Performance Indicators |

| 9 Kenya Construction Materials Market - Opportunity Assessment |

| 9.1 Kenya Construction Materials Market Opportunity Assessment, By Product type 2024 & 2031F |

| 9.2 Kenya Construction Materials Market Opportunity Assessment, By Application, 2024 & 2031F |

| 10 Kenya Construction Materials Market - Competitive Landscape |

| 10.1 Kenya Construction Materials Market Revenue Share, By Companies, 2024 |

| 10.2 Kenya Construction Materials Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero