Malaysia Automotive Wipers Market (2025-2031) Outlook | Share, Analysis, Growth, Size, Industry, Revenue, Trends, Forecast, Companies, Value

| Product Code: ETC258386 | Publication Date: Aug 2022 | Updated Date: Feb 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 | |

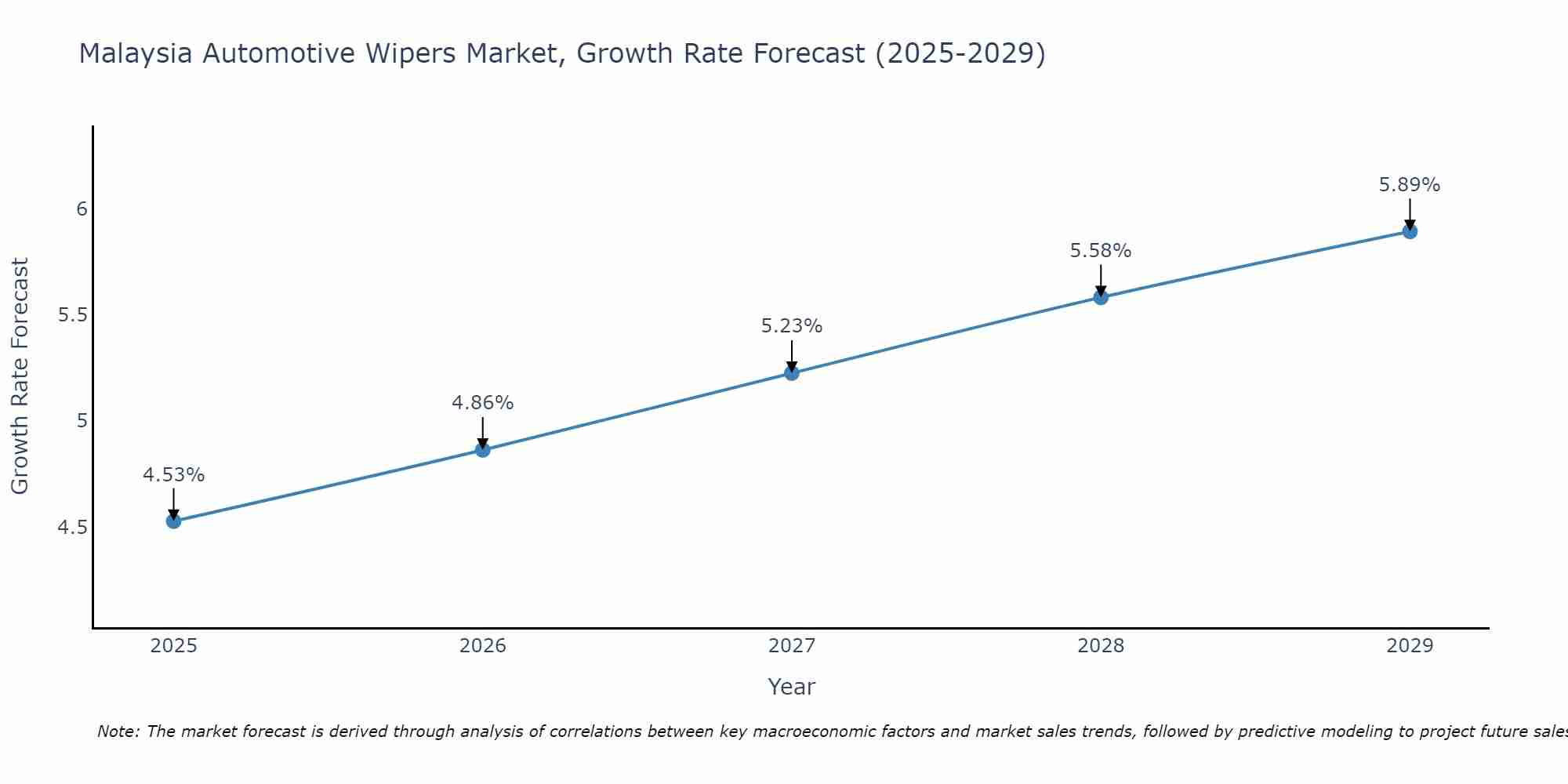

Malaysia Automotive Wipers Market Size Growth Rate

The Malaysia Automotive Wipers Market is poised for steady growth rate improvements from 2025 to 2029. From 4.53% in 2025, the growth rate steadily ascends to 5.89% in 2029.

Automotive Wipers Market: Malaysia vs Top 5 Major Economies in 2027 (Asia)

By 2027, Malaysia's Automotive Wipers market is forecasted to achieve a growing growth rate of 5.23%, with China leading the Asia region, followed by India, Japan, Australia and South Korea.

Malaysia Automotive Wipers Market Synopsis

The Malaysia automotive wipers market continues to evolve in response to changing consumer preferences and technological advancements. As of the last available data, the market showed steady growth, driven by an increasing number of vehicles on the road and the necessity of wiper systems for safe driving during frequent tropical rain showers. Market players have been focusing on innovation, introducing advanced wiper blade materials and technologies that enhance visibility and durability. Moreover, the shift towards electric vehicles (EVs) and autonomous driving technologies is likely to impact this market, with a growing demand for sophisticated wiper systems to accommodate these trends.

Drivers of the Market

The Malaysia automotive wipers market is expected to see sustained growth in the coming years. Factors contributing to this growth include a growing automotive industry, changing weather patterns, and the increasing adoption of advanced wiper technologies. As drivers prioritize safety and convenience, the demand for wipers with features like automatic rain-sensing capabilities and self-adjusting speeds is expected to rise.

Challenges of the Market

The Malaysia automotive wipers market presents several challenges that industry players need to navigate to maintain their competitive edge. Firstly, one significant challenge is the evolving regulatory landscape. Malaysia, like many other countries, is increasingly focusing on environmental sustainability and safety. This has led to the implementation of stricter regulations governing automotive components, including wipers. Companies operating in this market must continually invest in research and development to ensure their wiper products meet these evolving standards, which can be costly and resource-intensive.

COVID 19 Impact on the Market

The pandemic disrupted the automotive industry as lockdowns and economic uncertainty led to reduced vehicle sales and production. Consumers were more cautious about non-essential expenditures, including automotive accessories like wipers. However, the market showed resilience as the need for personal transportation increased, with consumers preferring private vehicles over public transport to minimize infection risk. Post-pandemic, the automotive wipers market is expected to recover gradually as economic stability returns.

Key Players in the Market

The Malaysia automotive wipers market is a competitive industry with several leading players that dominate the market. These companies have a significant presence in the country and play a pivotal role in shaping the industry`s dynamics. Below, I`ll provide you with a paragraph describing some of the leading players in the Malaysia automotive wipers market:Among the prominent players in the Malaysia automotive wipers market, Bosch stands out as a market leader, offering a wide range of high-quality wiper products known for their durability and performance. Another key player is Valeo, which has a strong presence and is known for its innovative wiper technologies that enhance visibility during adverse weather conditions. Trico, with its reliable and efficient wiper solutions, also holds a significant market share. Additionally, Federal-Mogul Motorparts, with its Anco brand, is a well-established player that caters to various vehicle segments. These leading companies not only offer a diverse product portfolio but also emphasize customer satisfaction through their extensive distribution networks and exceptional aftermarket support, making them crucial players in the Malaysia automotive wipers market.

Key Highlights of the Report:

- Malaysia Automotive Wipers Market Outlook

- Market Size of Malaysia Automotive Wipers Market, 2024

- Forecast of Malaysia Automotive Wipers Market, 2031

- Historical Data and Forecast of Malaysia Automotive Wipers Revenues & Volume for the Period 2021-2031

- Malaysia Automotive Wipers Market Trend Evolution

- Malaysia Automotive Wipers Market Drivers and Challenges

- Malaysia Automotive Wipers Price Trends

- Malaysia Automotive Wipers Porter's Five Forces

- Malaysia Automotive Wipers Industry Life Cycle

- Historical Data and Forecast of Malaysia Automotive Wipers Market Revenues & Volume By Automotive Wiper Arm Type for the Period 2021-2031

- Historical Data and Forecast of Malaysia Automotive Wipers Market Revenues & Volume By Synchronized Radial Arm for the Period 2021-2031

- Historical Data and Forecast of Malaysia Automotive Wipers Market Revenues & Volume By Pantograph Arm for the Period 2021-2031

- Historical Data and Forecast of Malaysia Automotive Wipers Market Revenues & Volume By Application for the Period 2021-2031

- Historical Data and Forecast of Malaysia Automotive Wipers Market Revenues & Volume By Windshield Wipers for the Period 2021-2031

- Historical Data and Forecast of Malaysia Automotive Wipers Market Revenues & Volume By Rear Wipers for the Period 2021-2031

- Historical Data and Forecast of Malaysia Automotive Wipers Market Revenues & Volume By Headlight Wipers for the Period 2021-2031

- Historical Data and Forecast of Malaysia Automotive Wipers Market Revenues & Volume By Blade Type for the Period 2021-2031

- Historical Data and Forecast of Malaysia Automotive Wipers Market Revenues & Volume By Traditional Bracket Blades for the Period 2021-2031

- Historical Data and Forecast of Malaysia Automotive Wipers Market Revenues & Volume By Low-profile Beam Blades for the Period 2021-2031

- Historical Data and Forecast of Malaysia Automotive Wipers Market Revenues & Volume By Hybrid Blades for the Period 2021-2031

- Malaysia Automotive Wipers Import Export Trade Statistics

- Market Opportunity Assessment By Automotive Wiper Arm Type

- Market Opportunity Assessment By Application

- Market Opportunity Assessment By Blade Type

- Malaysia Automotive Wipers Top Companies Market Share

- Malaysia Automotive Wipers Competitive Benchmarking By Technical and Operational Parameters

- Malaysia Automotive Wipers Company Profiles

- Malaysia Automotive Wipers Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 Malaysia Automotive Wipers Market Overview |

3.1 Malaysia Country Macro Economic Indicators |

3.2 Malaysia Automotive Wipers Market Revenues & Volume, 2021 & 2031F |

3.3 Malaysia Automotive Wipers Market - Industry Life Cycle |

3.4 Malaysia Automotive Wipers Market - Porter's Five Forces |

3.5 Malaysia Automotive Wipers Market Revenues & Volume Share, By Automotive Wiper Arm Type, 2021 & 2031F |

3.6 Malaysia Automotive Wipers Market Revenues & Volume Share, By Application, 2021 & 2031F |

3.7 Malaysia Automotive Wipers Market Revenues & Volume Share, By Blade Type, 2021 & 2031F |

4 Malaysia Automotive Wipers Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.3 Market Restraints |

5 Malaysia Automotive Wipers Market Trends |

6 Malaysia Automotive Wipers Market, By Types |

6.1 Malaysia Automotive Wipers Market, By Automotive Wiper Arm Type |

6.1.1 Overview and Analysis |

6.1.2 Malaysia Automotive Wipers Market Revenues & Volume, By Automotive Wiper Arm Type, 2021-2031F |

6.1.3 Malaysia Automotive Wipers Market Revenues & Volume, By Synchronized Radial Arm, 2021-2031F |

6.1.4 Malaysia Automotive Wipers Market Revenues & Volume, By Pantograph Arm, 2021-2031F |

6.2 Malaysia Automotive Wipers Market, By Application |

6.2.1 Overview and Analysis |

6.2.2 Malaysia Automotive Wipers Market Revenues & Volume, By Windshield Wipers, 2021-2031F |

6.2.3 Malaysia Automotive Wipers Market Revenues & Volume, By Rear Wipers, 2021-2031F |

6.2.4 Malaysia Automotive Wipers Market Revenues & Volume, By Headlight Wipers, 2021-2031F |

6.3 Malaysia Automotive Wipers Market, By Blade Type |

6.3.1 Overview and Analysis |

6.3.2 Malaysia Automotive Wipers Market Revenues & Volume, By Traditional Bracket Blades, 2021-2031F |

6.3.3 Malaysia Automotive Wipers Market Revenues & Volume, By Low-profile Beam Blades, 2021-2031F |

6.3.4 Malaysia Automotive Wipers Market Revenues & Volume, By Hybrid Blades, 2021-2031F |

7 Malaysia Automotive Wipers Market Import-Export Trade Statistics |

7.1 Malaysia Automotive Wipers Market Export to Major Countries |

7.2 Malaysia Automotive Wipers Market Imports from Major Countries |

8 Malaysia Automotive Wipers Market Key Performance Indicators |

9 Malaysia Automotive Wipers Market - Opportunity Assessment |

9.1 Malaysia Automotive Wipers Market Opportunity Assessment, By Automotive Wiper Arm Type, 2021 & 2031F |

9.2 Malaysia Automotive Wipers Market Opportunity Assessment, By Application, 2021 & 2031F |

9.3 Malaysia Automotive Wipers Market Opportunity Assessment, By Blade Type, 2021 & 2031F |

10 Malaysia Automotive Wipers Market - Competitive Landscape |

10.1 Malaysia Automotive Wipers Market Revenue Share, By Companies, 2024 |

10.2 Malaysia Automotive Wipers Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero