Mexico Air Conditioner Market (2016-2022) | Industry, Revenue, Trends, Forecast, Value, Analysis, Companies, Share, Outlook, Growth & Size

Market Forecast by (Room (Window and Split), Ductless (Floor Standing, Cassette and Ceiling Suspended), Ducted (Roof Top Packaged and Ceiling Concealed), Centralized (Chiller, VRF, AHU/FCU, and Others), End Users (Residential, Hospitality, Commercial & Retail, Industrial, Government & Transportation and Others) and Regions (Northern, Southern, Central, Eastern and Western) and Competitive Landscape

| Product Code: ETC000328 | Publication Date: Sep 2016 | Updated Date: May 2024 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 122 | No. of Figures: 42 | No. of Tables: 7 | |

Mexico Air Conditioner Market Competition 2023

Mexico Air Conditioner market currently, in 2023, has witnessed an HHI of 8431, Which has increased slightly as compared to the HHI of 7661 in 2017. The market is moving towards Highly concentrated. Herfindahl index measures the competitiveness of exporting countries. The range lies from 0 to 10000, where a lower index number represents a larger number of players or exporting countries in the market while a large index number means fewer numbers of players or countries exporting in the market.

Mexico Export Potential Assessment For Air Conditioner Market (Values in USD Thousand)

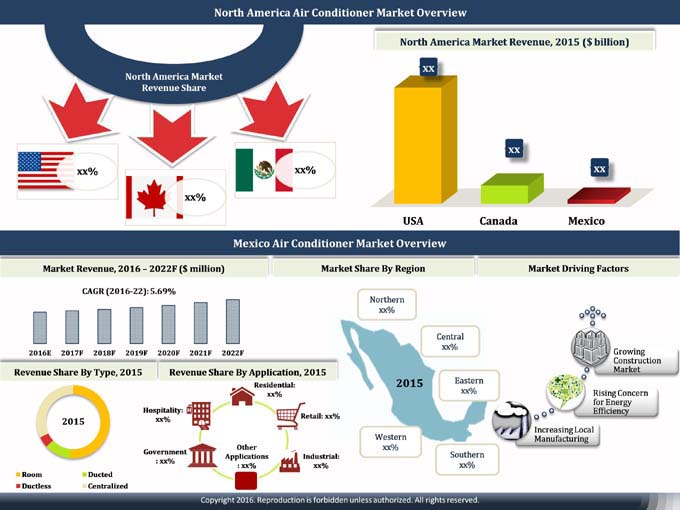

Rising disposable income, growing concerns for energy efficiency and expansion of public & private infrastructures, and the National Infrastructure Plan are the key factors expected to drive Mexico's air conditioner market.

According to 6Wresearch, Mexico Air Conditioner market is projected to grow at a CAGR of 5.69% during 2016-22. Though, Mexican air conditioner market recorded negative CAGR during 2012-15 but is likely to post growth over the next six years. The declining construction sector and falling currency have significantly impacted the growth of the air conditioning market during this time period.

Central Mexico is the leading revenue contributing region in the entire market. The region is expected to maintain its market leadership in the forecast period as well due to proposed new commercial establishments. Most of the new constructions for commercial buildings are proposed especially in Mexico City and Monterrey.

The report thoroughly covers the air conditioner market by types, applications, and regions. The report provides an unbiased and detailed analysis of the ongoing trends, opportunities/high growth areas, market drivers, which would help the stakeholders to decide and align their market strategies according to the current and future market dynamics.

Key Highlights of the Report:

• Historical & Forecast data of North America Air Conditioner Market for the Period 2012-2022F.

• Historical & Forecast data of Mexico Air Conditioner Market Revenue for the Period 2012-2022F.

• Historical & Forecast data of Mexico Window AC Market Revenue & Volume for the Period 2012-2022F.

• Historical & Forecast data of Mexico Split AC Market Revenue & Volume for the Period 2012-2022F.

• Historical & Forecast data of Mexico Packaged AC Market Revenue & Volume for the Period 2012-2022F.

• Historical & Forecast data of Mexico Ceiling Concealed AC Market Revenue & Volume for the Period 2012-2022F.

• Historical & Forecast data of Mexico Cassette AC Market Revenue & Volume for the Period 2012-2022F.

• Historical & Forecast data of Mexico Floor Standing AC Market Revenue & Volume for the Period 2012-2022F.

• Historical & Forecast data of Mexico Suspended AC Market Revenue & Volume for the Period 2012-2022F.

• Historical & Forecast data of Mexico Centralized AC Market Revenue for the Period 2012-2022F.

• Historical & Forecast data of Mexico Centralized AC Market Revenue, By Segments for the Period 2012-2022F.

• Historical & Forecast data of Mexico Air Conditioner Application Market Revenue for the period 2012-2022F.

• Historical & Forecast data of Mexico Air Conditioner Regional Market Revenue for the Period 2010-2015.

• Market Trends.

• Players Market Share

• Competitive Landscape.

Markets Covered

The report provides a detailed analysis of the following market segments:

• By AC Types:

o Room AC

• Window AC

• Split AC

o Ducted AC

• Packaged AC

• Ceiling Concealed AC

o Ductless AC

• Suspended Type AC

• Cassette AC

• Floor Standing AC

o Centralized AC

• AHU/FCU

• Chiller/VRF

• Others

• By End-User Applications:

o Residential

o Commercial & Retail

o Hospitality

o Industrial

o Government & Transportation

o Others

• By Regions:

o Northern Region

o Southern Region

o Central Region

o Eastern Region

o Western Region

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary

2 Introduction

2.1 Key Highlights

2.2 Report Description

2.3 Market Scope & Segmentation

2.4 Research Methodology

2.5 Assumptions

3 North America Air Conditioners Market Overview

3.1 North America Air Conditioner Market Revenue, 2012-2022 ($ Billion)

3.2 North America Market Revenue Share, By Country (2015 & 2022F)

4 Mexico Air Conditioner Market Overview

4.1 Overview & Analysis

4.2 Mexico Air Conditioner Market Revenue (2012-2022F)

4.3 Mexico Air Conditioner Market Revenue Share, By Types

4.4 Mexico Air Conditioner Market Revenue Share, By Region

4.5 Mexico Air Conditioner Market Revenue Share, By End User Industry

5 Mexico Room Air Conditioner Market Overview

5.1 Mexico Window Air Conditioner Market Revenues & Volume (2012-2022F)

5.2 Mexico Split Air Conditioner Market Revenues & Volume (2012-2022F)

5.3 Mexico Room Air Conditioner Market Revenue Share, By Type

6 Mexico Ducted Air Conditioner Market Overview

6.1 Mexico Packaged Air Conditioner Market Revenues & Volume (2012-2022F)

6.2 Mexico Ceiling Concealed Air Conditioner Market Revenues & Volume (2012-2022F)

6.3 Mexico Ducted Air Conditioner Market Revenue Share, By Type

7 Mexico Ductless Air Conditioner Market Overview

7.1 Mexico Cassette Air Conditioner Market Revenues & Volume (2012-2022F)

7.2 Mexico Floor Standing Air Conditioner Market Revenues & Volume (2012-2022F)

7.3 Mexico Ceiling Suspended Air Conditioner Market Revenues & Volume (2012-2022F)

7.4 Mexico Ductless Air Conditioner Market Revenue Share, By Type

8 Mexico Centralized Air Conditioner Market Overview

8.1 Mexico Centralized Air Conditioner Market Revenues (2012-2022F)

8.2 Mexico Chiller & VRF Market Revenues (2012-2022F)

8.3 Mexico AHU & FCU Market Revenues (2012-2022F)

8.4 Mexico Other Air Conditioning Components Market Revenues (2012-2022F)

9 Mexico Air Conditioner Market Regional Analysis

9.1 Central Region

9.2 Northern Region

9.3 Southern Region

9.4 Eastern Region

9.5 Western Region

10 Mexico Air Conditioner Market End-User Market Analysis

10.1 Residential

10.2 Commercial & Retail

10.3 Government & Transportation

10.4 Hospitality

10.5 Industrial (Manufacturing)

10.6 Other Applications

11 Mexico Air Conditioner Market-Market Dynamics

11.1 Growing Construction Industry

11.2 Rising Concern for Energy Efficiency

11.3 Increasing Local Manufacturing

11.4 Mismanagement in Logistics & Supply Chain

12 Mexico Air Conditioner Market Recent Trends & Developments

12.1 Inverter Chiller Technology in Mexico

12.2 Technological Innovations

12.3 Smart Air Conditioners

13 Policy & Regulatory Landscape

13.1 Mexico: Tax Structure

13.2 Import Data

13.3 Export Data

14 Competitive Benchmarking

14.1 Competitive Benchmarking, By Product

14.2 Competitive Benchmarking, By Operation

14.3 Company Revenue Market Share

15 Company Profiles

15.1 Carrier Mexico S.A. de C.V.

15.2 Trane S.A. de C.V.

15.3 Daikin Air-conditioning Mexico, S. de R.L. de C.V.

15.4 PIMS S.A. de C.V

15.5 Whirlpool Mexico S.A. de C.V.

15.6 LG Electronics Mexicali S.A. de C.V.

15.7 Controladora Mabe, S.A. de C.V.

15.8 Lennox International Inc.

15.9 Hitaircon S.A. de C.V.

15.10 Haier America LLC.

16 Recommendations

17 Disclaimer

List of Figures

Figure 1 North America Air Conditioner Market Revenue, 2012-2022 ($ Billion)

Figure 2 North America Market Revenue Share, By Country, 2015 & 2022

Figure 3 Mexico Air Conditioner Market Revenue, 2012-2022 ($ Million)

Figure 4 Mexico Air Conditioner Market Revenue Share, By Type, 2015 & 2022

Figure 5 Mexico Air Conditioner Market Revenue Share, By Region, 2015 & 2022

Figure 6 Mexico Air Conditioner Market Revenue Share, By End User, 2015 & 2022

Figure 7 Mexico Window Air Conditioner Market Revenue & Volume (2012 - 2022F)

Figure 8 Mexico Split Air Conditioner Market Revenue & Volume (2012 - 2022F)

Figure 9 Mexico Room Air Conditioner Market Revenue Share, By Type (2015 & 2022)

Figure 10 Mexico Packaged Air Conditioner Market Revenue & Volume (2012 - 2022F)

Figure 11 Mexico Ceiling Concealed Air Conditioner Market Revenue & Volume (2012 - 2022F)

Figure 12 Mexico Ducted Air Conditioner Market Revenue Share, By Type (2015 & 2022)

Figure 13 Mexico Cassette Air Conditioner Market Revenue & Volume (2012 - 2022F)

Figure 14 Mexico Floor Standing Conditioner Market Revenue & Volume (2012 - 2022F)

Figure 15 Mexico Suspended Type Air Conditioner Market Revenue & Volume (2012 - 2022F)

Figure 16 Mexico Ductless Air Conditioner Market Revenue & Volume (2015 & 2022)

Figure 17 Mexico Centralized Air Conditioner Market Revenue, 2012 - 2022 ($ Million)

Figure 18 Mexico Centralized Air Conditioner Market Revenue Share, By Type (2015 & 2022)

Figure 19 Mexico Chiller & VRF/Condensing Unit Market Revenue, 2012 - 2022 ($ Million)

Figure 20 Mexico AHU & FCU Market Revenue, 2012 - 2022 ($ Million)

Figure 21 Mexico Other Air Conditioning Components Market Revenue, 2012 - 2022 ($ Million)

Figure 22 Mexico Central Region Air Conditioner Market Revenue, 2012 - 2022 ($ Million)

Figure 23 Mexico Nothern Region Air Conditioner Market Revenue, 2012 - 2022 ($ Million)

Figure 24 Mexico Southern Region Air Conditioner Market Revenue, 2012 - 2022 ($ Million)

Figure 25 Mexico Eastern Region Air Conditioner Market Revenue, 2012 - 2022 ($ Million)

Figure 26 Mexico Western Region Air Conditioner Market Revenue, 2012 - 2022 ($ Million)

Figure 27 Mexico Air Conditioner Market Revenue in Residential Sector, 2012 - 2022 ($ Million)

Figure 28 Mexico Residential Building Projects, By value, 2012 - 2015 ($ Million)

Figure 29 Mexico Residential Flats Constructed, 2011 - 2014 (Thousand Units)

Figure 30 Mexico Air Conditioner Market Revenue in Commercial & Retail Sector, By value, 2012 - 2022 ($ Million)

Figure 31 Mexico Air Conditioner Market Revenues, By Shopping Center, By Region, 2015

Figure 32 Mexico Number of Companies Registered, 2010-2014

Figure 33 Mexico Air Conditioner Market Revenues in Government & Transportation Sector, 2012 - 2022 ($ Million)

Figure 34 Mexico Air Conditioner Market Revenues in Hospitality Sector, 2012 - 2022 ($ Million)

Figure 35 Mexico Number of Hotels, 2015

Figure 36 Mexico Air Conditioner Market Revenues in Manufacturing Sector, 2012 - 2022 ($ Million)

Figure 37 Mexico Air Conditioner Market Revenues in Other Sector, 2012 - 2022 ($ Million)

Figure 38 Mexico Construction Industry Market Revenues, 2011 - 2015 ($ Billion)

Figure 39 Mexico Residential and Non-Residential Buildings Industry, 2011-2015 ($ Billion)

Figure 40 Percent Change in Value of U.S.-Mexico Freight flows by Mode of Transport, July 2014-15

Figure 41 Mexico Electricity Consumption, Billion Kwh (2010-14)

Figure 42 Mexico Air Conditioner Market Revenue Share, By Company (2015)

List of Tables

Table 1 Mexico List of New Airport Projects, 2012 - 2022 ($ Million)

Table 2 List of Major Industries in Mexico, 2015 ($ Million)

Table 3 Mexico Tax Structure for Air Conditioners, 2015

Table 4 Companies Importing Air Conditioners in Mexico

Table 5 Companies Exporting Air Conditioners from Mexico

Table 6 Mexico Air Conditioner Company Benchmarking, By Product (2015)

Table 7 Mexico Air Conditioner Company Benchmarking, By Operation (2015)

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

- Kenya Road Stabilization Equipment Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- North America Sodium chloride Market (2025-2031) | Analysis, Revenue, Forecast, Trends, Companies, Size, Growth, Share, Industry, Outlook & Value

- North America Vinyl Flooring Market (2025-2031) | Value, Growth,Size, Analysis, Revenue, Industry, Forecast, Share, Outlook, Companies & Trends

- Tajikistan Thermal Camera Market (2025-2031) | Trends, Size, Growth, Share, Industry, Companies, Value, Analysis, Revenue, Forecast & Outlook

- Singapore Professional AV Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero