Myanmar Construction Materials Market (2025-2031) | Growth, Share, Outlook, Size, Trends, Analysis, Industry, Companies, Forecast, Revenue & Value

Market Forecast By Product type (Construction aggregates, Concrete bricks, Cement, Construction metals), By Application (Residential, Commercial, Industrial) And Competitive Landscape

| Product Code: ETC016734 | Publication Date: Oct 2020 | Updated Date: Dec 2024 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

Myanmar Construction Materials Market Size Growth Rate

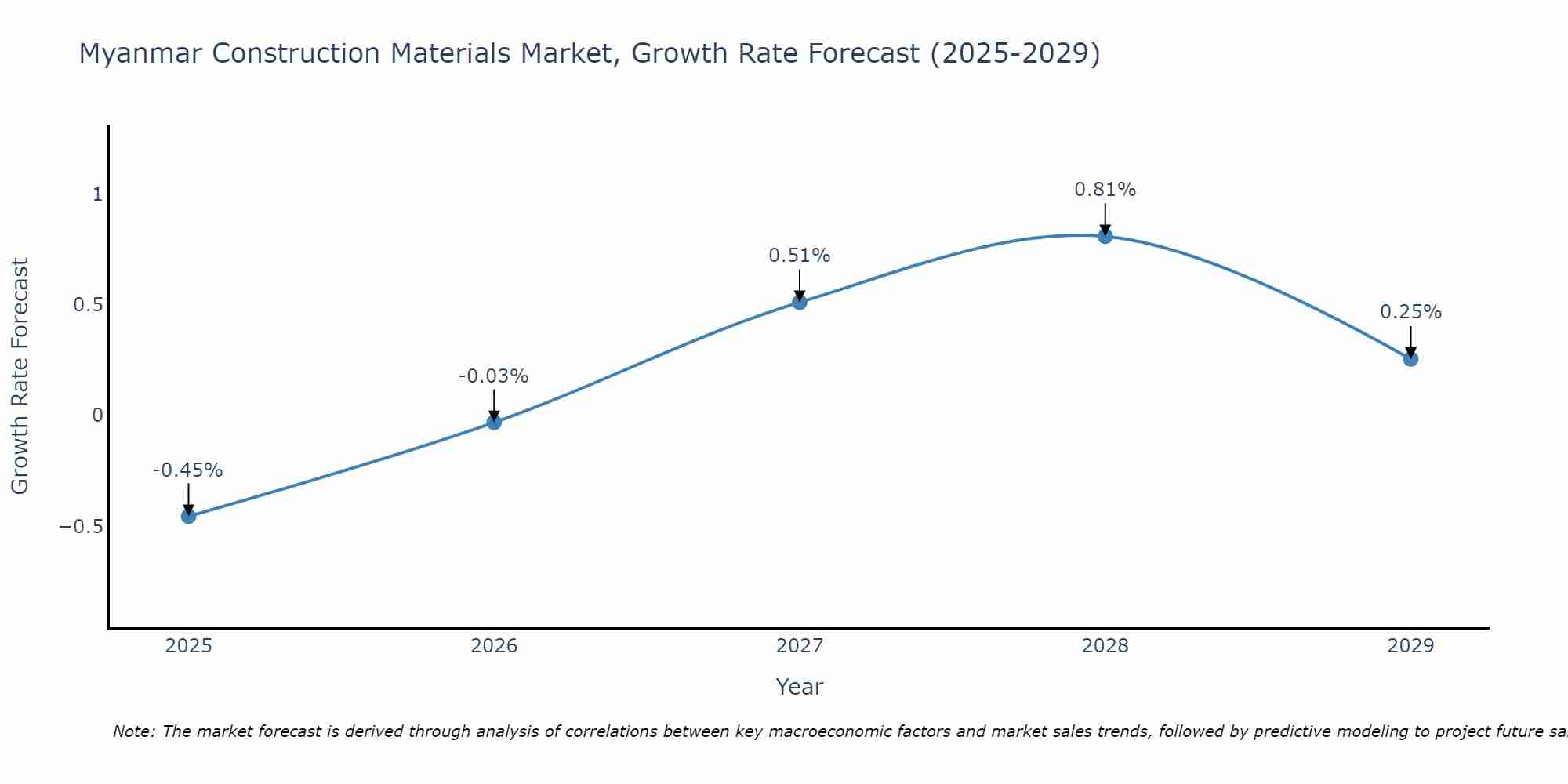

The Myanmar Construction Materials Market is projected to witness mixed growth rate patterns during 2025 to 2029. Growth accelerates to 0.81% in 2028, following an initial rate of -0.45%, before easing to 0.25% at the end of the period.

Construction Materials Market: Myanmar vs Top 5 Major Economies in 2027 (Asia)

In the Asia region, the Construction Materials market in Myanmar is projected to expand at a stable growth rate of 0.51% by 2027. The largest economy is China, followed by India, Japan, Australia and South Korea.

Topics Covered in the Myanmar Construction Materials Market

Myanmar Construction Materials Market report thoroughly covers the market by product type and application. The market outlook report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Myanmar Construction Materials Market Synopsis

Myanmar Construction Materials Market has been one of the fastest-growing sectors in recent years. The market is experiencing a surge owing to the increased construction and infrastructure projects in the country. The demand for these raw materials is increasing, with a surge in construction projects across the country. However, with the increase in demand comes a challenge to the supply chain. The country has limited production capacity, this leads to make the country depends on imports, particularly from neighbouring countries such as Thailand, China, and Vietnam. The high transportation costs and import taxes can lead to the higher prices of construction materials.

According to 6Wresearch, the Myanmar Construction Materials Market size is estimated to grow at a CAGR of with a CAGR of 6.8% during the forecast period 2025-2031. The market is expected to secure a considerable growth in the coming years, majorly owing to the government's support to the infrastructure development. The construction of highways, railways, and airports are some of the major contributors driving the growth of the Myanmar Construction Materials industry. Also, the urbanization and increasing population growth in urban areas have augmented the demand for affordable housing, boosting the demand for construction materials. Despite the growth prospects, there are certain challenges that could impede its growth.

The country's infrastructure is still in its nascent stage, which leads to logistical problems in transporting materials across the country. Furthermore, the lack of access to finance and expensive machinery and equipment are another challenges that need to be addressed. Nevertheless, there have been some trends ongoing in the market such as the increased use of green building materials, which are environmentally friendly and promote sustainable development. Also, due to the lack of quality control in building materials, the demand for higher quality and certified materials is rising. Additionally, with the increasing competition in the market, many companies are offering customized solutions to meet specifically growing customer needs.

Government Initiatives introduced in the Myanmar Construction Materials Market

To prepare for the country's rapid development, the Myanmar government has introduced several policies and programmes aimed to evolve the construction industry growth in the country. Primarily, implementation of the Myanmar Building Code in 2020, which sets out the minimum requirements for building construction and technical standards. The government is also working towards streamlining the licensing process for construction projects, making it faster for investors to obtain permits that are required. To improve the quality of construction, the government has setup the Construction Quality Control Authority (CQCA) and the Urban and Housing Development Department (UHDD), which oversee and govern regulations related to construction.

Key Players in the Myanmar Construction Materials Market

There has been a massive presence of the international companies in the Myanmar Construction Materials Market in recent years. Which consist of the leading players in the market include Asia General Holdings, ASEAN Ceramics Holding, and Myanmar Plywood. Furthermore, there are also several local suppliers and manufacturers who cater the customer’s demand. The competition among these players is high, and companies are investing in R&D to come up with innovative and cost-effective solutions to meet the growing demand.

Market Analysis by Application

According to Ravi Bhandari, Research Head, 6Wresearch, the commercial construction materials market has experienced the most prominent growth in recent times, followed by foreign investments and an increase in demand for office and retail spaces.

Key attractiveness of the report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Myanmar Construction Materials Market Outlook

- Market Size of Myanmar Construction Materials Market, 2024

- Forecast of Myanmar Construction Materials Market, 2031

- Historical Data and Forecast of Myanmar Construction Materials Revenues & Volume for the Period 2021 - 2031

- Myanmar Construction Materials Market Trend Evolution

- Myanmar Construction Materials Market Drivers and Challenges

- Myanmar Construction Materials Price Trends

- Myanmar Construction Materials Porter's Five Forces

- Myanmar Construction Materials Industry Life Cycle

- Historical Data and Forecast of Myanmar Construction Materials Market Revenues & Volume By Product type for the Period 2021 - 2031

- Historical Data and Forecast of Myanmar Construction Materials Market Revenues & Volume By Construction aggregates for the Period 2021 - 2031

- Historical Data and Forecast of Myanmar Construction Materials Market Revenues & Volume By Concrete bricks for the Period 2021 - 2031

- Historical Data and Forecast of Myanmar Construction Materials Market Revenues & Volume By Cement for the Period 2021 - 2031

- Historical Data and Forecast of Myanmar Construction Materials Market Revenues & Volume By Construction metals for the Period 2021 - 2031

- Historical Data and Forecast of Myanmar Construction Materials Market Revenues & Volume By Application for the Period 2021 - 2031

- Historical Data and Forecast of Myanmar Construction Materials Market Revenues & Volume By Residential for the Period 2021 - 2031

- Historical Data and Forecast of Myanmar Construction Materials Market Revenues & Volume By Commercial for the Period 2021 - 2031

- Historical Data and Forecast of Myanmar Construction Materials Market Revenues & Volume By Industrial for the Period 2021 - 2031

- Myanmar Construction Materials Import Export Trade Statistics

- Market Opportunity Assessment By Product type

- Market Opportunity Assessment By Application

- Myanmar Construction Materials Top Companies Market Share

- Myanmar Construction Materials Competitive Benchmarking By Technical and Operational Parameters

- Myanmar Construction Materials Company Profiles

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Product Type:

- Construction Aggregates

- Concrete Bricks

- Cement

- Construction Metals

By Application:

- Residential

- Commercial

- Industrial

Myanmar Construction Materials Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Myanmar Construction Materials Market Overview |

| 3.1 Myanmar Country Macro Economic Indicators |

| 3.2 Myanmar Construction Materials Market Revenues & Volume, 2021 & 2031F |

| 3.3 Myanmar Construction Materials Market - Industry Life Cycle |

| 3.4 Myanmar Construction Materials Market - Porter's Five Forces |

| 3.5 Myanmar Construction Materials Market Revenues & Volume Share, By Product type 2024 & 2031F |

| 3.6 Myanmar Construction Materials Market Revenues & Volume Share, By Application, 2024 & 2031F |

| 4 Myanmar Construction Materials Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Myanmar Construction Materials Market Trends |

| 6 Myanmar Construction Materials Market, By Types |

| 6.1 Myanmar Construction Materials Market, By Product type |

| 6.1.1 Overview and Analysis |

| 6.1.2 Myanmar Construction Materials Market Revenues & Volume, By Product type 2021 - 2031F |

| 6.1.3 Myanmar Construction Materials Market Revenues & Volume, By Construction aggregates, 2021 - 2031F |

| 6.1.4 Myanmar Construction Materials Market Revenues & Volume, By Concrete bricks, 2021 - 2031F |

| 6.1.5 Myanmar Construction Materials Market Revenues & Volume, By Cement, 2021 - 2031F |

| 6.1.6 Myanmar Construction Materials Market Revenues & Volume, By Construction metals, 2021 - 2031F |

| 6.2 Myanmar Construction Materials Market, By Application |

| 6.2.1 Overview and Analysis |

| 6.2.2 Myanmar Construction Materials Market Revenues & Volume, By Residential, 2021 - 2031F |

| 6.2.3 Myanmar Construction Materials Market Revenues & Volume, By Commercial, 2021 - 2031F |

| 6.2.4 Myanmar Construction Materials Market Revenues & Volume, By Industrial, 2021 - 2031F |

| 7 Myanmar Construction Materials Market Import-Export Trade Statistics |

| 7.1 Myanmar Construction Materials Market Export to Major Countries |

| 7.2 Myanmar Construction Materials Market Imports from Major Countries |

| 8 Myanmar Construction Materials Market Key Performance Indicators |

| 9 Myanmar Construction Materials Market - Opportunity Assessment |

| 9.1 Myanmar Construction Materials Market Opportunity Assessment, By Product type 2024 & 2031F |

| 9.2 Myanmar Construction Materials Market Opportunity Assessment, By Application, 2024 & 2031F |

| 10 Myanmar Construction Materials Market - Competitive Landscape |

| 10.1 Myanmar Construction Materials Market Revenue Share, By Companies, 2024 |

| 10.2 Myanmar Construction Materials Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero