Nigeria Elevator and Escalator Market (2023-2029) | Value, Size, Outlook, Industry, Analysis, Trends, Share, Revenue, Growth, Companies, COVID-19 IMPACT & Forecast

Market Forecast By Types (Elevator, Escalator, Moving Walkways), By Services (Maintenance & Repair, New Installation, Modernization), By End-User (Residential, Commercial, Public) And Competitive Landscape

| Product Code: ETC005709 | Publication Date: Jan 2024 | Updated Date: Jan 2024 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 16 | No. of Tables: 10 |

Nigeria Elevator and Escalator Market Synopsis

The Nigeria Elevator and Escalator Market witnessed reasonable growth in the period before the pandemic. The growth could be attributed to numerous commercial and residential projects in Nigeria along with various government initiatives towards residential sectors to tackle the housing deficit in the country such as the Upgrading of Informal Settlements and the National Housing Program. However, the demand for elevators and escalators in Nigeria saw a sharp decline owing to the pandemic during the year 2020 as economic activities were suspended to curb the effect of the pandemic.

According to 6Wresearch, the Nigeria Elevator And Escalator Market is projected to grow at a CAGR of 6.4% in terms of revenues during 2023-2029F. Investment in infrastructure by the Nigerian government with a budget allocation of N1.42 trillion in 2022-23 along with an increasing number of hotel chains in the pipeline in Nigeria coupled with the growing number of skyscrapers would aid the market of Elevators & escalators in coming years. Moreover, the construction of a hotel around Lagos Murtala Muhammed International Airport which is planned to be completed by 2024 would be a major driver for the Nigeria Elevator and Escalator Market growth. Moreover, supply chain also got hampered thereby, further declining the demand and the revenues of elevators and escalators in Nigeria.

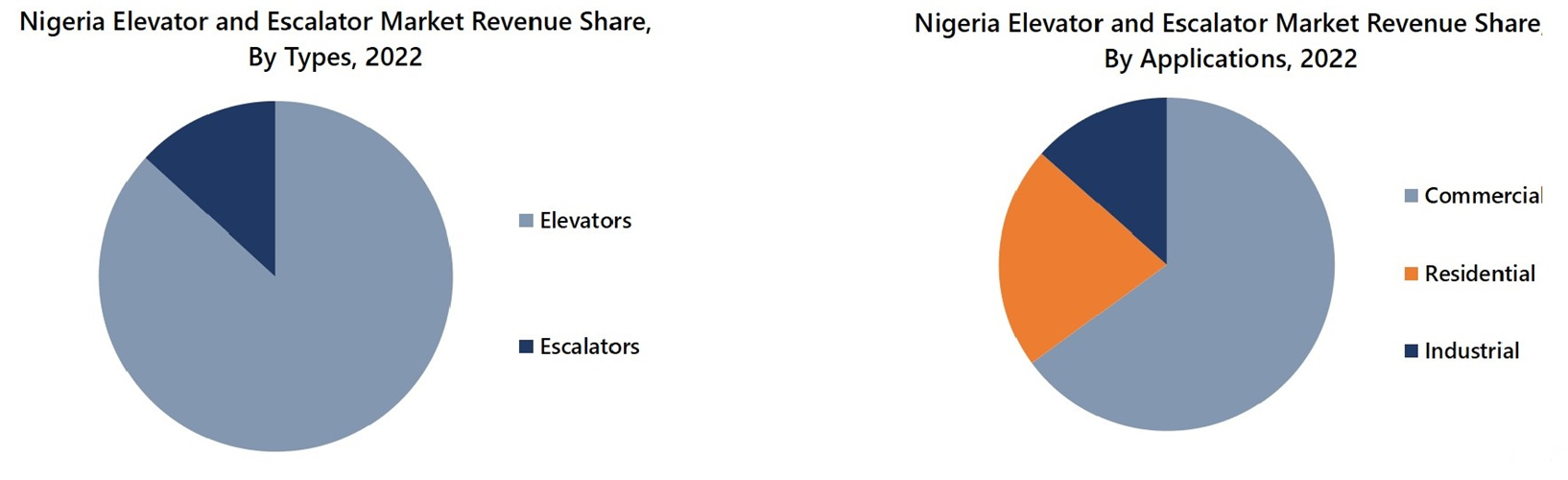

Market Segmentation by Types

The elevator and escalator market in Nigeria was dominated by elevator during the year 2022. Elevator hold the maximum revenue and volume share in Nigeria, and it is expected that this trend would continue in the forecast period. The growth of elevators in Nigeria could be attributed to Nigerian government investment in housing and infrastructure projects worth N123.1 billion between the year 2022 and 2025 and this would further propel the market for elevators.

Market Segmentation by Applications

The commercial application is anticipated to garner the majority revenue share in Nigeria elevator and escalator market in the forecast period on the back of investment in infrastructure by the Nigerian government and owing to the rise in the market for passenger elevators.

Market Segmentation by Services

Nigeria elevator and escalator market is dominated by the new installation segment during 2022 on account of ongoing construction projects such as the construction of Wachakal Airport, Abuja World Trade Center Hotel Tower and many others.

Key Attractiveness of the Report

- 11 Years of Market Numbers.

- Historical Data Starting from 2019 to 2022.

- Base Year: 2022

- Forecast Data until 2029.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Nigeria Elevator & Escalator Market Overview

- Nigeria Elevator & Escalator Market Outlook

- Nigeria Elevator & Escalator Market Forecast

- Historical Data and Forecast of Nigeria Elevator & Escalator Market Revenues for the Period 2019-2029F

- Historical Data and Forecast of Nigeria Elevator & Escalator Market Revenues, By Types, for the Period 2019-2029F

- Historical Data and Forecast of Nigeria Elevator & Escalator Market Revenues, By Service Type, for the Period 2019-2029F

- Historical Data and Forecast of Nigeria Elevator & Escalator Market Revenues, By Applications, for the Period 2019-2029F

- Market Drivers and Restraints

- Industry Life Cycle

- Porter’s Five Force Analysis

- Impact Analysis of Covid-19

- Market Trends

- Africa Country-wise Elevator & Escalator Market Revenue Ranking, By Companies

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

Thereportprovides a detailed analysis of the following market segments:

By Types

- Elevator

- Escalator

By Applications

- Commercial

- Residential

- Industrial

By Services

- New Installation

- Modernisation

- Maintenance

Frequently Asked Questions About the Market Study (FAQs):

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. Nigeria Elevator and Escalator Market Overview |

| 3.1. Nigeria Elevator and Escalator Market Revenues & Volume, 2019-2029F |

| 3.2. Nigeria Elevator and Escalator Market Revenue and Volume Share, By Types |

| 3.3. Nigeria Elevator and Escalator Market-Industry Life Cycle |

| 3.4. Nigeria Elevator and Escalator Market-Porter’s Five Forces |

| 4. Nigeria Elevator And Escalator Market Dynamics |

| 4.1. Nigeria Elevator and Escalator Market Dynamics Impact Analysis |

| 4.2. Nigeria Elevator and Escalator Market Dynamics Driver |

| 4.3. Nigeria Elevator and Escalator Market Dynamics Driver Restraint |

| 5. Nigeria Elevator And Escalator Market Trends |

| 6. Nigeria Elevator Market Overview, By Type |

| 6.1. Nigeria New Installation Elevator Market Revenue and Volume Share, By Types 2022 & 2029F |

| 6.2. Nigeria New Installation Elevator Market Revenues and Volume, By Types. 2019-2029F |

| 6.2.1 Nigeria New Installation Elevator Market Revenues and Volume, By Passenger, 2019-2029F |

| 6.2.1 Nigeria New Installation Elevator Market Revenues and Volume, By Cargo, 2019-2029F |

| 6.2.3 Nigeria New Installation Elevator Market Revenues and Volume, By Home, 2019-2029F |

| 7. Nigeria Escalator Market Overview, By Type |

| 7.1 Nigeria New Installation Escalator Market Revenue and Volume Share, By Types, 2022 & 2029F |

| 7.2. Nigeria New Installation Escalator Market Revenues and Volume, By Types, 2019-2029F |

| 7.2.1. Nigeria New Installation Escalator Market Revenues and Volume, By Moving Stairway, 2019-2029F |

| 7.2.2. Nigeria New Installation Escalator Market Revenues and Volume, By Moving Walk away, 2019-2029F |

| 8. Nigeria Elevator and Escalator Market Overview, By Service type |

| 8.1. Nigeria Elevator and Escalator Market Revenue Share & Revenue, By Services 2022 & 2029F |

| 8.1.1. Nigeria Elevator and Escalator Market Revenue, By New Installation, 2019-2029F |

| 8.1.2. Nigeria Elevator and Escalator Market Revenue, By Maintenance, 2019-2029F |

| 8.1.3. Nigeria Elevator and Escalator Market Revenue, By Modernisation, 2019-2029F |

| 9. Nigeria Elevator and Escalator Market Overview, By Applications |

| 9.1. Nigeria Elevator and Escalator Market Revenue Share & Revenue, By Application 2022 & 2029F |

| 9.1.1. Nigeria Elevator and Escalator Market Revenue, By Commercial 2019-2029F |

| 9.1.2. Nigeria Elevator and Escalator Market Revenue, By Residential 2019-2029F |

| 9.1.3. Nigeria Elevator and Escalator Market Revenue, By Industrial 2019-2029F |

| 10. Nigeria Elevator and Escalator Market Key Performance Indicators |

| 11. Nigeria Elevator and Escalator Market- Opportunity assessment |

| 11.2. Nigeria Elevator and Escalator Market Opportunity Assessment, By Service, 2029F |

| 11.3. Nigeria Elevator and Escalator Market Opportunity Assessment, By Application, 2029F |

| 12. Nigeria Elevator and Escalator Market – Competitive Landscape |

| 12.1. Nigeria Elevator and Escalator Market Competitive Benchmarking, By Company |

| 12.2. Nigeria Elevator and Escalator Market Competitive Benchmarking, By Technical Parameters |

| 12.3. Nigeria Elevator and Escalator Market Competitive Benchmarking, By Operating Parameters |

| 13. Company Profile |

| 13.1. Otis Worldwide Corporation |

| 13.2. Schindler Holding Ltd. |

| 13.3. KONE Corporation |

| 13.4. Mitsubishi Electric Corporation |

| 13.5. TK Elevator GmbH |

| 13.6. Hyundai Elevator Co. Ltd |

| 13.7. FUJIHD Elevator Co.,Ltd. |

| 13.8. Hitachi Ltd |

| 13.9. Kleemann Hellas S.A. |

| 13.10. Akotex Elevator Company |

| 14. Key strategic recommendations |

| 15. Disclaimer |

| List of Figures |

| 1. Nigeria Elevator and Escalator Market Revenues and Volume, 2019-2029F ($ Million, Units) |

| 2. Nigeria Elevator and Escalator Market Revenue Share, By Types, 2022 & 2029F |

| 3. Nigeria Elevator and Escalator Market Volume Share, By Types, 2022 & 2029F |

| 4. Nigeria’s Anticipated Hotel Pipeline Onsite Construction Deals, 2022-2027F |

| 5. Nigeria New Installation Elevator Market Revenue Share, By Types, 2022 & 2029F |

| 6. Nigeria New Installation Elevator Market Volume Share, By Types, 2022 & 2029F |

| 7. Nigeria New Installation Escalator Market Revenue Share, By Types, 2022 & 2029F |

| 8: Nigeria New Installation Escalator Market Volume Share, By Types, 2022 & 2029F |

| 9. Nigeria Elevator and Escalator Market Revenue Share, By Services, 2022 & 2029F |

| 10. Nigeria Elevator and Escalator Market Revenue Share, By Applications, 2022 & 2029F |

| 11. Number of Hotel Rooms Nigeria, 2019-2023E (In Thousand) |

| 12. Nigeria Elevator and Escalator Market Opportunity Assessment, By Services, 2029F |

| 13. Nigeria Elevator and Escalator Market Opportunity Assessment, By Applications, 2029F |

| 14. Nigeria Elevator and Escalator Market Revenue Share, By Company, 2023 |

| 15. Ongoing Total Pipeline By Industry, 2023 |

| 16. Sector-wise Number of Projects and their Value, 2022-27 |

| List of Tables |

| 1. Hotel Chain Development Pipeline in Nigeria, 2023-2025E |

| 2. Upcoming Skyscraper Projects in Nigeria, 2023-2025 |

| 3. Nigeria New Installation Elevator Market Revenues, By Types, 2019-2029F ($ Million) |

| 4. Nigeria New Installation Elevator Market Volume, By Types, 2019-2029F (Units) |

| 5. Nigeria New Installation Escalator Market Revenues, By Types, 2019-2029F ($ Million) |

| 6. Nigeria New Installation Escalator Market Volume, By Types, 2019-2029F (Units) |

| 7. Nigeria Elevator and Escalator Market Revenues, By Services, 2019-2029F ($ Million) |

| 8. Nigeria Elevator and Escalator Market Revenues, By Applications, 2019-2029F ($ Million) |

| 9. List of Planned and Under Construction Projects in Nigeria |

| 10. Nigeria Ongoing Infrastructure Projects 2023-2024 |

Market Forecast By Types (Elevator, Escalator, Moving Walkways), By Services (Maintenance & Repair, New Installation, Modernization), By End-User (Residential, Commercial, Public) And Competitive Landscape

| Product Code: ETC005709 | Publication Date: Sep 2020 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

Nigeria Elevator And Escalator Market is projected to grow over the coming years. Nigeria Elevator And Escalator Market report is a part of our periodical regional publication Africa Elevator And Escalator Market outlook report. 6W tracks elevator and escalator market for over 60 countries with individual country-wise market opportunity assessment and publishes with the report titled Global Elevator And Escalator Market outlook report annually.

Nigeria Elevator and Escalator Market report comprehensively covers the market by Types, Services and End Users. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities, high growth areas, and market drivers, which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Nigeria Elevator and escalator market Synopsis

Nigeria Elevator and escalator market is expected to gain momentum during the upcoming years owing to the growing residential sector. The rising development of infrastructure along with increasing number of multicomplexes and shopping malls is driving the Nigeria Elevator and escalator market growth. Moreover, the upsurge in the ageing population backed by rising penetration towards comfort beholds the development of the market. The rising disposable income coupled with improvement in the standard of living is one of the major factor contributing to the Nigeria Elevator and escalator market Revenue.

According to 6Wresearch, the Nigeria Elevator And Escalator Market size is expected to record growth during 2020-2026. The rising initiatives taken by the government to improve the infrastructure coupled with strengthening of tourism rector and building of hotels drives the growth of the market. However, the outbreak of COVID-19 led to the decline in Nigeria elevator and escalator market share due to the shutting down of multicomplexes. The nationwide lockdown also led to the disruption in supply chain.

Market Analysis by type

Based on type, the elevator segment occupied the largest share and is expected t6o lead the market during the upcoming years as well owing to the strengthening of construction sector.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2016 to 2019.

- Base Year: 2019

- Forecast Data until 2026.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Nigeria Elevator and Escalator Market Outlook

- Market Size of Nigeria Elevator and Escalator Market, 2019

- Forecast of Nigeria Elevator and Escalator Market, 2026

- Historical Data and Forecast of Nigeria Elevator and Escalator Revenues & Volume for the Period 2016 - 2026

- Nigeria Elevator and Escalator Market Trend Evolution

- Nigeria Elevator and Escalator Market Drivers and Challenges

- Nigeria Elevator and Escalator Price Trends

- Nigeria Elevator and Escalator Porter's Five Forces

- Nigeria Elevator and Escalator Industry Life Cycle

- Historical Data and Forecast of Nigeria Elevator and Escalator Market Revenues & Volume By Types for the Period 2016 - 2026

- Historical Data and Forecast of Nigeria Elevator and Escalator Market Revenues & Volume By Elevator for the Period 2016 - 2026

- Historical Data and Forecast of Nigeria Elevator and Escalator Market Revenues & Volume By Escalator for the Period 2016 - 2026

- Historical Data and Forecast of Nigeria Elevator and Escalator Market Revenues & Volume By Moving Walkways for the Period 2016 - 2026

- Historical Data and Forecast of Nigeria Elevator and Escalator Market Revenues & Volume By Services for the Period 2016 - 2026

- Historical Data and Forecast of Nigeria Elevator and Escalator Market Revenues & Volume By Maintenance & Repair for the Period 2016 - 2026

- Historical Data and Forecast of Nigeria Elevator and Escalator Market Revenues & Volume By New Installation for the Period 2016 - 2026

- Historical Data and Forecast of Nigeria Elevator and Escalator Market Revenues & Volume By Modernization for the Period 2016 - 2026

- Historical Data and Forecast of Nigeria Elevator and Escalator Market Revenues & Volume By End-User for the Period 2016 - 2026

- Historical Data and Forecast of Nigeria Elevator and Escalator Market Revenues & Volume By Residential for the Period 2016 - 2026

- Historical Data and Forecast of Nigeria Elevator and Escalator Market Revenues & Volume By Commercial for the Period 2016 - 2026

- Historical Data and Forecast of Nigeria Elevator and Escalator Market Revenues & Volume By Public for the Period 2016 - 2026

- Nigeria Elevator and Escalator Import Export Trade Statistics

- Market Opportunity Assessment By Types

- Market Opportunity Assessment By Services

- Market Opportunity Assessment By End-User

- Nigeria Elevator and Escalator Top Companies Market Share

- Nigeria Elevator and Escalator Competitive Benchmarking By Technical and Operational Parameters

- Nigeria Elevator and Escalator Company Profiles

- Nigeria Elevator and Escalator Key Strategic Recommendations

Market Segmentation:

The report provides a detailed analysis of the following market segments:

- By Types

- Elevator

- Escalator

- Moving Walkways

- By Services

- Maintenance & Repair

- New Installation

- Modernization

- By End-User

- Residential

- Commercial

- Public

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero