Pakistan Pasta Market (2025-2031) | Size, Industry, Trends, Growth, Companies, Outlook, Revenue, Value, Analysis, Forecast & Share

Market Forecast By Raw Material (Barley, Durum Wheat Semolina, Wheat, Maize, Rice, Others), By Product Raw Materials (Canned/Preserved Pasta, Fresh/Chilled Pasta, Dried Pasta, Others), By Distribution Channel (Hypermarkets, Supermarkets, Independent Small Groceries, Discounters, E-commerce Stores, Others) And Competitive Landscape

| Product Code: ETC027597 | Publication Date: Jun 2023 | Updated Date: Jan 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

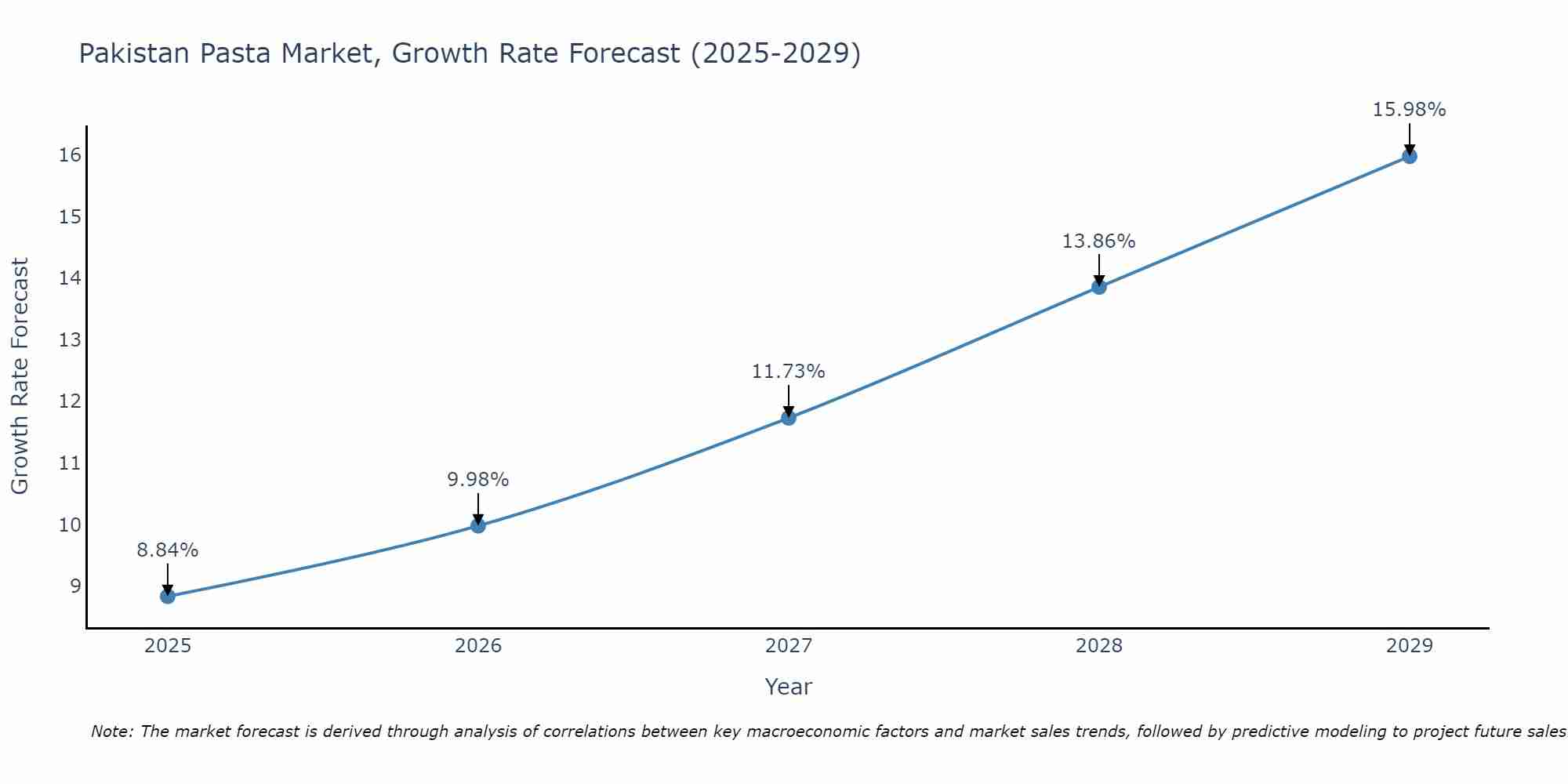

Pakistan Pasta Market Size Growth Rate

The Pakistan Pasta Market is likely to experience consistent growth rate gains over the period 2025 to 2029. The growth rate starts at 8.84% in 2025 and reaches 15.98% by 2029.

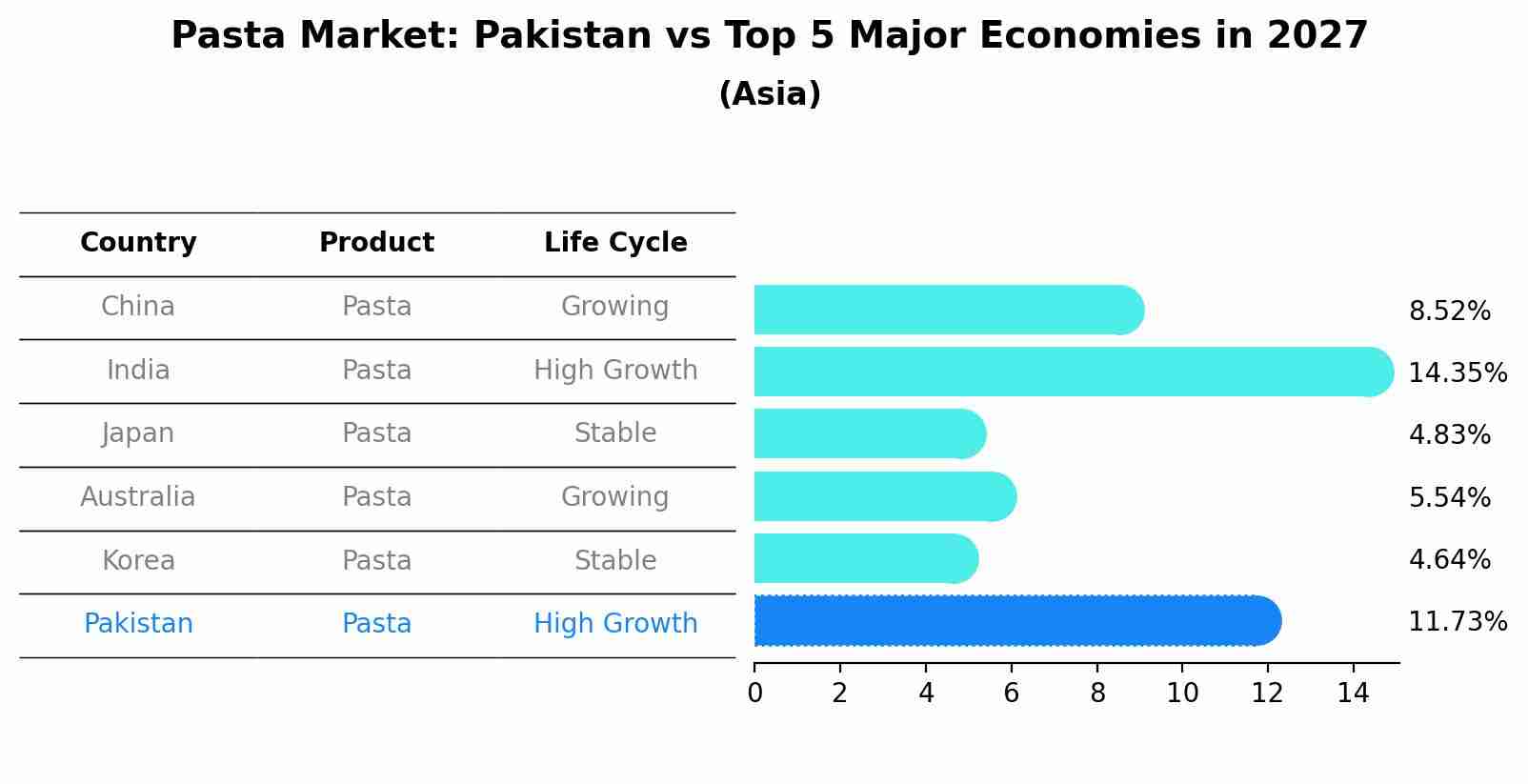

Pasta Market: Pakistan vs Top 5 Major Economies in 2027 (Asia)

The Pasta market in Pakistan is projected to grow at a high growth rate of 11.73% by 2027, highlighting the country's increasing focus on advanced technologies within the Asia region, where China holds the dominant position, followed closely by India, Japan, Australia and South Korea, shaping overall regional demand.

Pakistan Pasta Market Highlights

| Report Name | Pakistan Pasta Market |

| Forecast period | 2025-2031 |

| CAGR | 6% |

| Growing Sector | Food |

Topics Covered in the Pakistan Pasta Market Report

Pakistan Pasta Market report thoroughly covers the raw material, product raw material and distribution channel. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Pakistan Pasta Market Synopsis

The Pakistan pasta market has seen steady growth in recent years, driven by several key factors. Changing consumer preferences, particularly among younger generations, have led to a greater demand for convenient, quick, and diverse meal options. Increasing urbanization has expanded access to supermarkets and modern retail channels, while rising disposable incomes have allowed more consumers to afford a variety of pasta products, including premium and international brands.

According to 6Wresearch, the Pakistan Pasta Market revenue is expected to reach at a significant CAGR of 6% during the forecast period 2025-2031. The Pakistan pasta market is influenced by several key drivers that are shaping its growth. A significant factor is the rising population and urbanization, which is leading to changing dietary habits and a shift towards more convenience-oriented food products like pasta. The increasing awareness of Western cuisines, especially among the younger population, is also contributing to the growing demand for pasta varieties. Additionally, the government's initiatives to enhance the agricultural sector and support local manufacturers have created favorable conditions for domestic pasta production, thereby reducing reliance on imports, leading to the Pakistan Pasta Market growth.

However, the market faces several challenges that need to be addressed to sustain growth. Infrastructure limitations, such as inadequate cold chain facilities and transportation networks, pose logistical challenges for both producers and retailers. Furthermore, fluctuating raw material prices, particularly wheat, can impact production costs and, consequently, the final product prices. Another challenge is consumer perception; pasta must compete with traditional staple foods, and increasing its acceptance requires targeted marketing efforts and educational campaigns about its nutritional value.

Pakistan Pasta Market Trends

The Pakistan pasta market has witnessed certain trends which are expected to continue over the forecast period. One of the major trends is the introduction of new flavors and variants by key players to cater to the diverse tastes of consumers. Additionally, there has been a rise in demand for organic and gluten-free pasta products among health-conscious consumers, leading to an increase in production by manufacturers.

Investment Opportunities in the Pakistan Pasta Market

Investors can find promising opportunities in Pakistan's evolving pasta market, driven by changing consumer preferences and supportive governmental policies. One potential area is the expansion of local production facilities. Investing in state-of-the-art manufacturing plants equipped with modern technology can enhance production efficiency and ensure higher quality standards, meeting both domestic needs and potential export demands. Additionally, the rising preference for health-conscious products offers a lucrative investment avenue. Companies can focus on producing whole grain, gluten-free, or fortified pasta varieties that cater to the growing segment of health-focused consumers.

Leading Players of the Pakistan Pasta Market

Some of the major key players in the Pakistan pasta market include National Foods Limited, Shan Foods Private Limited, Continental Biscuits Limited, and Lazzat Foods. These players are adopting various strategies such as new product launches, partnerships, and acquisitions to maintain their position in the market.

Government Regulations Introduced in the Pakistan Pasta Market

The Pakistan government has established regulations regarding the labeling and packaging of food products to ensure consumer safety and maintain product quality. These regulations require clear and accurate information on ingredients, nutritional values, and expiration dates, building consumer trust. Additionally, strict import regulations have boosted demand for domestic pasta brands by limiting foreign competition and encouraging local production. The government has also launched various initiatives to promote healthier eating habits, including awareness campaigns about nutritious food choices. These efforts have further contributed to the growth of the pasta market, particularly as health-conscious consumers seek healthier alternatives like whole wheat and organic pasta.

Future Insights of the Pakistan Pasta Market

The future of the Pakistan pasta industry appears promising, driven by trends that are poised to shape consumer dynamics and drive market growth. Consumer preferences are increasingly leaning towards convenience, fostering demand for ready-to-cook and easy-to-prepare pasta varieties. This shift is anticipated to drive innovations in packaging and product offerings, making pasta even more appealing to busy urban lifestyles. Additionally, as global culinary influences continue to permeate the region, there is a growing interest in gourmet and international pasta variants. This offers opportunities for brands to experiment with flavors and ingredients that appeal to a diverse palate.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories.

Durum Wheat Semolina to Dominate the Market - By Raw Material

According to Ravi Bhandari, Research Head, 6wresearch, the segment using durum wheat semolina has experienced the most significant growth in Pakistan. Durum wheat is the preferred raw material for pasta production due to its high protein content and superior cooking quality, resulting in a better texture and taste.

Dried Pasta to dominate the market - By Product Raw Material

Dried pasta remains the fastest-growing segment in Pakistan's pasta market. Its convenience, long shelf life, and ease of preparation make it the preferred choice for busy consumers. As lifestyles become more fast-paced and demand for quick, ready-to-cook meals increases, dried pasta’s popularity has surged.

Supermarkets to Dominate the Market – By Distribution Channel

The supermarket channel has seen the most growth in the distribution of pasta products in Pakistan. As urbanization increases, supermarkets have become the primary retail destination for pasta, offering a wide range of domestic and international brands.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects

Key Highlights of the Report:

- Pakistan Pasta Market Outlook

- Market Size of Pakistan Pasta Market, 2024

- Forecast of Pakistan Pasta Market, 2031

- Historical Data and Forecast of Pakistan Pasta Revenues & Volume for the Period 2021-2031

- Pakistan Pasta Market Trend Evolution

- Pakistan Pasta Market Drivers and Challenges

- Pakistan Pasta Price Trends

- Pakistan Pasta Porter's Five Forces

- Pakistan Pasta Industry Life Cycle

- Historical Data and Forecast of Pakistan Pasta Market Revenues & Volume By Raw Material for the Period 2021-2031

- Historical Data and Forecast of Pakistan Pasta Market Revenues & Volume By Barley for the Period 2021-2031

- Historical Data and Forecast of Pakistan Pasta Market Revenues & Volume By Durum Wheat Semolina for the Period 2021-2031

- Historical Data and Forecast of Pakistan Pasta Market Revenues & Volume By Wheat for the Period 2021-2031

- Historical Data and Forecast of Pakistan Pasta Market Revenues & Volume By Maize for the Period 2021-2031

- Historical Data and Forecast of Pakistan Pasta Market Revenues & Volume By Rice for the Period 2021-2031

- Historical Data and Forecast of Pakistan Pasta Market Revenues & Volume By Others for the Period 2021-2031

- Historical Data and Forecast of Pakistan Pasta Market Revenues & Volume By Product Raw Materials for the Period 2021-2031

- Historical Data and Forecast of Pakistan Pasta Market Revenues & Volume By Canned/Preserved Pasta for the Period 2021-2031

- Historical Data and Forecast of Pakistan Pasta Market Revenues & Volume By Fresh/Chilled Pasta for the Period 2021-2031

- Historical Data and Forecast of Pakistan Pasta Market Revenues & Volume By Dried Pasta for the Period 2021-2031

- Historical Data and Forecast of Pakistan Pasta Market Revenues & Volume By Others for the Period 2021-2031

- Historical Data and Forecast of Pakistan Pasta Market Revenues & Volume By Distribution Channel for the Period 2021-2031

- Historical Data and Forecast of Pakistan Pasta Market Revenues & Volume By Hypermarkets for the Period 2021-2031

- Historical Data and Forecast of Pakistan Pasta Market Revenues & Volume By Supermarkets for the Period 2021-2031

- Historical Data and Forecast of Pakistan Pasta Market Revenues & Volume By Independent Small Groceries for the Period 2021-2031

- Historical Data and Forecast of Pakistan Pasta Market Revenues & Volume By Discounters for the Period 2021-2031

- Historical Data and Forecast of Pakistan Pasta Market Revenues & Volume By E-commerce Stores for the Period 2021-2031

- Historical Data and Forecast of Pakistan Pasta Market Revenues & Volume By Others for the Period 2021-2031

- Pakistan Pasta Import Export Trade Statistics

- Market Opportunity Assessment By Raw Material

- Market Opportunity Assessment By Product Raw Materials

- Market Opportunity Assessment By Distribution Channel

- Pakistan Pasta Top Companies Market Share

- Pakistan Pasta Competitive Benchmarking By Technical and Operational Parameters

- Pakistan Pasta Company Profiles

- Pakistan Pasta Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Raw Material

- Barley

- Durum Wheat Semolina

- Wheat

- Maize

- Rice

- Others

By Product

- Canned/Preserved Pasta

- Fresh/Chilled Pasta

- Dried Pasta

- Others

By Distribution Channel

- Hypermarkets

- Supermarkets

- Independent Small Groceries

- Discounters

- E-commerce Stores

- Others

Pakistan Pasta Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Pakistan Pasta Market Overview |

| 3.1 Pakistan Country Macro Economic Indicators |

| 3.2 Pakistan Pasta Market Revenues & Volume, 2021 & 2031F |

| 3.3 Pakistan Pasta Market - Industry Life Cycle |

| 3.4 Pakistan Pasta Market - Porter's Five Forces |

| 3.5 Pakistan Pasta Market Revenues & Volume Share, By Raw Material, 2021 & 2031F |

| 3.6 Pakistan Pasta Market Revenues & Volume Share, By Product Raw Materials, 2021 & 2031F |

| 3.7 Pakistan Pasta Market Revenues & Volume Share, By Distribution Channel, 2021 & 2031F |

| 4 Pakistan Pasta Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Pakistan Pasta Market Trends |

| 6 Pakistan Pasta Market, By Types |

| 6.1 Pakistan Pasta Market, By Raw Material |

| 6.1.1 Overview and Analysis |

| 6.1.2 Pakistan Pasta Market Revenues & Volume, By Raw Material, 2021 - 2031F |

| 6.1.3 Pakistan Pasta Market Revenues & Volume, By Barley, 2021 - 2031F |

| 6.1.4 Pakistan Pasta Market Revenues & Volume, By Durum Wheat Semolina, 2021 - 2031F |

| 6.1.5 Pakistan Pasta Market Revenues & Volume, By Wheat, 2021 - 2031F |

| 6.1.6 Pakistan Pasta Market Revenues & Volume, By Maize, 2021 - 2031F |

| 6.1.7 Pakistan Pasta Market Revenues & Volume, By Rice, 2021 - 2031F |

| 6.1.8 Pakistan Pasta Market Revenues & Volume, By Others, 2021 - 2031F |

| 6.2 Pakistan Pasta Market, By Product Raw Materials |

| 6.2.1 Overview and Analysis |

| 6.2.2 Pakistan Pasta Market Revenues & Volume, By Canned/Preserved Pasta, 2021 - 2031F |

| 6.2.3 Pakistan Pasta Market Revenues & Volume, By Fresh/Chilled Pasta, 2021 - 2031F |

| 6.2.4 Pakistan Pasta Market Revenues & Volume, By Dried Pasta, 2021 - 2031F |

| 6.2.5 Pakistan Pasta Market Revenues & Volume, By Others, 2021 - 2031F |

| 6.3 Pakistan Pasta Market, By Distribution Channel |

| 6.3.1 Overview and Analysis |

| 6.3.2 Pakistan Pasta Market Revenues & Volume, By Hypermarkets, 2021 - 2031F |

| 6.3.3 Pakistan Pasta Market Revenues & Volume, By Supermarkets, 2021 - 2031F |

| 6.3.4 Pakistan Pasta Market Revenues & Volume, By Independent Small Groceries, 2021 - 2031F |

| 6.3.5 Pakistan Pasta Market Revenues & Volume, By Discounters, 2021 - 2031F |

| 6.3.6 Pakistan Pasta Market Revenues & Volume, By E-commerce Stores, 2021 - 2031F |

| 6.3.7 Pakistan Pasta Market Revenues & Volume, By Others, 2021 - 2031F |

| 7 Pakistan Pasta Market Import-Export Trade Statistics |

| 7.1 Pakistan Pasta Market Export to Major Countries |

| 7.2 Pakistan Pasta Market Imports from Major Countries |

| 8 Pakistan Pasta Market Key Performance Indicators |

| 9 Pakistan Pasta Market - Opportunity Assessment |

| 9.1 Pakistan Pasta Market Opportunity Assessment, By Raw Material, 2021 & 2031F |

| 9.2 Pakistan Pasta Market Opportunity Assessment, By Product Raw Materials, 2021 & 2031F |

| 9.3 Pakistan Pasta Market Opportunity Assessment, By Distribution Channel, 2021 & 2031F |

| 10 Pakistan Pasta Market - Competitive Landscape |

| 10.1 Pakistan Pasta Market Revenue Share, By Companies, 2024 |

| 10.2 Pakistan Pasta Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero