Peru Electric Motor Market (2025-2031) | Trends, Companies, Revenue, Growth, Forecast, Share, Size, Outlook, Industry, Value & Analysis

Market Forecast By Motor Type (Alternate Current (AC) Motor, Direct Current (DC) Motor, Hermetic Motor), By Output Power, By Voltage Range (9 V & Below, 10-20 V, 21-60 V, 60 V & Above), By Application (Industrial machinery, Motor vehicles, Heating, ventilating, and cooling (HVAC) equipment, Aerospace & transportation, Household appliances, Other), By Speed (RPM) (Low-Speed Electric Motors (Less Than 1,000 RPM), Medium-Speed Electric Motors (1,001-25,000 RPM), High-Speed Electric Motors (25,001-75,000 RPM), Ultrahigh-Speed Electric Motors (Greater Than 75,001 RPM)) And Competitive Landscape

| Product Code: ETC041087 | Publication Date: Jan 2021 | Updated Date: Sep 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

Peru Electric Motor Market | Country-Wise Share and Competition Analysis

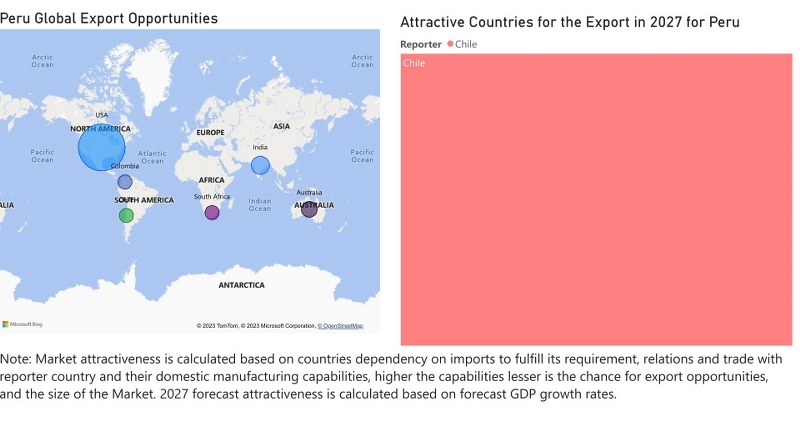

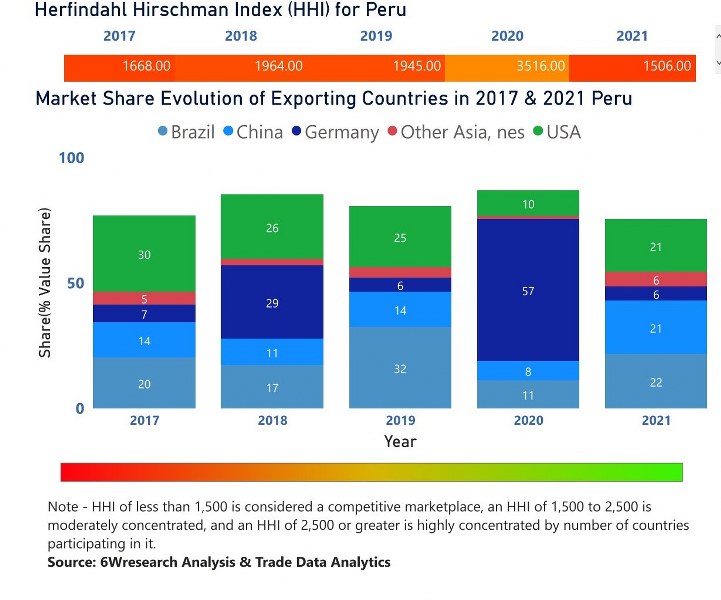

In the year 2021, Brazil was the largest exporter in terms of value, followed by China. It has registered a growth of 0.36% over the previous year. While China registered a growth of 43.71% as compare to the previous year. In the year 2017 USA was the largest exporter followed by Brazil. In term of Herfindahl Index, which measures the competitiveness of countries exporting, Peru has the Herfindahl index of 1668 in 2017 which signifies moderately concentrated also in 2021 it registered a Herfindahl index of 1506 which signifies moderately concentrated in the market.

![Peru Electric Motor Market | Country-Wise Share and Competition Analysis]() Oman Electric Motor Market - Export Market Opportunities

Oman Electric Motor Market - Export Market Opportunities

Peru Electric Motor Market Growth Rate

According to 6Wresearch internal database and industry insights, the Peru Electric Motor Market is projected to grow at a compound annual growth rate (CAGR) of 8.7% during the forecast period 2025–2031.

Peru Electric Motor Market Highlights

| Report Name | Peru Electric Motor Market |

| Forecast Period | 2025–2031 |

| CAGR | 8.7% |

| Growing Sector | Mining & Water Utilities |

Topics Covered in the Peru Electric Motor Market Report

The Peru Electric Motor Market report thoroughly covers the market by motor type, by output power, by voltage, by range, by application, and by speed (RPM). The market report provides an unbiased and detailed analysis of ongoing market trends, opportunities/high growth areas, and market drivers, which would help stakeholders to devise and align their market strategies according to the current and future market dynamics.

Peru Electric Motor Market Synopsis

Peru Electric Motor Market is experiencing healthy growth over the years as the large-scale mining investments, water security programs, and grid-connected renewable projects are pushing the growth of market. In Peru, copper, zinc, and silver operations rely on rugged, high-efficiency motors for conveyors, crushers, ventilation fans, and pumping. In some area of Peru, urbanization is expanding along with infrastructure upgrades such as metro lines and airport expansions, is further boosting demand across HVAC, industrial machinery, and transport-related applications.

Evaluation of Growth Drivers in the Peru Electric Motor Market

Below mentioned some growth drivers and their impact on market dynamics:

| Drivers | Primary Segments Affected | Why it Matters |

| Mining Expansion & Brownfield Upgrades | Industrial machinery, Utilities | Large copper and polymetallic mines require medium- and high-voltage motors for mills, hoists, ventilation, and dewatering; brownfield debottlenecking sustains replacement demand. |

| Urban Water & Wastewater Projects | Utilities | Upgrades by utilities such as SEDAPAL and regional providers drive continuous demand for high-reliability pumping motors and VFD-integrated systems. |

| Food Processing & Cold Chain | Industrial machinery, HVAC | Expansion of agro-exports increasing the use of motors in compressors, refrigeration, and packaging lines. |

| Renewable Energy (Wind/Solar) | Utilities, Other (pumping) | New wind corridors along the coast and solar in the south elevate demand for IE3/IE4 motors in balance-of-plant and solar pumping. |

| Transport & Infrastructure | HVAC, Motor vehicles | Mass transit expansion in Lima and airport modernizations increase installations of efficient HVAC and traction-related auxiliary motors. |

Peru Electric Motor Market Size is projected to expand at a CAGR of 8.7% during the forecast period 2025-2031. Mining remains as driving sector in this market, while municipal water resilience and renewable additions broaden the base. Several factors are driving the growth, including a rise in foreign investments in the country's manufacturing sector, the increasing adoption of automation in the industrial sector, and the need for energy-efficient motors. The country has experienced a surge in construction activities due to a growing urban population, which has resulted in a high demand for motors in the construction sector. Further, the emphasis is growing on energy efficiency and workforce upskilling via technical institutes, is catalysing adoption of premium-efficiency motors.

Evaluation of Restraints in the Peru Electric Motor Market

Below mentioned are some major restraints and their influence on market dynamics:

| Restraints | Primary Segments Affected | What this Means |

| Import Dependence & FX Volatility | All Segments | Exchange-rate swings and shipping lead times impact project budgets and stocking strategies. |

| Altitude & Harsh Operating Conditions | Industrial machinery, Utilities | High-elevation mines and dusty environments necessitate derating, specialized cooling, and IP/NEMA protection raising capex. |

| SME Cost Sensitivity | HVAC, Industrial machinery | Many SMEs delay upgrades to IE3/IE4, favouring the lower upfront-cost IE1/IE2 units. |

| Grid & Power Quality Issues | Utilities, Industrial machinery | Voltage dips and harmonics in remote sites increase failures without VFDs/filters, elevating lifecycle costs. |

| Permitting & Social Delays | Utilities, Infrastructure | Project timelines can slip due to permitting, community consultation, or right-of-way issues, deferring motor demand. |

Peru Electric Motor Market Challenges

There are many challenges which are influencing the Peru Electric Motor Market include the limited depth of domestic motor manufacturing and component ecosystems, which make the market dependent on imports and regional hubs. Secondly, the high-altitude deployments demand downsizing and specialized enclosures, while coastal salinity and desert dust accelerate wear without proper coatings and filtration. Also, there is skill gap for advanced automation and predictive maintenance persists outside the major urban centres, stretching the commissioning and reversal times.

Peru Electric Motor Market Trends

Some major trends contributing in the market are:

- Shift to IE3/IE4 Motors: In industries, users are transitioning to premium efficiency classes to cut operation costs and to meet the tight energy guidelines such as mines and water utilities lead early adoption.

- Variable Frequency Drives & Digitalization: VFD-integrated motors with IoT condition monitoring are scaling in dewatering, ventilation, and booster stations, enabling energy savings and predictive maintenance.

- Explosion-Proof & Safety-Certified Designs: Hazardous-area motors are growing for underground mining and processing facilities to meet international safety norms.

- Hybrid & Solar Pumping in Rural Andes: Off-grid or weak-grid areas adopt solar–diesel hybrid pumping systems, lifting demand for robust IE2/IE3 motors and controls.

- Corrosion-Resistant & Tropicalized Builds: Seaside plants require anti-corrosion coatings, stainless hardware, and IP66/Type 4X enclosures to withstand saline, fog, and dust.

Investment Opportunities in the Peru Electric Motor Industry

Here are some investment opportunities in the Peru Electric Motor Industry:

- High-Efficiency Motors: Policies are supporting for energy savings in utilities and large industry underpins sustained demand for IE3/IE4 replacements and retrofits.

- Smart Motor Systems: Bundled motor + VFD + IoT packages are increasingly preferred in mines and water networks to minimize downtime and optimize power.

- Service, Repair & Training Hubs: Regional centres in Arequipa, Trujillo, and Piura can reduce turnaround times and build local skills for harsh-duty applications.

- Irrigation & Water Transfer: Large pumping for coastal valleys and highland irrigation expands demand for medium-voltage motors and soft starters.

- Transport & HVAC Upgrades: Public works and private real estate growth support the high-efficiency HVAC motors and drives for stations, terminals, and commercial buildings.

Top 5 Leading Players in the Peru Electric Motor Market

Here are some major companies include:

1. ABB

| Company Name | ABB |

| Established Year | 1988 |

| Headquarters | Zürich, Switzerland |

| offical Website | Click Here |

This company supplies high-efficiency motors, VFDs, and automation solutions widely used in Peru’s mining ventilation, mill drives auxiliaries, and municipal water pumping stations.

2. Siemens

| Company Name | Siemens |

| Established Year | 1847 |

| Headquarters | Munich, Germany |

| offical Website | Click Here |

This company provides low- and medium-voltage motors, servo drives, and integrated automation platforms with strong references in infrastructure, water utilities, and processing plants.

3. WEG

| Company Name | WEG |

| Established Year | 1961 |

| Headquarters | Jaragua do Sul, Brazil |

| offical Website | Click Here |

This company delivers rugged motors and drives suited to coastal salinity and dusty mine conditions; strong footprint in aggregates, food processing, and utilities.

4. Nidec

| Company Name | Nidec |

| Established Year | 1973 |

| Headquarters | Kyoto, Japan |

| offical Website | Click Here |

This company offers a broad portfolio from fractional to large industrial motors and traction-related solutions, serving OEMs in HVAC, appliances, and transport.

5. Regal Rexnord

| Company Name | Regal Rexnord |

| Established Year | 1955 |

| Headquarters | Milwaukee, USA |

| offical Website | Click Here |

This company provides energy-efficient motors, gear drives, and condition-monitoring solutions for conveying, packaging, and fluid handling in industrial and commercial sites.

Government Regulations Introduced in the Peru Electric Motor Market

According to Peruvian Government Data, some guidance is issued by government on energy efficiency in the Peru Electric Motor Industry. Authorities are promoting higher minimum performance levels for industrial motors through these standards coordinated by the Ministry of Energy and Mines (MINEM) and the national standards body (INACAL). Publicly funded water and wastewater projects increasingly specify IE3 motors, and incentives support the efficiency upgrades and smart controls in priority sectors. Renewable-energy-linked pumping solutions are encouraged in remote areas to reduce diesel use and emissions.

Future Insights of the Peru Electric Motor Market

The future outlook Peru Electric Motor Market is positive as mining throughput, water resilience initiatives, and coastal infrastructure upgrades continue. In the coming years, the adoption of premium-efficiency motors, advanced drives, and predictive maintenance is raising, while regional service hubs shorten the downtime. Further, local workforce development and OEM–distributor partnerships are expected to expand, to improve the after-sales support and total cost of ownership for end-users in challenging coastal and high-altitude environments.

Market Segmentation Analysis

The report offers a comprehensive study of the following market segments and their leading categories:

1-100 kW Motors to Dominate the Market – By Output Power

According to Sachin, Senior Research Analyst,6Wresearch, motors in the range of 1-100 kW band are projected to lead the market due to its broad use in mine auxiliary systems, municipal water pumping, and commercial/industrial HVAC. Further, sub-1 kW units address appliances and light machinery, while >100 kW motors serve critical heavy-duty applications such as large slurry pumping and crushing important but fewer in installed base compared to the versatile mid-range.

60 V & Above Motors to Dominate the Market – By Voltage Range

60 V & Above segments are set to lead the market due to the prevalence of medium-voltage equipment in mining and large water transfer schemes. Further, lower-voltage categories address appliances, controls, and light-duty equipment, but large infrastructure and process industries prefer higher voltages for efficiency, reduced line losses, and better torque characteristics over long duty cycles.

Alternate Current (AC) Motors to Dominate the Market – By Motor Type

AC motors are set to command the market owing to their robustness, cost-efficiency, and compatibility with VFDs across mines, utilities, and HVAC. DC and hermetic motors have defined niches, yet the scale of AC deployment in process industries and municipal services secures its lead.

Industrial Machinery to Dominate the Market – By Application

Industrial machinery is predicted to capture the largest Peru Electric Motor Market Share, led by mining, food processing, and packaging. Utilities (water/wastewater) and HVAC remain significant contributors, while motor vehicles and other transport-linked applications add steady auxiliary demand in depots, terminals, and workshops.

Medium-Speed Motors to Dominate the Market – By Speed (RPM)

Medium-Speed Electric Motors are likely to lead due to their broad deployment in pumps, compressors, blowers, and conveyors across industrial plants and utilities. And, low-speed motors are important in high-torque duties, while high- and ultrahigh-speed categories address specialized equipment. Further, medium-speed units strike the best balance of efficiency, reliability, and versatility for core applications of Peru.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024.

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects

Key Highlights of the Report:

- Peru Electric MotorOutlook

- Market Size ofPeru Electric Motor market, 2024

- Forecast ofPeru Electric Motor market, 2031

- Historical Data and Forecast ofPeru Electric MotorRevenues & Volume for the Period

- 2021-2031

- Peru Electric Motor Trend Evolution

- Peru Electric Motor Drivers and Challenges

- Peru Electric MotorPrice Trends

- Peru Electric MotorPorter's Five Forces

- Peru Electric MotorIndustry Life Cycle

- Historical Data and Forecast of Peru Electric Motor Revenues & Volume By Motor Type for the Period 2021-2031

- Historical Data and Forecast of Peru Electric Motor Revenues & Volume ByAlternate Current (AC) Motorfor the Period 2021-2031

- Historical Data and Forecast of Peru Electric Motor Revenues & Volume ByDirect Current (DC) Motorfor the Period 2021-2031

- Historical Data and Forecast of Peru Electric Motor Revenues & Volume ByHermetic Motorfor the Period 2021-2031

- Historical Data and Forecast of Peru Electric Motor Revenues & Volume By Voltage Range for the Period 2021-2031

- Historical Data and Forecast of Peru Electric Motor Revenues & Volume By9 V & Belowfor the Period 2021-2031

- Historical Data and Forecast of Peru Electric Motor Revenues & Volume By10-20 Vfor the Period 2021-2031

- Historical Data and Forecast of Peru Electric Motor Revenues & Volume By21-60 Vfor the Period 2021-2031

- Historical Data and Forecast of Peru Electric Motor Revenues & Volume By60 V & Abovefor the Period 2021-2031

- Historical Data and Forecast of Peru Electric Motor Revenues & Volume By Application for the Period 2021-2031

- Historical Data and Forecast of Peru Electric Motor Revenues & Volume ByIndustrial Machineryfor the Period 2021-2031

- Historical Data and Forecast of Peru Electric Motor Revenues & VolumeBy Motor Vehiclesfor the Period 2021-2031

- Historical Data and Forecast of Peru Electric Motor Revenues & VolumeBy Heatingfor the Period 2021-2031

- Historical Data and Forecast of Peru Electric Motor Revenues & Volume By Ventilatingfor the Period 2021-2031

- Historical Data and Forecast of Peru Electric Motor Revenues & Volume ByCooling (HVAC) Equipmentfor the Period 2021-2031

- Historical Data and Forecast of Peru Electric Motor Revenues & VolumeBy Aerospace & Transportationfor the Period 2021-2031

- Historical Data and Forecast of Peru Electric Motor Revenues & VolumeBy Household Appliancesfor the Period 2021-2031

- Historical Data and Forecast of Peru Electric Motor Revenues & Volume ByOtherfor the Period 2021-2031

- Historical Data and Forecast of Peru Electric Motor Revenues & Volume By Speed (RPM) for the Period 2021-2031

- Historical Data and Forecast of Peru Electric Motor Revenues & Volume By(Low-Speed Electric Motors (Less Than 1,000 RPM)for the Period 2021-2031

- Historical Data and Forecast of Peru Electric Motor Revenues & Volume ByMedium-Speed Electric Motors (1,001-25,000 RPM)for the Period 2021-2031

- Historical Data and Forecast of Peru Electric Motor Revenues & Volume ByHigh-Speed Electric Motors (25,001-75,000 RPM)for the Period 2021-2031

- Historical Data and Forecast of Peru Electric Motor Revenues & Volume ByUltrahigh-Speed Electric Motors (Greater Than 75,001 RPM)for the Period 2021-2031

- Peru Electric Motor Import Export Trade Statistics

- Market Opportunity Assessment By Motor Types

- Market Opportunity Assessment By Voltage Range

- Market Opportunity Assessment By Applications

- Market Opportunity Assessment By Speed

- Peru Electric Motor Top Companies Market Share

- Peru Electric Motor Competitive Benchmarking By Motor Types , voltage Range, Application and Speed

- Peru Electric Motor Company Profiles

- Peru Electric Motor Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Motor Type

- Alternate Current (AC) Motor

- Direct Current (DC) Motor

- Hermetic Motor

By Voltage Range

- 9 V & Below

- 10-20 V

- 21-60 V

- 60 V & Above

By Application

- Industrial Machinery

- Motor Vehicles

- Heating

- Ventilating, And Cooling (HVAC) Equipment

- Aerospace & Transportation

- Household Appliances

- Other

By Speed

- Low-Speed Electric Motors (Less Than 1,000 RPM)

- Medium-Speed Electric Motors (1,001-25,000 RPM)

- High-Speed Electric Motors (25,001-75,000 RPM)

- Ultrahigh-Speed Electric Motors (Greater Than 75,001 RPM)

Peru Electric Motor Market (2025-2031): FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of The Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. Peru Electric Motor Market Overview |

| 3.1. Peru Country Indicators |

| 3.2. Peru Electric Motor Market Revenues, 2021-2031F |

| 3.3. Peru Electric Motor Market Revenue Share, By Voltage, 2021 & 2031F |

| 3.4. Peru Electric Motor Market Revenue Share, By Types, 2021 & 2031F |

| 3.5. Peru Electric Motor Market Revenue Share, By Applications, 2021 & 2031F |

| 3.6. Peru Electric Motor Market Revenue Share, By End-Users, 2021 & 2031F |

| 3.7. Peru Electric Motor Market - Industry Life Cycle |

| 3.8. Peru Electric Motor Market - Porter’s Five Forces |

| 4. Peru Electric Motor Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.3. Market Restraints |

| 5. Peru Electric Motor Market Trends |

| 6. Peru Electric Motor Market Overview, By Voltage |

| 6.1. Peru Low Voltage Electric Motor Market Revenues, 2021-2031F |

| 6.2. Peru Medium Voltage Electric Motor Market Revenues, 2021-2031F |

| 6.3. Peru High Voltage Electric Motor Market Revenues, 2021-2031F |

| 7. Peru Electric Motor Market Overview, By Types |

| 7.1. Peru Electric Motor Market Revenues, By AC Type, 2021-2031F |

| 7.2. Peru Electric Motor Market Revenues, By DC Type, 2021-2031F |

| 8. Peru Electric Motor Market Overview, By Applications |

| 8.1. Peru Electric Motor Market Revenues, By Pump Application, 2021-2031F |

| 8.2. Peru Electric Motor Market Revenues, By Fan Application, 2021-2031F |

| 8.3. Peru Electric Motor Market Revenues, By Conveyor Application, 2021-2031F |

| 8.4. Peru Electric Motor Market Revenues, By Compressors Application, 2021-2031F |

| 8.5. Peru Electric Motor Market Revenues, By Other Applications, 2021-2031F |

| 9. Peru Electric Motor Market Overview, By End-Users |

| 9.1. Peru Electric Motor Market Revenues, By Industrial Processing, 2021-2031F |

| 9.2. Peru Electric Motor Market Revenues, By Commercial HVAC, 2021-2031F |

| 9.3. Peru Electric Motor Market Revenues, By Automotive, 2021-2031F |

| 9.4. Peru Electric Motor Market Revenues, By Consumer Appliances, 2021-2031F |

| 9.5. Peru Electric Motor Market Revenues, By Power Generation, 2021-2031F |

| 9.6. Peru Electric Motor Market Revenues, By Others, 2021-2031F |

| 10. Peru Electric Motor Market - Key Performance Indicators |

| 11. Peru Electric Motor Market - Opportunity Assessment |

| 11.1. Peru Electric Motor Market Opportunity Assessment, By Types, 2031F |

| 11.2. Peru Electric Motor Market Opportunity Assessment, By Applications, 2031F |

| 12. Peru Electric Motor Market Competitive Landscape |

| 12.1. Peru Electric Motor Market Revenue Share, By Companies, 2024 |

| 12.2. Peru Electric Motor Market Competitive Benchmarking, By Operating & Technical Parameters |

| 13. Company Profiles |

| 14. Key Recommendations |

| 15. Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Australia IT Asset Disposal Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero

Oman Electric Motor Market - Export Market Opportunities

Oman Electric Motor Market - Export Market Opportunities