Saudi Arabia Air Pollution Control Systems Market (2018-2024) | Forecast, Trends, Share, Size, Revenue, Companies, Industry, Analysis, Outlook, Growth & Value

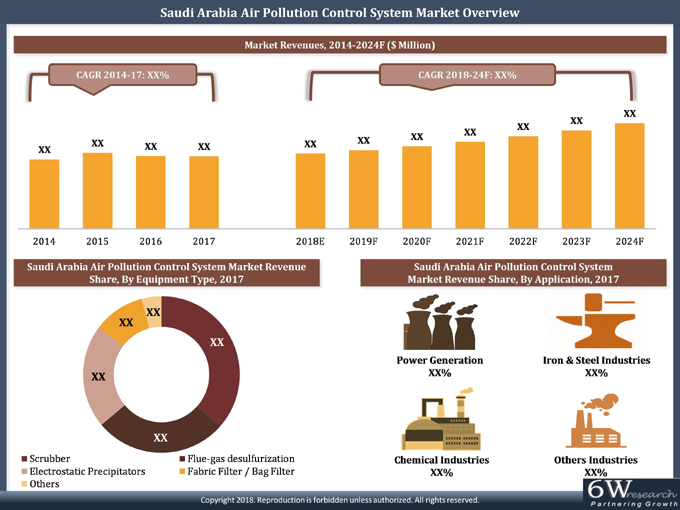

Market Forecast By Equipment Types (Electrostatic Precipitators (ESP), Flue-Gas Desulfurization (FGD), Scrubber, Fabric Filter / Bag Filter and Others), By Applications (Power Generation, Iron & Steel Industry, Chemical Industry, and Others), By Regions (Eastern, Western, Central and Southern) and Competitive Landscape

| Product Code: ETC000437 | Publication Date: Jan 2018 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 113 | No. of Figures: 44 | No. of Tables: 9 |

Saudi Arabia Air Pollution Control Systems Market is anticipated to register sound revenue in the next few years on the back of the rising vehicle emission, and dust storms are leading to instigate the product demand in the market in the coming timeframe. Additionally, the growing industrial landscape in the country is estimated to be of great importance for the product demand owing to the rising emission of carbon gas from industries, that simultaneously stimulates the nearby area’s population to install air pollution control systems in order to reduce the risk of respiratory disease, hence is estimated to spur the massive growth of the Saudi Arabia air pollution control systems market in the years ahead.

Air Pollution Control System (APCS) is an industrial equipment used to eliminate polluting contents from air released during industrial processing. APCs are majorly used in power generation, iron & steel, chemical, and cement manufacturing industries. In Saudi Arabia, the chemical industry sector holds the majority of the revenue share in the air pollution control system market due to the presence of a large number of petrochemical and chemical industries.According to 6Wresearch, Saudi Arabia air pollution control system market size is projected to grow at a CAGR of 5.8% during 2018-24. The industrial sector is expected to strengthen on account of increasing foreign investment which in turn is expected to yield a moderate growth in the air pollution control system market during the forecast period. Additionally, strict emission laws for industrial pollution content by the government would further surge the demand for APCS in the country. The Chemical and petrochemical sectors would continue to dominate the Saudi Arabia air pollution control systems market share over the coming years on account of growing downstream petrochemical industrial activities in Saudi Arabia. Additionally, growing investors' confidence and a rise in government spending for infrastructural development are likely to lead to the influx of new industries which would further surge the demand for APCS. The Saudi Arabia air pollution control systems market report thoroughly covers Saudi Arabia's air pollution control system market by equipment type, applications, and regions. The Saudi Arabia air pollution control systems market outlook report provides an unbiased and detailed analysis of the Saudi Arabia air pollution control systems market trends, opportunities, high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Saudi Arabia Air Pollution Control System Market day by day boosts the investment different sector of the manufacturing to work on the air pollution control system these activity impacts a lot to the country while generating awareness and enforcement of the air pollution control system. This is a positive impact on air pollution control in the coming years. The Chemical and petrochemical sectors dominate the air pollution control system market in Saudi Arabia growing more industries and activities relates to petrochemical. Saudi Arabia's air pollution control system market government also boosts the investment in manufacturing the industrial and different sectors also involved in the growth of Saudi Arabia. In the future governments plan to grow new more industries in the country. In Saudi Arabia introducing enforcement of air pollution norms and growing awareness about the air pollution and positive effect of installation rate of air pollution control system in the chemical, power generation industries as well as in petrochemical during the forecast period. According to the research in Saudi Arabia air pollution control systems market growing more in the future.

In Saudi Arabia Air Pollution Control Systems Market is a positive impact on air pollution control in the coming years. The Chemical and petrochemical sectors dominate the air pollution control system market in Saudi Arabia growing more industries and activities relates to petrochemical. Saudi Arabia Air Pollution Control System Market day by day boosts the investment different sector of the manufacturing to work on the air pollution control system these activity impacts a lot to the country while generating awareness and enforcement of the air pollution control system.

The Saudi Arabia Air Pollution Control Systems Market is expected to register significant revenue growth during the forecast period 2020-26F owing to the rising growth of the transport sector along with a surge in the mandates for regular pollution checks to address the rising environmental issues in the country. Further, an increase in the awareness regarding pollution check norms would reinforce the engagement of air pollution control systems in the petrochemical, chemical, and power generation industry also in the country six years down the line. The high rise growth of the petroleum industry, further, is anticipated to drive significant revenues for the growth of the Saudi Arabia air pollution control systems market in the years to come.

Saudi Arabia's air pollution control system market is projected to secure tremendous growth in the coming timeframe backed by the rising growth of the industrial landscape in the country. Further, the growing petrochemical industry is estimated to generate high sales revenues in the country underpinned by the rising chemical production use domestically for other product manufacturing and also rising export of chemicals this is leading to highly responsible for generating pollution and is boost the demand for air pollution control system in the manufacturing of petrochemical and is estimated to bolster the growth of the Saudi Arabia air pollution control system market in the years ahead.

Key Highlights of the Report:

• Saudi Arabia Air Pollution Control Systems Market Overview

• Saudi Arabia Air Pollution Control Systems Market Outlook

• Saudi Arabia Air Pollution Control Systems Market Forecast

• Historical Data of Air Pollution Control Market Revenues for the Period 2014-2017.

• Saudi Arabia Air Pollution Control Systems Market Size and Saudi Arabia Air Pollution Control

Systems Market Forecast of Revenues, until 2024.

• Historical Data of Air Pollution Control Market by Equipment Type for the Period 2014-2017.

• Market Size & Forecast of Saudi Arabia Air Pollution Control Systems Market Revenue, By Equipment Type until 2024.

• Historical Data of Saudi Arabia Air Pollution Control Systems Market Revenue, By Applications for the Period 2014-2017.

• Market Size & Forecast of Saudi Arabia Air Pollution Control Market Revenues, By Applications until 2024.

• Historical Data of Saudi Arabia Air Pollution Control Market Revenues, By Regions for the Period 2014-2017.

• Market Size & Forecast of Air Pollution Control Market Revenues, By Regions until 2024.

• Market Drivers and Restraints.

• Saudi Arabia Air Pollution Control Systems Market Trends and Developments

• Saudi Arabia Air Pollution Control Systems Market Share, By Players

• Saudi Arabia Air Pollution Control Systems Market Overview on Competitive Landscape

• Company Profiles.

• Key Strategic Pointers.

Markets Covered

The Saudi Arabia air pollution control systems market report provides a detailed analysis of the following market segments:

• By Equipment Types:

o Electrostatic Precipitators (ESP)

o Flue-gas desulfurization (FGD)

o Scrubber

o Fabric Filter / Bag Filter

o Others

• By Applications:

o Power Generation

o Iron & Steel Industry

o Chemical Industry

o Others

• By Regions:

o Eastern

o Western

o Central

o Southern

Frequently Asked Questions About the Market Study (FAQs):

1. Executive Summary

2. Introduction

2.1. Report Description

2.2. Key Highlights of the Report

2.3. Market Scope & Segmentation

2.4. Methodology Adopted and Key Data Points

2.5. Assumptions

3. Global Air Pollution Control System Market Overview

3.1. Global Air Pollution Control System Market Revenues, 2014-2024F

4. Saudi Arabia Air Pollution Control System Market Overview

4.1. Indonesia Country Overview

4.2. Saudi Arabia Air Pollution Control System Market Revenues, 2014-2024F

4.3. Saudi Arabia Air Pollution Control System Market Industry Life Cycle

4.4. Saudi Arabia Air Pollution Control System Market Porter Five Force Model

4.5. Saudi Arabia Air Pollution Control System Market Revenue Share, By Equipment Type, 2017 & 2024F

4.6. Saudi Arabia Air Pollution Control System Market Revenues Share, By Application, 2017 & 2024F

4.7. Saudi Arabia Air Pollution Control System Market Revenue Share, By Regions, 2017 & 2024F

5. Saudi Arabia Air Pollution Control System Market Dynamics

5.1. Impact Analysis

5.2. Market Drivers

5.3. Market Restraints

6. Saudi Arabia Air Pollution Control System Market Trends

6.1. Solar Powered Air Pollution Control System

7. Saudi Arabia Air Pollution Control System Market Overview, By Equipment Type

7.1. Saudi Arabia Electrostatic Precipitators Market Revenues, 2014-2024F

7.2. Saudi Arabia Flue-Gas Desulfurization Market Revenues, 2014-2024F

7.3. Saudi Arabia Scrubber Market Revenues, 2014-2024F

7.4. Saudi Arabia Fabric Filter Market Revenues, 2014-2024F

7.5. Saudi Arabia Other Air Pollution Control System Market Revenues, 2014-2024F

8. Saudi Arabia Air Pollution Control System Market Overview, By Application

8.1. Saudi Arabia Power Generation Industry Air Pollution Control System Market Revenues, 2014-2024F

8.2. Saudi Arabia Chemical Industry Air Pollution Control System Market Revenues, 2014-2024F

8.3. Saudi Arabia Iron & Steel industry Air Pollution Control System Market Revenues, 2014-2024F

8.4. Saudi Arabia Other End-User Industry Air Pollution Control System Market Revenues, 2014-2024F

9. Saudi Arabia Air Pollution Control System Market Overview, By Regions

9.1. Saudi Arabia Eastern Region Air Pollution Control System Market Revenues, 2014-2024F

9.2. Saudi Arabia Central Region Air Pollution Control System Market Revenues, 2014-2024F

9.3. Saudi Arabia Western Region Air Pollution Control System Market Revenues, 2014-2024F

9.4. Saudi Arabia Southern Region Air Pollution Control System Market Revenues, 2014-2024F

10. Saudi Arabia Air Pollution Control System Market Key Performance Indicators

10.1. Saudi Arabia Oil & Gas Sector Market Outlook

10.2. Saudi Arabia Government Spending Outlook

10.3. Saudi Arabia Industrial Sector Outlook

11. Saudi Arabia Air Pollution Control System Market Opportunity Assessment

11.1. Saudi Arabia Air Pollution Control System Market Opportunity Assessment By Equipment Type

11.2. Saudi Arabia Air Pollution Control System Market Opportunity Assessment By Application

12. Competitive Landscape

12.1. Saudi Arabia Air Pollution Control System Market Company Ranking, 2017

12.2. Competitive Benchmarking, By Equipment Type

13. Company Profiles

13.1. Thermax Private Limited

13.2. Amec Foster Wheeler plc

13.3. GE Power Systems Inc.

13.4. Gulf Advanced Control Systems Arabia

13.5. Doosan Lentjes Gmbh

13.6. AAF Saudi Arabia ltd.

13.7. ERG (Air Pollution Control) Ltd

13.8. Hamon & Cie (International) S.A

13.9. Donaldson Company, Inc.

14. Strategic Recommendations

15. Disclaimer

List of Figures

1. Global Air Pollution Control System Market Revenues, 2014-2024F ($ Billion)

2. Saudi Arabia Air Pollution Control System Market Revenues, 2014-2024F ($ Million)

3. Saudi Arabia Air Pollution Control System Market Industry Life Cycle

4. Saudi Arabia Air Pollution Control Porter Five Force Model

5. Saudi Arabia Air Pollution Control Revenue Share, By Equipment Type, 2017 & 2024F

6. Saudi Arabia Air Pollution Control System Market Revenue Share, By Application, 2017 & 2024F

7. Saudi Arabia Air Pollution Control System Market Revenue Share, By Regions, 2017 & 2024F

8. Saudi Vision 2030 - Key Targets

9. Carbon Emission Rate in Saudi Arabia, 2010-2016 (Million Tonnes)

10. Foreign Direct Investment in Saudi Arabia, 2014-2020 ($ Million)

11. Saudi Arabia Electrostatic Precipitators Market Revenues, 2014-2024F ($ million)

12. Saudi Arabia Flue-gas desulfurization Market Revenues, 2014-2024F ($ million)

13. Saudi Arabia Scrubber Market Revenues, 2014-2024F ($ million)

14. Saudi Arabia Fabric Filter Market Revenues, 2014-2024F ($ million)

15. Saudi Arabia Others Air Pollution Control System Market Revenues, 2014-2024F ($ million)

16. Saudi Arabia Power Generation Industry Air Pollution Control System Market Revenues, 2014-2024F ($ Million)

17. Upcoming Power Plant Projects in Saudi Arabia

18. Saudi Arabia Power Iron & Steel industry Air Pollution Control System Market Revenues, 2014-2024F ($ Million)

19. Saudi Arabia Power Chemical Industry Air Pollution Control System Market Revenues, 2014-2024F ($ Million)

20. Saudi Arabia Petrochemical Production Capacity, 2015-2016 (Million tons per annum)

21. Production of Refined Products, 2014-2016 (Million Barrels)

22. Saudi Arabia Other Industries Air Pollution Control System Market Revenues, 2014-2024F ($ Million)

23. Saudi Arabia Mining Contribution to GDP, 2015-2020 ($ Billion)

24. Production of Minerals in Saudi Arabia, 2014-2016

25. Saudi Arabia Upcoming Cement Plant Projects

26. Cement Production in Saudi Arabia, 2013- 2016 (Thousand Tonnes)

27. Cement Domestic Sales in Saudi Arabia, 2010 - 2016 (Thousand Tonnes)

28. Number of Pulp & Paper Factories, 2016-17

29. Saudi Arabia Eastern Region Air Pollution Control System Market Revenues, 2014-2024F ($ Million)

30. Saudi Arabia Central Region Air Pollution Control System Market Revenues, 2014-2024F ($ Million)

31. Saudi Arabia Western Region Air Pollution Control System Market Revenues, 2014-2024F ($ Million)

32. Saudi Arabia Southern Region Air Pollution Control System Market Revenues, 2014-2024F ($ Million)

33. Saudi Arabia Oil Revenues, 2012-2017E ($ Billion)

34. Saudi Arabia Oil & Gas Construction Contracts Awards, 2013-2015 ($ Billion)

35. Saudi Arabia Crude Oil and Natural Gas Production, 2005-2016 (Thousand barrels per day, Billion cubic meters)

36. Saudi Arabia Actual Government Spending Vs Actual Government Revenues, 2012-2021F ($ Billion)

37. Saudi Arabia Government Budget Spending Outlook, 2018E ($ Billion)

38. Value of Projects at Pre-Execution Stage By Industry, 2017 ($ Million)

39. Total Number of Manufacturing Facilities in Saudi Arabia, Till Q3 2017

40. Saudi Arabia Air Pollution Control System Market Opportunity Assessment By Equipment Type ($ Million)

41. Saudi Arabia Air Pollution Control System Market Opportunity Assessment By Application ($ Million)

42. Saudi Arabia Air Pollution Control System Market Revenue Share, By Company, 2016

43. Number of Under Construction Manufacturing Factories as of Q1, 2017

44. Riyadh Industrial Cities Composition, 2014 & 2018

List of Tables

1. Total number of Operating Industrial Units, Total Finance, 2010 & 2017 3rd Quarter

2. Industrial Ambient Air Quality Standards in Yanbu and Jubail, 2016

3. Industrial Ambient Air Quality Guideline Values Standards in Yanbu and Jubail, 2016

4. Saudi Arabia Upcoming Petrochemical Projects

5. Pulp & Paper Factories Under Construction in Saudi Arabia, Q1-Q3 2017

6. Saudi Arabia Approved Budget Per Sector and Actual Expenses Up to End of Q3 of Fiscal Year 2017 ($ Billion)

7. Under Construction Manufacturing Units in Saudi Arabia, 2017

8. Upcoming Manufacturing Plants in Saudi Arabia

9. Upcoming Manufacturing Facilities in Saudi Arabia

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- North America Sodium chloride Market (2025-2031) | Analysis, Revenue, Forecast, Trends, Companies, Size, Growth, Share, Industry, Outlook & Value

- North America Vinyl Flooring Market (2025-2031) | Value, Growth,Size, Analysis, Revenue, Industry, Forecast, Share, Outlook, Companies & Trends

- Tajikistan Thermal Camera Market (2025-2031) | Trends, Size, Growth, Share, Industry, Companies, Value, Analysis, Revenue, Forecast & Outlook

- Singapore Professional AV Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- Saudi Arabia Genset Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- India OOH Advertising Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- Vietnam Twisted Pair Cables Market (2024-2030) | Size & Revenue, Forecast, Share, Companies, Competitive Landscape, Analysis, Trends, Value, Segmentation, Outlook, Industry, Growth

- South Africa B2B Cleaning Market (2025-2031) | Size & Revenue, Forecast, Share, Companies, Competitive Landscape, Analysis, Trends, Value, Segmentation, Outlook, Industry, Growth

- Mexico Dispersion Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- India's Printer Market Faces 20.7% Decline in Q4 2023: Epson and HP Lead Amidst Downturn

- India's Camera Market Sees 8.9% Decline in Q4 2023; Canon Leads with 38.4% Share

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- The future of gaming industry in the Philippines