Saudi Arabia Bulb Market (2025-2031) Outlook | Value, Share, Revenue, Industry, Forecast, Growth, Analysis, Companies, Size & Trends

| Product Code: ETC258759 | Publication Date: Aug 2022 | Updated Date: Apr 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 | |

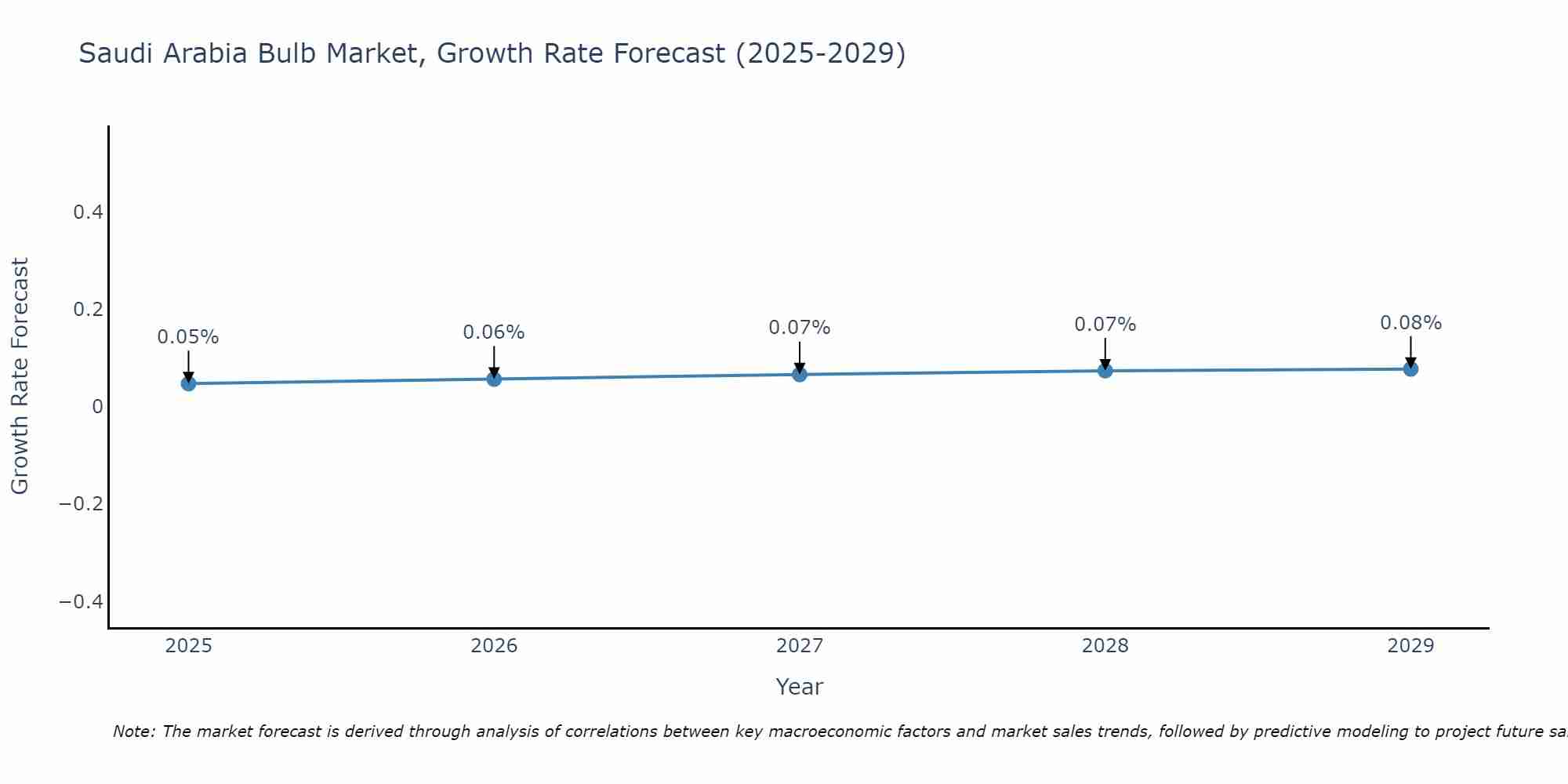

Saudi Arabia Bulb Market Size Growth Rate

The Saudi Arabia Bulb Market is likely to experience consistent growth rate gains over the period 2025 to 2029. From 0.05% in 2025, the growth rate steadily ascends to 0.08% in 2029.

Saudi Arabia Bulb Market Synopsis

The Saudi Arabia bulb market has undergone a transformation in recent years due to the global shift towards energy-efficient lighting solutions. Traditional incandescent bulbs have been phased out in favor of more energy-efficient options like compact fluorescent lamps (CFLs) and light-emitting diodes (LEDs). This shift is driven by energy conservation initiatives, environmental concerns, and the cost-effectiveness of long-lasting bulbs. LED technology, in particular, has gained prominence due to its durability, low energy consumption, and versatility in design. The market`s evolution is closely linked to consumer preferences, government policies promoting energy efficiency, and technological advancements in lighting.

Drivers of the Market

The Saudi Arabia Bulb market is witnessing substantial growth due to several driving factors. One of the key drivers is the ongoing government-led initiatives to promote energy efficiency and sustainability. Consumers and businesses alike are transitioning towards energy-efficient lighting solutions, which has increased the demand for LED and other efficient bulb types. The growing construction and real estate sectors in the country are also contributing to market growth, as new infrastructure projects and residential developments require lighting solutions. Moreover, rising awareness among consumers about the benefits of longer-lasting bulbs and reduced energy consumption is stimulating the adoption of advanced lighting technologies.

Opportunities of the Market

Challenges of the Market

In the Saudi Arabia bulb market, challenges arise from the shift towards energy-efficient lighting technologies. LED bulbs have gained popularity due to their longevity and lower energy consumption, but challenges include ensuring consistent light quality, addressing concerns about blue light emissions, and managing consumer expectations regarding bulb lifespan and cost.

COVID-19 Impact on the Market

The Saudi Arabia bulb market encountered challenges due to the COVID-19 pandemic. The lockdowns and reduced consumer spending affected both residential and commercial lighting demand. As a result, the market experienced a temporary dip, with disruptions in supply chains and manufacturing activities adding to the challenges. However, the market demonstrated resilience as remote work and home-focused activities increased the importance of proper lighting environments. The shift toward energy-efficient lighting solutions, including LEDs, also contributed to the market`s recovery as businesses and households sought cost-effective and sustainable options.

Key Players in the Market

Prominent companies in the Saudi Arabia Bulb market, such as Philips Lighting Middle East and GE Lighting, dominate the production and distribution of lighting solutions. These industry leaders offer a wide range of innovative and energy-efficient bulbs to meet the country`s illumination needs while emphasizing sustainability and energy conservation.

Key Highlights of the Report:

- Saudi Arabia Bulb Market Outlook

- Market Size of Saudi Arabia Bulb Market, 2024

- Forecast of Saudi Arabia Bulb Market, 2031

- Historical Data and Forecast of Saudi Arabia Bulb Revenues & Volume for the Period 2021-2031

- Saudi Arabia Bulb Market Trend Evolution

- Saudi Arabia Bulb Market Drivers and Challenges

- Saudi Arabia Bulb Price Trends

- Saudi Arabia Bulb Porter's Five Forces

- Saudi Arabia Bulb Industry Life Cycle

- Historical Data and Forecast of Saudi Arabia Bulb Market Revenues & Volume By Type for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Bulb Market Revenues & Volume By Incandescent Bulbs for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Bulb Market Revenues & Volume By Fluorescent Bulbs for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Bulb Market Revenues & Volume By CFLs for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Bulb Market Revenues & Volume By Halogens for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Bulb Market Revenues & Volume By LEDs for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Bulb Market Revenues & Volume By Application for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Bulb Market Revenues & Volume By Lamps & Light Bulbs for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Bulb Market Revenues & Volume By Operation Theatre (OT Instruments) for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Bulb Market Revenues & Volume By Torchlights and Flashlights for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Bulb Market Revenues & Volume By Automobile Headlights for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Bulb Market Revenues & Volume By Mining Headgears for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Bulb Market Revenues & Volume By Others for the Period 2021-2031

- Saudi Arabia Bulb Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Application

- Saudi Arabia Bulb Top Companies Market Share

- Saudi Arabia Bulb Competitive Benchmarking By Technical and Operational Parameters

- Saudi Arabia Bulb Company Profiles

- Saudi Arabia Bulb Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 Saudi Arabia Bulb Market Overview |

3.1 Saudi Arabia Country Macro Economic Indicators |

3.2 Saudi Arabia Bulb Market Revenues & Volume, 2021 & 2031F |

3.3 Saudi Arabia Bulb Market - Industry Life Cycle |

3.4 Saudi Arabia Bulb Market - Porter's Five Forces |

3.5 Saudi Arabia Bulb Market Revenues & Volume Share, By Type, 2021 & 2031F |

3.6 Saudi Arabia Bulb Market Revenues & Volume Share, By Application, 2021 & 2031F |

4 Saudi Arabia Bulb Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.3 Market Restraints |

5 Saudi Arabia Bulb Market Trends |

6 Saudi Arabia Bulb Market, By Types |

6.1 Saudi Arabia Bulb Market, By Type |

6.1.1 Overview and Analysis |

6.1.2 Saudi Arabia Bulb Market Revenues & Volume, By Type, 2021-2031F |

6.1.3 Saudi Arabia Bulb Market Revenues & Volume, By Incandescent Bulbs, 2021-2031F |

6.1.4 Saudi Arabia Bulb Market Revenues & Volume, By Fluorescent Bulbs, 2021-2031F |

6.1.5 Saudi Arabia Bulb Market Revenues & Volume, By CFLs, 2021-2031F |

6.1.6 Saudi Arabia Bulb Market Revenues & Volume, By Halogens, 2021-2031F |

6.1.7 Saudi Arabia Bulb Market Revenues & Volume, By LEDs, 2021-2031F |

6.2 Saudi Arabia Bulb Market, By Application |

6.2.1 Overview and Analysis |

6.2.2 Saudi Arabia Bulb Market Revenues & Volume, By Lamps & Light Bulbs, 2021-2031F |

6.2.3 Saudi Arabia Bulb Market Revenues & Volume, By Operation Theatre (OT Instruments), 2021-2031F |

6.2.4 Saudi Arabia Bulb Market Revenues & Volume, By Torchlights and Flashlights, 2021-2031F |

6.2.5 Saudi Arabia Bulb Market Revenues & Volume, By Automobile Headlights, 2021-2031F |

6.2.6 Saudi Arabia Bulb Market Revenues & Volume, By Mining Headgears, 2021-2031F |

6.2.7 Saudi Arabia Bulb Market Revenues & Volume, By Others, 2021-2031F |

7 Saudi Arabia Bulb Market Import-Export Trade Statistics |

7.1 Saudi Arabia Bulb Market Export to Major Countries |

7.2 Saudi Arabia Bulb Market Imports from Major Countries |

8 Saudi Arabia Bulb Market Key Performance Indicators |

9 Saudi Arabia Bulb Market - Opportunity Assessment |

9.1 Saudi Arabia Bulb Market Opportunity Assessment, By Type, 2021 & 2031F |

9.2 Saudi Arabia Bulb Market Opportunity Assessment, By Application, 2021 & 2031F |

10 Saudi Arabia Bulb Market - Competitive Landscape |

10.1 Saudi Arabia Bulb Market Revenue Share, By Companies, 2024 |

10.2 Saudi Arabia Bulb Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero