Saudi Arabia Canned Beans Market (2025-2031) Outlook | Growth, Size, Forecast, Industry, Trends, Companies, Analysis, Value, Share & Revenue

| Product Code: ETC219579 | Publication Date: Aug 2022 | Updated Date: Feb 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 | |

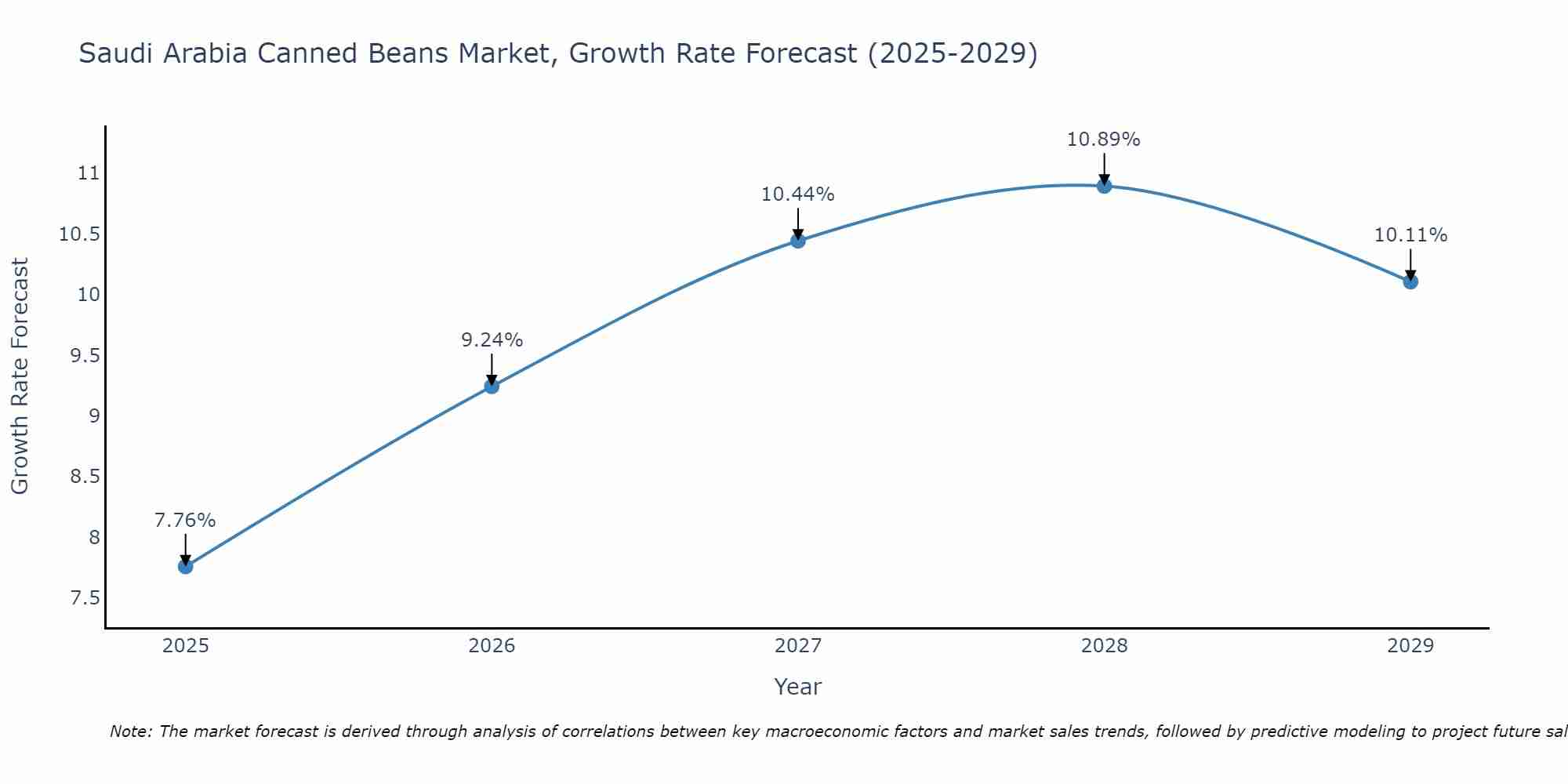

Saudi Arabia Canned Beans Market Size Growth Rate

The Saudi Arabia Canned Beans Market is projected to witness mixed growth rate patterns during 2025 to 2029. Growth accelerates to 10.89% in 2028, following an initial rate of 7.76%, before easing to 10.11% at the end of the period.

Saudi Arabia Canned Beans Market Synopsis

Canned beans have become a popular choice among consumers in Saudi Arabia due to their convenience and longer shelf life. The canned beans market in the country has witnessed notable growth as urbanization and busier lifestyles lead to an increased demand for ready-to-eat or easy-to-cook food options. A variety of beans, such as kidney beans, chickpeas, and black beans, are widely available in canned forms, catering to diverse culinary preferences. The market`s expansion is also attributed to the presence of established local producers and imported brands that adhere to quality and safety standards.

Drivers of the Market

The Saudi Arabia canned beans market is influenced by several drivers that contribute to its expansion. Canned beans, known for their convenience and nutritional value, have gained popularity among consumers seeking quick meal solutions. The rise in urbanization, busy lifestyles, and working populations has increased the demand for ready-to-eat and easy-to-prepare food products, including canned beans. Moreover, as plant-based diets gain traction, canned beans serve as a valuable source of plant-based protein and fiber. The growth of the retail sector, coupled with product innovations and flavor variations, further fuels market growth. The government`s focus on food security and domestic production also supports the canned beans market by encouraging local bean cultivation and processing.

Opportunities of the Market

Challenges of the Market

The saudi arabia canned beans market faces several challenges. Despite the convenience and longer shelf life offered by canned beans, there is growing concern among consumers about the health impacts of preservatives and high sodium content in these products. Additionally, the competition with fresh and frozen alternatives, which are perceived as healthier, poses a challenge to the growth of the canned beans market.

COVID-19 Impact on the Market

The Saudi Arabia canned beans market faced initial challenges from the COVID-19 pandemic as supply chain disruptions hampered the availability of canned beans. Panic buying and stockpiling also led to short-term spikes in demand. However, with the gradual reopening of the economy and improved supply chain management, the market has stabilized. There is a growing demand for canned beans due to their extended shelf life and convenience, as consumers continue to cook more at home. This shift in consumer behavior has prompted manufacturers to explore new packaging options and flavors to meet evolving preferences.

Key Players in the Market

The saudi arabia canned beans market features several noteworthy players that supply a variety of canned bean products to meet the dietary preferences of consumers. Prominent brands in this market include Del Monte, Al Wadi Al Akhdar, and Al Islami Foods, known for their quality and diverse range of canned beans, such as kidney beans, black beans, and chickpeas. These leading players have earned trust among consumers for delivering convenient and nutritious options for quick meals. They maintain their market leadership by adhering to strict quality standards and ensuring consistent availability of canned bean products.

Key Highlights of the Report:

- Saudi Arabia Canned Beans Market Outlook

- Market Size of Saudi Arabia Canned Beans Market, 2024

- Forecast of Saudi Arabia Canned Beans Market, 2031

- Historical Data and Forecast of Saudi Arabia Canned Beans Revenues & Volume for the Period 2021-2031

- Saudi Arabia Canned Beans Market Trend Evolution

- Saudi Arabia Canned Beans Market Drivers and Challenges

- Saudi Arabia Canned Beans Price Trends

- Saudi Arabia Canned Beans Porter's Five Forces

- Saudi Arabia Canned Beans Industry Life Cycle

- Historical Data and Forecast of Saudi Arabia Canned Beans Market Revenues & Volume By Type for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Canned Beans Market Revenues & Volume By Navy Beans for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Canned Beans Market Revenues & Volume By Kidney Beans for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Canned Beans Market Revenues & Volume By Garbanzo Beans for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Canned Beans Market Revenues & Volume By Pinto Beans for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Canned Beans Market Revenues & Volume By Others for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Canned Beans Market Revenues & Volume By Category for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Canned Beans Market Revenues & Volume By Conventional for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Canned Beans Market Revenues & Volume By Organic for the Period 2021-2031

- Saudi Arabia Canned Beans Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Category

- Saudi Arabia Canned Beans Top Companies Market Share

- Saudi Arabia Canned Beans Competitive Benchmarking By Technical and Operational Parameters

- Saudi Arabia Canned Beans Company Profiles

- Saudi Arabia Canned Beans Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 Saudi Arabia Canned Beans Market Overview |

3.1 Saudi Arabia Country Macro Economic Indicators |

3.2 Saudi Arabia Canned Beans Market Revenues & Volume, 2021 & 2031F |

3.3 Saudi Arabia Canned Beans Market - Industry Life Cycle |

3.4 Saudi Arabia Canned Beans Market - Porter's Five Forces |

3.5 Saudi Arabia Canned Beans Market Revenues & Volume Share, By Type, 2021 & 2031F |

3.6 Saudi Arabia Canned Beans Market Revenues & Volume Share, By Category, 2021 & 2031F |

4 Saudi Arabia Canned Beans Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.3 Market Restraints |

5 Saudi Arabia Canned Beans Market Trends |

6 Saudi Arabia Canned Beans Market, By Types |

6.1 Saudi Arabia Canned Beans Market, By Type |

6.1.1 Overview and Analysis |

6.1.2 Saudi Arabia Canned Beans Market Revenues & Volume, By Type, 2021-2031F |

6.1.3 Saudi Arabia Canned Beans Market Revenues & Volume, By Navy Beans, 2021-2031F |

6.1.4 Saudi Arabia Canned Beans Market Revenues & Volume, By Kidney Beans, 2021-2031F |

6.1.5 Saudi Arabia Canned Beans Market Revenues & Volume, By Garbanzo Beans, 2021-2031F |

6.1.6 Saudi Arabia Canned Beans Market Revenues & Volume, By Pinto Beans, 2021-2031F |

6.1.7 Saudi Arabia Canned Beans Market Revenues & Volume, By Others, 2021-2031F |

6.2 Saudi Arabia Canned Beans Market, By Category |

6.2.1 Overview and Analysis |

6.2.2 Saudi Arabia Canned Beans Market Revenues & Volume, By Conventional, 2021-2031F |

6.2.3 Saudi Arabia Canned Beans Market Revenues & Volume, By Organic, 2021-2031F |

7 Saudi Arabia Canned Beans Market Import-Export Trade Statistics |

7.1 Saudi Arabia Canned Beans Market Export to Major Countries |

7.2 Saudi Arabia Canned Beans Market Imports from Major Countries |

8 Saudi Arabia Canned Beans Market Key Performance Indicators |

9 Saudi Arabia Canned Beans Market - Opportunity Assessment |

9.1 Saudi Arabia Canned Beans Market Opportunity Assessment, By Type, 2021 & 2031F |

9.2 Saudi Arabia Canned Beans Market Opportunity Assessment, By Category, 2021 & 2031F |

10 Saudi Arabia Canned Beans Market - Competitive Landscape |

10.1 Saudi Arabia Canned Beans Market Revenue Share, By Companies, 2024 |

10.2 Saudi Arabia Canned Beans Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero