Saudi Arabia CCTV Market (2025-2031) | Size, Share, Growth, Industry, Value, Revenue, Analysis, Segmentation, Trends, Outlook

Market Forecast By Product Types (Conventional, Discreet, Dome, Bullet CCTV Cameras), By Technology (Analog CCTV Systems, Wireless CCTV Systems, IP-based CCTV Systems, Hybrid CCTV Systems), By Applications (BFSI, Healthcare, Transportation, Education, Business, Retail), By Surveillance Components (CCTV Camera, Video Surveillance Storage Mechanisms, Video Surveillance Software, Analytics) And Competitive Landscape

| Product Code: ETC013619 | Publication Date: Oct 2020 | Updated Date: Feb 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

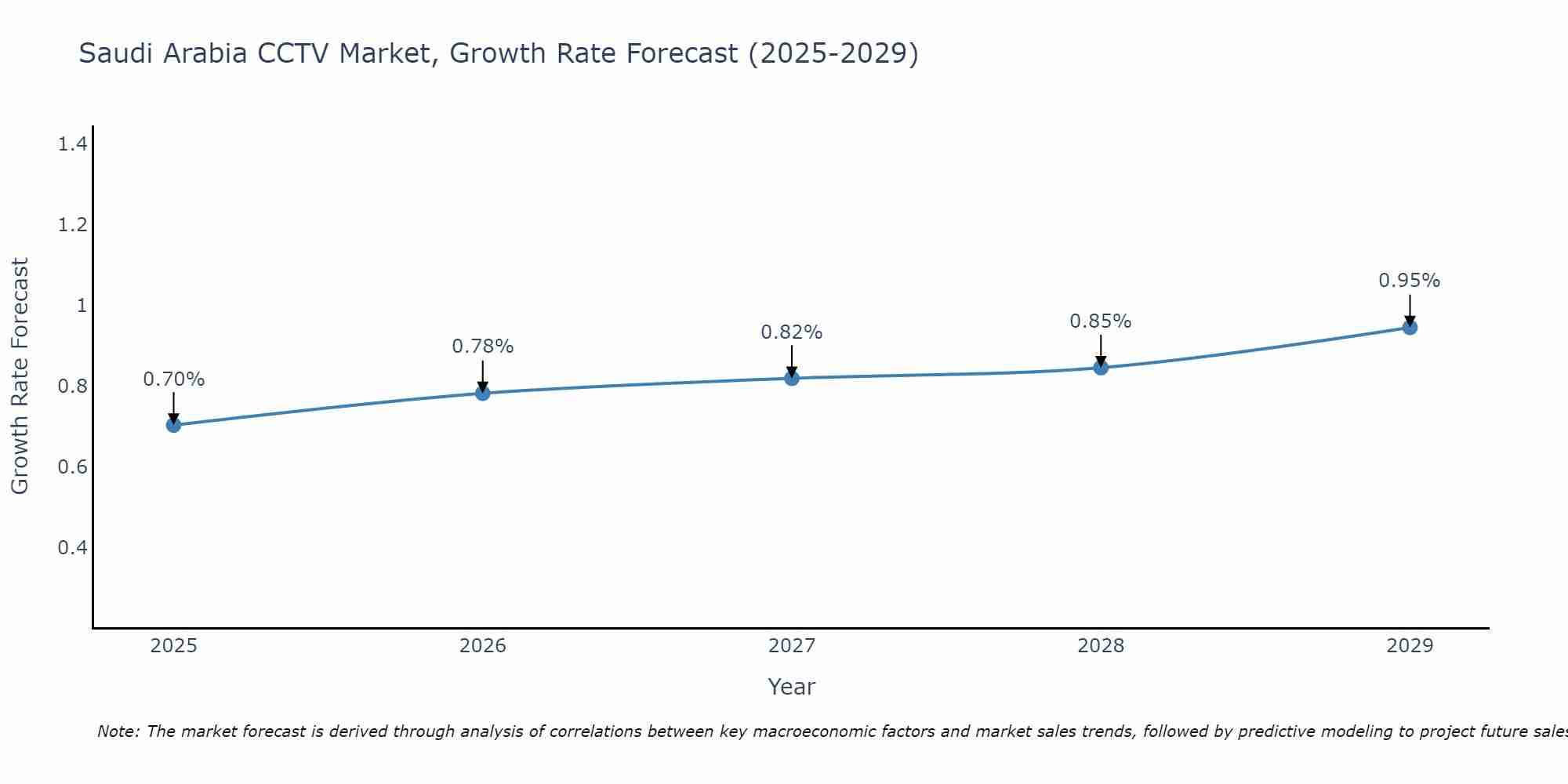

Saudi Arabia CCTV Market Size Growth Rate

The Saudi Arabia CCTV Market is likely to experience consistent growth rate gains over the period 2025 to 2029. From 0.70% in 2025, the growth rate steadily ascends to 0.95% in 2029.

Saudi Arabia CCTV Market Highlights

| Report Name | Saudi Arabia CCTV Market |

| Forecast period | 2025-2031 |

| CAGR | 7.9% |

| Growing Sector | Retail Sector |

Topics Covered in the Saudi Arabia CCTV Market Report

Saudi Arabia CCTV Market report thoroughly covers the market by Product Type, by Technology Type, by Applications and Surveillance Components. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Saudi Arabia CCTV Market Synopsis

The Saudi Arabia CCTV Market has experienced significant growth in recent years, driven by increasing investments in infrastructure, growing concerns about public safety, and advancements in surveillance technology. The market has been boosted by initiatives under Vision 2030, which emphasize the development of smart cities and the enhancement of security systems across various sectors. Additionally, the rising adoption of IP-based CCTV systems and integration with advanced technologies, such as AI and IoT, has further propelled market demand, making it an essential component of the country's security framework.

According to 6Wresearch, the Saudi Arabia CCTV Market anticipated to grow at a CAGR of 7.9% during the forecast period 2025-2031. The Saudi Arabia CCTV market growth is driven by a combination of factors that underline its position as an influential economic player in the region. A significant driver is the country's Vision 2030 initiative, which aims to diversify the economy away from oil dependence and promote sectors such as technology, tourism, and renewable energy. Additionally, Saudi Arabia's strategic geographic location at the crossroads of Europe, Asia, and Africa makes it a major hub for trade and investment. The government's substantial investments in infrastructure, alongside reforms focused on enhancing the ease of doing business, further contribute to attracting international companies and fostering a dynamic local economy.

However, the Saudi Arabia CCTV Market also faces several challenges that can impact its economic growth and diversification efforts. One notable issue is the dependence on oil revenue, which makes the economy vulnerable to fluctuations in global energy prices. While diversification is underway, the transition to a more diversified economy will take time and sustained effort. Furthermore, navigating regulatory complexities and ensuring workforce localization pose obstacles for businesses operating in the region. Addressing these challenges will require continued reforms, strategic investments, and fostering strong partnerships between public and private sectors to ensure long-term economic resilience.

Saudi Arabia CCTV Market Trends

The Saudi Arabia CCTV Industry has been experiencing significant growth in recent years, driven by rising demand for advanced surveillance systems and increasing investments in infrastructure and security projects. Government initiatives such as the Saudi Vision 2030 have emphasized the importance of smart cities and enhanced safety measures, fueling the adoption of state-of-the-art CCTV technologies. Additionally, advancements in AI-driven video analytics, facial recognition, and cloud-based solutions are transforming the market, offering improved efficiency and real-time monitoring capabilities. With expanding applications across sectors such as retail, transportation, and healthcare, the CCTV market in Saudi Arabia is poised for continued expansion in the coming years.

Investment Opportunities in the Saudi Arabia CCTV Market

The Saudi Arabia CCTV market offers a wide range of investment opportunities, particularly as the demand for cutting-edge surveillance solutions continues to grow. One area of interest lies in the rapidly evolving technologies such as AI-powered analytics, which are driving increased adoption across various industries. Investors can also consider tapping into the rising demand for cloud-based CCTV systems, which provide scalability and real-time monitoring benefits. Notably, with the market's diversification across retail, transportation, and healthcare, there is significant potential for expansion in these sectors.

Another lucrative avenue is the increasing focus on boosting Saudi Arabia CCTV market share by building partnerships with local companies and technology providers to cater to the government’s smart city initiatives. These projects, aligned closely with the objectives of Saudi Vision 2030, are set to generate sustained demand for advanced security systems. By capitalizing on these emerging trends, stakeholders can position themselves strategically for long-term growth in the Saudi Arabia CCTV market.

Leading Players in the Saudi Arabia CCTV Market

The Saudi Arabia CCTV market is highly competitive, driven by key players leveraging advanced technologies to meet evolving security needs. Leading companies include Hikvision, known for its AI-powered video surveillance products and IP cameras, and Dahua Technology, offering high-performance CCTV cameras and integrated solutions. Axis Communications specializes in reliable, cutting-edge network cameras, while Honeywell provides smart CCTV solutions for residential, commercial, and industrial applications. Bosch Security Systems stands out with intelligent surveillance systems and superior analytics. Together, these companies are shaping the market with innovations in AI, IoT, and cloud-based solutions.

Government Regulations

The Saudi Arabian government has implemented a series of regulations to monitor and standardize the use of CCTV systems across the country. These regulations are primarily overseen by the Saudi Data and Artificial Intelligence Authority (SDAIA) and aim to enhance security, protect personal data, and ensure compliance with privacy laws. All CCTV installations must adhere to specific technical standards and guidelines, including camera placement restrictions to avoid infringing on individuals' privacy, such as in residential areas or private spaces. Additionally, public and private entities are required to register their surveillance systems and maintain recorded footage for a minimum specified period, as outlined by regulatory authorities. Non-compliance with these rules may lead to penalties or legal action, underscoring the government's commitment to balancing security needs with individual rights.

Future Insights of the Saudi Arabia CCTV Market

The Saudi Arabia CCTV market is poised for significant growth in the coming years, driven by advancements in technology and increasing security concerns. Key factors contributing to this growth include the integration of artificial intelligence (AI) and machine learning in CCTV systems, enabling enhanced surveillance capabilities such as facial recognition and behaviour analysis. Additionally, the rising demand for smart city initiatives and infrastructure development across the Kingdom is expected to boost the adoption of high-definition and cloud-based CCTV systems. Regulatory frameworks emphasizing public safety and national security are further anticipated to propel the market forward. Collectively, these trends signal a robust trajectory for the Saudi Arabia CCTV market in the near future.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories.

Dome Cameras to Dominate the Market - By Product Type

According to Suryakant, Senior Research Analyst, 6Wresearch, Dome CCTV cameras are expected to lead the Cambodian CCTV market due to their flexibility, compact design, and suitability for both indoor and outdoor surveillance scenarios. Bullet cameras will remain a strong contender, particularly for outdoor security applications. Conventional and discreet cameras will continue to serve niche markets with specific security requirements.

IP-Based CCTV Systems to Dominate the Market - By Technology

IP-based CCTV systems are expected to lead the Saudi Arabian market, driven by the growing demand for advanced connectivity, remote monitoring, and superior video resolution. Wireless CCTV systems are gaining popularity due to their easy installation, while hybrid systems will attract businesses seeking a blend of traditional and modern features. Analog systems will remain relevant for small-scale users and budget-conscious consumers. ts.

Business and Retail Sectors to Dominate the Market - By Applications

The business and retail sectors are forecasted to drive the demand for CCTV systems in Saudi Arabia, fuelled by rising security concerns and regulatory compliance needs. The healthcare and transportation sectors are also investing significantly in surveillance solutions to enhance safety and operational efficiency. BFSI, education, and other industries are increasingly adopting CCTV systems to strengthen security and improve operational environments.

CCTV Cameras to Dominate the Market - By Surveillance Components

CCTV cameras are projected to remain the dominant component in Saudi Arabia’s video surveillance market, supported by advancements in technology and the need for reliable security solutions. Video surveillance storage mechanisms are expected to expand due to the growing need for high-capacity storage driven by high-definition footage. Additionally, video surveillance software and analytics are anticipated to grow rapidly, enabling organizations to leverage data insights for optimized security and operational decision-making.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024

- Base Year: 2024

- Forecast Data until 2031

- Key Performance Indicators Impacting the Market

- Major Upcoming Developments and

Key Highlights of the Report:

- Saudi Arabia CCTV Market Outlook

- Market Size of Saudi Arabia CCTV Market, 2024

- Forecast of Saudi Arabia CCTV Market, 2031

- Historical Data and Forecast of Saudi Arabia CCTV Revenues & Volume for the Period 2021 - 2031

- Saudi Arabia CCTV Market Trend Evolution

- Saudi Arabia CCTV Market Drivers and Challenges

- Saudi Arabia CCTV Price Trends

- Saudi Arabia CCTV Porter's Five Forces

- Saudi Arabia CCTV Industry Life Cycle

- Historical Data and Forecast of Saudi Arabia CCTV Market Revenues & Volume By Product Types for the Period 2021- 2031

- Historical Data and Forecast of Saudi Arabia CCTV Market Revenues & Volume By Conventional for the Period 2021 - 2031

- Historical Data and Forecast of Saudi Arabia CCTV Market Revenues & Volume By Discreet for the Period 2021 - 2031

- Historical Data and Forecast of Saudi Arabia CCTV Market Revenues & Volume By Dome for the Period 2019 - 2031

- Historical Data and Forecast of Saudi Arabia CCTV Market Revenues & Volume By Bullet CCTV Cameras for the Period 2021 - 2031

- Historical Data and Forecast of Saudi Arabia CCTV Market Revenues & Volume By Technology for the Period 2021- 2031

- Historical Data and Forecast of Saudi Arabia CCTV Market Revenues & Volume By Analog CCTV Systems for the Period 2021 - 2031

- Historical Data and Forecast of Saudi Arabia CCTV Market Revenues & Volume By Wireless CCTV Systems for the Period 2021 - 2031

- Historical Data and Forecast of Saudi Arabia CCTV Market Revenues & Volume By IP-based CCTV Systems for the Period 2021 - 2031

- Historical Data and Forecast of Saudi Arabia CCTV Market Revenues & Volume By Hybrid CCTV Systems for the Period 2021 - 2031

- Historical Data and Forecast of Saudi Arabia CCTV Market Revenues & Volume By Applications for the Period 2021 - 2031

- Historical Data and Forecast of Saudi Arabia CCTV Market Revenues & Volume By BFSI? for the Period 2021 - 2031

- Historical Data and Forecast of Saudi Arabia CCTV Market Revenues & Volume By Healthcare for the Period 2021 - 2031

- Historical Data and Forecast of Saudi Arabia CCTV Market Revenues & Volume By Transportation for the Period 2021 - 2031

- Historical Data and Forecast of Saudi Arabia CCTV Market Revenues & Volume By Education for the Period 2021 - 2031

- Historical Data and Forecast of Saudi Arabia CCTV Market Revenues & Volume By Business for the Period 2021 - 2031

- Historical Data and Forecast of Saudi Arabia CCTV Market Revenues & Volume By Retail for the Period 2021- 2031

- Historical Data and Forecast of Saudi Arabia CCTV Market Revenues & Volume By Surveillance Components for the Period 2021 - 2031

- Historical Data and Forecast of Saudi Arabia CCTV Market Revenues & Volume By CCTV Camera for the Period 2021 - 2031

- Historical Data and Forecast of Saudi Arabia CCTV Market Revenues & Volume By Video Surveillance Storage Mechanisms for the Period 2021- 2031

- Historical Data and Forecast of Saudi Arabia CCTV Market Revenues & Volume By Video Surveillance Software for the Period 2021 - 2031

- Historical Data and Forecast of Saudi Arabia CCTV Market Revenues & Volume By Analytics for the Period 2021 - 2031

- Saudi Arabia CCTV Import Export Trade Statistics

- Market Opportunity Assessment By Product Types

- Market Opportunity Assessment By Technology

- Market Opportunity Assessment By Applications

- Market Opportunity Assessment By Surveillance Components

- Saudi Arabia CCTV Top Companies Market Share

- Saudi Arabia CCTV Competitive Benchmarking By Technical and Operational Parameters

- Saudi Arabia CCTV Company Profiles

- Saudi Arabia CCTV Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Product Types

- Conventional

- Discreet

- Dome

- Bullet CCTV Cameras

By Technology

- Analog CCTV Systems

- Wireless CCTV Systems

- IP-Based CCTV Systems

- Hybrid CCTV Systems

By Applications

- BFSI

- Healthcare

- Transportation

- Education

- Business

- Retail

By Surveillance Components

- CCTV Camera

- Video Surveillance Storage Mechanisms

- Video Surveillance Software

- Analytics

Saudi Arabia CCTV Market: FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Saudi Arabia CCTV Market Overview |

| 3.1 Saudi Arabia CCTV Market Revenues & Volume, 2021 - 2031F |

| 3.2 Saudi Arabia CCTV Market - Industry Life Cycle |

| 3.3 Saudi Arabia CCTV Market - Porter's Five Forces |

| 3.4 Saudi Arabia CCTV Market Revenues & Volume Share, By Product Types, 2021 & 2031F |

| 3.5 Saudi Arabia CCTV Market Revenues & Volume Share, By Technology, 2021 & 2031F |

| 3.6 Saudi Arabia CCTV Market Revenues & Volume Share, By Applications, 2021 & 2031F |

| 3.7 Saudi Arabia CCTV Market Revenues & Volume Share, By Surveillance Components, 2021 & 2031F |

| 4 Saudi Arabia CCTV Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Saudi Arabia CCTV Market Trends |

| 6 Saudi Arabia CCTV Market Segmentation |

| 6.1 Saudi Arabia CCTV Market, By Product Types |

| 6.1.1 Overview and Analysis |

| 6.1.2 Saudi Arabia CCTV Market Revenues & Volume, By Product Types, 2021 - 2031F |

| 6.1.3 Saudi Arabia CCTV Market Revenues & Volume, By Conventional, 2021 - 2031F |

| 6.1.4 Saudi Arabia CCTV Market Revenues & Volume, By Discreet, 2021 - 2031F |

| 6.1.5 Saudi Arabia CCTV Market Revenues & Volume, By Dome, 2021 - 2031F |

| 6.1.6 Saudi Arabia CCTV Market Revenues & Volume, By Bullet CCTV Cameras, 2021 - 2031F |

| 6.2 Saudi Arabia CCTV Market, By Technology |

| 6.2.1 Overview and Analysis |

| 6.2.2 Saudi Arabia CCTV Market Revenues & Volume, By Analog CCTV Systems, 2021 - 2031F |

| 6.2.3 Saudi Arabia CCTV Market Revenues & Volume, By Wireless CCTV Systems, 2021 - 2031F |

| 6.2.4 Saudi Arabia CCTV Market Revenues & Volume, By IP-based CCTV Systems, 2021 - 2031F |

| 6.2.5 Saudi Arabia CCTV Market Revenues & Volume, By Hybrid CCTV Systems, 2021 - 2031F |

| 6.3 Saudi Arabia CCTV Market, By Applications |

| 6.3.1 Overview and Analysis |

| 6.3.2 Saudi Arabia CCTV Market Revenues & Volume, By BFSI , 2021 - 2031F |

| 6.3.3 Saudi Arabia CCTV Market Revenues & Volume, By Healthcare, 2021 - 2031F |

| 6.3.4 Saudi Arabia CCTV Market Revenues & Volume, By Transportation, 2021 - 2031F |

| 6.3.5 Saudi Arabia CCTV Market Revenues & Volume, By Education, 2021 - 2031F |

| 6.3.6 Saudi Arabia CCTV Market Revenues & Volume, By Business , 2021 - 2031F |

| 6.3.7 Saudi Arabia CCTV Market Revenues & Volume, By Retail, 2021 - 2031F |

| 6.4 Saudi Arabia CCTV Market, By Surveillance Components |

| 6.4.1 Overview and Analysis |

| 6.4.2 Saudi Arabia CCTV Market Revenues & Volume, By CCTV Camera, 2021 - 2031F |

| 6.4.3 Saudi Arabia CCTV Market Revenues & Volume, By Video Surveillance Storage Mechanisms, 2021 - 2031F |

| 6.4.4 Saudi Arabia CCTV Market Revenues & Volume, By Video Surveillance Software, 2021 - 2031F |

| 6.4.5 Saudi Arabia CCTV Market Revenues & Volume, By Analytics, 2021 - 2031F |

| 7 Saudi Arabia CCTV Market Import-Export Trade Statistics |

| 7.1 Saudi Arabia CCTV Market Export to Major Countries |

| 7.2 Saudi Arabia CCTV Market Imports from Major Countries |

| 8 Saudi Arabia CCTV Market Key Performance Indicators |

| 9 Saudi Arabia CCTV Market - Opportunity Assessment |

| 9.1 Saudi Arabia CCTV Market Opportunity Assessment, By Product Types, 2021 & 2031F |

| 9.2 Saudi Arabia CCTV Market Opportunity Assessment, By Technology, 2021 & 2031F |

| 9.3 Saudi Arabia CCTV Market Opportunity Assessment, By Applications, 2021 & 2031F |

| 9.4 Saudi Arabia CCTV Market Opportunity Assessment, By Surveillance Components, 2021 & 2031F |

| 10 Saudi Arabia CCTV Market - Competitive Landscape |

| 10.1 Saudi Arabia CCTV Market Revenue Share, By Companies, 2024 |

| 10.2 Saudi Arabia CCTV Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero