Saudi Arabia Chocolate Market (2025-2031) | Analysis, Size, Share, Trends, Growth, Revenue, Forecast, industry & Outlook

Market Forecast By Types (Dark Chocolate, Milk Chocolate, White Chocolate), By Products (Softline, Boxed Assortments, Contlines, Seasonal Chocolates, Molded Chocolates And Others), By Distribution Channel (Supermarket and hypermarkets, Specialist Retailers, Convenience Stores, Online Channel And Others), By Regions (Eastern, Western, Central, Southern) and Competitive Landscape.

| Product Code: ETC001360 | Publication Date: Mar 2023 | Updated Date: Mar 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

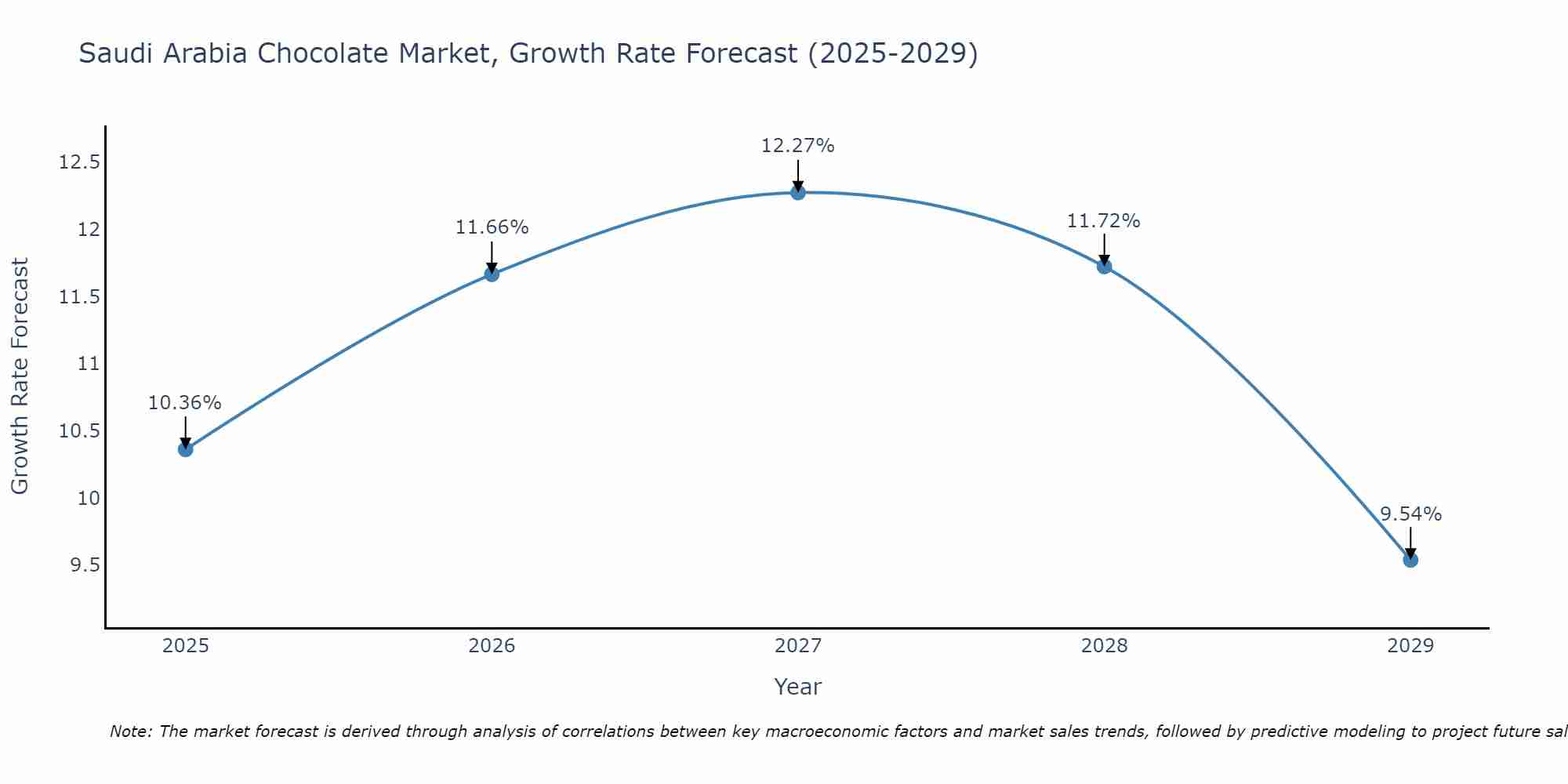

Saudi Arabia Chocolate Market Size Growth Rate

The Saudi Arabia Chocolate Market is projected to witness mixed growth rate patterns during 2025 to 2029. Starting at 10.36% in 2025, the market peaks at 12.27% in 2027, and settles at 9.54% by 2029.

Saudi Arabia Chocolate Market Highlights

| Report Name | Saudi Arabia Chocolate Market |

| Forecast period | 2025-2031 |

| CAGR | 6.8% |

| Growing Sector | Supermarkets and hypermarkets |

Topics Covered in the Saudi Arabia Chocolate Market Report

Saudi Arabia Chocolate Market report thoroughly covers the market by types, by products, by distribution channel and by regions. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Saudi Arabia Chocolate Market Synopsis

The chocolate market in Saudi Arabia has witnessed significant growth in recent years, driven by changing consumer preferences, an increasing demand for premium confectionery products, and the rising influence of Western lifestyles. With a youthful population and a growing trend of gifting chocolate during festivals and special occasions, the market is expanding steadily. Additionally, the emergence of innovative flavors and the introduction of healthier chocolate options have further fueled consumer interest. Coupled with advancements in distribution channels, including online platforms, the Saudi Arabia chocolate market is poised for continued growth in the coming years.

According to 6Wresearch, the Saudi Arabia Chocolate Market is anticipated to grow at a CAGR of 6.8% during the forecast period 2025-2031. This growth is attributed to the increasing demand for premium and innovative chocolate products, alongside a rising awareness of healthier options, such as dark and sugar-free chocolates. The expanding retail sector and the growing influence of e-commerce are also critical factors driving this upward trend. Additionally, the popularity of gifting chocolates during cultural festivals and celebrations is expected to play a significant role in boosting sales. Such factors collectively position the Saudi Arabia chocolate market for robust growth in the years to come.

However, the Saudi Arabia chocolate industry faces several challenges that could hinder its growth. One notable issue is the fluctuating cost of raw materials, such as cocoa, which is heavily influenced by global market dynamics and supply chain disruptions. Additionally, rising health consciousness among consumers, while driving demand for healthier options, also poses a challenge for traditional chocolate products that are often high in sugar and calories. The industry must also contend with increasing competition from imported brands, which can overshadow local manufacturers. Furthermore, extreme temperatures in the region create logistical difficulties in storage and transportation, as chocolates require controlled environments to prevent melting and maintain quality. Addressing these challenges will be critical for the sustained growth of the Saudi Arabia chocolate market.

Saudi Arabia Chocolate Market Trends

The Saudi Arabia chocolate market is witnessing notable trends that are shaping its evolution and consumer preferences. One key trend is the rising demand for premium and artisanal chocolates, driven by an increasing population of affluent consumers seeking high-quality and unique products. There is also a growing interest in healthier chocolate alternatives, such as sugar-free, organic, and dark chocolate options, reflecting the health-conscious shift among consumers. Additionally, innovative and locally inspired flavors are gaining traction as manufacturers explore ways to differentiate themselves in a competitive landscape. The adoption of e-commerce as a distribution channel is another significant trend, enabling brands to reach a broader audience and cater to the tech-savvy population. These trends collectively indicate a dynamic and evolving market primed for innovation and growth.

Investment Opportunities in the Saudi Arabia Chocolate Market

The Saudi Arabia chocolate market presents lucrative investment opportunities driven by its evolving consumer preferences and expanding distribution channels. Investors can capitalize on the rising demand for premium and artisanal chocolates by supporting brands that emphasize quality and craftsmanship. The growing health-conscious trend also opens doors for investments in healthier chocolate alternatives, including sugar-free, organic, and dark chocolate options, which are increasingly sought after by discerning consumers. Furthermore, there is significant potential in innovating with unique, culturally inspired flavors that resonate with local tastes, offering brands a competitive edge. E-commerce platforms also provide a promising avenue for investment, as the shift to online shopping accelerates and allows greater market reach. With its dynamic trends and increasing consumer demand, the Saudi Arabia chocolate market remains a fertile ground for strategic investments and long-term growth.

Leading Players in the Saudi Arabia Chocolate Market

Leading players in the Saudi Arabia chocolate market include both established international brands and emerging local companies. Global giants like Mars, Nestlé, and Ferrero hold a significant share due to their strong brand recognition and wide product portfolios, catering to diverse consumer preferences. Meanwhile, regional brands such as Patchi and Bateel excel by offering premium chocolates and luxury gifting options tailored to local tastes and cultural preferences. These key players leverage a combination of innovative flavor profiles, attractive packaging, and strategic marketing campaigns to maintain their competitive edge in this rapidly expanding market.

Government Regulations

Government regulations play a crucial role in shaping the Saudi Arabia chocolate market growthby ensuring product quality, safety, and compliance with local standards. Regulations surrounding food safety, labeling, and halal certification are particularly significant given the cultural and religious context of the region. The Saudi Food and Drug Authority (SFDA) mandates stringent guidelines for the production, import, and sale of chocolates to guarantee that they meet both international standards and local consumer needs. Additionally, regulations addressing the import of raw materials and tariffs impact the market dynamics for both domestic producers and global brands operating within the Kingdom. These policies help maintain consumer trust and provide a level playing field for all market players while encouraging innovation and sustainable practices.

Future Insights of the Saudi Arabia Chocolate Market

The Saudi Arabia chocolate market is poised for significant growth, driven by evolving consumer preferences and an expanding young population with a rising demand for premium and innovative chocolate products. The increasing penetration of e-commerce and digital marketing is expected to further boost sales, offering convenience and accessibility to a broader audience. Additionally, the focus on health-conscious and sugar-free chocolate options aligns with global trends, creating opportunities for niche markets. Local manufacturers and international players are likely to invest in product diversification, sustainable sourcing, and advanced production technologies to meet consumer expectations and regulatory requirements. With continued economic development and urbanization, the chocolate market in Saudi Arabia is set to flourish in the coming years.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories.

Milk chocolateto Dominate the Market-By Types

According to Ayushi, Senior Research Analyst, 6Wresearch, milk chocolate dominates the market in Saudi Arabia. The appeal of milk chocolate lies in its smooth texture and balanced sweetness, which resonates strongly with consumers across age groups. Its versatility in being used for snacks, desserts, and gifting purposes further enhances its widespread popularity. While dark chocolate is gaining traction due to its health benefits, milk chocolate continues to hold the lion’s share due to its broad consumer base.

Boxed assortmentsto Dominate the Market-ByProducts

Boxed assortments stand out as the leading segment in the Saudi Arabia Chocolate Market Share. These assortments are particularly favored due to their popularity for gifting during celebrations, holidays, and special occasions like Ramadan and Eid. The cultural importance of sharing and gifting in Saudi Arabia makes this segment a preferred choice among consumers. Additionally, the aesthetically appealing and premium packaging of boxed assortments further enhances their attractiveness, driving their dominance within the market.

Supermarkets and hypermarketsto Dominate the Market-By Distribution Channel

The supermarkets and hypermarkets segment takes precedence as the most dominant distribution channel. These outlets offer consumers a wide variety of chocolate products, often at competitive prices, and provide an in-person shopping experience allowing for spontaneous purchases. The widespread presence of these stores across urban and suburban areas makes them highly accessible.

Western Regionto Dominate the Market-By Regions

The Western region leads in chocolate market consumption. Being home to cities like Jeddah and Makkah, the Western region benefits from a high influx of tourists and pilgrims, particularly during Umrah and Hajj seasons, significantly boosting chocolate sales. The region's cosmopolitan nature and higher disposable incomes also contribute to the dominance of the chocolate market in this area.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024

- Base Year 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Saudi Arabia Chocolate Market Overview

- Saudi Arabia Chocolate Market Outlook

- Saudi Arabia Chocolate Market Forecast

- Historical Data of Saudi Arabia Chocolate Market Revenues & Volume for the Period 2021-2031

- Saudi Arabia Chocolate Market Size and Saudi Arabia Chocolate Market Forecast of Revenues & Volume, Until 2031

- Historical Data of Saudi Arabia Chocolate Market Revenues & Volume, by Types, for the Period 2021-2031

- Market Size & Forecast of Saudi Arabia Chocolate Market Revenues & Volume, by Types, Until 2031

- Historical Data of Saudi Arabia Chocolate Market Revenues & Volume, by Products, for the Period 2021-2031

- Market Size & Forecast of Saudi Arabia Chocolate Market Revenues & Volume, by Products, Until 2031

- Historical Data of Saudi Arabia Chocolate Market Revenues and Volume, By Distribution Channel, for the Period 2021-2031

- Market Size & Forecast of Saudi Arabia Chocolate Market Revenues and Volume, By Distribution Channel, Until 2031

- Historical Data of Central Chocolate Market Revenues and Volume, for the Period 2021-2031

- Market Size & Forecast of Central Chocolate Market Revenues and Volume, Until 2031

- Historical Data of Western Chocolate Market Revenues and Volume, for the Period 2021-2031

- Market Size & Forecast of Western Chocolate Market Revenues and Volume, Until 2031

- Historical Data of Eastern Chocolate Market Revenues and Volume, for the Period 2021-2031

- Market Size & Forecast of Eastern Chocolate Market Revenues and Volume, Until 2031

- Historical Data of Southern Chocolate Market Revenues and Volume, for the Period 2021-2031

- Market Size & Forecast of Southern Chocolate Market Revenues and Volume, Until 2031

- Market Drivers and Restraints

- Saudi Arabia Chocolate Market Price Trends

- Saudi Arabia Chocolate Market Trends and Products Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- Saudi Arabia Chocolate Market Share, By Players

- Saudi Arabia Chocolate Market Share, By Regions

- Saudi Arabia Chocolate Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

- Market Scope and Segmentation

Markets Covered

The report provides a detailed analysis of the following market segments

By Types

- Dark Chocolate

- Milk Chocolate

- White Chocolate

By Products

- Softline

- Boxed Assortments

- Contlines

- Seasonal Chocolates

- Moulded Chocolates

- Others

By Distribution Channel

- Supermarket and hypermarkets

- Specialist Retailers

- Convenience Stores

- Online Channel

- Others

By Regions

- Central

- Western

- Eastern

- Southern

Saudi Arabia Chocolate Market (2025-2031): FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of The Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. Saudi Arabia Chocolate Market Overview |

| 3.1 Saudi Arabia Country Indicators |

| 3.2 Saudi Arabia Chocolate Market Revenues, 2021-2031F |

| 3.3 Saudi Arabia Chocolate Market Revenue Share, By Product Types, 2021 & 2031F |

| 3.4 Saudi Arabia Chocolate Market Revenue Share, By Distribution Channels, 2021 & 2031F |

| 3.5 Saudi Arabia Chocolate Market Revenue Share, By Chocolate Types, 2021 & 2031F |

| 3.6 Saudi Arabia Chocolate Market-Industrial Life Cycle |

| 3.7 Saudi Arabia Chocolate Market-Porter’s Five Force Model |

| 4. Saudi Arabia Chocolate Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5. Saudi Arabia Chocolate Market Trends |

| 6. Saudi Arabia Chocolate Market Overview, By Product Types |

| 6.1 Saudi Arabia Milk Chocolate Market Revenues, 2021-2031F |

| 6.2 Saudi Arabia White Chocolate Market Revenues, 2021-2031F |

| 6.3 Saudi Arabia Dark Chocolate Market Revenues, 2021-2031F |

| 7. Saudi Arabia Chocolate Market Overview, By Distribution Channels |

| 7.1 Saudi Arabia Chocolate Market Revenues, By Supermarkets/ Hypermarkets, 2021-2031F |

| 7.2 Saudi Arabia Chocolate Market Revenues, By Grocery/ Mom n Pop Stores, 2021-2031F |

| 7.3 Saudi Arabia Chocolate Market Revenues, By Convenience Stores, 2021-2031F |

| 7.4 Saudi Arabia Chocolate Market Revenues, By Online Channel, 2021-2031F |

| 7.5 Saudi Arabia Chocolate Market Revenues, By Other Distribution Channels, 2021-2031F |

| 8. Saudi Arabia Chocolate Market Overview, By Chocolate Types |

| 8.1 Saudi Arabia Chocolate Market Revenues, By Countlines & Straight-lines, 2021-2031F |

| 8.2 Saudi Arabia Chocolate Market Revenues, By Moulded or Bar, 2021-2031F |

| 8.3 Saudi Arabia Chocolate Market Revenues, By Choco-Panned & Sugar Panned, 2021-2031F |

| 8.4 Saudi Arabia Chocolate Market Revenues, By Other Chocolate Types, 2021-2031F |

| 9. Saudi Arabia Chocolate Market – Key Performance Indicators |

| 10. Saudi Arabia Chocolate Market – Opportunity Assessment |

| 10.1 Saudi Arabia Chocolate Market Opportunity Assessment, By Distribution Channels, 2031F |

| 10.2 Saudi Arabia Chocolate Market Opportunity Assessment, By Chocolate Types, 2031F |

| 10.3 Saudi Arabia Chocolate Market Opportunity Assessment, By Product Types, 2031F |

| 11. Saudi Arabia Chocolate Market Competitive Landscape |

| 11.1 Saudi Arabia Chocolate Market Competitive landscape, By Technical and Operating Parameters |

| 11.2 Saudi Arabia Chocolate Market Revenue Share, By Company, 2024 |

| 12. Key Strategic Recommendations |

| 13. Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero