Saudi Arabia Crude Oil Market (2025-2031) Outlook | Share, Forecast, Size, Revenue, Trends, Growth, Companies, Industry, Analysis, Value

Market Forecast By Derivatives (Paraffin, Pentane, Octane, Naphthene, Aromatics, Asphaltic), By Composition (Hydrocarbon Compounds, Carbon, Hydrogen, Non-Hydrocarbon Compounds, Organometallic Compounds, Sodium, Calcium), By Type (Light Distillates, Light Oils, Medium Oils, Heavy Fuel Oil), By End Use (Light Commercial Vehicles, Passenger Vehicles, Mining, Agriculture, Residential) And Competitive Landscape

| Product Code: ETC412655 | Publication Date: Oct 2022 | Updated Date: Apr 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 |

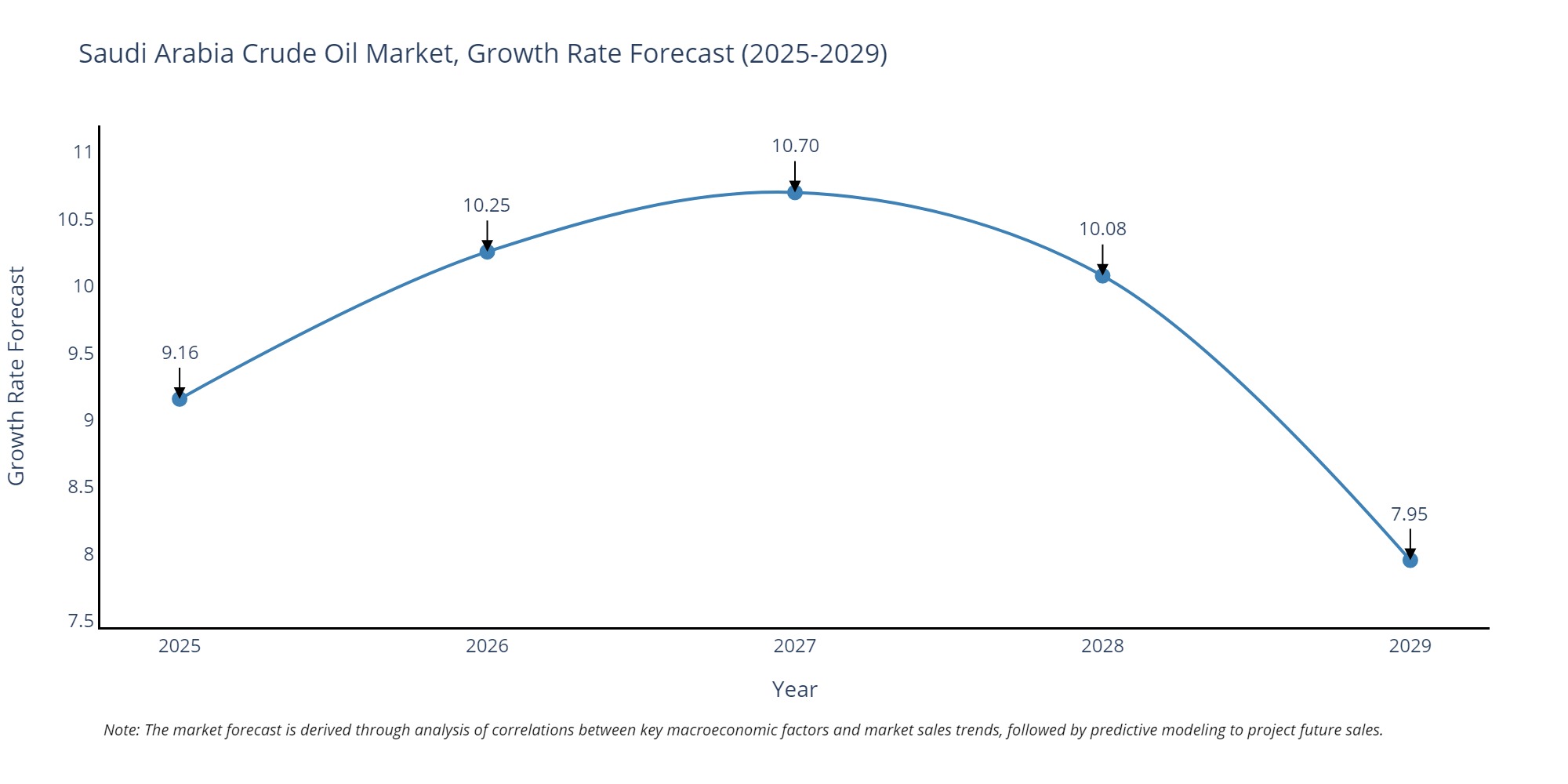

Saudi Arabia Crude Oil Market Growth Rate

Saudi Arabia is expected to see a 10.70% Exponential growth in the Crude Oil market by 2027. This surge is attributed by several ongoing aspects, including increased investments in oil exploration and improved oil extraction technologies. This anticipated growth underlines the Kingdom's strategic efforts to fortify its position as a leading global oil supplier. By leveraging its abundant oil reserves and continuously upgrading its extraction technologies, Saudi Arabia is well-equipped to meet increasing global energy demands. This growth trajectory also reflects the Kingdom's successful implementation of initiatives under the Vision 2030 plan, aimed at enhancing both domestic and international energy capabilities.

Additionally, as the country is investing significantly in infrastructure development and technological advancements, the efficiency and scale of its oil operations are projected to see impressive enhancements, further supporting to the anticipated market growth.

Saudi Arabia Crude Oil Market Synopsis

The cornerstone of Saudi Arabia economy, the crude oil market, holds global significance. The country possesses some of the world`s largest proven crude oil reserves and is a key player in the international oil market. Saudi Arabia production levels influence global oil prices and geopolitics. The government`s management of the oil sector, in alignment with market dynamics and global demand, has far-reaching economic implications for the nation. Efforts to diversify the economy have led to discussions about the country`s long-term dependence on oil exports.

Drivers of the Market

The Saudi Arabia crude oil market is driven by the country`s role as a major crude oil producer and exporter. Saudi Arabia position as one of the world`s largest oil producers influences global oil prices and supply dynamics. The country`s oil production capacity, geopolitical influence, and market policies have significant implications for the global energy market. Factors such as global demand, geopolitical events, and technological advancements also impact the dynamics of the Saudi Arabia crude oil market.

Challenges of the Market

The Crude Oil Market in Saudi Arabia, despite being a major global player, faces challenges related to oil price volatility. The country`s economy is heavily dependent on oil exports, rendering it susceptible to fluctuations in oil prices. Efforts to diversify the economy through initiatives like Vision 2031 underscore the need to reduce this dependency. Achieving a balance between maximizing oil revenue and ensuring long-term economic resilience is a complex challenge. Additionally, geopolitical factors and global shifts towards renewable energy sources can impact long-term demand for crude oil.

COVID-19 Impact on the Market

The COVID-19 pandemic had a significant impact on the crude oil market in Saudi Arabia and globally. Lockdowns, travel restrictions, and reduced economic activities led to a sharp decline in oil demand. This, coupled with a price war between major oil-producing nations, resulted in a historic drop in oil prices. Saudi Arabia, as a key oil producer, faced challenges in managing its oil production and exports amidst market uncertainties. The country worked with other oil-producing nations to stabilize the market through production cuts. As global economic activities started to recover, oil demand and prices gradually rebounded.

Key Players in the Market

The Saudi Arabia oil market is highly concentrated and dominated by the state-owned company Saudi Aramco. It holds a virtual monopoly in crude oil production, refining, distribution, and marketing activities. Other key players in the market include Kuwait Petroleum Corporation (KPC), Abu Dhabi National Oil Company (ADNOC), Qatar Petroleum International (QPI), and Emirates National Oil Company (ENOC). Additionally, other private firms such as PetroRabigh, SABIC Petrochemical Complex, Shell Group of Companies and Total have also carved out their respective share of the local market. In recent years foreign investment has been increasing in response to reforms initiated by Vision 2031 which encourages international companies to invest in downstream opportunities within the Kingdom.

Key Highlights of the Report:

- Saudi Arabia Crude Oil Market Outlook

- Market Size of Saudi Arabia Crude Oil Market, 2024

- Forecast of Saudi Arabia Crude Oil Market, 2031

- Historical Data and Forecast of Saudi Arabia Crude Oil Revenues & Volume for the Period 2021-2031

- Saudi Arabia Crude Oil Market Trend Evolution

- Saudi Arabia Crude Oil Market Drivers and Challenges

- Saudi Arabia Crude Oil Price Trends

- Saudi Arabia Crude Oil Porter's Five Forces

- Saudi Arabia Crude Oil Industry Life Cycle

- Historical Data and Forecast of Saudi Arabia Crude Oil Market Revenues & Volume By Derivatives for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Crude Oil Market Revenues & Volume By Paraffin for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Crude Oil Market Revenues & Volume By Pentane for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Crude Oil Market Revenues & Volume By Octane for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Crude Oil Market Revenues & Volume By Naphthene for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Crude Oil Market Revenues & Volume By Aromatics for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Crude Oil Market Revenues & Volume By Asphaltic for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Crude Oil Market Revenues & Volume By Composition for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Crude Oil Market Revenues & Volume By Hydrocarbon Compounds for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Crude Oil Market Revenues & Volume By Carbon for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Crude Oil Market Revenues & Volume By Hydrogen for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Crude Oil Market Revenues & Volume By Non-Hydrocarbon Compounds for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Crude Oil Market Revenues & Volume By Organometallic Compounds for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Crude Oil Market Revenues & Volume By Sodium for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Crude Oil Market Revenues & Volume By Calcium for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Crude Oil Market Revenues & Volume By Type for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Crude Oil Market Revenues & Volume By Light Distillates for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Crude Oil Market Revenues & Volume By Light Oils for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Crude Oil Market Revenues & Volume By Medium Oils for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Crude Oil Market Revenues & Volume By Heavy Fuel Oil for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Crude Oil Market Revenues & Volume By End Use for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Crude Oil Market Revenues & Volume By Light Commercial Vehicles for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Crude Oil Market Revenues & Volume By Passenger Vehicles for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Crude Oil Market Revenues & Volume By Mining for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Crude Oil Market Revenues & Volume By Agriculture for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Crude Oil Market Revenues & Volume By Residential for the Period 2021-2031

- Saudi Arabia Crude Oil Import Export Trade Statistics

- Market Opportunity Assessment By Derivatives

- Market Opportunity Assessment By Composition

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By End Use

- Saudi Arabia Crude Oil Top Companies Market Share

- Saudi Arabia Crude Oil Competitive Benchmarking By Technical and Operational Parameters

- Saudi Arabia Crude Oil Company Profiles

- Saudi Arabia Crude Oil Key Strategic Recommendations

Saudi Arabia Crude Oil Market (2024-2030): FAQs

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero