Saudi Arabia Plough Market (2025-2031) | Value, Analysis, Size, Growth, Trends, Industry, Share, Revenue, Companies, Forecast & Outlook

| Product Code: ETC051499 | Publication Date: Jul 2023 | Updated Date: Feb 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

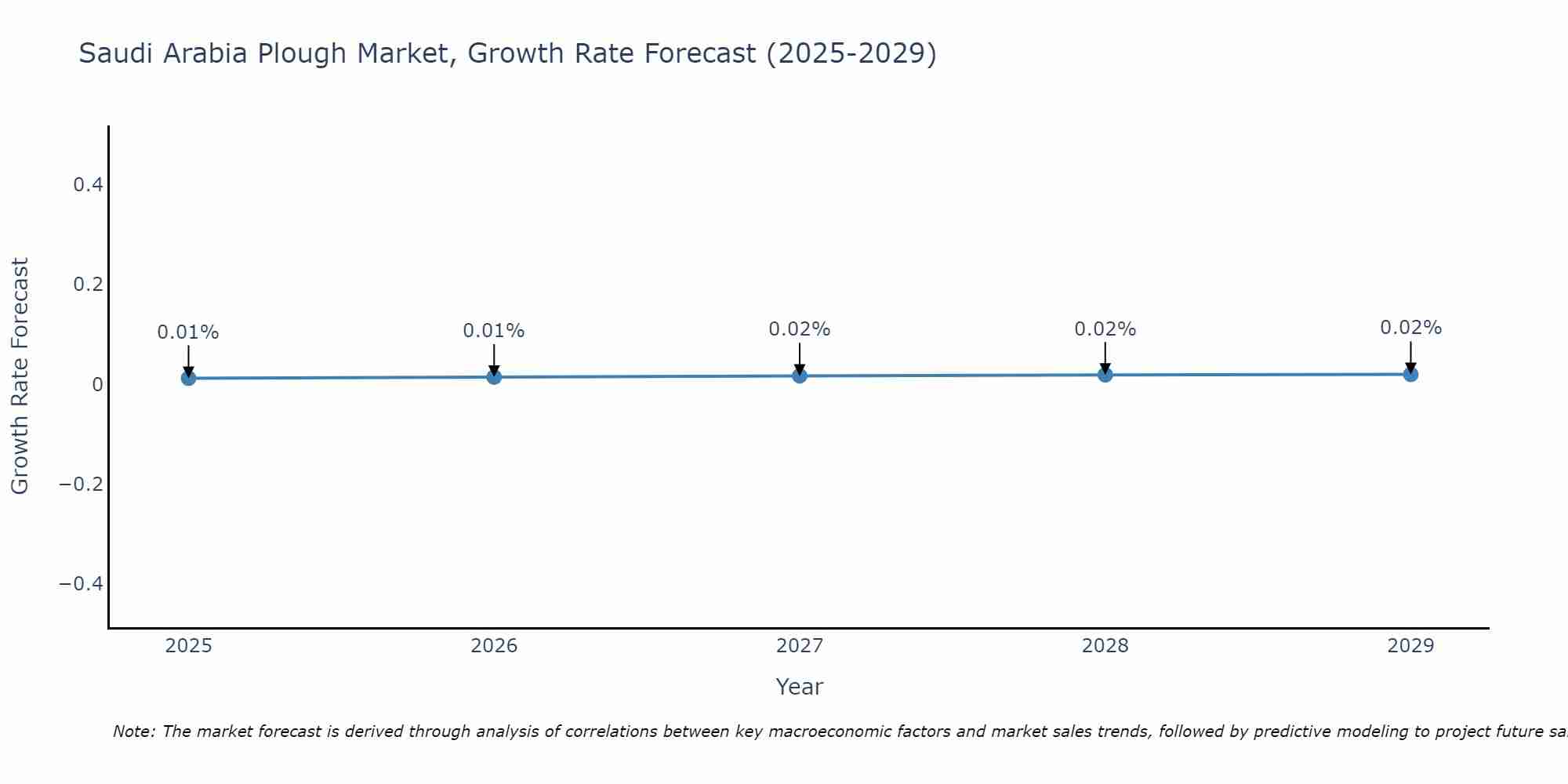

Saudi Arabia Plough Market Size Growth Rate

The Saudi Arabia Plough Market is likely to experience consistent growth rate gains over the period 2025 to 2029. From 0.01% in 2025, the growth rate steadily ascends to 0.02% in 2029.

Saudi Arabia Plough Market Synopsis

The Saudi Arabia plough market is expected to witness a significant growth during the forecast period of 2025-2031. This growth is attributed to the increasing mechanization of farming and rising demand for advanced agricultural equipment in the country. In addition, government initiatives such as subsidies on ploughs, increased support for small farmers and high investments in agriculture are likely to further drive market growth over the forecast period.

Market Drivers

The adoption of mechanized farming activities has been increasing significantly due to its numerous advantages such as less manual labor requirements, improved yield output with precise operations and cost reduction associated with manpower costs. As a result, this has become one of the major drivers for the Saudi Arabia plough market. Rising Demand For Advanced Agricultural Equipment: There has been an increase in demand from both large scale commercial farms and smallholders for efficient farming equipment that can reduce labor requirement while improving yields at reduced costs. This is likely to create opportunities for manufacturers operating in the Saudi Arabia plough market over the forecast period. The government provides various incentives such as reasonable loans or subsidies on agricultural machinery purchases which have encouraged farmers to invest more capital into modernizing their farm production processes. This factor is also likely to contribute towards positive growth prospects for manufacturers operating in this region over coming years.

Challenges of the Market

Most farmers lack awareness about advanced technologies available nowadays which can significantly improve their efficiency but comes at higher prices than conventional machinery options available currently in markets leading them away from investing into these solutions hence restraining potential expansion of companies manufacturing these products within Saudi Arabia.

Covid 19 Impact on the Market

However, COVID-19 pandemic has caused a slow down in production activities leading to an overall decline in demand for ploughs from all sectors including agriculture. This will lead to decreased revenues for manufacturers operating within this space over the forecast period (2025-2031). Additionally, rising prices of raw materials used in manufacturing these products may further hamper industry profitability during the period under review.

key players of the Market

Major players operating within Saudi Arabia plough market include Agrigem Ltd., John Deere Inc., Kubota Corporation, AGCO Corporation and Same Deutz Fahr Group SDF Group among others. These companies have adopted various strategies such as mergers & acquisitions and product launches in order to gain traction within the highly competitive landscape prevailing within Saudi Arabia plough market.

Key Highlights of the Report:

- Saudi Arabia Plough Market Outlook

- Market Size of Saudi Arabia Plough Market, 2024

- Forecast of Saudi Arabia Plough Market, 2031

- Historical Data and Forecast of Saudi Arabia Plough Revenues & Volume for the Period 2021-2031

- Saudi Arabia Plough Market Trend Evolution

- Saudi Arabia Plough Market Drivers and Challenges

- Saudi Arabia Plough Price Trends

- Saudi Arabia Plough Porter's Five Forces

- Saudi Arabia Plough Industry Life Cycle

- Historical Data and Forecast of Saudi Arabia Plough Market Revenues & Volume By Types for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Plough Market Revenues & Volume By Traditional Plough for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Plough Market Revenues & Volume By Modern Plough for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Plough Market Revenues & Volume By Specialist Plough for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Plough Market Revenues & Volume By Application for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Plough Market Revenues & Volume By Farm for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Plough Market Revenues & Volume By Individual Farming for the Period 2021-2031

- Saudi Arabia Plough Import Export Trade Statistics

- Market Opportunity Assessment By Types

- Market Opportunity Assessment By Application

- Saudi Arabia Plough Top Companies Market Share

- Saudi Arabia Plough Competitive Benchmarking By Technical and Operational Parameters

- Saudi Arabia Plough Company Profiles

- Saudi Arabia Plough Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 Saudi Arabia Plough Market Overview |

3.1 Saudi Arabia Country Macro Economic Indicators |

3.2 Saudi Arabia Plough Market Revenues & Volume, 2021 & 2031F |

3.3 Saudi Arabia Plough Market - Industry Life Cycle |

3.4 Saudi Arabia Plough Market - Porter's Five Forces |

3.5 Saudi Arabia Plough Market Revenues & Volume Share, By Types, 2021 & 2031F |

3.6 Saudi Arabia Plough Market Revenues & Volume Share, By Application, 2021 & 2031F |

4 Saudi Arabia Plough Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.3 Market Restraints |

5 Saudi Arabia Plough Market Trends |

6 Saudi Arabia Plough Market, By Types |

6.1 Saudi Arabia Plough Market, By Types |

6.1.1 Overview and Analysis |

6.1.2 Saudi Arabia Plough Market Revenues & Volume, By Types, 2021-2031F |

6.1.3 Saudi Arabia Plough Market Revenues & Volume, By Traditional Plough, 2021-2031F |

6.1.4 Saudi Arabia Plough Market Revenues & Volume, By Modern Plough, 2021-2031F |

6.1.5 Saudi Arabia Plough Market Revenues & Volume, By Specialist Plough, 2021-2031F |

6.2 Saudi Arabia Plough Market, By Application |

6.2.1 Overview and Analysis |

6.2.2 Saudi Arabia Plough Market Revenues & Volume, By Farm, 2021-2031F |

6.2.3 Saudi Arabia Plough Market Revenues & Volume, By Individual Farming, 2021-2031F |

7 Saudi Arabia Plough Market Import-Export Trade Statistics |

7.1 Saudi Arabia Plough Market Export to Major Countries |

7.2 Saudi Arabia Plough Market Imports from Major Countries |

8 Saudi Arabia Plough Market Key Performance Indicators |

9 Saudi Arabia Plough Market - Opportunity Assessment |

9.1 Saudi Arabia Plough Market Opportunity Assessment, By Types, 2021 & 2031F |

9.2 Saudi Arabia Plough Market Opportunity Assessment, By Application, 2021 & 2031F |

10 Saudi Arabia Plough Market - Competitive Landscape |

10.1 Saudi Arabia Plough Market Revenue Share, By Companies, 2024 |

10.2 Saudi Arabia Plough Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero