Saudi Arabia Solar Panel Market (2018-2024) | Size, Share, Growth, Revenue, Analysis, Forecast, Tends, Industry & Outlook

Market Forecast By Types (Monocrystalline, Polycrystalline, and Thin-film (Amorphous Silicon, Cadmium Telluride, and Copper Indium Gallium Selenide)), By Applications (Residential, Commercial, Industrial, and Power Utilities), By Regions (Eastern, Western, Central, and Southern) and Competitive Landscape

| Product Code: ETC000481 | Publication Date: Aug 2022 | Updated Date: May 2024 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 120 | No. of Figures: 47 | No. of Tables: 15 | |

Saudi Arabia Solar Panel Market Competition 2023

Saudi Arabia Solar Panel market currently, in 2023, has witnessed an HHI of 9793, Which has increased substantially as compared to the HHI of 2138 in 2017. The market is moving towards Highly concentrated. Herfindahl index measures the competitiveness of exporting countries. The range lies from 0 to 10000, where a lower index number represents a larger number of players or exporting countries in the market while a large index number means fewer numbers of players or countries exporting in the market.

Saudi Arabia Export Potential Assessment For Solar Panel Market (Values in USD Thousand)

Latest (2023) Development of the Saudi Arabia Solar Panel Market

Saudi Arabia Solar Panel Market has witnessed many technological changes in recent years in bio solar cells. Perovskite is a lightweight calcium titanium oxide mineral and a group of compounds that have the same type of crystal structure. Insight has developed a technology that uses hexagonal lenses in the protective glass that coats solar panels to concentrate light and produce more energy.

Desert Technologies Industries has recently announced that it has joined Made in Saudi Arabia program which is further boosting the growth of the market. The company is one of the leading exporters of solar panels in the country. The aim is to expand the nation and encourage non-oil sectors in order to encourage renewable energy.

Mergers and Acquisitions

- Renew Power merge with SPAC RMG II on August 17, 2021.

Saudi Arabia Solar Panel Market Synopsis

Saudi Arabia Solar Panel Market Report thoroughly covers the Solar Panel market by types, applications, and regions. The Saudi Arabia Solar Panel Market Outlook report provides an unbiased and detailed analysis of Saudi Arabia Solar Panel Market Trends, opportunities/high growth areas, and market drivers which would help the stakeholders devise and align their market strategies according to the current and future market dynamics.

Saudi Arabia is one of the major consumers of solar panels in the Middle East region. Growth in Saudi Arabia solar panel market is buoyed by factors such as growing energy demand and shifting focus towards non-oil sectors. Additionally, the Saudi government aims to increase the share of cleaner fuel in the country's power generation capacity. The solar panel market in Saudi Arabia would surge on account of growing investment in the renewable energy sector of which a major share would go into solar energy. Rising environmental concerns coupled with increasing awareness regarding the reduction of carbon emissions is driving the Saudi Arabia Solar Panel Market Growth. Surging penetration towards the utilization of renewable energy is boosting the development of the market. The increasing adoption of solar energy in industrial, commercial, and residential sectors is proliferating the growth of the industry. Increasing efforts taken by the government in order to develop renewable energy coupled with initiatives taken by the national administration are adding to the Saudi Arabia Solar Panel Market Share. Increasing installation of solar parks coupled with the increasing price of electricity is also propelling the development of the industry.

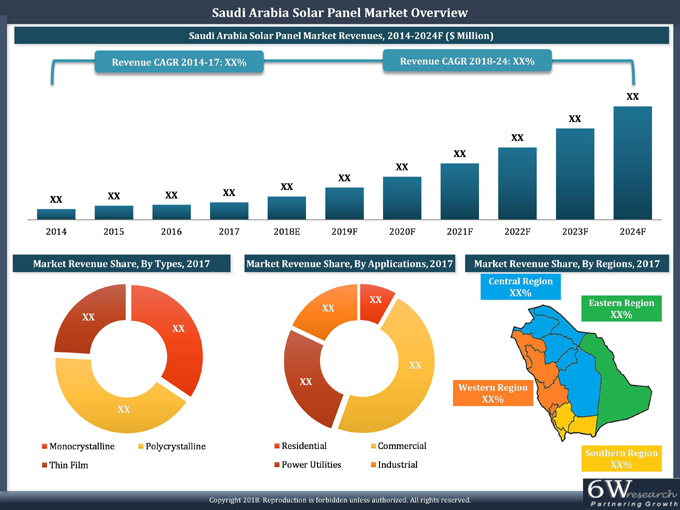

According to 6Wresearch, Saudi Arabia Solar Panel market size is projected to grow at a CAGR of 30.2% during 2018-2024. Saudi Arabia is likely to ramp up spending on the renewable energy sector. Spending on solar energy is growing tremendously over the past few years. For instance, Saudi Arabia has signed a memorandum of understanding (MoU) with SoftBank Group to build the world's largest solar project of 200 GW worth $200 Billion by 2030, which would positively impact the solar panel market in the coming years.

Market Analysis By Types

Amongst all types, polycrystalline solar panel captured the significant Saudi Arabia Solar Panel Market share in terms of revenues and is expected to maintain market leadership over the forecast period as well. The commercial application was the key revenue-generating application followed by the Power Utility application in Saudi Arabia Solar Panel market. Key players in Saudi Arabia solar panel market include First Solar, Canadian Solar, Jinko Solar, Trina Solar, GTek Solar, and Desert Technologies.

Key Players in The Market

Some of the key players in Saudi Arabia Solar Panel Market are:

- First Solar

- Canadian Solar

- Jinko Solar

- Trina Solar

- GTek Solar

- Desert Technologies

Key Attractiveness of The Report

- 10 Years Market Numbers.

- Historical Data Starting from 2014 to 2017.

- Base Year: 2017.

- Forecast Data until 2024.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Saudi Arabia Solar Panel Market Overview

- Saudi Arabia Solar Panel Market Outlook

- Saudi Arabia Solar Panel Market Forecast

- Saudi Arabia Solar Panel Market Size and Saudi Arabia Solar Panel Market Forecast Revenues until 2024

- Historical Data of Saudi Arabia Solar Panel Market Revenues for the Period 2014-2017.

- Market Size & Forecast of Saudi Arabia Solar Panel Market Revenues until 2024.

- Historical Data of Saudi Arabia Solar Panel Market Revenues By Types for the Period 2014-2017.

- Market Size & Forecast of Saudi Arabia Solar Panel Market Revenues By Types until 2024.

- Historical Data of Saudi Arabia Solar Panel Market Revenues By Applications for the Period 2014-2017.

- Market Size & Forecast of Saudi Arabia Solar Panel Market Revenues By Applications until 2024.

- Historical Data of Saudi Arabia Solar Panel Market Revenues By Regions for the Period 2014-2017.

- Saudi Arabia Solar Panel Market Size & Forecast of Saudi Arabia Solar Panel Market Revenues By Regions until 2024.

- Market Drivers and Restraints.

- Saudi Arabia Solar Panel Market Trends and Developments.

- Saudi Arabia Solar Panel Market Share, By Players.

- Saudi Arabia Solar Panel Market Overview on Competitive Benchmarking, By Types

- Company Profiles.

- Strategic Recommendations.

Markets Covered

The Saudi Arabia Solar Panel Market Report provides a detailed analysis of the following market segments:

By Types

- Monocrystalline

- Polycrystalline

- Thin-film

-

- Amorphous Silicon

- Cadmium Telluride

- Copper Indium Gallium Selenide

By Applications

- Residential

- Commercial

- Industrial

- Power Utilities

By Regions

- Eastern

- Western

- Central

- Southern

Saudi Arabia Solar Panel Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of The Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. Saudi Arabia Solar Panel Market Overview |

| 3.1 Saudi Arabia Country Indicators |

| 3.2 Saudi Arabia Solar Panel Market Revenues, 2014-2024F |

| 3.3 Saudi Arabia Solar Energy Outlook |

| 3.4 Saudi Arabia Solar Panel Market Revenue Share, By Types, 2017 & 2024F |

| 3.5 Saudi Arabia Solar Panel Market Revenue Share, By Applications, 2017 & 2024F |

| 3.6 Saudi Arabia Solar Panel Market Revenue Share, By Regions, 2017 & 2024F |

| 3.7 Saudi Arabia Solar Panel Market Industry Life Cycle |

| 3.8 Saudi Arabia Solar Panel Market Porter's 5 Forces Model, 2017 |

| 4. Saudi Arabia Solar Panel Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5. Saudi Arabia Solar Panel Market Trends |

| 5.1 Market Trends |

| 6. Saudi Arabia Solar Panel Market Overview, By Types |

| 6.1 Saudi Arabia Monocrystalline Solar Panel Market Revenues, 2014 - 2024F |

| 6.2 Saudi Arabia Polycrystalline Solar Panel Market Revenues, 2014 - 2024F |

| 6.3 Saudi Arabia Thin-Film Solar Panel Market Revenues, 2014 - 2024F |

| 6.3.1 Saudi Arabia Thin-Film Solar Panel Market Revenue Share, By Sub Segment, 2017 & 2024F |

| 6.3.2 Saudi Arabia Thin-Film Solar Panel Market Revenues, By Sub Segment, 2014-2017 & 2018-2024F |

| 6.4 List of Solar Projects in Saudi Arabia, By Types of Panel |

| 7. Saudi Arabia Solar Panel Market Overview, By Applications |

| 7.1 Saudi Arabia Commercial Application Solar Panel Market Revenues, 2014 - 2024F |

| 7.1.1 Saudi Arabia Commercial Sector Overview |

| 7.2 Saudi Arabia Residential Application Solar Panel Market Revenues, 2014 - 2024F |

| 7.2.1 Saudi Arabia Residential Sector Overview |

| 7.3 Saudi Arabia Power Utilities Application Solar Panel Market Revenues, 2014 - 2024F |

| 7.3.1 Saudi Arabia Power Sector Overview |

| 7.4 Saudi Arabia Industrial Application Solar Panel Market Revenues, 2014 - 2024F |

| 7.4.1 Saudi Arabia Industrial Sector Overview |

| 8. Saudi Arabia Solar Panel Market Overview, By Regions |

| 8.1 Saudi Arabia Central Region Solar Panel Market Revenues, 2014 - 2024F |

| 8.2 Saudi Arabia Eastern Region Solar Panel Market Revenues, 2014 - 2024F |

| 8.3 Saudi Arabia Southern Region Solar Panel Market Revenues, 2014 - 2024F |

| 8.4 Saudi Arabia Western Region Solar Panel Market Revenues, 2014 - 2024F |

| 9. Upcoming Solar Projects In Saudi Arabia |

| 9.1 Ongoing Solar Power Projects |

| 10. Saudi Arabia Solar Panel Market - Key Performance Indicators |

| 10.1 Saudi Arabia Power Sector Outlook |

| 10.2 Saudi Arabia Government Spending Outlook |

| 10.3 Saudi Arabia Construction Market Outlook |

| 10.4 Major Infrastructure Projects in Saudi Arabia |

| 11. Saudi Arabia Solar Panel Market Opportunity Assessment |

| 11.1 Saudi Arabia Solar Panel Market Opportunity Assessment, By Types |

| 11.2 Saudi Arabia Solar Panel Market Opportunity Assessment, By Applications |

| 12. Saudi Arabia Solar Panel Market Competitive Landscape |

| 12.1 Saudi Arabia Solar Panel Market Revenue Share, By Company, 2017 |

| 12.2 Competitive Benchmarking, By Types |

| 13. Company Profiles |

| 13.1 Canadian Solar Middle East Limited |

| 13.2 Desert Technologies |

| 13.3 First Solar International Middle East FZ-LLC |

| 13.4 Green Technology Company (GTek Solar) |

| 13.5 Hanwha Q CELLS Co., Ltd. |

| 13.6 Jinko Solar |

| 13.7 Solar Frontier K.K |

| 13.8 SunPower |

| 13.9 Trina Solar Middle East Ltd |

| 13.10 Yingli Green Energy Holding Co., Ltd. |

| 14. Strategic Recommendations |

| 14.1 Opportunity In Domestic Manufacturing |

| 14.2 Opportunity In Power Utility Sector |

| 14.3 Opportunity In Residential Sector |

| 15. Disclaimer |

| List of Figures |

| 1. Saudi Arabia Solar Panel Market Revenues, 2014 - 2024F ($ Million) |

| 2. Saudi Arabia Total Energy Mix, 2017 & 2032 |

| 3. Saudi Arabia Installed Solar Photovoltaic Capacity, 2010-2017 (MW) |

| 4. Saudi Arabia Solar Panel Market Revenue Share, By Types, 2017 & 2024F |

| 5. Saudi Arabia Solar Panel Market Revenue Share, By Applications, 2017 & 2024F |

| 6. Saudi Arabia Solar Panel Market Revenue Share, By Regions, 2017 & 2024F |

| 7 . Saudi Arabia Solar Panel Market industry Life Cycle, 2017 |

| 8. The Preliminary Schedule For The 9.5 Gigawatt Tender In Saudi Arabia, 2018-2023 |

| 9. Solar Panel Price Trend, 2014-2018 ($ Per Watt) |

| 10. Photovoltaic Power Potential in Saudi Arabia |

| 11. Saudi Arabia Distribution Of Energy Consumption, By Sectors, 2016 |

| 12. Saudi Arabia Building Sector Construction Contracts Awards, 2013-2017 ($ Million) |

| 13. Saudi Arabia Pace of Project Cancellations, 2013-2017 ($ Billion) |

| 14. Saudi Arabia Monocrystalline Solar Panel Market Revenues, 2014 - 2024F ($ Million) |

| 15. Saudi Arabia Polycrystalline Solar Panel Market Revenues, 2014 - 2024F ($ Million) |

| 16. Saudi Arabia Thin-Film Solar Panel Market Revenues, 2014 - 2024F ($ Million) |

| 17. Saudi Arabia Thin-Film Solar Panel Market Revenue Share, By Sub Segment, 2017 & 2024F |

| 18. Saudi Arabia Commercial Application Solar Panel Market Revenues, 2014 - 2024F ($ Million) |

| 19. Riyadh Office Supply, 2014-2019F ('000 Sq. m.) |

| 20. Jeddah Office Supply, 2014-2019F ('000 Sq. m.) |

| 21. Riyadh Retail Supply, 2014-2019F ('000 Sq. m.) |

| 22. Jeddah Retail Supply, 2014-2019F ('000 Sq. m.) |

| 23. Riyadh Hotel Supply, 2014-2019F (No. of Rooms0 |

| 24. Jeddah Hotel Supply, 2014-2019F (No. of Rooms |

| 25. Major Upcoming Healthcare Projects in Saudi Arabia |

| 26. Upcoming Healthcare Projects in Saudi Arabia |

| 27. Saudi Arabia Residential Application Solar Panel Market, 2014 - 2024F ($ Million) |

| 28. Saudi Arabia Power Utilities Application Solar Panel Market Revenues, 2014 - 2024F ($ Million) |

| 29. Upcoming Power Plant Projects in Saudi Arabia |

| 30. Saudi Arabia Industrial Application Solar Panel Market Revenues, 2014 - 2024F ($ Million) |

| 31. Total Number of Manufacturing Facilities in Saudi Arabia, Q1-Q3 2017 |

| 32. Production of Refined Products in Saudi Arabia, 2014-2016 (Million Barrels) |

| 33. Saudi Arabia Central Region Solar Panel Market Revenues, 2014 - 2024F ($ Million) |

| 34. Saudi Arabia Eastern Region Solar Panel Market Revenues, 2014 - 2024F ($ Million) |

| 35. Saudi Arabia Southern Region Solar Panel Market Revenues, 2014 - 2024F ($ Million) |

| 36. Saudi Arabia Western Region Solar Panel Market Revenues, 2014 - 2024F ($ Million) |

| 37. Saudi Arabia Renewable Energy Contribution to Total Installed Power Capacity, 2015-2023F (GW) |

| 38. Saudi Arabia Actual Government Spending Vs Actual Government Revenues, 2012-2023F ($ Billion) |

| 39. Saudi Arabia Government Budget Spending Outlook, 2018 ($ Billion) |

| 40. Saudi Arabia Construction Contracts Awards, 2016-2017 ($ Million) |

| 41. Saudi Arabia Building Construction Projects Value by Status, 2017 |

| 42. Saudi Arabia Value of Awarded Contracts, 2013-2018E ($ Billion) |

| 43. Value of Awarded Contracts by Sector During Q1'17 |

| 44. Upcoming Construction Projects in Saudi Arabia |

| 45. Saudi Arabia Solar Panel Market Opportunity Assessment, By Types, 2024F |

| 46. Saudi Arabia Solar Panel Market Opportunity Assessment, By Applications, 2024F |

| 47. Saudi Arabia Solar Panel Market Revenue Share, By Company, 2017 |

| List of Tables |

| 1. Saudi Arabia Tariffs (2017) |

| 2. Saudi Arabia Tariffs (2018) |

| 3. Efficiency Rating of PV Models by Solar Panel Manufacturer |

| 4. Saudi Arabia Thin-Film Solar Panel Market Revenues, By Sub Segment, 2014-2017 ($ Million) |

| 5. Saudi Arabia Thin-Film Solar Panel Market Revenues, By Segment, 2018-2024 ($ Million) |

| 6. List of Solar Projects in Saudi Arabia, By Types of Panel |

| 7. Upcoming Hotels Projects in Saudi Arabia |

| 8. Upcoming Residential Projects in Saudi Arabia |

| 9. Saudi Arabia Upcoming Industrial Projects |

| 10. Under Construction Manufacturing Units in Saudi Arabia, Q4 2017 & Q1 2018 |

| 11. Upcoming Manufacturing Plants in Saudi Arabia |

| 12. Saudi Arabia Upcoming Petrochemical Projects |

| 13. Saudi Arabia Upcoming Solar Projects |

| 14. Saudi Arabia Budget Expenses By Sectors, 2017 and 2018 ($ Billion) |

| 15. List of Major Infrastructure Projects in Saudi Arabia |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Kenya Road Stabilization Equipment Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- North America Sodium chloride Market (2025-2031) | Analysis, Revenue, Forecast, Trends, Companies, Size, Growth, Share, Industry, Outlook & Value

- North America Vinyl Flooring Market (2025-2031) | Value, Growth,Size, Analysis, Revenue, Industry, Forecast, Share, Outlook, Companies & Trends

- Tajikistan Thermal Camera Market (2025-2031) | Trends, Size, Growth, Share, Industry, Companies, Value, Analysis, Revenue, Forecast & Outlook

- Singapore Professional AV Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- Saudi Arabia Genset Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- India OOH Advertising Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- Vietnam Twisted Pair Cables Market (2024-2030) | Size & Revenue, Forecast, Share, Companies, Competitive Landscape, Analysis, Trends, Value, Segmentation, Outlook, Industry, Growth

- South Africa B2B Cleaning Market (2025-2031) | Size & Revenue, Forecast, Share, Companies, Competitive Landscape, Analysis, Trends, Value, Segmentation, Outlook, Industry, Growth

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero