Singapore Bicycles Market (2024-2030) | Analysis, Outlook, Trends, Share, Growth, Companies, Value, Size, Industry, Forecast, Revenue

| Product Code: ETC027647 | Publication Date: Jul 2023 | Updated Date: May 2024 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

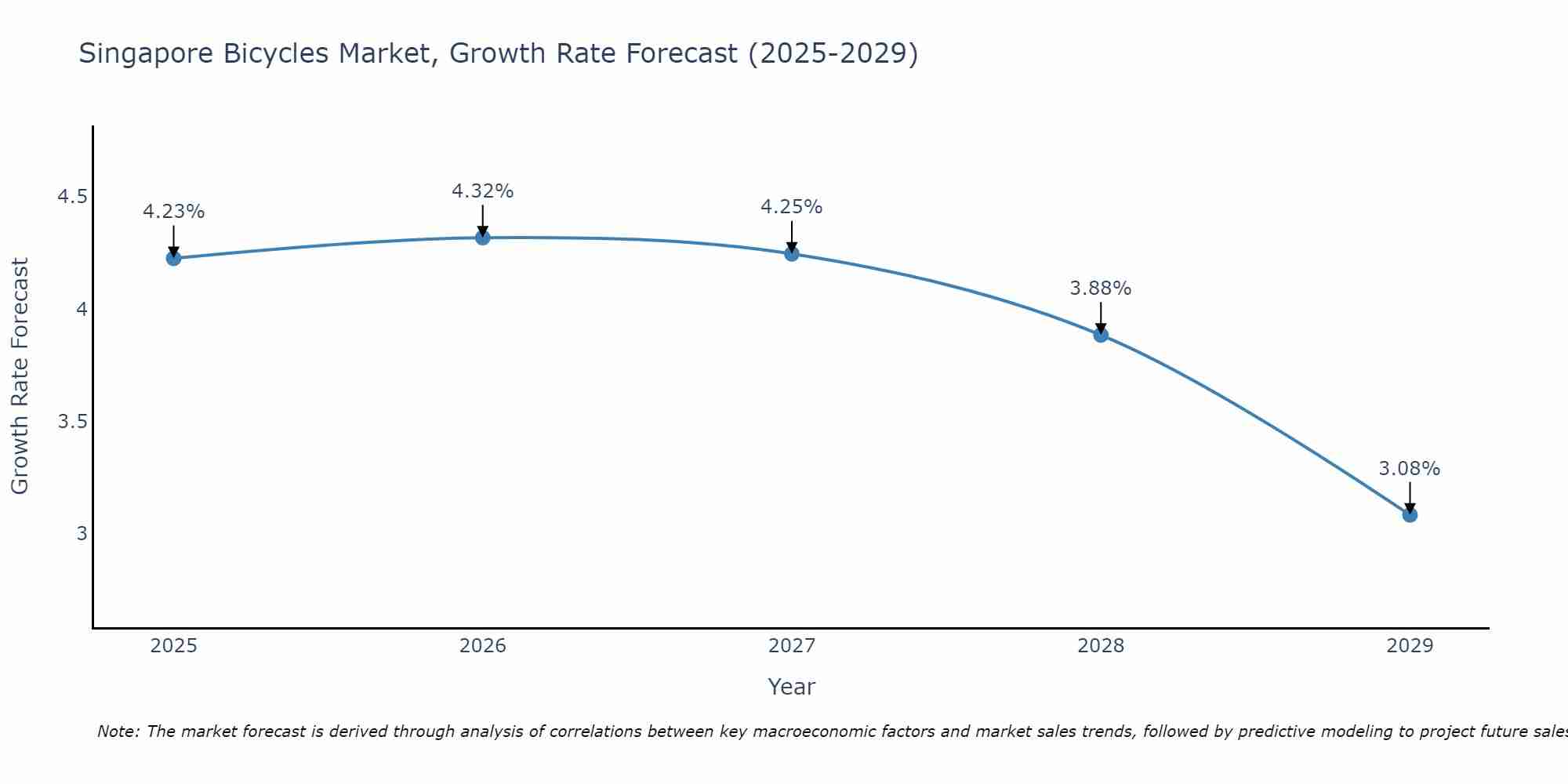

Singapore Bicycles Market Size Growth Rate

The Singapore Bicycles Market is projected to witness mixed growth rate patterns during 2025 to 2029. The growth rate begins at 4.23% in 2025, climbs to a high of 4.32% in 2026, and moderates to 3.08% by 2029.

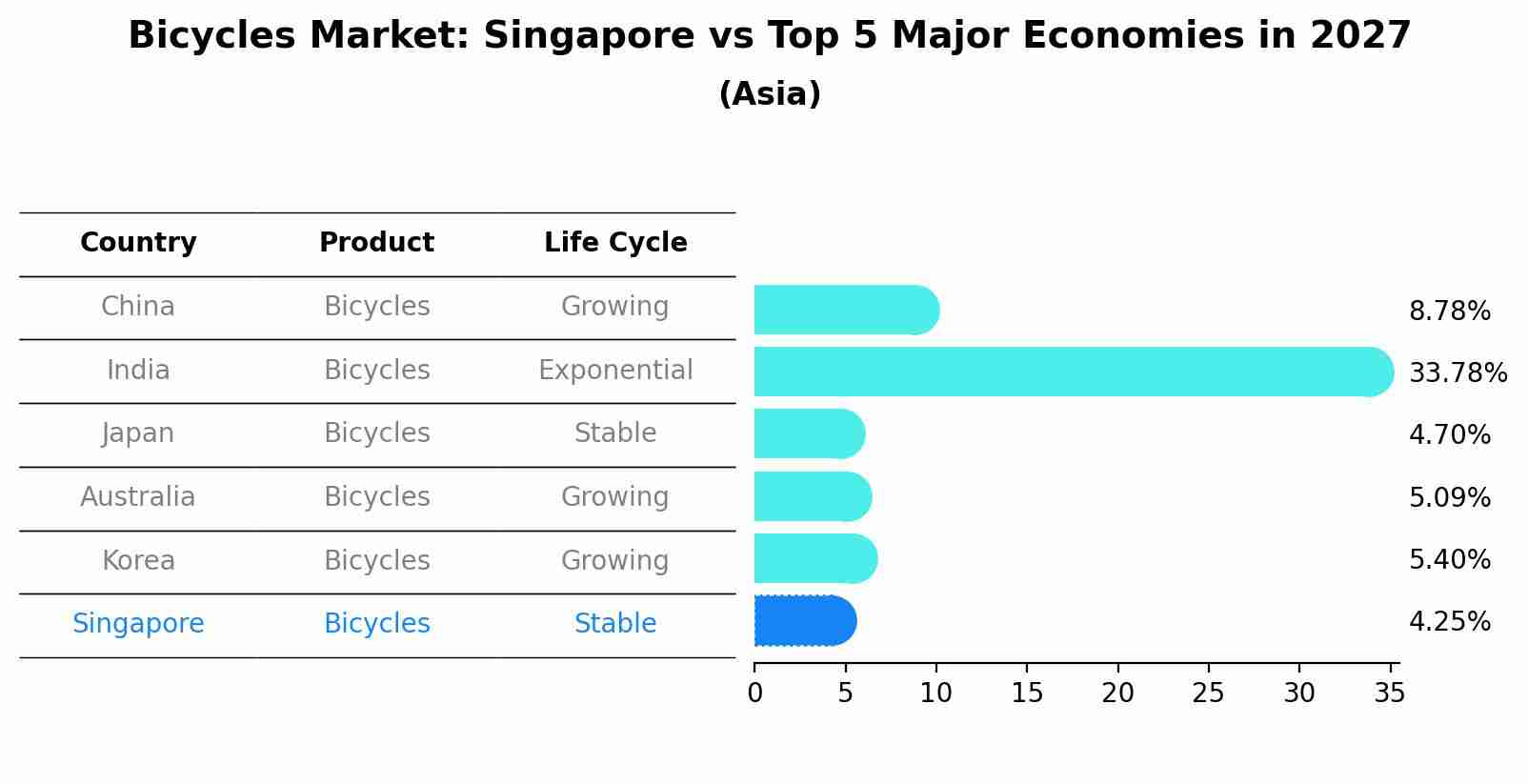

Bicycles Market: Singapore vs Top 5 Major Economies in 2027 (Asia)

The Bicycles market in Singapore is projected to grow at a stable growth rate of 4.25% by 2027, within the Asia region led by China, along with other countries like India, Japan, Australia and South Korea, collectively shaping a dynamic and evolving market environment driven by innovation and increasing adoption of emerging technologies.

Singapore Bicycles Market Synopsis

The Singapore Bicycles market is projected to grow at a CAGR of 5.6% during the forecast period (2020-2026). Factors such as increasing awareness about health benefits of cycling, growing environmental concerns and rising fuel prices are driving the demand for bicycles in Singapore. However, lack of dedicated infrastructure and abundance of public transport may hamper the growth of the market.

Market Drivers

Rising Fuel Prices: Increasing fuel prices have encouraged people to opt for alternative modes of transportation such as bicycles which require no fuel or electricity for operation, thereby propelling the growth of bicycle industry in Singapore.Growing Environmental Concerns: The need to reduce carbon footprint has resulted in significant adoption rate for green mobility options like bicycles among high net worth individuals and millennials, facilitating an increase in demand for these products over recent years.Fitness Benefits Associated With Cycling: Cycling is increasingly being viewed as a source of physical activity by people across all age brackets due to its immense health benefits associated with it, further boosting up sales figures globally including those from Singapore markets as well.

Market challenges

Lack Of Dedicated Infrastructure For Cyclists/Bicyclists In Cities And Public Roads: Although cycling is becoming popular amongst commuters due to its convenience, safety remains an issue due to lack of dedicated cycle lanes on public roads that can separate cyclists/bicyclists from other motorized vehicles thus posing potential risk while riding on busy streets.Abundance Of Public Transportation Options Available At Low Costs : There exists plethora number public transportation options available at low costs compared with buying a bicycle leading many commuters towards opting these services instead.This factor could act negatively on sale figures registered by local manufacturers operating within this segment in long run.

Key players

Some major players operating within this space include Merida Industry Co Ltd., Giant Manufacturing Co Ltd., Accell Group Nv, Dorel Industries Inc., among others.

Covid-19 Impact

The coronavirus pandemic had adversely impacted almost every sector worldwide including that affecting sale figures registered by bikes manufacturers operating within this space.Increase work from home culture caused reduction activities significantly reducing commuting related needs, henceforth adding more pressure upon already struggling bike industry players.

Key Highlights of the Report:

- Singapore Bicycles Market Outlook

- Market Size of Singapore Bicycles Market, 2023

- Forecast of Singapore Bicycles Market, 2030

- Historical Data and Forecast of Singapore Bicycles Revenues & Volume for the Period 2020-2030

- Singapore Bicycles Market Trend Evolution

- Singapore Bicycles Market Drivers and Challenges

- Singapore Bicycles Price Trends

- Singapore Bicycles Porter's Five Forces

- Singapore Bicycles Industry Life Cycle

- Historical Data and Forecast of Singapore Bicycles Market Revenues & Volume By Product for the Period 2020-2030

- Historical Data and Forecast of Singapore Bicycles Market Revenues & Volume By Mountain for the Period 2020-2030

- Historical Data and Forecast of Singapore Bicycles Market Revenues & Volume By Hybrid for the Period 2020-2030

- Historical Data and Forecast of Singapore Bicycles Market Revenues & Volume By Road for the Period 2020-2030

- Historical Data and Forecast of Singapore Bicycles Market Revenues & Volume By Others for the Period 2020-2030

- Historical Data and Forecast of Singapore Bicycles Market Revenues & Volume By Technology for the Period 2020-2030

- Historical Data and Forecast of Singapore Bicycles Market Revenues & Volume By Electric for the Period 2020-2030

- Historical Data and Forecast of Singapore Bicycles Market Revenues & Volume By Conventional for the Period 2020-2030

- Historical Data and Forecast of Singapore Bicycles Market Revenues & Volume By End-users for the Period 2020-2030

- Historical Data and Forecast of Singapore Bicycles Market Revenues & Volume By Men for the Period 2020-2030

- Historical Data and Forecast of Singapore Bicycles Market Revenues & Volume By Women for the Period 2020-2030

- Historical Data and Forecast of Singapore Bicycles Market Revenues & Volume By Kids for the Period 2020-2030

- Singapore Bicycles Import Export Trade Statistics

- Market Opportunity Assessment By Product

- Market Opportunity Assessment By Technology

- Market Opportunity Assessment By End-users

- Singapore Bicycles Top Companies Market Share

- Singapore Bicycles Competitive Benchmarking By Technical and Operational Parameters

- Singapore Bicycles Company Profiles

- Singapore Bicycles Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 Singapore Bicycles Market Overview |

3.1 Singapore Country Macro Economic Indicators |

3.2 Singapore Bicycles Market Revenues & Volume, 2020 & 2030F |

3.3 Singapore Bicycles Market - Industry Life Cycle |

3.4 Singapore Bicycles Market - Porter's Five Forces |

3.5 Singapore Bicycles Market Revenues & Volume Share, By Product, 2020 & 2030F |

3.6 Singapore Bicycles Market Revenues & Volume Share, By Technology, 2020 & 2030F |

3.7 Singapore Bicycles Market Revenues & Volume Share, By End-users, 2020 & 2030F |

4 Singapore Bicycles Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.3 Market Restraints |

5 Singapore Bicycles Market Trends |

6 Singapore Bicycles Market, By Types |

6.1 Singapore Bicycles Market, By Product |

6.1.1 Overview and Analysis |

6.1.2 Singapore Bicycles Market Revenues & Volume, By Product, 2020-2030F |

6.1.3 Singapore Bicycles Market Revenues & Volume, By Mountain, 2020-2030F |

6.1.4 Singapore Bicycles Market Revenues & Volume, By Hybrid, 2020-2030F |

6.1.5 Singapore Bicycles Market Revenues & Volume, By Road, 2020-2030F |

6.1.6 Singapore Bicycles Market Revenues & Volume, By Others, 2020-2030F |

6.2 Singapore Bicycles Market, By Technology |

6.2.1 Overview and Analysis |

6.2.2 Singapore Bicycles Market Revenues & Volume, By Electric, 2020-2030F |

6.2.3 Singapore Bicycles Market Revenues & Volume, By Conventional, 2020-2030F |

6.3 Singapore Bicycles Market, By End-users |

6.3.1 Overview and Analysis |

6.3.2 Singapore Bicycles Market Revenues & Volume, By Men, 2020-2030F |

6.3.3 Singapore Bicycles Market Revenues & Volume, By Women, 2020-2030F |

6.3.4 Singapore Bicycles Market Revenues & Volume, By Kids, 2020-2030F |

7 Singapore Bicycles Market Import-Export Trade Statistics |

7.1 Singapore Bicycles Market Export to Major Countries |

7.2 Singapore Bicycles Market Imports from Major Countries |

8 Singapore Bicycles Market Key Performance Indicators |

9 Singapore Bicycles Market - Opportunity Assessment |

9.1 Singapore Bicycles Market Opportunity Assessment, By Product, 2020 & 2030F |

9.2 Singapore Bicycles Market Opportunity Assessment, By Technology, 2020 & 2030F |

9.3 Singapore Bicycles Market Opportunity Assessment, By End-users, 2020 & 2030F |

10 Singapore Bicycles Market - Competitive Landscape |

10.1 Singapore Bicycles Market Revenue Share, By Companies, 2023 |

10.2 Singapore Bicycles Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero