Singapore Building Management System Market (2024-2030) | Analysis, Revenue, Size, Companies, Forecast, Industry, Share, Trends, Growth & Value

Market Forecast By Type (Solution,Services), By Solution (Facility Management,Security Management,Energy Management,Infrastructure Management,Emergency Management), By Service Type (Professional Services, Managed Services), By Application (Residential, Commercial, Industrial) And Competitive Landscape

| Product Code: ETC4468708 | Publication Date: Jul 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 67 | No. of Figures: 12 | No. of Tables: 8 | |

Topics Covered in Singapore Building Management System Market Report

Singapore Building Management System Market Report thoroughly covers the market by type, solution, services type and application. Singapore Building Management System Market Outlook report provides an unbiased and detailed analysis of the ongoing Singapore Building Management System Market trends, opportunities/high growth areas, and market drivers. This would help stakeholders devise and align their market strategies according to the current and future market dynamics.

Singapore Building Management System Market Synopsis

The Building Management System (BMS) market in Singapore has expanded, fueled by technological advancements and a heightened focus on energy efficiency and sustainability. This trend has accelerated the adoption of advanced BMS solutions across various sectors. Initiatives such as development of Asia’s Infrastructure Exchange, and the Green Town Programme are driving both government and private sector investments in smart building technologies. These efforts are aimed at meeting the rising demand for energy-efficient and intelligent commercial and residential buildings.

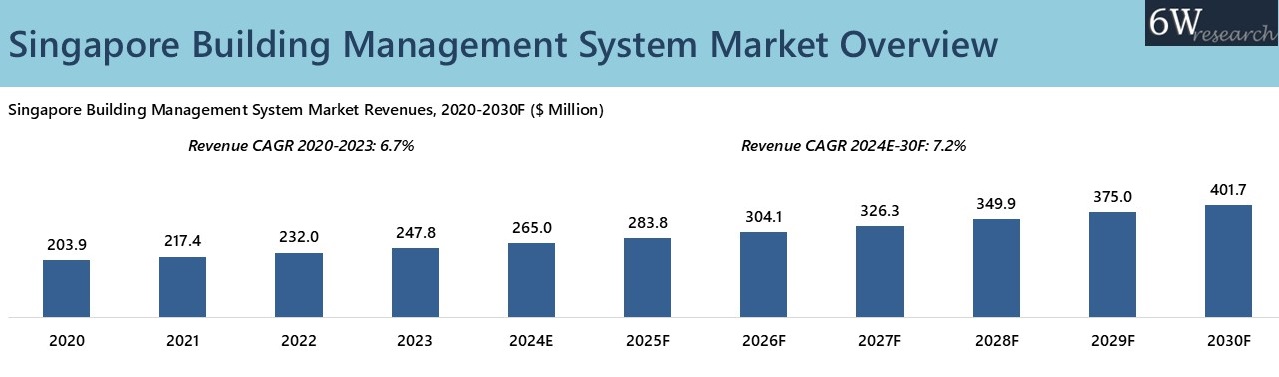

According to 6Wresearch, Singapore Building Management System Market is projected to grow at a CAGR of 7.2% from 2024-2030F. This anticipated growth is driven by investments from both the government and private sectors, aimed at advancing industrial, residential, and commercial development. For instance, Singapore's healthcare sector is upgrading to more advanced building automation controls and sanctioned $1.38 billion for the Woodlands Health Campus, new SGH facilities, and IT infrastructure till 2036. Additionally, international events like the World Cities Summit 2025 are driving the government to prioritize upgrading hotel infrastructure with advanced technologies to support major upcoming events such as the Motorshow 2025 and the ASEAN Para Games 2029. This initiative includes new hotel projects like The Standard Singapore, the 192-room Somerset Clarke Quay Singapore slated for 2026, and the Luxury Marina Bay Sands (Tower 4) expected by 2028. These developments are fuelling the demand for advanced Building Management System (BMS) technologies to efficiently manage security, accommodations, and overall operations. Additionally, government initiatives such as the Green Building Masterplan, Energy Conservation Act and GreenGov.SG program supports sustainability goals and boosts energy efficiency across buildings. Collectively, these factors create an optimal environment for the widespread adoption of advanced BMS solutions in Singapore.

Market Segmentation by Type

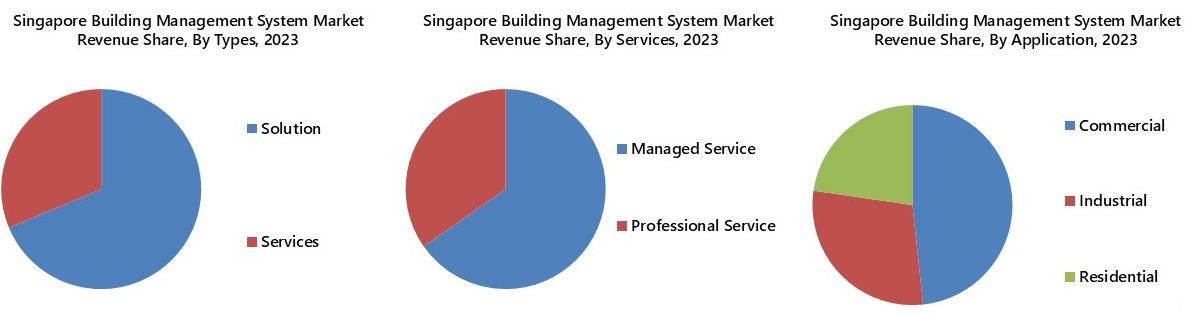

The Solution segment captured the highest revenue share in 2023 and is expected to maintain this position due to its integrated, technology-driven approaches, such as building automation and energy management systems. These solutions offer comprehensive benefits, including improved efficiency, cost savings, and sustainability, making them more valuable than standalone services.

Market Segmentation by Solution

In 2023, facility management hold the largest revenue share as it plays a crucial role in optimizing the operation and maintenance of buildings. As buildings become more complex and energy-efficient, the demand for FM solutions that can effectively manage HVAC systems, lighting.

Market Segmentation by Service Type

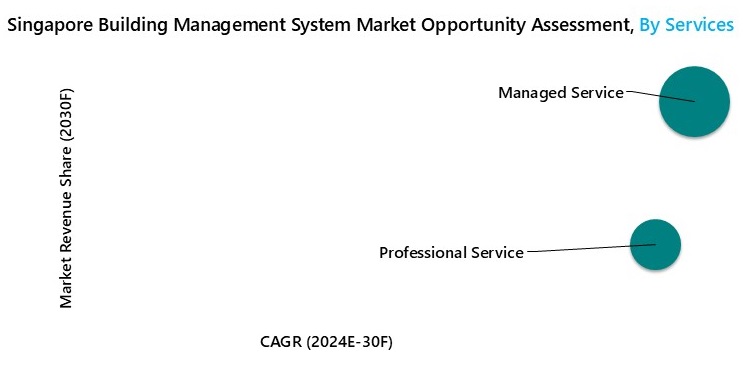

Managed services led the revenue share in 2023 and is expected to dominate in future due to their scalability, cost efficiency and ongoing support. These services help organizations reduce upfront investments and operational costs through subscription-based models that bundle monitoring, maintenance, and updates, offering a comprehensive and cost-effective solution.

Market Segmentation by Application

The commercial segment held the largest share in 2023 and is expected to maintain its lead due to the high penetration of Building Management Systems (BMS) in Singapore’s commercial buildings. To meet the government’s targets of achieving net zero emissions by 2050 and greening 80% of buildings by 2030, commercial building owners and developers are increasingly investing in technologies that support attaining Super Low Energy (SLE) certification.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2020 to 2023.

- Base Year: 2023

- Forecast Data until 2030.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Singapore Building Management System Market Overview

- Singapore Building Management System Market Outlook

- Singapore Building Management System Market Forecast

- Industry Life Cycle

- Porter’s Five Forces Analysis

- Historical Data and Forecast of Singapore Building Management System Market Revenues for the Period 2020-2030F

- Historical Data and Forecast of Singapore Building Management System Market Revenues, By Type, for the Period 2020-2030F

- Historical Data and Forecast of Singapore Building Management System Market Revenues, By Solution, for the Period 2020-2030F

- Historical Data and Forecast of Singapore Building Management System Market Revenues, By Services, for the Period 2020-2030F

- Historical Data and Forecast of Singapore Building Management System Market Revenues, By Application, for the Period 2020-2030F

- Market Drivers and Restraints

- Market Evolution & Trends

- Market Opportunity Assessment

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

Thereportprovides a detailed analysis of the following market segments:

By Type

- Solution

- Services

By Solution

- Facility Management

- Security Management

- Energy Management

- Infrastructure Management

- Emergency Management

By Service Type

- Professional Services

- Managed Services

By Application

- Residential

- Commercial

- Industrial

Singapore Building Management System Market (2025-2031) : FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. Singapore Building Management System Market Overview |

| 3.1. Singapore Building Management System Market Revenues (2020-2030F) |

| 3.2. Singapore Building Management System Market Industry Life Cycle |

| 3.3. Singapore Building Management System Market Porter’s Five Forces Model |

| 4. Singapore Building Management System Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.2.1 Increasing demand for energy-efficient and sustainable buildings in Singapore |

| 4.2.2 Government initiatives promoting smart city solutions and digital transformation |

| 4.2.3 Growing awareness about the benefits of building management systems in enhancing operational efficiency and reducing costs |

| 4.3. Market Restraints |

| 4.3.1 High initial investment required for implementing building management systems |

| 4.3.2 Lack of skilled professionals to operate and maintain advanced building management systems |

| 4.3.3 Concerns regarding data privacy and cybersecurity risks associated with interconnected building systems |

| 5. Singapore Building Management System Market Evolution & Trends |

| 6. Singapore Building Management System Market Overview, By Type |

| 6.1. Singapore Building Management System Market Revenue Share and Revenues, By Type (2023 & 2030F) |

| 6.1.1. Singapore Building Management System Market Revenues, By Solution (2020-2030F) |

| 6.1.2. Singapore Building Management System Market Revenues, By Services (2020-2030F) |

| 7. Singapore Building Management System Market Overview, By Solution |

| 7.1. Singapore Building Management System Market Revenue Share and Revenues, By Solution (2023 & 2030F) |

| 7.1.1. Singapore Building Management System Market Revenues, By Facility Management (2020-2030F) |

| 7.1.2. Singapore Building Management System Market Revenues, By Security Management (2020-2030F) |

| 7.1.3. Singapore Building Management System Market Revenues, By Emergency Management (2020-2030F) |

| 7.1.4. Singapore Building Management System Market Revenues, By Energy Management (2020-2030F) |

| 7.1.5. Singapore Building Management System Market Revenues, By Infrastructure Management (2020-2030F) |

| 8. Singapore Building Management System Market Overview, By Services |

| 8.1. Singapore Building Management System Market Revenue Share and Revenues, By Services (2023 & 2030F) |

| 8.1.1. Singapore Building Management System Market Revenues, By Managed Service (2020-2030F) |

| 8.1.2. Singapore Building Management System Market Revenues, By Professional Service (2020-2030F) |

| 9. Singapore Building Management System Market Overview, By Application |

| 9.1. Singapore Building Management System Market Revenue Share and Revenues, By Application (2023 & 2030F) |

| 9.1.1. Singapore Building Management System Market Revenues, By Commercial (2020-2030F) |

| 9.1.2. Singapore Building Management System Market Revenues, By Industrial (2020-2030F) |

| 9.1.3. Singapore Building Management System Market Revenues, By Residential (2020-2030F) |

| 10. Singapore Building Management System Market Key Performance Indicators |

| 10.1 Energy savings achieved through the implementation of building management systems |

| 10.2 Reduction in maintenance costs and downtime of building equipment |

| 10.3 Percentage increase in tenant satisfaction levels due to improved building comfort and services |

| 11. Singapore Building Management System Market Opportunity Assessment |

| 11.1. Singapore Building Management System Market Opportunity Assessment, By Type (2030F) |

| 11.2. Singapore Building Management System Market Opportunity Assessment, By Solution (2030F) |

| 11.3. Singapore Building Management System Market Opportunity Assessment, By Services (2030F) |

| 11.4. Singapore Building Management System Market Opportunity Assessment, By Application (2030F) |

| 12. Singapore Building Management System Market Competitive Landscape |

| 12.1. Singapore Building Management System Market Revenue Ranking, By Top 3 Companies (2023) |

| 12.2. Singapore Building Management System Market Competitive Benchmarking, By Operating Parameters |

| 13. Company Profiles |

| 13.1 Schneider Electric SE |

| 13.2 Siemens AG |

| 13.3 ABB Ltd |

| 13.4 Honeywell International Inc. |

| 13.5 Mitsubishi Electric Corporation |

| 13.6 Johnson Controls International |

| 13.7Azbil Corporation |

| 13.8 Delta electronics |

| 13.9 D-Tech Controls |

| 14. Key Strategic Recommendations |

| 15. Disclaimer |

| List of Figures |

| 1. Singapore Building Management System Market Revenues, 2020-2030F ($ million) |

| 2. Singapore Under Construction Residential Units, 2024E-2028F |

| 3. Singapore Building Management System Market Revenue Share, By Type, 2023 & 2030F |

| 4. Singapore Building Management System Market Revenue Share, By Solution, 2023 & 2030F |

| 5. Singapore Building Management System Market Revenue Share, By Services, 2023 & 2030F |

| 6. Singapore Building Management System Market Revenue Share, By Application, 2023 & 2030F |

| 7. Number of Private Residential Units Supply in Pipeline (under construction) |

| 8. Singapore Building Management System Market Opportunity Assessment, By Type, 2030F |

| 9. Singapore Building Management System Market Opportunity Assessment, By Solution, 2030F |

| 10. Singapore Building Management System Market Opportunity Assessment, By Services, 2030F |

| 11. Singapore Building Management System Market Opportunity Assessment, By Application, 2030F |

| 12. Singapore Building Management System Market Revenue Share, By Companies, 2023 |

| List of Tables |

| 1. Singapore Building Management System Market Revenues, By Type, 2020-2030F ($ million) |

| 2. Singapore Building Management System Market Revenues, By Solution, 2020-2030F ($ million) |

| 3. Singapore Building Management System Market Revenues, By Services, 2020-2030F ($ million) |

| 4. Singapore Building Management System Market Revenues, By Application, 2020-2030F ($ million) |

| 5. Singapore Luxury Residential Transactions in H2 2023 |

| 6. Number of Private Residential Units Supply in Pipeline (under construction) |

| 7. Key Hotel Openings in Singapore |

| 8. Singapore Grade A Office Market Statistics in Q4 2023 |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero