South Africa 800kW and Above Gas Engine for Generators Market (2025-2031) | Size, Share, Value, Industry, Companies, Trends, Analysis, Outlook, Revenue, Growth & Forecast

Market Forecast By Power Ratings (0.8-1 MW, 1.1-2 MW, 2.1-5 MW and Above 5 MW), By Applications (Commercial, Industrial, Power Utility, Others (Logistics and Residential)) And Competitive Landscape

| Product Code: ETC072240 | Publication Date: Jan 2025 | Updated Date: Jan 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

South Africa 800kW and Above Gas Engine for Generators Market Highlights

| Report Name | South Africa 800kW and Above Gas Engine for Generators Market |

| CAGR | 6.3% |

| Growing Sector | Renewable energy |

| Forecast Period | 2025-2031 |

Topics Covered in South Africa 800kW and Above Gas Engine for Generators Market Report

The South Africa 800kW and Above Gas Engine for Generators Market report thoroughly covers the market by power ratings, and by application. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

South Africa 800kW and Above Gas Engine for Generators Market Synopsis

The South Africa market for 800kW and above gas engines used in generators has experienced significant growth due to increasing energy demands and the need for reliable, efficient power solutions. These gas engines are pivotal for industries requiring consistent energy supply, particularly in sectors like manufacturing, mining, and healthcare. Key drivers of market expansion include growing concerns over energy sustainability, the rising cost of diesel fuels, and an emphasis on reducing carbon emissions through cleaner energy alternatives. Additionally, government initiatives promoting the use of natural gas and advancements in gas engine technology have further fuelled this market. Despite challenges such as initial setup costs and infrastructure limitations, the adoption of these high-capacity gas engines continues to rise, indicating a promising outlook for the industry.

According to 6Wresearch, South Africa 800kW and Above Gas Engine for Generators Market size is projected to witness a CAGR of 6.3% during the forecast period of 2025-2031. the growing demand for reliable and sustainable energy solutions is a significant factor. Frequent power outages and load-shedding events in South Africa have heightened the need for backup power sources, making gas generators an attractive option. Additionally, the global push towards cleaner energy and reduced carbon emissions has spurred interest in gas-powered solutions, as they produce fewer emissions compared to diesel or coal-based generators.

High initial investment costs for gas engines and infrastructure requirements for natural gas supply can act as barriers to widespread adoption. Furthermore, regulatory complexities and the availability of natural gas resources in certain regions make implementation more difficult. Addressing these challenges will be crucial for the sustained growth and development of this market in the region.

South Africa 800kW and Above Gas Engine for Generators Market trends

- Industrial and Commercial Applications – These high-capacity gas engines are seeing rising adoption in industrial facilities and large commercial establishments, where reliable and efficient power generation is essential. This includes applications in manufacturing plants, data centers, hospitals, and shopping malls.

- Increased Availability of Natural Gas – The availability of natural gas is also a key factor contributing to the growing demand for 800kW and above gas engines in South Africa. With the country's significant reserves of natural gas, companies are looking towards this clean-burning fuel as an alternative to traditional fossil fuels.

- Shift Towards Natural Gas - With the global emphasis on cleaner energy sources, natural gas is becoming an increasingly viable fuel option, boosting the market for gas-powered generators. Moreover, the use of natural gas can help companies meet their sustainability goals and reduce their environmental impact.

Investment opportunities in South Africa 800kW and Above Gas Engine for Generators Market

- Abundance of Natural Gas Resources – South Africa’s increasing exploration of natural gas reserves supports the adoption of gas engines. With a push towards cleaner energy sources, natural gas-powered generators present an opportunity to decrease dependence on coal while providing cost-effective power solutions for industrial and commercial applications.

- Infrastructure Development - Investments in infrastructure and industrial projects are creating a rising need for high-capacity generators. Sectors such as mining, manufacturing, and agriculture in South Africa require dependable power solutions, making this market an attractive space for investors focusing on large-scale energy systems.

- Export and Regional Opportunities - South Africa also serves as a gateway for tapping into broader markets across the Africa continent. Neighboring countries experiencing energy shortages could benefit from advancements in gas engine technologies, making South Africa a regional hub for generator production and distribution.

South Africa 800kW and Above Gas Engine for Generators Market: Leading Players

The South Africa market for gas engines of 800kW and above, designed for generators, is characterized by the presence of several key players driving innovation and competitiveness. Among the leading companies are global giants such as Caterpillar Inc., renowned for their wide range of heavy-duty engines, and Cummins Inc., which offers cutting-edge technology in power solutions. Local and regional companies also play a strong role, catering to specific customer needs with tailored solutions. Companies like GE Power and MTU Friedrichshafen GmbH are pivotal due to their advanced engine technology, focus on sustainability, and reliable support infrastructure. These players contribute significantly to shaping the market dynamics, addressing energy demand, and meeting South Africa's growing needs for efficient power generation solutions.

South Africa 800kW and Above Gas Engine for Generators Market: Government Initiatives

The South Africa government has been actively promoting energy diversification and sustainability to address the country’s rising electricity demands and frequent power outages. Initiatives such as the Integrated Resource Plan (IRP) encourage the adoption of cleaner and more efficient energy solutions, including gas-powered generators. Policies aimed at reducing dependence on coal and fostering private sector investment in energy infrastructure have stimulated interest in large-scale gas engines, particularly those with capacities of 800kW and above. Additionally, incentives for renewable and gas-based energy projects are creating opportunities for businesses to adopt environmentally friendly and cost-effective power generation technologies. These efforts symbolize a strategic shift towards energy reliability and environmental preservation in South Africa’s energy landscape.

Future Insights of South Africa 800kW and Above Gas Engine for Generators Market

Future developments in this sector are likely to focus on improving fuel efficiency, lowering operational costs, and enhancing system durability. Strategic investments in research and development, as well as partnerships with global manufacturers, could further propel the market. Furthermore, government policies that support renewable energy adoption and energy security may amplify the demand for gas-powered generators, making them an integral part of South Africa's energy landscape in the coming years. the presence of established players and rising investments by new entrants are expected to intensify competition. This could result in technological advancements, cost reductions, and greater product diversity to cater to different customer needs.

Market Segments

2.1-5 MW to dominate the market - By power ratings

According to Ravi Bhandari, Research Head, 6Wresearch, the market for gas engines in the 800kW and above category within South Africa is experiencing steady growth, particularly in the 2.1-5 MW range. This is driven by increasing energy demands, a need for reliable power generation, and a focus on sustainable and cleaner energy alternatives. Gas engines have become a preferred solution for industrial and commercial sectors due to their efficiency, lower emissions, and ability to operate on various fuels such as natural gas and biogas.

Commercial to dominate the market – By application

Companies within this sector are leveraging advancements in gas engine technology to provide high-efficiency systems with improved fuel flexibility and reduced emissions. The capability of these engines to operate on both natural gas and sustainable biogas appeals to industries aiming to lower their carbon footprints while maintaining energy security. Furthermore, as load-shedding and grid reliability remain ongoing challenges in South Africa, gas-powered generators in the 800kW and above range have emerged as a vital backup and supplemental power solution.

Key Attractiveness of the Report

- 10 Years of Market Data

- Historical Data from 2021 to 2024

- Base Year: 2024

- Market Forecast Until 2031

- Key Performance Indicators Impacting the Market

- Market Dynamics and Trends

- Major Developments and Upcoming Projects

Key Highlights of the Report:

- South Africa 800kW and Above Gas Engine for Generators Market Overview

- South Africa 800kW and Above Gas Engine for Generators Market Outlook

- South Africa 800kW and Above Gas Engine for Generators Market Forecast

- Historical Data & Forecast of South Africa 800kW and Above Gas Engine for Generators Market Revenues and Volume for the Period 2021-2031F

- Historical Data & Forecast of South Africa 800kW and Above Gas Engine for Generators Market Revenues and Volume, By Power Ratings, for the Period 2021-2031F

- Historical Data & Forecast of South Africa 800kW and Above Gas Engine for Generators Market Revenues and Volume, By Applications, for the Period 2021-2031F

- Total Cost Analysis

- South Africa 800kW and Above Gas Engine for Generators Market Trends

- South Africa 800kW and Above Gas Engine for Generators Industry Life Cycle

- Porter’s Five Force Analysis

- South Africa 800kW and Above Gas Engine for Generators Market Opportunity Assessment

- South Africa 800kW and Above Gas Engine for Generators Market Share, By Company

- South Africa 800kW and Above Gas Engine for Generators Market Overview on Competitive Benchmarking

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Power Ratings

- 0.8-1 MW

- 1.1-2 MW

- 2.1-5 MW

- Above 5 MW

By Applications

- Commercial

- Industrial

- Power Utility

- Others (Logistics and Residential Applications)

South Africa 800kW and Above Gas Engine for Generators Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of The Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 South Africa 800kW and Above Gas Engine For Generators Market Overview |

| 3.1 South Africa 800kW and Above Gas Engine for Generators Market Revenues and Volume, 2021-2031F |

| 3.2 South Africa 800kW and Above Gas Engine For Generators Market - Industry Life Cycle |

| 3.3 South Africa 800kW and Above Gas Engine For Generators Market - Porter’s Five Forces |

| 4 South Africa 800kW and Above Gas Engine For Generators Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5. South Africa 500kW and Above Gas Engine for Generators Market Overview, By Countries |

| 5.1. South Africa 500kW and Above Gas Engine for Generators Market Revenues and Volumes, 2021-2031F |

| 5.1.1. South Africa 500kW and Above Gas Engine for Generators Market Revenue Share, By Power Output, 2021 and 2031F |

| 5.1.1.1. South Africa 0.5-1 MW Gas Engine for Generators Market Revenues,2021-2031F |

| 5.1.1.2. South Africa 1.1-2 MW Gas Engine for Generators Market Revenues, 2021-2031F |

| 5.1.1.3. South Africa 2.1-5 MW Gas Engine for Generators Market Revenues, 2021-2031F |

| 5.1.1.4. South Africa Above 5 MW Gas Engine for Generators Market Revenues, 2021-2031F |

| 5.1.2. South Africa 500kW and Above Gas Engine for Generators Market Revenue Share, By Applications, 2021 and 2031F |

| 5.1.2.1. South Africa 500kW and Above Gas Engine for Generators Market Revenues, By Commercial Application, 2021-2031F |

| 5.1.2.2. South Africa 500kW and Above Gas Engine for Generators Market Revenues, By Industrial Application, 2021-2031F |

| 5.1.2.3. South Africa 500kW and Above Gas Engine for Generators Market Revenues, By Power Utility, 2021-2031F |

| 5.1.2.4. South Africa 500kW and Above Gas Engine for Generators Market Revenues, By Others, 2021-2031F |

| 6 South Africa 800kW and Above Gas Engine For Generators Market Trends |

| 7 South Africa 800kW and Above Gas Engine for Generators Market Competitive Benchmarking, By Operating Parameters & Technical Parameters |

| 8 Company Profiles |

| 1. Caterpillar Inc. |

| 2. Siemens AG |

| 3. Cummins Inc. |

| 4. Rolls Royce Plc. |

| 5. Kawasaki Heavy Industries |

| 6. Mitsubishi Heavy Industries Group |

| 7. Wartsila Corporation |

| 8. INNIO Jenbacher GmbH & Co OG |

| 9. Moteurs Baudouin SA |

| 10. MAN Energy Solutions SE |

| 9 Key Strategic Recommendation |

| 10 Disclaimer |

Market Forecast By Power Ratings (0.8-1 MW, 1.1-2 MW, 2.1-5 MW and Above 5 MW), By Applications (Commercial, Industrial, Power Utility, Others (Logistics and Residential)) And Competitive Landscape

| Product Code: ETC072240 | Publication Date: Aug 2022 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 80 | No. of Figures: 14 | No. of Tables: 8 |

South Africa 800kW and above gas engines for generators market report thoroughly covers the gas engine market by power ratings and applications. South Africa 800kW and above gas engines for generators market report provides an unbiased and detailed analysis of the on-going market trends, opportunities/high growth areas, market drivers which would help the stakeholders to device and align their market strategies according to the current and future market dynamics.

South Africa 800kW and Above Gas Engine for Generators Market Synopsis

Gas Engine market in South Africa has witnessed a steady growth in the recent years owing to various advantages that they offer viz. lower carbon emissions, higher efficiency, and less cost of operation. The demand for gas engines is bound to increase with the increase in demand for electricity especially in developing and emerging economies. However, owing to the COVID-19 pandemic the market is likely to witness a slowdown in 2020 as a result of the suspension of economic activities and disruptions in international supply chain.

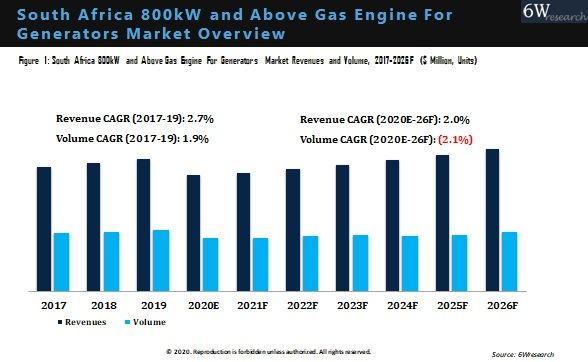

According to 6Wresearch, South Africa 800kW and Above Gas Engine for Generators Market size is expected to grow at a CAGR of 2.0% during 2020-26. The growing need for energy efficiency and increasing need for electricity generation are anticipated to drive growth for gas engines in the country. South Africa’s Independent Power Producer Procurement Programme is a key agent for acquiring electricity capacity from the private sector for both renewable and non-renewable energy sources, as aligned with national policy. Independent power producers, in collaboration with Eskom, offer sustainable and complementary solutions to meet the country’s electricity generation requirements.

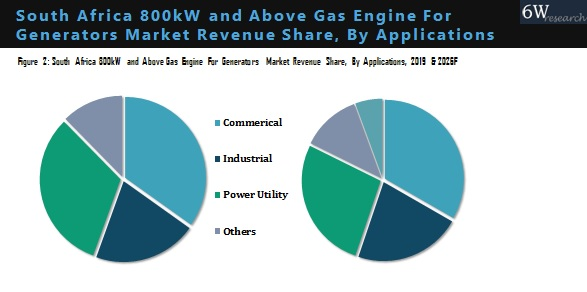

Market Analysis by Applications

The power utility application held the highest revenue share in the overall South Africa 800kW and above gas engine for generators market. Furthermore, The National Development Plan 2030 envisages that adequate investment in energy infrastructure will promote economic growth and development. The country recently decommissioned a 35 GW of coal-fired power capacity and is likely to switch to natural gas for power generation thereby facilitating growth of gas engine market in the region over the short term.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2016 to 2019.

- Base Year: 2019.

- Forecast Data until 2026.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- South Africa 800kW and Above Gas Engine for Generators Market Overview

- South Africa 800kW and Above Gas Engine for Generators Market Outlook

- South Africa 800kW and Above Gas Engine for Generators Market Forecast

- Historical Data & Forecast of South Africa 800kW and Above Gas Engine for Generators Market Revenues and Volume for the Period 2016-2026F

- Historical Data & Forecast of South Africa 800kW and Above Gas Engine for Generators Market Revenues and Volume, By Power Ratings, for the Period 2016-2026F

- Historical Data & Forecast of South Africa 800kW and Above Gas Engine for Generators Market Revenues and Volume, By Applications, for the Period 2016-2026F

- Total Cost Analysis

- South Africa 800kW and Above Gas Engine for Generators Market Trends

- South Africa 800kW and Above Gas Engine for Generators Industry Life Cycle

- Porter’s Five Force Analysis

- South Africa 800kW and Above Gas Engine for Generators Market Opportunity Assessment

- South Africa 800kW and Above Gas Engine for Generators Market Share, By Company

- South Africa 800kW and Above Gas Engine for Generators Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Power Ratings

- 0.8-1 MW

- 1.1-2 MW

- 2.1-5 MW

- Above 5 MW

By Applications

- Commercial

- Industrial

- Power Utility

- Others (Logistics and Residential Applications)

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Vietnam Twisted Pair Cables Market (2024-2030) | Size & Revenue, Forecast, Share, Companies, Competitive Landscape, Analysis, Trends, Value, Segmentation, Outlook, Industry, Growth

- South Africa B2B Cleaning Market (2025-2031) | Size & Revenue, Forecast, Share, Companies, Competitive Landscape, Analysis, Trends, Value, Segmentation, Outlook, Industry, Growth

- Mexico Dispersion Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- United States Video Conferencing Market (2025-2031) | Outlook, Industry, Size, Revenue, Share, Trends, Forecast, Growth, Companies, Analysis & Value

- Australia Electric Motor Market (2025-2031) | Trends, Share, Size, Value, Revenue, Industry, Growth, Analysis, Segmentation & Outlook

- Italy Textile Auxiliaries Market (2025-2031) | Outlook, Value, Companies, Share, Industry, Growth, Trends, Revenue, Forecast, Analysis & Size

- Tajikistan Diesel Genset (Generator) Market (2025-2031) | Value, Industry, Forecast, Revenue, Trends, Outlook, Share, Size, Companies, Growth & Analysis

- China Diesel Genset (Generator) Market (2025-2031) | Growth, Size, Trends, Industry, Value, Share, Analysis, Revenue, Segmentation & Outlook

- China Low Voltage Electric Motor Market (2025-2031) | Analysis, Size, Share, Trends, Growth, Revenue, industry, Forecast, Outlook & Segmentation

- Thailand Low Voltage Electric Motor Market (2025-2031) | Outlook, Revenue, Share, Value, Industry, Growth, Trends, Forecast, Analysis, Size & Companies

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- India's Printer Market Faces 20.7% Decline in Q4 2023: Epson and HP Lead Amidst Downturn

- India's Camera Market Sees 8.9% Decline in Q4 2023; Canon Leads with 38.4% Share

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- The future of gaming industry in the Philippines