South Africa Plastic Market (2025-2031) | Forecast, Value, Outlook, Analysis, Size, Trends, Industry, Companies, Growth, Revenue & Share

Market Forecast By Product (Polyethylene (PE), Polypropylene (PP), Polyurethane (PU), Polyvinyl chloride (PVC), Polyethylene terephthalate (PET), Polystyrene (PS), Acrylonitrile butadiene styrene (ABS), Others), By Application (Injection Molding, Blow Molding, Roto Molding, Compression Molding, Casting, Thermoforming, Extrusion, Others), By End-use (Packaging, Construction, Electrical & Electronics, Automotive, Medical Devices, Agriculture, Furniture & Bedding, Others) And Competitive Landscape

| Product Code: ETC170287 | Publication Date: Jan 2022 | Updated Date: Jan 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

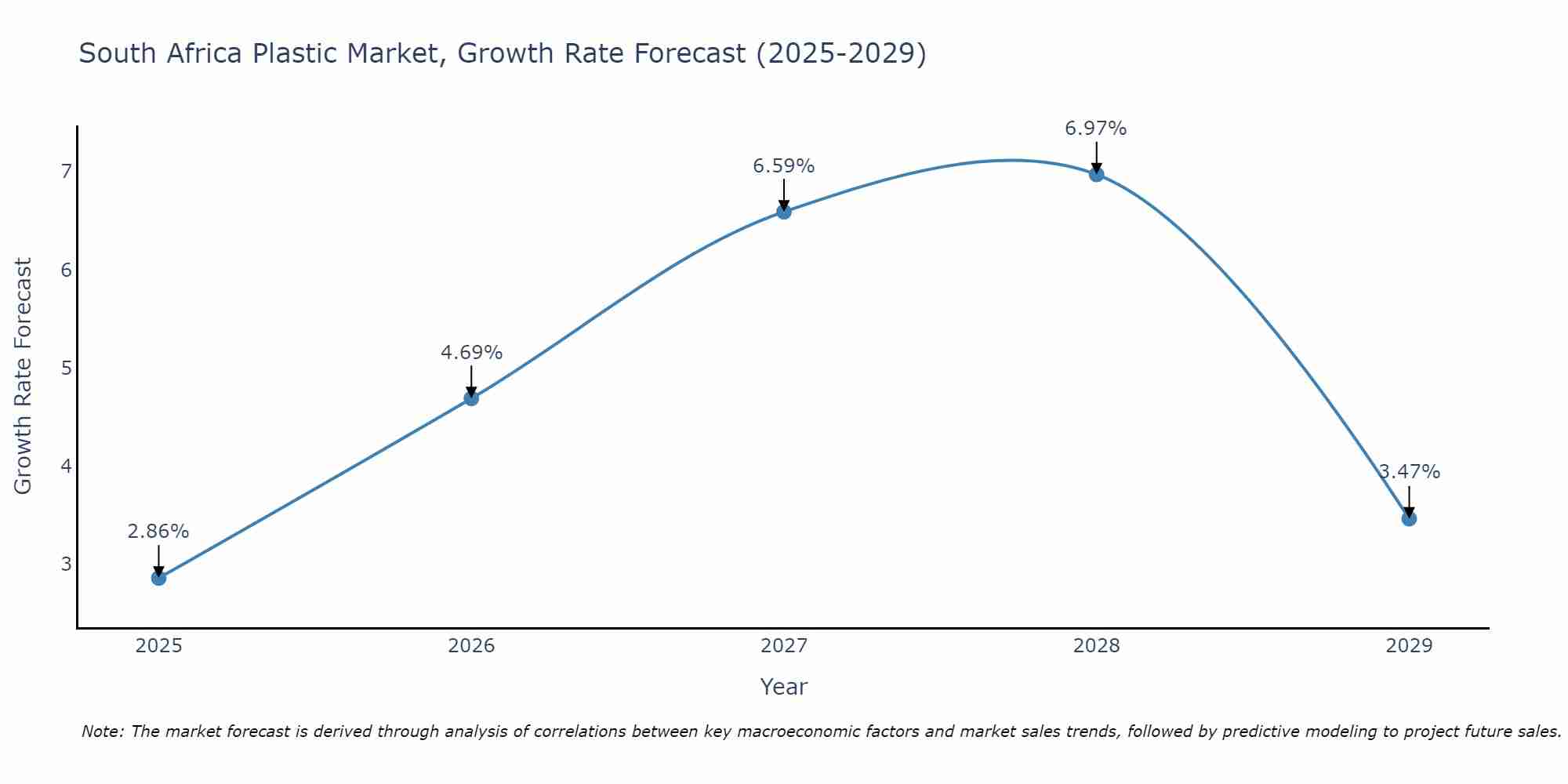

South Africa Plastic Market Size Growth Rate

The South Africa Plastic Market is projected to witness mixed growth rate patterns during 2025 to 2029. Starting at 2.86% in 2025, the market peaks at 6.97% in 2028, and settles at 3.47% by 2029.

Topics Covered in the South Africa Plastic Market Report

South Africa Plastic Market Report thoroughly covers the market by Product, Application, and End-Use. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

South Africa Plastic Market Synopsis

South Africa Plastic Market is witnessing remarkable growth over the years driven by the increasing demand for plastic in various industries. However, challenges such as rising environmental concerns and stricter regulations highlight the need for sustainable alternatives and recycling initiatives to sustain growth in the market. The expanding agricultural activities in South Africa, driven by the need for enhanced food security and export opportunities, are propelling the demand for high-quality plastic materials.

According to 6Wresearch, the South Africa Plastic Market size is expected to grow at a significant CAGR of 5.1% during the forecast period from 2025-2031. With an increase in urban population and rapid development of cities, there has been a rise in demand for plastic products in South Africa. The manufacturing sector is a major consumer of plastics in South Africa. As the country continues to develop its industries, there is a higher demand for packaging materials, machinery components, and other plastic products used in various industrial processes. The rising middle class and changing lifestyles have led to a shift in consumer preferences towards convenience and packaged goods, hence driving the demand for plastic packaging. Advancements in polymer science and technology have led to the development of new types of plastics that are more durable, lightweight, and cost-effective. These innovations have further boosted the demand for plastics in various industries. Furthermore, the automotive industry in South Africa also contributes to market growth. The production of lightweight plastic components helps in reducing vehicle weights, leading to better fuel efficiency and compliance with stringent emission regulations. This trend encourages the use of advanced plastic materials in automotive manufacturing, which in turn, supports the overall the South Africa Plastic Market growth.

The increasing usage of plastics has resulted in environmental pollution, particularly with single-use disposable plastics. This has a negative impact on the plastic market. The country is facing problems in managing plastic waste effectively. There is a lack of proper infrastructure and resources for collecting, sorting, and processing plastic waste remains a significant challenge. Plastics are made from petrochemicals derived from crude oil, making their production costs high due to the fluctuations in oil prices. There is still a lack of awareness among consumers about the importance of responsible plastic use and proper waste management.

South Africa Plastic Industry: Leading Players

The plastic industry in South Africa is dominated by a few key players, with Sasol being the largest producer of plastics in the country. The company produces a wide range of plastic products, including packaging materials and automotive components. Another major player in the market is Mpact Limited, which specializes in producing sustainable packaging solutions for various industries. Nampak, one of Africa's leading manufacturers of paper and plastic packaging, also has a significant presence in the South African market. Other notable players include Safripol, Astrapak Limited, and Polyoak Packaging.

South Africa Plastic Market: Government Regulations

The South African government has implemented several initiatives to promote sustainability and reduce the impact of plastic pollution on the environment. A plastic bag levy was introduced, which has significantly reduced the consumption of single-use plastic bags in the country. The government also launched the Operation Clean Sweep initiative, aimed at preventing plastic pellets from entering waterways and oceans.

Future Insights of the Market

The South Africa Plastic Market is expected to experience significant growth in the coming years, driven by increasing demand from various industries such as packaging, construction, and automotive. With a growing focus on sustainability and eco-friendly solutions, there is a shift towards using recyclable plastics and bio-based materials in production. Technological advancements in processing and manufacturing are also expected to drive market growth.

Market Segmentation by Product

According to Nitesh, Research Manager, 6Wresearch, Polyethylene (PE) stands out as the leading product in the market. Polyethylene, known for its versatility and wide range of applications, dominates due to its use in packaging, geomembranes, and various consumer products. Its affordability, chemical resistance, and ease of processing make it a preferred choice across multiple industries, including packaging, agriculture, and construction.

Market Segmentation by Application

Based on the Application, Packaging emerges as the leading segment. The dominance of packaging is driven by the burgeoning demand for flexible and rigid plastic solutions in consumer goods, food and beverage, and industrial applications. The versatility, lightweight nature, and cost-effectiveness of plastic packaging make it an indispensable component in modern supply chains, catering to both local and export markets.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- South Africa Plastic Market Outlook

- Market Size of South Africa Plastic Market, 2024

- Forecast of South Africa Plastic Market, 2031

- Historical Data and Forecast of South Africa Plastic Revenues & Volume for the Period 2021-2031

- South Africa Plastic Market Trend Evolution

- South Africa Plastic Market Drivers and Challenges

- South Africa Plastic Price Trends

- South Africa Plastic Porter's Five Forces

- South Africa Plastic Industry Life Cycle

- Historical Data and Forecast of South Africa Plastic Market Revenues & Volume By Product for the Period 2021-2031

- Historical Data and Forecast of South Africa Plastic Market Revenues & Volume By Polyethylene (PE) for the Period 2021-2031

- Historical Data and Forecast of South Africa Plastic Market Revenues & Volume By Polypropylene (PP) for the Period 2021-2031

- Historical Data and Forecast of South Africa Plastic Market Revenues & Volume By Polyurethane (PU) for the Period 2021-2031

- Historical Data and Forecast of South Africa Plastic Market Revenues & Volume By Polyvinyl chloride (PVC) for the Period 2021-2031

- Historical Data and Forecast of South Africa Plastic Market Revenues & Volume By Polyethylene terephthalate (PET) for the Period 2021-2031

- Historical Data and Forecast of South Africa Plastic Market Revenues & Volume By Polystyrene (PS) for the Period 2021-2031

- Historical Data and Forecast of South Africa Plastic Market Revenues & Volume By Acrylonitrile butadiene styrene (ABS) for the Period 2021-2031

- Historical Data and Forecast of South Africa Polyethylene (PE) Plastic Market Revenues & Volume By Others for the Period 2021-2031

- Historical Data and Forecast of South Africa Plastic Market Revenues & Volume By Application for the Period 2021-2031

- Historical Data and Forecast of South Africa Plastic Market Revenues & Volume By Injection Molding for the Period 2021-2031

- Historical Data and Forecast of South Africa Plastic Market Revenues & Volume By Blow Molding for the Period 2021-2031

- Historical Data and Forecast of South Africa Plastic Market Revenues & Volume By Roto Molding for the Period 2021-2031

- Historical Data and Forecast of South Africa Plastic Market Revenues & Volume By Compression Molding for the Period 2021-2031

- Historical Data and Forecast of South Africa Plastic Market Revenues & Volume By Casting for the Period 2021-2031

- Historical Data and Forecast of South Africa Plastic Market Revenues & Volume By Thermoforming for the Period 2021-2031

- Historical Data and Forecast of South Africa Plastic Market Revenues & Volume By Extrusion for the Period 2021-2031

- Historical Data and Forecast of South Africa Plastic Market Revenues & Volume By Others for the Period 2021-2031

- Historical Data and Forecast of South Africa Plastic Market Revenues & Volume By End-use for the Period 2021-2031

- Historical Data and Forecast of South Africa Plastic Market Revenues & Volume By Packaging for the Period 2021-2031

- Historical Data and Forecast of South Africa Plastic Market Revenues & Volume By Construction for the Period 2021-2031

- Historical Data and Forecast of South Africa Plastic Market Revenues & Volume By Electrical & Electronics for the Period 2021-2031

- Historical Data and Forecast of South Africa Plastic Market Revenues & Volume By Automotive for the Period 2021-2031

- Historical Data and Forecast of South Africa Plastic Market Revenues & Volume By Medical Devices for the Period 2021-2031

- Historical Data and Forecast of South Africa Plastic Market Revenues & Volume By Agriculture for the Period 2021-2031

- Historical Data and Forecast of South Africa Plastic Market Revenues & Volume By Furniture & Bedding for the Period 2021-2031

- Historical Data and Forecast of South Africa Plastic Market Revenues & Volume By Others for the Period 2021-2031

- South Africa Plastic Import Export Trade Statistics

- Market Opportunity Assessment By Product

- Market Opportunity Assessment By Application

- Market Opportunity Assessment By End-use

- South Africa Plastic Top Companies Market Share

- South Africa Plastic Competitive Benchmarking By Technical and Operational Parameters

- South Africa Plastic Company Profiles

- South Africa Plastic Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the following market segments:

By Product

- Polyethylene (PE)

- Polypropylene (PP)

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Polystyrene (PS)

- Acrylonitrile Butadiene Styrene (ABS)

- Others

By Application

- Injection Molding

- Blow Molding

- Roto Molding

- Compression Molding

- Casting

- Thermoforming

- Extrusion

- Others

By End-Use

- Packaging

- Construction

- Electrical & Electronics

- Automotive

- Medical Devices

- Agriculture

- Furniture & Bedding

- Others

South Africa Plastic Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 South Africa Plastic Market Overview |

| 3.1 South Africa Country Macro Economic Indicators |

| 3.2 South Africa Plastic Market Revenues & Volume, 2021 & 2031F |

| 3.3 South Africa Plastic Market - Industry Life Cycle |

| 3.4 South Africa Plastic Market - Porter's Five Forces |

| 3.5 South Africa Plastic Market Revenues & Volume Share, By Product, 2021 & 2031F |

| 3.6 South Africa Plastic Market Revenues & Volume Share, By Application, 2021 & 2031F |

| 3.7 South Africa Plastic Market Revenues & Volume Share, By End-use, 2021 & 2031F |

| 4 South Africa Plastic Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 South Africa Plastic Market Trends |

| 6 South Africa Plastic Market, By Types |

| 6.1 South Africa Plastic Market, By Product |

| 6.1.1 Overview and Analysis |

| 6.1.2 South Africa Plastic Market Revenues & Volume, By Product, 2021-2031F |

| 6.1.3 South Africa Plastic Market Revenues & Volume, By Polyethylene (PE), 2021-2031F |

| 6.1.4 South Africa Plastic Market Revenues & Volume, By Polypropylene (PP), 2021-2031F |

| 6.1.5 South Africa Plastic Market Revenues & Volume, By Polyurethane (PU), 2021-2031F |

| 6.1.6 South Africa Plastic Market Revenues & Volume, By Polyvinyl chloride (PVC), 2021-2031F |

| 6.1.7 South Africa Plastic Market Revenues & Volume, By Polyethylene terephthalate (PET), 2021-2031F |

| 6.1.8 South Africa Plastic Market Revenues & Volume, By Polystyrene (PS), 2021-2031F |

| 6.1.9 South Africa Plastic Market Revenues & Volume, By Others, 2021-2031F |

| 6.1.10 South Africa Plastic Market Revenues & Volume, By Others, 2021-2031F |

| 6.2 South Africa Plastic Market, By Application |

| 6.2.1 Overview and Analysis |

| 6.2.2 South Africa Plastic Market Revenues & Volume, By Injection Molding, 2021-2031F |

| 6.2.3 South Africa Plastic Market Revenues & Volume, By Blow Molding, 2021-2031F |

| 6.2.4 South Africa Plastic Market Revenues & Volume, By Roto Molding, 2021-2031F |

| 6.2.5 South Africa Plastic Market Revenues & Volume, By Compression Molding, 2021-2031F |

| 6.2.6 South Africa Plastic Market Revenues & Volume, By Casting, 2021-2031F |

| 6.2.7 South Africa Plastic Market Revenues & Volume, By Thermoforming, 2021-2031F |

| 6.2.8 South Africa Plastic Market Revenues & Volume, By Others, 2021-2031F |

| 6.2.9 South Africa Plastic Market Revenues & Volume, By Others, 2021-2031F |

| 6.3 South Africa Plastic Market, By End-use |

| 6.3.1 Overview and Analysis |

| 6.3.2 South Africa Plastic Market Revenues & Volume, By Packaging, 2021-2031F |

| 6.3.3 South Africa Plastic Market Revenues & Volume, By Construction, 2021-2031F |

| 6.3.4 South Africa Plastic Market Revenues & Volume, By Electrical & Electronics, 2021-2031F |

| 6.3.5 South Africa Plastic Market Revenues & Volume, By Automotive, 2021-2031F |

| 6.3.6 South Africa Plastic Market Revenues & Volume, By Medical Devices, 2021-2031F |

| 6.3.7 South Africa Plastic Market Revenues & Volume, By Agriculture, 2021-2031F |

| 6.3.8 South Africa Plastic Market Revenues & Volume, By Others, 2021-2031F |

| 6.3.9 South Africa Plastic Market Revenues & Volume, By Others, 2021-2031F |

| 7 South Africa Plastic Market Import-Export Trade Statistics |

| 7.1 South Africa Plastic Market Export to Major Countries |

| 7.2 South Africa Plastic Market Imports from Major Countries |

| 8 South Africa Plastic Market Key Performance Indicators |

| 9 South Africa Plastic Market - Opportunity Assessment |

| 9.1 South Africa Plastic Market Opportunity Assessment, By Product, 2021 & 2031F |

| 9.2 South Africa Plastic Market Opportunity Assessment, By Application, 2021 & 2031F |

| 9.3 South Africa Plastic Market Opportunity Assessment, By End-use, 2021 & 2031F |

| 10 South Africa Plastic Market - Competitive Landscape |

| 10.1 South Africa Plastic Market Revenue Share, By Companies, 2024 |

| 10.2 South Africa Plastic Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero