South Africa Poultry Market (2025-2031) | Outlook, Analysis, Companies, Industry, Size, Trends, Revenue, Forecast, Growth, Value & Share

Market Forecast By Segments (Broiler, Eggs), By End Uses (Food Service, Household), By Distribution Channels (Traditional Retail Stores, Business To Business, Modern Retail Stores) And Competitive Landscape

| Product Code: ETC384228 | Publication Date: Aug 2022 | Updated Date: Jan 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 | |

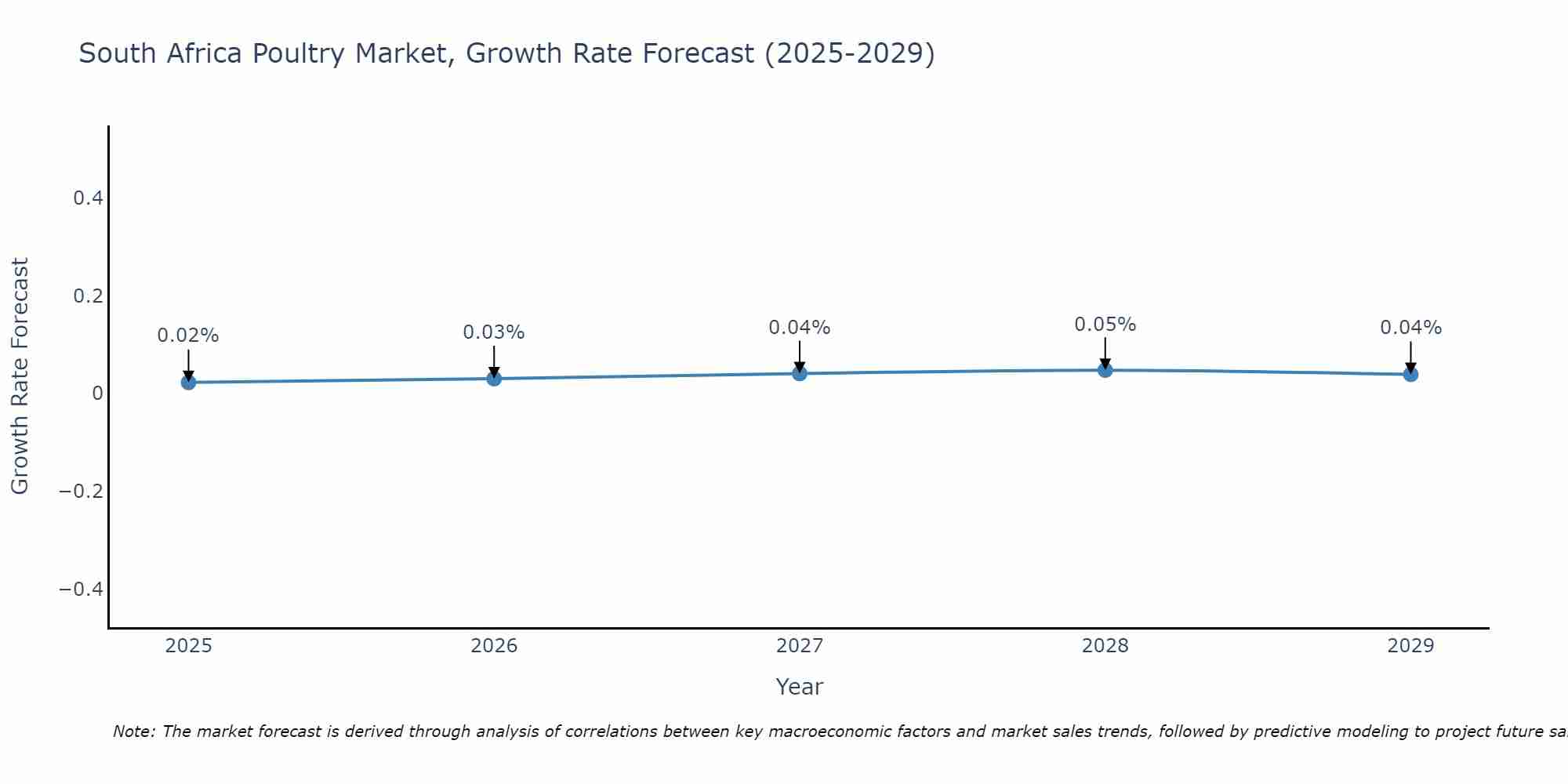

South Africa Poultry Market Size Growth Rate

The South Africa Poultry Market is projected to witness mixed growth rate patterns during 2025 to 2029. Starting at 0.02% in 2025, the market peaks at 0.05% in 2028, and settles at 0.04% by 2029.

Topics Covered in the South Africa Poultry Market Report

South Africa Poultry Market Report thoroughly covers the market by Segments, End Uses, and Distribution Channels. The South Africa Poultry Market Outlook report provides an unbiased and detailed analysis of the ongoing South Africa Poultry Market trends, opportunities/high growth areas, and market drivers. This would help stakeholders devise and align their market strategies according to the current and future market dynamics.

South Africa Poultry Market Synopsis

South Africa Poultry Market is experiencing significant growth, driven by increasing demand for affordable and high-protein food sources. This market focuses on the production and distribution of broilers and eggs, which play a crucial role in the country's food supply. Poultry meat, particularly chicken, is a staple in the South African diet due to its affordability, nutritional value, and versatility in various culinary dishes. The market is characterized by a strong demand-supply dynamic, with domestic production primarily fulfilling consumption needs.

According to 6Wresearch, South Africa Poultry Market size is projected to rise at a CAGR of 5.8% during 2025-2031. The increasing demand for poultry products across various sectors is driving the South Africa poultry market. Poultry, being a primary source of affordable protein, is essential for both food service and household consumption. Additionally, the expanding food service industry contributes significantly, with poultry being a staple in many menus. Furthermore, the household sector is also witnessing growing consumption of poultry products due to rising health consciousness and changing dietary preferences. These factors collectively accelerate South Africa Poultry Market growth, indicating high potential for providers in this essential food sector.

Additionally, the sector shows potential for growth through value-added products and the adoption of innovative farming practices. As consumer preferences continue to evolve towards healthier and more sustainable food options, the poultry market in South Africa is poised for further development and diversification.However, the South Africa poultry market presents unique challenges. One major obstacle is the stringent regulatory landscape, requiring comprehensive compliance from producers. Additionally, high feed costs and limited local production capabilities create dependence on imports, increasing prices and suppressing demand. Furthermore, competition from established global players exacerbates the difficulties for emerging local companies.

South Africa Poultry Market: Leading Players

The South Africa Poultry Market is witnessing significant growth, with key players like Rainbow Chicken, Astral Foods, and Daybreak Farms shaping its trajectory. These industry leaders are known for their advanced farming techniques and robust product offerings.

South Africa Poultry Market: Government Initiatives

The South Africa poultry industry is witnessing significant growth, driven by active government initiatives aimed at strengthening agricultural practices and food security. These policies focus on upgrading farming infrastructure and promoting the use of advanced technologies to improve efficiency and sustainability in poultry production. The government's commitment to agricultural development further boosts the demand for high-quality poultry products, essential for minimizing food insecurity.

Future Insights of the Market

The South Africa poultry industry is poised for significant growth in the coming years. Key drivers include advancements in farming technology and an increasing demand for affordable protein sources. The market is witnessing a shift towards the adoption of innovative farming practices that enhance the quality and sustainability of poultry production, reducing environmental impact and improving efficiency. With the government's push towards agricultural development, the industry is expected to see a surge in investment. Furthermore, the rise in food service and household consumption of poultry products across South Africa is fueling the demand for poultry, promising a robust future for the market.

Market Segmentation By Segments

According to Ravi Bhandari, Research Head, 6Wresearch, the broiler segment takes the lead over the eggs segment. Broilers, which are chickens raised specifically for meat production, account for the majority of the market share due to their high demand and consumption. Chicken meat is a core part of the South African diet, making broilers an essential component of the poultry industry.

Market Segmentation By End Uses

The Food Service segment is seeing significant growth owing to its widespread use across various restaurants and catering services. Its adaptability and nutritional value make it a preferred choice for many applications.

Market Segmentation By Distribution Channels

The Modern Retail Stores segment is experiencing noteworthy growth. This rise is attributed to the increasing consumer preference for convenient and high-quality poultry products available in supermarkets and retail chains.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- South Africa Poultry Market Outlook

- Market Size of South Africa Poultry Market, 2024

- Forecast of South Africa Poultry Market, 2031

- Historical Data and Forecast of South Africa Poultry Revenues & Volume for the Period 2021 - 2031

- South Africa Poultry Market Trend Evolution

- South Africa Poultry Market Drivers and Challenges

- South Africa Poultry Price Trends

- South Africa Poultry Porter's Five Forces

- South Africa Poultry Industry Life Cycle

- Historical Data and Forecast of South Africa Poultry Market Revenues & Volume By Segments for the Period 2021 - 2031

- Historical Data and Forecast of South Africa Poultry Market Revenues & Volume By Broiler for the Period 2021 - 2031

- Historical Data and Forecast of South Africa Poultry Market Revenues & Volume By Eggs for the Period 2021 - 2031

- Historical Data and Forecast of South Africa Poultry Market Revenues & Volume By End Uses for the Period 2021 - 2031

- Historical Data and Forecast of South Africa Poultry Market Revenues & Volume By Food Service for the Period 2021 - 2031

- Historical Data and Forecast of South Africa Poultry Market Revenues & Volume By Household for the Period 2021 - 2031

- Historical Data and Forecast of South Africa Poultry Market Revenues & Volume By Distribution Channels for the Period 2021 - 2031

- Historical Data and Forecast of South Africa Poultry Market Revenues & Volume By Traditional Retail Stores for the Period 2021 - 2031

- Historical Data and Forecast of South Africa Poultry Market Revenues & Volume By Business To Business for the Period 2021 - 2031

- Historical Data and Forecast of South Africa Poultry Market Revenues & Volume By Modern Retail Stores for the Period 2021 - 2031

- South Africa Poultry Import Export Trade Statistics

- Market Opportunity Assessment By Segments

- Market Opportunity Assessment By End Uses

- Market Opportunity Assessment By Distribution Channels

- South Africa Poultry Top Companies Market Share

- South Africa Poultry Competitive Benchmarking By Technical and Operational Parameters

- South Africa Poultry Company Profiles

- South Africa Poultry Key Strategic Recommendations

Market Covered

The report provides a detailed analysis of the following market segments:

By Segments

- Broiler

- Eggs

By End Uses

- Food Service

- Household

By Distribution Channels

- Traditional Retail Stores

- Business To Business

- Modern Retail Stores

South Africa Poultry Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 South Africa Poultry Market Overview |

| 3.1 South Africa Country Macro Economic Indicators |

| 3.2 South Africa Poultry Market Revenues & Volume, 2021 & 2031F |

| 3.3 South Africa Poultry Market - Industry Life Cycle |

| 3.4 South Africa Poultry Market - Porter's Five Forces |

| 3.5 South Africa Poultry Market Revenues & Volume Share, By Segments, 2021 & 2031F |

| 3.6 South Africa Poultry Market Revenues & Volume Share, By End Uses, 2021 & 2031F |

| 3.7 South Africa Poultry Market Revenues & Volume Share, By Distribution Channels, 2021 & 2031F |

| 4 South Africa Poultry Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 South Africa Poultry Market Trends |

| 6 South Africa Poultry Market Segmentations |

| 6.1 South Africa Poultry Market, By Segments |

| 6.1.1 Overview and Analysis |

| 6.1.2 South Africa Poultry Market Revenues & Volume, By Broiler, 2021-2031F |

| 6.1.3 South Africa Poultry Market Revenues & Volume, By Eggs, 2021-2031F |

| 6.2 South Africa Poultry Market, By End Uses |

| 6.2.1 Overview and Analysis |

| 6.2.2 South Africa Poultry Market Revenues & Volume, By Food Service, 2021-2031F |

| 6.2.3 South Africa Poultry Market Revenues & Volume, By Household, 2021-2031F |

| 6.3 South Africa Poultry Market, By Distribution Channels |

| 6.3.1 Overview and Analysis |

| 6.3.2 South Africa Poultry Market Revenues & Volume, By Traditional Retail Stores, 2021-2031F |

| 6.3.3 South Africa Poultry Market Revenues & Volume, By Business To Business, 2021-2031F |

| 6.3.4 South Africa Poultry Market Revenues & Volume, By Modern Retail Stores, 2021-2031F |

| 7 South Africa Poultry Market Import-Export Trade Statistics |

| 7.1 South Africa Poultry Market Export to Major Countries |

| 7.2 South Africa Poultry Market Imports from Major Countries |

| 8 South Africa Poultry Market Key Performance Indicators |

| 9 South Africa Poultry Market - Opportunity Assessment |

| 9.1 South Africa Poultry Market Opportunity Assessment, By Segments, 2021 & 2031F |

| 9.2 South Africa Poultry Market Opportunity Assessment, By End Uses, 2021 & 2031F |

| 9.3 South Africa Poultry Market Opportunity Assessment, By Distribution Channels, 2021 & 2031F |

| 10 South Africa Poultry Market - Competitive Landscape |

| 10.1 South Africa Poultry Market Revenue Share, By Companies, 2024 |

| 10.2 South Africa Poultry Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero