South Africa Styrenic Polymers Market (2025-2031) | Outlook, Industry, Forecast, Value, Size, Growth, Share, Analysis, Trends, Companies & Revenue

Market Forecast By Product Type (Polystyrene, ABS, SAN, MBS, MABS, SMMA, SBS, Others) And Competitive Landscape

| Product Code: ETC348528 | Publication Date: Aug 2022 | Updated Date: Jan 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 | |

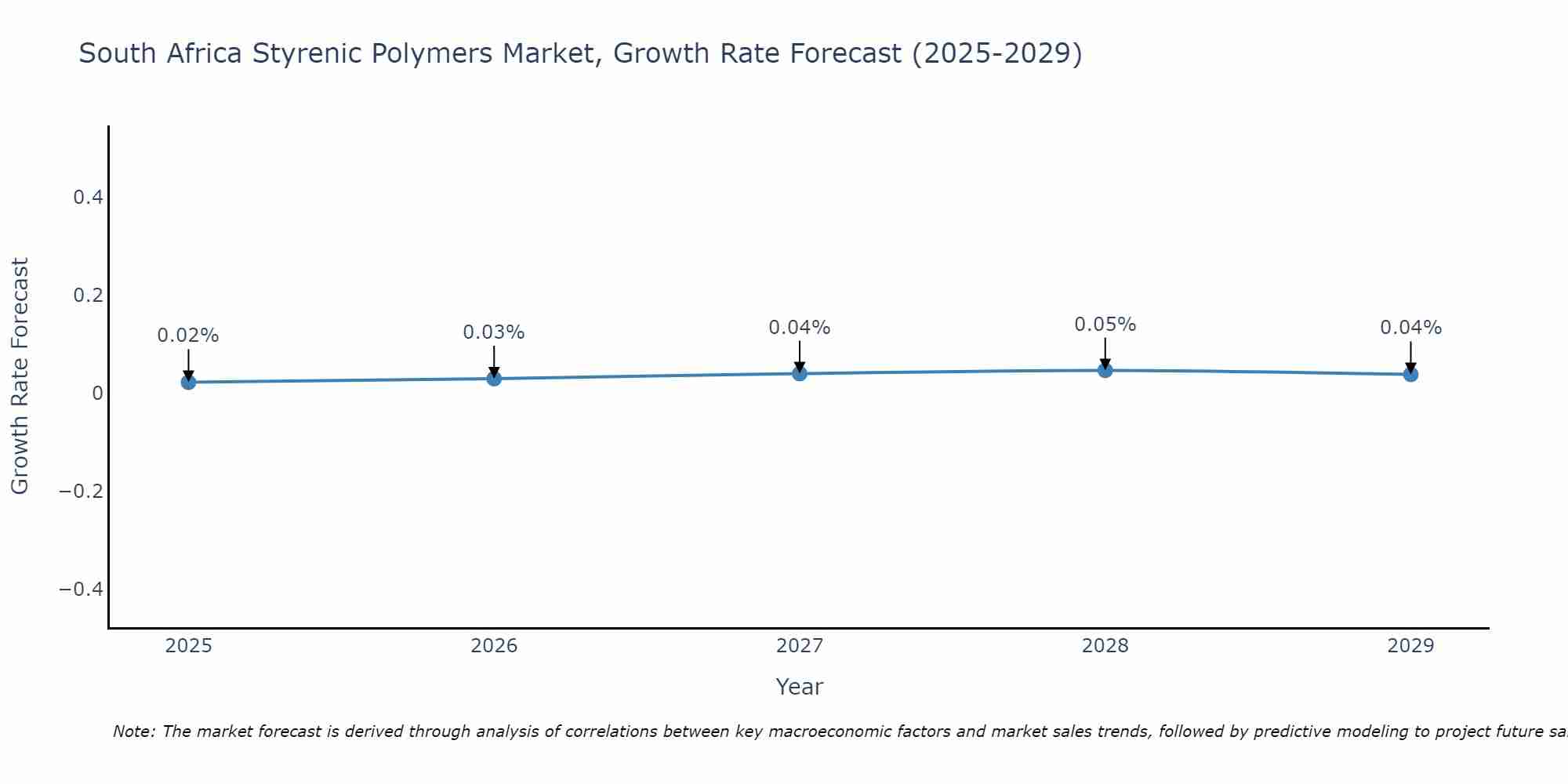

South Africa Styrenic Polymers Market Size Growth Rate

The South Africa Styrenic Polymers Market is projected to witness mixed growth rate patterns during 2025 to 2029. Starting at 0.02% in 2025, the market peaks at 0.05% in 2028, and settles at 0.04% by 2029.

Topics Covered in South Africa Styrenic Polymers Market Report

South Africa Styrenic Polymers Market report thoroughly covers the market By Product Type. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

South Africa Styrenic Polymers Market Synopsis

South Africa styrenic polymers market is an essential sector within the country's plastics industry, contributing significantly to manufacturing and consumer goods. The market is on an upward trajectory, driven by a blend of technological innovations and evolving consumer preferences. The market benefits from a strong foundation in sectors such as packaging, automotive, and construction, which are significant consumers of styrenic polymers due to their versatility, durability, and cost-efficiency. Environmental regulations have also stimulated the development of sustainable styrenic polymer variants, aligning the industry with global sustainability trends.

According to 6Wresearch, the South Africa Styrenic Polymers Market size is expected to grow at a significant CAGR of 4.3% during the forecast period 2025-2031. Several factors contribute to the growth of the South African styrenic polymers market. Technological advancements in polymer modification enhance the properties and applications of styrenic plastics, driving their adoption in automotive, electronics, and packaging industries. Consumer preferences for sustainable and recyclable materials boost the demand for innovative styrenic products.

Additionally, regulatory frameworks that promote the use of high-performance and environmentally friendly materials further support market expansion. The increasing urbanization and industrialization rates in South Africa also create a growing demand for these versatile polymers across various sectors, leading to the South Africa Styrenic Polymers Market growth.The market faces several challenges that hinder its growth. The fluctuating cost of raw materials, particularly styrene monomer, poses a significant economic hurdle. Environmental concerns and stringent regulatory standards for plastic usage and disposal add another layer of complexity, compelling manufacturers to invest in sustainable practices which can be costly. Additionally, the market struggles with technological limitations in recycling processes, impacting the development of efficient waste management systems.

South Africa Styrenic Polymers Market: Leading Players

The market features prominent players such as Sasol Limited, Dow Chemical Company, and LyondellBasell, which play significant roles in shaping the dynamics. Sasol Limited, being a local giant, leverages its extensive supply chain and production capabilities to meet domestic and international demand.

South Africa Styrenic Polymers Market: Government Initiatives

The South African government has implemented several initiatives to boost the styrenic polymers market. The Department of Trade, Industry, and Competition’s (DTIC) Industrial Policy Action Plan (IPAP) aims to enhance local manufacturing capabilities and reduce dependence on imports. Additionally, the Plastics SA initiative promotes recycling and sustainable practices within the industry, addressing environmental concerns. These government policies, coupled with incentives for technological advancements and investment in innovation, provide a supportive environment for the styrenic polymers market to thrive.

Future Insights of the Market

The future outlook for the South Africa styrenic polymers market is promising, with emerging trends offering substantial growth potential. The increasing adoption of biodegradable and recyclable polymers is set to drive market expansion as industries shift towards sustainability. Innovation in polymer blends and composites can open new applications, particularly in automotive and construction sectors.

Market Segmentation by Product Type

According to Ravi Bhandari, Research Head, 6Wresearch, Acrylonitrile Butadiene Styrene (ABS) is currently leading. This dominance can be attributed to ABS's versatility, strength, and high resistance to impact and chemical corrosion. It is extensively used in applications ranging from automotive components to consumer electronics, making it the most sought-after styrenic polymer in the country.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024.

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- South Africa Styrenic Polymers Market Outlook

- Market Size of South Africa Styrenic Polymers Market, 2024

- Forecast of South Africa Styrenic Polymers Market, 2031

- Historical Data and Forecast of South Africa Styrenic Polymers Revenues & Volume for the Period 2021 - 2031

- South Africa Styrenic Polymers Market Trend Evolution

- South Africa Styrenic Polymers Market Drivers and Challenges

- South Africa Styrenic Polymers Price Trends

- South Africa Styrenic Polymers Porter's Five Forces

- South Africa Styrenic Polymers Industry Life Cycle

- Historical Data and Forecast of South Africa Styrenic Polymers Market Revenues & Volume By Product Type for the Period 2021 - 2031

- Historical Data and Forecast of South Africa Styrenic Polymers Market Revenues & Volume By Polystyrene for the Period 2021 - 2031

- Historical Data and Forecast of South Africa Styrenic Polymers Market Revenues & Volume By ABS for the Period 2021 - 2031

- Historical Data and Forecast of South Africa Styrenic Polymers Market Revenues & Volume By SAN for the Period 2021 - 2031

- Historical Data and Forecast of South Africa Styrenic Polymers Market Revenues & Volume By MBS for the Period 2021 - 2031

- Historical Data and Forecast of South Africa Styrenic Polymers Market Revenues & Volume By MABS for the Period 2021 - 2031

- Historical Data and Forecast of South Africa Styrenic Polymers Market Revenues & Volume By SMMA for the Period 2021 - 2031

- Historical Data and Forecast of South Africa Styrenic Polymers Market Revenues & Volume By SBS for the Period 2021 - 2031

- Historical Data and Forecast of South Africa Polystyrene Styrenic Polymers Market Revenues & Volume By Others for the Period 2021 - 2031

- South Africa Styrenic Polymers Import Export Trade Statistics

- Market Opportunity Assessment By Product Type

- South Africa Styrenic Polymers Top Companies Market Share

- South Africa Styrenic Polymers Competitive Benchmarking By Technical and Operational Parameters

- South Africa Styrenic Polymers Company Profiles

- South Africa Styrenic Polymers Key Strategic Recommendations

Market Covered:

The report offers a comprehensive study of the following market segments:

By Product Type:

- Polystyrene

- ABS

- SAN

- MBS

- MABS

- SMMA

- SBS

- Others

South Africa Styrenic Polymers Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 South Africa Styrenic Polymers Market Overview |

| 3.1 South Africa Country Macro Economic Indicators |

| 3.2 South Africa Styrenic Polymers Market Revenues & Volume, 2021 & 2031F |

| 3.3 South Africa Styrenic Polymers Market - Industry Life Cycle |

| 3.4 South Africa Styrenic Polymers Market - Porter's Five Forces |

| 3.5 South Africa Styrenic Polymers Market Revenues & Volume Share, By Product Type, 2021 & 2031F |

| 4 South Africa Styrenic Polymers Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 South Africa Styrenic Polymers Market Trends |

| 6 South Africa Styrenic Polymers Market, By Types |

| 6.1 South Africa Styrenic Polymers Market, By Product Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 South Africa Styrenic Polymers Market Revenues & Volume, By Product Type, 2021-2031F |

| 6.1.3 South Africa Styrenic Polymers Market Revenues & Volume, By Polystyrene, 2021-2031F |

| 6.1.4 South Africa Styrenic Polymers Market Revenues & Volume, By ABS, 2021-2031F |

| 6.1.5 South Africa Styrenic Polymers Market Revenues & Volume, By SAN, 2021-2031F |

| 6.1.6 South Africa Styrenic Polymers Market Revenues & Volume, By MBS, 2021-2031F |

| 6.1.7 South Africa Styrenic Polymers Market Revenues & Volume, By MABS, 2021-2031F |

| 6.1.8 South Africa Styrenic Polymers Market Revenues & Volume, By SMMA, 2021-2031F |

| 6.1.9 South Africa Styrenic Polymers Market Revenues & Volume, By Others, 2021-2031F |

| 6.1.10 South Africa Styrenic Polymers Market Revenues & Volume, By Others, 2021-2031F |

| 7 South Africa Styrenic Polymers Market Import-Export Trade Statistics |

| 7.1 South Africa Styrenic Polymers Market Export to Major Countries |

| 7.2 South Africa Styrenic Polymers Market Imports from Major Countries |

| 8 South Africa Styrenic Polymers Market Key Performance Indicators |

| 9 South Africa Styrenic Polymers Market - Opportunity Assessment |

| 9.1 South Africa Styrenic Polymers Market Opportunity Assessment, By Product Type, 2021 & 2031F |

| 10 South Africa Styrenic Polymers Market - Competitive Landscape |

| 10.1 South Africa Styrenic Polymers Market Revenue Share, By Companies, 2024 |

| 10.2 South Africa Styrenic Polymers Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero