Thailand Automotive Components Market (2025-2031) Outlook | Size, Revenue, Value, Companies, Share, Growth, Forecast, Analysis, Trends, Industry

| Product Code: ETC282865 | Publication Date: Aug 2022 | Updated Date: Feb 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 | |

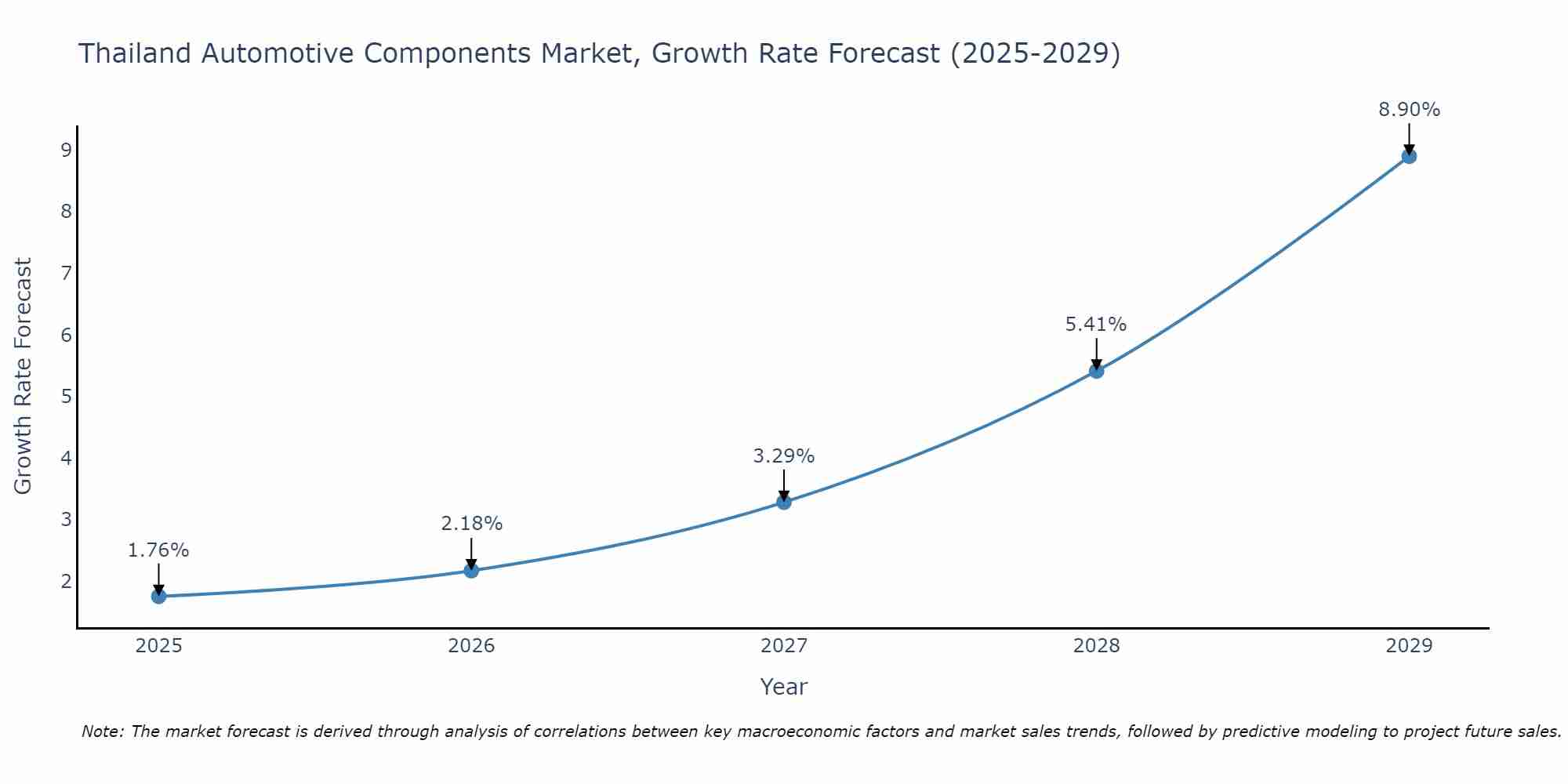

Thailand Automotive Components Market Size Growth Rate

The Thailand Automotive Components Market is likely to experience consistent growth rate gains over the period 2025 to 2029. From 1.76% in 2025, the growth rate steadily ascends to 8.90% in 2029.

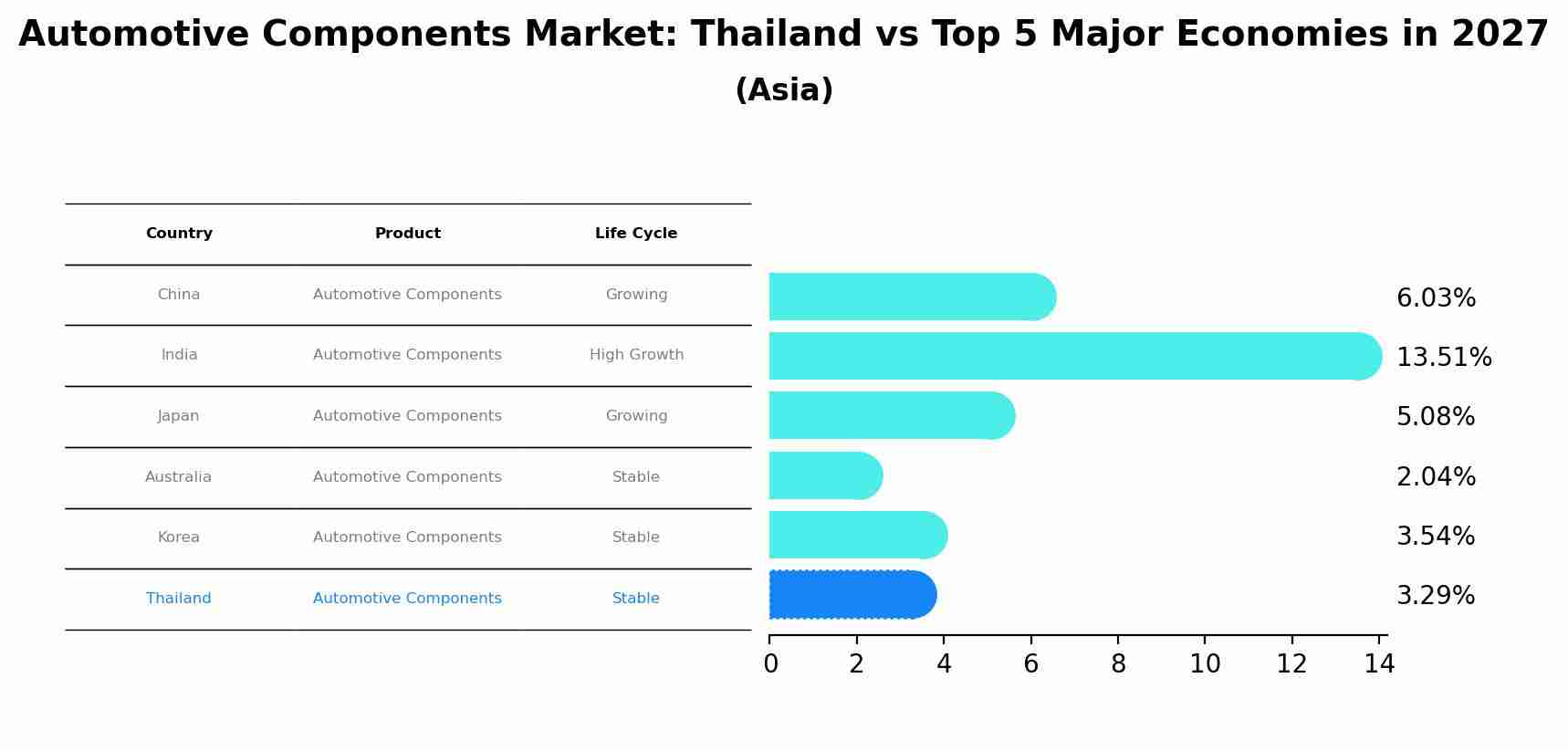

Automotive Components Market: Thailand vs Top 5 Major Economies in 2027 (Asia)

By 2027, Thailand's Automotive Components market is forecasted to achieve a stable growth rate of 3.29%, with China leading the Asia region, followed by India, Japan, Australia and South Korea.

Thailand Automotive Components Market Synopsis

The Thailand automotive components market is experiencing growth, primarily driven by the expanding automotive industry in the country. Thailand has emerged as a major hub for automotive manufacturing and exports in Southeast Asia, leading to increased demand for various automotive components. The market includes a wide range of products such as engine parts, suspension systems, braking systems, and electrical components. Key players in the market include Denso, Continental AG, and Aisin Seiki, who provide a comprehensive range of automotive components to meet the industry`s needs.

Drivers of the Market

The Thailand Automotive Components market is being driven by a combination of factors. Firstly, Thailand has emerged as a major automotive manufacturing hub in Southeast Asia, attracting investments from global automotive OEMs and suppliers. This has led to an increased demand for automotive components, ranging from engine parts to electronic systems. Secondly, the growth of the electric vehicle (EV) segment is driving the demand for specialized automotive components such as batteries, electric drivetrains, and charging infrastructure. Additionally, the government`s support for the automotive industry through incentives and policies is encouraging the development and production of automotive components locally. This, in turn, is contributing to the growth of the automotive components market in Thailand.

Challenges of the Market

The challenges in the Thailand Automotive Components Market include global supply chain disruptions, rapidly evolving technology, and fluctuating demand. Supply chain disruptions, such as those witnessed during the COVID-19 pandemic, can impact the availability of critical components. Additionally, advancements in electric and autonomous vehicles are reshaping the automotive landscape, requiring suppliers to adapt quickly. Market players must diversify their product portfolios and enhance supply chain resilience to mitigate these challenges.

COVID-19 Impact on the Market

The COVID-19 pandemic significantly impacted the Thailand Automotive Components Market. As vehicle production slowed and supply chains were disrupted, component manufacturers faced a decrease in demand and operational challenges. The shift towards remote work and reduced mobility affected the demand for certain components, such as in-vehicle entertainment systems. However, the industry adapted by diversifying products and exploring opportunities in electric and autonomous vehicles, anticipating potential growth in these segments as the world recovers from the pandemic.

Key Players in the Market

The Thailand Automotive Components market features leading players such as Denso Corporation, Continental AG, and Robert Bosch GmbH. Denso Corporation is a global leader in automotive components, offering a wide range of products, including sensors, ignition systems, and more. Continental AG specializes in advanced automotive technologies, providing components that enhance safety and connectivity. Robert Bosch GmbH is known for its comprehensive portfolio of automotive components, ranging from fuel injection systems to advanced driver assistance systems.

Key Highlights of the Report:

- Thailand Automotive Components Market Outlook

- Market Size of Thailand Automotive Components Market, 2024

- Forecast of Thailand Automotive Components Market, 2031

- Historical Data and Forecast of Thailand Automotive Components Revenues & Volume for the Period 2021-2031

- Thailand Automotive Components Market Trend Evolution

- Thailand Automotive Components Market Drivers and Challenges

- Thailand Automotive Components Price Trends

- Thailand Automotive Components Porter's Five Forces

- Thailand Automotive Components Industry Life Cycle

- Historical Data and Forecast of Thailand Automotive Components Market Revenues & Volume By Vehicle Type for the Period 2021-2031

- Historical Data and Forecast of Thailand Automotive Components Market Revenues & Volume By Passenger Car for the Period 2021-2031

- Historical Data and Forecast of Thailand Automotive Components Market Revenues & Volume By Light Commercial Vehicle for the Period 2021-2031

- Historical Data and Forecast of Thailand Automotive Components Market Revenues & Volume By Medium & Heavy Commercial Vehicle for the Period 2021-2031

- Historical Data and Forecast of Thailand Automotive Components Market Revenues & Volume By Two-Wheeler for the Period 2021-2031

- Historical Data and Forecast of Thailand Automotive Components Market Revenues & Volume By Three-Wheeler for the Period 2021-2031

- Historical Data and Forecast of Thailand Automotive Components Market Revenues & Volume By OTR for the Period 2021-2031

- Historical Data and Forecast of Thailand Automotive Components Market Revenues & Volume By Component for the Period 2021-2031

- Historical Data and Forecast of Thailand Automotive Components Market Revenues & Volume By Engine Parts for the Period 2021-2031

- Historical Data and Forecast of Thailand Automotive Components Market Revenues & Volume By Body & Chassis for the Period 2021-2031

- Historical Data and Forecast of Thailand Automotive Components Market Revenues & Volume By Suspension & Brakes for the Period 2021-2031

- Historical Data and Forecast of Thailand Automotive Components Market Revenues & Volume By Drive Transmission & Steering Parts for the Period 2021-2031

- Historical Data and Forecast of Thailand Automotive Components Market Revenues & Volume By Electrical Parts for the Period 2021-2031

- Historical Data and Forecast of Thailand Automotive Components Market Revenues & Volume By Equipments for the Period 2021-2031

- Historical Data and Forecast of Thailand Automotive Components Market Revenues & Volume By Demand Category for the Period 2021-2031

- Historical Data and Forecast of Thailand Automotive Components Market Revenues & Volume By OEM for the Period 2021-2031

- Historical Data and Forecast of Thailand Automotive Components Market Revenues & Volume By Replacement for the Period 2021-2031

- Thailand Automotive Components Import Export Trade Statistics

- Market Opportunity Assessment By Vehicle Type

- Market Opportunity Assessment By Component

- Market Opportunity Assessment By Demand Category

- Thailand Automotive Components Top Companies Market Share

- Thailand Automotive Components Competitive Benchmarking By Technical and Operational Parameters

- Thailand Automotive Components Company Profiles

- Thailand Automotive Components Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 Thailand Automotive Components Market Overview |

3.1 Thailand Country Macro Economic Indicators |

3.2 Thailand Automotive Components Market Revenues & Volume, 2021 & 2031F |

3.3 Thailand Automotive Components Market - Industry Life Cycle |

3.4 Thailand Automotive Components Market - Porter's Five Forces |

3.5 Thailand Automotive Components Market Revenues & Volume Share, By Vehicle Type, 2021 & 2031F |

3.6 Thailand Automotive Components Market Revenues & Volume Share, By Component, 2021 & 2031F |

3.7 Thailand Automotive Components Market Revenues & Volume Share, By Demand Category, 2021 & 2031F |

4 Thailand Automotive Components Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.3 Market Restraints |

5 Thailand Automotive Components Market Trends |

6 Thailand Automotive Components Market, By Types |

6.1 Thailand Automotive Components Market, By Vehicle Type |

6.1.1 Overview and Analysis |

6.1.2 Thailand Automotive Components Market Revenues & Volume, By Vehicle Type, 2021-2031F |

6.1.3 Thailand Automotive Components Market Revenues & Volume, By Passenger Car, 2021-2031F |

6.1.4 Thailand Automotive Components Market Revenues & Volume, By Light Commercial Vehicle, 2021-2031F |

6.1.5 Thailand Automotive Components Market Revenues & Volume, By Medium & Heavy Commercial Vehicle, 2021-2031F |

6.1.6 Thailand Automotive Components Market Revenues & Volume, By Two-Wheeler, 2021-2031F |

6.1.7 Thailand Automotive Components Market Revenues & Volume, By Three-Wheeler, 2021-2031F |

6.1.8 Thailand Automotive Components Market Revenues & Volume, By OTR, 2021-2031F |

6.2 Thailand Automotive Components Market, By Component |

6.2.1 Overview and Analysis |

6.2.2 Thailand Automotive Components Market Revenues & Volume, By Engine Parts, 2021-2031F |

6.2.3 Thailand Automotive Components Market Revenues & Volume, By Body & Chassis, 2021-2031F |

6.2.4 Thailand Automotive Components Market Revenues & Volume, By Suspension & Brakes, 2021-2031F |

6.2.5 Thailand Automotive Components Market Revenues & Volume, By Drive Transmission & Steering Parts, 2021-2031F |

6.2.6 Thailand Automotive Components Market Revenues & Volume, By Electrical Parts, 2021-2031F |

6.2.7 Thailand Automotive Components Market Revenues & Volume, By Equipments, 2021-2031F |

6.3 Thailand Automotive Components Market, By Demand Category |

6.3.1 Overview and Analysis |

6.3.2 Thailand Automotive Components Market Revenues & Volume, By OEM, 2021-2031F |

6.3.3 Thailand Automotive Components Market Revenues & Volume, By Replacement, 2021-2031F |

7 Thailand Automotive Components Market Import-Export Trade Statistics |

7.1 Thailand Automotive Components Market Export to Major Countries |

7.2 Thailand Automotive Components Market Imports from Major Countries |

8 Thailand Automotive Components Market Key Performance Indicators |

9 Thailand Automotive Components Market - Opportunity Assessment |

9.1 Thailand Automotive Components Market Opportunity Assessment, By Vehicle Type, 2021 & 2031F |

9.2 Thailand Automotive Components Market Opportunity Assessment, By Component, 2021 & 2031F |

9.3 Thailand Automotive Components Market Opportunity Assessment, By Demand Category, 2021 & 2031F |

10 Thailand Automotive Components Market - Competitive Landscape |

10.1 Thailand Automotive Components Market Revenue Share, By Companies, 2024 |

10.2 Thailand Automotive Components Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero