Thailand Granite Market (2025-2031) | Size, Companies, Share, Outlook, Forecast, Growth, Industry, Revenue, Analysis, Value & Trends

| Product Code: ETC049505 | Publication Date: Jul 2023 | Updated Date: Feb 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

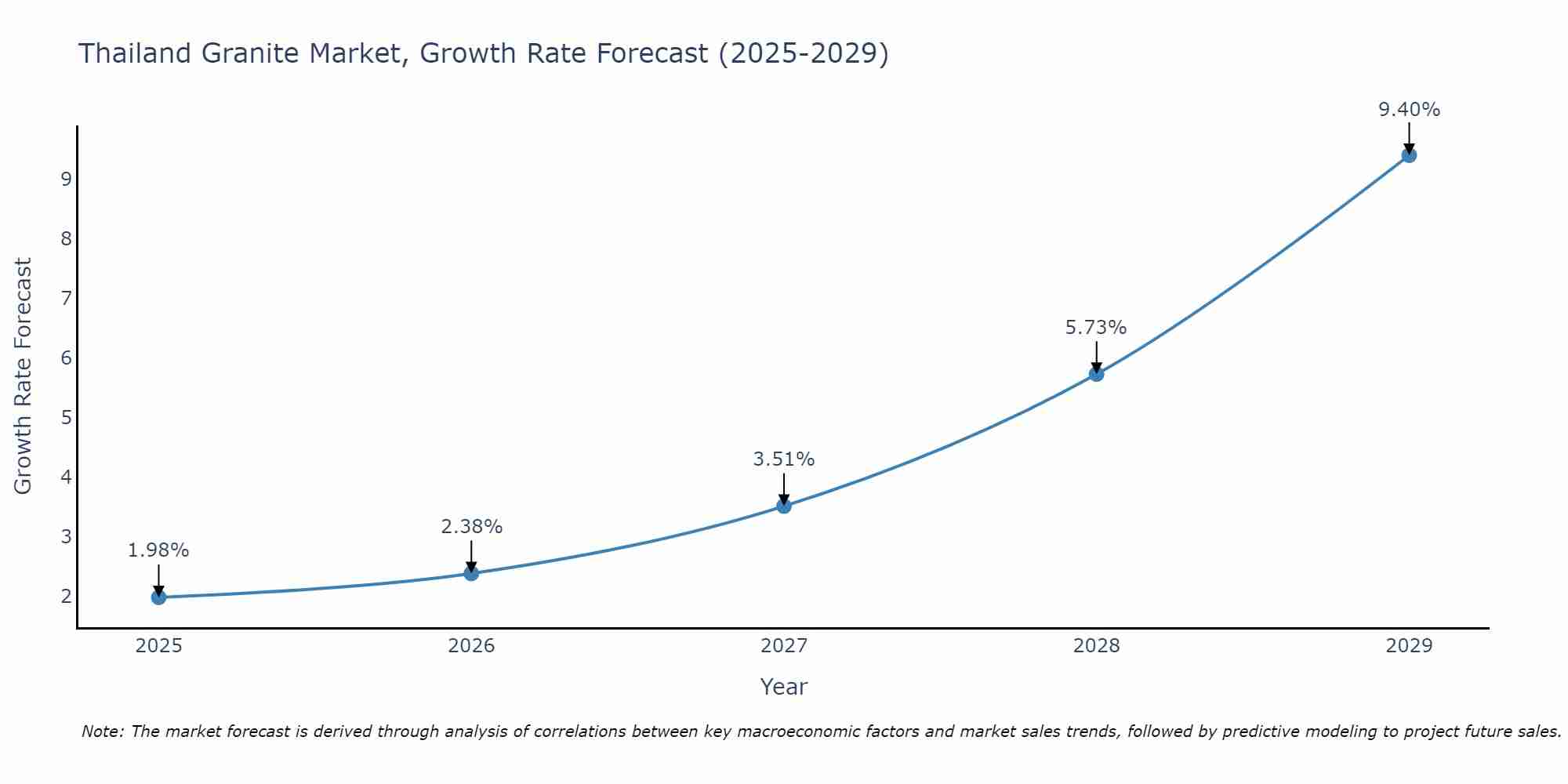

Thailand Granite Market Size Growth Rate

The Thailand Granite Market is poised for steady growth rate improvements from 2025 to 2029. From 1.98% in 2025, the growth rate steadily ascends to 9.40% in 2029.

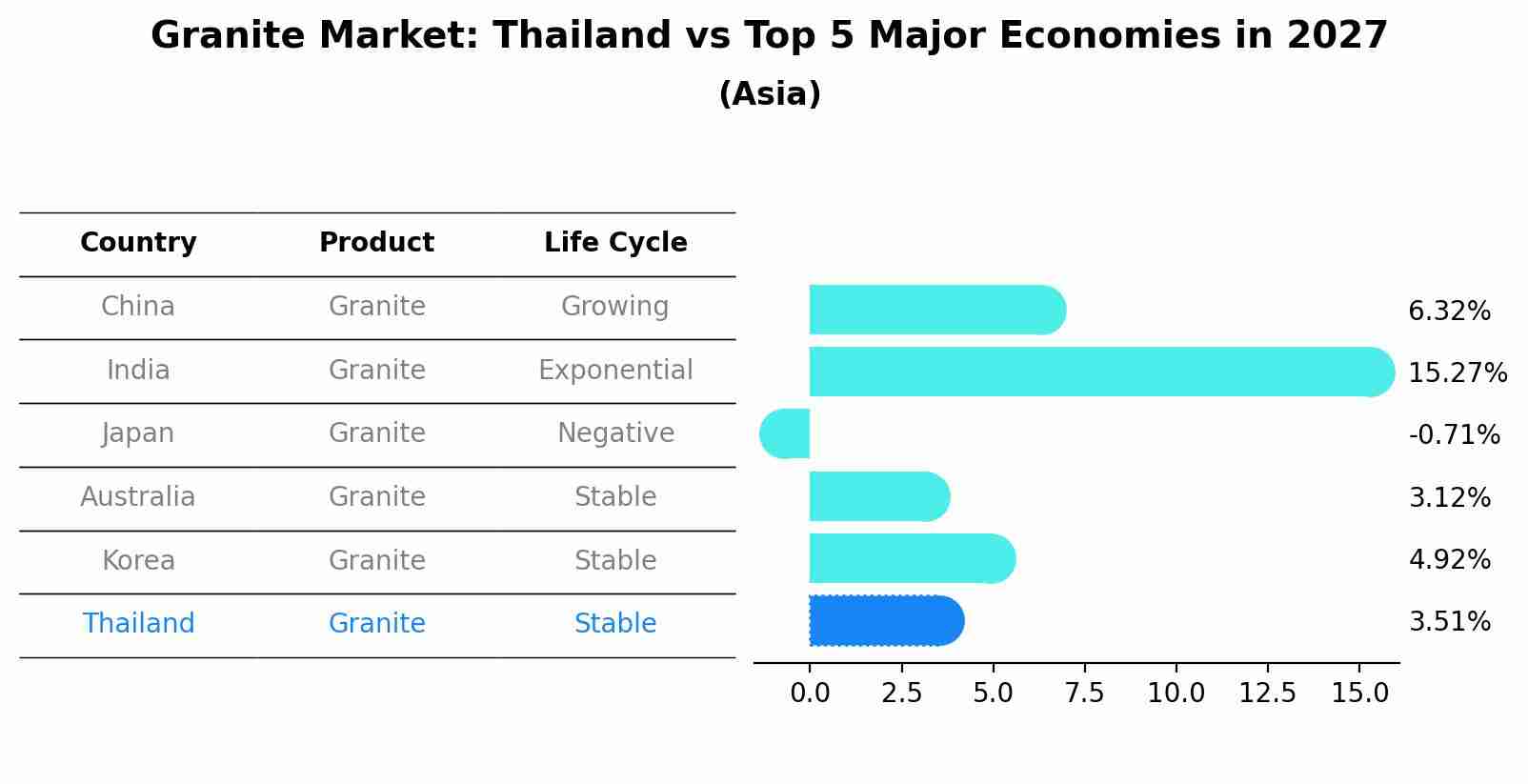

Granite Market: Thailand vs Top 5 Major Economies in 2027 (Asia)

Thailand's Granite market is anticipated to experience a stable growth rate of 3.51% by 2027, reflecting trends observed in the largest economy China, followed by India, Japan, Australia and South Korea.

Thailand Granite Market Synopsis

The granite market in Thailand has been a significant sector within the construction industry. Granite, a durable and attractive natural stone, is widely used for various applications, including countertops, flooring, cladding, monuments, and sculptures. The demand for granite in Thailand has been driven by the country`s construction and infrastructure development projects. Before the Covid-19 pandemic, the Thailand granite market was experiencing steady growth, fueled by construction activities and infrastructure projects. However, the pandemic`s impact temporarily affected market growth due to disruptions in construction activities and supply chains.

Market Drivers

Thailand ongoing infrastructure development projects, such as highways, airports, and commercial buildings, have been a major driver for the granite market. The growth in the real estate sector, including residential and commercial projects, has increased the demand for granite products. Granite`s natural beauty, durability, and resistance to wear and tear make it a preferred choice for various applications. Thailand tourism industry also indirectly impacts the granite market through the development of hotels, resorts, and other tourist facilities that utilize granite in their construction.

Challenges of the Market

The granite market may face challenges due to fluctuations in the Thailand economy, affecting construction activities and consumer spending on real estate. While granite is popular, it faces competition from other natural stones and engineered materials used in construction and interior design. The extraction and processing of granite raise environmental concerns, such as deforestation, land degradation, and water pollution. Ensuring compliance with environmental and safety regulations can be a challenge for industry players.

Covid-19 Impact on the Market

The Covid-19 pandemic had a significant impact on the Thailand granite market. Construction projects were temporarily halted or delayed due to lockdowns and restrictions, affecting the demand for granite products. Additionally, disruptions in supply chains, especially for imported raw materials, affected production capabilities. However, as construction activities gradually resumed, the market started showing signs of recovery.

Key Players of the Market

The Thailand granite market comprises various local and international players involved in the extraction, processing, and distribution of granite products. Some key players in the market include: SCG (Siam Cement Group), Italian Thailand Development Public Company Limited, Tachawit Marble & Granite Co., Ltd., Cemstone Public Company Limited, Bangkok Granite Co., Ltd.

Key Highlights of the Report:

- Thailand Granite Market Outlook

- Market Size of Thailand Granite Market, 2024

- Forecast of Thailand Granite Market, 2031

- Historical Data and Forecast of Thailand Granite Revenues & Volume for the Period 2021-2031

- Thailand Granite Market Trend Evolution

- Thailand Granite Market Drivers and Challenges

- Thailand Granite Price Trends

- Thailand Granite Porter's Five Forces

- Thailand Granite Industry Life Cycle

- Historical Data and Forecast of Thailand Granite Market Revenues & Volume By Product for the Period 2021-2031

- Historical Data and Forecast of Thailand Granite Market Revenues & Volume By Granite Slabs for the Period 2021-2031

- Historical Data and Forecast of Thailand Granite Market Revenues & Volume By Granite Tiles for the Period 2021-2031

- Historical Data and Forecast of Thailand Granite Market Revenues & Volume By Others for the Period 2021-2031

- Historical Data and Forecast of Thailand Granite Market Revenues & Volume By Application for the Period 2021-2031

- Historical Data and Forecast of Thailand Granite Market Revenues & Volume By Kitchen Countertops for the Period 2021-2031

- Historical Data and Forecast of Thailand Granite Market Revenues & Volume By Flooring for the Period 2021-2031

- Historical Data and Forecast of Thailand Granite Market Revenues & Volume By Stair Treads for the Period 2021-2031

- Historical Data and Forecast of Thailand Granite Market Revenues & Volume By Monuments for the Period 2021-2031

- Historical Data and Forecast of Thailand Granite Market Revenues & Volume By Others for the Period 2021-2031

- Thailand Granite Import Export Trade Statistics

- Market Opportunity Assessment By Product

- Market Opportunity Assessment By Application

- Thailand Granite Top Companies Market Share

- Thailand Granite Competitive Benchmarking By Technical and Operational Parameters

- Thailand Granite Company Profiles

- Thailand Granite Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 Thailand Granite Market Overview |

3.1 Thailand Country Macro Economic Indicators |

3.2 Thailand Granite Market Revenues & Volume, 2021 & 2031F |

3.3 Thailand Granite Market - Industry Life Cycle |

3.4 Thailand Granite Market - Porter's Five Forces |

3.5 Thailand Granite Market Revenues & Volume Share, By Product, 2021 & 2031F |

3.6 Thailand Granite Market Revenues & Volume Share, By Application, 2021 & 2031F |

4 Thailand Granite Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.3 Market Restraints |

5 Thailand Granite Market Trends |

6 Thailand Granite Market, By Types |

6.1 Thailand Granite Market, By Product |

6.1.1 Overview and Analysis |

6.1.2 Thailand Granite Market Revenues & Volume, By Product, 2021-2031F |

6.1.3 Thailand Granite Market Revenues & Volume, By Granite Slabs, 2021-2031F |

6.1.4 Thailand Granite Market Revenues & Volume, By Granite Tiles, 2021-2031F |

6.1.5 Thailand Granite Market Revenues & Volume, By Others, 2021-2031F |

6.2 Thailand Granite Market, By Application |

6.2.1 Overview and Analysis |

6.2.2 Thailand Granite Market Revenues & Volume, By Kitchen Countertops, 2021-2031F |

6.2.3 Thailand Granite Market Revenues & Volume, By Flooring, 2021-2031F |

6.2.4 Thailand Granite Market Revenues & Volume, By Stair Treads, 2021-2031F |

6.2.5 Thailand Granite Market Revenues & Volume, By Monuments, 2021-2031F |

6.2.6 Thailand Granite Market Revenues & Volume, By Others, 2021-2031F |

7 Thailand Granite Market Import-Export Trade Statistics |

7.1 Thailand Granite Market Export to Major Countries |

7.2 Thailand Granite Market Imports from Major Countries |

8 Thailand Granite Market Key Performance Indicators |

9 Thailand Granite Market - Opportunity Assessment |

9.1 Thailand Granite Market Opportunity Assessment, By Product, 2021 & 2031F |

9.2 Thailand Granite Market Opportunity Assessment, By Application, 2021 & 2031F |

10 Thailand Granite Market - Competitive Landscape |

10.1 Thailand Granite Market Revenue Share, By Companies, 2024 |

10.2 Thailand Granite Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero