Thailand Marine Engine Market (2023-2029) | Share, Trends, Growth, Size, Value, Industry, Analysis, Forecast, Segmentation, Outlook & COVID-19 IMPACT

Market Forecast by Power (Below 100 Hp, 100.1-500 Hp, 500.1-1000 Hp, Above 1000 Hp), by Propulsion Type (Diesel Engine, Steam Turbine, Gas Turbine, LNG Engine, Others (Nuclear, Fuel Cell, Solar Water Jet and Wind)), by Application (Commercial, Recreational, Offshore Oil and Gas, Navy, Others (Finishing, Coast Guards, Safety Boats)), by Region (Northern Region, North-eastern Region, Eastern Region, Central Region, Southern Region) And Competitive Landscape

| Product Code: ETC4377994 | Publication Date: Sep 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 72 | No. of Figures: 13 | No. of Tables: 11 | |

Thailand Marine Engine Market Synopsis

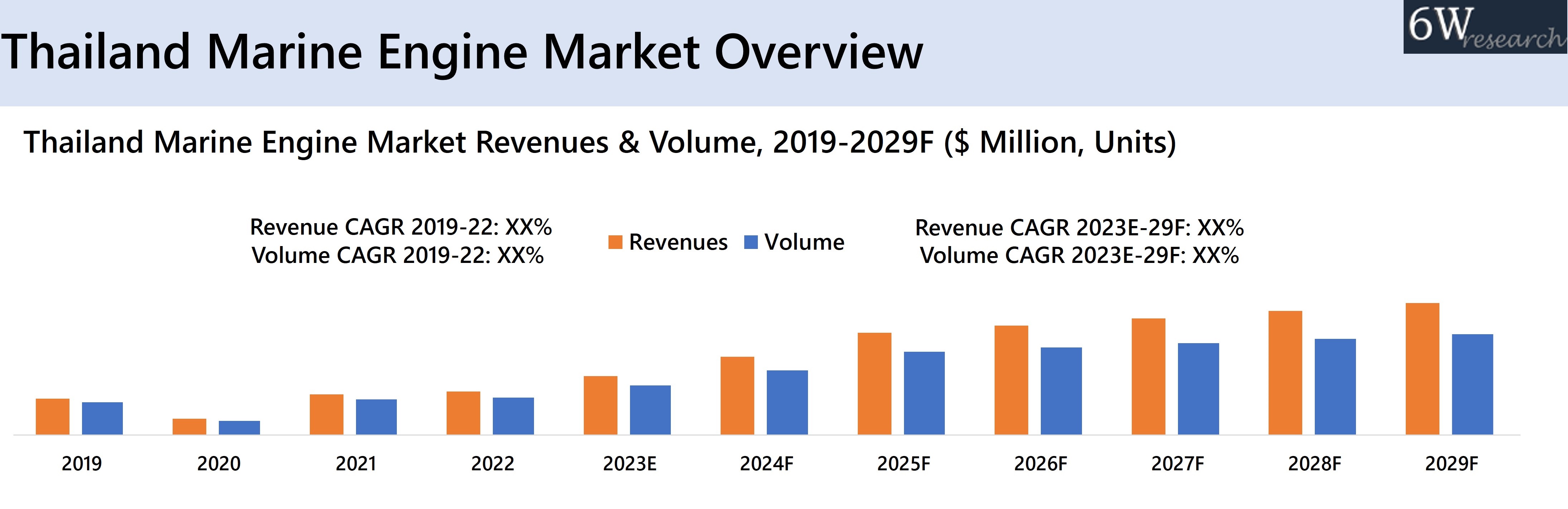

Thailand marine engine market witnessed significant growth in recent years owing to the growing urbanization and increased rate of commercial activities in Thailand, resulting in increased demand for cargo ships and containers used for international and regional transportation of raw materials and merchandise. However, the spread of the COVID-19 pandemic in 2020 resulted in a fall in market revenues due to the lockdown measures adopted to curb the spread of the virus, which in turn led to disruptions in the supply chain and delays in the production process. For instance, Thailand's total container volume in 2020 plummeted 5.49% from 2019 volume, 9,574,612 TEU and 10,130,294 TEU respectively. However, as the economic conditions are normalizing and commercial activities are resuming, the Thailand marine engine industry rebounded in 2021 and registered growth. Moreover, in 2022, exports were hit by slowing demand in Q4 which affected the marine engine market and registered slow growth in 2022.

According to 6Wresearch, Thailand marine engine market revenue size is projected to grow at a CAGR of 14.4% during 2023-2029. The development of port infrastructure and rising investment such as the Eastern Economic Corridor (EEC), a $43 Billion infrastructure development initiative of Thailand, intends to transform the country into a high-income nation by improving regional connectivity, transportation infrastructure, and trade logistics and with "National Maritime Navigation Line" to improve the transportation of cargo by sea and to grow Thailand's export industries, would further anticipate to offer high-growth opportunities for the marine engines market in the forecast period. Strict rules to regulate pollution as Thailand complies with international laws and norms that the International Maritime Organisation (IMO) has established in order to lessen marine pollution, enhance maritime safety, and encourage environmentally friendly shipping methods act as a restraint for conventional marine engine market in the country.

According to 6Wresearch, Thailand marine engine market revenue size is projected to grow at a CAGR of 14.4% during 2023-2029. The development of port infrastructure and rising investment such as the Eastern Economic Corridor (EEC), a $43 Billion infrastructure development initiative of Thailand, intends to transform the country into a high-income nation by improving regional connectivity, transportation infrastructure, and trade logistics and with "National Maritime Navigation Line" to improve the transportation of cargo by sea and to grow Thailand's export industries, would further anticipate to offer high-growth opportunities for the marine engines market in the forecast period. Strict rules to regulate pollution as Thailand complies with international laws and norms that the International Maritime Organisation (IMO) has established in order to lessen marine pollution, enhance maritime safety, and encourage environmentally friendly shipping methods act as a restraint for conventional marine engine market in the country.

![Thailand Marine Engine Market Revenue Share]() Market by Power

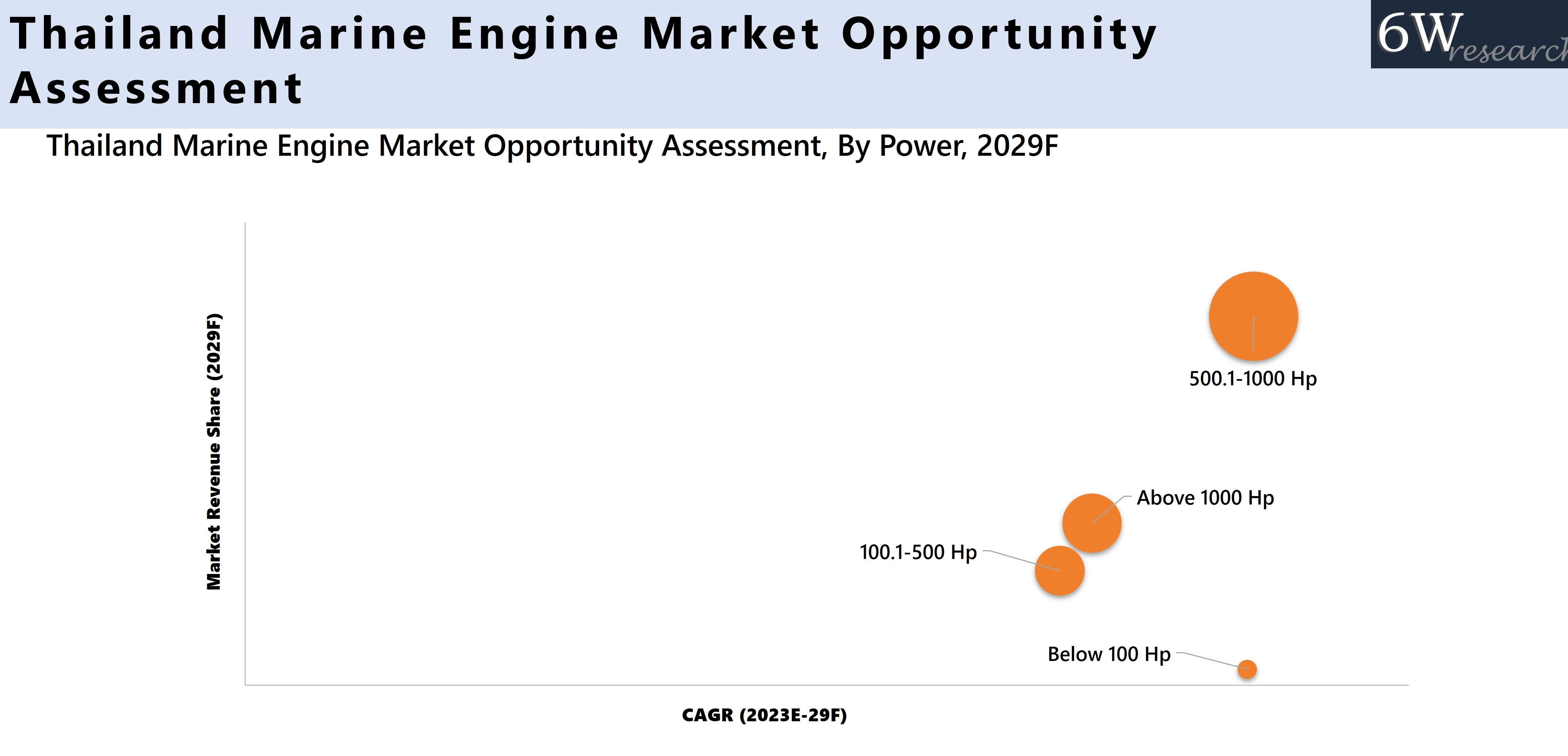

Market by Power

The 500.1-1000 Hp power segment, acquired the maximum revenue share in 2022 on account of increased trade activities in 2021 and 2022, and with national marine transport policy to promote the expansion of maritime transportation and the strengthening of Thailand's export sector would further boost the 500.1-1000 Hp engine market.

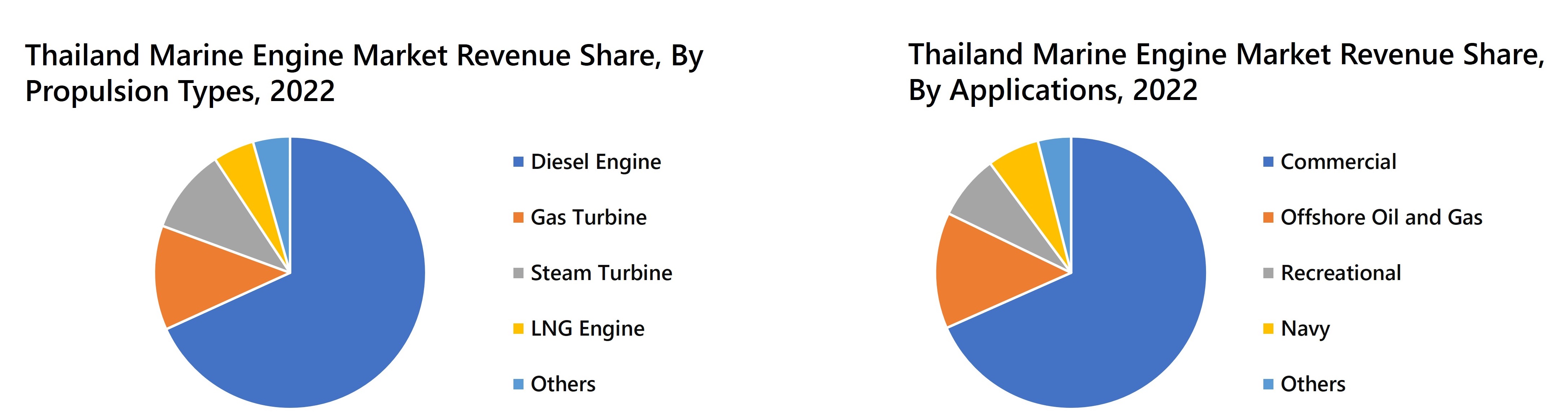

Market by Propulsion Types

By propulsion type, Diesel Engine acquired the major revenue in 2022 on account of rising exports in Thailand as to travel long distances, fuel is a crucial factor to keep operating for longer periods period. Moreover, rising port infrastructure coupled with rising shipping activities would help diesel marine engines maintain their dominance in the forecast period. The LNG segment is also anticipated to grow in the forthcoming years.

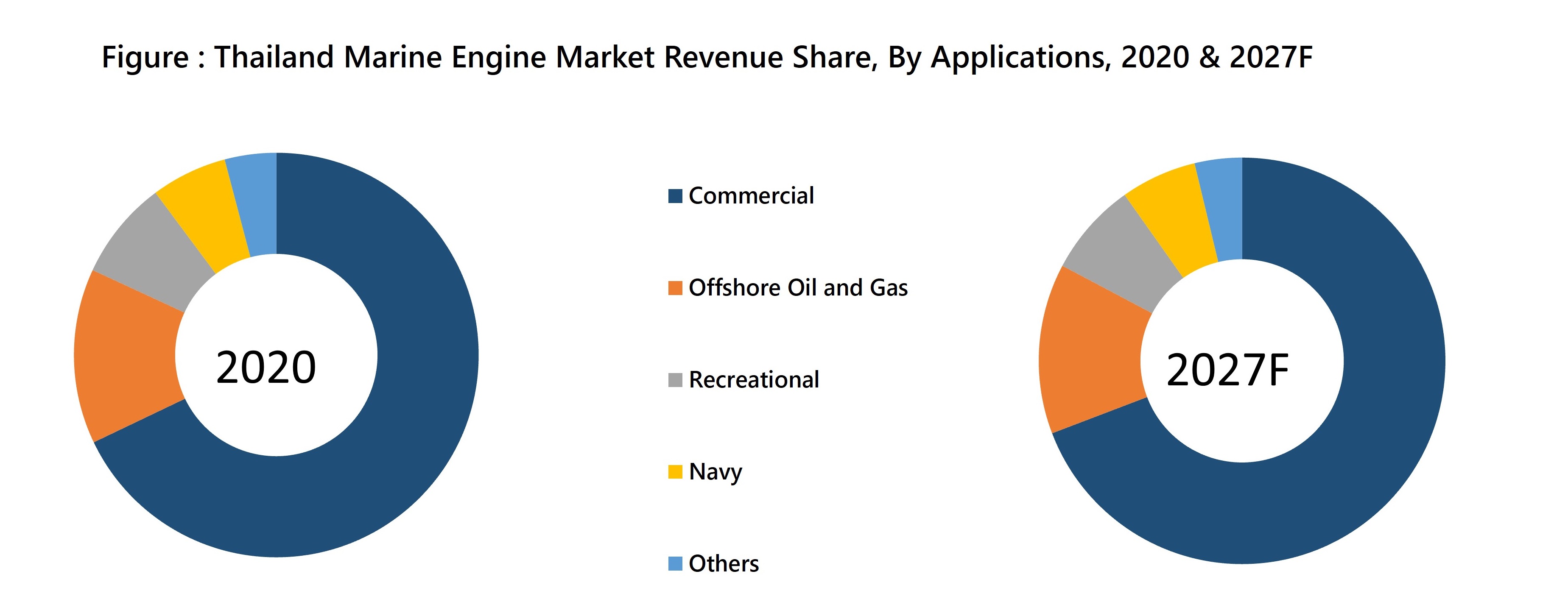

Market by Applications

The commercial sector is expected to record the highest growth in the forecast period as the marine market in Thailand is growing steadily on account of the growing efforts of the government to boost tourism and leisure activities under Thailand's 4.0 developmental plans.

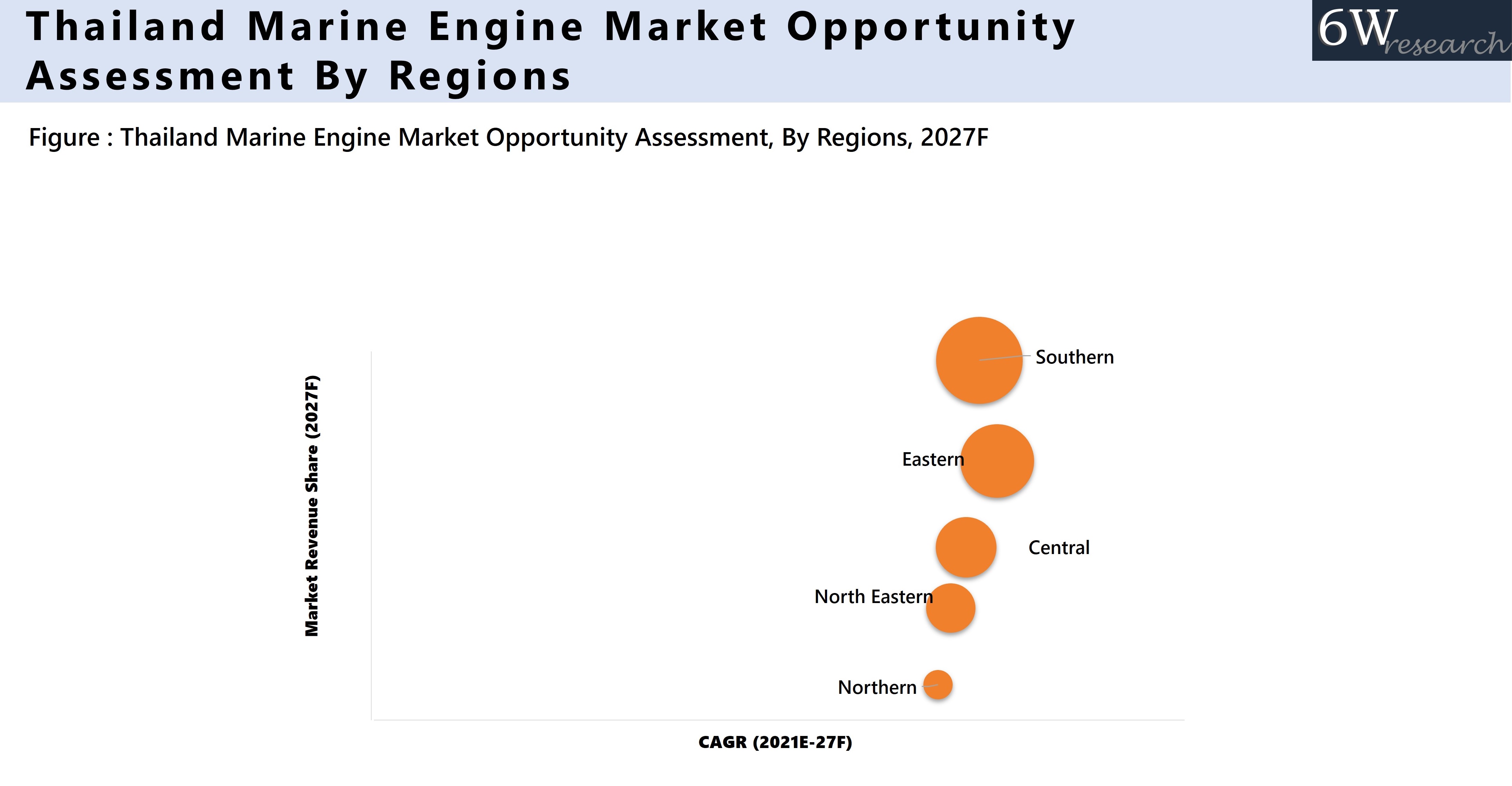

Market by Regions

Thailand's southern region had the largest revenue share in the marine engine industry in 2022 on account of the presence of well-known tourist destinations such as Phuket province, Ko Samui, Ko Phi Phi, and rising maritime activities. Additionally, with increasing industrialization and port development initiatives would further provide more opportunities in the southern region. The eastern region is also projected to grow in the near future.

![Thailand Marine Engine Market Opportunity Assessment]() Key Attractiveness of the Report

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 11 Years Market Numbers.

- Historical Data Starting from 2019 to 2022.

- Base Year: 2022

- Forecast Data until 2029.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Thailand Marine Engine Market Overview

- Thailand Marine Engine Market Outlook

- Thailand Marine Engine Market Forecast

- Historical Data and Forecast of Thailand Marine Engine Market Revenues and Volume for the Period 2019-2029F

- Historical Data and Forecast of Thailand Marine Engine Market Revenues and Volume, By Power for the Period 2019-2029F

- Historical Data and Forecast of Thailand Marine Engine Market Revenues, By Propulsion Types for the Period 2019-2029F

- Historical Data and Forecast of Thailand Marine Engine Market Revenues, By Applications for the Period 2019-2029F

- Historical Data and Forecast of Thailand Marine Engine Market Revenues, By Regions for the Period 2019-2029F

- Market Drivers, Restraints

- Market Trends

- Industry Life Cycle

- Thailand Marine Engine Market Porter’s Five Forces

- Market Opportunity Assessment

- Company Ranking

- Market Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

Thereportprovides a detailed analysis of the following market segments:

By Power

- Below 100 Hp

- 100.1-500 Hp

- 500.1-1000 Hp

- Above 1000 Hp

By Propulsion Types

- Diesel Engine

- Steam Turbine

- Gas Turbine

- LNG Engine

- Others (Nuclear, Fuel Cell, Solar Water Jet, and Wind)

By Applications

- Commercial

- Recreational

- Offshore Oil and Gas

- Navy

- Others (Finishing, Coast Guards, Safety Boats)

By Regions

- Northern Region

- North-eastern Region

- Eastern Region

- Central Region

- Southern Region

Thailand Marine Engine Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of the Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Robust Forecasting Model |

| 2.5 Assumptions |

| 3. Thailand Marine Engine Market Overview |

| 3.1 Thailand Marine Engine Market Revenues, 2019-2029F |

| 3.2 Thailand Marine Engine Market Industry Life Cycle |

| 3.3 Thailand Marine Engine Market Porter’s Five Forces |

| 4. Thailand Marine Engine Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Growth in the shipping industry in Thailand |

| 4.2.2 Increase in demand for marine transport services |

| 4.2.3 Government initiatives to boost maritime trade and tourism |

| 4.3 Market Restraints |

| 4.3.1 Volatility in fuel prices |

| 4.3.2 Stringent environmental regulations affecting engine technology |

| 4.3.3 Competition from alternative modes of transport |

| 5. Thailand Marine Engine Market Trends |

| 6. Thailand Marine Engine Market Overview, By Power |

| 6.1 Thailand Marine Engine Market Revenues and Revenue Share, By Power, 2019-2029F |

| 6.1.1 Thailand Marine Engine Market Revenues, By Below 100 Hp, 2019-2029F |

| 6.1.2 Thailand Marine Engine Market Revenues, By 100.1-500 Hp, 2019-2029F |

| 6.1.3 Thailand Marine Engine Market Revenues, By 500.1-1000 Hp, 2019-2029F |

| 6.1.4 Thailand Marine Engine Market Revenues, By Above 1000 Hp, 2019-2029F |

| 6.2 Thailand Marine Engine Market Volume and Volume Share, By Power, 2019-2029F |

| 6.2.1 Thailand Marine Engine Market Volume, By Below 100 Hp, 2019-2029F |

| 6.2.2 Thailand Marine Engine Market Volume, By 100.1-500 Hp, 2019-2029F |

| 6.2.3 Thailand Marine Engine Market Volume, By 500.1-1000 Hp, 2019-2029F |

| 6.2.4 Thailand Marine Engine Market Volume, By Above 1000 Hp, 2019-2029F |

| 7. Thailand Marine Engine Market Overview, By Propulsion Types |

| 7.1 Thailand Marine Engine Market Revenue Share and Revenues, By Propulsion Types, 2019-2029F |

| 7.1.1 Thailand Marine Engine Market Revenues, By Diesel Engine, 2019-2029F |

| 7.1.2 Thailand Marine Engine Market Revenues, By Steam Turbine, 2019-2029F |

| 7.1.3 Thailand Marine Engine Market Revenues, By Gas Turbine, 2019-2029F |

| 7.1.4 Thailand Marine Engine Market Revenues, By LNG Engine, 2019-2029F |

| 7.1.5 Thailand Marine Engine Market Revenues, By Others, 2019-2029F |

| 8. Thailand Marine Engine Market Overview, By Applications |

| 8.1 Thailand Marine Engine Market Revenue Share and Revenues, By Applications, 2019-2029F |

| 8.1.1 Thailand Marine Engine Market Revenues, By Commercial, 2019-2029F |

| 8.1.2 Thailand Marine Engine Market Revenues, By Recreational, 2019-2029F |

| 8.1.3 Thailand Marine Engine Market Revenues, By Offshore Oil and Gas, 2019-2029F |

| 8.1.4 Thailand Marine Engine Market Revenues, By Navy, 2019-2029F |

| 8.1.5 Thailand Marine Engine Market Revenues, By Others, 2019-2029F |

| 9. Thailand Marine Engine Market Overview, By Regions |

| 9.1 Thailand Marine Engine Market Revenue Share and Revenues, By Regions, 2019-2029F |

| 9.1.1 Thailand Marine Engine Market Revenues, By Northern Thailand Region, 2019-2029F |

| 9.1.2 Thailand Marine Engine Market Revenues, By North-eastern Region, 2019-2029F |

| 9.1.3 Thailand Marine Engine Market Revenues, By Eastern Region, 2019-2029F |

| 9.1.4 Thailand Marine Engine Market Revenues, By Central Region, 2019-2029F |

| 9.1.5 Thailand Marine Engine Market Revenues, By Southern Region, 2019-2029F |

| 10. Thailand Marine Engine Market Key Performance Indicators |

| 10.1 Average age of marine engines in Thailand |

| 10.2 Adoption rate of eco-friendly engine technologies |

| 10.3 Number of new players entering the Thailand marine engine market |

| 10.4 Investment in infrastructure and port facilities |

| 10.5 Number of vessels using marine engines in Thailand |

| 11. Thailand Marine Engine Market Opportunity Assessment |

| 11.1 Thailand Marine Engine Market Opportunity Assessment, By Power, 2029F |

| 11.2 Thailand Marine Engine Market Opportunity Assessment, By Propulsion Types, 2029F |

| 11.3 Thailand Marine Engine Market Opportunity Assessment, By Applications, 2029F |

| 11.4 Thailand Marine Engine Market Opportunity Assessment, By Regions, 2029F |

| 12. Thailand Marine Engine Market Competitive Landscape |

| 12.1 Thailand Marine Engine Market Revenue Ranking, By Companies, 2022 |

| 12.2 Thailand Marine Engine Market Competitive Benchmarking, By Technical Parameters |

| 12.3 Thailand Marine Engine Market Competitive Benchmarking, By Operating Parameters |

| 13. Company Profiles |

| 13.1 Cummins Inc. |

| 13.2 Caterpillar Inc. |

| 13.3 Mitsubishi Heavy Industries Engine System Asia Pte Ltd. |

| 13.4 Yamaha Motor Co. Ltd. |

| 13.5 Mercury Marine |

| 13.6 Winterthur Gas & Diesel Ltd. |

| 13.7 AB Volvo |

| 13.8 MAN Energy Solutions SE |

| 13.9 Yanmar Holdings Co. Ltd. |

| 13.10 Rolls Royce Public Limited Company |

| 14. Key Strategic Recommendations |

| 15. Disclaimer |

| List of Figures |

| 1. Thailand Marine Engine Market Revenues and Volume, 2019-2029F ($ Million, Units) |

| 2. Thailand Top 8 Export Products, year on year % change, Jan-Dec 2021 |

| 3. Thailand Marine Engine Market Revenue Share, By Power, 2022 & 2029F |

| 4. Thailand Marine Engine Market Volume Share, By Power, 2022 & 2029F |

| 5. Thailand Marine Engine Market Revenue Share, By Propulsion Types, 2022 & 2029F |

| 6. Thailand Marine Engine Market Revenue Share, By Applications, 2022 & 2029F |

| 7. Thailand Marine Engine Market Revenue Share, By Regions, 2022 & 2029F |

| 8. Thailand Tourist Arrivals, 2022-2023 (Million) |

| 9. Thailand Marine Engine Market Opportunity Assessment, By Power, 2029F |

| 10. Thailand Marine Engine Market Opportunity Assessment, By Propulsion Types, 2029F |

| 11. Thailand Marine Engine Market Opportunity Assessment, By Applications, 2029F |

| 12. Thailand Marine Engine Market Opportunity Assessment, By Regions, 2029F |

| 13. Thailand Marine Engine Market Revenue Ranking, By Companies, 2022 |

| List of Tables |

| 1. Upcoming Ports project in Thailand |

| 2. Thailand Export-Import and Trade Value, 2022 |

| 3. Thailand Marine Engine Market Revenues, By Power, 2019-2029F (Units) |

| 4. Thailand Marine Engine Market Volume, By Power, 2019-2029F (Units) |

| 5. Thailand Marine Engine Market Revenues, By Propulsion Types, 2019-2029F ($ Million) |

| 6. Thailand Marine Engine Market Revenues, By Applications, 2019-2029F ($ Million) |

| 7. Thailand Marine Engine Market Revenues, By Regions, 2019-2029F ($ Million) |

| 8. Maritime Key Figure for 2021 |

| 9. Thailand Carrying Capacity by Type of Ship, 2005-2021 (Thousand DWT) |

| 10. Thailand Maritime Service Exports by Main Category, 2005-2021 (% of Total Exports) |

| 11. Thailand Total Trade through Maritime in Transport Services, 2005-2021 ($ Million) |

Market Forecast by Power (Below 100 Hp, 100.1-500 Hp, 500.1-1000 Hp, Above 1000 Hp), by Propulsion Type (Diesel Engine, Steam Turbine, Gas Turbine, LNG Engine, Others (Nuclear, Fuel Cell, Solar Water Jet and Wind)), by Application (Commercial, Recreational, Offshore Oil and Gas, Navy, Others (Finishing, Coast Guards, Safety Boats)), by Region (Northern Region, North-eastern Region, Eastern Region, Central Region, Southern Region) And Competitive Landscape

| Product Code: ETC4377994 | Publication Date: Mar 2023 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 77 | No. of Figures: 15 | No. of Tables: 11 |

Thailand Marine Engine Market Synopsis

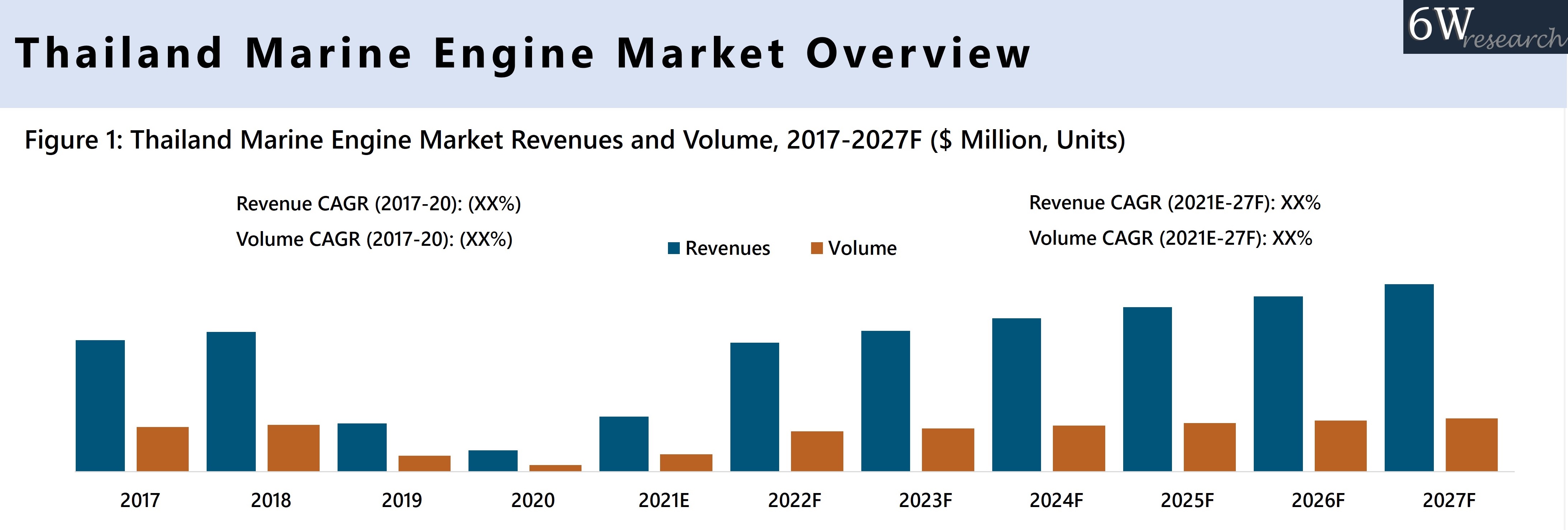

Thailand Marine Engine Market has grown steadily in recent years, owing to rising population and industrialization, which have significantly increased the rate of commercial activities in Thailand, resulting in increased demand for cargo ships and containers used for international and regional transportation of raw materials and merchandise. Furthermore, Thailand has emerged as the world's seventh largest producer of palm oil, exporting palm oil products to countries like China, India, Pakistan, Philippines and other countries, as this trend continues, the demand for marine engines is expected to grow over the forecast period.

According to 6Wresearch, Thailand marine engine market revenue size is projected to grow at a CAGR of 22.6% during 2021-2027. This industry in the country is one of the prominent parts of Asia Pacific Marine Engine Market. The sector is a crucial part of the country and it has been attaining continuous growth in the country due to the growth in industrialization and population. The spread of COVID-19 in 2020 resulted in fall of market revenues due to the lockdown measures adopted to curb the spread of the virus, which in turn led to disruptions in supply chain and delay in production process. For instance, Thailand total containers volume in 2020 plummeted 5.49% from 2019 volume, 9,574,612 TEU and 10,130,294 TEU respectively. However, as the economic conditions are normalizing and commercial activities are resuming, the market is anticipated to recover by 2022 and register growth thereafter.

Furthermore, The Eastern Economic Corridor (EEC), a 1.5 trillion baht infrastructure development initiative of Thailand, intends to transform the country into a high-income nation by improving regional connectivity, transportation infrastructure, and trade logistics. Hence these factors are anticipated to offer high-growth opportunities for the Marine Engines Market in Thailand in the forecast period.

Market by Power

In 2020, 500.1-1000 Hp power type registered highest revenue share in Thailand Marine Engine Industry, as this segment has a broad range of applications including offshore activities like drilling and OSVs. 100.1-500 Hp power type acquired highest volume share in 2020 as they are used for small sized cargo vessels, tugboats and tankers in domestic trade and medium sized fishing boats. The 500.1-1000 Hp power type will account for the highest market share.

Market by Propulsion Type

Diesel marine engine accounted for maximum revenue share in Thailand marine engine market, by propulsion types, in 2020 as it is most commonly used in almost all types of vessels such as in small boats and recreational vessels due to their operating simplicity, robustness and fuel economy compared to other propulsion types.

Market by Application

By applications, commercial sector acquired highest revenue share in Thailand marine engine market in 2020, on account of rising commercial freight transport in the country. HPT, the largest port operator at Laem Chabang Port, handled over 3 million TEU in 2020, accounting for 30% of the Thai market and further intends to expect the port capacity to approximately 6.75million TEU in the upcoming years. Hence the size of the commercial fleet in Thailand is expected to increase, and with that, increase the share of nation’s carriers in overall cargo turnover.

Market by Region

The southern region of Thailand had the biggest revenue share in the marine engine market in 2020, as the region is responsible for the bulk of the country's port trade activities and cargo services. Rising industrialization, and port expansion projects by port authority of Thailand, is likely to boost demand for marine engines in the country. Further, Songkhla and Phuket Ports have also been built to serve the southern part of Thailand.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 11 Years Market Numbers.

- Historical Data Starting from 2017 to 2020.

- Base Year: 2020.

- Forecast Data until 2027.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects

Key Highlights of the Report

- Thailand Marine Engine Market Overview

- Thailand Marine Engine Market Outlook

- Thailand Marine Engine Market Forecast

- Historical Data and Forecast of Thailand Marine Engine Market Revenues and Volume for the Period 2017-2027F

- Historical Data and Forecast of Thailand Marine Engine Market Revenues and Volume, By Power for the Period 2017-2027F

- Historical Data and Forecast of Thailand Marine Engine Market Revenues, By Propulsion Types for the Period 2017-2027F

- Historical Data and Forecast of Thailand Marine Engine Market Revenues, By Applications for the Period 2017-2027F

- Historical Data and Forecast of Thailand Marine Engine Market Revenues, By Regions for the Period 2017-2027F

- Market Drivers, Restraints

- Market Trends

- Industry Life Cycle

- Thailand Marine Engine Market – Porter’s Five Forces

- Market Opportunity Assessment

- Company Shares

- Market Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Power

- Below 100 Hp

- 100.1-500 Hp

- 500.1-1000 Hp

- Above 1000 Hp

By Propulsion Type

- Diesel Engine

- Steam Turbine

- Gas Turbine

- LNG Engine

- Others (Nuclear, Fuel Cell, Solar Water Jet and Wind)

By Application

- Commercial

- Recreational

- Offshore Oil and Gas

- Navy

- Others (Finishing, Coast Guards, Safety Boats)

By Region

- Northern Region

- North-eastern Region

- Eastern Region

- Central Region

- Southern Region

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero