UAE Chocolate Market (2022-2028) | Size, Share, Segmentation, Growth, Revenue, Analysis, Forecast, Trends, industry & COVID-19 IMPACT

Market Forecast By Product Types (Milk, White, Dark), By Chocolate Types (Count Lines & Straight Lines, Molded or Bar, Choco-Panned & Sugar Panned, Others (Box Chocolates, Novelties)), By Sales Channels (Online, Offline), By Regions (Abu Dhabi, Dubai, Sharjah, Ajman, Umm-Al-Quwain, Fujairah, Ras Al Khaimah, Al Ain) and Competitive Landscape

| Product Code: ETC215843 | Publication Date: Feb 2023 | Updated Date: May 2024 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 87 | No. of Figures: 35 | No. of Tables: 5 | |

United Arab Emirates (UAE) Chocolate Market Competition 2023

United Arab Emirates (UAE) Chocolate market currently, in 2023, has witnessed an HHI of 1214, Which has increased slightly as compared to the HHI of 812 in 2017. The market is moving towards highly competitive. Herfindahl index measures the competitiveness of exporting countries. The range lies from 0 to 10000, where a lower index number represents a larger number of players or exporting countries in the market while a large index number means fewer numbers of players or countries exporting in the market.

United Arab Emirates (UAE) Export Potential Assessment For Chocolate Market (Values in USD Thousand)

UAE Chocolate Market report thoroughly covers the chocolate market by product types, chocolate types, sales channels, and regions. The report provides an unbiased and detailed analysis of the ongoing UAE chocolate market trends, opportunities, high growth areas, market drivers, and market revenue share ranking by companies, which would help stakeholders to devise and align market strategies according to the current and future market dynamics.

Latest 2023 Development of the UAE Chocolate Market

UAE Chocolate Market is growing steadily owing to several growth factors. The market has also witnessed some latest developments and projects which include the introduction of new chocolate brands which offer innovative and unique chocolate products. The expansion of local chocolate production in the UAE to meet the growing demand for high-quality chocolate is one of the major developments in the chocolate industry. The demand for organic and artisanal chocolate products is on increasing in the UAE, leading to an increase in the number of speciality chocolate shops and cafes. The growth of modern retail networks such as supermarkets and hypermarkets has made it feasible for consumers to purchase high-quality chocolate products.

The growing trend of gifting premium chocolate products, especially during holidays and special occasions, has also contributed to the UAE chocolate market growth. Apart from this, some chocolate brands are focusing on sustainability and fair-trade practices, using ingredients sourced from sustainable and ethical sources. Moreover, the growth of online sales channels is rapidly increasing in the UAE which provides customers with an opportune and accessible way to purchase their favourite chocolate products. These are some of the latest developments and projects in the UAE Chocolate Industry, reflecting the demand for innovative, superior quality, and sustainable chocolate products in the country.

UAE Chocolate Market Synopsis

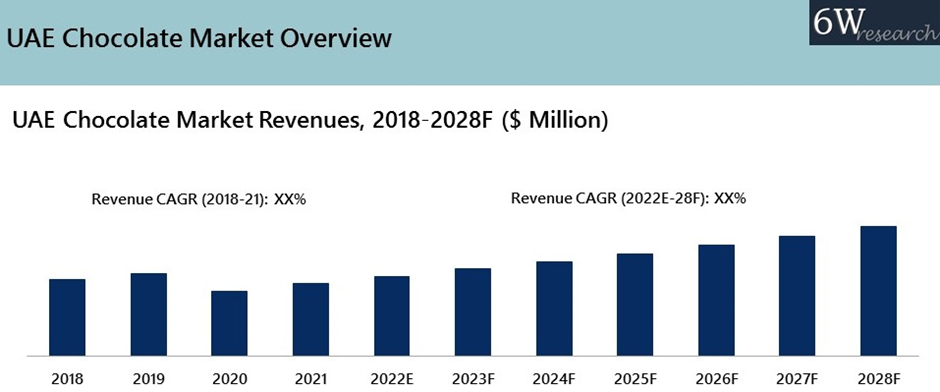

UAE chocolate market witnessed steady growth in the previous few years owing to growth in the retail and hospitality & tourism sectors. The market was impacted negatively in the year 2020 on account of the COVID-19 pandemic outburst, which resulted in a temporary shutdown of retail stores thereby resulting in a decline in chocolate sales. However, the market revived soon and is expected to further grow during the forecast period on account of the expansion of the retail sector and rapid growth in the tourism sector post-covid.

According to 6Wresearch, The UAE chocolate market size is projected to grow at a CAGR of 8.4% during 2022-28. UAE chocolate market is likely to experience significant growth in the forthcoming period on growing retail sales of confectionery products in UAE coupled with the upcoming 199 hotel projects across the country which would generate demand for chocolates from international visitors. Furthermore, the upcoming construction of malls and hypermarkets would further expand the sales network thereby supporting the growth in sales of chocolates in the UAE.

Market by Product Types Analysis

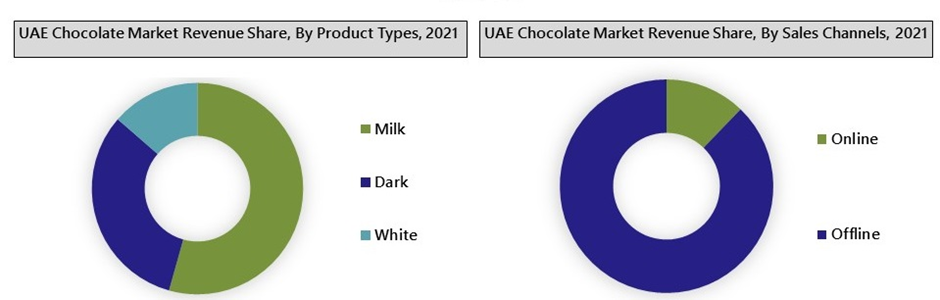

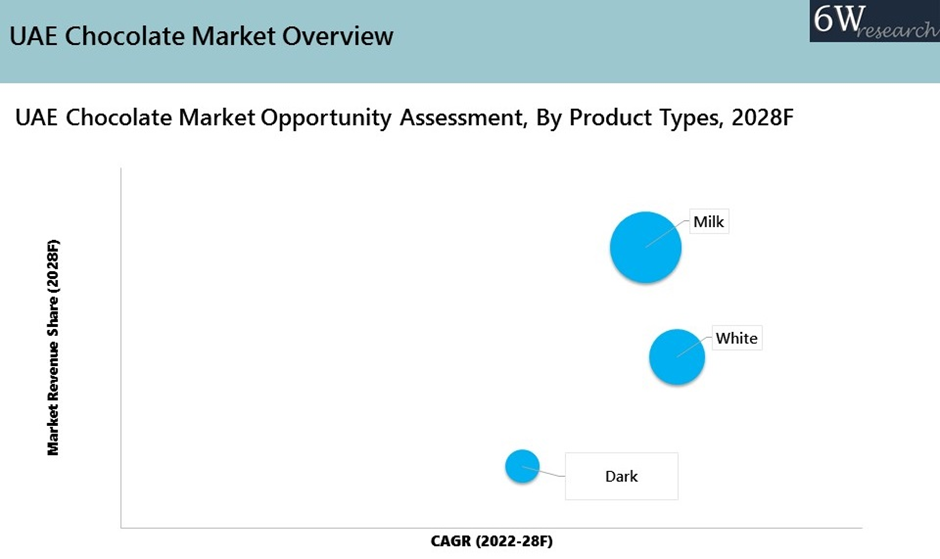

By product types, milk chocolates dominated the UAE chocolate market for the year 2021 owing to variations in product lines with a wider price range. However, dark chocolates would witness significant growth in the coming years on account of rising health concerns among people and numerous health benefits offered by dark chocolates. Additionally, rising cases associated with mental health would aid the growth of this segment as dark chocolates help to reduce anxiety and clinical depression.

Market by Region Analysis

By regions, Dubai garnered the majority revenue share for the year 2021 and would continue to dominate the market in the coming years owing to the revival of the tourism sector in the region post-covid which witnessed a growth rate of around 32% in international overnight visitors in the year 2021 along with increasing retail sales in the emirate. Furthermore, Dubai’s 2040 plan which focuses on the rapid expansion of its tourism sector coupled with ongoing construction of malls and hypermarkets would aid the growth of the UAE chocolate market during the forecast period.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2018 to 2021.

- Base Year: 2021

- Forecast Data until 2028.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- UAE Chocolate Market Overview

- UAE Chocolate Market Outlook

- UAE Chocolate Market Forecast

- Historical Data and Forecast of UAE Chocolate Market Revenues for the Period 2018-2028F

- Historical Data and Forecast of UAE Chocolate Market Revenues, By Product Types for the Period 2018-2028F

- Historical Data and Forecast of UAE Chocolate Market Revenues, By Chocolate Types for the Period 2018-2028F

- Historical Data and Forecast of India Chocolate Market Revenues, By Sales Channels for the Period 2018-2028F

- Historical Data and Forecast of India Chocolate Market Revenues, By Regions for the Period 2018-2028F

- Covid-19 Impact on UAE Chocolate Market

- UAE Chocolate Market Drivers and Restraints

- UAE Chocolate Market Trends

- UAE Chocolate Market PESTLE Analysis

- UAE Chocolate Market Porter’s Five Forces

- UAE Chocolate Market Industry Life Cycle

- UAE Chocolate Market -Consumer Analysis

- UAE Chocolate Market - Key Untapped Areas to Explore

- UAE Chocolate Market Import-Export Trade Statistics

- UAE Chocolate Market Opportunity Assessment

- UAE Chocolate Market Revenue Ranking, By Companies

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Product Types

- Milk

- White

- Dark

By Chocolate Types

- Count Lines & Straight Lines

- Molded or Bar

- Choco-Panned & Sugar Panned

- Others (Box Chocolates, Novelties)

By Sales Channels

- Online

- Offline

By Regions

- Abu Dhabi

- Dubai

- Sharjah

- Ajman

- Umm-Al-Quwain

- Fujairah

- Ras Al Khaimah

- Al Ain

UAE Chocolate Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of the Report |

| 2.3 Market Scope and Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. UAE Chocolate Market Overview |

| 3.1 UAE Chocolate Market Revenues (2018-2028F) |

| 3.2 UAE Chocolate Market - Industry Life Cycle |

| 3.3 UAE Chocolate Market - Porter’s Five Forces Model |

| 3.4 UAE Chocolate Market - PESTEL Analysis |

| 4. Impact Analysis of COVID-19 on UAE Chocolate Market |

| 5. UAE Chocolate Market Dynamics |

| 5.1 Impact Analysis |

| 5.2 Market Drivers |

| 5.3 Market Restraints |

| 6. UAE Chocolate Market Trends |

| 7. UAE Chocolate Market Overview, By Product Types |

| 7.1 UAE Chocolate Market Revenue Share and Revenues, By Milk (2018-2028F) |

| 7.2 UAE Chocolate Market Revenue Share and Revenues, By White (2018-2028F) |

| 7.3 UAE Chocolate Market Revenue Share and Revenues, By Dark (2018-2028F) |

| 8. UAE Chocolate Market Overview, By Chocolate Types |

| 8.1 UAE Chocolate Market Revenue Share and Revenues, By Count Lines & Straight Lines (2018-2028F) |

| 8.2 UAE Chocolate Market Revenue Share and Revenues, By Molded or Bar (2018-2028F) |

| 8.3 UAE Chocolate Market Revenue Share and Revenues, By Choco-Panned & Suguar Panned (2018-2028F) |

| 8.3 UAE Chocolate Market Revenue Share and Revenues, By Others (2018-2028F) |

| 9. UAE Chocolate Market Overview, By Sales Channels |

| 9.1 UAE Chocolate Market Revenue Share and Revenues, By Online (2018-2028F) |

| 9.2 UAE Chocolate Market Revenue Share and Revenues, By Offline (2018-2028F) |

| 10. UAE Chocolate Market Overview, By Regions |

| 10.1 UAE Chocolate Market Revenue Share and Revenues, By Abu Dhabi (2018-2028F) |

| 10.2 UAE Chocolate Market Revenue Share and Revenues, By Dubai (2018-2028F) |

| 10.3 UAE Chocolate Market Revenue Share and Revenues, By Sharjah (2018-2028F) |

| 10.4 UAE Chocolate Market Revenue Share and Revenues, By Ajman (2018-2028F) |

| 10.5 UAE Chocolate Market Revenue Share and Revenues, By Umm-Al-Quwain (2018-2028F) |

| 10.6 UAE Chocolate Market Revenue Share and Revenues, By Fujairah (2018-2028F) |

| 10.7 UAE Chocolate Market Revenue Share and Revenues, By Ras Al Khaimah (2018-2028F) |

| 10.8 UAE Chocolate Market Revenue Share and Revenues, By Al Ain (2018-2028F) |

| 11. UAE Chocolate Market - Trade Statistics |

| 11.1 UAE Chocolate Market Export to Major Countries |

| 11.2 UAE Chocolate Market Import From Major Countries |

| 12. UAE Chocolate Market - Key Performance Indicators |

| 13. UAE Chocolate Market - Consumer Survey Analysis |

| 14. UAE Chocolate Market - Opportunity Assessment |

| 14.1 UAE Chocolate Market Opportunity Assessment, By Product Types (2028F) |

| 14.2 UAE Chocolate Market Opportunity Assessment, By Chocolate Types (2028F) |

| 14.3 UAE Chocolate Market Opportunity Assessment, By Sales Channels (2028F) |

| 14.4 UAE Chocolate Market Opportunity Assessment, By Regions (2028F) |

| 15. UAE Chocolate Market - Competitive Landscape |

| 15.1 UAE Chocolate Market Revenue Share Ranking, By Companies (2021) |

| 15.2 UAE Chocolate Market Competitive Benchmarking, By Technical Parameters |

| 15.3 UAE Chocolate Market Competitive Benchmarking, By Operating Parameters |

| 16. Company Profiles |

| 16.1 Mondelez International, Inc. |

| 16.2 Mars, Incorporated |

| 16.3 Nestlé S.A. |

| 16.4 Ferrero Group |

| 16.5 The Hershey Company |

| 16.6 Chocoladefabriken Lindt & Sprüngli AG |

| 16.7 Ritter Sport Company |

| 16.8 IFFCO Group |

| 16.9 Notions Group |

| 16.10 Patchi |

| 16.11 Yildiz Holding |

| 17. Key Strategic Recommendations |

| 18. Disclaimer |

| List of Figures |

| Figure 1: UAE Chocolate Market Revenues, 2018-2028F ($ Million) |

| Figure 2: UAE Revenue generated from Tourism, 2018-2020 (in USD Billion) |

| Figure 3: UAE Retail Sales of Confectionery, 2018-2024F (Value in $ Million) |

| Figure 4: Cocoa Prices UAE vs International, April 2022 (in US Dollar Per Kg) |

| Figure 5: Fluctuating Cocoa Prices Internationally, Nov 2021-Apr 2022 (in US Dollar Per Kg) |

| Figure 6: UAE Cocoa Import vs Export Value, 2017-2020 (in US Dollar) |

| Figure 7: UAE Chocolate Market Revenue Share, By Product Types, 2021 & 2028F |

| Figure 8: UAE Chocolate Market Revenue Share, By Chocolate Types, 2021 & 2028F |

| Figure 9: UAE Chocolate Market Revenue Share, By Sales Channels, 2021 & 2028F |

| Figure 10: UAE Chocolate Market Revenue Share, By Regions, 2021 & 2028F |

| Figure 11: UAE Chocolate Market Share of Top 3 Export Partners, 2020 |

| Figure 12: UAE Chocolate Market Export Data, By Country, 2020 (in $ Thousand) |

| Figure 13: UAE Chocolate Market Share of Top 3 Import Partners, 2020 |

| Figure 14: UAE Chocolate Market Export Data, By Country, 2020 (in $ Thousand) |

| Figure 15: UAE Growth in Retail Sales, 2021 & 2025F |

| Figure 16: UAE Retail Supply, By Top 2 regions, 2020 |

| Figure 17: UAE Upcoming Hotel Projects, By Top 3 Regions, 2021-2024F |

| Figure 18: UAE Hotel Project Pipeline, 2021-2024F |

| Figure 19: UAE International Tourism, Number of Arrivals, 2015-2020 (in Thousands) |

| Figure 20: Parameters Considered by Consumers while Buying Chocolates in UAE, 2021 |

| Figure 21: Frequency of Buying Chocolates in UAE, 2021 |

| Figure 22: Weekly Money Spent on Chocolates by Consumers in UAE, 2021 (AED) |

| Figure 23: Consumer Preference for Mode For Purchase of Chocolates in UAE, 2021 |

| Figure 24: Preferred Areas to Purchase Chocolates By Consumers in UAE, 2021 |

| Figure 25: Consumer Preference for Chocolate Flavors in UAE, 2021 |

| Figure 26: Consumer Preference for Chocolate Types in UAE, 2021 |

| Figure 27: Motivational Factors for Consumers to Switch to another Chocolate Provider, UAE, 2021 |

| Figure 28: UAE Chocolate Market Opportunity Assessment, By Product Types (in $ Million) |

| Figure 29: UAE Chocolate Market Opportunity Assessment, By Chocolate Types, 2028F (in $ Million) |

| Figure 30: UAE Chocolate Market Opportunity Assessment, By Sales Channels (in $ Million) |

| Figure 31: UAE Chocolate Market Opportunity Assessment, By Regions, 2028F (in $ Million) |

| Figure 32: UAE Chocolate Market Revenue Ranking, By Companies, 2021 |

| Figure 33: Dubai Hotel Project Pipeline, 2022E-2025F |

| Figure 34: Dubai Number of Hotel Projects, 2022E-2025F |

| Figure 35: Dubai International Tourist Arrivals, 2017-2021 |

| List of Tables |

| Table 1: UAE Ongoing Tourism Projects |

| Table 2: UAE Chocolate Market Revenues, By Product Types, 2018-2028F ($ Million) |

| Table 3: UAE Chocolate Market Revenues, By Chocolate Types, 2018-2028F ($ Million) |

| Table 4: UAE Chocolate Market Revenues, By Sales Channels, 2018-2028F ($ Million) |

| Table 5: UAE Chocolate Market Revenues, By Regions, 2018-2028F ($ Million) |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

- Kenya Road Stabilization Equipment Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- North America Sodium chloride Market (2025-2031) | Analysis, Revenue, Forecast, Trends, Companies, Size, Growth, Share, Industry, Outlook & Value

- North America Vinyl Flooring Market (2025-2031) | Value, Growth,Size, Analysis, Revenue, Industry, Forecast, Share, Outlook, Companies & Trends

- Tajikistan Thermal Camera Market (2025-2031) | Trends, Size, Growth, Share, Industry, Companies, Value, Analysis, Revenue, Forecast & Outlook

- Singapore Professional AV Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero