UAE Ready Mix Concrete Market (2024-2030) | Industry, Segmentation, Share, Analysis, Forecast, Companies, Outlook, Competitive Landscape, Trends, Value, Growth, Size & Revenue

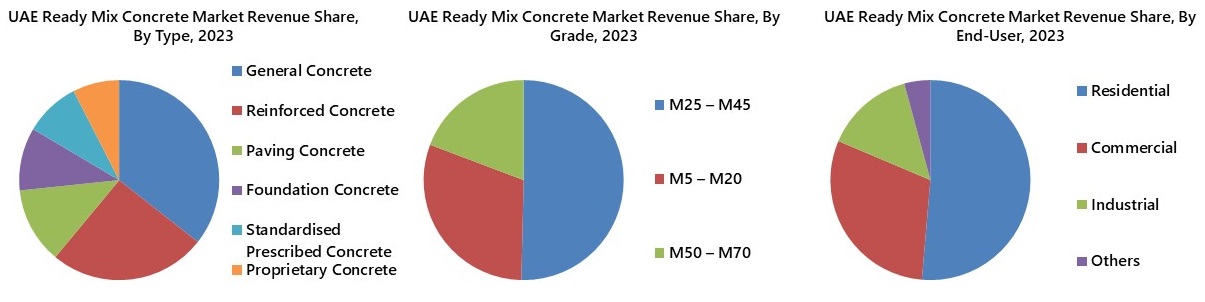

Market Forecast By Type (General Concrete, Reinforced Concrete, Paving Concrete, Foundation Concrete, Proprietary Concrete, Standardised Prescribed Concrete), By Grade (C10 to C20, C25 to C35, C40 and Above), By End-User (Residential, Commercial, Industrial, Others (Dams, Canal etc,.)) and competitive landscape

| Product Code: ETC10152966 | Publication Date: Dec 2024 | Updated Date: Apr 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 81 | No. of Figures: 21 | No. of Tables: 12 |

UAE Ready Mix Concrete Market Growth Rate

According to 6Wresearch, The UAE Ready Mix Concrete Market is projected to grow at a CAGR of 5.6% during 2024–2030, fueled by real estate expansion, major infrastructure projects, hospitality sector growth, and national development initiatives.

Topics Covered in UAE Ready Mix Concrete Market Report

UAE Ready Mix Concrete Market Report thoroughly covers the market by type, by grade and by end-user. UAE Ready Mix Concrete Market Outlook report provides an unbiased and detailed analysis of the ongoing UAE Ready Mix Concrete Market trends, opportunities/high growth areas, and market drivers. This would help stakeholders devise and align their market strategies according to the current and future market dynamics.

UAE Ready Mix Concrete Market Synopsis

UAE Ready Mix Concrete market has witnessed substantial growth in recent years, driven by a robust expansion in both commercial and residential construction, complemented by large-scale government infrastructure initiatives. Notable projects such as the Wasl Tower, the $204 million Regalia residential development, and the Bloom Living project, which includes 4,000 villas and apartments, have been key drivers of this demand. Additionally, Dubai's real estate market saw a remarkable 40% year-on-year growth in Q3 2023, further propelling the need for ready mix concrete.

The ongoing growth is further bolstered by significant transportation and infrastructure projects, including the $11 billion Etihad Rail, the proposed $5.9 billion Hyperloop system connecting Dubai and Abu Dhabi, and the $2.7 billion Sheikh Zayed double-deck road. These initiatives are expected to sustain and intensify demand for ready mix concrete, positioning the market for continued expansion.

According to 6Wresearch, the UAE Ready Mix Concrete Market is forecasted to grow at a compound annual growth rate (CAGR) of 5.6% from 2024 to 2030. The surge in international tourism has contributed directly to the growth of the UAE's hospitality sector, further amplifying the demand for ready mix concrete. As of 2023, Dubai is home to 820 hospitality establishments, including 624 hotels and 196 apartments, marking a 2.0% year-on-year increase. Upcoming luxury developments, such as the Marriott Mirfa Resort in Abu Dhabi (2025) and Baccarat Dubai (2026), are expected to further escalate demand for ready-mix concrete in the region. Moreover, the UAE's $300 billion industrial development plan, aimed at advancing the nation's industrial sector by 2030, along with the "Projects of the 50" initiative focused on industrial, transportation, and energy infrastructure, will likely provide a significant boost to the ready-mix concrete market in the coming years.

Market Segmentation By Type

Reinforced concrete is expected to see the highest growth in the UAE Ready Mix Concrete market, driven by rising demand in the construction sector for durable, high-strength materials. Major infrastructure projects, government initiatives, and urbanization are key factors.

Market Segmentation By Grade

The C40 and above grade ready-mix concrete segment in the UAE is expected to grow rapidly due to rising demand for high-rise buildings, mega infrastructure projects, and stringent durability standards. As urbanization and complex construction projects like bridges, skyscrapers, and commercial developments increase, high-strength concrete is essential for structural integrity, weather resistance, and long-term performance.

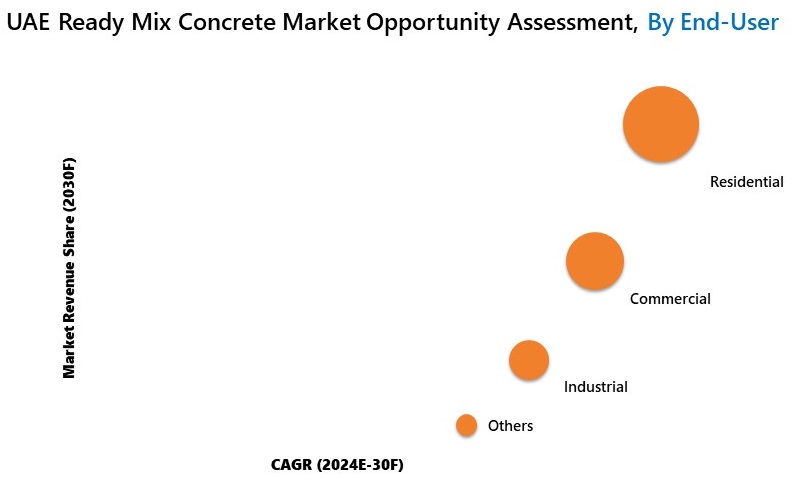

Market Segmentation By End-User

The residential application segment is expected to experience the highest growth driven by increasing urbanization, demand for new housing, and infrastructure development, which are propelling the need for ready-mix concrete in residential construction projects.

Key Attractiveness of the Report

- Key Attractiveness of the Report:

- 10 Years of Market Numbers.

- Historical Data Starting from 2020 to 2023.

- Base Year: 2023

- Forecast Data until 2030

- Key Performance Indicators Impacting the market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- UAE Ready Mix Concrete Market Overview

- UAE Ready Mix Concrete Market Outlook

- UAE Ready Mix Concrete Market Forecast

- Industry Life Cycle

- Porter’s Five Forces Analysis

- Historical Data and Forecast of UAE Ready Mix Concrete Market Revenues for the Period 2020-2030F

- Historical Data and Forecast of UAE Ready Mix Concrete Market Revenues and Volume, By Type, for the Period 2020-2030F

- Historical Data and Forecast of UAE Ready Mix Concrete Market Revenues, By Grade, for the Period 2020-2030F

- Historical Data and Forecast of UAE Ready Mix Concrete Market Revenues, By End-User, for the Period 2020-2030F

- Market Drivers and Restraints

- Market Evolution & Trends

- Market Opportunity Assessment

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Type

- General Concrete

- Reinforced Concrete

- Paving Concrete

- Foundation Concrete

- Proprietary Concrete

- Standardised Prescribed Concrete

By Grade

- C10 to C20

- C25 to C35

- C40 and Above

By End-User

- Residential

- Commercial

- Industrial

- Others (Dams, Canal etc,.)

UAE Ready Mix Concrete Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. UAE Ready Mix Concrete Market Overview |

| 3.1. UAE Ready Mix Concrete Market Revenues and Volume (2020-2030F) |

| 3.2. UAE Ready Mix Concrete Market - Industrial Life Cycle, 2023 |

| 3.3. UAE Ready Mix Concrete Market - Porter’s Five Forces, 2023 |

| 3.4 UAE Ready Mix Concrete Market - Pestle Analysis, 2023 |

| 3.4 UAE Ready Mix Concrete Market - Ecosystem, 2023 |

| 4. UAE Ready Mix Concrete Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.3. Market Restraints |

| 5. UAE Ready Mix Concrete Market Trends |

| 6. UAE Ready Mix Concrete Market Overview, By Type |

| 6.1 UAE Ready Mix Concrete Market Revenue Share & Revenues , By Type, 2023 & 2030F |

| 6.1.1 UAE Ready Mix Concrete Market Revenues, By General Concrete , (2020-2030F) |

| 6.1.2 UAE Ready Mix Concrete Market Revenues, By Reinforced Concrete, (2020-2030F) |

| 6.1.3 UAE Ready Mix Concrete Market Revenues, By Paving Concrete, (2020-2030F) |

| 6.1.4 UAE Ready Mix Concrete Market Revenues, By Foundation Concrete, (2020-2030F) |

| 6.1.5 UAE Ready Mix Concrete Market Revenues, By Proprietary Concrete, (2020-2030F) |

| 6.1.6 UAE Ready Mix Concrete Market Revenues, By Standardised Prescribed Concrete, (2020-2030F) |

| 6.2 UAE Ready Mix Concrete Market Volume Share & Volumes, By Type (2023 & 2030F) |

| 6.2.1. UAE Ready Mix Concrete Market Volumes, By General Concrete(2020-2030F) |

| 6.2.2. UAE Ready Mix Concrete Market Volumes, By Reinforced Concrete (2020-2030F) |

| 6.2.3. UAE Ready Mix Concrete Market Volumes, By Paving Concrete (2020-2030F) |

| 6.2.4. UAE Ready Mix Concrete Market Volumes, By Foundation Concrete (2020-2030F) |

| 6.2.5. UAE Ready Mix Concrete Market Volumes, By Proprietary Concrete (2020-2030F) |

| 6.2.6. UAE Ready Mix Concrete Market Volumes, By Standardized Prescribed Concrete (2020-2030F) |

| 7. UAE Ready Mix Concrete Market Overview, By Grade |

| 7.1 UAE Ready Mix Concrete Market Revenue Share, By Grade, (2020-2030F) |

| 7.1.1 UAE Ready Mix Concrete Market Revenues, By C10 – C20 , (2020-2030F) |

| 7.1.2 UAE Ready Mix Concrete Market Revenues, By C25 – C35 , (2020-2030F) |

| 7.1.3 UAE Ready Mix Concrete Market Revenues, By C40 and Above, (2020-2030F) |

| 8. UAE Ready Mix Concrete Market Overview, By End-User |

| 8.1 UAE Ready Mix Concrete Market Revenue Share, By End-User, (2020-2030F) |

| 8.1.1 UAE Ready Mix Concrete Market Revenues, By Residential, (2020-2030F) |

| 8.1.2 UAE Ready Mix Concrete Market Revenues, By Commercial, (2020-2030F) |

| 8.1.3 UAE Ready Mix Concrete Market Revenues, By Industrial, (2020-2030F) |

| 8.1.4 UAE Ready Mix Concrete Market Revenues, By Others (Dams, Canal, etc.), (2020-2030F) |

| 9. UAE Ready Mix Concrete Market Key Performance Indicators |

| 10. UAE Ready Mix Concrete Market Analysis of Cost, Selling Price and Quantity |

| 10.1. UAE Ready Mix Concrete Market Analysis of Cost, Selling Price and Quantity, Cost of RMC Produced |

| 10.2. UAE Ready Mix Concrete Market Analysis of Cost, Selling Price and Quantity, Selling Price of RMC |

| 10.3. UAE Ready Mix Concrete Market Analysis of Cost, Selling Price and Quantity, Quantity of concrete for a particular built-up area |

| 11. UAE Ready Mix Concrete Market Opportunity Assessment |

| 11.1. UAE Ready Mix Concrete Market Opportunity Assessment, By Type, 2030F |

| 11.2. UAE Ready Mix Concrete Market Opportunity Assessment, By Grade, 2030F |

| 11.3. UAE Ready Mix Concrete Market Opportunity Assessment, By End-User, 2030F |

| 12. UAE Ready Mix Concrete Market Competitive Landscape |

| 12.1. UAE Ready Mix Concrete Market Revenue Share, By Top 3 Companies (2023) |

| 12.2. UAE Ready Mix Concrete Market Competitive Benchmarking, By Technical & Operating Parameters |

| 13. Company Profiles |

| 13.1. Cemex |

| 13.2. Lafarge Emirates Cement LLC |

| 13.3. National Ready Mix Concrete Co. |

| 13.4. Unibeton |

| 13.5. Al Ghurair Construction Readymix LLC |

| 13.6. Transgulf Readymix Concrete Co. LLC |

| 13.7. Readymix Abu Dhabi |

| 13.8. Unimix |

| 13.9. Oryx Mix Concrete Products |

| 13.10. Emirates Beton Ready Mix |

| 13.11. Conmix |

| 14. Key Strategic Recommendations |

| 15. Disclaimer |

| List of Figures |

| 1. UAE Ready Mix Concrete Market Revenues and Volume, 2020-2030F ($ Million, Million Tonnes) |

| 2. UAE Major Smart City Projects, 2023 |

| 3. Value of Pipeline Projects, By Status, (%), 2024 |

| 4. Dubai Residential Sale, 2019-2023 (Thousand Units) |

| 5. UAE Population, Million (2020-2030F) |

| 6. Bulk Ordinary Portland Cement (OPC) prices in Dubai, 2022-2023 (AED per Ton) |

| 7. Average weekly Vessel calls at Jebel Ali Port (Ro/Ro Vessels) 2022 -2024E. |

| 8. UAE Ready Mix Concrete Market Revenue Share, By Type, 2023 & 2030F |

| 9. UAE Ready Mix Concrete Market Volume Share, By Type, 2023 & 2030F |

| 10. UAE Ready Mix Concrete Market Revenue Share, By Grade, 2023 & 2030F |

| 11. UAE Ready Mix Concrete Market Revenue Share, By End-User, 2023 & 2030F |

| 12. UAE Total Hotel Rooms Supply, (In Thousands) 2021-2027F |

| 13. UAE Top 6 Hotel Operators Supply, 2023-2030F |

| 14. Value of Awarded Projects in UAE, ($ Million) |

| 15. Average cost to RMC manufacturer & ASP, AED per cubic meter (2024E) |

| 16. Cost of Raw Materials for RMC in the UAE, AED per Ton |

| 17. UAE Ready Mix Concrete Market Opportunity Assessment, By Type, 2030F |

| 18. UAE Ready Mix Concrete Market Opportunity Assessment, By Grade , 2030F |

| 19. UAE Ready Mix Concrete Market Opportunity Assessment, By End-User, 2030F |

| 20. UAE Ready Mix Concrete Market Revenue Ranking, By Companies, 2023 |

| 21. Investment in Construction Projects currently under Execution in the UAE, 2024 |

| List of tables |

| 1. Value of UAE Major Construction Projects in the Pipeline, 2024 |

| 2. UAE Ready Mix Concrete Market Revenues, By Type, 2020-2030F ($ Million) |

| 3. UAE Ready Mix Concrete Market Volume, By Type, 2020-2030F (Million Tonnes) |

| 4. UAE Ready Mix Concrete Market Revenues, By Grade, 2020-2030F ($ Million) |

| 5. UAE Ready Mix Concrete Market Revenues, By End-User, 2020-2030F ($ Million) |

| 6. Upcoming Construction Projects in UAE, 2024-2025 |

| 7. Price of RMC, AED (Nov 2024) |

| 8. Pump charges, AED (2024) |

| 9. Extra additives Price, AED (2024) |

| 10. Temperature charges, AED (2024) |

| 11. Density Range of Different Types of Concrete (in tonnes/m³) |

| 12. Mega UAE Construction Projects with Strategic Insights for RMC Manufacturers |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero