UAE Stationery Market (2023-2029) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation, Outlook & COVID-19 IMPACT

Market Forecast By Type (Paper Products, Writing Instruments, Office Stationery, Art & Craft Stationery), By Sales Channel (Online, Offline), By Application (Educational, Commercial, Others), And Competitive Landscape

| Product Code: ETC002746 | Publication Date: Feb 2023 | Updated Date: May 2024 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 68 | No. of Figures: 17 | No. of Tables: 7 | |

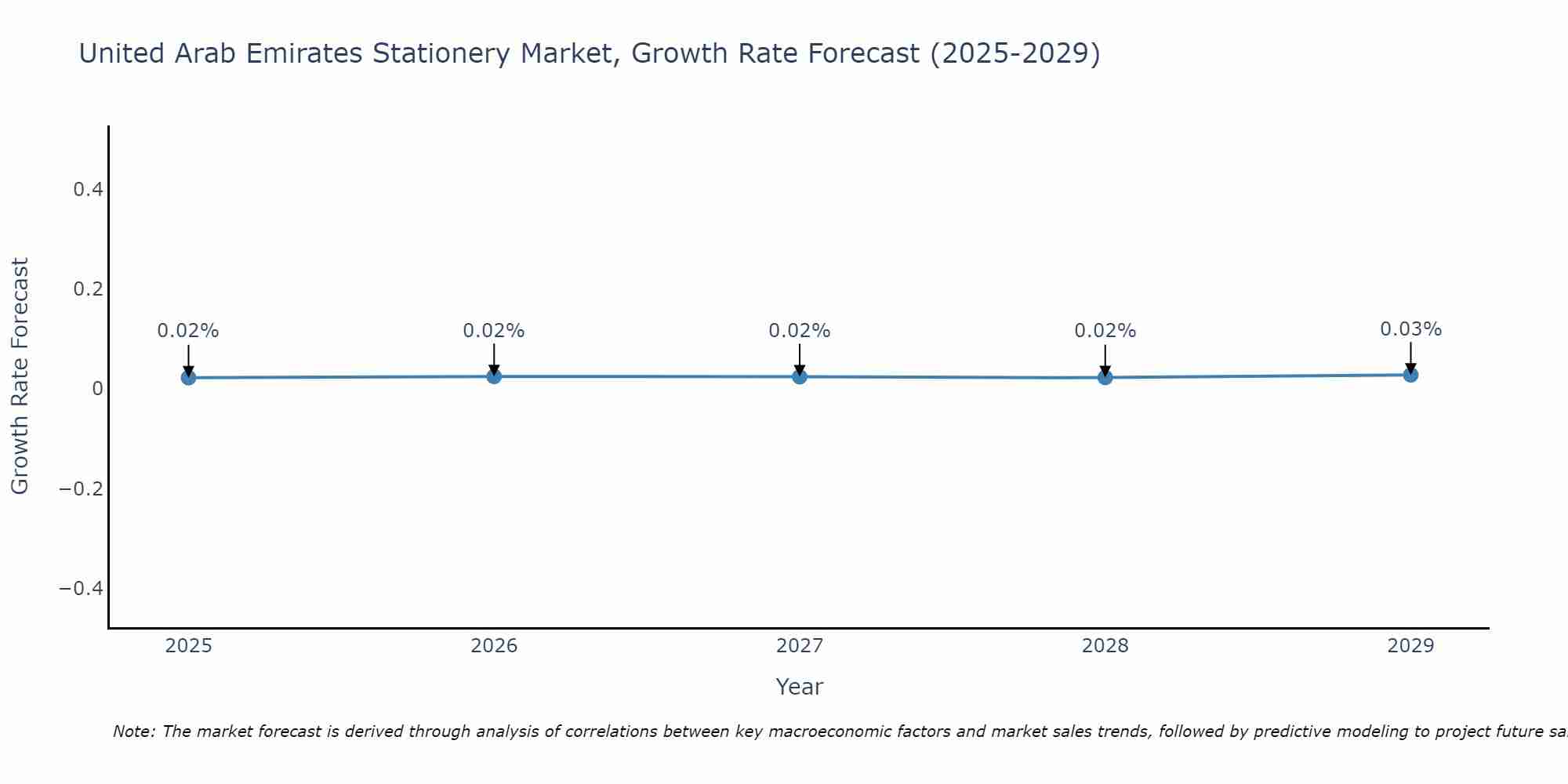

United Arab Emirates Stationery Market Size Growth Rate

The United Arab Emirates Stationery Market is projected to witness mixed growth rate patterns during 2025 to 2029. From 0.02% in 2025, the growth rate steadily ascends to 0.03% in 2029.

UAE Stationery Market Synopsis

UAE Stationery Market had experienced decline in revenue during 2020 owing to the COVID-19 pandemic. The temporary closure of educational institutions led to a swift transition to remote learning, causing an increased demand for technological tools like laptops and iPads and a subsequent decrease in demand for stationery products. Nevertheless, as schools reopened, the market recuperated. This recovery was aided by an upsurge in government investment in education sector and an influx of international students, which rose to 51,652 in 2022 from 48,800 in 2019.

According to 6Wresearch, UAE Stationery Market size is projected to grow at a CAGR of 2.9% during 2023-2029F. UAE stationery market has entered the later stages of growth, primarily due to the country's increasing shift towards digitalization and a paperless economy. However, the market still presents growth opportunities, particularly in response to the rising demand for eco-friendly, biodegradable, and recyclable stationery. Additionally, the market for office spaces is anticipated to grow in the future, given the numerous multi-million-dollar office projects in the pipeline, including the Dubai Urban Tech District, which is expected to generate 4,000 jobs in green urban technology, education, and training. The Mohammed bin Rashid Library, with over 54,000 square meters, seven floors, and nine thematic libraries, is another significant project that will contribute to the growth of office spaces in the country. Furthermore, programs such as the "National Program for Gifted and Creative Students" and the launch of the "Arts in Schools" program in 2021 by Abu Dhabi Education Council (ADEC) aim to promote art education in public schools across Abu Dhabi and develop students' drawing, painting, sculpture, and other art-related skills. These programs have resulted in an increased demand for various stationery products, such as pens, pencils, notebooks, and other writing and drawing instruments, thereby further boost the UAE stationery Market Share.

According to 6Wresearch, UAE Stationery Market size is projected to grow at a CAGR of 2.9% during 2023-2029F. UAE stationery market has entered the later stages of growth, primarily due to the country's increasing shift towards digitalization and a paperless economy. However, the market still presents growth opportunities, particularly in response to the rising demand for eco-friendly, biodegradable, and recyclable stationery. Additionally, the market for office spaces is anticipated to grow in the future, given the numerous multi-million-dollar office projects in the pipeline, including the Dubai Urban Tech District, which is expected to generate 4,000 jobs in green urban technology, education, and training. The Mohammed bin Rashid Library, with over 54,000 square meters, seven floors, and nine thematic libraries, is another significant project that will contribute to the growth of office spaces in the country. Furthermore, programs such as the "National Program for Gifted and Creative Students" and the launch of the "Arts in Schools" program in 2021 by Abu Dhabi Education Council (ADEC) aim to promote art education in public schools across Abu Dhabi and develop students' drawing, painting, sculpture, and other art-related skills. These programs have resulted in an increased demand for various stationery products, such as pens, pencils, notebooks, and other writing and drawing instruments, thereby further boost the UAE stationery Market Share.

![UAE Stationery Market Revenue Share]() Market by Type

Market by Type

UAE Stationery Industry is primarily driven by paper products, which account for the majority of revenue due to their extensive usage in educational institutions and official sectors. Moreover, the government's efforts to enhance the education sector, along with the increasing number of international students, are expected to create a surge in demand for paper-based products such as notebooks, registers, and notepads in the future.

Market by Sales Channel

United Arab Emirates (UAE) Stationery Market is mainly dominated by offline channels, which are considered the traditional and favoured mode of purchasing stationery products by consumers. Retail stores are easily accessible in every locality, offering promotional offers at competitive prices. Furthermore, there is a growing number of specialty stores, convenient stores, hypermarkets, and supermarkets across the country, contributing to the offline channel's dominance.

Market by Application

Education sector dominates the UAE stationery market and the same trend is expected to continue in the future owing rising number of enrolments along with rising number of secondary schools. Also, rising government investment would boost the growth in number of schools which would subsequently boost the demand for stationeries in the coming years.

![UAE Stationery Market Opportunity Assessment]() Key Attractiveness of the Report

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 11 Years Market Numbers.

- Historical Data Starting from 2019 to 2022.

- Base Year: 2022

- Forecast Data until 2029.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- UAE Stationery Market Overview

- UAE Stationery Market Outlook

- UAE Stationery Market Forecast

- Historical Data and Forecast of UAE Stationery Market Revenues, for the Period 2019-2029F

- Historical Data and Forecast of UAE Stationery Market Revenues, By Types, for the Period 2019-2029F

- Historical Data and Forecast of UAE Stationery Market Revenues, By Sales Channel, for the Period 2019-2029F

- Historical Data and Forecast of UAE Stationery Market Revenues, By Application, for the Period 2019-2029F

- UAE Stationery Market Revenue Share, By Market Players

- UAE Stationery Market Drivers and Restraints

- UAE Stationery Market Trends

- UAE Stationery Porters Five Forces

- UAE Stationery Opportunity Assessment, By Types, 2029F

- UAE Stationery Opportunity Assessment, By Sales Channel, 2029F

- UAE Stationery Opportunity Assessment, Application, 2029F

- Market Player’s Revenue Ranking

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Type

- Paper Products

- Writing Instruments

- Office Stationery

- Art & Craft Stationery

By Sales Channel

- Online

- Offline

By Application

- Educational

- Commercial

UAE Stationery Market: FAQs

|

1. Executive Summary |

|

2. Introduction |

|

2.1. Report Description |

|

2.2. Key Highlights of the Report |

|

2.3. Market Scope & Segmentation |

|

2.4. Research Methodology |

|

2.5. Assumptions |

|

3. UAE Stationery Market Overview |

|

3.1. UAE Stationery Market Revenues (2019-2029F) |

|

3.2. UAE Stationery- Industry Life Cycle |

|

3.3. UAE Stationery- Porter’s Five Forces |

|

4. UAE Stationery Market Dynamics |

|

4.1. Impact Analysis |

|

4.2. Market Drivers |

|

4.3. Market Restraints |

|

5. UAE Stationery Market Trends & Evolution |

|

6. UAE Stationery Market Overview, By Types |

|

6.1. UAE Stationery Market Revenue Share and Revenues, By Types (2019-2029F) |

|

6.1.1 UAE Stationery Market Revenues, By Paper Products (2019-2029F) |

|

6.1.2 UAE Stationery Market Revenues, By Office Stationery (2019-2029F) |

|

6.1.3 UAE Stationery Market Revenues, By Art & Craft Stationery (2019-2029F) |

|

6.1.4 UAE Stationery Market Revenues, By Writing Instruments (2019-2029F) |

|

6.2. UAE Stationery Market Revenue Share and Revenues, By Writing Instruments (2019-2029F) |

|

6.2.1 UAE Stationery Market Revenues, By Pencil (2019-2029F) |

|

6.2.2 UAE Stationery Market Revenues, By Pens (2019-2029F) |

|

6.3. UAE Stationery Market Revenue Share and Revenues, By Pens (2019-2029F) |

|

6.3.1 UAE Stationery Market Revenues, By Ball Point Pen (2019-2029F) |

|

6.3.2 UAE Stationery Market Revenues, By Gel Pen (2019-2029F) |

|

6.3.3 UAE Stationery Market Revenues, By Roller Pen (2019-2029F) |

|

6.3.4 UAE Stationery Market Revenues, By Fountain Pens (2019-2029F) |

|

6.3.5 UAE Stationery Market Revenue Share & Revenues, By Other Pens (2019-2029F) |

|

7. UAE Stationery Market Overview, By Sales Channel |

|

7.1. UAE Stationery Market Revenue Share and Revenues, By Sales Channel (2019-2029F) |

|

7.1.1 UAE Stationery Market Revenues, By Online (2019-2029F) |

|

7.1.2 UAE Stationery Market Revenues, By Offline (2019-2029F) |

|

7.2. UAE Stationery Market Revenue Share and Revenues, By Offline Sales Channel (2019-2029F) |

|

7.1.1 UAE Stationery Market Revenues, By Specialized Stores (2019-2029F) |

|

7.1.2 UAE Stationery Market Revenues, By Supermarkets & Hypermarkets (2019-2029F) |

|

7.1.3 UAE Stationery Market Revenues, By Convenient Stores (2019-2029F) |

|

7.1.4 UAE Stationery Market Revenues, By Others (2019-2029F) |

|

8. UAE Stationery Market Overview, By Application |

|

8.1. UAE Stationery Market Revenue Share and Revenues, By Application (2022 & 2029F) |

|

8.1.1 UAE Stationery Market Revenues, By Educational (2019-2029F) |

|

8.1.2 UAE Stationery Market Revenues, By Commercial (2019-2029F) |

|

8.1.3 UAE Stationery Market Revenues, By Others (2019-2029F) |

|

9. UAE Stationery Market Key Performance Indicators |

|

10. UAE Stationery Market Opportunity Assessment |

|

10.1 UAE Stationery Market Opportunity Assessment, By Type (2029F) |

|

10.2 UAE Stationery Market Opportunity Assessment, By Sales Channel (2029F) |

|

10.3 UAE Stationery Market Opportunity Assessment, By Application (2028F) |

|

11. UAE Stationery Market Competitive Landscape |

|

11.1 UAE Stationery Market Revenue Ranking, By Companies (2022) |

|

11.2 UAE Stationery Market Competitive Benchmarking, By Technical Parameter |

|

11.3 UAE Stationery Market Competitive Benchmarking, By Operating Parameter |

|

12. Company Profiles |

|

12.1 STAEDTLER Mars GmbH & Co. KG |

|

12.2 BIC Corporation |

|

12.3 Asia Pacific Resources International (April) Holdings Ltd |

|

12.4 Carioca s.p.a. |

|

12.5 Faber-Castell |

|

12.6 Newell Brands |

|

12.7 Pilot Corporation |

|

12.8 Pentel Co., Ltd |

|

12.9 Farook International Stationery |

|

13. Key Strategic Recommendations |

|

14. Disclaimer |

|

List of Figures |

|

1. UAE Stationery Market Revenues, 2019-2029F ($ Million) |

|

2. UAE Total Adult Literacy Rate, 2018-2022 (%) |

|

3. UAE Total Number of International Students In Higher Education, 2016-2022 |

|

4. Sector Wise New Office Space Requirement in UAE, 2021-22 |

|

5. Dubai Total Number of Office Unit Sold and Transaction value 2019-2022 ($Million) |

|

6. UAE Investment in EdTech Startup, 2020-2021, ($ Million) |

|

7. UAE Stationery Market Revenue Share, By Types 2022 & 2029F |

|

8. UAE Stationery Market Revenue Share, By Types, Writing Instruments 2022 & 2029F |

|

9. UAE Stationery Market Revenue Share, By Writing Instruments, Pens 2022 & 2029F |

|

10. UAE Stationery Market Revenue Share, By Sales Channel 2022 & 2029F |

|

11. UAE Stationery Market Revenue Share, By Sales Channel, Offline 2022 & 2029F |

|

12. UAE Stationery Market Revenue Share, By Application 2022 & 2029F |

|

13. Monthly Hiring Rates in December 2021 Relative to December 2019, By Country, (%) |

|

14. Number of Institution in Higher Education |

|

15. UAE Total Spending on Education Sector, 2017-2022 ($ Billion) |

|

16. UAE Stationery Market, Company Share, 2019 & 2022 |

|

17. Number of high school students in the United Arab Emirates (UAE) 2019-2024F |

|

List of Tables |

|

1. UAE Stationery Market Revenues, By Types 2019-2029F ($ Million) |

|

2. UAE Stationery Market Revenues, By Types, Writing Instruments 2019-2029F ($ Million) |

|

3. UAE Stationery Market Revenues, By Writing Instruments, Pens 2019-2029F ($ Million) |

|

4. UAE Stationery Market Revenues, By Sales Channel 2019-2029F ($ Million) |

|

5. UAE Stationery Market Revenues, By Sales Channel, Offline 2019-2029F ($ Million) |

|

6. UAE Stationery Market Revenues, By Applications 2019-2029F ($ Million) |

|

7. UAE Office Space, 2023E |

Market Forecast By Product (Paper, Writing Instrument, Office Stationery, Others), By Application (Education, Office, Others) And Competitive Landscape

| Product Code: ETC002746 | Publication Date: May 2020 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

UAE Stationery Market has witnessed robust growth in the past few years owing to increasing government investment in the educational sector, growing disposable income of consumers and high literacy rate in the country. Additionally, the growing number of youth willing towards higher education, rapid urbanization and increasing employment would increase the demand for the stationery market in UAE.

According to 6wresearch, UAE Stationery Market size is expected to grow during 2020-2026. In terms of product, the paper segment is accounted to dominate the stationery market revenue in UAE on account of the growing demand for notebooks and books in educational and commercial sectors. Moreover, the writing instrument segment is expected to lead a major share in the stationery market revenue in UAE owing to increasing demand for pen, pencil and other writing instruments in the daily writing task and also due to increasing competition of brands and product innovation during the forecast period.

In UAE, the Stationery Market is expected to witness a decline in the economic growth during the first quarter of 2020 owing to the coronavirus pandemic which has a worse impact on the worldwide business. However, during the second half of 2020-2026, the Stationery Market in UAE is anticipated to recover with healthy growth in the economy. In application, the education segment is holding a large revenue share in the stationery market during the past few years in UAE on account of improving the educational system, standardized qualification and the increasing number of schools, colleges and other educational institutes.

The UAE Stationery Market report thoroughly covers the UAE Stationery Market by product and application. The UAE Stationery Market outlook report provides an unbiased and detailed analysis of the on-going UAE Stationery Market trends, opportunities/high growth areas, market drivers, and UAE Stationery Market share by companies, which would help stakeholders to device and align market strategies according to the current and future market dynamics.

Key Highlights

- UAE Stationery Market Overview

- UAE Stationery Market Outlook

- UAE Stationery Market Forecast

- Historical Data of UAE Stationery Market Revenues and Volumes, for the Period 2016-2019.

- Market Size & Forecast of UAE Stationery Market Revenues and Volumes, until 2026.

- Historical Data of UAE Stationery Market Revenues and Volumes, by Product, for the Period 2016-2019.

- Market Size & Forecast of UAE Stationery Market Revenues and Volumes, by product, until 2026.

- Historical Data of UAE Stationery Market Revenues and Volumes, by application, for the Period 2016-2019.

- Market Size & Forecast of UAE Stationery Market Revenues and Volumes, by application, until 2026.

- Market Drivers and Restraints

- UAE Stationery Market Price Trends

- UAE Stationery Market Trends and Industry Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- UAE Stationery Market Share, By Players

- UAE Stationery Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Markets Covered

The UAE Stationery Market report provides a detailed analysis of the following market segments:

- By Product:

-

- Paper

- Writing Instrument

- Office Stationery

- Others

- By Applications:

- Education

- Office

- Others

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero