Vietnam Diesel Genset Market (2025-2031) | Growth, Size, Value, Industry, Share, Trends, Analysis, Revenue, Segmentation, Outlook

Market Forecast By KVA Rating (5 KVA-75 KVA, 75.1 KVA-375 KVA, 375.1 KVA-750 KVA, 750.1 KVA-1000 KVA And Above 1000 KVA), By Applications (Residential, Commercial, Industrial, Transportation & Public Infrastructure), By Regions (Eastern, Northern, Western And Southern) And Competitive Landscape

| Product Code: ETC090029 | Publication Date: Dec 2023 | Updated Date: Feb 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

Vietnam Diesel Genset Market Highlights

| Report Name | Vietnam Diesel Genset Market |

| Forecast period | 2025-2031 |

| CAGR | 5.2% |

| Growing Sector | Industrial |

Topics Covered in the Vietnam Diesel Genset Market Report

The Vietnam Diesel Genset Market report thoroughly covers the market by kVA rating and applications. The report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high-growth areas, and market drivers to help stakeholders align their strategies with current and future market dynamics.

Vietnam Diesel Genset Market Synopsis

The Vietnam Diesel Genset Market is experiencing substantial growth due to factors such as rapid industrialization, urbanization, and infrastructure development. The increasing need for reliable power backup solutions across various sectors is driving the demand for diesel generator sets. The market is segmented by kVA rating and applications, with the industrial sector holding the largest share. Key players are focusing on technological advancements and compliance with stringent emission regulations to maintain competitiveness. The government's initiatives towards infrastructure development and the privatization of power plants are expected to create lucrative opportunities for market participants.

According to 6Wresearch, the Vietnam diesel Genset Market is projected to grow at a CAGR of 5.2% during the forecast period 2025–2031. The primary driver of the Vietnam diesel genset market is the inadequate power supply infrastructure. Vietnam's energy consumption has increased significantly, resulting in a widening gap between energy demand and supply. This has prompted individuals, businesses, and industries to install backup power solutions, with diesel gensets being the most preferred. Rapid industrialization and urbanization have led to the establishment of new manufacturing units and commercial spaces, increasing the demand for uninterrupted power supply. Diesel gensets are widely used to ensure operational continuity during power outages, thereby fueling market growth. This trend is reflected in the Vietnam Diesel Genset Market Growth.

However, the market faces challenges due to stringent government regulations aimed at reducing emissions. The Vietnamese government has been introducing stricter regulations to curb emissions, including potential taxes and penalties for high-emission equipment. Compliance with these regulations may require significant investment in cleaner, more efficient technologies or retrofitting existing gensets with emission control devices, which can be costly.

Additionally, the high cost of diesel fuel and the availability of alternative power backup solutions, such as gas generators and renewable energy systems, pose challenges to the market. Consumers are becoming more inclined towards sustainable and cost-effective power solutions, which may hinder the growth of diesel gensets. Despite these challenges, ongoing infrastructure projects, including the construction of special economic zones (SEZs), metro trains, smart cities, and state and national roads, are expected to drive the demand for diesel gensets. These projects require reliable power backup solutions, providing growth opportunities for market players.

Vietnam Diesel Genset Market Trends

A notable trend in the Vietnam diesel genset market is the increasing adoption of technologically advanced and fuel-efficient generator sets. Manufacturers are focusing on developing gensets with improved fuel efficiency and lower emissions to comply with stringent environmental regulations and meet consumer demand for sustainable solutions. Another trend is the growing preference for rental services of diesel gensets, especially in the construction and event management sectors. Renting gensets offers flexibility and cost advantages, as it eliminates the need for significant capital investment and maintenance costs. This trend is expected to contribute to market growth during the forecast period.

Investment Opportunity in the Vietnam Diesel Genset Market

The privatization of power plants in Vietnam is gaining momentum, creating investment opportunities in the diesel genset market. Private investors are increasingly participating in the power sector, leading to the establishment of new power plants and the upgrading of existing ones. This development is expected to drive the demand for diesel gensets for both primary and backup power applications. Furthermore, the government's focus on developing smart cities and modern infrastructure presents significant investment prospects. These projects require reliable power solutions, and diesel gensets are anticipated to play a crucial role in ensuring uninterrupted power supply, thereby attracting investments in this sector.

Leading Players in the Vietnam Diesel Genset Market

The Vietnam diesel genset market is characterized by the presence of several key players, including Caterpillar Inc., Cummins Inc., Rolls-Royce plc, Generac Holdings Inc., Kohler Co., Mitsubishi Heavy Industries, Ltd., Perkins Engines Company Limited, Yanmar Holdings Co., Ltd., Kirloskar Oil Engines Limited, Wärtsilä Corporation, Doosan Corporation, and Deere & Company. These companies are focusing on product innovation, strategic partnerships, and expansion initiatives to strengthen their market position.

Government Regulations in the Vietnam Diesel Genset Market

The Vietnamese government has implemented stringent regulations to control emissions from diesel generators. In 2023, Vietnam implemented new regulations mandating that all diesel engines meet Euro 4 emission standards, pushing manufacturers to adopt cleaner technologies. These regulations aim to reduce environmental pollution and promote the use of energy-efficient equipment. Compliance with these regulations requires manufacturers to invest in research and development to produce gensets that meet the specified emission standards. This includes the adoption of advanced technologies such as selective catalytic reduction (SCR) systems and diesel particulate filters (DPF) to reduce nitrogen oxide (NOx) and particulate matter emissions.

Future Insights of the Vietnam Diesel Genset Market

The Vietnam Diesel Genset Market is expected to experience steady growth due to the country’s increasing energy demand and infrastructural developments. The expansion of industrial zones and commercial spaces will continue to drive demand for backup power solutions, ensuring a positive market outlook. Despite growing concerns over emissions and the rising adoption of renewable energy sources, diesel gensets will remain an essential power solution for industries requiring high-capacity and reliable power backup. Technological advancements in diesel gensets, such as improved fuel efficiency, reduced emissions, and integration with digital monitoring systems, will shape the future of the market. The adoption of smart gensets equipped with IoT-based remote monitoring and predictive maintenance features is expected to increase, allowing businesses to optimize operations and reduce maintenance costs. These advancements will also help companies comply with stringent emission regulations.

Market Segmentation Analysis

The report offers a comprehensive study of the following market segments and their leading categories:

5 kVA – 75 kVA Gensets to Witness High Growth – By kVA Rating

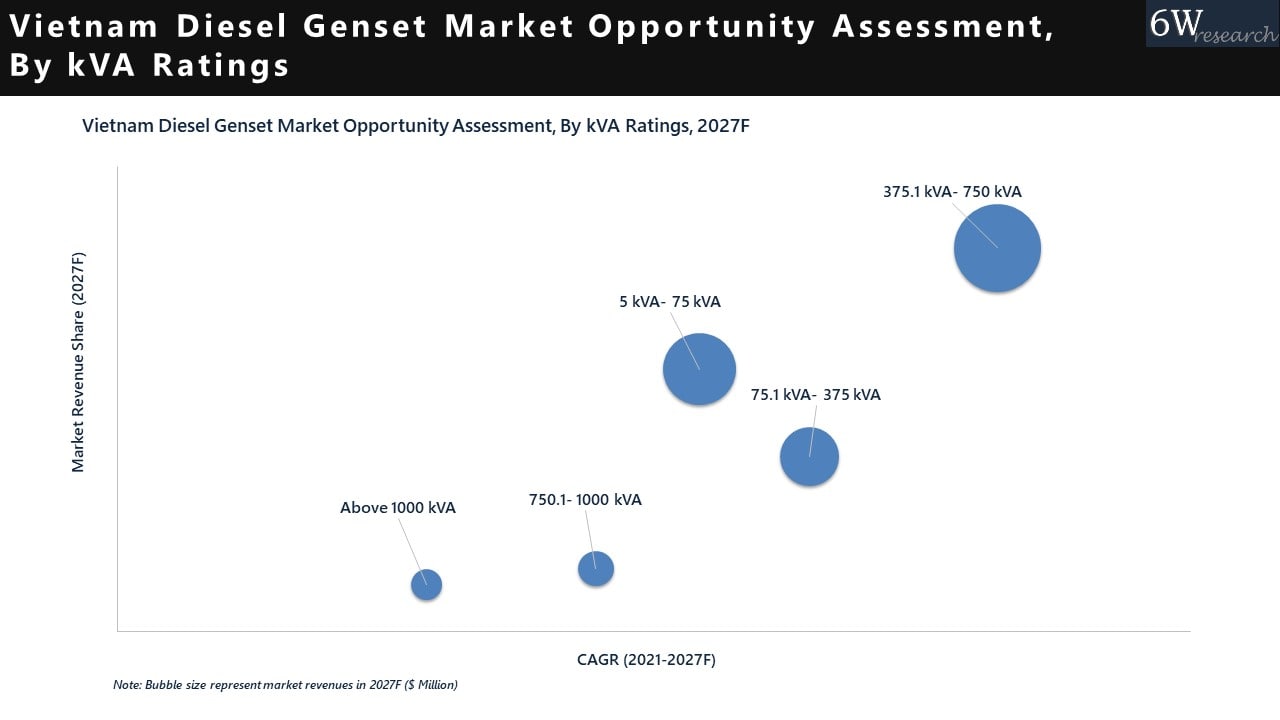

According to Ashutosh, Senior Research Analyst, 6Wresearch, The 5 kVA – 75 kVA segment is projected to experience significant growth, capturing a market share of around 30% by 2031. These low-power gensets are widely used in small businesses, residential backup systems, and telecom infrastructure. The growing adoption of small-capacity gensets in remote and off-grid areas will further drive the demand for this segment.

Commercial Sector to Gain Momentum – By Application

The commercial segment is expected to witness a CAGR of 5.8% during the forecast period, driven by increasing demand from hotels, shopping malls, office buildings, and hospitals. With Vietnam’s growing urban population and expanding commercial hubs, the need for reliable power backup solutions in commercial establishments is rising. Gensets in this category typically range from 75.1 kVA to 375 kVA, catering to the energy requirements of medium-sized businesses.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2031 to 2024.

- Base Year: 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Vietnam Diesel Genset Market Outlook

- Market Size of Vietnam Diesel Genset Market, 2024

- Forecast of Vietnam Diesel Genset Market, 2031

- Historical Data and Forecast of Vietnam Diesel Genset Market Revenues & Volume for the Period 2021 - 2031

- Vietnam Diesel Genset Market Trend Evolution

- Vietnam Diesel Genset Market Drivers and Challenges

- Vietnam Diesel Genset Market Price Trends

- Vietnam Diesel Genset Market Porter's Five Forces

- Vietnam Diesel Genset Market Industry Life Cycle

- Historical Data and Forecast of Vietnam Diesel Genset Market Revenues and volume by KVA ratings for the Period 2021-2031

- Historical Data and Forecast of Vietnam Diesel Genset Market Revenues and Volume by 5 - 75 KVA for the Period 2021-2031

- Historical Data and Forecast of Vietnam Diesel Genset Market Revenues and volume by 75.1 - 375 KVA for the Period 2021-2031

- Historical Data and Forecast of Vietnam Diesel Genset Market Revenues and volume by 375.1 - 750 KVA for the Period 2021-2031

- Historical Data and Forecast of Vietnam Diesel Genset Market Revenues and volume by 750.1 - 1000 KVA for the Period 2021-2031

- Historical Data and Forecast of Vietnam Diesel Genset Market Revenues and volume by Above 1000 KVA for the Period 2021-2031

- Historical Data and Forecast of Vietnam Diesel Genset Market Revenues and volume by Application for the Period 2021-2031

- Historical Data and Forecast of Vietnam Diesel Genset Market Revenues and volume by Residential for the Period 2021-2031

- Historical Data and Forecast of Vietnam Diesel Genset Market Revenues and volume by Commercial for the Period 2021-2031

- Historical Data and Forecast of Vietnam Diesel Genset Market Revenues and volume by Industrial for the Period 2021-2031

- Historical Data and Forecast of Vietnam Diesel Genset Market Revenues and volume by Transportation and public Infrastructure for the Period 2021-2031

- Vietnam Diesel Genset Market Import Export Trade Statistics

- Market Opportunity Assessment by KVA ratings

- Market Opportunity Assessment by Application

- Vietnam Diesel Genset Market Top Companies Market Share

- Vietnam Diesel Genset Market Competitive Benchmarking by Technical and Operational Parameters

- Vietnam Diesel Genset Market Company Profiles

- Vietnam Diesel Genset Market Key Strategic Recommendation

Markets Covered

The report offers a comprehensive analysis of the following market segments:

By kVA Rating:

- 5 kVA–75 kVA

- 75.1 kVA–375 kVA

- 375.1 kVA–750 kVA

- 750.1 kVA–1000 kVA

- Above 1000 kVA

By Applications:

- Residential

- Commercial

- Industrial

- Transportation & Public Infrastructure

Vietnam Diesel Genset Market (2025-2031) : FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Vietnam Diesel Genset Market Overview |

| 3.1 Vietnam Country Macro Economic Indicators |

| 3.2 Vietnam Diesel Genset Market Revenues & Volume, 2021 & 2031F |

| 3.3 Vietnam Diesel Genset Market- Industry Life Cycle |

| 3.4 Vietnam Diesel Genset Market- Porter's Five Forces |

| 3.5 Vietnam Diesel Genset Market Revenues & Volume Share, By KVA rating , 2021 & 2031F |

| 3.6 Vietnam Diesel Genset Market Revenues & Volume Share, By Application 2021 & 2031F |

| 4 Vietnam Diesel Genset Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Vietnam Diesel Genset Market Trends |

| 6. Vietnam Diesel Genset Market, By KVA Ratings |

| 6.1 Vietnam Diesel Genset Market Revenues & Volume, By 5 KVA-75 KVA 2021 & 2031F |

| 6.2 Vietnam Diesel Genset Market Revenues & Volume, By 75.1 KVA-375 KVA, 2021 & 2031F |

| 6.3 Vietnam Diesel Genset Market Revenues & Volume, By 375.1 KVA-750 KVA, 2021 & 2031F |

| 6.3 Vietnam Diesel Genset Market Revenues & Volume, By 750.1 KVA-1000 KVA , 2021 & 2031F |

| 6.3 Vietnam Diesel Genset Market Revenues & Volume, By Above 1000 KVA, 2021 & 2031F |

| 7 Vietnam Diesel Genset Market, By Application |

| 7.1 Vietnam Diesel Genset Market Revenues & Volume, By Residential, 2021 & 2031F |

| 7.2 Vietnam Diesel Genset Market Revenues & Volume, By Commercial, 2021 & 2031F |

| 7.3 Vietnam Diesel Genset Market Revenues & Volume, By Industrial, 2021 & 2031F |

| 7.3 Vietnam Diesel Genset Market Revenues & Volume, By Transportation & public Infrastructure 2021 & 2031F |

| 8 Vietnam Diesel Genset Market Import-Export Trade Statistics |

| 8.1 Vietnam Diesel Genset Market Export to Major Countries |

| 8.2 Vietnam Diesel Genset Market Imports from Major Countries |

| 9 Vietnam Diesel Genset Market Key Performance Indicators |

| 10 Vietnam Diesel Genset Market- Opportunity Assessment |

| 10.1 Vietnam Diesel Genset Market Opportunity Assessment, By KVA rating , 2031 |

| 10.2 Vietnam Diesel Genset Market Opportunity Assessment, By Application, 2031 |

| 11 Vietnam Diesel Genset Market- Competitive Landscape |

| 11.1 Vietnam Diesel Genset Market Revenue Share, By Companies, 2024 |

| 11.2 Vietnam Diesel Genset Market Competitive Benchmarking, By Operating and Technical Parameters |

| 12 Company Profiles |

| 13 Recommendations |

| 14 Disclaimer |

Market Forecast By KVA (5 - 75 KVA, 75.1 - 375 KVA, 375.1 - 750 KVA, 750.1 - 1000 KVA, Above 1000 KVA), By Application (Residential, Commercial, Industrial, Transportation & Public Infrastructure) And Competitive Landscape

| Product Code: ETC090029 | Publication Date: Jul 2022 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

Topics Covered in the Vietnam Diesel Genset Market

Vietnam Diesel Genset (Generator) Market report comprehensively covers the market by kVA ratings & application. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities, high growth areas, and market drivers, which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

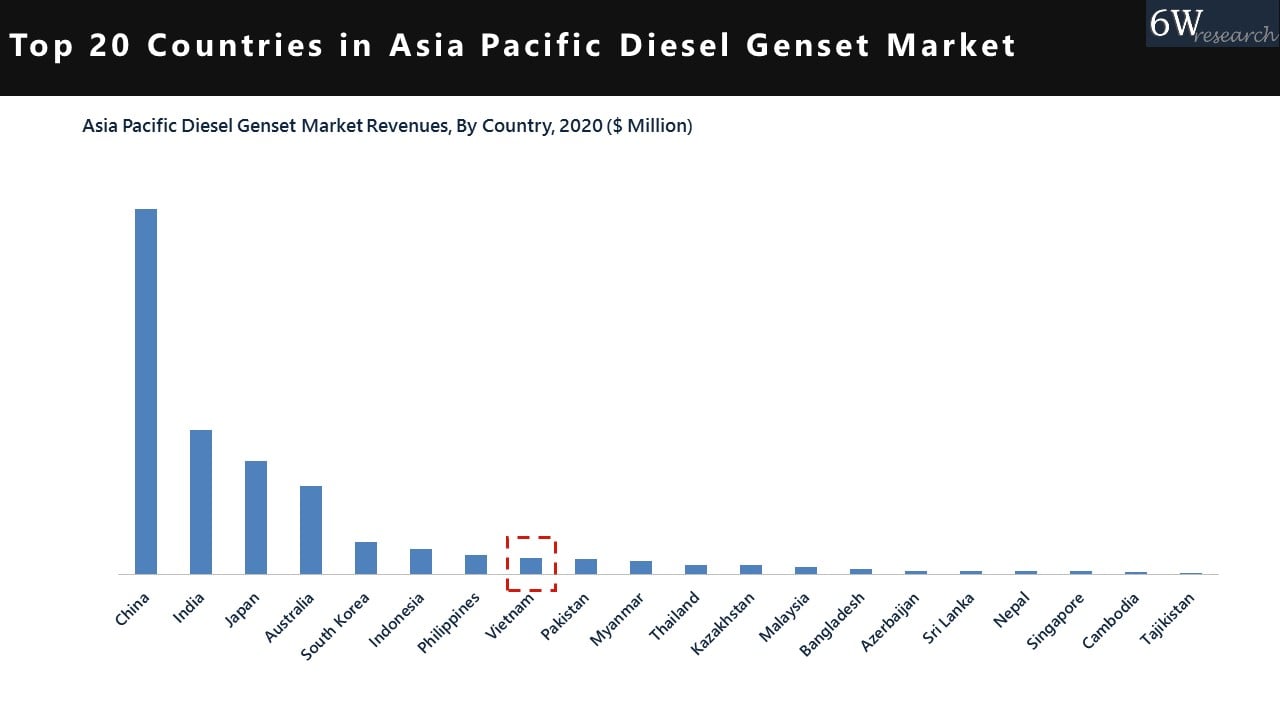

Vietnam Diesel Genset (Generator) Market is projected to grow over the coming year. Vietnam Diesel Genset (Generator) Market report is a part of our periodical regional publication Asia Pacific Diesel Genset (Generator) Market outlook report. 6W tracks the diesel genset market for over 60 countries with individual country-wise market opportunity assessments and publishes the report titled Global Diesel Genset (Generator) Market outlook report annually.

Latest Development (2023) of the Vietnam Diesel Genset (Generator) Market

Vietnam Diesel Genset (Generator) Market is significantly growing on account of increasing industrialization and urbanization. There is a shift towards eco-friendly technologies due to rising awareness among people about the protection of the environment. The producers of diesel gensets are taking various measures to produce efficient and sustainable products. There is heavy investment in the research domain to develop and advance the technology that can easily reduce carbon emissions and improvised the efficiency of fuel. Due to economic growth, and a supportive and favorable regulatory environment for renewable energy sources, Vietnam is set to become the leading market in Asia. The producers are keeping up with the latest development and sustainability standards to cater to the needs of the consumers and due to this, Vietnam Diesel Genset (Generator) Industry is expanding.

Vietnam Diesel Genset Market Synopsis

Vietnam Diesel Genset Market is anticipated to gain momentum in the upcoming years. The key factor for the growth of the market on account of increasing disposable income coupled with rising demand for regular and reliable power supply. Increasing urbanization and infrastructure development are accelerating the Vietnam Diesel Generator Market Growth. The growing expansion of the industrial and construction sector coupled with increasing power blackouts triggers the potential growth of the market.

According to 6Wresearch, Vietnam Diesel Genset (Generator) Market size is projected to grow at a CAGR of 2.4% during 2021-2027. Vietnam occupies the 8th position in terms of market size in the APAC Diesel Genset Market. The lack of infrastructure and rising demand for a continuous supply of electricity is adding to the Vietnam Diesel Generator Market Share. The various industries and sectors are constantly demanding the uninterrupted power supply and this is leading to the growth of the market. The various government initiatives towards the development of the infrastructure are another factor that is boosting the market. Foreign investment in oil and gas exploration is another factor that is driving the growth of the market. There are numerous challenges present in the market. There should be more investment in the research and development domain to develop advanced products. The major companies should expand their distribution networks by collaborating with local distributors so that the market can grow at a rapid pace.

Market by KVA

Market by KVA

On the basis of KVA, the market is segmented into 5 - 75 KVA, 75.1 - 375 KVA, 375.1 - 750 KVA, 750.1 - 1000 KVA, and Above 1000 KVA.

Market by Application

Market by Application

According to Dhaval, Research Manager, 6Wresearch, on the basis of Application, the market is segmented into Residential, Commercial, Industrial, and Transportation & Public Infrastructure. The commercial segment will dominate the market due to its extensive use as a power backup source in various commercial establishments and it will lead to an increase in Vietnam Diesel Genset Market Share.

COVID-19 Impact on Vietnam Diesel Genset (Generator) Market

The Diesel Genset Market in Vietnam was significantly impacted by the sudden outbreak of the pandemic. There was a decline in the demand for the diesel genset due to lockdown measures and supply chain disruptions and it resulted in a drop in the sales of the machines. The construction industry primarily uses the diesel gensets and it has been severely affected by COVID-19. The demand for generators declined due to the cancellation of projects due to government-mandated lockdown and social distancing measures. There was a reduction in commercial operations that relied heavily on backup power and it led to less requirement of the generators in small and medium-sized industries.

Vietnam Diesel Genset (Generator) Market: Key Players

These are the key players in the market and they are extensively engaged in the production and distribution of the Genset (Generator) and it leading to Vietnam Diesel Genset (Generator) Market Share.

- Cummins Inc.

- Caterpillar Inc.

- Mitsubishi Heavy Industries, Ltd.

- Kohler Co.

- Atlas Copco AB

- Yanmar Holdings Co., Ltd.

- Himoinsa S.L.

- MTU Onsite Energy (a brand of Rolls-Royce Power Systems)

- Doosan Corporation

- Wuxi Kipor Power Co., Ltd.

Key attractiveness of the report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2017 to 2020.

- Base Year: 2020.

- Forecast Data until 2027.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Vietnam Diesel Genset Market Outlook

- Market Size of Vietnam Diesel Genset Market, 2020

- Forecast of Vietnam Diesel Genset Market, 2027

- Historical Data and Forecast of Vietnam Diesel Genset Revenues & Volume for the Period 2017 - 2027

- Vietnam Diesel Genset Market Trend Evolution

- Vietnam Diesel Genset Market Drivers and Challenges

- Vietnam Diesel Genset Price Trends

- Vietnam Diesel Genset Porter's Five Forces

- Vietnam Diesel Genset Industry Life Cycle

- Historical Data and Forecast of Vietnam Diesel Genset Market Revenues & Volume By KVA for the Period 2017 - 2027

- Historical Data and Forecast of Vietnam Diesel Genset Market Revenues & Volume By 5 - 75 KVA for the Period 2017 - 2027

- Historical Data and Forecast of Vietnam Diesel Genset Market Revenues & Volume By 75.1 - 375 KVA for the Period 2017 - 2027

- Historical Data and Forecast of Vietnam Diesel Genset Market Revenues & Volume By 375.1 - 750 KVA for the Period 2017 - 2027

- Historical Data and Forecast of Vietnam Diesel Genset Market Revenues & Volume By 750.1 - 1000 KVA for the Period 2017 - 2027

- Historical Data and Forecast of Vietnam Diesel Genset Market Revenues & Volume By Above 1000 KVA for the Period 2017 - 2027

- Historical Data and Forecast of Vietnam Diesel Genset Market Revenues & Volume By Application for the Period 2017 - 2027

- Historical Data and Forecast of Vietnam Diesel Genset Market Revenues & Volume By Residential for the Period 2017 - 2027

- Historical Data and Forecast of Vietnam Diesel Genset Market Revenues & Volume By Commercial for the Period 2017 - 2027

- Historical Data and Forecast of Vietnam Diesel Genset Market Revenues & Volume By Industrial for the Period 2017 - 2027

- Historical Data and Forecast of Vietnam Diesel Genset Market Revenues & Volume By Transportation & Public Infrastructure for the Period 2017 - 2027

- Vietnam Diesel Genset Import Export Trade Statistics

- Market Opportunity Assessment By KVA

- Market Opportunity Assessment By Application

- Vietnam Diesel Genset Top Companies Market Share

- Vietnam Diesel Genset Competitive Benchmarking By Technical and Operational Parameters

- Vietnam Diesel Genset Company Profiles

- Vietnam Diesel Genset Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By KVA

- 5 - 75 KVA

- 75.1 - 375 KVA

- 375.1 - 750 KVA

- 750.1 - 1000 KVA

- Above 1000 KVA

By Application

- Residential

- Commercial

- Industrial

- Transportation & Public Infrastructure

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

- Kenya Road Stabilization Equipment Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- North America Sodium chloride Market (2025-2031) | Analysis, Revenue, Forecast, Trends, Companies, Size, Growth, Share, Industry, Outlook & Value

- North America Vinyl Flooring Market (2025-2031) | Value, Growth,Size, Analysis, Revenue, Industry, Forecast, Share, Outlook, Companies & Trends

- Tajikistan Thermal Camera Market (2025-2031) | Trends, Size, Growth, Share, Industry, Companies, Value, Analysis, Revenue, Forecast & Outlook

- Singapore Professional AV Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero