Bangladesh Stationery Market (2023-2029) | Size, Share, Growth, Forecast, Revenue, Analysis, Forecast, Value & Outlook

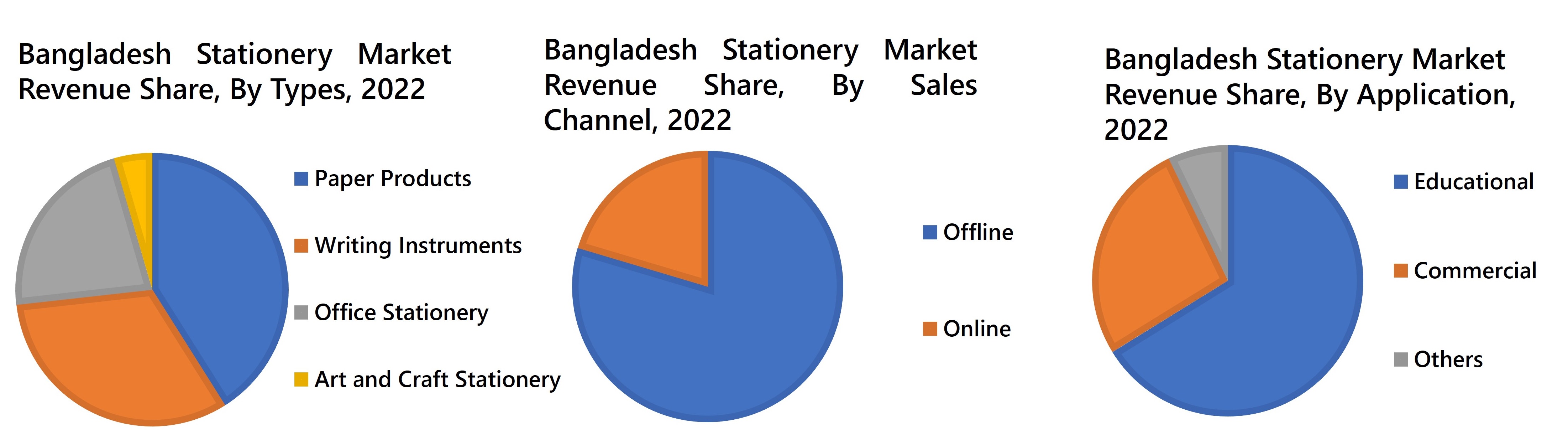

Market Forecast By Type (Paper Products, Writing Instruments, Office Stationery, Art & Craft Stationery), By Sales Channel (Online, Offline), By Application (Educational, Commercial, Others) and Competitive Landscape

| Product Code: ETC000500 | Publication Date: Sep 2023 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 65 | No. of Figures: 14 | No. of Tables: 8 |

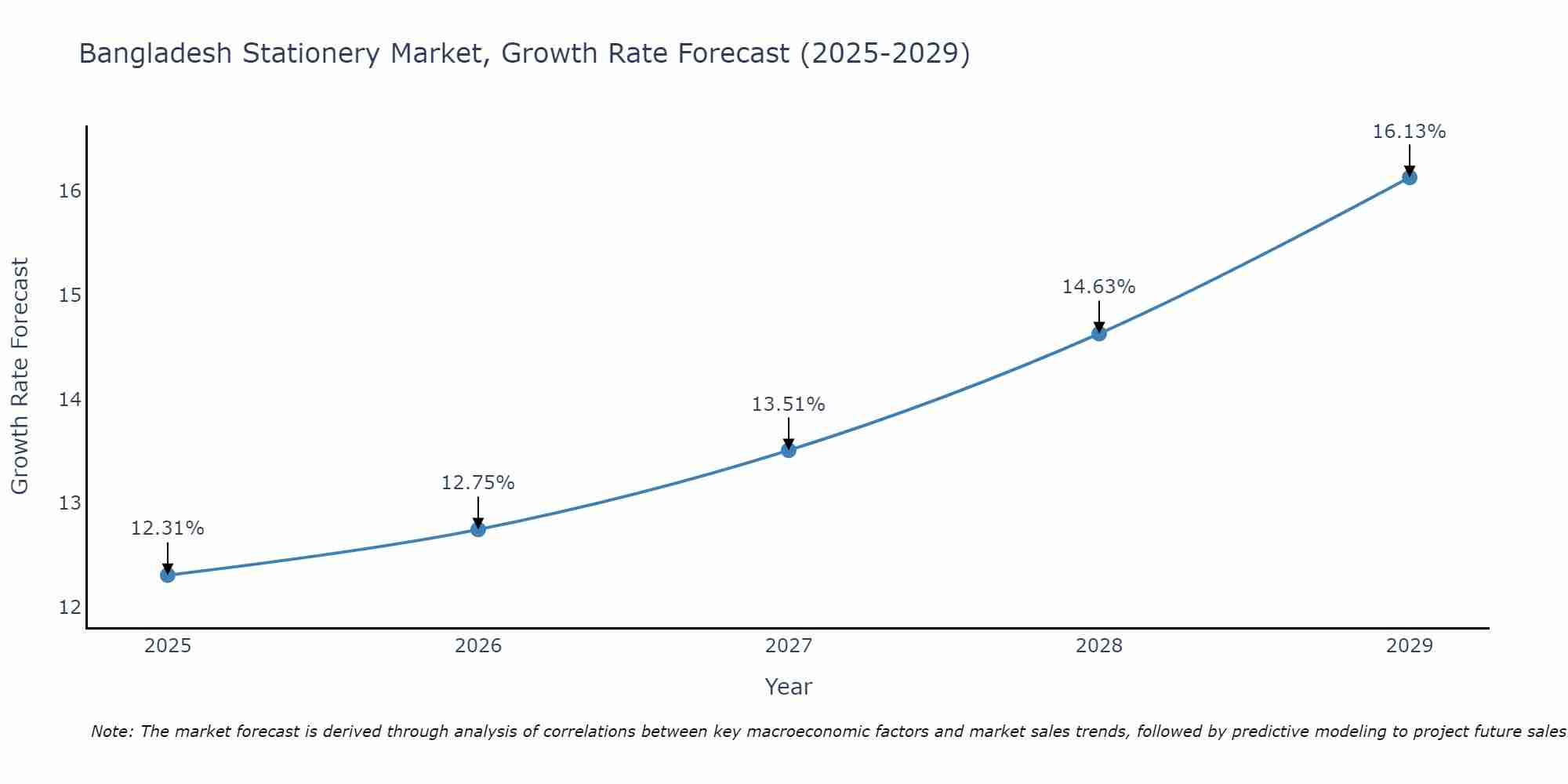

Bangladesh Stationery Market Size Growth Rate

The Bangladesh Stationery Market is likely to experience consistent growth rate gains over the period 2025 to 2029. The growth rate starts at 12.31% in 2025 and reaches 16.13% by 2029.

Stationery Market: Bangladesh vs Top 5 Major Economies in 2027 (Asia)

The Stationery market in Bangladesh is projected to grow at a high growth rate of 13.51% by 2027, highlighting the country's increasing focus on advanced technologies within the Asia region, where China holds the dominant position, followed closely by India, Japan, Australia and South Korea, shaping overall regional demand.

Bangladesh Stationery Market Synopsis

The Bangladesh Stationery Market during the COVID-19 pandemic in 2020 was negatively affected owing to the closure of schools and offices. Also, many stationery items are imported, and the pandemic has led to disruptions in transportation and logistics, causing delays and shortages of products. However, the rise in the total number of branches of banks from 10,578 in 2019 to 11,030 in October’2022 resulted in the growth of market revenues of stationery items. Moreover, during the period, January 2020-January’2023, the population in the country increased by 8 million, and in order to pursue a good quality of education in urban places, the urban population grew from 37% to 40% in the same period which led to a great demand of stationery products in the past years.

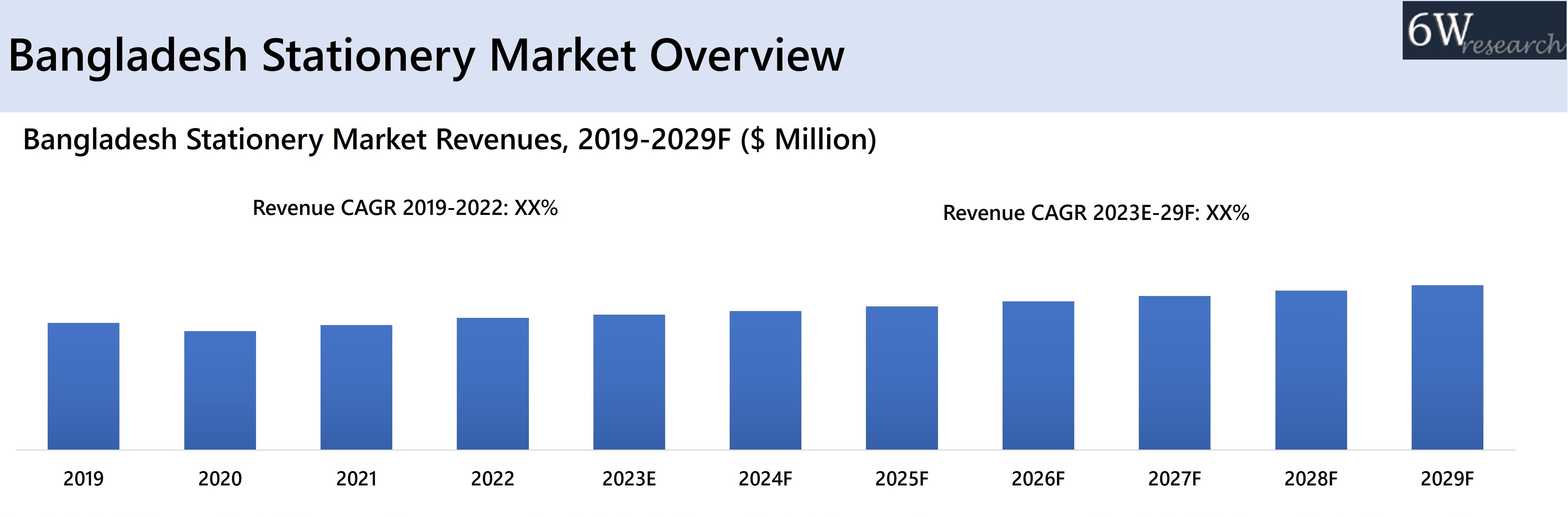

According to 6Wresearch, the Bangladesh stationery market size is projected to grow at a CAGR of 3.3% during 2023-2029. The Bangladesh stationery market is expected to show significant growth over the coming years on account of the initiatives taken by the government of Bangladesh such as Shobai Miley Shikhi (“Everyone Learns Together”), a Pilot Programme that includes the development of schools, reaching out to children in hard-to-reach areas, and introduction of art & craft in courses. These initiatives would increase the enrolment of students in primary and secondary schools which would propel the Bangladesh Stationery Industry in the forthcoming years. Moreover, the government plans to increase the percentage of enrolments of students in technical education from 17% in 2022 to 30% by 2030 which would further create more demand for stationery products.

According to 6Wresearch, the Bangladesh stationery market size is projected to grow at a CAGR of 3.3% during 2023-2029. The Bangladesh stationery market is expected to show significant growth over the coming years on account of the initiatives taken by the government of Bangladesh such as Shobai Miley Shikhi (“Everyone Learns Together”), a Pilot Programme that includes the development of schools, reaching out to children in hard-to-reach areas, and introduction of art & craft in courses. These initiatives would increase the enrolment of students in primary and secondary schools which would propel the Bangladesh Stationery Industry in the forthcoming years. Moreover, the government plans to increase the percentage of enrolments of students in technical education from 17% in 2022 to 30% by 2030 which would further create more demand for stationery products.

![Bangladesh Stationery Market Revenue Share]() Market by Type

Market by Type

Paper products acquired a major revenue share in the Bangladesh stationery market due to their widespread use in offices and education institutions. Additionally, the government's efforts to strengthen the educational sector with initiatives like Everyone Learns Together would raise demand for paper products in the coming years.

Market by Sales Channel

Due to the rapid and simple availability of stationery items such as pens, paper, and art & craft items in nearby specialized stores, convenience stores, and other retail shops, the offline sales channel gained the majority of the revenue share in the Bangladesh stationery market and would maintain its dominance during the forecast period.”

Market by Application

The educational sector acquired the major revenue share in the Stationery Market in Bangladesh on account of the rise in the number of institutions which has grown from 3,000 in 2012 to 6,000 in 2019. Further, initiatives to bring back the out-of-school children are supported by Qatar with funding of $1.27 million which would further boost the use of stationery items in the education sector.

![Bangladesh Stationery Market Opportunity Assessment]() Key Attractiveness of the Report

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 11 Years Market Numbers.

- Historical Data Starting from 2019 to 2022.

- Base Year: 2022

- Forecast Data until 2029.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Bangladesh Stationery Market Overview

- Bangladesh Stationery Market Outlook

- Bangladesh Stationery Market Forecast

- Historical Data and Forecast of Bangladesh Stationery Market Revenues, for the Period 2019-2029F

- Historical Data and Forecast of Bangladesh Stationery Market Revenues, By Types, for the Period 2019-2029F

- Historical Data and Forecast of Bangladesh Stationery Market Revenues, By Sales Channel, for the Period 2019-2029F

- Historical Data and Forecast of Bangladesh Stationery Market Revenues, By Application, for the Period 2019-2029F

- Bangladesh Stationery Market Drivers and Restraints

- Bangladesh Stationery Market Trends

- Bangladesh Stationery Market Porters Five Forces

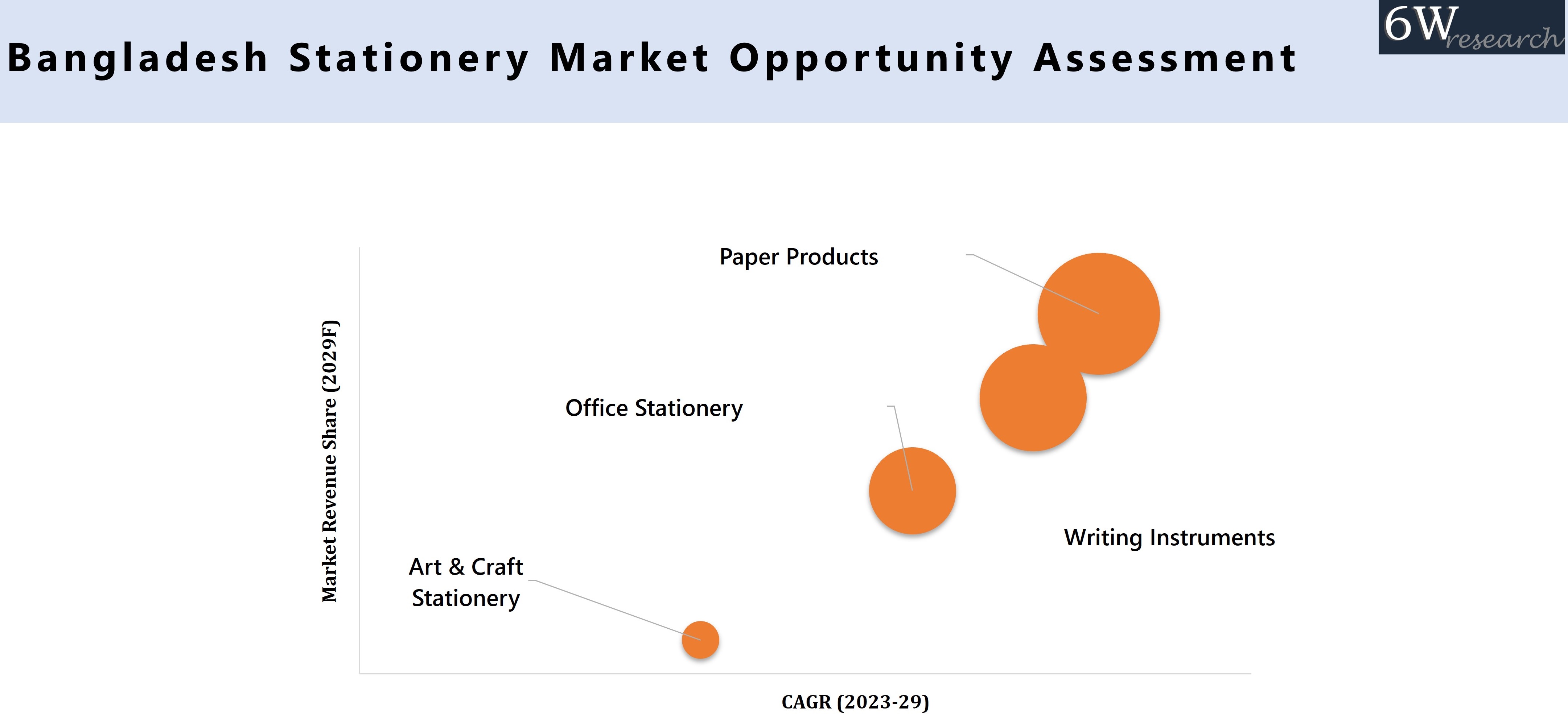

- Bangladesh Stationery Market Opportunity Assessment, By Types, 2029F

- Bangladesh Stationery Market Opportunity Assessment, By Sales Channel, 2029F

- Bangladesh Stationery Market Opportunity Assessment, Application, 2029F

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Type

- Paper Products

- Writing Instruments

- Office Stationery

- Art & Craft Stationery

By Sales Channel

- Online

- Offline

By Application

- Educational

- Commercial

- Others

Bangladesh Stationery Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. Bangladesh Stationery Market Overview |

| 3.1. Bangladesh Stationery Market Revenues (2019-2029F) |

| 3.2. Bangladesh Stationery- Industry Life Cycle |

| 3.3. Bangladesh Stationery- Porter’s Five Forces |

| 4. Bangladesh Stationery Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.3. Market Restraints |

| 5. Bangladesh Stationery Market Trends & Evolution |

| 6. Bangladesh Stationery Market Overview, By Types |

| 6.1. Bangladesh Stationery Market Revenue Share and Revenues, By Types (2019-2029F) |

| 6.1.1 Bangladesh Stationery Market Revenues, By Paper Products (2019-2029F) |

| 6.1.2 Bangladesh Stationery Market Revenues, By Office Stationery (2019-2029F) |

| 6.1.3 Bangladesh Stationery Market Revenues, By Art & Craft Stationery (2019-2029F) |

| 6.1.4 Bangladesh Stationery Market Revenues, By Writing Instruments (2019-2029F) |

| 6.2. Bangladesh Stationery Market Revenue Share and Revenues, By Writing Instruments (2019-2029F) |

| 6.2.1 Bangladesh Stationery Market Revenues, By Pencil (2019-2029F) |

| 6.2.2 Bangladesh Stationery Market Revenues, By Pens (2019-2029F) |

| 6.3. Bangladesh Stationery Market Revenue Share and Revenues, By Pens (2019-2029F) |

| 6.3.1 Bangladesh Stationery Market Revenues, By Ball Point Pen (2019-2029F) |

| 6.3.2 Bangladesh Stationery Market Revenues, By Gel Pen (2019-2029F) |

| 6.3.3 Bangladesh Stationery Market Revenues, By Roller Pen (2019-2029F) |

| 6.3.4 Bangladesh Stationery Market Revenues, By Fountain Pens (2019-2029F) |

| 6.3.5 Bangladesh Stationery Market Revenue Share & Revenues, By Other Pens (2019-2029F) |

| 7. Bangladesh Stationery Market Overview, By Sales Channel |

| 7.1. Bangladesh Stationery Market Revenue Share and Revenues, By Sales Channel (2019-2029F) |

| 7.1.1 Bangladesh Stationery Market Revenues, By Online (2019-2029F) |

| 7.1.2 Bangladesh Stationery Market Revenues, By Offline (2019-2029F) |

| 7.2. Bangladesh Stationery Market Revenue Share and Revenues, By Offline Sales Channel (2019-2029F) |

| 7.1.1 Bangladesh Stationery Market Revenues, By Specialized Stores (2019-2029F) |

| 7.1.2 Bangladesh Stationery Market Revenues, By Supermarkets & Hypermarkets (2019-2029F) |

| 7.1.3 Bangladesh Stationery Market Revenues, By Convenient Stores (2019-2029F) |

| 7.1.4 Bangladesh Stationery Market Revenues, By Others (2019-2029F) |

| 8. Bangladesh Stationery Market Overview, By Application |

| 8.1. Bangladesh Stationery Market Revenue Share and Revenues, By By Application (2022 & 2029F) |

| 8.1.1 Bangladesh Stationery Market Revenues, By Educational (2019-2029F) |

| 8.1.2 Bangladesh Stationery Market Revenues, By Commercial (2019-2029F) |

| 8.1.3 Bangladesh Stationery Market Revenues, By Others (2019-2029F) |

| 9. Bangladesh Stationery Market Key Performance Indicators |

| 10. Bangladesh Stationery Market Opportunity Assessment |

| 10.1 Bangladesh Stationery Market Opportunity Assessment, By Type (2029F) |

| 10.2 Bangladesh Stationery Market Opportunity Assessment, By Sales Channel (2029F) |

| 10.3 Bangladesh Stationery Market Opportunity Assessment, By Application (2028F) |

| 11. Bangladesh Stationery Market Competitive Landscape |

| 11.1 Bangladesh Stationery Market Revenue Ranking, By Companies (2022) |

| 11.2 Bangladesh Stationery Market Competitive Benchmarking, By Technical Parameter |

| 11.3 Bangladesh Stationery Market Competitive Benchmarking, By Operating Parameter |

| 12. Company Profiles |

| 12.1 Bashundhara Group |

| 12.2 Meghna Group Of Industries |

| 12.3 Matador Ball pen Industries |

| 12.4 Linc Limited |

| 12.5 Hindustan Pencils Pvt. Limited |

| 12.6 Shachihata Inc. |

| 12.7 Faber-Castell |

| 12.8 BIC Corporation |

| 13. Key Strategic Recommendations |

| 14. Disclaimer |

| List of Figures |

| 1. Bangladesh Stationery Market Revenues, 2019-2029F ($ Million) |

| 2. Percentage Of Students To Enroll In Technical Education In Bangladesh, 2022-2030F |

| 3. Bangladesh Stationery Market Revenue Share, By Types, 2022 & 2029F |

| 4. Bangladesh Stationery Market Revenue Share, By Writing Instruments, 2022 & 2029F |

| 5. Bangladesh Writing Instruments Stationery Market Revenue Share, By Pens, 2022 & 2029F |

| 6. Bangladesh Stationery Market Revenue Share, By Sales Channel, 2022 & 2029F |

| 7. Bangladesh Stationery Market Revenue Share, By Offline Sales Channel, 2022 & 2029F |

| 8. Bangladesh Stationery Market Revenue Share, By Application, 2022 & 2029F |

| 9. Bangladesh Number of Institutions Managed by Non-State Actors, 2012-2019 |

| 10. Bangladesh Number of Branches of Private Commercial Banks, 2018-2021 (Units) |

| 11. Bangladesh Number of All Banks, 2017-2021 (Units) |

| 12. Bangladesh Number of Branches of All Banks, 2017-Oct’2022 (Units) |

| 13. Bangladesh Stationery Market Revenue Ranking, By Companies, 2022 |

| 14. ADB Funding To Bangladesh, 2023-2025 ($ Million) |

| List of Tables |

| 1. Bangladesh Stationery Market Revenues, By Types, 2019-2029F ($ Million) |

| 2. Bangladesh Stationery Market Revenues, By Writing Instruments, 2019-2029F ($ Million) |

| 3. Bangladesh Writing Instruments Stationery Market Revenues, By Pens, 2019-2029F ($ Million) |

| 4. Bangladesh Stationery Market Revenues, By Sales Channel, 2019-2029F ($ Million) |

| 5. Bangladesh Stationery Market Revenues, By Offline Sales Channel, 2019-2029F ($ Million) |

| 6. Bangladesh Stationery Market Revenues, By Application, 2019-2029F ($ Million) |

| 7. Bangladesh Net Enrolment Rate (NER) and Dropout Rate in Primary Education 2018-2021 |

| 8. Upcoming Project In Education Sector |

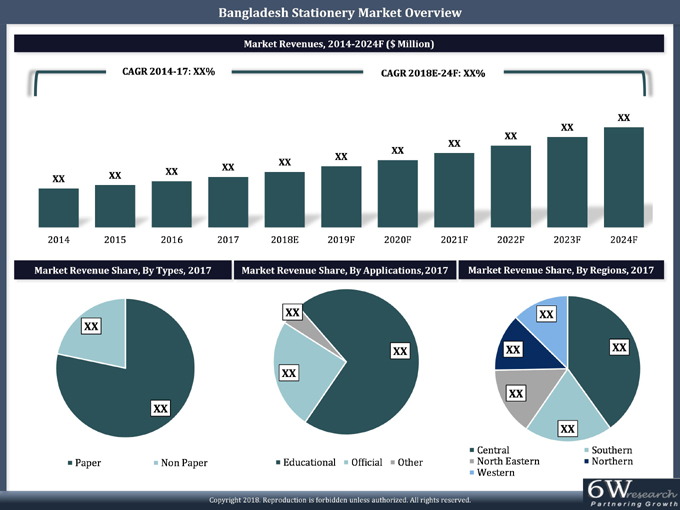

Market Forecast By Types (Paper Stationery (Copier, Exercise Notebook, Premium Paper Stationery, and Other Paper Stationery) and Non-Paper Stationery (Pen, Pencil and Other Non-Paper Stationery (Art Stationery, Scale, Sharpener, Eraser, Pencil Box, Files and Folders, Adhesive Stationery and Technical Instruments))), By Applications (Education, Office and Others (Retail, Healthcare, Artistic)), By Regions (Northern, Western, North Eastern, Central, and Southern) and Competitive Landscape.

| Product Code: ETC000500 | Publication Date: Jul 2018 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 165 | No. of Figures: 118 | No. of Tables: 14 |

Latest 2023 Developments:

Bangladesh Stationery Market witnessed many changes Pilot Corporation announced its full line of FriXion erasable pens, markers, and highlighters are the first and only writing instruments. The market also witnessed some changes like pencil boxes attached to the battery-operated plastic fan or LED lights that help students even during power cuts amongst the host of new stationery. A pen with a colour sensor simply points anything in your environment to the colour. The smart pen enables video recording along with the writing facility.

To enquire about latest release please click here

Previous Release:

Bangladesh stationery market report comprehensively covers the Bangladesh Stationery Market by types, applications, and regions. The Bangladesh stationery market outlook report provides an unbiased and detailed analysis of the Bangladesh stationery market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Bangladesh Stationery Market Synopsis

Bangladesh Stationery Market is expected to register healthy economic growth, increasing emphasis on the development of the education sector along with a rising adult literacy rate are the major factors driving the growth of the stationery market in Bangladesh. Additionally, as the proportion of the urban population continues to increase in the country, the development of new commercial spaces such as offices and educational institutes would drive Bangladesh stationery market forecast revenues in near future. An increasing number of people working in corporate is accelerating the development of the industry.

According to 6Wresearch, Bangladesh stationery market size is projected to grow at a CAGR of 10.3% during 2018-2024. The primary and secondary education enrolment rate of Bangladesh has been climbing steadily over the past years. Therefore, a significant portion of the demand for stationery items comes from the education sector in the country. Further, the growing e-commerce industry is also providing new avenues for the distribution of stationery products to end consumers. Increasing development in the commercial sector coupled with rising innovation of products such as the introduction of 3D pens is accelerating the Bangladesh Stationery Market Growth. Rising awareness regarding the importance of education coupled with rising initiatives taken by the government is also adding to the Bangladesh Stationery Market Share.

Bangladesh stationery market is projected to witness progressive growth in the upcoming six years on the back of a rise in the education system. Increased government initiative by developing schools in rural areas along with increased improvement in the education system by providing adequate training and recruiting professional teachers is estimated to strengthen the education system of the country and as a result, is expected to positively impact the stationary market growth in the coming years.

Bangladesh stationery market is projected to gain traction in the upcoming six years on the back of the rising potential growth of the corporate sector in the country. The rising growth of the tech-savvy population coupled with an increase in the shift of the population into the service sector where pen and paper are attributed as essentials and is estimated to act as a catalyst for the growth of the Bangladesh stationery market in the coming timeframe. Also, most of the sector has become digital but still, pen and paper are the most usable and common stationery products to be used and are estimated to boost the growth of the Bangladesh stationery market in the coming timeframe.

Market Analysis by product type

Moreover, on the basis of product type, Paper is estimated to dominate the overall market share owing to the rising literacy rate and use of paper in almost every profession in the country and as a result is expected to strengthen the Bangladesh stationery market and would benefit Bangladesh stationery market growth during the forecast period.

Market Analysis by Paper Stationery

In paper stationery, exercise notebooks held the largest Bangladesh stationery market share by type, while in the non-paper stationery segment, pen and pencil segments account for the largest revenue and volume shares in the overall Bangladesh stationery market. Plans outlined under the national 7th Five-Year Plan to achieve the education Millennium Development Goals over the next decade would help the stationery market to grow in the country.

Key Highlights of the Report:

- Bangladesh Stationery Market Overview

- Bangladesh stationery Market Outlook

- Bangladesh Stationery Market Size and Bangladesh Stationery Market Forecast of Revenues Until 2024

- Historical & Forecast data of the Global Stationery Market Revenues for the period 2014-2024F.

- Historical & Forecast data of Bangladesh Stationery Market Revenues for the period 2014-2024F.

- Historical & Forecast data of the Bangladesh Paper Stationery Market Revenues for the period 2014-2024F.

- Historical & Forecast data of the Bangladesh Copier Paper Market Revenues & Volume for the period 2014-2024F.

- Historical & Forecast data of the Bangladesh Copier Paper Market Revenues & Volume, By Types for the period 2014-2024F.

- Historical & Forecast data of the Bangladesh Exercise Notebook Market Revenues & Volume for the period 2014-2024F.

- Historical & Forecast data of the Bangladesh Exercise Notebook Market Revenues & Volume, By Types for the period 2014-2024F.

- Historical & Forecast data of the Bangladesh Notebook Market Revenues & Volume for the period 2014-2024F.

- Historical & Forecast data of the Bangladesh Notebook Market Revenues & Volume, By Types for the period 2014-2024F.

- Historical & Forecast data of the Bangladesh Drawing Book Market Revenues & Volume for the period 2014-2024F.

- Historical & Forecast data of the Bangladesh Notepad Market Revenues & Volume, By Types for the period 2014-2024F.

- Historical & Forecast data of the Bangladesh Other Notebooks Market Revenues & Volume for the period 2014-2024F.

- Historical & Forecast data of the Bangladesh Premium Paper Stationery Market Revenues & Volume for the period 2014-2024F.

- Historical & Forecast data of the Bangladesh Premium Paper Stationery Market Revenues & Volume, By Types for the period 2014-2024F.

- Historical & Forecast data of the Bangladesh Spiral/Wiro Notebook Market Revenues & Volume for the period 2014-2024F.

- Historical & Forecast data of the Bangladesh Executive Notebook Market Revenues & Volume for the period 2014-2024F.

- Historical & Forecast data of the Bangladesh Diary Market Revenues & Volume for the period 2014-2024F.

- Historical & Forecast data of the Bangladesh Other Paper Stationery Market Revenues for the period 2014-2024F.

- Historical & Forecast data of the Bangladesh Stationery Market, for Non-Paper Category, by Revenues & Volume for the period 2014-2024F.

- Historical & Forecast data of the Bangladesh Stationery Market, for Non-Paper Category, by Types for the period 2014-2024F.

- Historical & Forecast data of the Pen Market Revenues & Volume for the period 2014-2024F.

- Historical & Forecast data of the Pen Market Revenues & Volume, By Types for the period 2014-2024F.

- Historical & Forecast data of the Pencil Market Revenues & Volume for the period 2014-2024F.

- Historical & Forecast data of the Pencil Market Revenues & Volume, By Types for the period 2014-2024F.

- Historical & Forecast data of the Eraser Market Revenues & Volume for the period 2014-2024F.

- Historical & Forecast data of the Art Stationery Market Revenues for the period 2014-2024F.

- Historical & Forecast data of the Scale Market Revenues & Volume for the period 2014-2024F.

- Historical & Forecast data of the Pencil Box Market Revenues & Volume for the period 2014-2024F.

- Historical & Forecast data of the Sharpener Market Revenues & Volume for the period 2014-2024F.

- Historical & Forecast data of the Files and Folders Market Revenues for the period 2014-2024F.

- Historical & Forecast data of the Adhesives Market Revenues for the period 2014-2024F.

- Historical & Forecast data of the Technical Instruments Market Revenues for the period 2014-2024F.

- Bangladesh Stationery Market Revenues and Volume Analysis

- Bangladesh Stationery Market Drivers and Restraints

- Bangladesh Stationery Market Trends and Developments.

- Bangladesh Stationery Market Share, by Players

- Bangladesh Stationery Market Overview on Competitive Landscape.

- Company Profiles.

- Strategic Recommendations.

Markets Covered

The Bangladesh stationery market report provides a detailed analysis of the following market segments:

By Types:

1. Paper Stationery

- Copier

- Exercise Notebook

- Premium Paper Stationery

- Other Paper Stationery

2. Non-Paper Stationery

- Pen

- Pencil

3. Other Non-Paper Stationery

- Art Stationery

- Scale

- Sharpener

- Eraser

- Pencil Box

- Files and Folders

- Adhesive Stationery

- Technical Instruments

By Applications:

- Education

- Office

- Others (Retail, Healthcare, Artistic)

By Regions:

- Northern

- Western

- North Eastern

- Central

- Southern

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero